Mid-Year Review 2025: Which "Mudslide" Caused You Massive Losses?

TechFlow Selected TechFlow Selected

Mid-Year Review 2025: Which "Mudslide" Caused You Massive Losses?

Rising tokens are all alike; each crashing token crashes in its own way.

Written by: Bright, Foresight News

Crypto is full of ghosts and monsters. Tokens going to zero happen frequently, but large-cap tokens plunging over 80% within an hour? That’s rare. Still, sudden crashes—halving or even dropping to the ankles—remain especially "eye-catching" in this volatile market.

It's already past halfway through 2025. Bitcoin has experienced a V-shaped trajectory from $100K to $70K back to $110K. Amid this ride, how many of the massive red candles—the crypto "mudslides"—have you managed to dodge?

Milei’s Unwashable Stain: Libra

Meme coins were the dominant narrative in the crypto world from 2024 to 2025. From community-driven memes to AI Agent FOMO, meme tokens with over $100 million market cap frequently emerged on-chain, as P-leaguers enthusiastically battled across various storytelling games.

Looking back, two presidents played historically significant roles in this meme-fueled frenzy.

The first was U.S. President Donald Trump. His namesake token, Trump, launched in January, surged to nearly $80 billion in market cap within two days. Many early adopters in Chinese-speaking communities became legends overnight, bagging single-token A8 returns—the most undisputed "big opportunity" of 2025 so far. Trump’s entry into crypto pushed the meme coin sector to its peak. Markets shook, and it was widely believed that political leaders and celebrities worldwide would follow suit.

Sure enough, the second contender for the “2025 Most Influential Figure in Crypto” award stepped onto the stage: Argentine President Javier Milei. On February 14th, Milei publicly endorsed LIBRA, a token initially promoted on X as a tool to support small businesses and startups in Argentina. Riding on the coattails of Trump’s success, LIBRA rocketed to a $4.24 billion market cap within half an hour. But when insider addresses were revealed making massive profits and Milei denied any connection to the token, LIBRA crashed almost instantly to $0.20, becoming the first major "mudslide" in crypto since the new year.

If Trump represented the pinnacle of the meme coin era, then Libra marked its turning point—from boom to bust. According to DefiLlama data, after the Libra incident, Solana’s liquidity plummeted from $12.1 billion to $8.29 billion, and SOL price dropped over 20%.

On-chain data shows about 75,000 users were affected by Libra’s collapse, suffering total losses of approximately $286 million—over 86% of all traders involved. It stands as the largest on-chain fraud of 2025. The Libra scandal, which drained liquidity and shattered trust in celebrity-backed tokens, exposed the ugly faces behind KIP Protocol, Kelsier Ventures, Meteora, Jupiter, and other actors linked to repeated "RUG PULL" schemes.

Hayden Davis, CEO of Kelsier Ventures, was one of the masterminds. Rumors claimed he said he could influence President Milei via bribes to his sister. In reality, Hayden Davis is a repeat offender who orchestrated multiple meme coin rug pulls, including MELANIA, ENRON, and BOB, pocketing over $200 million. Later, he casually referred to Libra as just “a meme,” revealing his view of meme coins purely as tools for extraction—with no regard for responsibility or consequences.

In the fast-spinning world of crypto, retail investors have a high tolerance for losses. But what Davis said reflects the mindset of every meme manipulator: “But (what I did) isn’t illegal in the meme market. This happens in every trade. These are the rules here. People know it, agree to it, and make money from it. If you’re going to blame me, you must blame everyone else too.”

“This isn’t a capital market. It’s a casino.”

The Brutally Executed “Delisted Coin”: ACT

Even established community memes face risks of collapse under coordinated systems built by exchanges, market makers, and large holders.

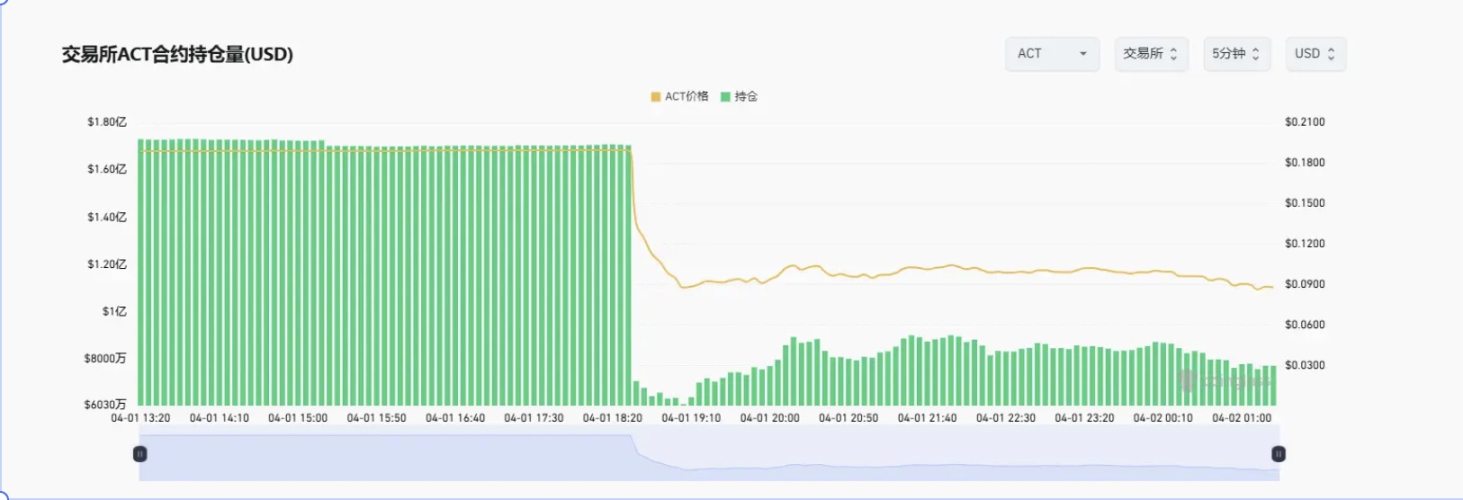

On April 1st, 2025, at 6:30 PM, low-market-cap tokens like ACT halved in value within 30 minutes—an April Fool’s horror story. ACT, which had briefly breached a $1 billion market cap during the AI Agent hype in 2024, plunged from $0.1899 to $0.0836 in just 36 minutes—a staggering drop of over 55%.

Turn the clock back to 3:30 PM on April 1st. Binance announced adjustments to leverage tiers and margin requirements for several USDT-margined perpetual contracts—including ACTUSDT, PNUTUSDT, and NEOUSDT—with changes taking effect at 6:30 PM.

This notice targeted position size caps and margin ratios for these token contracts, clearly acting as the spark for the evening’s panic. For example, ACT’s maximum position limit dropped from $4.5 million to $3.5 million post-adjustment.

After the crash, most users blamed Binance, claiming the reduced position cap triggered forced liquidations and subsequent panic selling. Additionally, the community questioned whether Wintermute, suspected market maker for ACT, actively dumped the token at the same time.

At 8 PM, Binance released a preliminary investigation report stating ACT’s decline stemmed primarily from four users—three VIPs and one non-VIP—selling around $1.05 million worth of spot tokens in a short period.

Wintermute founder Evgeny Gaevoy stated the firm did not lead the sell-off on ACT or other meme coins, only performing arbitrage on AMM pools after extreme volatility occurred—not causing the crash itself.

Suddenly, four obscure Binance users took the fall. Yet CoinGlass data showed Binance’s ACT futures open interest dropped 75% precisely at 6:30 PM—hardly explainable as the work of just four large sellers.

ACT was essentially declared chronically dead. Perhaps there was no clear villain like in the Libra case, but retail investors still became victims of a "random" glitch in the game set up by rule-makers.

VC Token Collapse: OM

Adapting Tolstoy’s famous line: “Rising tokens are all alike; each crashing token crashes in its own way.”

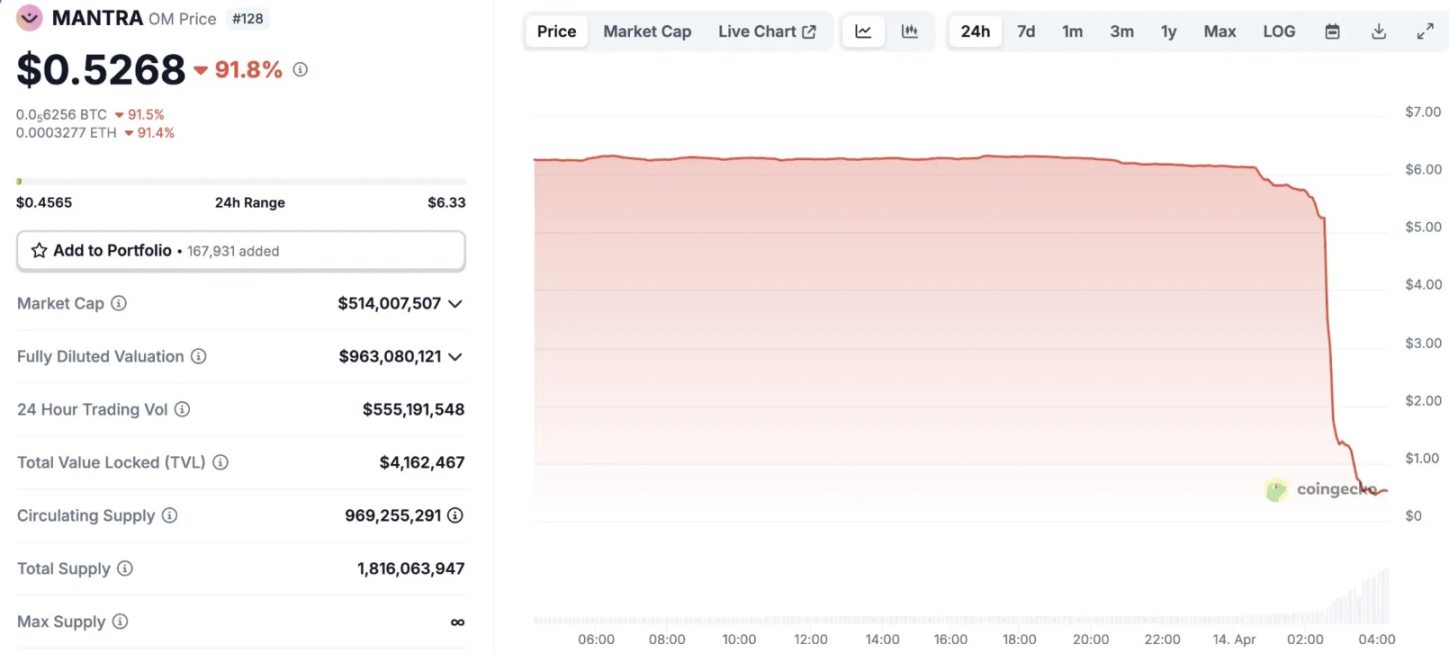

On April 14th, 2025, MANTRA (OM) erased $5.5 billion in market cap in just 15 minutes—plunging over 90%, falling from top 25 to beyond rank 90 in crypto market cap. This qualifies as one of the worst disasters in recent crypto history.

Yet before the crash, OM seemed unstoppable—a true "zombie coin." From October 2023 to February 2025, OM surged from $0.017 to $9.17, a near 540x gain—extremely unusual for a VC-backed token. The market and community attributed OM’s endless rise to powerful whales controlling the supply.

OM ticked nearly every box for ideal VC tokens—prestigious funding background, real-world use cases (tokenizing assets with Middle Eastern real estate groups), listing on major exchanges like Binance—and above all, relentless upward momentum.

But abnormality always has a cause. The entire project was highly opaque. Multiple reports indicated the MANTRA team held 792 million OM in a single address—90% of total supply—meaning actual circulating supply may have been less than 1%. One observer noted: “They didn’t even bother spreading the holdings across multiple wallets.”

Analyst Mosi once wrote about how a project with merely $4 million TVL could sustain a $10+ billion FDV—the only way being control of nearly all circulating supply.

The MANTRA team repeatedly manipulated the community regarding OM airdrops, initially loudly promising distribution of 50 million OM within a month, with 20% unlocked upon listing. In practice, they delayed endlessly and changed rules, effectively locking community tokens passively. Had they actually distributed the promised airdrop, real circulation would’ve increased significantly—leading, per on-chain analysis, to inevitable price drops.

In stark contrast to their broken promises, large OM holder addresses frequently withdrew funds and transferred them to exchanges.

On March 25th, Laser Digital—one of MANTRA’s investment firms—deposited 1.7 million OM ($11.49 million) into Binance. According to Genç Trader, wallet address 0x9a…1a28 transferred around $20 million worth of OM to OKX the day before the crash. Chain data shows this address had withdrawn ~$40 million in OM from Binance in early March, identifying it as one of the whales driving the prior price surge.

Additionally, on-chain investigator ZachXBT claimed on the day of the crash that Denko (founder of Reef Finance) and Fukogoryushu might be involved. Allegedly, in the days before OM’s 90% price drop, both individuals contacted multiple parties attempting to secure large loans using their OM holdings as collateral. Whispers of off-exchange OTC deals added conspiracy theories to what appeared to be a well-prepared harvest.

In response to the crash, the MANTRA team issued a statement blaming irrational liquidations unrelated to the project, denying any involvement. Later, co-founder JP Mullin said in a podcast: “I feel terrible, the community feels terrible—but we didn’t do anything wrong.” He subtly implied the crash was caused by a specific exchange attacking OM and promised “full transparency” along with buyback and burn plans.

Yet to this day, the MANTRA team has consistently gone back on its word. After deflecting blame and shifting narratives, they’ve allowed unfulfilled promises to fade as the token price continues its downward spiral.

Binance Alpha’s New Scissors: ZKJ, KOGE

Talking about crypto in 2025, Binance Alpha’s innovation is unavoidable. But the flash crashes of ZKJ and KOGE quickly doused the public’s enthusiasm for grinding Alpha trading volume.

On June 15th at 8:30 PM, Polyhedra Network’s native token ZKJ plunged over 85% in two hours—from $2 down to $0.29—wiping out nearly $500 million in market cap. Meanwhile, 48 Club DAO’s governance token KOGE fell from $61 to $8.46 in just thirty minutes.

Coinglass data showed that between 8 PM and 10 PM alone, total liquidations across the market reached $102 million—with ZKJ accounting for $94.3 million, including $93.7 million in long positions wiped out, completely draining contract liquidity.

Binance Alpha’s points mechanism created a “liquidity illusion”—users frantically traded pairs to earn points for potential airdrops. However, many Alpha tokens were highly volatile new launches or memes, making blind grinding unsuitable for risk-averse players. Thus, tokens with better liquidity and relatively stable prices rose to the top of “first grind” lists.

ZKJ and KOGE—right at the center of the storm—were exactly those two most-traded tokens on BSC within Binance Alpha before the crash. The low-slippage strategy of cross-trading ZKJ-KOGE became common knowledge across social platforms and communities. Prior to the event, daily trading volume of this pair consistently exceeded $200 million.

But calm before the storm never lasts. The “liquidity illusion” led LPs (liquidity providers) in ZKJ-KOGE pools to set extremely narrow price ranges. Once the illusion broke and heavy selling pushed prices beyond these tight bands, insufficient buy-side depth triggered an endless death spiral.

On-chain analyst Ai Yi analyzed that the ZKJ and KOGE crashes bore signs of a carefully planned harvesting operation. Three key addresses targeted the massive trading volume and liquidity generated by mutual brushing under Binance Alpha, delivering a double blow of “massive liquidity withdrawal + continuous dumping,” collapsing both tokens:

Address starting with 0x1A2 withdrew ~$3.76 million in KOGE and $532k in ZKJ in bilateral liquidity between 8:28 PM and 8:33 PM, swapped 45,470 KOGE for ZKJ (~$3.8 million), then sold 1.573 million ZKJ in batches.

A second critical address removed ~$2.07 million in KOGE and $1.38 million in ZKJ in liquidity while dumping 1 million ZKJ.

A third address received 772,000 ZKJ transferred from the second address and immediately dumped them, further accelerating ZKJ’s downfall.

Thus, Binance Alpha cannot serve as a guarantee of project safety or credibility. Short-term stability and high returns are merely poisonous traps designed to condition your thinking—so when the net finally closes, you’ll still be clinging to false hope.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News