Coinbase: On-Chain Is Booming — Can the "Water Seller" Really Win Effortlessly?

TechFlow Selected TechFlow Selected

Coinbase: On-Chain Is Booming — Can the "Water Seller" Really Win Effortlessly?

Explore the core logic behind Coinbase's business model and future growth.

Author: Dolphin Research, Xueqiu

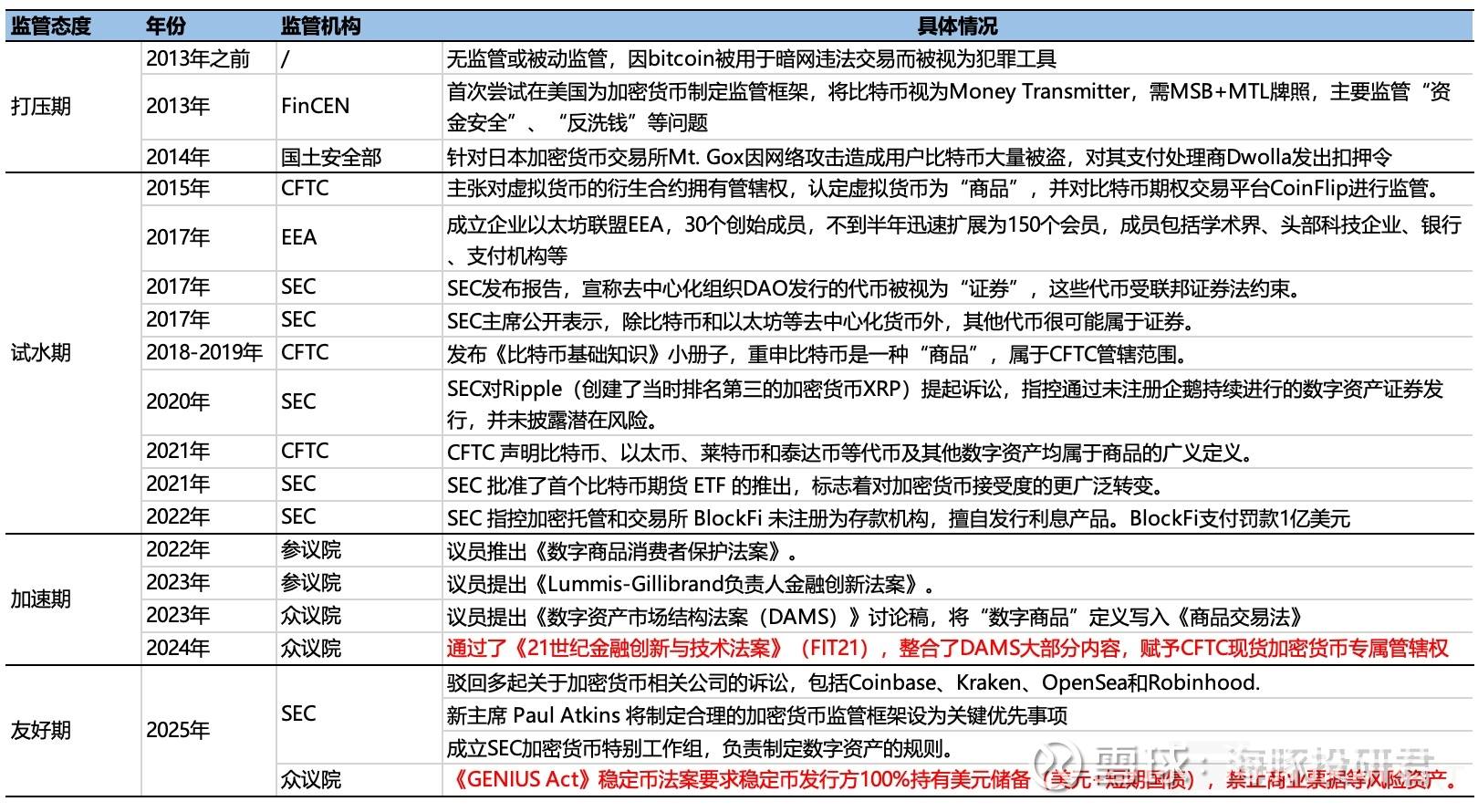

If interest rate cuts, Bitcoin’s halving cycle, weakening dollar credibility, and a Trump administration favorable to crypto regulation have collectively supported the rise of cryptocurrencies since 2022,

as of June 23, the total market capitalization of the crypto space has reached $3.3 trillion—nearly tripling since 2023. Bitcoin, the most well-known cryptocurrency, accounting for over 60% of total market cap, has surged from under $30,000 per coin in mid-2023 to over $100,000 today.

What does $3.3 trillion represent? It equals roughly 3% of global GDP. If we treat the entire crypto asset class as a single national economy or a company named "Crypto," then:

Crypto today equates to the economic scale of a top-tier developed nation—ranking 7th globally, ahead of France;

It also surpasses Apple ($3 trillion) to become the world's third-largest company by market cap. Only Microsoft and NVIDIA, both around $3.6 trillion, remain ahead. Given current trends, Crypto could soon become the largest company in the world.

From a global asset allocation perspective, crypto assets are increasingly hard to ignore. Hence, Dolphin Research has decided to begin tracking this sector.

Given that regulation remains the biggest influencing factor—currently transitioning from strict to gradually more relaxed—we will prioritize studying leading companies with strong business models and high compliance standards.

This crypto series begins with $Coinbase Global(COIN)$, focusing in this article on Coinbase’s business model and core growth logic. The next piece will center on stablecoins and assess the future value of both Coinbase and $Circle(CRCL)$.

Below is the detailed analysis

I. Exchanges Are Not the Endgame

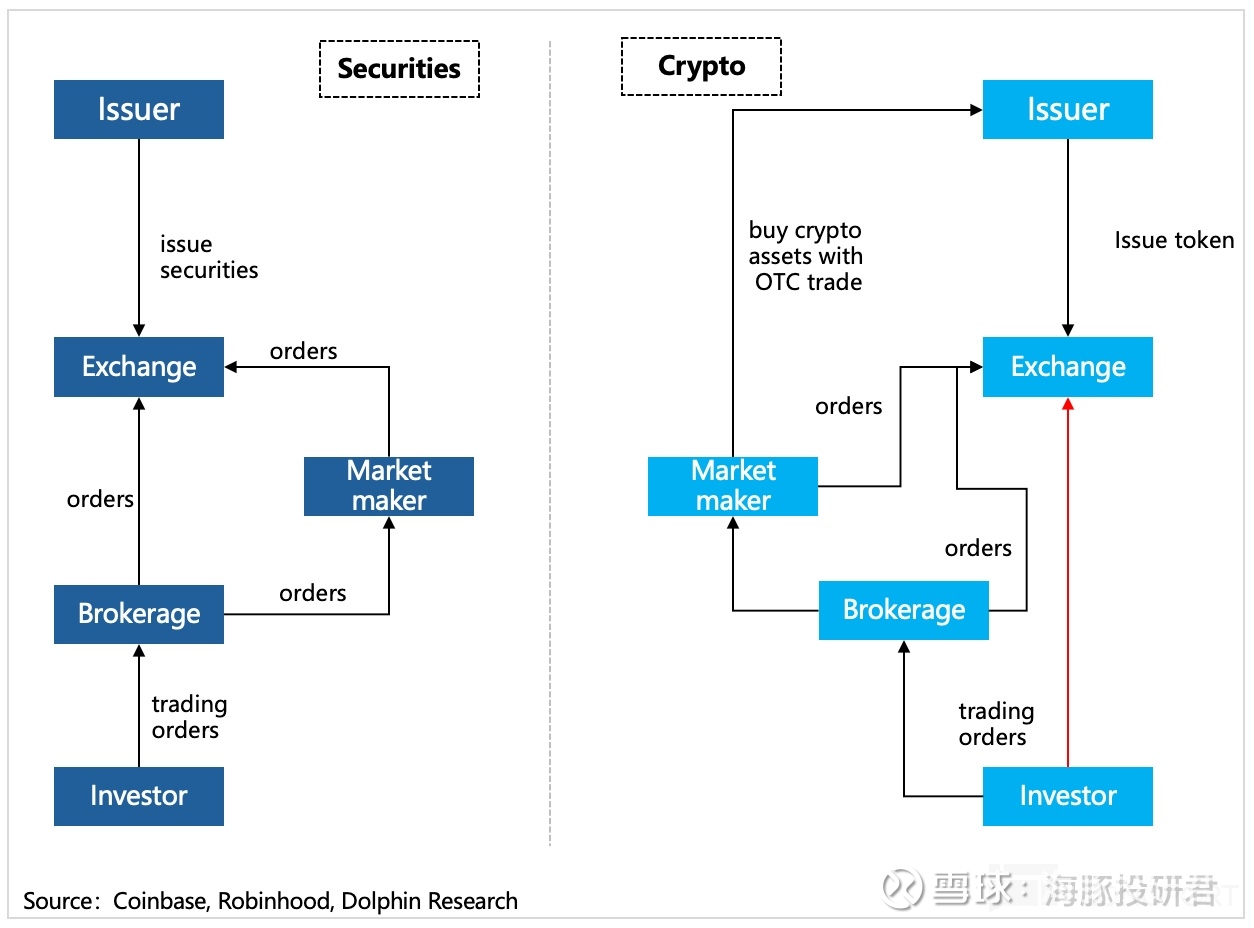

If “cryptocurrencies” are viewed as listed stocks in equity markets or commodity contracts in traditional markets, then Coinbase functions like the NYSE or CME Group—providing fundamental exchange-like services such as price quoting, trade matching, and settlement.

However, unlike traditional exchanges, Coinbase also assumes the role of a “broker”—directly serving investors by offering trading, lending, custody, staking, and withdrawal services.

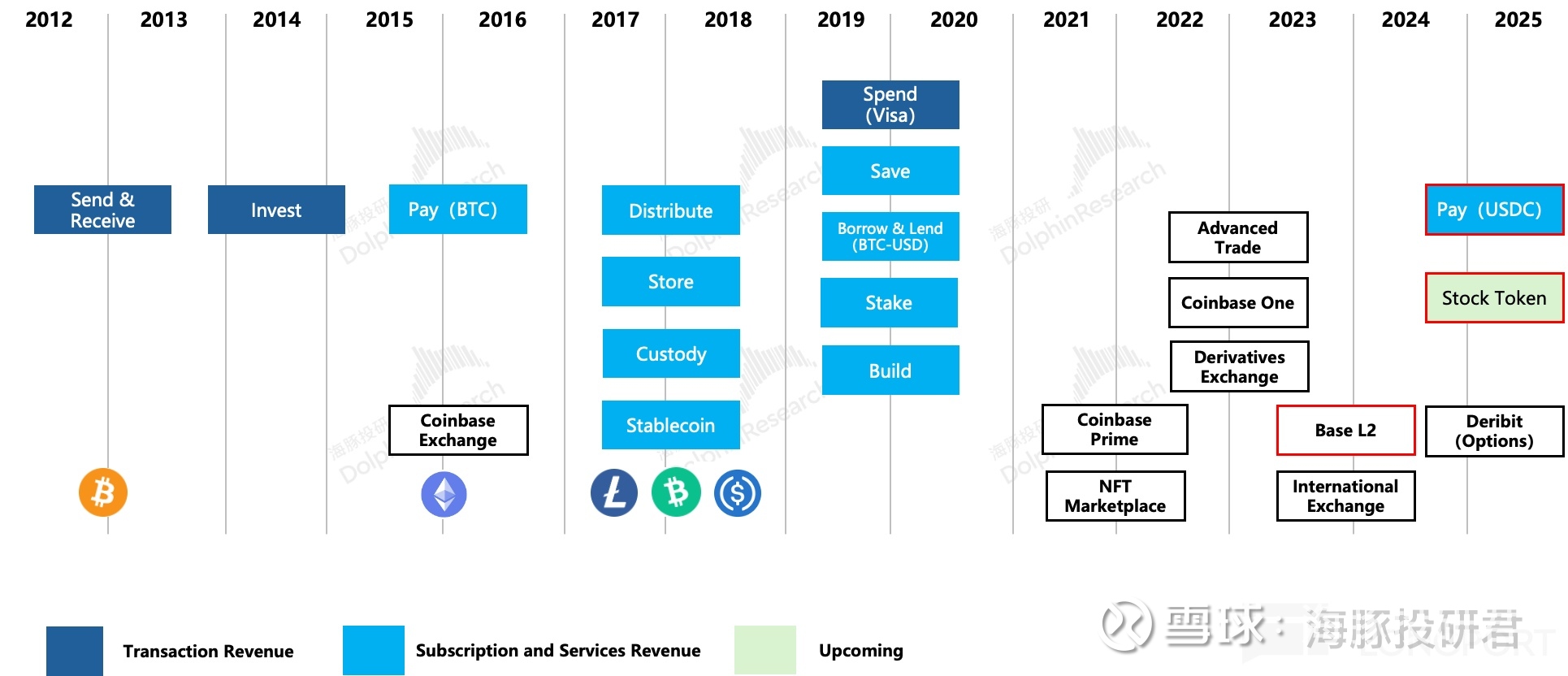

With improvements in digital wallets and merchant ecosystems, Coinbase has expanded BTC-based payment use cases. In 2019, it partnered with Visa to launch the Coinbase Card, enabling users to spend crypto online or offline. Yet widespread adoption has been slow, largely due to crypto’s extreme price volatility. Therefore, only with the emergence and official recognition of stablecoins can Coinbase’s payment initiatives gain real traction.

Beyond trading and payments, Coinbase is applying for a stock token trading platform. If approved by the SEC, users would be able to indirectly invest in equities via Coinbase.

Thus, Coinbase’s future business vision becomes clearer: accelerating real-world asset tokenization and building a comprehensive on-chain financial platform—not merely functioning as a crypto exchange.

Dolphin Research believes that expanding use cases through payments and investments is key to broadening crypto adoption. As these scenarios grow, so does the overall crypto market—and as the “water seller” in this gold rush, Coinbase stands to benefit significantly.

In the crypto ecosystem, platforms like Coinbase not only vertically shorten the industry chain but also rapidly expand across multiple demand scenarios. This expansion was partly enabled by historically lax regulation and favorable conditions for business growth. For leaders like Coinbase—with scale and compliance advantages—increased regulatory scrutiny may actually help eliminate weaker competitors.

Hence, it’s logical that Coinbase should capture a larger share of profits.

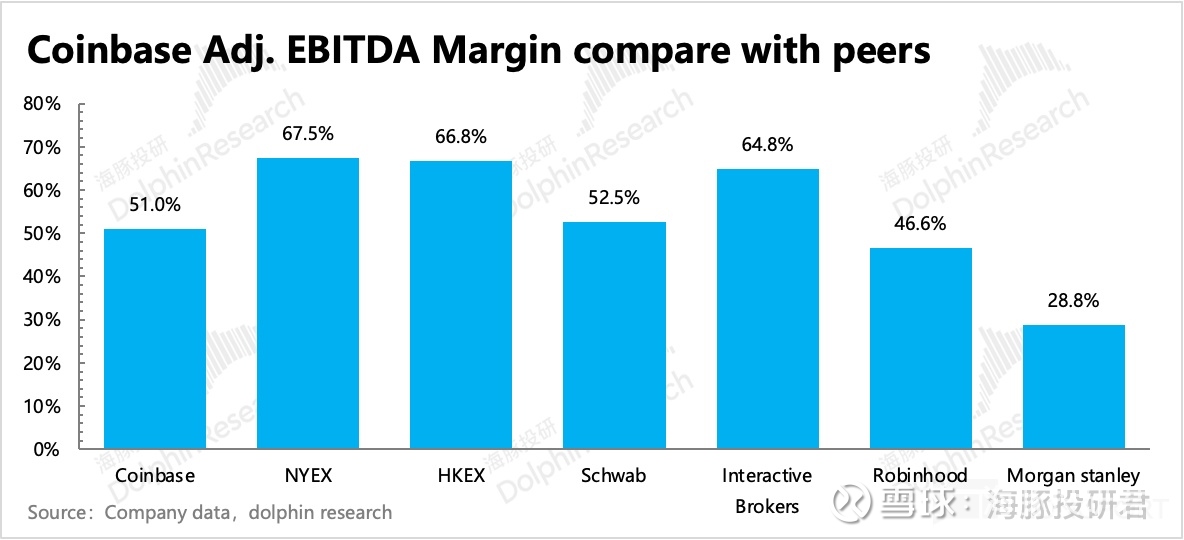

This is indeed the case. However, due to the high volatility of crypto markets, Coinbase’s earnings are unstable. Excluding special periods (e.g., IPOs, acquisitions affecting short-term margins), its normal profitability—measured by margin—typically ranges between 25% and 65%. Despite the wide range, this already aligns with mature traditional financial institutions.

In 2024, Coinbase’s margin resembles that of low-cost or zero-commission brokers like Robinhood, but remains below pure-play exchanges, suggesting it hasn’t fully capitalized on the profit potential from its exchange and integrated产业链 advantages.

As crypto gains broader mainstream acceptance and the market continues to expand, if Coinbase maintains its competitive position, its margin ceiling will gradually rise. In the end state, Dolphin Research believes Coinbase could achieve profitability superior to traditional financial firms.

II. Compliance Advantage Unlocks Value Beyond “Trading”

What kind of competitive landscape does Coinbase face? Dolphin Research analyzes this by reviewing its core business and model.

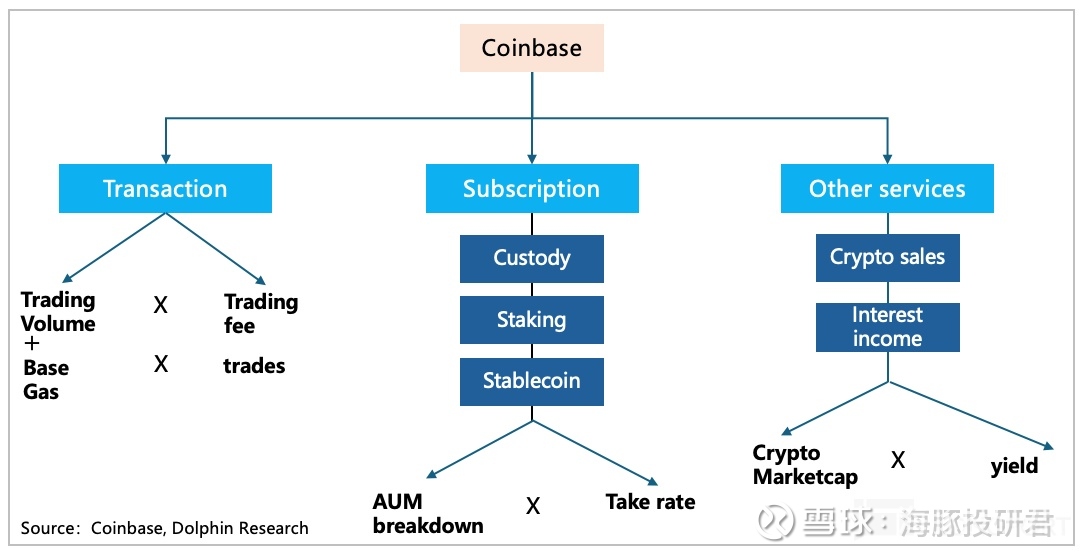

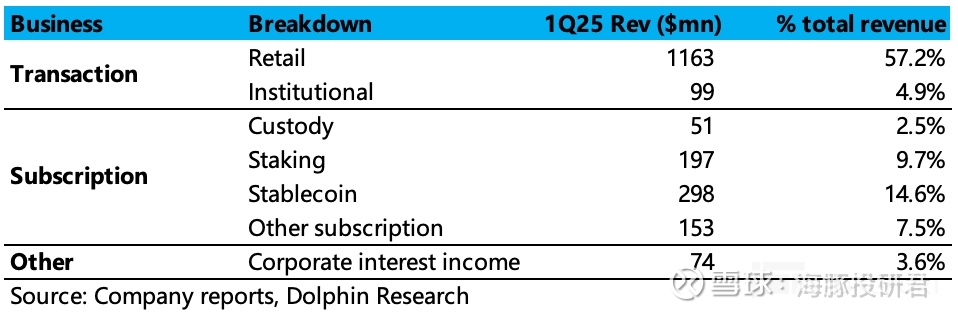

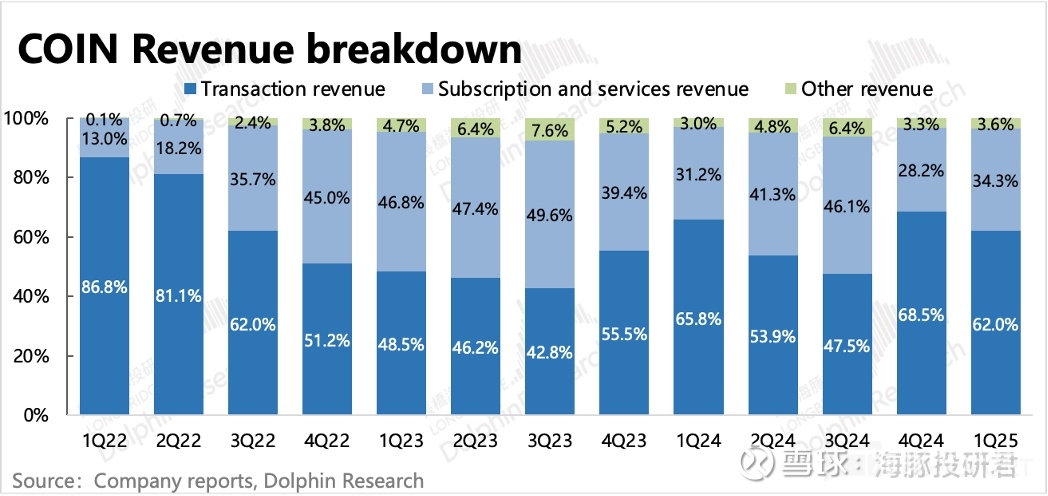

Looking directly at revenue breakdowns, Coinbase has three main income streams: transaction revenue, subscription revenue, and others.

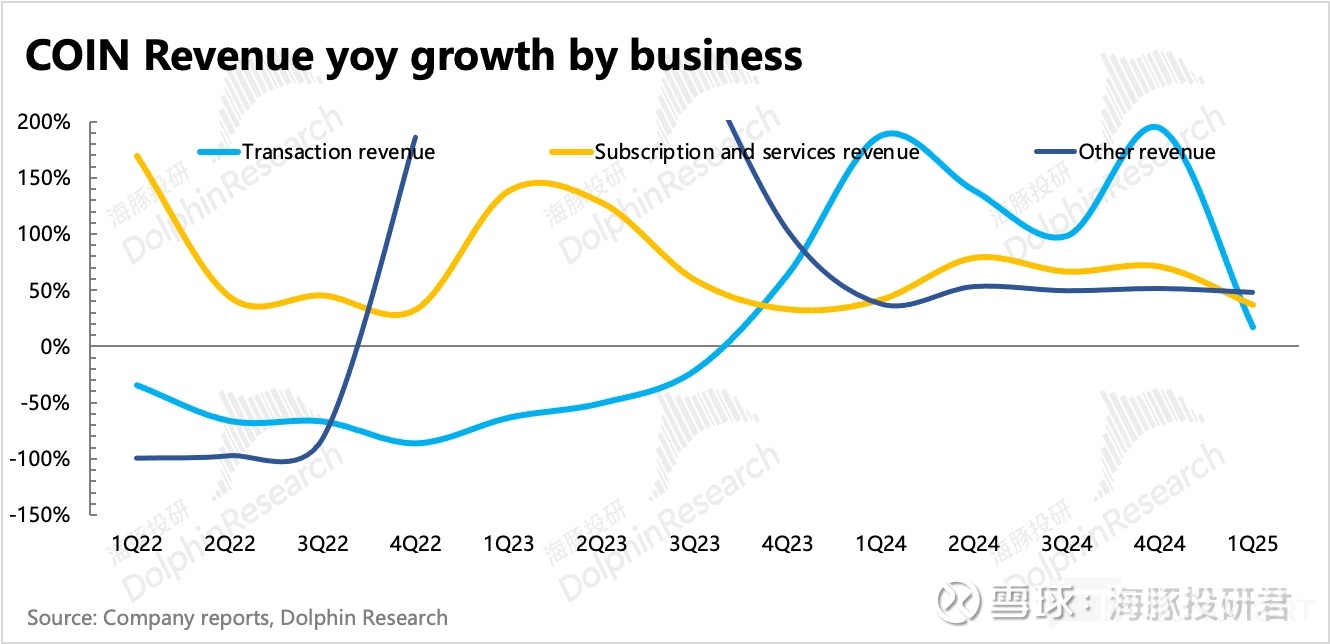

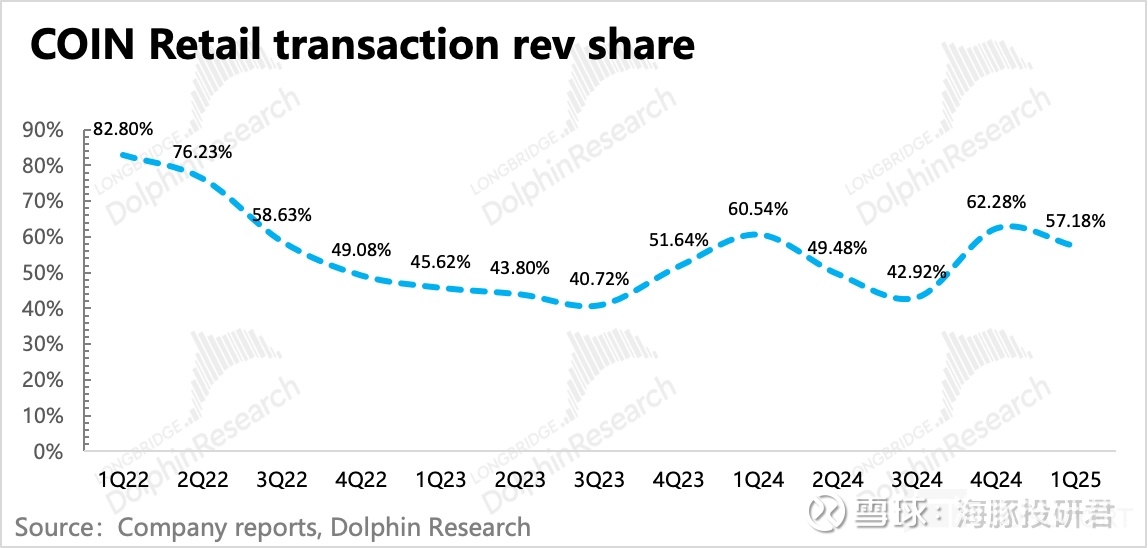

Transaction revenue is highly sensitive to market cycles and currently accounts for about 50% of total revenue—the primary revenue driver. Subscription and other revenues—including custody, settlement, staking, stablecoins, data/cloud services, and investment gains—act as stabilizers, helping smooth out fluctuations in transaction income.

Yet a clear trend emerges: as use cases broaden, competition intensifies, and funding sources evolve, Coinbase’s reliance on transaction revenue will continue to decline.

1. Trading Barriers Will Gradually Lower

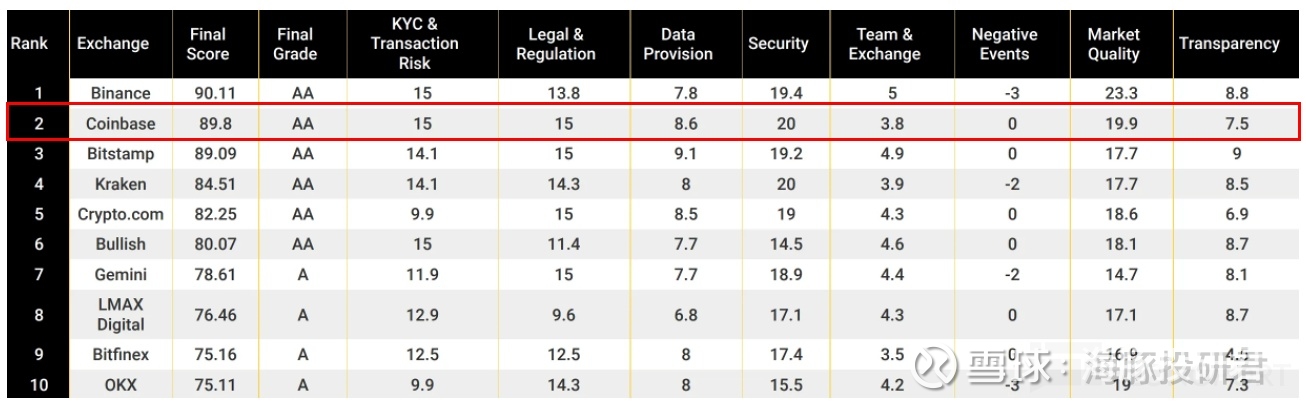

Compared to peers, Coinbase’s strengths lie in compliance and security, while its weaknesses include high retail fees and limited derivatives offerings. Over the past 1–2 years, however, Coinbase has been rapidly catching up.

Source: CoinDesk

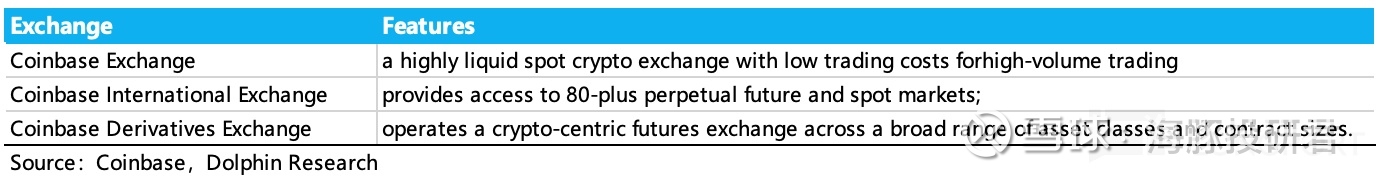

Coinbase operates three exchanges: Coinbase Exchange for spot trading; Coinbase International Exchange (CIE) targeting professional individuals and institutions outside the U.S.; and Coinbase Derivatives Exchange (CDE), formed via acquisition of FairX.

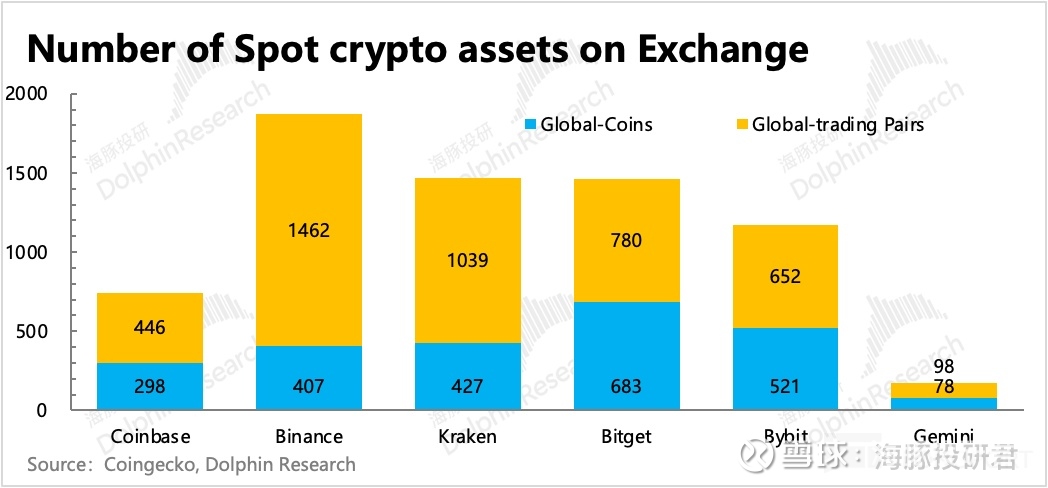

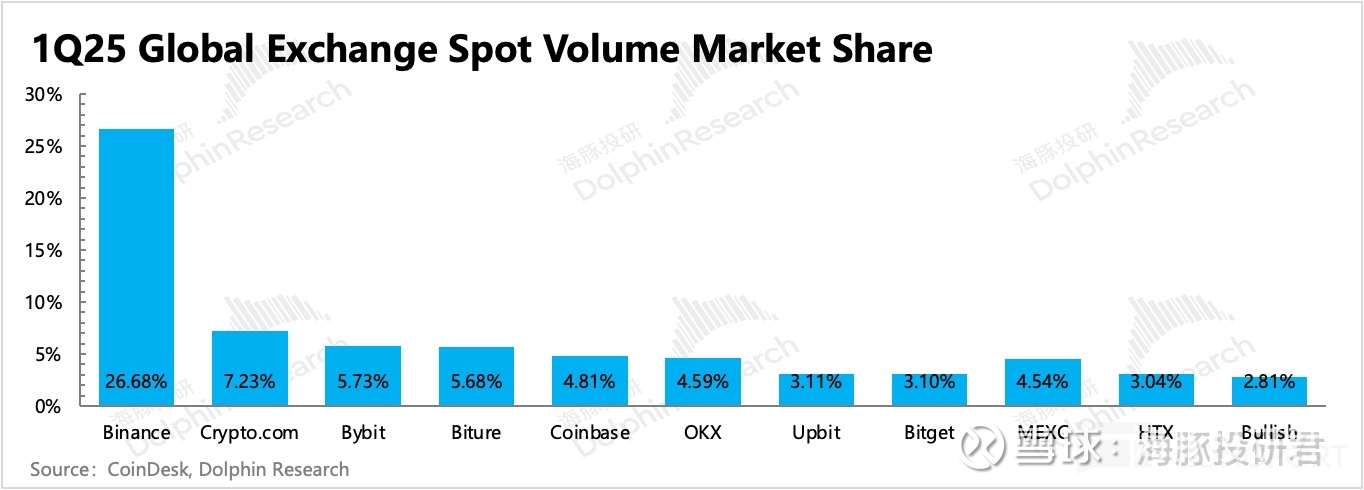

These three exchanges cover nearly 300 major cryptocurrencies available today. In the U.S. spot market, Coinbase leads in product coverage (thanks to compliance barriers limiting rivals’ listing of long-tail tokens). But globally, especially including derivatives, Coinbase lags behind platforms like Binance and Bybit.

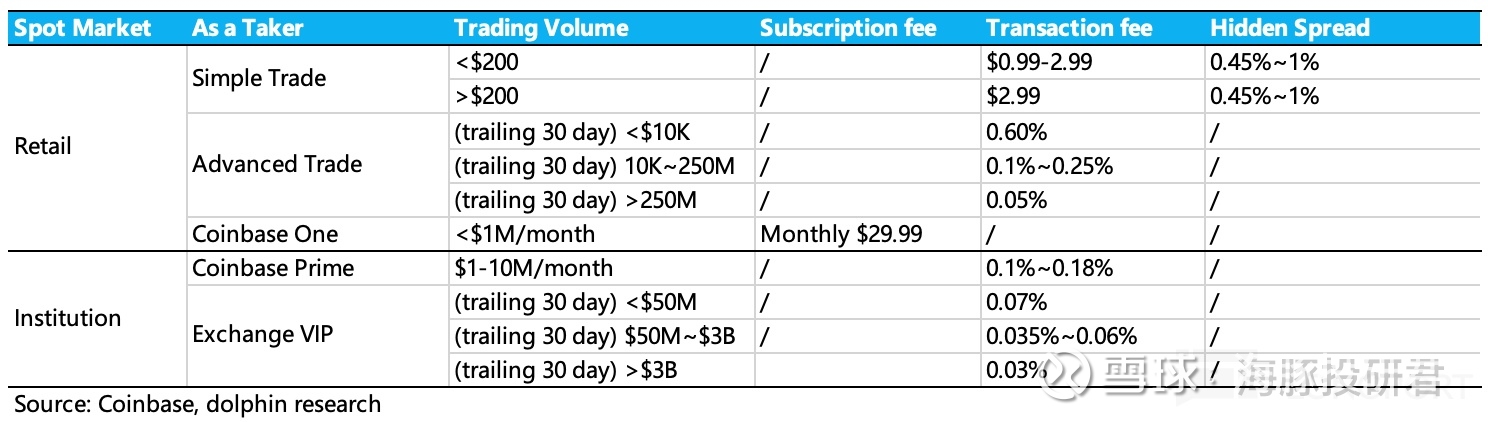

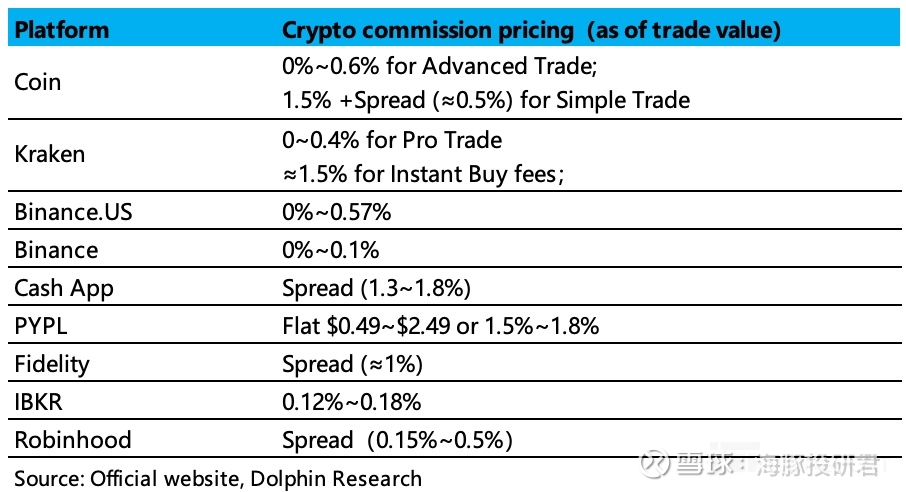

Beyond product range, another key differentiator is trading cost. Like traditional securities, Coinbase charges based on trade volume and tiered fee structures. Below shows taker (immediate order fill) rates; maker (limit order) fees are generally lower:

For retail users, different trading methods (Simple Trade, Advanced Trade, Coinbase One) incur varying costs. Total user cost = “trading fee + hidden spread”:

1) Retail trading costs range from as low as 0.05% to as high as 2.5% (by end of 2022, fees for trades above $200 dropped from 1.49% to max 0.6%).

2) Institutional clients using Prime or Exchange VIP tiers pay between 0.03% and 0.18%.

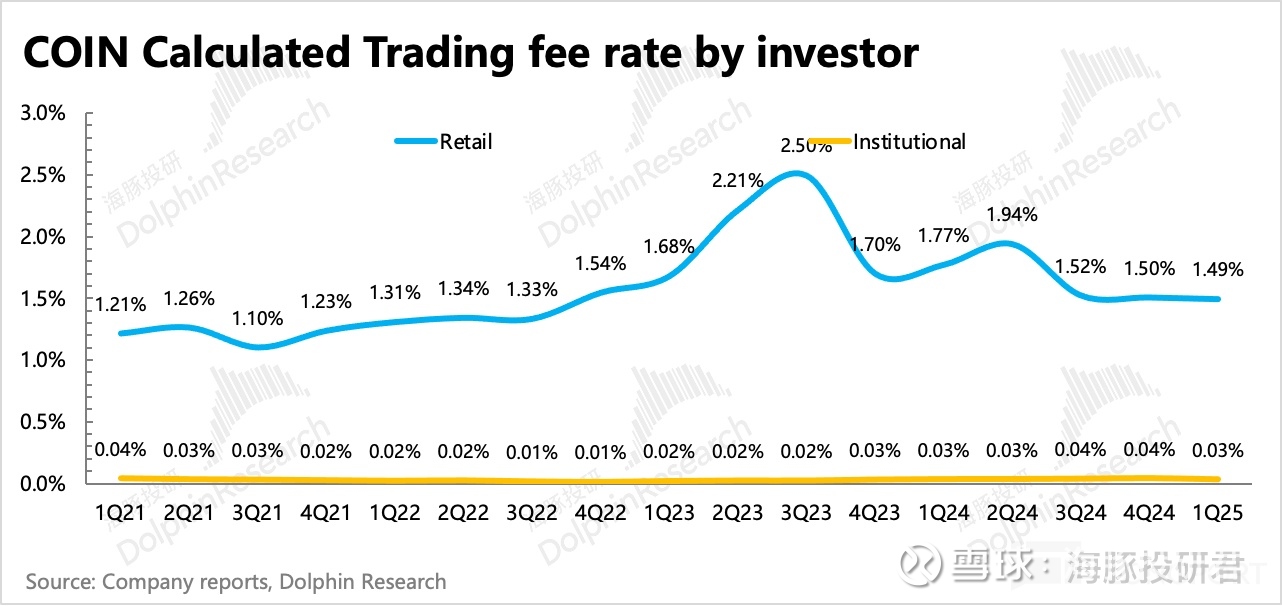

In terms of overall blended fees reflected in financial reports, retail and institutional trading fees (including spread) stand at 1.49% and 0.03%, respectively. Compared to peers—especially exchanges—Coinbase’s retail pricing is uncompetitive.

Taking Binance as an example: its highest retail spot fee tier is just 0.1%, one-sixth of Coinbase’s rate (even after Coinbase’s 2023 price cut). Using BNB to pay fees offers an additional 25% discount.

As shown below, among alternative crypto platforms, those with exchange characteristics generally charge less than Coinbase, while payment-focused platforms are more expensive. Discount brokers also offer lower trading costs than Coinbase.

Coinbase reduced fees in August 2022 with the launch of Advanced Trade: for users trading under $10K in the past 30 days, costs (taker 0.6%, maker 0.4%, minimal hidden spread) were less than half of Simple Trade (1.49% + ~0.5% spread).

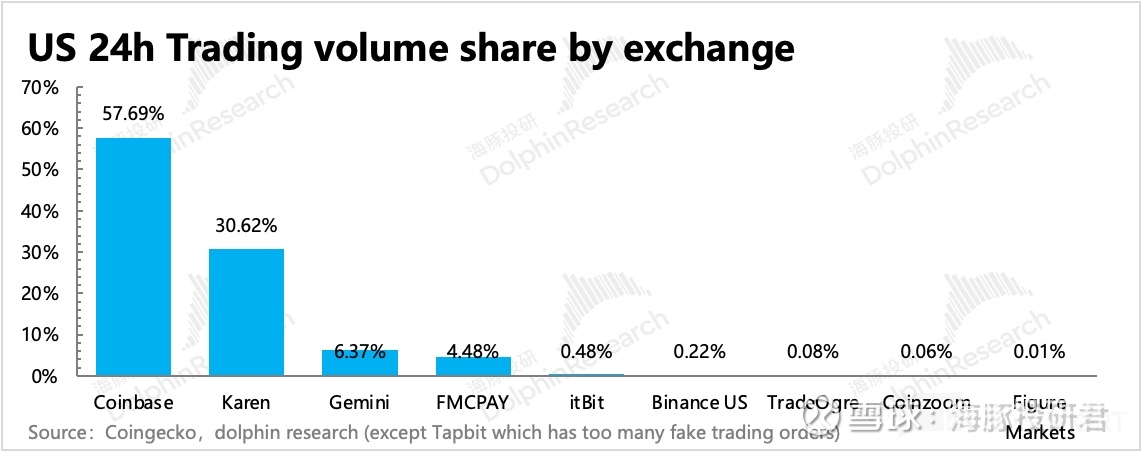

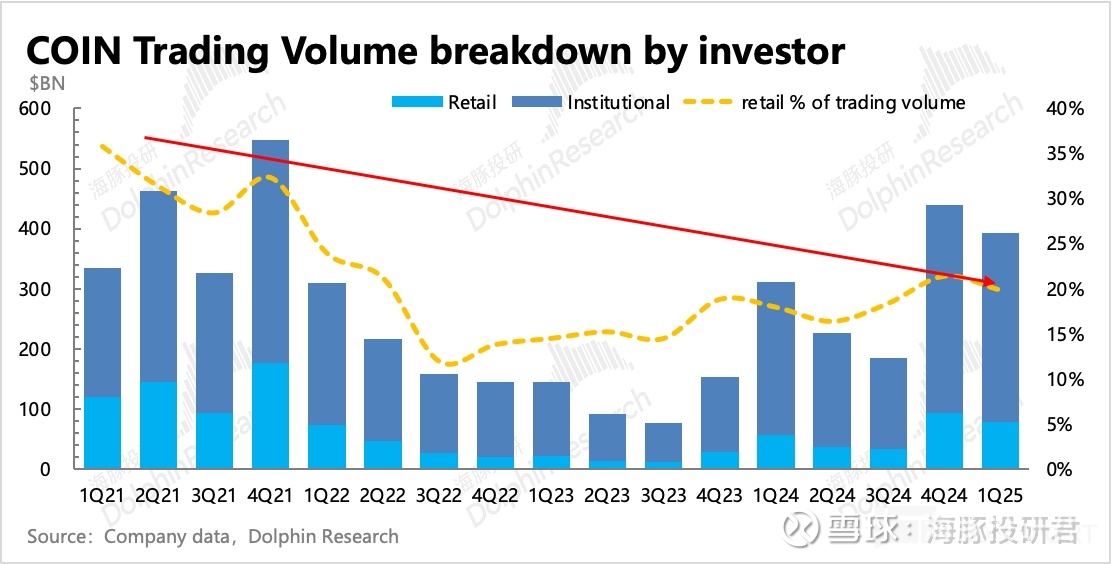

Limited trading options (especially derivatives) and high costs dampen retail trading activity. Although Coinbase holds the largest amount of crypto assets globally (12% AUC), its trading volume share is only 5%. This is for spot alone; including derivatives, Coinbase falls outside the top 10.

Only in the U.S., due to licensing and compliance advantages, does Coinbase dominate—accounting for over 50% of domestic spot trading volume.

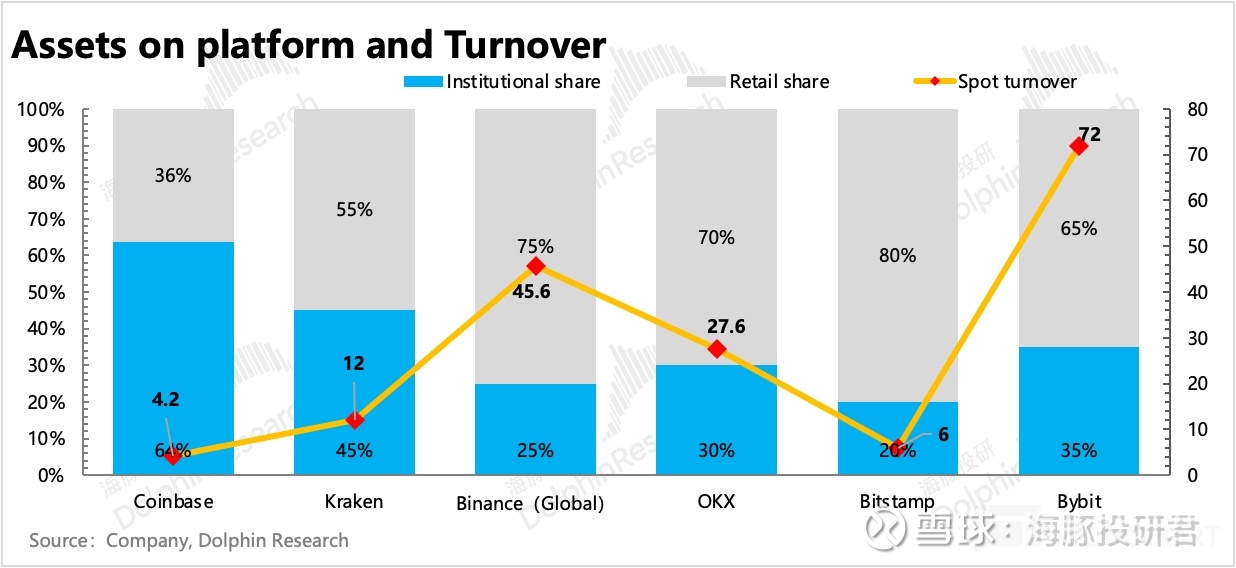

Why does Coinbase hold significant assets but lag in trading volume?

The issue lies in turnover rate—Coinbase’s is notably lower than peers, inconsistent with crypto’s high-risk, high-volatility nature. Turnover is merely symptomatic; the root cause is differences in capital structure (user type), which stem from product features and trade-offs.

A common trend: among retail investors, the proportion allocating crypto as long-term holdings is rising—these users naturally trade infrequently. Among institutions, quant funds focused on short-term volatility still dominate, though as mainstream capital enters, overall institutional trading frequency will decline.

On Coinbase, limited trading pairs and higher fees reduce appeal to active traders. However, its compliance and security attract high-net-worth retail investors seeking long-term allocation and institutional investors requiring stringent custody compliance—both low-frequency trading groups.

Nonetheless, Coinbase clearly recognizes its trading disadvantages and is actively closing the gap.

To address limited trading options, Coinbase has accelerated new token listings and announced in early May the acquisition of Deribit—the world’s largest crypto options and futures platform—to strengthen its derivatives offerings and institutional client base. (Dolphin Research will analyze Deribit in detail after Q2 earnings reflect the merger.)

Regarding high trading costs: these are partially tied to trading volume. Short-term, Coinbase’s fees remain elevated not only due to extra compliance and technical expenses (e.g., Base development), but possibly also because lower volumes make aggressive fee cuts financially unappealing.

In the longer term, however, Dolphin Research expects Coinbase to continue lowering fees.

(1) Regulatory relaxation, internal consolidation, intensified external competition

Future competition will extend beyond crypto-native exchanges. Growing threats are emerging from traditional financial institutions.

Currently, Coinbase’s key advantage—especially in the U.S.—is compliance. It is the only publicly listed crypto exchange and the first licensed to operate nationwide.

But the flip side of “compliance” is suboptimal performance in tradable assets (number of cryptos, derivatives). Since 2025, under active support from the Trump administration, crypto is gaining wider official recognition.

“Recognition” primarily means inclusion into a “friendly regulatory framework” without suppression. Key drivers include the U.S. Market Structure Act and Stablecoin Act.

The House-passed Market Structure Act grants CFTC exclusive jurisdiction over spot crypto markets. If passed by the Senate and signed into law, it would resolve the long-standing SEC vs. CFTC regulatory conflict.

Regulation under CFTC rather than SEC brings greater operational ease:

1) No need for additional licenses (ATS+BD); 2) Reduced clearing costs; 3) New tokens don’t require individual disclosure filings.

Under CFTC oversight, crypto exchanges launching derivatives only need broker registration, while spot trading may not require CFTC registration at all—eliminating high compliance costs (legal, auditing) and avoiding costly integration with NMS-level clearing systems.

Greater regulatory acceptance benefits compliant leaders like Coinbase, accelerating the exit of smaller, non-compliant platforms.

At the same time, official endorsement encourages traditional financial institutions to accelerate their transformation—especially innovative players quick to adapt to frontier shifts.

Among retail-facing platforms, consider brokers like Robinhood or payment wallets like Block. Both have offered crypto trading for years and are expanding into “investment” and “merchant payment” use cases. However, due to compliance and security requirements, they focus mainly on top-tier cryptos like BTC and ETH—their biggest disadvantage versus Coinbase being “fewer tradable assets.”

As crypto gains broader legitimacy, these traditional players will likely expand their crypto offerings. With existing user bases and ecosystem advantages, they will pose direct challenges to Coinbase.

(2) Capital inflows shifting toward institutions

Another impact of regulatory progress is changing capital inflow patterns. Historically, institutional participation has been dominated by quant funds chasing volatility, while mainstream institutions faced compliance constraints limiting allocations. As regulations loosen, mainstream institutional involvement will grow.

For new retail investors, exposure to crypto may no longer require “direct participation.” From safety and convenience perspectives, investing via institutional funds becomes a viable alternative.

Thus, retail trading’s share of the market will further shrink, and amid ongoing competition, fee reductions will become inevitable for Coinbase.

2. Future Value Add Comes From Expanding On-Chain Use Cases

As of Q1 2025, retail transaction revenue (fees + spread) accounted for 92% of transaction revenue and 57% of total revenue. Margins on transaction revenue are extremely high—so if fee cuts fail to boost trading volume significantly, the impact on Coinbase’s overall earnings could be substantial.

Yet this shift is unavoidable. Therefore, developing non-transaction revenue is critical now and in the future.

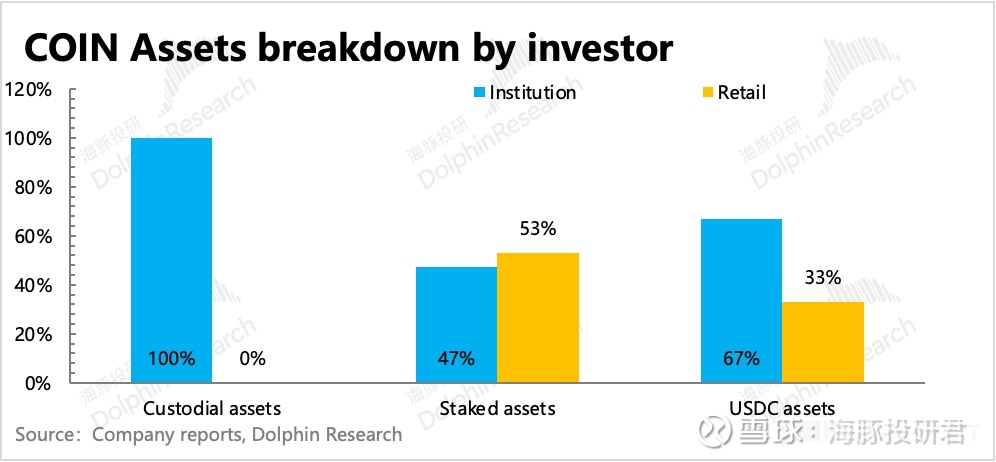

Currently, Coinbase’s non-transaction income consists mainly of subscription-based financial services: custody, staking, stablecoins, and lending. Except for payment use cases—which rely more on retail adoption—these services primarily serve users with large capital pools, meaning institutional clients are the main target.

Hence, lowering trading fees to reduce entry barriers and boosting value-added services makes strategic sense—explaining why Coinbase is willing to slash institutional trading fees down to peer levels.

Next, we examine specific subscription segments with relatively high current contribution and strong potential for growth as institutions enter:

(1) Institutional Custody: The Easiest Value-Added Service to Scale

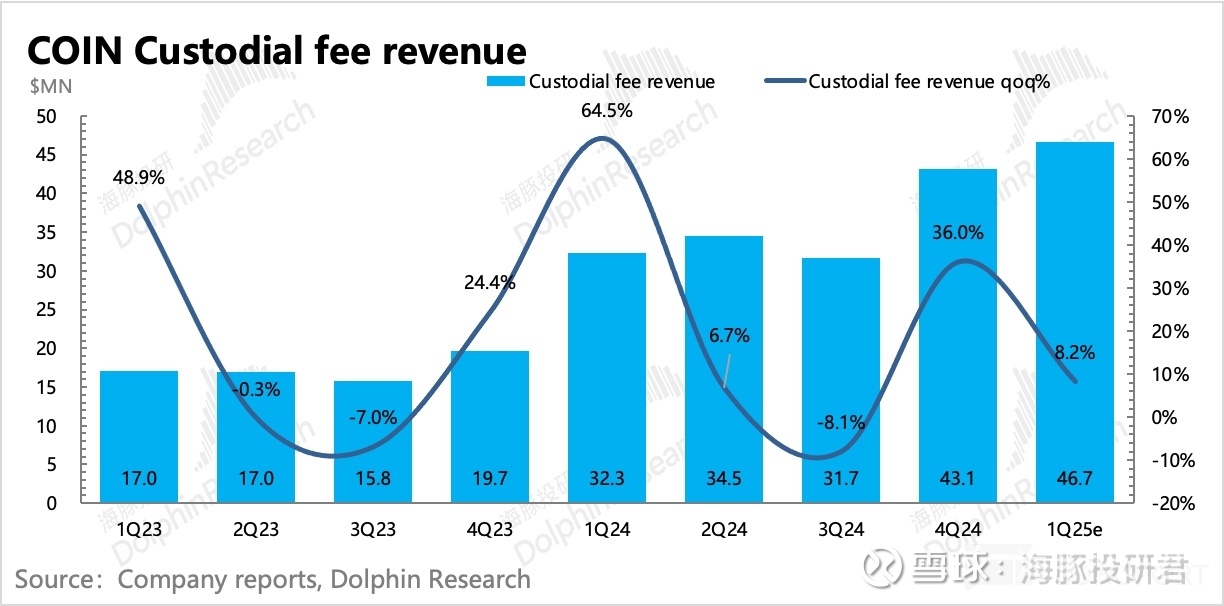

Custody services typically arise alongside trading, offering institutions cold storage, 24/7 withdrawal processing, insurance, audits, and compliance reporting. Estimated blended custody fees hover around 0.1%. (No longer disclosed separately starting Q1 2025; figure below reflects Dolphin Research estimates.)

With stable fees, custody revenue grows primarily with institutional asset expansion. For institutions, Coinbase’s compliance edge is a top decision factor. Therefore, as long as regulation continues to ease, this revenue stream can sustain growth.

However, long-term external competition remains a concern: when more compliant traditional financial institutions with cross-market assets enter (“downward disruption”), how can Coinbase retain mainstream capital?

(2) Staking Revenue: Medium-Term Growth Has a Ceiling

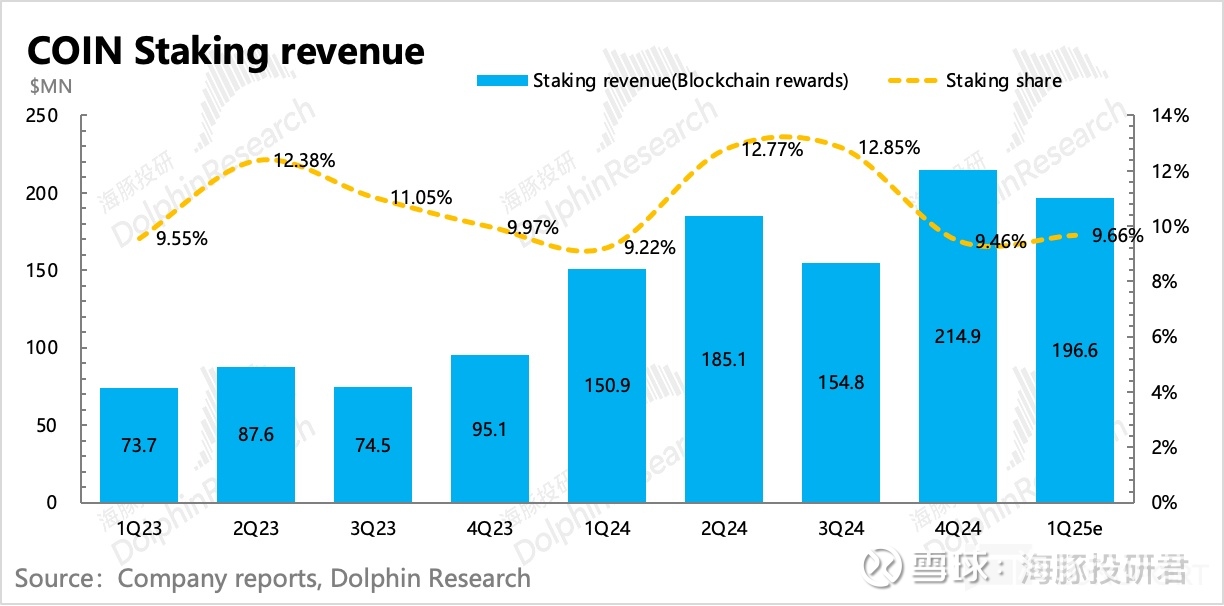

Prior to partnering with Circle in 2022, crypto staking was Coinbase’s largest non-transaction revenue source, contributing up to 13% of total revenue at its peak.

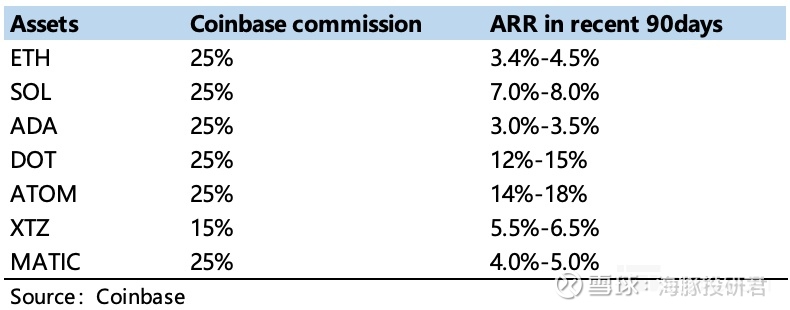

Staking income resembles users earning returns by investing crypto in mining projects (becoming validators on PoS blockchains), with Coinbase taking a cut as custodian. Coinbase retains 25% of the yield collected upfront, passing the rest to users.

Yields vary widely by token, depending on price stability, inflation rate (supply growth), and validator competition (total staked amount).

Top-tier tokens like ETH have lower yields—typically 3.4%–4.5%—due to fixed or declining supply and intense validator competition. Smaller tokens like DOT offer higher yields (12%–15%) due to less saturation.

Short-term, staking revenue scales with growing staked assets. But medium- to long-term, constrained supply leads to declining block rewards for quality cryptos. For lower-tier or niche tokens, even with high issuance rates, low or volatile token values mean actual USD-denominated yields remain modest. Thus, staking revenue faces structural growth limits.

So far, Coinbase’s subscription business appears secure in the short-to-medium term—benefiting from market expansion and sustained competitive advantages (security, compliance, government backing). But long-term, as traditional institutions accelerate their entry, what will keep them choosing Coinbase as the preferred partner?

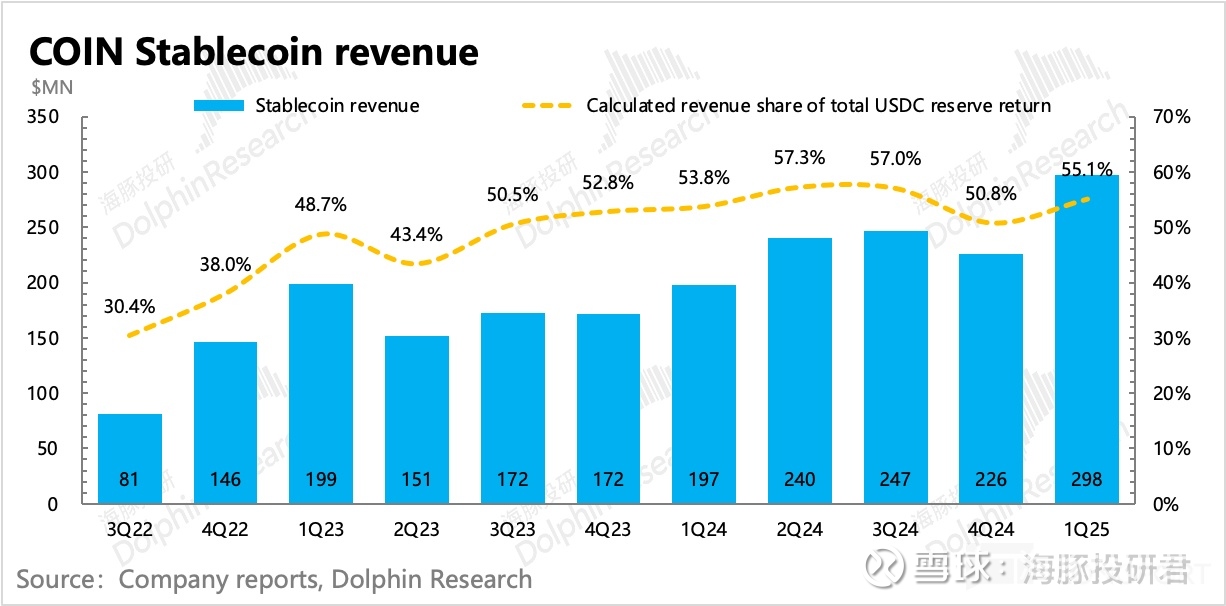

The answer lies in (3) stablecoin operations. First, stablecoins expand the crypto market itself—under official recognition, real-world assets move faster onto chains, and capital flows in for stable purposes like payments and store-of-value, not just speculation. Second, Coinbase enjoys outsized advantages from its unique position in the USDC ecosystem.

Thus, the stablecoin segment—contributing 15% of revenue—is Coinbase’s future growth artery and the key determinant of whether its valuation is fully priced in. Currently, Coinbase captures 55% of total USDC-related revenue, despite holding only 17% of circulating USDC—clear evidence of its “privilege.”

However, part of Coinbase’s special status stems from its deep ties with Circle. Their interests, however, aren’t perfectly aligned. Coinbase might provide distribution advantages to USDT—the larger stablecoin—if user demand rises. Meanwhile, post-IPO, Circle will push for higher revenue shares to meet growth targets.

Such business divergences—given only minor equity stakes (the original 50-50 Centre joint venture dissolved in 2023, with full USDC issuance rights transferred to Circle)—make it difficult to ensure cooperation won’t fray as disagreements grow:

Last year’s decision to bring Binance, a Coinbase rival, into the ecosystem partnership—though Binance’s cut is negligible—already weakened Coinbase’s competitive edge derived from USDC.

Beyond that, Circle is increasing its own revenue share by capturing USDC balances (via Mint wallet incentives encouraging market makers and payment providers to keep funds in Mint instead of exchange wallets) and expanding issuer-dependent use cases (e.g., cross-chain bridges, tokenized T-Bills, traditional clearing).

The 2023 agreement lasts seven years—until 2030—so revenue splits likely won’t change much before then (after USDC’s sixfold surge, Circle’s scarcity value is already being questioned). But beyond 2030?

In a trillion-dollar market forecast, how much can USDC capture? Within the USDC ecosystem, Coinbase controls the application layer while Circle holds issuance power—who will ultimately wield more influence? In other words, at current prices, which—Coinbase or Circle—has greater future value potential? The next article will dive deep into stablecoins to answer this.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News