Pantera Capital: Why We Launched the "Crypto Treasury Reserve" Fund?

TechFlow Selected TechFlow Selected

Pantera Capital: Why We Launched the "Crypto Treasury Reserve" Fund?

DAT enables stock market investors to gain exposure to crypto assets through familiar tools and intermediaries.

Author: Cosmo Jiang, General Partner

Translation: TechFlow

Pantera Capital has launched a fund to provide investors with access to opportunities related to Digital Asset Treasuries (DATs).

As an early mover in this emerging industry, Pantera firmly positioned itself as a cornerstone investor in some of the first DAT initiatives in the U.S., including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP). Our rigorous due diligence process led to several investments that delivered strong short-term performance.

Pantera’s early involvement and initial success helped catalyze this growing trend. As a result, we have become the preferred partner for many prospective DAT teams—many of whom are still in the conceptual stage—and they often seek our strategic guidance to navigate potential risks.

We now maintain a robust pipeline of investment opportunities and plan to offer investor access through the Pantera DAT Fund. Over the past few months, we have evaluated more than fifty project proposals, identifying key factors behind success and failure, further refining our investment due diligence process and our ability to support portfolio companies. At the core of Pantera’s strategy is intelligently backing high-quality entrepreneurs, and we are excited to continue applying this philosophy in this nascent field.

A Timely Opportunity

This year’s equity markets reflect traditional investors’ embrace of digital assets—whether through ETFs, Circle’s IPO, or DATs. A major catalyst for this shift was Coinbase’s inclusion in the S&P 500. Today, every global fund manager is compelled to incorporate digital assets into their index frameworks and must pay attention. We believe this trend is only beginning and will serve as a long-term, sustainable force extending the growth cycle.

DATs represent a new frontier for public market exposure to crypto assets, benefiting from this broader structural shift. DATs enable equity investors to gain exposure to digital assets through familiar tools and intermediaries. We believe the ecosystem of digital asset treasury companies will expand significantly, and meaningful opportunities remain for those who act early.

Therefore, we believe now is the ideal time to invest in this fund. Being at the beginning of a new category is rare; identifying it and acting swiftly is critical to capturing this opportunity.

In our prior blockchain newsletter, we detailed the investment thesis behind DATs and explained why such companies could trade at valuations above their underlying net asset value (NAV) over time. Building on that context, we’d like to further explain why the Pantera DAT Fund’s investment strategy is compelling.

Asymmetric Risk/Reward Potential

The Pantera DAT Fund can participate in initial investments in DATs, meaning we invest at prices close to or equal to the underlying token value (1.0x NAV), often before the DAT begins public trading and potentially commanding a premium. We believe this approach offers asymmetric risk/reward characteristics—a “heads you win, tails you don’t lose much” scenario—compared to directly holding the underlying tokens.

Below is a simple visualization of the asymmetric return profile of a DAT investment.

Upside Potential – “Heads You Win”:

The near-term upside for a DAT investment lies in its potential to trade at a premium to NAV (notably, peer DATs currently trade at 1.5x to 10.0x NAV). Long-term appreciation comes from both growth in per-share NAV and the ability to sustain such premiums.

Downside Protection – “Tails You Don’t Lose Much”:

Downside is limited because even if a DAT fails to trade at a premium, investors enter at approximately 1.0x NAV and still retain proportional ownership of the underlying NAV and the returns from the base tokens (e.g., spot BTC, ETH). Moreover, as the market becomes saturated, we anticipate consolidation opportunities may emerge if DATs begin trading below 1.0x NAV. A key component of our due diligence is selecting management teams whose incentives are aligned with investors, ensuring they take appropriate actions in adverse scenarios—such as M&A or share buybacks—rather than pursuing reckless expansion.

Market enthusiasm for DATs is extremely high, and this trend is evolving faster than we anticipated when funding the first such vehicle. Like any industry, we expect excess returns to attract competition, which will eventually compress margins. Therefore, capturing this window of opportunity in an emerging category is crucial. DATs are highly volatile, and that volatility will persist. As with any new trend, some ventures will succeed while others will fail. We firmly believe that through our intellectual leadership, value-added strategic guidance, deal structuring expertise, and disciplined due diligence, we can consistently drive successful outcomes.

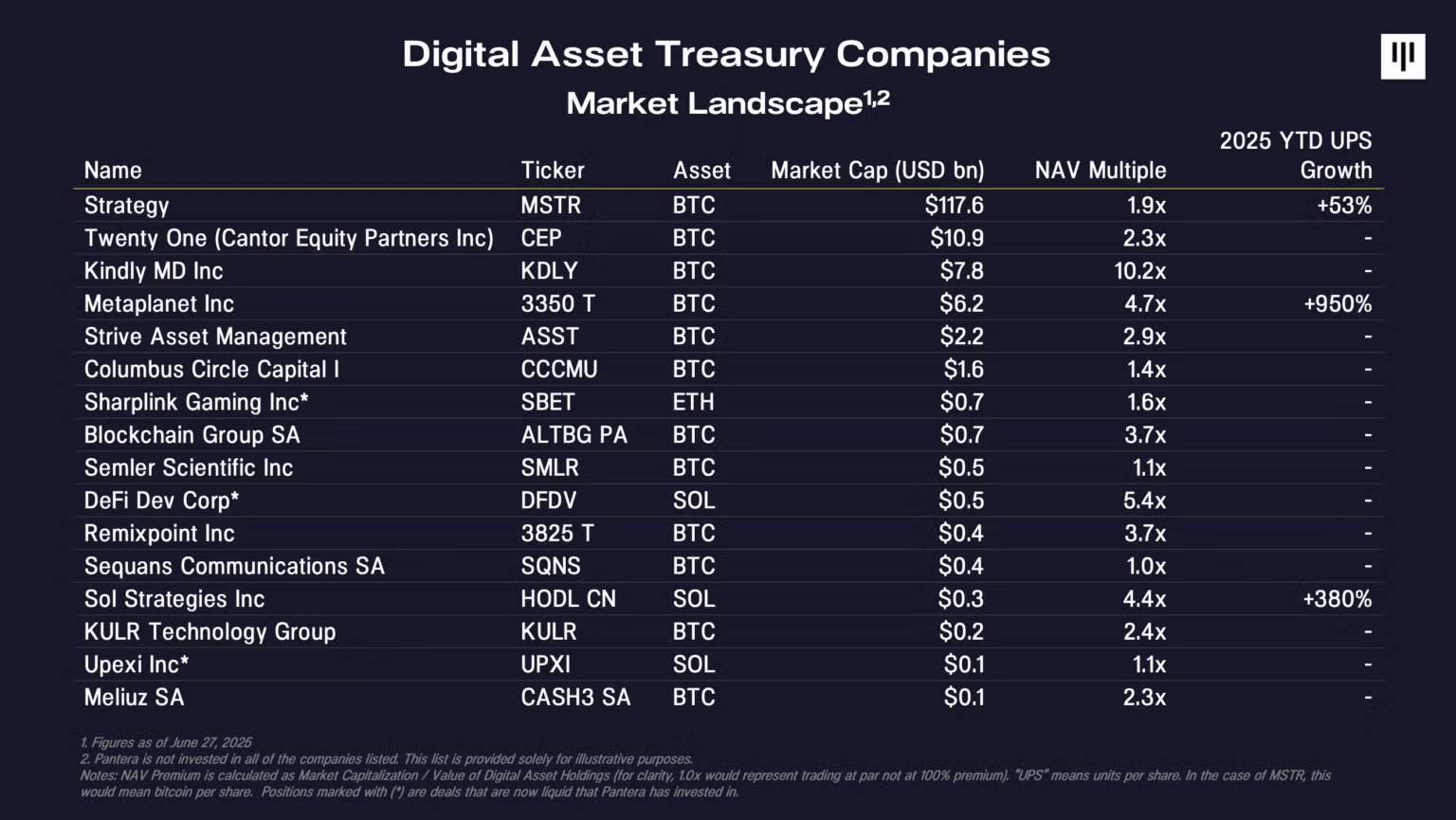

DAT Market Landscape

Theme Discussion: The Investment Case for Digital Asset Treasury Companies

Tom Lee, Managing Partner and Head of Research at Fundstrat, and Cosmo Jiang, General Partner at Pantera, will dive deep into the growth trajectory of DATs. They will address common concerns surrounding DATs and articulate the investment rationale behind this new avenue for public market exposure to crypto assets.

Pantera is proud to be a cornerstone investor in BitMine Immersion Technologies, with Tom Lee serving as Chairman and helping shape the company’s Ethereum treasury strategy. This marks the first of what we expect to be many transactions completed via the Pantera DAT Fund.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News