Arthur Hayes: The real stablecoin play isn't betting on Circle—go long Bitcoin and JPMorgan

TechFlow Selected TechFlow Selected

Arthur Hayes: The real stablecoin play isn't betting on Circle—go long Bitcoin and JPMorgan

Stop sitting on the sidelines, waiting for Powell to "bless" the bull market.

Author: Arthur Hayes

Translation: TechFlow

(The views expressed in this article are those of the author alone and do not constitute the basis for investment decisions, nor should they be construed as recommendations or advice regarding investment transactions.)

Equity investors have been chanting: "Stablecoins, stablecoins, stablecoins; Circle, Circle, Circle."

Why such enthusiasm? Because the U.S. Treasury Secretary (BBC) said so:

The result is this chart:

This chart compares the market capitalizations of Circle and Coinbase. Keep in mind that Circle must hand over 50% of its net interest income to its "dad," Coinbase. Yet, Circle's market cap is nearly 45% of Coinbase’s. This naturally invites reflection...

Another result is this painful chart (painful because I hold Bitcoin instead of $CRCL):

This chart shows Circle’s price divided by Bitcoin’s price, indexed at 100 from Circle’s IPO date. Since its IPO, Circle has outperformed Bitcoin by nearly 472%.

Crypto enthusiasts should ask themselves: Why does BBC favor stablecoins so much? Why did the "Genius Act" gain bipartisan support? Do U.S. politicians truly care about financial freedom—or is there another motive?

Perhaps politicians do care about financial freedom at an abstract level, but hollow ideals don’t drive action. There must be more concrete reasons behind their sudden embrace of stablecoins.

Recall 2019, when Facebook attempted to integrate the Libra stablecoin into its social media empire, only to have it shelved due to opposition from policymakers and the Federal Reserve. To understand BBC’s enthusiasm for stablecoins, we need to examine the core problems he faces.

U.S. Treasury Secretary Scott “BBC” Bessent confronts the same fundamental challenge as his predecessor Janet “Bad Girl” Yellen: their superiors—the President and Congress—love spending but hate raising taxes. The burden of funding government operations through borrowing at reasonable rates thus falls on the Treasury Secretary.

But soon enough, markets showed little appetite for long-term sovereign debt from highly indebted developed economies—especially at high prices and low yields. This is the “fiscal dilemma” that both BBC and Yellen have witnessed over recent years:

The Trampoline Effect of Global Sovereign Bond Yields:

Here is a comparison of 30-year bond yields: UK (white), Japan (gold), USA (green), Germany (pink), France (red).

If rising yields weren’t bad enough, the real value of these bonds is even worse:

Real Value = Bond Price / Gold Price

TLT US is an ETF tracking U.S. Treasuries with maturities over 20 years. The following chart shows TLT US divided by gold price, indexed at 100. Over the past five years, the real value of long-term Treasuries has plummeted by 71%.

If past performance isn't concerning enough, Yellen and current Treasury Secretary Bessent also face the following constraints:

The Treasury’s bond sales team must design an issuance plan to meet these demands:

-

Approximately $2 trillion in annual federal deficits

-

$3.1 trillion in debt maturing in 2025

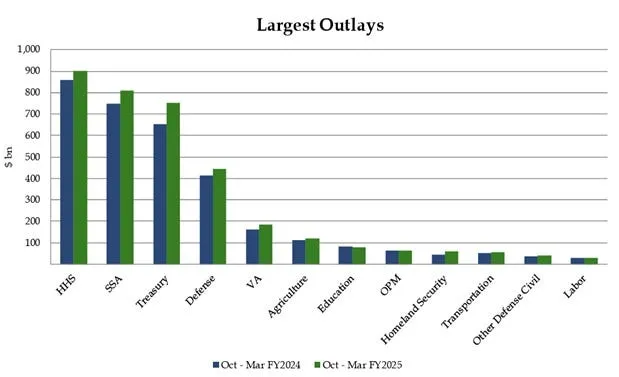

This chart details major U.S. federal government spending items and their year-on-year changes. Note that each major expenditure is growing at or faster than nominal U.S. GDP growth.

The previous two charts show that the weighted average interest rate on currently outstanding U.S. debt lies below all points on the Treasury yield curve.

-

The financial system uses nominally risk-free Treasuries as collateral to issue credit. Interest must therefore be paid, or else the government risks nominal default—a scenario that would destroy the entire fiat financial system. Since the yield curve is now above the weighted average rate of existing debt, interest expenses will keep rising as maturing debt is refinanced at higher rates.

-

Military spending won’t decrease, given that the U.S. is currently involved in conflicts in Ukraine and the Middle East.

-

Healthcare spending will continue to rise, especially in the early 2030s when the Baby Boomer generation reaches peak medical needs, largely funded by Big Pharma companies backed by the U.S. government.

Keep the 10-Year Treasury Yield Below 5%

-

When the 10-year yield approaches 5%, the MOVE index (measuring bond market volatility) spikes, often heralding financial crises.

Issue Debt in a Way That Stimulates Financial Markets

-

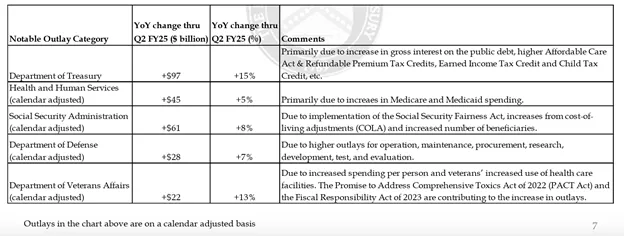

Data from the Congressional Budget Office shows that despite data only going up to 2021, after the 2008 global financial crisis, the U.S. stock market continued to rise, driving capital gains tax revenues upward.

-

The U.S. government relies on taxing year-after-year gains in the stock market to avoid massive fiscal shortfalls.

U.S. government policy has always favored wealthy asset owners. In the past, only property-owning white men could vote. Although modern America has universal suffrage, power still resides with the few who control wealth in public companies. Data shows that roughly 10% of households own over 90% of stock market wealth.

A clear example was during the 2008 global financial crisis, when the Federal Reserve printed money to bail out banks and the financial system, yet allowed those same banks to foreclose on people’s homes and businesses. This phenomenon—“socialism for the rich, capitalism for the poor”—explains why New York City mayoral candidate Mamdani is so popular among the poor—they want a taste of that “socialism” too.

During periods of Federal Reserve quantitative easing (QE), the Treasury Secretary’s job was relatively easy. The Fed printed money to buy bonds, enabling cheap government borrowing while simultaneously boosting equity markets. But now, at least outwardly, the Fed must appear committed to fighting inflation and cannot cut rates or restart QE. Thus, the Treasury Department must shoulder the burden alone.

In September 2022, amid concerns over the sustainability of the largest peacetime deficit in U.S. history and the Fed’s hawkish stance, markets began marginally selling bonds. The 10-year yield nearly doubled within two months, and equities fell nearly 20% from summer highs. At that point, former Treasury Secretary Yellen introduced what Hudson Bay Capital called “Aggressive Treasury Issuance” (ATI)—issuing more short-term Treasury bills rather than coupon-bearing bonds—to drain $2.5 trillion from the Fed’s Reverse Repo (RRP) facility and inject liquidity into financial markets.

This policy successfully achieved its goals: controlling yields, stabilizing markets, and stimulating the economy. However, RRP balances are now nearly depleted. The question facing current Treasury Secretary Bessent is: under current conditions, how can he find trillions of dollars to buy Treasuries at high prices and low yields?

Q3 2022 was extremely difficult for markets. The following chart compares the Nasdaq 100 (green) with the 10-year Treasury yield (white). As yields spiked, equities plunged sharply.

The ATI policy effectively reduced RRP (red) and drove up financial assets like the Nasdaq 100 (green) and Bitcoin (magenta). The 10-year yield (white) never broke above 5%.

Major U.S. “Too Big To Fail” (TBTF) banks have two pools of funds ready to purchase trillions in Treasuries whenever profit potential is sufficient. These two pools are:

-

Demand/Time Deposits

-

Reserves Held at the Federal Reserve

This article focuses on eight TBTF banks because their existence and profitability depend on government guarantees on their liabilities, and regulatory policies tend to favor them over non-TBTF institutions. Therefore, as long as a reasonable profit is available, these banks will comply with government requests. If the Treasury Secretary (BBC) asks them to buy Treasuries, he will offer risk-free returns in return.

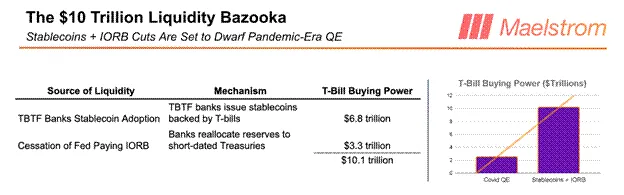

BBC’s enthusiasm for stablecoins may stem from the fact that issuing stablecoins allows TBTF banks to unleash up to $6.8 trillion in Treasury bill purchasing power. These dormant deposits can be re-leveraged within the fiat financial system, pushing markets upward. The next section will detail how issuing stablecoins enables Treasury bill purchases and boosts TBTF bank profitability.

Additionally, we’ll briefly explain how stopping interest payments on reserves could release another $3.3 trillion for Treasury purchases—an approach technically not QE, but one that would similarly benefit fixed-supply monetary assets like Bitcoin.

Now, let’s turn to BBC’s new favorite toy—the stablecoin, this “monetary weapon of mass construction.”

Stablecoin Liquidity Model

My forecast rests on several key assumptions:

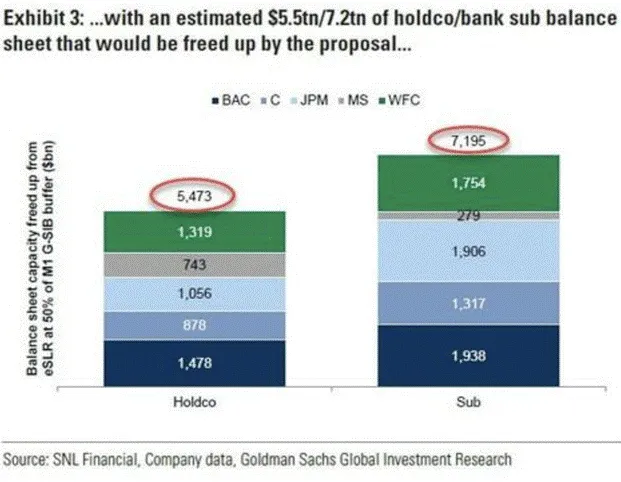

Treasuries Receive Full or Partial Exemption from the Supplementary Leverage Ratio (SLR)

-

Implication of Exemption: Banks won’t need to hold equity capital against their Treasury portfolios. With full exemption, banks could buy Treasuries with infinite leverage.

-

Recent Policy Shift: The Fed recently voted to reduce capital requirements for banks holding Treasuries. This proposal is expected to free up as much as $5.5 trillion in bank balance sheet capacity for Treasury purchases within the next three to six months. Markets are forward-looking, so this buying power may enter the Treasury market early, lowering yields ceteris paribus.

Banks Are Profit-Seeking, Loss-Minimizing Organizations

-

Lessons from Long-Term Treasury Risks: From 2020 to 2022, the Fed and Treasury urged banks to load up on Treasuries, prompting widespread purchases of longer-dated, higher-yielding coupon bonds. By April 2023, however, the fastest rate hikes since the 1980s caused massive mark-to-market losses, leading to the collapse of three banks within a week.

-

The TBTF Safety Net: Within the TBTF sector, JPMorgan Chase’s “held-to-maturity” bond portfolio is already underwater by more than its total equity capital. Were it forced to mark to market, the bank would be insolvent. To resolve the crisis, the Fed and Treasury effectively nationalized the entire U.S. banking system via the Bank Term Funding Program (BTFP). Non-TBTF banks remain vulnerable—any management team that causes failure due to Treasury losses will be replaced, and the bank sold cheaply to Jamie Dimon or another TBTF player. Hence, bank CIOs are wary of loading up on long-dated Treasuries, fearing the Fed might again pull the rug out via rate hikes.

-

Attractiveness of T-Bills: Banks will buy T-bills because they are high-yield, zero-duration cash-like instruments.

-

High Net Interest Margin (NIM) Is Key: Banks will only use deposits to buy T-bills if they generate strong NIM and require little or no capital backing.

JPMorgan recently announced plans to launch a stablecoin called JPMD, running on Base, Coinbase’s Ethereum Layer-2 network. This means JPMorgan deposits will fall into two categories:

-

Traditional Deposits (Regular Deposits)

-

Though digital, movement within the financial system requires banks to interface using outdated legacy systems, requiring significant manual oversight.

-

Traditional deposits can only be transferred Monday through Friday, 9 AM to 4:30 PM.

-

Yields are extremely low. According to FDIC data, the average regular checking account earns just 0.07%, and one-year CDs pay 1.62%.

-

-

Stablecoin Deposits (JPMD)

-

JPMD runs on a public blockchain (Base), accessible 24/7/365.

-

By law, JPMD cannot pay interest, but JPMorgan may attract customers to convert traditional deposits into JPMD through generous cash-back rewards.

-

Whether staking yield will be permitted remains unclear.

-

Staking Yield: Customers lock up JPMD with JPMorgan and earn a return.

-

Customers will shift funds from traditional deposits to JPMD because JPMD is more functional, and banks will offer cash-back incentives. Currently, TBTF banks hold around $6.8 trillion in demand and time deposits. Given the superiority of stablecoin products, traditional deposits will rapidly convert to JPMD or similar stablecoins issued by other TBTF banks.

If all traditional deposits convert to JPMD, JPMorgan could drastically cut compliance and operations costs. Here’s why:

The first reason is cost reduction. If all traditional deposits become JPMD, JPMorgan could effectively eliminate its compliance and operations departments. Let me explain why Jamie Dimon gets so excited when he understands how stablecoins actually work.

Compliance, at a high level, consists of rules set by regulators and enforced by humans using 1990s-era technology. These rules follow an “if-this-then-that” structure. Such logic can be interpreted by a senior compliance officer and encoded into rules perfectly executed by AI agents. Since JPMD offers fully transparent transaction records (all public addresses are public), an AI agent trained on relevant regulations can ensure certain transactions are never approved. AI can instantly generate any report requested by regulators, and regulators can verify data accuracy because all data lives on the public blockchain. Overall, “Too Big To Fail” (TBTF) banks spend $20 billion annually on compliance and the operational/technical infrastructure required to meet banking regulations. Converting all traditional deposits to stablecoins could reduce this cost to near zero.

The second reason JPMorgan pushes JPMD is that it allows the bank to risklessly use custodied stablecoin assets (AUC) to buy billions in Treasury bills (T-bills). This is because T-bills carry almost no interest rate risk and yield close to the Fed Funds Rate. Recall that under new SLR rules, TBTF banks now have $5.5 trillion in T-bill purchasing capacity. The banks need idle cash reserves to fund these purchases—and stablecoin-held deposits are ideal.

Some readers may argue JPMorgan can already buy T-bills with traditional deposits. My response: stablecoins are the future because they not only improve customer experience but also save TBTF banks $20 billion in costs. That alone is enough incentive for banks to adopt stablecoins; additional NIM gains are just icing on the cake.

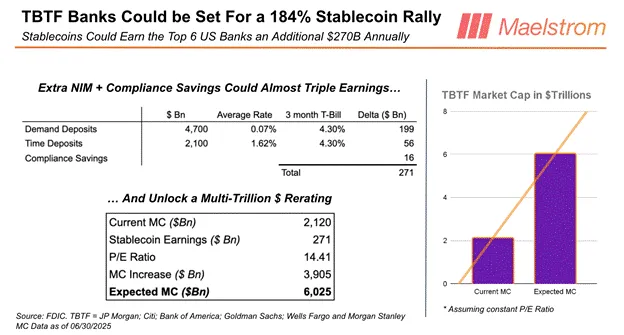

I know many readers may want to invest their hard-earned money into Circle ($CRCL) or the next shiny stablecoin issuer. But don’t underestimate the profit potential of “Too Big To Fail” (TBTF) banks in the stablecoin space. If we take the average P/E ratio of TBTF banks—14.41—and multiply it by cost savings and stablecoin NIM potential, the result is $3.91 trillion.

The current combined market cap of the eight TBTF banks is about $2.1 trillion, meaning stablecoins could lift their stock prices by an average of 184%. If there’s a scalable, contrarian investment strategy, it’s going long an equal-weight basket of TBTF bank stocks based on this stablecoin thesis.

What About Competition?

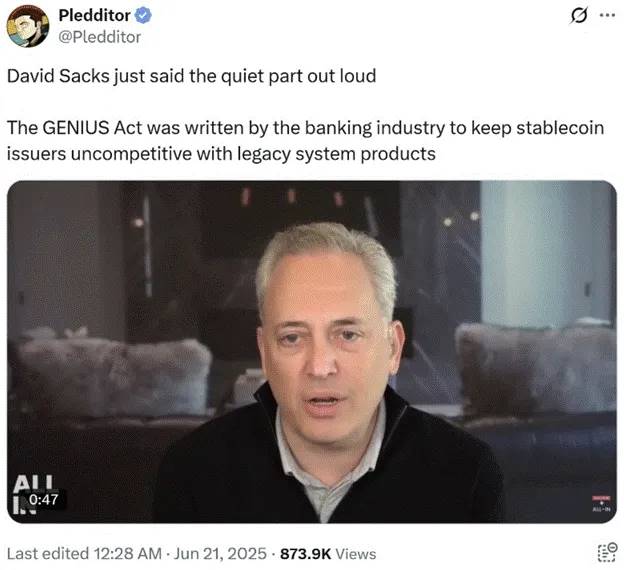

Don’t worry—The Genius Act ensures non-bank stablecoin issuers cannot compete at scale. The bill explicitly bans tech giants like Meta from issuing their own stablecoins; they must partner with banks or fintech firms. Sure, anyone could theoretically obtain a bank charter or acquire an existing bank, but all new owners must win regulatory approval. How long that takes? Stay tuned.

Another provision hands the stablecoin market to banks by banning interest payments to stablecoin holders. Without the ability to pay interest, fintech firms cannot lure deposits away from banks at low cost. Even successful issuers like Circle will never access the $6.8 trillion TBTF traditional deposit market.

Moreover, fintech companies like Circle and small banks lack government guarantees on their liabilities, unlike TBTF banks. If my mother were to use a stablecoin, she’d choose one issued by a TBTF bank. People of her Baby Boomer generation will never trust fintech or small banks for such purposes due to the absence of government backing.

David Sachs, former Trump administration “crypto czar,” agrees. I believe many corporate crypto donors will be disappointed—after donating so much to crypto-friendly campaigns, they’ve been quietly shut out of America’s lucrative stablecoin market. Perhaps they should change tactics and genuinely advocate for financial freedom, rather than just providing a footstool for TBTF bank CEOs’ toilets.

In short, TBTF (Too Big To Fail) banks adopting stablecoins eliminates competition from fintech firms for their deposit base, reduces reliance on expensive and error-prone human compliance officers, and increases net interest margins (NIM) by avoiding interest payments—all of which drives stock prices higher. In return, grateful for the “gift” of stablecoins granted by The BBC Act, TBTF banks will purchase up to $6.8 trillion in Treasury bills (T-bills).

ATI: Yellen’s Playbook—Stablecoins and The BBC Act

Next, I’ll discuss how The BBC Act could release another $3.3 trillion in idle reserves from the Fed’s balance sheet.

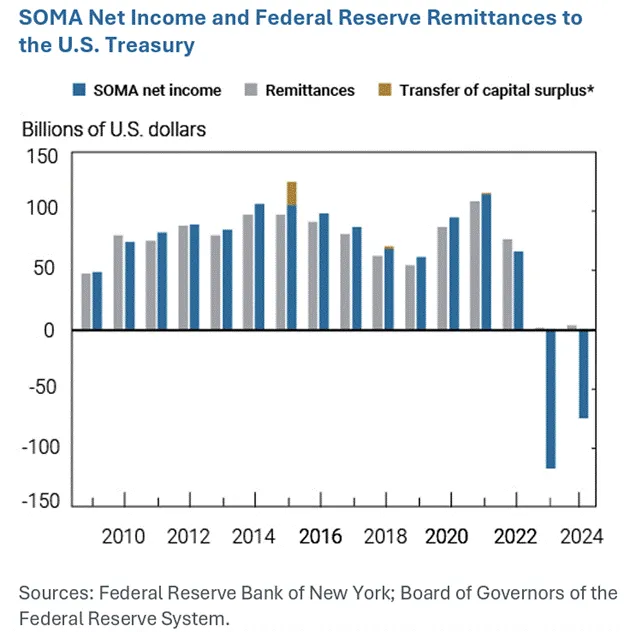

Interest on Reserve Balances (IORB)

After the 2008 Global Financial Crisis (GFC), the Fed decided to prevent bank failures due to reserve shortages. It created reserves by buying T-bills and mortgage-backed securities (MBS) from banks—a process known as Quantitative Easing (QE). These reserves sat quietly on the Fed’s balance sheet. In theory, banks could convert these reserves into circulating currency and lend them out, but they chose not to—because the Fed paid them enough interest to sit on the reserves instead. This way, the Fed “froze” these reserves to prevent inflation from spiking further.

However, the Fed now faces a problem: when it raises rates, IORB payments also increase. This is problematic because the unrealized losses on the Fed’s bond portfolio grow alongside rising rates. The result: the Fed is trapped in insolvency and negative cash flow. But this negative cash flow is purely a policy choice—and thus reversible.

Senator Ted Cruz recently suggested the Fed should stop paying IORB. This would force banks to make up lost interest income by converting reserves into T-bills. Specifically, I believe banks would buy T-bills due to their high yield and cash-like nature.

According to Reuters, Ted Cruz has been urging Senate colleagues to strip the Fed of its authority to pay banks interest on reserves, arguing this change could significantly reduce the fiscal deficit.

Why should the Fed print money and block banks from supporting the “Empire”? There’s no good reason for politicians to oppose this policy shift. Both Democrats and Republicans love fiscal deficits—so why not unleash $3.3 trillion in bank purchasing power into the Treasury market, allowing them to spend even more? Given the Fed’s unwillingness to assist the “Trump team” in financing an “America First” agenda, I believe Republican lawmakers will use their majority in both chambers to revoke this Fed power. So next time yields spike, legislators will be ready to release this flood of funds to support unchecked spending.

Before concluding, I want to outline Maelstrom’s cautious strategy positioning between now and Q3, amid the inevitable increase in dollar liquidity once The BBC Act is implemented.

A Cautionary Tale

While I’m very bullish long-term, I believe dollar liquidity creation may experience a brief pause after Trump’s spending bill—dubbed the “Big Beautiful Bill”—passes.

Under current bill language, the legislation will raise the debt ceiling. While many provisions will be bargaining chips, Trump won’t sign a bill that doesn’t raise the ceiling—he needs extra borrowing capacity to fund his agenda. There’s no indication Republicans will push for spending cuts. So for traders, the question becomes: what happens to dollar liquidity when the Treasury resumes net borrowing?

Since January 1, the Treasury has primarily funded operations by drawing down its Treasury General Account (TGA) balance. As of June 25, the TGA stood at $364 billion. According to the Treasury’s guidance in its latest quarterly refunding announcement, if the debt ceiling is raised today, the TGA will be replenished to $850 billion through new debt issuance. This would cause a contraction of $486 billion in dollar liquidity.

The only major source of dollar liquidity that could offset this negative shock is the Overnight Reverse Repo Program (RRP), which currently holds $461 billion.

Given the TGA replenishment plan, this isn’t a clear short-Bitcoin trade, but rather a market environment requiring caution—a bull market potentially interrupted by short-term volatility. I expect sideways or slightly lower markets until Jerome Powell’s speech at Jackson Hole in August. If TGA replenishment negatively impacts dollar liquidity, Bitcoin could dip to the $90,000–$95,000 range. If the impact is negligible, Bitcoin may trade around $100,000, struggling to break the $112,000 all-time high.

I suspect Powell may announce an end to Quantitative Tightening (QT) or some seemingly mild but impactful adjustment to bank regulation. By early September, the debt ceiling will be raised, the TGA mostly replenished, and Republicans will focus on winning voters ahead of the November 2026 elections. Then, amid a surge in money creation, bulls will strike back with strong green candles.

Between now and end-August, Maelstrom will increase allocation to staked USDe (Ethena USD). We’ve exited all illiquid altcoin positions and may reduce Bitcoin exposure depending on market behavior. Risky altcoin positions bought around April 9 this year generated 2x to 4x returns within three months. But without clear liquidity catalysts, the altcoin sector may suffer heavy losses.

After the correction, we’ll confidently reposition, hunting for undervalued assets—perhaps capturing 5x to 10x gains before the next slowdown in fiat liquidity creation, expected late 2025 or early 2026.

Checking the Boxes

Systemically important banks’ (TBTF) adoption of stablecoins could unlock up to $6.8 trillion in T-bill purchasing power.

The Fed stopping Interest on Reserve Balances (IORB) could release another $3.3 trillion in T-bill demand.

In total, thanks to “BBC” policies, as much as $10.1 trillion could flow into the T-bill market. If my forecast is correct, this $10.1 trillion liquidity injection would impact risk assets similarly to former Treasury Secretary Yellen’s $2.5 trillion liquidity move—fueling a market “blitzkrieg”!

This adds another arrow to “BBC”’s liquidity quiver. Once Trump’s “Big Beautiful Bill” passes and raises the debt ceiling, this tool may be activated. Soon after, investors will again worry: how can the U.S. Treasury market absorb the flood of new debt without collapsing?

Some still wait for “Monetary Godot”—hoping Fed Chair Powell announces a new round of unlimited QE and rate cuts before they sell bonds and buy crypto. But I tell you, that won’t happen—at least not until the U.S. enters a hot war with Russia, China, or Iran, or a systemically important financial institution is on the brink of collapse. Not even a recession will bring “Godot” forth. So stop listening to that “weak man”—focus on the ones truly in control!

The next few charts will illustrate the opportunity cost investors incur while waiting for “Monetary Godot.”

As the Fed’s balance sheet (white line) shrinks and the effective federal funds rate (gold line) rises, Bitcoin and other risk assets should logically fall.

Yet former Treasury Secretary “Bad Gurl” Yellen didn’t disappoint the wealthy. She implemented ATI (possibly referring to asset-backed liquidity tools) to stabilize markets. During this period, Bitcoin (gold line) rose 5x, while the overnight reverse repo (RRP) balance dropped 95%.

Don’t repeat the same mistake! Many financial advisors still urge clients to buy bonds, predicting yields will fall. I agree central banks will eventually cut rates and print money to prevent sovereign bond market collapse. But even if central banks stay passive, treasuries will act.

The core argument of this article is that by supporting stablecoin regulation, relaxing SLR constraints, and halting IORB payments, the Fed could unleash up to $10.1 trillion in Treasury purchasing power. But is earning 5% to 10% on bonds really worth it? You might miss Bitcoin surging 10x to $1 million or the Nasdaq 100 rocketing 5x to 100,000 points—both plausible by 2028.

The real stablecoin “game” isn’t betting on traditional fintech players like Circle. It’s recognizing that the U.S. government has handed systemically important banks (TBTF) a multi-trillion-dollar “liquidity bazooka” disguised as “innovation.” This isn’t DeFi, nor financial freedom—it’s debt monetization dressed in Ethereum’s clothes. If you’re still waiting for Powell to whisper “QE infinity” before taking risks, congratulations—you’re the market’s greater fool.

Instead, you should go long Bitcoin, go long JPMorgan, and stop wasting time on Circle. The stablecoin Trojan horse has already entered the financial fortress—but inside, it doesn’t carry dreams of libertarians. It’s packed with liquidity destined to buy U.S. Treasury bills. This liquidity will prop up equity markets, cover fiscal gaps, and soothe Baby Boomer anxieties.

Stop sitting on the sidelines waiting for Powell to bless the bull run. “BBC” has finished the preamble and is ready to flood global markets with liquidity. Seize the moment—don’t be a passive bystander.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News