When foreign KOLs fall from grace, was their overnight wealth just a "conspiracy" we didn't understand?

TechFlow Selected TechFlow Selected

When foreign KOLs fall from grace, was their overnight wealth just a "conspiracy" we didn't understand?

Did the allegations against Lexapro and GCR expose the dark side of the crypto circle?

Author: Cookie, BlockBeats

Within the crypto space, KOLs who have achieved significant gains and amassed large followings—whose tweets and on-chain activities can drive strong copy-trading effects for certain tokens—have always been surrounded by controversy.

This time, two such KOLs have been thrust into the spotlight. One is relatively known only among meme coin enthusiasts in the Chinese-speaking community, while the other is a veteran figure familiar to most crypto players. What exactly happened to bring these two KOLs under intense scrutiny?

Lexapro: An Outer Member of the "LA Vape Cabal" and Moonshot "Fall Out"

The term "LA Vape Cabal" originated from an English-speaking online poker livestream hosted by prominent KOL @notthreadguy. Its members include FaZe Banks (co-founder of esports group FaZe Clan), Frank (founder of NFT project DeGods), Malcolm (from deLabs, parent company of DeGods), and crypto KOLs including threadguy, rasmr, and OGshoots.

The "LA Vape Cabal" has long been controversial, accused of leveraging their fanbases to exit liquidity and manipulate meme coin markets—especially during the $LIBRA ("Argentina Coin") incident, where they were widely criticized for alleged insider involvement.

(For more background on the "LA Vape Cabal," refer to BlockBeats’ article: “The Man Called threadguy Has Disappeared.”)

Lexapro is widely considered part of the "LA Vape Cabal" by both Chinese and English-speaking communities. Some claim he participates in their private chat groups:

Here, "He" refers to Lexapro

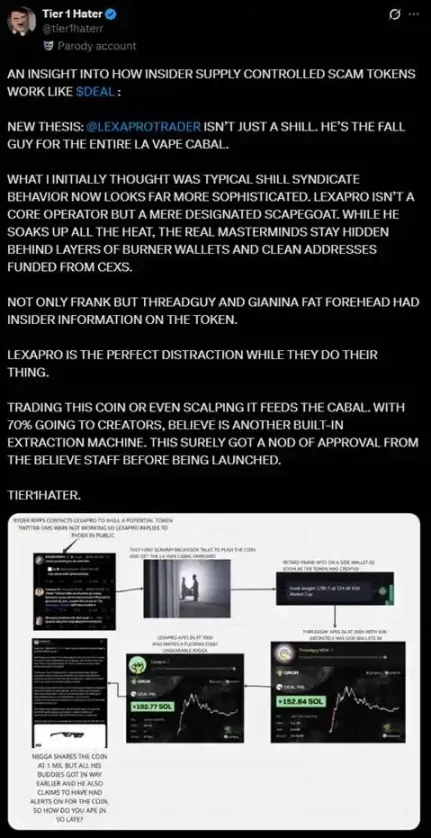

In early June, @tier1haterr accused Lexapro and the "LA Vape Cabal" of colluding to promote the token $DEAL launched within the Believe ecosystem:

He presented a chain of evidence through one image:

First, due to a Twitter DM outage at the time, Lexapro publicly replied to RYDER RIPPS on Twitter, revealing preliminary coordination between them. Afterward, Frank (DeGods founder) bought $780.5 worth when the token’s market cap was just $24,600. Threadguy purchased $3,000 when the market cap reached $300,000 (eventually profiting around $13,000). Lexapro first bought $4,720 when the market cap hit $700,000, then added positions at $1.5 million and $1.26 million valuations, totaling approximately $16,700 invested. He then published a long promotional tweet about $DEAL when its market cap reached $1 million.

On-chain data shows that Lexapro later transferred this entire holding to another wallet and sold it all, suffering about a 57% loss. @tier1haterr argues that in this "LA Vape Cabal" operation, Lexapro acted as a scapegoat—but given that creators of the Believe ecosystem received up to 70% of revenue (potentially involving kickbacks) and other "Cabal" members clearly profited, he does not believe Lexapro was innocent.

$DEAL peaked at a $2 million market cap before steadily declining; it now sits at just $97,000.

Earlier, Lexapro had also faced accusations of manipulating $HOUSE. Because he frequently defended himself, when the $RICH and Moonshot drama unfolded, the English-speaking crypto community reacted with a sense of “finally caught red-handed”:

"You don’t hate these people enough."

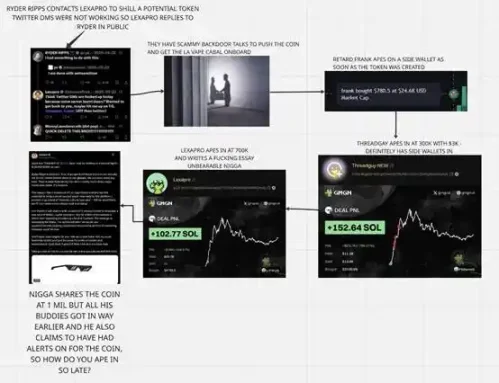

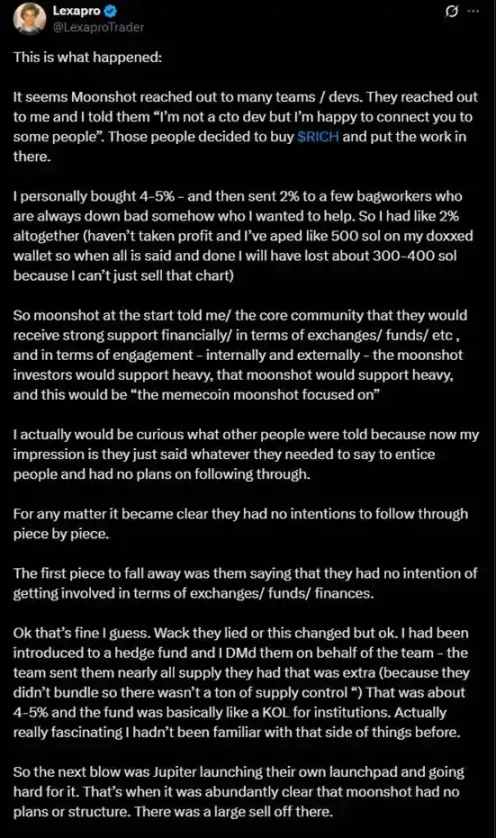

In the leaked chat logs below, Lexapro and Moonshot employee sidewinder engage in a chaotic blame-shifting drama.

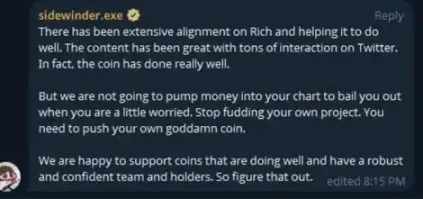

According to the conversation, both parties previously discussed a coordinated pump of $RICH, a token launched on Moonshot. In the screenshots above, Lexapro confronts sidewinder first—claiming Moonshot failed to fulfill prior commitments, and that $RICH’s price movement depends on Moonshot, not him.

Sidewinder fires back—no, this isn’t Moonshot’s token, it’s *your* token. You controlled its supply through bundling and brought in retail investors (CX).

Lexapro gets angry—You’re being disrespectful. Watch your tone—the next thing you say will determine the fate of Moonshot Launchpad.

Sidewinder’s final message essentially reiterates: Moonshot won’t help you pump the token. Handle it yourself.

During a brief rebound after $RICH dropped from its peak market cap of $11 million, Lexapro heavily promoted the token:

"Major figures/institutions are stepping in—it's like a make-or-break moment for Moonshot Launchpad. If you believe Moonshot can succeed, buy $RICH, targeting a $100 million market cap. The team is working hard; major marketing campaigns are about to launch. This should be the bottom." (Image source: @tier1haterr)

Lexapro issued a lengthy response (too long for one screenshot), arguing essentially that he lost money too, Moonshot didn’t deliver on their promise to support the price, they did nothing—and thus the failure lies with Moonshot, not him:

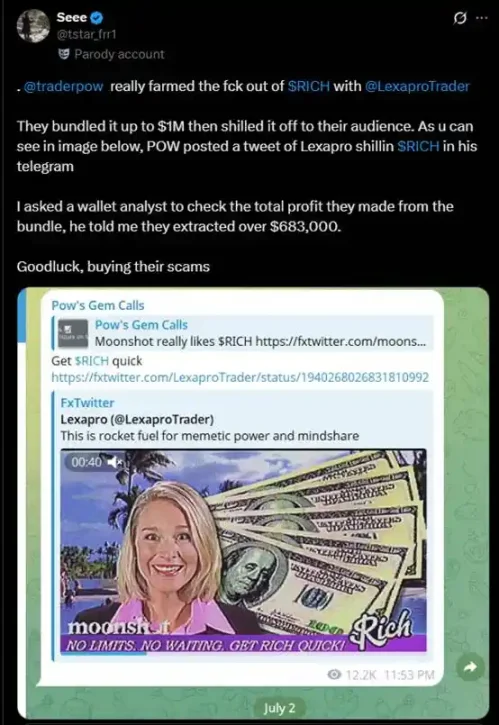

The community largely rejected his explanation. @tstar_frr1 even dragged in another Western influencer, pow:

"They planned to bundle $RICH to a $1 million market cap and then aggressively promote it to their followers. As seen in this screenshot, pow reposted Lexapro’s $RICH promotion in his Telegram channel saying 'get rich quick.' I consulted a wallet analyst who confirmed these individuals made over $683,000 in profits from $RICH. If you keep buying into their scam coins, good luck to you." (Image source: @tstar_frr1)

While the disclosed information doesn't fully reconstruct the entire event, it's clear that $RICH was intended to be a coordinated "pump scheme" involving Moonshot and at least Lexapro and other English-speaking KOLs. Ultimately, they fell out, leaving retail investors to bear the losses.

The biggest victims? The $RICH community—and the broader crypto community. With meme coin liquidity already thin and narratives struggling for attention, having such manipulation exposed deals yet another severe blow to meme coin investors' confidence. They constantly tell us to build, to believe—but can trust and effort truly lead to success?

Why are people so angry? Because everyone has their favorite meme coin, their preferred story. Many believe—or at least hope—they can achieve results through conviction. Regardless of who is right or wrong, it's always retail that suffers, and the reason is absurd: a dispute over profit-sharing between KOLs and project teams, despite all of them already taking shortcuts.

A small footnote to Lexapro’s downfall—he was kicked out of the $HOUSE whale group. In a reply tweet, he claimed he had no idea, expressing sadness: “I helped you so much, I’m really hurt.”

GCR: Accused of Bribing Binance Listing Team and Hacking Palm Beach Research Server

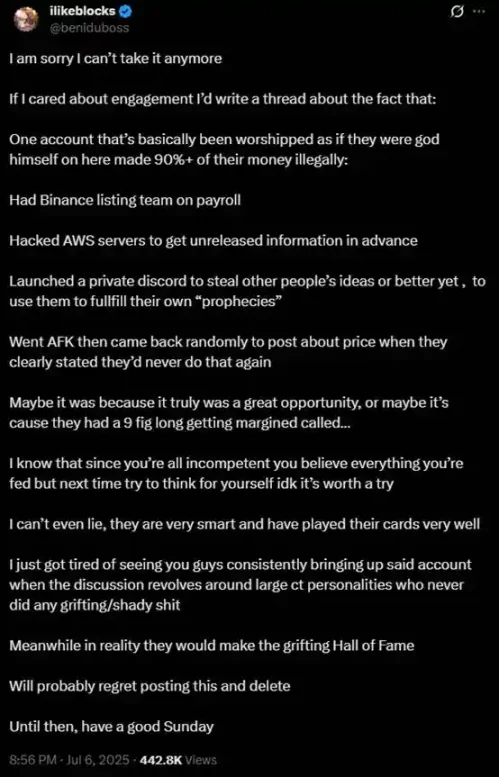

Just as the Lexapro scandal was unfolding, another wave hit the crypto world. On the evening of July 6, @beniduboss tweeted serious allegations against GCR:

"I can't take it anymore—a KOL (GCR) is worshipped like a god, but over 90% of his wealth was earned illegally. Bribing Binance’s listing team for insider info, hacking into Palm Beach Research’s AWS server to get report content early, running a private Discord channel where he steals others’ ideas to create his 'prophecies,' disappears, then returns occasionally to post price predictions—all because he holds nine-figure long positions."

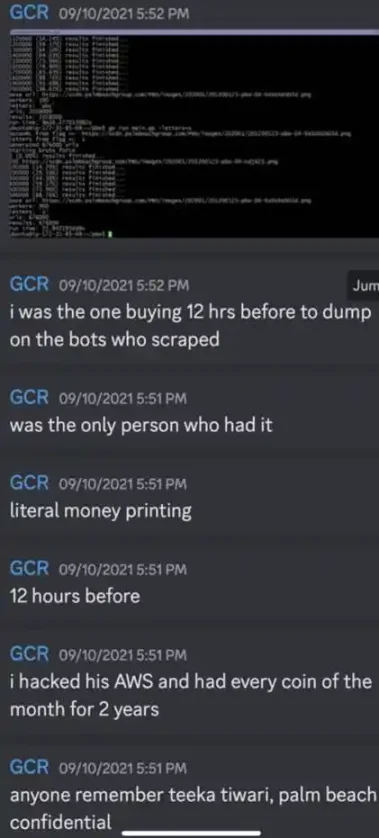

These allegations currently lack solid evidence, consisting mainly of疑似 GCR chat logs shared by @beniduboss from Discord:

A user疑似to be GCR claims to have hacked into Palm Beach Research’s AWS server, gaining access to reports 12 hours early, buying ahead, then dumping onto bots. Palm Beach Research, led by Teeka Tiwari’s crypto research team, once sold reports to crypto users and held influence years ago. Currently, its official website is inaccessible, and its Twitter account hasn’t updated since April last year.

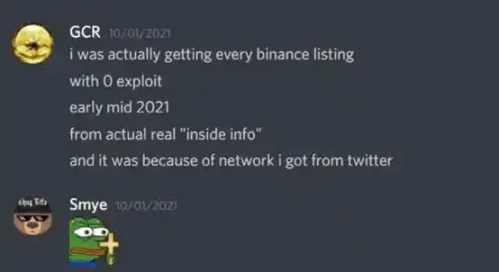

A user疑似to be GCR claims he had access to every Binance listing announcement in the first half of 2021

Soon after, counter-tweets defending GCR emerged:

@IamNomad stated that the above Discord screenshots originated around 2022, when a user attempted fraud/insider trading accusations against an exchange after suffering heavy losses, and deleted their Twitter account roughly six months later. @IamNomad has since deleted this tweet, stating he doesn’t want to escalate further conflict.

Overall, the current allegations against GCR lack strong evidence. However, yesterday, whistleblower @beniduboss reported receiving doxxing and death threats via Twitter DMs. He emphasized this wasn’t related to GCR but possibly carried out by an overzealous GCR fan. Previously, his tweets exposing GCR were flooded with bot-generated comments.

Conclusion

KOLs always remind me of my favorite drink, Monster Energy—great for a quick boost when tired, but when you're truly exhausted, you still need real sleep. Who would actually rely on energy drinks to replace rest?

When investing, you might glance at KOL commentary for psychological comfort during uncertainty, enjoy their entertaining takes for a laugh—but if you want to truly make money, you must rely on yourself. Ultimately, only you are trustworthy.

Any KOL may eventually "collapse"—but hopefully, that doesn’t mean collapse for you, because in your mind, KOLs never had a "house" to begin with.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News