A strong hand played poorly? Unveiling the ecosystem puzzle behind Aptos

TechFlow Selected TechFlow Selected

A strong hand played poorly? Unveiling the ecosystem puzzle behind Aptos

Capital can accelerate the maturity of a blockchain, but it cannot give it true vitality.

By Fairy, ChainCatcher

"The chain is fast, the heart aches, and the money is scarce." This tongue-in-cheek remark captures the frustration of many early supporters of Aptos.

While Sui has risen rapidly, the other "Move twin star" finds itself in a starkly different situation. Born with high TPS, the Move language, and strong backing from top-tier investors, Aptos entered the market with great fanfare. Yet while capital can accelerate a blockchain's launch, it cannot grant true, organic vitality.

What exactly has led Aptos into this predicament?

The Fading Halo: Ecosystem Growth Stalls

Aptos launched in 2022, backed by former Meta engineers, emerging as a flagship project under the banner of the "next-generation L1." With support from heavyweight institutions like a16z, YZi Labs, and Jump Crypto, Aptos enjoyed intense market enthusiasm in its early days. However, as market sentiment cooled, its once-compelling technical narrative has gradually lost its appeal.

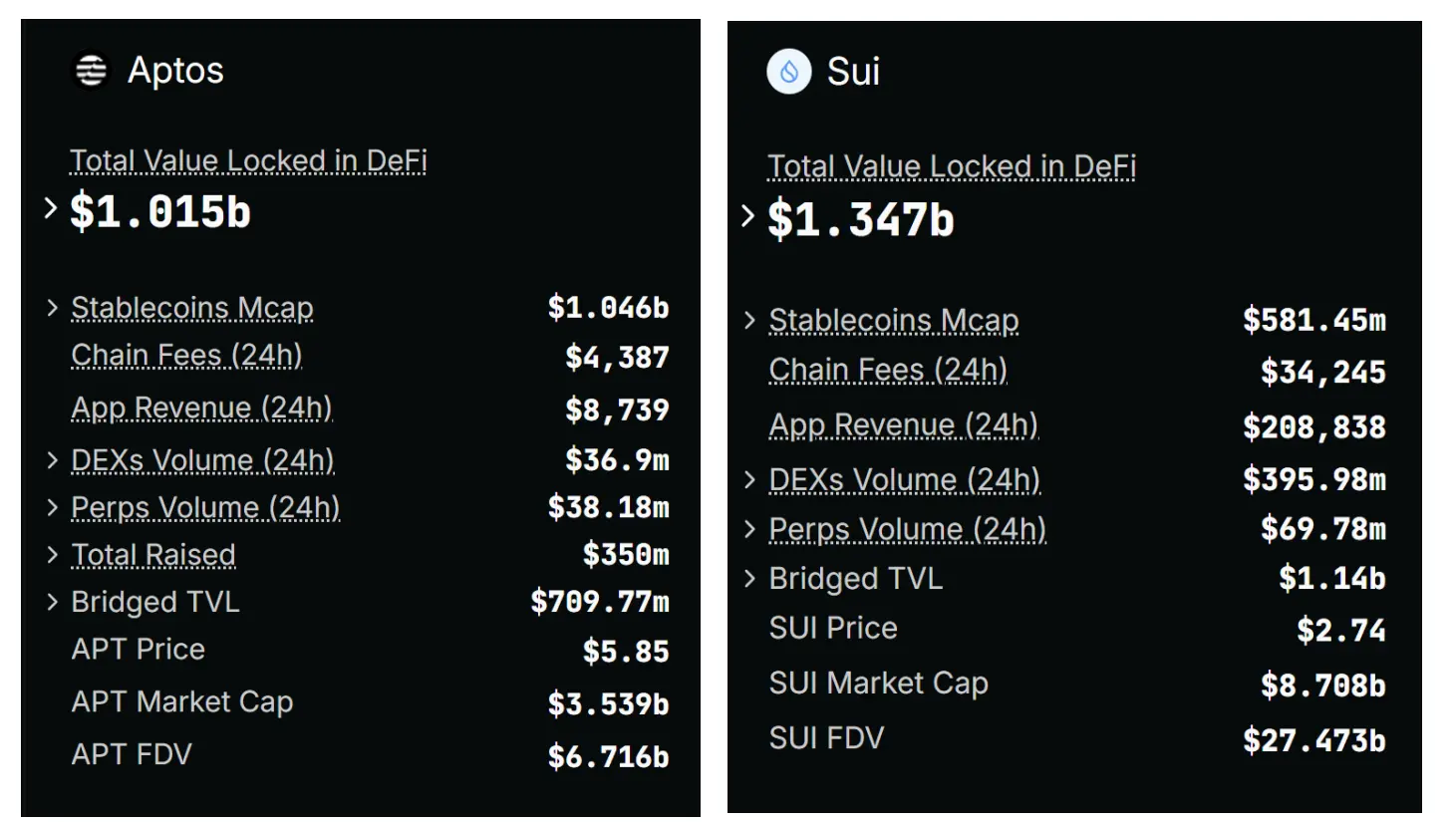

Data from Dune shows that Aptos currently sees around 1 million daily active addresses and 3–4 million daily transactions—while Sui, also built on the Move language, exceeds 10 million daily transactions, with far higher DEX trading volume and application revenue than Aptos.

So what went wrong with Aptos’ ecosystem growth?

Image source: Defillama

Fake Prosperity Built on Resource Dumping

Aptos' earlier expansion relied heavily on a "resource-driven" model rather than genuine market demand. Crypto KOL @cryptobraveHQ pointed out that Aptos distributed large amounts of tokens to partners, brought in well-known DeFi projects to bolster infrastructure, and conducted OTC fundraising rounds involving major players like Binance and OKX to build up its ecosystem. However, this "fast-track approach" failed to attract real user migration—it resembled more of a "resource arbitrage game":

-

After launching on Aptos, major DeFi projects saw limited growth in actual users; once token unlocks arrived, holdings were quickly dumped.

-

TVL appeared to grow, but much of the capital may have been "shelf-stacking" solely chasing incentives, failing to generate real liquidity.

-

Ecosystem resources favored parachuted-in projects instead of nurturing native developers, limiting the development of homegrown Aptos projects and preventing the ecosystem from achieving self-sustainability.

Aptos’ “ecosystem support” is form over substance

In mid-March, Aptos launched its LFM program aimed at helping ecosystem projects prepare for TGE. However, the community-backed first LFM member, Amnis Finance, suffered a botched airdrop.

Community member @KuiGas highlighted that Amnis Finance’s airdrop distribution was highly centralized: among 440,000 addresses, only 10,000 received tokens, leaving many genuine users empty-handed. This so-called “ecosystem support” airdrop debacle exposed Aptos’ shortcomings in project vetting and community governance.

Aptos provided Amnis with substantial resources, including token rewards, while the latter spent a year on marketing and giveaways. Yet the entire process prioritized optics over impact—resulting not in ecosystem growth, but a public relations failure:

-

No composability or synergy was created with core ecosystem components.

-

No reasonable guidance or community alignment was offered on airdrop logic prior to distribution.

@KuiGas noted that amid widespread controversy over Amnis Finance’s airdrop, Aptos chose silence and withdrawal—repeating its long-standing pattern of inaction.

Image source: @KuiGas

Executives Exit in Droves

Over the past year, Aptos has seen significant executive turnover, with CEO Mo Shaikh, product design lead Jessica Anerella, and product lead Cathy Sun all departing—one after another—raising concerns about internal mismanagement.

Crypto KOL @cryptobraveHQ revealed that last year, Aptos conducted off-market OTC sales of APT tokens at prices significantly below market value. At a time when APT traded between $10 and $13, certain investors gained access at roughly 40% of that price. Coincidentally, shortly after this revelation, co-founder and CEO Mo Shaikh, along with several employees from VC backgrounds, exited the company.

It’s speculated that these departures were directly tied to OTC-related favoritism, with the root cause being Aptos’ post-launch performance falling short of expectations.

Community Frustration Mounts: Is Aptos Doomed?

Aptos was once filled with promise, but now finds itself mired in skepticism and disappointment. "Lacking market sensitivity, unclear strategy, internal corruption..." Many community members express frustration, watching lofty expectations erode under harsh reality.

Community member @yi_juanmao pointed out that although both Aptos and Sui originated from elite tech firms, their trajectories have diverged sharply. He criticized Aptos for lacking Web3 fundamentals in market awareness, strategic planning, user engagement, and ecosystem collaboration. Instead, he said, Aptos remains obsessed with boasting its high TPS, behaving increasingly like a rigid Web2 corporation. He added that parasitic projects dominate the ecosystem, which relies excessively on financial infusions, resulting in a lifeless, stagnant system.

@Cary_Zz reflected on the changes over the past year: "Last year, the two Move-powered chains were neck-and-neck—and actually, Aptos had even greater momentum than SUI. The entire community was excited, anticipating an Aptos ecosystem boom. But one year later, everything has changed. One became a hero, the other a joke. SUI’s token price keeps rising, while Aptos’ team has been busy selling tokens cheap via OTC deals, embroiled in corruption and backroom dealings, ultimately leaving behind a mess after the CEO’s departure."

@imsongshu bluntly called out Aptos’ bureaucratic internal culture and extremely low operational efficiency. @cryptobraveHQ echoed this, noting that Aptos hides behind "compliance" excuses, dragging every process out for three months.

Capital hype may bring temporary prosperity, but what truly determines a blockchain’s long-term survival is user retention and sustainable ecosystem development.

L1 competition remains fierce. Whether Aptos can stage a comeback remains to be seen—only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News