DeFi for Dummies: From One-Click Interaction to True Cold Start, How Can the Chain Break Through?

TechFlow Selected TechFlow Selected

DeFi for Dummies: From One-Click Interaction to True Cold Start, How Can the Chain Break Through?

The convenience of "enabling everyone to interact with one click" might turn into a disaster of "losing everything with one click."

By 0xresearch

In the world of crypto, there's an often-overlooked truth: "The simpler it seems, the more dangerous it can be." Today’s DeFi landscape is rapidly moving toward "foolproof operations": Don’t know how to use smart contracts? Not familiar with blockchain? No problem. SDKs, aggregators, and wallet plugins now package complex on-chain actions into simple one-click interactions. Take Shogun SDK, for example—it compresses multi-step processes like signing, authorizing, and transferring into a single click, first debuting in the Berachain ecosystem.

Sounds perfect, right? Who wouldn’t want to perform on-chain operations as easily as scanning a QR code with Alipay? But here's the catch: these "barrier-free tools" also hide the inherent risks of on-chain activity. It's like giving someone a credit card and watching them max it out—not because the card is flawed, but because they don’t understand that debt must eventually be repaid. In DeFi, once you authorize a contract to manage your assets, it may gain permanent control over your entire wallet balance. For inexperienced users, casually clicking “authorize all assets” could become the first step toward instant financial ruin.

Beneath the convenience lies a minefield:

-

Clicking “authorize all assets” is like permanently handing your bank card and PIN to a stranger;

-

Hyped-up high yields may conceal 100% slippage, hidden pool vulnerabilities, or other risks;

-

Most users don’t realize certain contract authorizations allow indefinite control over their wallets;

Real-world case: In 2023, a user lost $180,000 within two minutes after accidentally clicking a phishing link—performing what looked like a simple payment scan, yet resulting in catastrophic loss.

Why is every chain chasing "foolproof interaction"?

The reason is simple: on-chain interaction remains extremely complex and intimidating for newcomers. You need to download a wallet, securely manage recovery phrases, understand gas fees, navigate cross-chain bridges, grasp token swaps, assess contract risks, approve transactions, sign messages… Any mistake along this path could lead to irreversible asset loss. Even after completing an action, users must still verify execution success and remember to revoke unnecessary permissions.

For Web2 users without technical backgrounds, this learning curve feels like needing to master a new language just to pay via smartphone. To enable seamless entry into the on-chain world, this "technical mountain" must be flattened. That’s where interaction tools like Shogun SDK come in—condensing 100-step processes into one click, reducing user experience from "expert-level operation" to the simplicity of "Alipay-style QR scanning."

From a broader ecosystem perspective, infrastructure like RaaS (Rollup-as-a-Service) and one-click chain deployment platforms are maturing rapidly. Launching a blockchain used to require writing low-level code, deploying consensus mechanisms, building explorers, and designing frontends—often taking months. Now, using services like Conduit, Caldera, or AltLayer, teams can launch a functional EVM-compatible chain in weeks, complete with governance tokens, economic models, and block explorers—almost as easy as opening an online store. This democratizes on-chain entrepreneurship, enabling any project team, community, or even hackathon group to "launch a chain."

But low technical barrier ≠ easy cold start

Many assume that "quickly launching a chain" guarantees success. In reality, the biggest hurdle isn't "can we build it?" but "will anyone actually use it?" Technology is merely the entry ticket. The real determinant of survival is whether genuine, sustainable user behavior can be cultivated.

Subsidies and airdrops can indeed attract large numbers of users and TVL initially—like a bubble tea shop offering free drinks and drawing lines around the block. But when promotions end, just as prices return to normal, if the product tastes bad or service is poor, customers walk away instantly—and so does the crowd.

The same applies on-chain: many new chains show impressive TVL during subsidy periods, but much of it comes from circular staking among projects, foundations, or institutions—creating artificial metrics without real user growth or transaction volume. Once subsidies and high APYs end, liquidity vanishes like receding tides, trading volumes plummet, and TVL evaporates.

Worse, if there’s no real demand for transactions, subsidy-driven capital creates only short-term arbitrage loops—users aim to "farm and dump," not engage with apps or contribute to ecosystem sustainability. The higher the rewards, the more speculative capital floods in; the faster they flee when incentives stop. What truly determines a chain’s successful cold start isn’t the scale of airdrops or subsidies, but whether projects exist that can retain users for ongoing consumption, trading, and community participation. Only then does a public chain begin its journey toward a virtuous cycle.

Berachain’s PoL: How a chain incentivizes real economy

Among emerging chains, Berachain has made intriguing progress. It introduced PoL (Proof of Liquidity)—unlike traditional PoS, which rewards validators, PoL directly distributes inflationary rewards to users who provide liquidity, actively incentivizing real economic activity on-chain.

To illustrate with a real-life analogy: traditional PoS chains are like rewarding shareholders to data centers (nodes) for maintaining servers; Berachain, however, gives shares directly to you—if you deposit assets into DEXs, lending protocols, or LSTs on Berachain and contribute liquidity, you earn continuous rewards.

Even more interesting is Berachain’s three-token design:

-

BERA: Native network token, used for gas fees and as the primary vehicle for PoL rewards;

-

HONEY: Ecosystem stablecoin, used for trading and borrowing;

-

BGT: Governance token, obtainable through locking, enabling voting rights or additional yield.

These three tokens interact synergistically, forming an “earn-use-govern” flywheel that keeps capital circulating within the chain while boosting governance engagement.

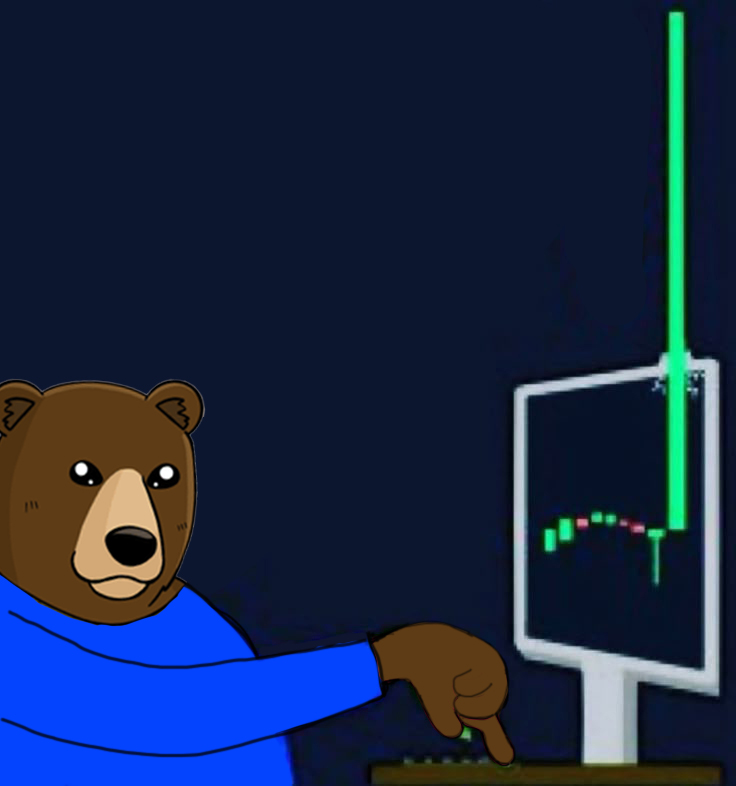

Data-wise, Berachain’s mainnet launched just five months ago, yet TVL is nearing $600 million, with over 150 native projects active. Compared to popular L1s like Solana, Sui, and Avalanche, its MC/TVL ratio stands at only 0.3x (industry average typically exceeds 1x), suggesting current market cap hasn't fully reflected its on-chain economic value.

This data has sparked divergent community sentiment:

-

Bearish camp (FUD): Fears PoL encourages "mine-and-dump" behavior, worrying about long-term price pressure;

-

Bullish camp (Bull): Believes PoL-driven real transactions and ecosystem adoption will drive prices upward over time.

The key lies in whether real transaction demand emerges within the ecosystem—otherwise, high APY subsidies risk devolving into Ponzi-like cycles.

Encouragingly, several projects within the ecosystem already generate real transaction revenue:

-

PuffPaw: Uses a “Vape-to-Earn” model to incentivize smoking cessation, linking health behaviors with token rewards, and has partnered with 50+ medical institutions across 17 countries;

-

DEXs, lending, and LST projects like Kodiak, Dolomite, and Infrared are driving real asset transactions and steadily growing TVL.

The activity and revenue potential of such projects are crucial to solving the "unsustainable subsidized liquidity" dilemma.

Other chains’ cold-start experiments

As launching blockchains becomes as easy as opening an online store, the competitive edge shifts to: Can the chain sustainably generate real transaction demand and fees, rather than relying on subsidies to prop up TVL?

Different chains are pursuing breakthroughs through unique narratives:

-

Pharos Network: Focuses on RWA (real-world assets), bringing physical assets on-chain;

-

Initia: Takes an unconventional approach via sub-chains and ecosystem fragmentation;

-

New ecosystems like HyperEVM attract projects through multi-chain deployments to boost their own transaction volume.

All these efforts point to the same fundamental question: Without real usage, subsidy funds will eventually run dry. Only when people actively use the chain, pay fees, and choose to keep capital onboard can a true flywheel effect begin.

Final thoughts

Simplifying DeFi operations and lowering barriers are indeed essential steps toward broader blockchain adoption. But this path cannot rely solely on “one-click interactions.” It must be paired with user education, transparent risk controls, and economically sustainable models driven by real ecosystem demand.

Otherwise, the convenience of “letting everyone interact with one click” may simply turn into a disaster of “losing everything with one click.”

Just as e-commerce sellers know: coupons can attract new customers, but what truly sustains a business is loyal repeat buyers. Building a blockchain is no different. True cold start begins when users feel confident using it, understand what they're doing, and continue generating real transactions—only then does the engine truly ignite.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News