Slashing Staking Rewards, Aptos' New Proposal Targets Whale "Passive Earning" Benefits

TechFlow Selected TechFlow Selected

Slashing Staking Rewards, Aptos' New Proposal Targets Whale "Passive Earning" Benefits

Can APT follow SUI's explosive growth playbook this time?

By: shushu

After months of dormancy in the Aptos ecosystem, a community proposal known as AIP-119 has injected fresh controversy and vitality into this Layer 1 blockchain.

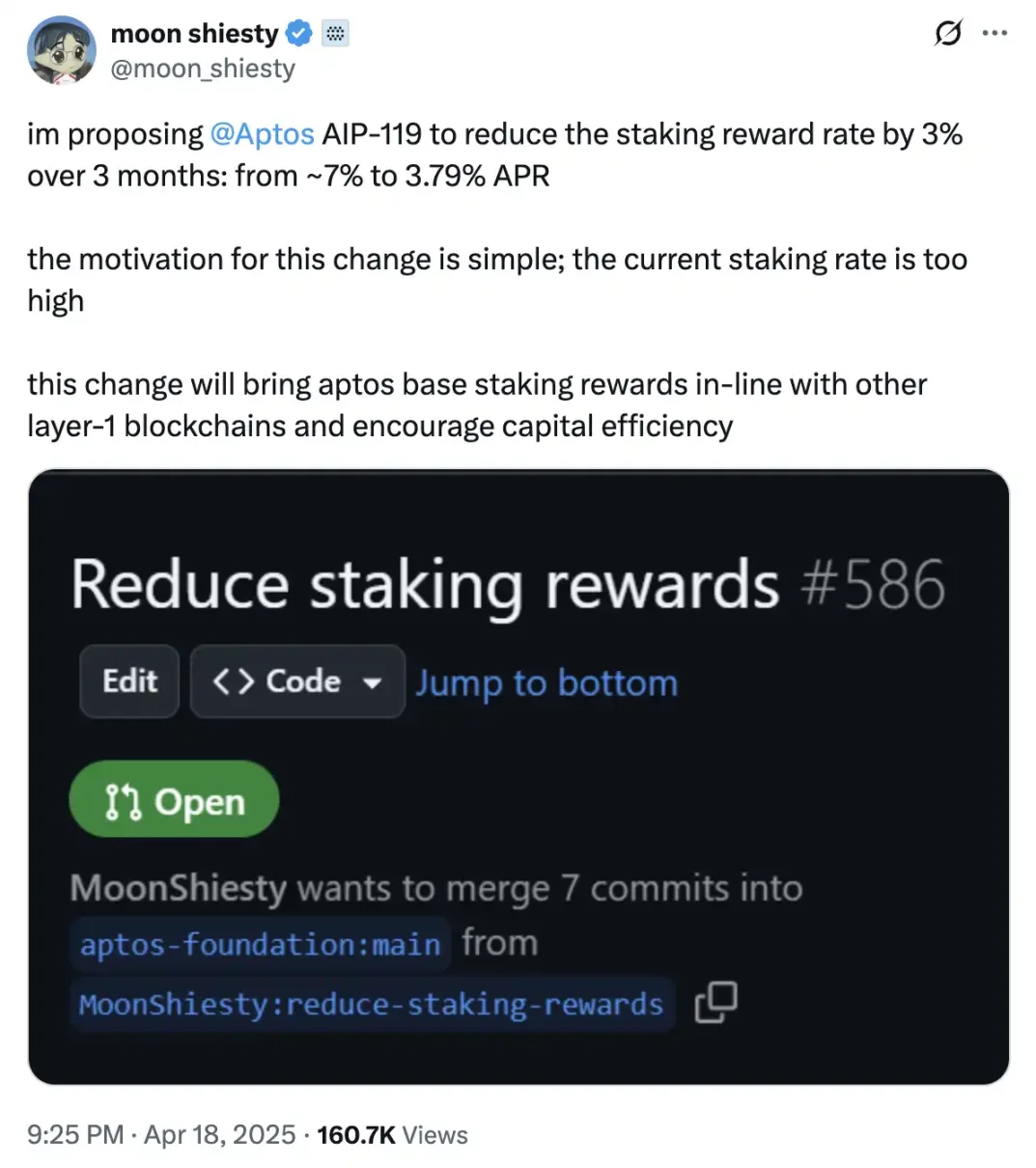

On April 18, Aptos community member moon shiesty launched the "AIP-119" proposal advocating for a "phased reduction in staking rewards," suggesting that the current staking reward rate—approximately 7%—be reduced by 1% each month over the next three months, ultimately bringing the annualized yield down to 3.79%.

The proposal argues that lowering the staking reward rate will benefit the long-term growth of the Aptos ecosystem, particularly by encouraging more active participation in DeFi competition, while also strengthening APT's token economics to support its long-term sustainability. As the first step in reforming Aptos' economic model, the proposal will be open to community feedback, and if approved, a six-month observation period will be implemented to assess its impact.

To many observers, this is not merely a technical governance adjustment, but an attempt to reconstruct the foundational logic of Aptos’ economic model.

The Hidden Dangers of High Yields and Structural Inflation

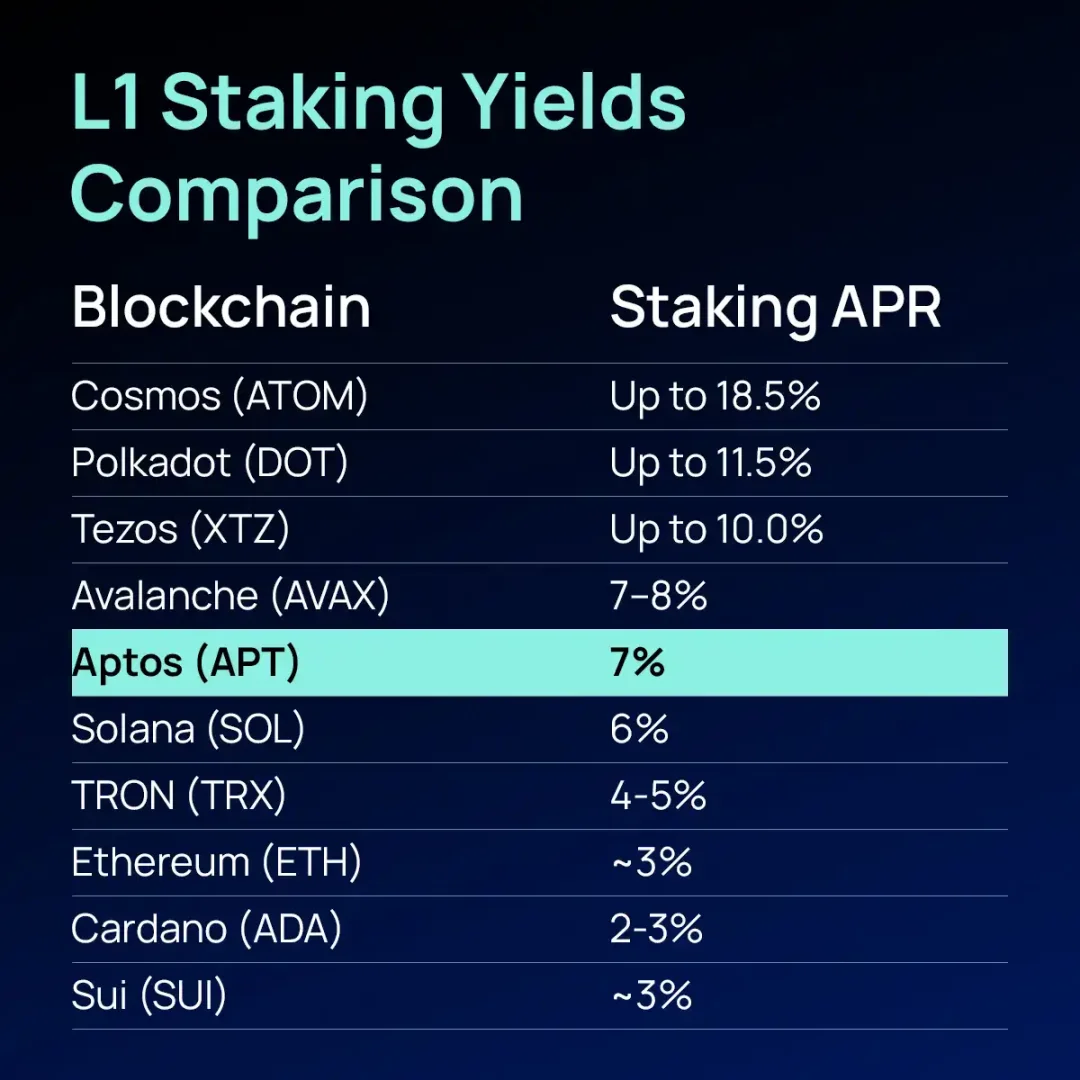

Aptos currently boasts one of the highest staking yields among L1 blockchains, but the associated problems are becoming increasingly apparent. While the 7% risk-free annual return attracts many users to stake and lock up their APT tokens, it simultaneously creates significant inflationary pressure and inefficient capital utilization.

The broader community believes this model continuously dilutes token value and hinders capital from flowing into riskier, more innovative applications. As the proposal’s author analogized, staking rewards play the role of a “central bank interest rate” on-chain, and this “interest rate” may now be misaligned with actual market conditions.

Over the past two years, although Aptos has attracted developers with its high performance and Move language security, its ecosystem activity has failed to keep pace. In contrast, Sui, its fellow “Move twin,” has continued to strengthen, creating a stark divergence.

Many community members attribute this to structural issues within Aptos’ token model—the concentration of a large portion of tokens in the hands of the foundation and core nodes, combined with initially set high staking rewards—which has led to excessive concentration of ecosystem capital in passive “easy earnings,” thereby suppressing constructive innovation.

Fireworks from a New Leader

The backdrop to this proposal includes a series of recent changes in Aptos’ management and market positioning. According to community reports, Mo Shaikh, co-founder of Aptos, faced legal disputes with early team members, resulting in Avery Ching, a Chinese-American engineer (previously CTO), taking over as CEO of Aptos Labs, while Mo Shaikh stepped back from day-to-day operations.

Since his appointment, Aptos’ strategic narrative has shifted from being a “scalable L1” to a “next-generation global transaction engine,” placing clearer emphasis on performance and transaction experience as core competitive advantages.

More notably, Aptos has re-engaged with the Chinese-speaking market: launching the Chinese community MovemakerCN, hosting multiple hackathons, and offering tens of millions of dollars in ecosystem grants—demonstrating a clear determination to rebuild community trust and expand its global developer network.

Technically, Aptos continues to advance performance upgrades such as Zaptos and Block-STM v2, aiming to attract developers under a new “low-yield, high-performance” ecosystem, rebuilding prosperity around PMF (product-market fit) driven by real user demand.

What Does the Community Think?

Although AIP-119 challenges the interests of existing stakeholders, overall community feedback has remained rational rather than emotional. Notably, major players including Amnis Finance—the largest liquid staking protocol—have offered thoughtful analysis and responses. Amnis publicly stated that while the direction of the proposal is reasonable, its execution pace is too aggressive and could harm Aptos’ competitiveness. They argue that staking yield functions like an interest rate tool in emerging markets; for a public chain like Aptos, high yields remain critical for attracting capital.

If yields drop to 3.79%, Aptos would rank among the lowest-yielding chains in the L1 landscape, potentially driving capital toward higher-return alternatives such as Solana or even U.S. Treasury bonds. Opponents also worry that a sharp decline in returns could weaken retail investors’ incentive to lock up tokens, increasing APT’s circulating supply and exacerbating selling pressure. The DeFi ecosystem might also face declining TVL due to shrinking leveraged staking strategies.

For validators, critics point out that lower yields would significantly impact the profitability of smaller nodes. For example, with a stake of 1 million APT, a 3.79% yield and 7% commission generates only about $13,000 in annual revenue, while operational costs can range from $72,000 to $96,000. This could force small validators to exit, increasing centralization risks. Thus, the Community Validator Support Program mentioned in the proposal has become a focal point—though specific implementation details remain unclear.

Supporters, however, emphasize that to overcome its current challenges, Aptos must first address inflation expectations and excessive token issuance. The high-yield staking mechanism has created a “credit illusion” that quietly erodes the ecosystem’s foundation. Every price rebound becomes a “dump window” for stakers, forming a persistent price ceiling—distorting market behavior and undermining confidence among long-term holders.

More importantly, the proposal introduces a “Community Staking Support Program,” aiming to assist smaller validators during the rate cut, mitigating the risk of declining decentralization. Similar to delegation support programs seen on other L1s like Solana, Aptos is beginning to acknowledge the delicate balance between network security and decentralization.

A Turning Point for Ecosystem Evolution

The deeper significance of AIP-119 lies in Aptos’ proactive adjustment of its economic and ecosystem mechanisms in response to market downturns, declining DeFi liquidity, and the “high APY trap.” Amid the widespread “issuance-staking-inflation” vicious cycle across L1s, Aptos stands out as a rare case actively compressing base yields to unlock long-term potential.

This has sparked a deeper debate: Must a healthy blockchain sacrifice risk-free returns? Is the equation “high APY = strong attractiveness” losing validity? True competitiveness stems from network utility and ecosystem sustainability—not short-term incentives. As Rui from Hashkey Capital noted: “The base yield for validators shouldn’t be high. They should earn MEV via LSTs, gain more ownership of the network through DeFi and ecosystem engagement, and have flexible entry and exit (APT has introduced the Delegators Pool).”

AIP-119 remains in draft form, but it may already mark a pivotal moment for Aptos to break free from stagnation and redefine its economic model. In making this decision, Aptos is not merely tweaking numbers—it is revalidating its collective governance mechanism and publicly declaring its commitment to long-termism.

Of course, alongside reducing staking rewards, Aptos must offer clearer and more compelling alternative incentives; otherwise, short-term capital flight and erosion of community trust will be unavoidable. But at least, moving from “self-inflicted cuts” to “ecosystem reinvention,” this chain is finally attempting to answer a question often raised but rarely taken seriously by most projects: What purpose does our system truly serve?

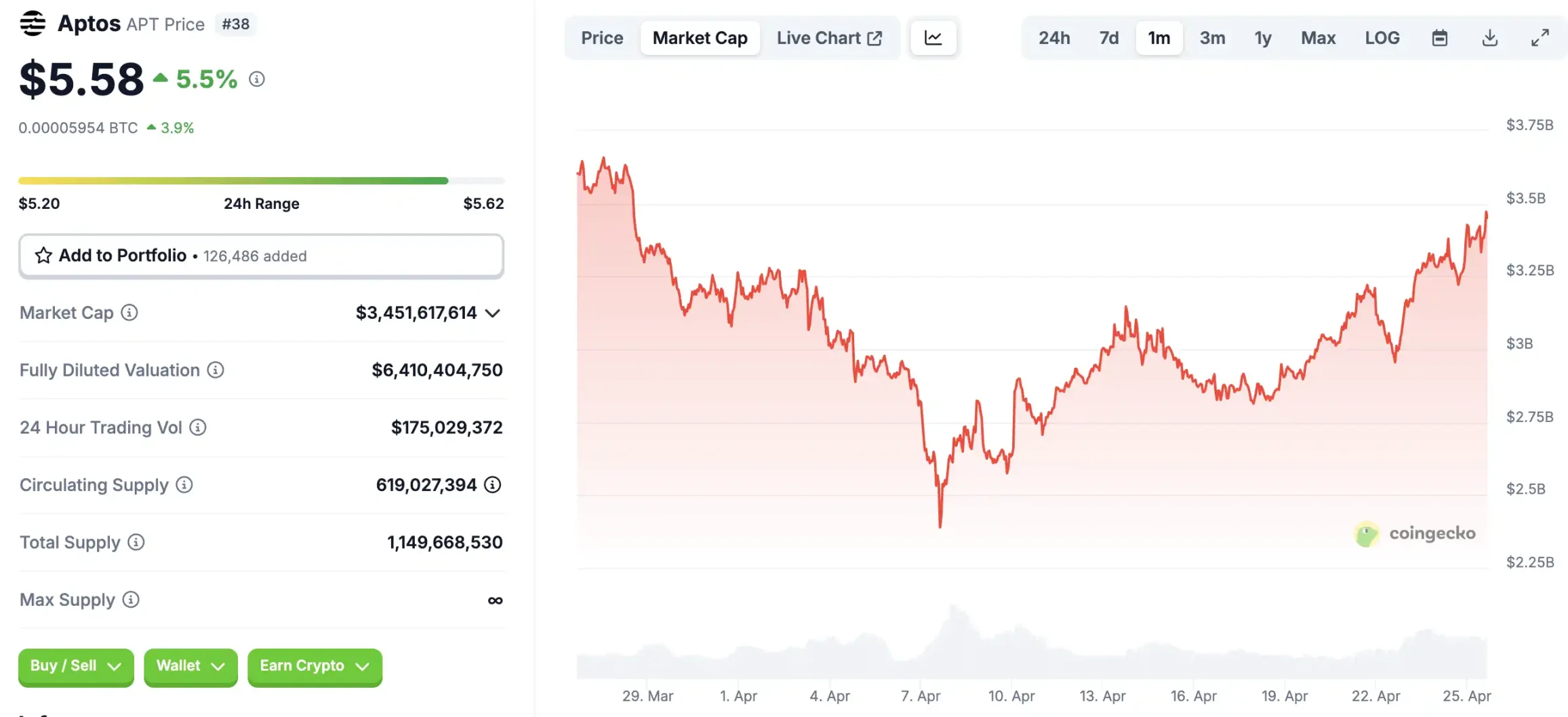

At the time of writing, APT was trading at $5.58, up 5.5% over 24 hours; since April, its price has recovered significantly from earlier market-wide declines.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News