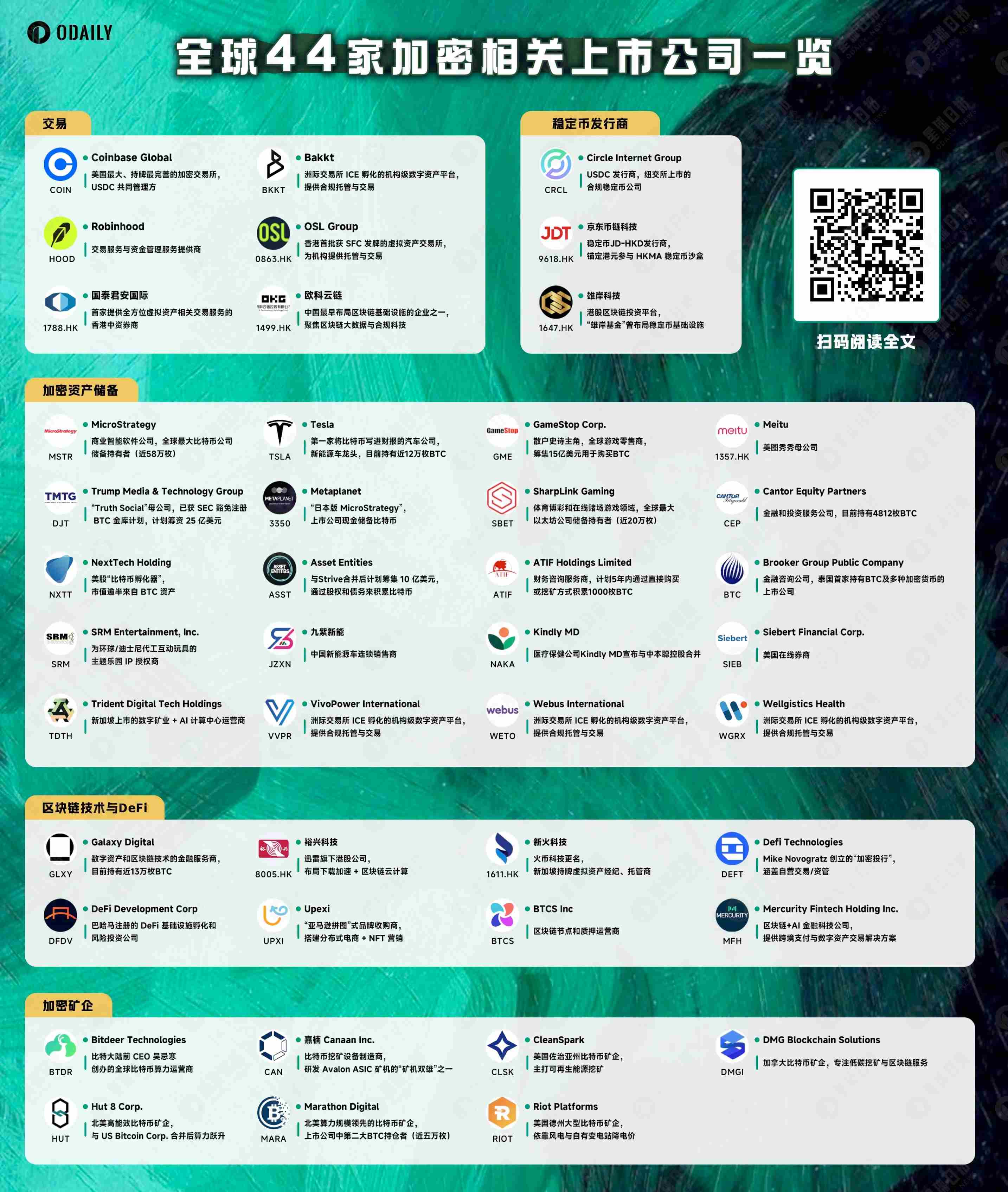

Crypto Becomes New Engine for Listed Companies' Stock Prices: Full Analysis of 44 Giants' Strategic Layout

TechFlow Selected TechFlow Selected

Crypto Becomes New Engine for Listed Companies' Stock Prices: Full Analysis of 44 Giants' Strategic Layout

Cryptocurrency assets are penetrating the global ecosystem of listed companies in a more compliant and capital-compelling manner.

By: Ethan (@ethanzhang_web3)

The crypto wave is sweeping across global capital markets!

From trading giants like Coinbase, to corporate Bitcoin buyers such as Meitu and MicroStrategy, and mining firms like Galaxy and Marathon forming a "mining + on-chain finance complex"—an increasing number of public companies are transforming cryptocurrencies and blockchain technology into powerful new narrative engines that drive stock price surges!

Beneath this surge lies what logic of capital and evolutionary trends? To cut through the fog, Odaily Planet Daily has conducted an in-depth scan of 44 representative listed companies worldwide, categorizing them into five key sectors based on their core crypto business attributes:

-

Crypto Exchanges: The Core Hubs of the Market

-

Stablecoin Issuers: Bridging Traditional and Crypto Finance

-

Heavy Crypto Asset Holders: "Digital Gold" on Balance Sheets

-

Pioneers of Blockchain Technology & DeFi: Building Future Financial Infrastructure

-

Crypto Miners: Guardians of Hashpower and Value

This article will break down each of these five camps—highlighting representative players and core strategies—to help users precisely identify the next wave of opportunities in the crypto capital market and get ahead of the narrative tide.

Crypto Exchanges: The Core Hubs of the Market

Coinbase Global (NASDAQ: COIN)

Coinbase Global, Inc. is a U.S.-based compliant cryptocurrency exchange founded in 2012 by Brian Armstrong and Fred Ehrsam. Coinbase provides a secure platform for buying, selling, transferring, and storing cryptocurrencies, serving retail investors, institutions, enterprises, and developers.

According to its Q1 2025 earnings report, Coinbase co-founded the USDC stablecoin with Circle Internet Group and currently holds 9,267 BTC and 137,334 ETH.

Bakkt (NYSE: BKKT)

Bakkt is a U.S. company launched in 2018 by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange. It focuses on digital asset custody, trading, and infrastructure services primarily targeting institutional investors. Bakkt offers platforms for trading and storing Bitcoin and other cryptocurrencies, emphasizing compliance and security, while also providing solutions for merchants to accept crypto payments.

In June 2025, Bakkt updated its previously announced plan to raise $1 billion, allowing it to allocate funds into Bitcoin and other digital assets based on market conditions and anticipated liquidity needs as part of its broader financial and corporate strategy. The statement added that Bakkt plans to explore opportunistic alternative financing options, including issuing convertible notes, bonds, or other debt instruments, to acquire Bitcoin or other digital assets or make other investments under its investment policy.

Robinhood (NASDAQ: HOOD)

Robinhood Markets, Inc. is a U.S. financial services company founded in 2013, known for its commission-free trading platform supporting stocks, ETFs, options, and cryptocurrencies. The company has expanded into crypto trading and is actively exploring the RWA (real-world assets) space, supporting assets like Bitcoin and Ethereum, and participating in the Global Dollar Network to promote USDG, a dollar-pegged stablecoin.

On May 20, Robinhood filed a 42-page proposal with the U.S. Securities and Exchange Commission (SEC) aiming to create a federal framework for tokenized real-world assets to modernize U.S. securities markets.

On June 3, Robinhood completed its $200 million cash acquisition of Luxembourg-based cryptocurrency exchange Bitstamp. This acquisition added over 50 licenses and registrations to Robinhood’s crypto operations and brought in a mature institutional client base.

OSL Group (HKEX: 0863)

OSL Group is a Hong Kong-headquartered licensed and compliant digital asset platform founded in 2018, one of Asia's regulated cryptocurrency exchanges. OSL provides cryptocurrency trading, custody, and compliance solutions for both institutional and retail clients, including secure digital asset storage, brokerage services, and blockchain-integrated software-as-a-service (SaaS) solutions.

CITIC Guoan Junan International (HKEX: 1788)

CITIC Guoan Junan International Holdings Limited is a Hong Kong-based financial services company established in 2007 and a subsidiary of Guoan Junan Securities, one of China’s largest securities firms. Its business includes brokerage, corporate finance, asset management, and wealth management. While primarily focused on traditional financial markets, the company has begun exploring blockchain and digital asset opportunities to adapt to the growing trend of cryptocurrency adoption in Asia, serving both institutional and retail clients while leveraging its parent company’s expertise to expand internationally.

On June 24, it officially received approval from the Hong Kong Securities and Futures Commission (SFC) to upgrade its existing securities trading license to include virtual asset trading services and related advisory capabilities. After the upgrade, clients can directly trade cryptocurrencies such as Bitcoin and Ethereum, and stablecoins like Tether (USDT), on its platform. CITIC Guoan Junan International thus became the first Chinese-owned securities firm in Hong Kong to offer comprehensive virtual asset-related trading services, covering trading, advisory, product issuance, and distribution.

OKLink (HKEX: 1499)

OKLink (OCEAN Kingdom Chain) is a Chinese blockchain technology company under the OK Group, founded in 2016. It specializes in blockchain infrastructure, data analytics, and financial services, offering solutions such as blockchain browsers, anti-money laundering (AML) tools, and stablecoin settlement networks. Its blockchain analytics platform supports transaction tracking and compliance checks. OKLink provides technical support to exchanges, institutions, and developers, promoting global cryptocurrency adoption with an emphasis on secure and scalable blockchain solutions.

Stablecoin Issuers: Bridging Traditional and Crypto Finance

Circle Internet Group (NYSE: CRCL)

Circle Internet Group is a U.S. fintech company founded in 2013. In 2018, it partnered with Coinbase to launch USDC, a U.S. dollar-pegged stablecoin. In 2025, Circle raised $1.05 billion through its IPO, with shares surging 168% on the first day of trading, valuing the company at $6.8 billion. Circle focuses on stablecoin payment and trading infrastructure within the crypto industry. USDC is the second-largest stablecoin after Tether (USDT) and is widely used as a bridging currency.

Jingdong Bichain Tech (HKEX: 9618)

Jingdong Bichain Tech belongs to JD.com, a Chinese e-commerce giant, focusing on blockchain applications in supply chain management, finance, and data security. Leveraging JD’s strengths in logistics and technology, the company develops blockchain applications to enhance transparency and efficiency in product traceability and anti-counterfeiting, while actively exploring global payments and its own stablecoin initiative.

On May 23, Jingdong Bichain Tech CEO Liu Peng stated that the first phase of its stablecoin will tentatively be pegged to the Hong Kong dollar and U.S. dollar, with details subject to regulatory and market demand adjustments. The JD stablecoin has not yet been officially launched but has entered the second phase of sandbox testing, preparing to offer mobile and PC applications for retail and institutional users. Test scenarios will mainly include cross-border payments, investment transactions, and retail payments.

Xiongan Blockchain Technology (HKEX: 1647)

Xiongan Blockchain Technology is a China-based company located in Xiongan New Area, specializing in blockchain and fintech solutions. The company develops blockchain platforms for smart city applications, financial services, and data management, aligning with China’s national strategy to promote blockchain adoption in government and enterprise sectors, with a focus on secure and scalable blockchain solutions. Its affiliated “Xiongan Fund” has previously invested in stablecoin infrastructure.

Heavy Crypto Asset Holders: "Digital Gold" on Balance Sheets

MicroStrategy (NASDAQ: MSTR)

MicroStrategy Incorporated is a U.S. business intelligence company founded in 1989. Since August 2020, under CEO Michael Saylor’s leadership, the company has accumulated nearly 580,000 bitcoins, making it the world’s largest corporate holder of Bitcoin. MicroStrategy treats Bitcoin as an inflation-resistant asset; its stock price has risen 4,315.85% since its first BTC purchase. Although its core business remains analytics software, its Bitcoin reserve strategy has fundamentally reshaped its valuation and market image.

Tesla (NASDAQ: TSLA)

Tesla, Inc. is a U.S. electric vehicle and clean energy company founded by Elon Musk in 2003, focusing on innovative EVs, solar products, and energy storage solutions. In 2021, Tesla purchased $1.5 billion worth of Bitcoin and briefly accepted it as payment before selling most of its holdings. Tesla’s foray into crypto sparked widespread corporate interest in digital assets, though its primary business remains centered on automobiles and renewable energy, with a market cap exceeding $1 trillion.

GameStop Corp. (NYSE: GME)

GameStop Corp. is a U.S. retail company founded in 1984, specializing in video games, electronics, and gaming accessories. It gained fame in 2021 due to a retail investor-driven stock surge. In 2022, GameStop launched an NFT marketplace to explore blockchain and digital collectibles and began holding Bitcoin as part of a crypto reserve strategy, emulating MicroStrategy to boost market attention.

Meitu (HKEX: 1357)

Meitu Company is a Chinese tech firm providing photo editing and social media apps, founded in 2008. In 2021, Meitu invested in Bitcoin and Ethereum to diversify its asset reserves. This move aligns with its strategy of embracing digital innovation, complementing its core AI-powered imaging and beauty tech businesses.

Trump Media & Technology Group (NASDAQ: DJT)

Trump Media & Technology Group (TMTG) is a U.S. media company founded in 2021, operating the Truth Social platform. The company has adopted a Bitcoin reserve strategy, aiming to hold $2.3 billion in crypto assets, potentially reshaping TMTG’s valuation narrative, despite its primary focus remaining on social media and content creation.

Metaplanet (Tokyo Stock Exchange: 3350)

Metaplanet is a Japanese publicly traded company following a MicroStrategy-style Bitcoin-centric strategy. In 2024, it allocated $5 billion to its U.S. subsidiary to acquire 210,000 BTC by 2027 and currently holds 12,345 BTC. With its core business lacking prominence, its crypto reserves have become the dominant force in its market narrative.

SharpLink Gaming (NASDAQ: SBET)

SharpLink Gaming is a U.S. online gaming and betting technology company. After facing delisting risks due to poor performance in 2024, it announced Ethereum as its primary reserve asset and secured a $425 million financing deal, causing its stock to surge 1,747.62%. It is now the largest publicly traded corporate holder of Ethereum, with a current holding of 188,478 ETH. Partnering with ConsenSys, it has gained support from the Ethereum ecosystem, potentially becoming a case study of how crypto reserves can revive struggling companies.

Cantor Equity Partners (NASDAQ: CEP)

Cantor Equity Partners is a U.S. financial services firm that, after merging with Twenty One Capital, adopted a Bitcoin reserve strategy aiming to hold $3 billion in digital assets. Backed by Tether, SoftBank, and Brandon Lutnick, it continues to focus on investment and advisory services, using its crypto strategy to attract capital market attention and drive valuation growth.

NextTech Holding (NASDAQ: NXTT)

Next Technology Holding Inc. is a diversified SaaS technology service company headquartered in Beijing, founded in 2019. It primarily provides technical services and solutions via its social e-commerce platform in mainland China. The company also offers AI software development and technical support services to clients in the U.S., Hong Kong, and Singapore.

It holds Bitcoin as reserves. On March 12, 2025, the company completed a transaction involving 5,000 BTC through stock and warrant issuance, increasing its total outstanding shares to 436 million. As of now, it holds a total reserve of 5,833 BTC.

Asset Entities (NASDAQ: ASST)

Asset Entities is a U.S. digital marketing and content creation company established on March 9, 2022, registered in Nevada, with headquarters in Dallas, Texas. It went public on the Nasdaq Stock Exchange on February 3, 2023. The company primarily provides social media marketing and content delivery services across platforms like Discord and TikTok. It also designs, develops, and manages Discord servers under the brand "AE.360.DDM," offering services in Discord investment education, entertainment, and social media marketing.

On May 7, 2025, Asset Entities Inc. announced a definitive merger agreement with Strive Asset Management. The merged entity will operate under the Strive brand, remain listed on Nasdaq, and become a publicly traded Bitcoin-focused financial company. The new company will focus on maximizing per-share Bitcoin exposure, with a long-term goal of outperforming Bitcoin to maximize value for common shareholders.

ATIF Holdings Limited (NASDAQ: ATIF)

ATIF Holdings Limited is a U.S. financial consulting company founded in 2015, headquartered in Los Angeles, California, with overseas business centers in Hong Kong and Shenzhen. It is a comprehensive international service group integrating internet financial services, investment and asset management, and IPO advisory services. It primarily provides professional IPO consulting, M&A advisory, and post-IPO compliance services for small and medium-sized enterprises seeking to list on U.S. exchanges, with business operations concentrated in Asia and North America.

In June 2025, ATIF Holdings Ltd. announced a share issuance plan to raise $100 million to purchase Dogecoin (DOGE) as treasury reserve investment. If executed, it would become the first U.S.-listed company to primarily invest in and hold a meme coin. Additionally, the company plans to continue purchasing mainstream meme coins as part of its long-term digital asset strategy.

Brooker Group Public Company (SET: BTC)

Brooker Group is a Thai financial consulting and investment firm listed on the Stock Exchange of Thailand. Its core business includes consulting, real estate, and investment management. It is also Thailand’s first publicly traded company to hold multiple cryptocurrencies including Bitcoin and Ethereum (source: official website disclosure), although specific amounts have not been disclosed.

SRM Entertainment, Inc. (NASDAQ: SRM)

SRM Entertainment, Inc. is a U.S. company listed on Nasdaq. Originally a manufacturer of toys and theme park souvenirs with a market cap of about $140 million, it primarily produces custom plush toys and water bottles. In 2025, it announced TRON’s TRX as its core reserve asset, supported by TRON founder Justin Sun.

On June 16, 2025, SRM announced a reverse merger with the Tron blockchain group led by Justin Sun, planning to rename the company “Tron Inc.”

Following the announcement, SRM’s stock surged over 500%, peaking above 600%, reaching around $11, followed by sustained high volatility.

JZXN New Energy (NASDAQ: JZXN)

JZXN New Energy (JZXN) is an electric vehicle dealer headquartered in Hangzhou, Zhejiang, selling EVs in China’s tier-three and tier-four cities through its subsidiaries. It reported approximately $46 million in revenue for fiscal year 2024 and remains unprofitable.

On May 22, 2025, the board approved a major strategic initiative: to purchase 1,000 BTC within the next year, funded by share issuance and cash, aiming to optimize its asset structure, diversify traditional operational risks, and leverage Bitcoin’s liquidity and appreciation potential for asset allocation. The company’s stock subsequently surged over 20%, briefly jumping to around $4.78.

Kindly MD (NASDAQ: NAKA)

Kindly MD is a U.S. integrated healthcare provider offering medical, pain management, behavioral health, and alternative medicine services. Its core medical services are covered by Medicare, Medicaid, and commercial insurance, aiming to reduce opioid dependency through personalized treatment. Notably, it changed its ticker symbol from KDLY to NAKA on May 23, 2025, to reflect alignment with its Bitcoin strategy.

On May 18, 2025, shareholders approved a merger with Nakamoto Holdings, a Bitcoin-native company, aiming to build a publicly traded “Bitcoin treasury platform.”

Siebert Financial Corp. (NASDAQ: SIEB)

Siebert Financial Corp. is a U.S. financial services company founded in 1967, offering retail and institutional securities brokerage, investment advisory, insurance services, and fintech products.

On June 9, 2025, its S-3 shelf registration statement became effective with the SEC, allowing it to issue various securities to raise up to $100 million. The prospectus explicitly states that proceeds will be used to purchase digital assets such as BTC, ETH, and Solana, as well as for investments in AI technology or strategic acquisitions.

Trident Digital Tech Holdings (NASDAQ: TDTH)

Trident Digital Tech Holdings is a Singapore-registered digital technology optimization and Web3.0 platform listed on Nasdaq, primarily offering online technology consulting and digital transformation solutions.

On June 12, 2025, the company announced fundraising of up to $500 million to build an XRP treasury and initiate staking mechanisms for yield generation, appointing Chaince Securities as a strategic advisor. Following the announcement, its stock plummeted nearly 38%.

VivoPower International (NASDAQ: VVPR)

VivoPower International is a UK-based sustainable energy solutions company headquartered in London, specializing in solar and electric vehicle infrastructure, listed on Nasdaq.

On May 28, 2025, it completed a $121 million private placement co-invested by a Saudi prince and Adam Traidman, announcing it would become the first publicly traded company to adopt XRP as its core treasury asset. Recently, it partnered with BitGo for OTC trading and custody, planning to initially deploy $100 million in XRP and stake it via the F-Assets mechanism on the Flare network to earn yield.

Webus International (NASDAQ: WETO)

Webus International Ltd. is a Hangzhou, China-based smart mobility technology provider operating the premium travel platform "Wetour," covering global charter buses, airport transfers, and long-distance tours. As of June 2025, its market cap was approximately $56 million, with core operations in AI-driven logistics optimization and passenger services.

In late May 2025, the company disclosed to the SEC its intention to raise up to $300 million through debt and credit financing to build an enterprise treasury centered on XRP. It signed a custodial agency agreement with Samara Alpha, registered in New York, requiring activation thresholds to be met upon asset transfer—currently still in a pending activation framework.

Wellgistics Health (NASDAQ: WGRX)

Wellgistics Health is a pharmaceutical wholesale and healthcare logistics tech platform headquartered in Tampa, Florida, connecting manufacturers, wholesalers, and independent pharmacies, with approximately $180 million in revenue in 2024.

On May 8, 2025, the company announced the launch of an XRP-based payment network and treasury reserve model to enable rapid, real-time settlement of cross-stage supply chain transactions.

Pioneers of Blockchain Technology & DeFi: Building Future Financial Infrastructure

Galaxy Digital (NYSE: GLXY)

Galaxy Digital is a global digital asset financial services group founded by Mike Novogratz in 2018, headquartered in New York, and listed on both Toronto and Nasdaq. Its core business includes cryptocurrency trading, asset management, and advisory services, encompassing trading, asset management, market making, lending, and staking of Bitcoin and Ethereum.

In 2025, it received Nasdaq listing approval from the SEC, advancing its expansion into the U.S. market, and obtained a derivatives license from the UK’s FCA. As of now, it publicly holds approximately 12,830 BTC (worth nearly $1.37 billion), with unrealized gains of about 26%.

Yusen Tech (HKEX: 8005)

Yusen Tech Investment Holding Co., Ltd. (listed on the Hong Kong Growth Enterprise Market in 2000, renamed in 2011, with a current market cap of about HK$2.4 billion) primarily engages in information appliance distribution, distributed storage, IDC services, and digital asset operations.

In 2021, it purchased mining equipment, ordering approximately RMB 290 million worth of mining rigs including 2,416 units of A10 Pro ASIC chips from Wuhan Quanyaocheng for mining Ethereum Classic and others. At the same time, it participated in IPFS/Filecoin-related infrastructure development, combining mining technology to build an on-chain service ecosystem.

SparkPool Technology (HKEX: 1611)

SparkPool Technology (formerly Huobi Tech; stock code: 1611.HK), founded by Huobi co-founder Du Jun, focuses on compliant digital asset services, including asset management, custody, mining, trading, and blockchain technology solutions.

In June 2025, it announced an upgraded banking account system to improve custody efficiency and formed a strategic partnership with HashKey Exchange to advance integrated asset custody across Hong Kong and Macau, offering diversified services such as CeFi lending, mining pools, and trading, establishing itself as one of Hong Kong’s major virtual asset service platforms. Additionally, Huobi Hong Kong Trust holds a TCSP license, enabling it to provide fiat and virtual asset custody services for institutions.

DeFi Technologies (NASDAQ: DEFT)

DeFi Technologies, headquartered in Canada, is listed on both Toronto and Nasdaq (stock codes DEFT/DEFI). Its subsidiary Valour is one of Europe’s leading issuers of digital asset ETPs (exchange-traded products), covering assets such as BTC, ETH, SOL, and ETC.

Public data shows that as of the end of May, the company holds approximately 208.8 BTC, 121 ETH, and 14,375 SOL, and participates in ETH staking.

In June 2025, DeFi Technologies appointed Manfred Knof, former CEO of Deutsche Bank, as a strategic advisor, potentially strengthening institutional influence on future development.

DeFi Development Corp (NASDAQ: DFDV)

DeFi Development Corp, formerly Janover Inc., originally focused on real estate fintech, transitioned in 2025 to focus on a Solana treasury. As of May 2025, it holds approximately 621,313 SOL (valued at about $107 million), with an average entry cost of around $139.66.

In June 2025, it became the first U.S.-listed treasury stock to issue its tokenized shares (DFDVx) on the Solana blockchain, partnering with Kraken to launch xStocks circulation.

Upexi (NASDAQ: UPXI)

Upexi is a U.S. e-commerce and consumer goods company focused on Amazon marketplace optimization, headquartered in Tampa, Florida, primarily offering consumer products such as functional foods and pet care. Like DeFi Development Corp, it initiated a Solana treasury transformation in 2025.

In April 2025, it raised $100 million from multiple crypto venture capitalists, allocating 95% of the funds to purchase SOL, currently holding approximately 679,677 SOL (average cost ~$142).

In June 2025, it further increased its position by 56,000 SOL, bringing total holdings to approximately 735,692 SOL (valued at ~$105 million), with a reported treasury gain of about 39% in its financial statements and an 8% monthly increase in holdings.

BTCS Inc. (NASDAQ: BTCS)

BTCS Inc. is a blockchain infrastructure company founded in 2014 and headquartered in Washington, D.C., focusing on NodeOps cloud nodes, Staking-as-a-Service (supporting multi-chain staking for ETH, ADA, ATOM, etc.), and on-chain data analytics, dedicated to digital asset management and DeFi solutions.

As of now, it holds 14,600 ETH and purchased an additional 1,000 ETH in June to expand its node operations. Its Q1 2025 financial report disclosed that its combined cash and crypto liquid balance reached $38.5 million, an 88% increase from year-end 2024.

Mercurity Fintech Holding Inc. (NASDAQ: MFH)

Mercurity Fintech Holding Inc. is a U.S.-listed blockchain technology company founded in 2011 as e-commerce firm Wowo Ltd.; it rebranded in 2020 as Mercurity Fintech, transforming into a “compliant fintech + blockchain payments and RWA market” platform.

On June 5, it announced a strategic partnership with SBI Digital Markets to jointly issue and distribute compliant RWA token products. In the same month, its platform integrated Franklin Templeton’s BENJI money market fund, bringing a $1.53 trillion asset manager into the on-chain ecosystem.

Crypto Miners: Guardians of Hashpower and Value

Bitdeer Technologies (NASDAQ: BTDR)

Bitdeer Technologies, founded in 2018 by Wu Jihan, co-founder of Bitmain, is a global Bitcoin mining and hashpower operator that went public via SPAC on Nasdaq in 2023. Bitdeer provides efficient, scalable mining solutions for institutional and retail clients through its infrastructure.

Public data shows that得益于 SEALMINER A1/A2 models going live, it mined 196 BTC in May, an 18% increase from April. It expects power capacity to reach 1.6 GW in June and is expanding HPC+AI data centers in Norway, Thailand, Bhutan, and other locations.

Canaan Inc. (NASDAQ: CAN)

Canaan Inc. was founded in 2013 and headquartered in Singapore, one of the first companies globally to launch ASIC Bitcoin miners. Its main products include the Avalon series of mining rigs, and it operates both proprietary and third-party mining rig leasing services. Its global operations span the U.S., Kazakhstan, Canada, and beyond, providing high-performance hardware and expanding into AI and blockchain technology solutions.

CleanSpark (NASDAQ: CLSK)

CleanSpark is a U.S. Bitcoin mining company focused on sustainable energy solutions. It powers its mining operations with renewable energy and operates mines in Georgia, Mississippi, Tennessee, and Wyoming, while owning and operating its own energy infrastructure.

As of June 2025, the company’s hash rate exceeded 50 EH/s, ranking among the top global mining firms, having self-mined over 12,500 BTC—approximately 694 BTC per month—all from its own mining rigs.

DMG Blockchain Solutions (TSXV: DMGI)

DMG Blockchain Solutions is a Canadian full-stack blockchain company claiming ESG compliance, using clean energy technologies combined with Bitcoin mining, blockchain software, custody services, and data center operations. Its subsidiary Systemic Trust focuses on compliant BTC trading and custody. It operates mining facilities and offers Mining-as-a-Service and blockchain software (Helm, Petra, Breeze, etc.).

To date, the company has accumulated approximately 351 BTC (worth ~$37.6 million), representing 110% of its market cap.

Hut 8 Corp. (NASDAQ: HUT)

Hut 8 Corp., founded in 2017 and headquartered in Miami, U.S., and Canada, is one of North America’s largest energy infrastructure operators, holding significant BTC reserves. Hut 8 also provides high-performance computing services and explores blockchain technology applications.

It continues to expand its self-mined Bitcoin and treasury size. As of March 31, 2025, it had self-mined 10,273 BTC, with a total treasury exceeding $1.1 billion. Additionally, its subsidiary American Bitcoin plans to spin off and go public to raise dedicated mining capital; Hut 8 secured a $130 million loan from Coinbase via revolving credit to expand capacity.

Marathon Digital (NASDAQ: MARA)

Marathon Digital Holdings is a U.S. Bitcoin mining company founded in 2010 and headquartered in Florida, listed on the Nasdaq Global Select Market. Formerly Marathon Patent Group, it pivoted to focus on Bitcoin mining and related infrastructure and has become the second-largest corporate BTC holder after MicroStrategy.

With consistently stable output over recent months, it achieved a record-high production of 950 BTC in May 2025, holding approximately 49,179 BTC in self-mined reserves. Its energized hash rate has reached 58.3 EH/s, contributing about 6.5% of daily Bitcoin block production globally, and it continues to expand immersion-cooled mining facilities.

Riot Platforms (NASDAQ: RIOT)

Riot Platforms (formerly Riot Blockchain) is a U.S. Bitcoin mining company founded in 2003 and headquartered in Castle Rock, Colorado, with Bitcoin mining as its core business and potential for high-power substation and AI data center transformation.

Public data shows a hash rate of 33.5 EH/s in January 2025, mining 527 BTC that month, with a total BTC reserve of approximately 18,221; in May, it produced 514 BTC, a 139% year-on-year increase.

Conclusion

From aggressive strategies like transforming corporate treasuries into “national Bitcoin reserves,” to SharpLink Gaming’s ambitious “ETH flagship” transformation, and pioneers like Metaplanet and Valour packaging on-chain assets into compliant financial products—public companies worldwide are integrating crypto assets into their value engines at an unprecedented speed and level of innovation. This is no longer just a technological experiment, but a profound revolution concerning balance sheet restructuring and future valuation paradigms.

This bull market is far more than simple price fluctuations. Its underlying momentum stems from traditional capital markets’ large-scale acceptance and revaluation of crypto narratives. Identifying these “narrative undervaluations” could become the most alpha-generating investment direction this summer. The convergence of crypto assets and traditional equities is unstoppable—the earlier one understands the rules of this “dual game,” the better positioned they will be to seize the opportunity amid the massive wave of value re-rating.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News