Deep Dive into AI Agents: Evolution, Applications, Token Roles, and Capital Scale

TechFlow Selected TechFlow Selected

Deep Dive into AI Agents: Evolution, Applications, Token Roles, and Capital Scale

AI, as one of the key narratives for Web3 in 2025, has raised $1.39 billion and seen over 17,000 agents launched on Virtuals Protocol.

Author: Dappradar

Translation: Felix, PANews

Since the beginning of 2025, on-chain activity related to AI has surged by 86%, with daily active unique wallets (dUAW) reaching approximately 4.5 million. This brings AI's dominance to 19%, just behind gaming at 20%. Considering its market share was only 9% at the start of the year, this marks a significant shift.

This explosive growth is not merely driven by hype; it reflects a structural change in how users interact with dApps. Whether through DeFi, social agents, or autonomous gaming assistants, AI agents are becoming the new layer of on-chain interaction. They do not replace users but rather extend them—automating, optimizing, and acting on their behalf.

Data supports this claim: AI has dominated Web3 discussions over the past month and is likely to define the next phase of its development. This report explores the evolution of AI agents, their use cases, the role of tokens, and the scale of capital fueling this transformation.

Key Takeaways

-

In June, AI’s on-chain dominance rose to 19% from 9% in January, transactional activity grew by 86%, and daily active unique wallets reached 4.5 million.

-

As of June 2025, AI agent projects have raised $1.39 billion—up 9.4% compared to total funding for all of 2024.

-

Since November 2024, 17,124 agents have gone live on Virtuals Protocol—an average of more than 85 new agents per day.

-

Despite a 64% drop from early June highs, AI token market cap remains at $5.9 billion, with a 24-hour trading volume of $1.4 billion.

-

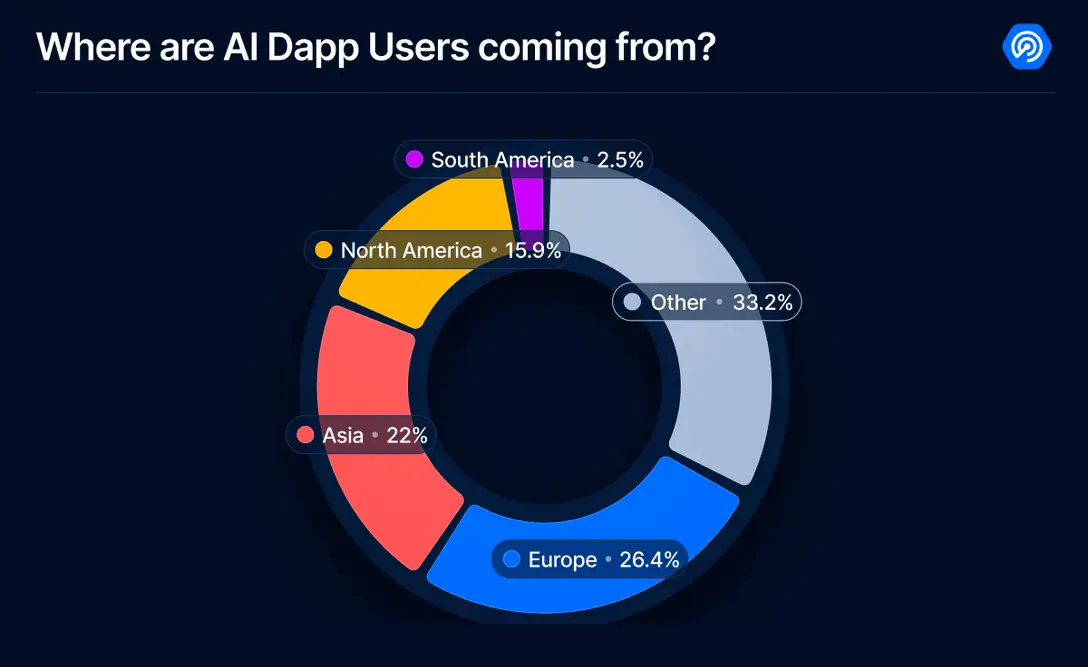

Europe (26.2%) and Asia (21.9%) lead in AI dApp usage, followed by North America (15.8%).

1. What Are AI Agents?

AI agents are autonomous software programs capable of performing tasks, making decisions, or interacting with users based on goals, prompts, or real-time data. Traditional AI agents span industries such as finance, healthcare, or customer service, while the Web3 ecosystem is giving rise to crypto-native agents with unique capabilities and roles.

In Web3, AI agents are evolving toward specialization. Some act as on-chain DeFi agents, executing trades, managing yield strategies, or serving as portfolio “managers.” Others function as social agents, representing users in decentralized social apps, managing profiles, and even responding to messages and interactions. In gaming, a new class of native game agents has emerged—AI companions trained on game lore, mechanics, or player behavior, acting as helpful guides or even opponents.

This isn’t theoretical speculation. According to cookie.fun, which tracks the agent economy, 1,748 AI agents are already active across various environments. Since its launch in November 2024, Virtuals Protocol—a platform allowing users to create and deploy their own AI agents—has launched over 17,000 agents. The actual number may be even higher, as multiple blockchains are now prioritizing infrastructure for creating, training, and deploying AI agents.

The agent economy is taking shape—and growing rapidly.

2. AI Agent Tokens: Utility, Hype, and Capital

In Web3, most AI agents are not launched independently but come bundled with tokens. The function of these tokens varies depending on the project’s vision and can serve multiple purposes. Often, they aim to support community governance, grant access to premium features, or act as a fundraising mechanism—especially given that training and maintaining AI agents still require substantial resources.

For others, tokens are primarily a capitalization strategy—an approach to gain liquidity, reward early adopters, or ride market momentum. In some cases, they resemble meme coins wrapped in AI branding: tokens issued around vague agent narratives lacking technical substance, simply catching the tailwind of speculative frenzy.

Despite the noise, the AI agent token market has made notable progress. At the time of writing, the total market cap of AI-related tokens stands at $5.9 billion, accounting for 0.18% of the entire crypto market. Daily trading volume over the past 24 hours is also substantial, exceeding $1.4 billion.

However, recent trends are less optimistic. Earlier this month, the AI agent sector’s market cap stood at $16.6 billion—meaning it has shrunk by 64% in just a few weeks. This decline reflects broader market conditions, not just sentiment toward AI. But it also highlights the volatility inherent in early-stage sectors where token hype often outpaces real utility.

AI agents are here to stay. But what about their tokens?

3. Top Blockchains Powering AI dApps

While AI agents are often the visible layer—interacting with users, executing transactions, or providing in-game assistance—their success largely depends on underlying infrastructure. Blockchains supporting high-capacity AI dApps are effectively laying the foundation for deployment, training, and interaction of AI agents.

Between January and June 24, 2025, the following blockchains led in AI dApp usage:

Matchain dominates with nearly 1.9 million daily active users, signaling that AI infrastructure is thriving, particularly under the push from social or agent-focused dApps. opBNB and Nebula follow closely, both showing strong engagement linked to lightweight or gamified AI services.

Although not all of these dApps currently deploy agents, the trend is clear. As AI agent frameworks mature, these blockchains could see the next wave of autonomous agents—across DeFi, gaming, or social applications.

We may still be in the infrastructure-building phase of the AI agent boom, and these networks are leading the charge.

4. Where Are the Users Coming From?

AI agents exist on-chain, but their users are global. Understanding geographic sources of engagement helps clarify adoption patterns, localization needs, and potential market opportunities.

From January to June 2025, according to Dappradar traffic data, Europe led in interactions with AI-related dApps at 26.2%. Asia followed at 21.9%, then North America at 15.8%. South America accounts for a smaller share at 2.5%, though its user base is steadily growing. Interestingly, 33% of traffic comes from unspecified or unclassifiable regions, grouped here as "Others."

This global distribution shows AI agents are not confined to one region. Whether it’s DeFi agents managing trades in Asia, social agents representing users in Europe, or gaming companions engaging players in North America, demand is diverse and increasingly cross-continental.

As the industry matures, we can expect more localized agent behaviors, improved language modeling, and even region-specific agent personalities. For now, the playing field is wide open, and the race for user attention is global.

5. Funding Floods Into AI Agents

The AI narrative continues to dominate headlines and funding rounds. While centralized AI giants like OpenAI, Anthropic, and Mistral have raised billions, the AI agent economy within Web3 is also gaining traction.

As of 2025, AI agent projects have raised $1.39 billion—up 9.4% from 2024’s total. This signals growing investor conviction that autonomous on-chain agents may represent the next frontier. While this figure still pales in comparison to investments in centralized AI, it’s noteworthy that funding in the AI agent space now rivals—or exceeds—that of other Web3 verticals like blockchain gaming.

This contrast is meaningful. Centralized AI investment remains dominant, with tens of billions flowing into model development, chips, and infrastructure. Yet in Web3, investors increasingly view AI agents as a new “primitive” that could reshape how users interact with protocols, navigate dApps, or automate personal financial strategies.

Momentum is building. If sustained, 2025 could become the first year AI agents attract more funding than any other Web3 vertical.

6. Conclusion

The rise of AI agents marks a profound shift in how users engage with decentralized systems. From DeFi traders and social companions to natively integrated gaming assistants, agents are rapidly evolving from experimental bots into core infrastructure.

The numbers back this up. Over 17,000 virtual agents have launched since late 2024. Even amid market downturns, the AI token market cap stands at $5.9 billion and continues to grow. Startups focused on agents have raised $1.39 billion this year alone. User engagement spans the globe, with strong participation in Europe, Asia, and North America.

Yet challenges remain. Many tokens are driven more by hype than utility. Not all agents deliver on the promise of autonomy. Cross-chain infrastructure remains uneven. But as tools mature and real-world use cases proliferate, the agent economy is approaching a new baseline—one where interaction with on-chain AI is no longer the exception, but the norm.

The race to build smarter agents, stronger ecosystems, and clearer standards has begun. And we’re still in the early innings.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News