Exclusive Interview with Hyperion CTO Mingxi: The Rise of the Liquidity Engine on Aptos

TechFlow Selected TechFlow Selected

Exclusive Interview with Hyperion CTO Mingxi: The Rise of the Liquidity Engine on Aptos

Hyperion is building a robust, scalable trading infrastructure for the Aptos network.

Author: Hyperion

Mingxi, CTO of Hyperion, gave this interview. She previously served as CEO of a Binance Labs-incubated project and has over ten years of experience in distributed systems and blockchain development.

Mingxi detailed how the team is building unified liquidity and trading infrastructure within the Aptos ecosystem, sharing Hyperion's growth, technological innovations, and future plans since its mainnet launch.

Hyperion’s Vision and Positioning

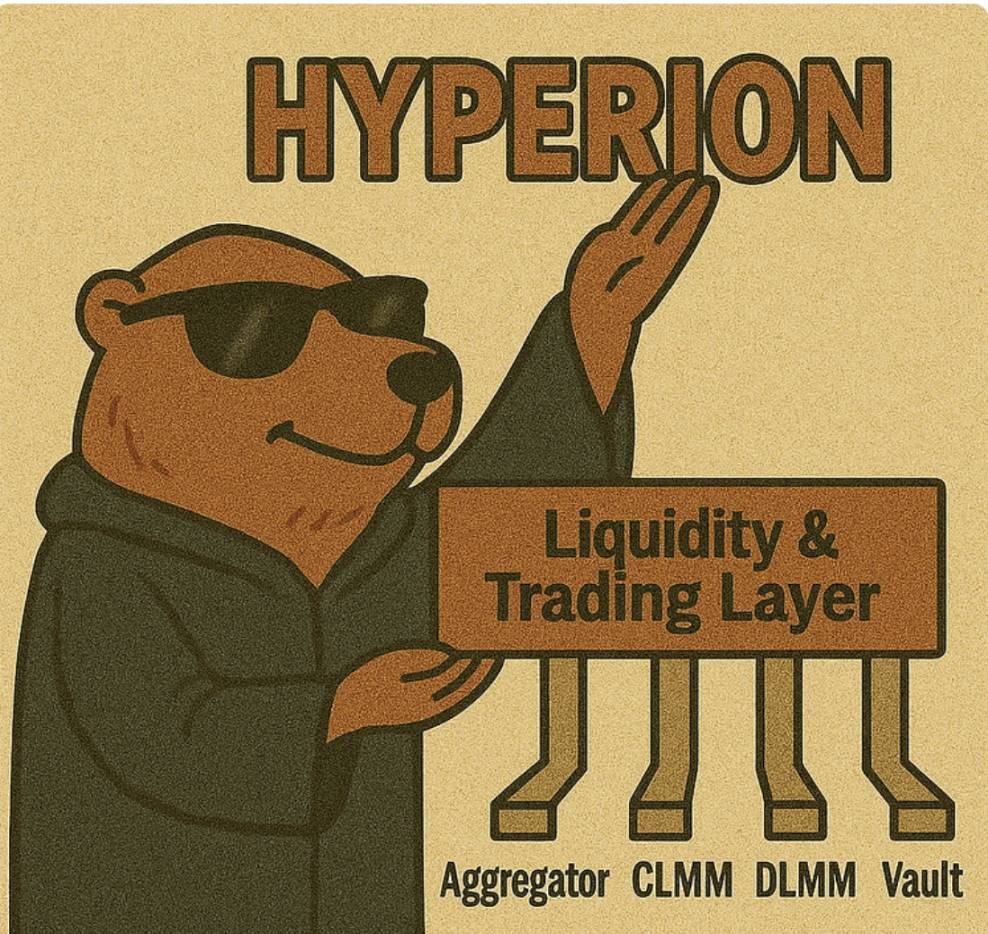

Mingxi stated that Hyperion aims to become the unified liquidity and trading layer on Aptos, integrating functionalities such as aggregators, market making, and strategies (Vaults) into a single high-performance on-chain platform. Through smart routing, capital-efficient concentrated positions, adaptive directional pools, and trustless strategies (Vaults), Hyperion enables both traders and LPs to achieve minimal slippage and optimal returns, automating tedious processes and significantly enhancing the on-chain trading experience.

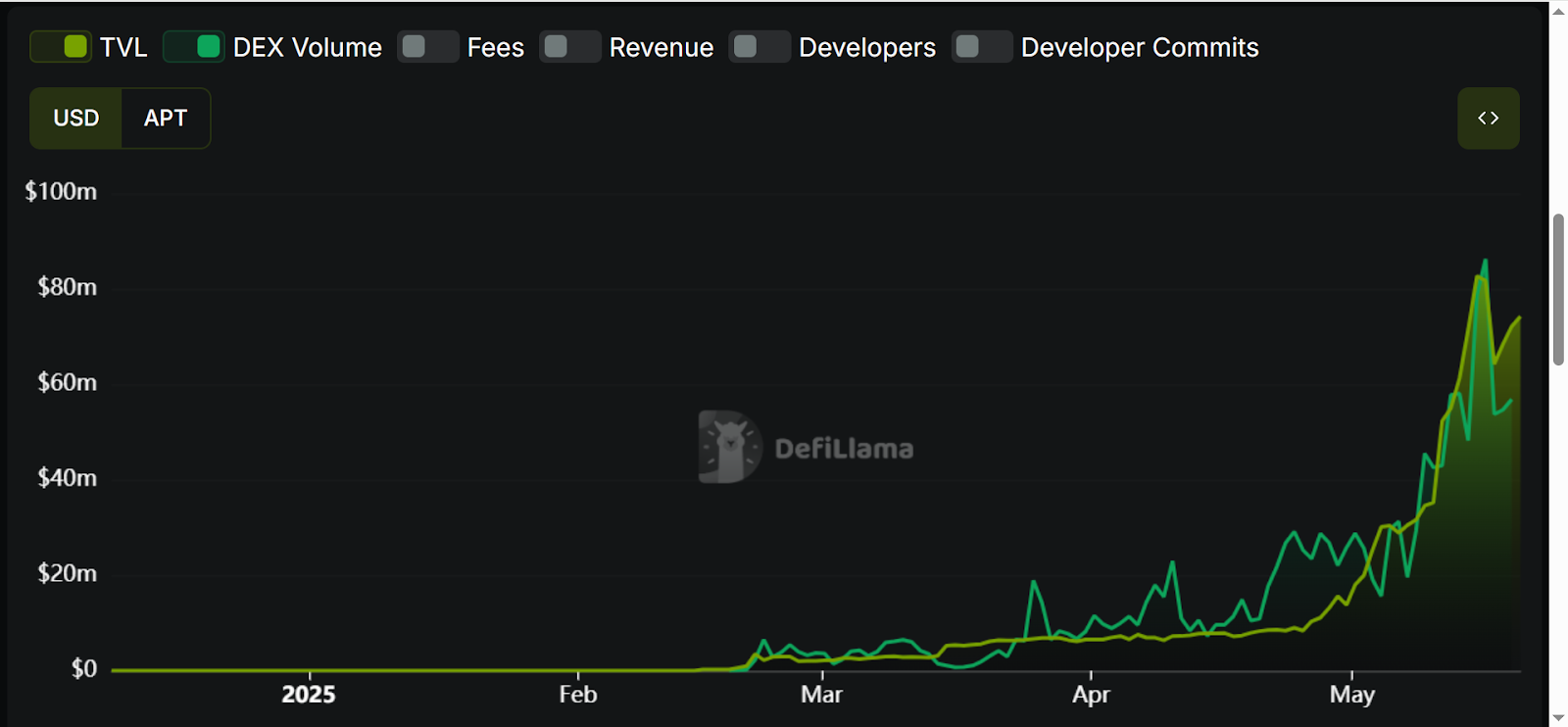

Over the past year, Hyperion has stood out in the Aptos ecosystem. Mingxi revealed that as of May 20, 2025, Hyperion’s TVL reached $80 million, with cumulative trading volume surpassing $1.5 billion, making it the highest-volume protocol on Aptos. Since its mainnet launch in February, Hyperion has achieved a monthly compound growth rate of 162.7% in TVL, 288.9% in trading volume, and 235.7% in protocol fees. These figures not only reflect the team’s execution capability but also demonstrate the strong demand and robust support within the Aptos ecosystem for efficient liquidity infrastructure.

Dex Innovation Empowers Aptos as a Global Trading Engine

Regarding Aptos’ technical foundation, Mingxi believes that Aptos’ high throughput and sub-second finality provide fertile ground for professional platforms like Hyperion. However, the Aptos DeFi ecosystem still faces challenges such as fragmented liquidity and low capital utilization.

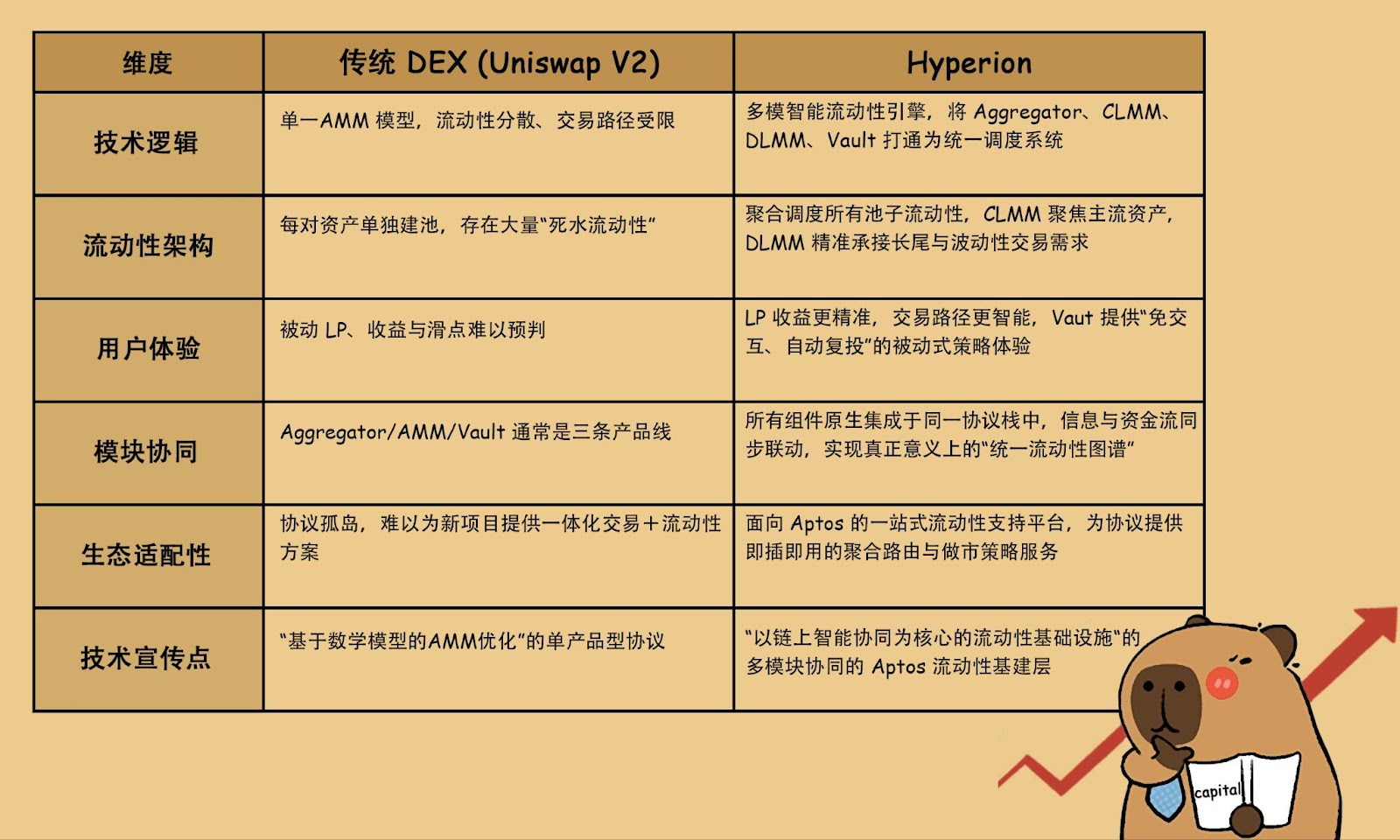

Hyperion introduced the Uni V3 model into the Aptos ecosystem, unifying aggregators, concentrated and directional market making (CLMM and DLMM), and automated strategies (Vaults) into a single composable liquidity layer. Through smart routing and efficient capital allocation, Hyperion allows both traders and LPs to easily access optimal prices and yields without manually managing complex operations.

With this approach, Hyperion is poised to aggregate liquidity and trading activities across the Aptos ecosystem, complete the liquidity puzzle, and elevate capital efficiency thresholds—supporting Aptos’ vision of becoming a global trading engine.

In-Depth Look at Hyperion’s Product Architecture and Technological Innovations

On the product side, Mingxi explained that Hyperion is built around four core modules:

-

Aggregator: A smart routing engine that searches across all liquidity pools for the best price, supporting multi-hop routing and trade splitting to ensure low slippage and optimal execution for every transaction.

-

CLMM (Concentrated Liquidity Market Making): Similar to Uniswap v3, it allows LPs to provide liquidity within specific price ranges, improving capital efficiency and depth for major trading pairs.

-

DLMM (Directional Liquidity Market Making): Supports asymmetric liquidity and directional strategies, ideal for volatile assets and dynamic price discovery.

-

Vault Platform: A trustless strategy platform where strategy providers can deploy automated strategies and earn performance fees, while users can easily participate in passive LP strategies. The platform automatically handles execution, rewards, and rebalancing.

These modules together form a modular and composable liquidity infrastructure, delivering ultra-fast, low-slippage trading experiences for users and native liquidity access for protocols.

In practice, Mingxi gave an example: when users swap volatile pairs like APT/USDC, Hyperion’s aggregator intelligently splits and routes trades across CLMM and DLMM pools for optimal execution. The vault platform automatically rebalances liquidity across price ranges to maximize returns—all made possible by Aptos’ sub-second finality and parallel execution capabilities.

Future Plans and Community Incentives

Looking ahead, Mingxi revealed that Hyperion plans to conduct its TGE in Q2 2025 and will release a new roadmap and major updates.

Prior to TGE, Hyperion is launching a series of initiatives offering three key incentives for users and LPs: first, high APRs—with annual yields exceeding 100% for APT-stablecoin pools and around 10% for pure stablecoin pairs; second, the Drips incentive system, active before and after TGE, rewarding early participation; third, exclusive campaigns with partners like OKX Wallet, including APT reward pools worth hundreds of thousands of dollars and additional ecosystem incentives.

Conclusion

Mingxi emphasized that Hyperion is building a solid, scalable trading infrastructure for the Aptos network, enabling developers, traders, and LPs alike to enjoy the best on-chain financial experience. She welcomes all DeFi users and members of the Aptos community to join Hyperion’s journey and collectively drive on-chain innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News