Tether hoards 80 tons of gold—take a quick look at its gold-backed token XAUT

TechFlow Selected TechFlow Selected

Tether hoards 80 tons of gold—take a quick look at its gold-backed token XAUT

Buying gold on-chain, convenient and hassle-free.

By Bright, Foresight News

On the evening of July 8, according to Bloomberg, Tether CEO Paolo Ardoino said in an interview that the stablecoin issuer owns its own vault in Switzerland and currently holds $8 billion worth of gold (approximately 80 tons). The vault is located in Switzerland, but for security reasons, the company declined to disclose its exact location or when it was established.

The vast majority of the gold is held directly by Tether. Paolo Ardoino explained that the decision to build their own vault stemmed from cost considerations. Paying fees to traditional vault operators commonly used in the precious metals industry is extremely expensive.

Tether has become one of the largest holders of physical gold globally, second only to banks and nation-states. The value of gold stored in its vault—around $8 billion—is roughly equivalent to UBS Group’s total holdings in precious metals and other commodities. Previously, during a speech at Bitcoin 2025 in Las Vegas, Paolo Ardoino disclosed that Tether's gold reserves stood at 50 tons.

Gold currently accounts for nearly 5% of Tether’s total reserves, primarily backing its gold-backed token XAUT and serving as collateral for stablecoins.

Tether Gold (XAUT) is a stablecoin issued by TG Commodities Limited, a subsidiary of Tether, pegged to physical gold. Each XAUT token represents one troy ounce of LBMA-certified refined gold. Currently, XAUT is supported on both the Ethereum and Tron networks.

In addition, Tether launched its own platform, Alloy by Tether, allowing users to use XAUT as collateral to mint a new synthetic dollar-pegged stablecoin called aUSDT.

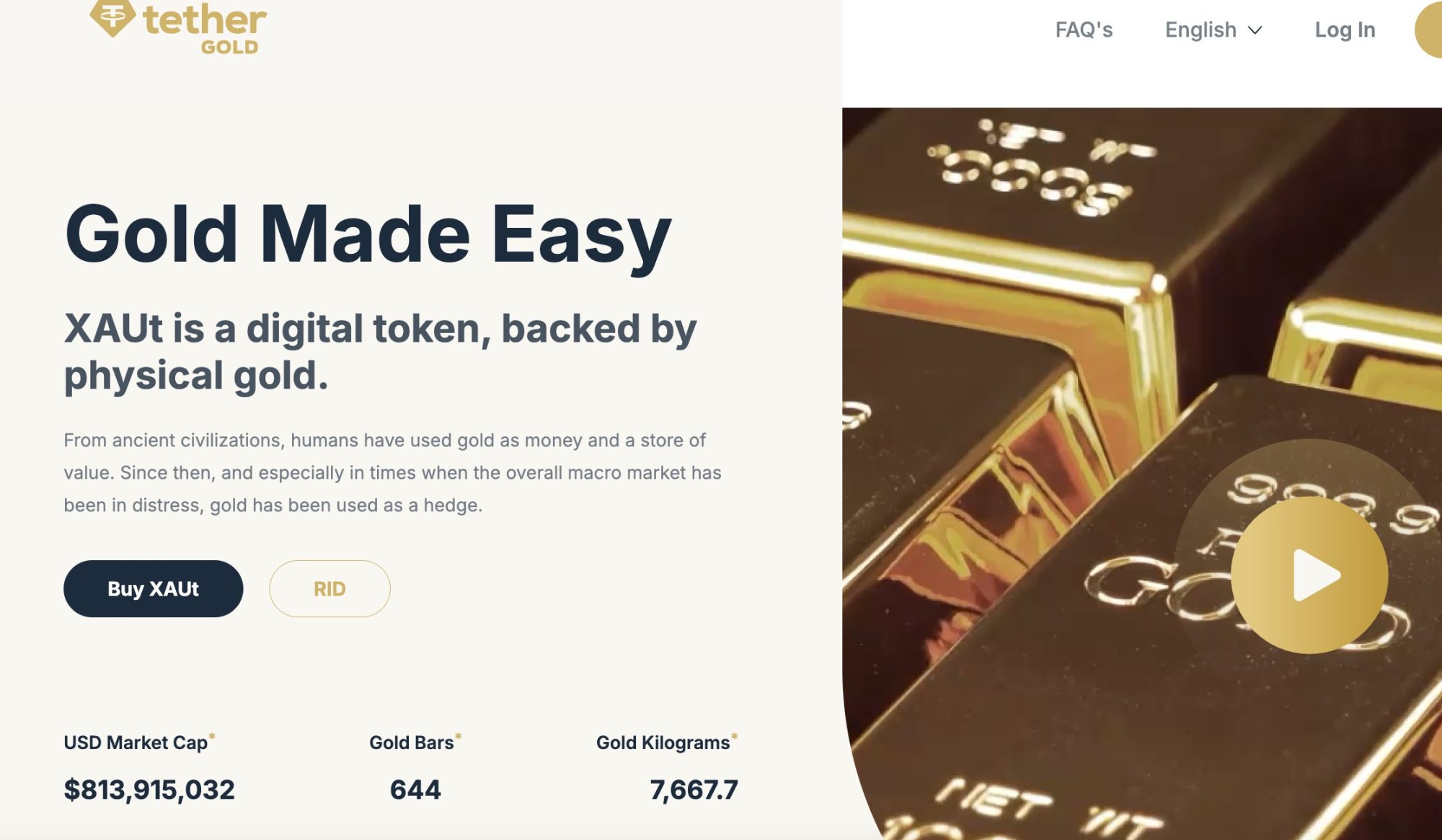

According to data from Tether’s official website, the current circulating market cap of XAUT is approximately $813 million, representing 7.66 tons of gold, equivalent to 644 standard "London Good Delivery" gold bars.

As described on Tether’s official site, compared to traditional gold, XAUT offers native advantages inherent to cryptocurrencies:

1. Easy transportation: Transporting XAUT tokens is no different than moving any other crypto asset.

2. Divisibility: XAUT can be divided down to increments as small as 0.000001 troy ounces of gold.

3. Round-the-clock trading: XAUT can be traded 24/7, 365 days a year on exchanges supporting the token.

4. Convenient redemption: Tether can deliver physical gold bars to any address within Switzerland.

5. Simple storage: Storing XAUT is just like storing any other cryptocurrency.

6. Easy verification: All physical gold backing XAUT tokens can be tracked via Tether’s website, enabling quick validation of gold holdings.

There are no custody fees for holding XAUT. Holders may redeem XAUT for physical gold at any time, subject to minimum redemption thresholds and associated fees. Below are the specific costs for purchasing and redeeming XAUT on Tether’s official platform.

Purchase fee: A one-time 0.25% transaction fee applies when buying XAUT through Tether’s official platform. Additionally, users must complete identity verification and pay a non-refundable $150 USDT verification deposit. The minimum purchase amount is 50 XAUT.

Redemption fee: Redeeming XAUT for physical gold incurs a one-time 0.25% fee. The current minimum redemption threshold is 430 XAUT, approximately equal to one standard "London Good Delivery" gold bar. Additional shipping fees may apply.

Currently, major exchanges such as Bybit and OKX support spot and leveraged trading of XAUT, while Bitfinex—the exchange operated by Tether’s parent entity—offers perpetual contracts with up to 100x leverage.

However, Tether is not the first to tokenize gold.

PAX Gold (PAXG) is a digital asset pegged to physical gold, issued by Paxos Trust Company, a U.S.-based fintech firm. Each PAXG token represents one troy ounce of LBMA-certified gold, with physical gold held in secure vaults in London under custody by Paxos. Launched on the Ethereum network in 2019 and regulated by the New York State Department of Financial Services (NYDFS), PAXG was the world’s first fully regulated gold-backed stablecoin.

Currently, PAXG has a market capitalization of approximately $843 million and primarily serves U.S. customers, hence it is listed on major U.S. exchanges including Coinbase.

Overall, as Tether shifts focus away from the U.S. market amid the regulatory evolution of bills like the GENIUS Act, it is increasingly turning its attention toward emerging markets. Tether’s long-standing brand recognition, substantial asset reserves, and accessible storage solutions are all contributing to the global expansion of XAUT.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News