The Undercurrents Beneath the "Year Effect": Crypto Funds Enter a Lull Before Dawn

TechFlow Selected TechFlow Selected

The Undercurrents Beneath the "Year Effect": Crypto Funds Enter a Lull Before Dawn

For crypto funds established during the pandemic-era liquidity surge, the current moment is bringing painful repercussions from a "bad year."

Author: Zen, PANews

"Vintage" originally refers to the "vintage year" of wine—favorable years are nature’s gifts, while poor ones inevitably reflect adverse weather and soil conditions. In venture capital, a fund’s “vintage” typically denotes its founding year. Just as wine vintages reflect terroir, fund vintages serve as snapshots of economic cycles, directly impacting returns.

For crypto funds established during the pandemic-era liquidity surge, the current market represents the painful backlash of a "bad vintage."

Rising on Bubbles, Falling on Bubbles

Recently, investors in crypto funds have taken to social media to share their frustrations. The trigger was Web3 fund ABCDE’s announcement that it would cease investing in new projects and halt fundraising for a second fund. Du Jun, ABCDE’s founder, stated that over the past three years, the $400 million fund had invested more than $40 million across over 30 projects. Despite the challenging market environment, he emphasized that the fund’s internal rate of return (IRR) remains globally competitive.

ABCDE pressing pause reflects the broader困境 facing crypto VCs today: shrinking fundraising volumes, waning investment appetite, widespread skepticism toward token lock-up mechanisms, and agile investors resorting to secondary markets and hedging strategies to preserve portfolio value. Amid high macro interest rates, uncertain regulation, and sector-specific challenges, crypto VCs are undergoing their most severe adjustment yet—especially those founded around 2021, whose exit timelines now face intensified pressure.

Bill Qian, co-founder of Cypher Capital, shared insights into his firm’s fund investments: "We’ve backed over 10 VC funds this cycle—all with exceptional GPs who captured top-tier deals. Yet we've already written down 60% of our LP investments in these VC funds, hoping to recover just 40% of principal. There’s no way around it—the 2022/23 vintage caught us at a bad time. Sometimes you do everything right and still lose—to timing and vintage. But I’m actually bullish on crypto VCs in the next cycle. Things reverse when they go too far. Just like how web2 VCs collapsed after 2000, later vintages became fertile ground for innovation."

The capital frenzy from 2021 to 2022 wasn’t solely driven by industry creativity or the DeFi, NFT, and blockchain gaming booms—it also coincided with an extraordinary macro backdrop. During the pandemic, central banks worldwide unleashed massive quantitative easing and near-zero interest rates, flooding the globe with liquidity. This era, dubbed the "Everything Bubble" by analysts and practitioners alike, saw speculative capital pouring into high-return assets. Cryptocurrencies were among the biggest beneficiaries.

In such a favorable climate, crypto VCs easily raised capital and engaged in "pump-and-dump" style investing—placing large bets on thematic trends with minimal due diligence on fundamentals. Similar to the dot-com bubble, this irrational exuberance and short-term price surges were essentially priced on expectations fueled by ultra-cheap capital. By channeling vast sums into overvalued projects, crypto VCs sowed the seeds of future trouble.

Borrowing from traditional equity incentive models, token vesting mechanisms aim to prevent early dumping by teams and investors through staggered releases over time, safeguarding ecosystem stability and retail interests. Common structures include "1-year cliff + 3-year linear release," sometimes extending to 5–10 years, ensuring neither founders nor VCs can cash out prematurely. These designs aren't inherently flawed—especially for an industry long plagued by reckless behavior. Token locks helped build investor confidence by curbing perceived malfeasance.

However, when the Federal Reserve began tightening monetary policy in 2022, liquidity rapidly dried up, bursting the crypto bubble. As inflated valuations corrected sharply, the market entered a painful phase of "value regression." Crypto VCs soon found themselves in a "darkest hour"—not only suffering heavy losses but also being wrongly accused by retail investors of reaping windfall profits.

According to data recently published by STIX founder Taran Sabharwal, nearly all tracked projects have seen dramatic valuation declines—SCR and BLAST down 85% and 88% respectively year-on-year. Evidence suggests many crypto VCs that committed to locked positions may have missed better exit opportunities in last year’s secondary markets. Forced to adapt, some turned to alternative strategies—Bloomberg reported that several VCs secretly partnered with market makers to hedge locked-up risks via derivatives and short positions, profiting even as prices fell.

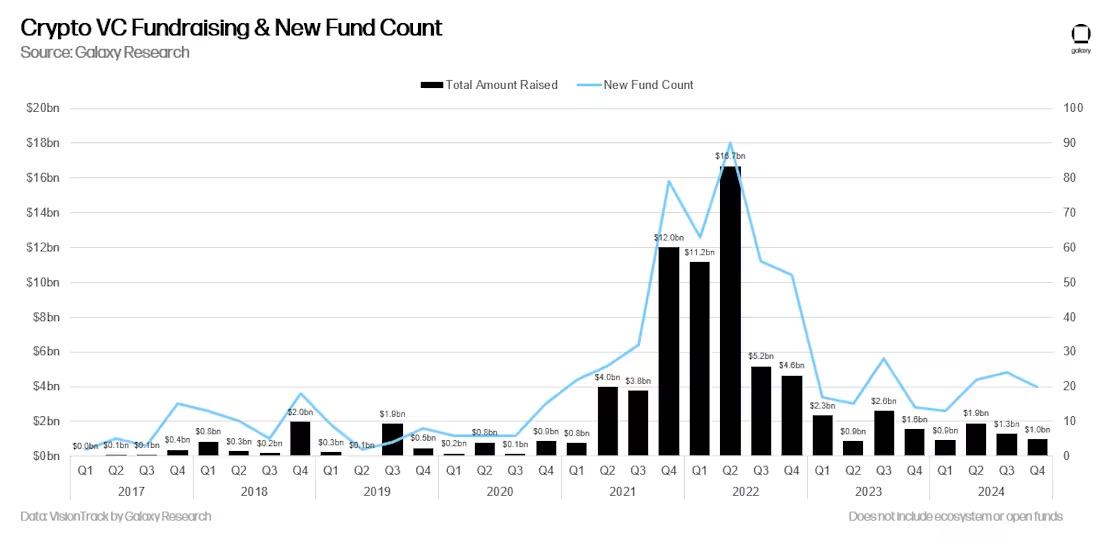

Fundraising for new crypto funds remains equally challenging amid weak market conditions. Galaxy Digital reported that although the number of new funds increased in 2024, it marked the weakest year for crypto venture fundraising since 2020 on an annualized basis, with 79 new funds raising $5.1 billion—far below the mania levels of the 2021–2022 bull run.

According to prior research by PANews, an estimated 107 Web3-related funds launched in the first half of 2022 alone, amassing a total of $39.9 billion.

Meme Mania and Bitcoin ETFs Diverting Capital

With no clear product narratives or real-world use cases emerging, the community has increasingly turned to meme-driven hype for attention and traffic. Meme coins, promising overnight riches, repeatedly spark trading frenzies, drawing away vast pools of speculative capital.

These meme projects often experience explosive one-time rallies but lack sustainable foundations. As the narrative of crypto becoming a "casino" spreads across chains, meme coins dominate liquidity, capturing user attention and capital allocation—crowding out potentially valuable Web3 projects that struggle for visibility and resources.

Meanwhile, hedge funds have begun entering the memecoin space to capture outsized returns from extreme volatility. One example is Stratos, a venture fund backed by a16z co-founder Marc Andreessen, which launched a liquid fund holding Solana-based meme coin WIF, generating a notable 137% return in Q1 2024.

Beyond memes, another landmark development—spot Bitcoin ETFs—may also be contributing to altcoin market stagnation and VC struggles.

Since the approval of the first spot Bitcoin ETFs in January 2024, both institutions and retail investors gained regulated access to Bitcoin. Within the first three days, nearly $2 billion flowed into these ETFs, significantly boosting Bitcoin’s market stature and liquidity. This further cemented Bitcoin’s status as "digital gold," attracting broader participation from traditional finance.

Yet the emergence of Bitcoin ETFs introduced a more convenient, lower-cost compliant investment route, altering the industry’s capital flow dynamics. Much of the capital that might have previously gone into early-stage VC funds or altcoins now stays parked in ETFs as passive holdings. This disrupted the historical pattern where Bitcoin rallies were followed by altcoin catch-ups, causing Bitcoin and other tokens to increasingly decouple in price movement and narrative.

Under this suction effect, Bitcoin’s dominance across the crypto market continues to rise. According to TradingView, as of April 22, Bitcoin’s market share (BTC.D) reached 64.61%, the highest since February 2021—solidifying its role as the primary institutional gateway.

The implications are multi-layered: traditional capital concentrates in Bitcoin, making it harder for Web3 startups to secure funding; for early-stage VCs, limited exit options and weak secondary market liquidity extend payout cycles and hinder profit realization, forcing them to scale back or even suspend investments.

External headwinds remain tough: high interest rates and tightening liquidity make LPs hesitant toward high-risk allocations, while evolving regulations remain incomplete.

As Hashkey Capital’s Rui wrote on X: “Will we stage a comeback like in 2020?” Many friends are pessimistic and exiting—their logic simple and effective. On one hand, most users who will join already have; people are accustomed to casino-style trading, judging projects purely by pump-and-dump patterns, just like shorting ETH has become routine—the user base is already defined. On the other, we’re struggling to see breakout applications at the infrastructure level. Social, gaming, identity—every major domain has already been 'reconstructed' by crypto, but ultimately left in disarray. It’s hard to find new infra opportunities or limitless imagination.

Amid these converging pressures, the "dark night" for crypto VCs may persist for quite some time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News