OKX's IPO Bet

TechFlow Selected TechFlow Selected

OKX's IPO Bet

Setting aside the regulatory farce, OKX actually has more advantages than Coinbase, the only successful publicly listed cryptocurrency exchange.

Author: Prathik Desai

Translation: Block unicorn

Preface

Mr. Joseph P. Kennedy made his fortune running liquor businesses during Prohibition (1920–1933, when the U.S. banned alcohol sales, production, and distribution). After Prohibition ended, he became the first chairman of the Securities and Exchange Commission (SEC). It's said that President Roosevelt, commenting on the appointment, remarked: "Let a thief catch a thief." Kennedy then enthusiastically cleaned up Wall Street with reformed zeal, establishing rules that still govern securities markets today.

A modern crypto parallel might be OKX’s transformation from regulatory outcast to potential IPO candidate.

According to a report on Sunday, Seychelles-based cryptocurrency exchange OKX is considering a U.S. public listing—just four months after agreeing to pay $505 million in penalties to the U.S. government for unlicensed operations.

In February 2025, the world’s second-largest centralized exchange (CEX) admitted processing over $1 trillion in unlicensed transactions involving U.S. users while knowingly violating anti-money laundering laws, agreeing to pay more than $500 million in hefty fines. Now, they hope to invite U.S. investors to buy shares in the company.

Few things signal “we’ve turned over a new leaf” more clearly than voluntarily submitting to quarterly earnings calls, disclosures, and filings required by the U.S. Securities and Exchange Commission (SEC).

Can a cryptocurrency company succeed on Wall Street? Circle recently proved it’s possible. Over recent weeks, the issuer of the USDC stablecoin has shown that if crypto firms follow the compliance path, investors will respond enthusiastically.

Circle’s stock surged from $31 to nearly $249 within weeks, rapidly creating billionaires and setting a new benchmark for crypto IPOs. Even Coinbase, the largest U.S. crypto exchange, which went public four years ago, has risen 40% over the past 10 days, trading near its highest level in four years.

Can OKX achieve similar success as an exchange?

Circle had a clean regulatory record when going public. They wore suits, testified before Congress for years, and published transparency reports. In contrast, OKX only recently admitted facilitating $5 billion in suspicious transactions and criminal proceeds, and has had to aggressively pledge never to repeat those mistakes.

Different CEX, Different Story

To understand OKX’s IPO prospects, consider Coinbase—the only major crypto exchange to successfully enter the public market. Both OKX and Coinbase earn money the same way: charging fees on every crypto trade.

When the crypto market goes wild—like during a bull run—they make huge profits. Both platforms offer core crypto services: spot trading, staking, and custody. However, their business approaches differ sharply.

Coinbase pursued a compliance-first strategy. They hired former regulators, built institutional-grade systems, and spent years preparing for a Wall Street listing. The strategy worked: they went public in April 2021, and despite market volatility, now boast a market cap exceeding $90 billion.

In 2024, Coinbase averaged $92 billion in monthly spot trading volume, primarily from U.S. customers who pay high fees for regulatory certainty. This is the tortoise approach: slow, steady, focused on mastering one market.

OKX chose the hare strategy: move fast, capture global market share, worry about regulation later. From a business standpoint, this strategy was extremely successful.

In 2024, OKX averaged $98.19 billion in monthly spot trading volume—6.7% higher than Coinbase—serving 50 million users across 160+ countries. When including derivatives trading (where they hold 19.4% of the global market), OKX processes far more crypto volume than Coinbase.

OKX’s daily spot volume is around $2 billion, with derivatives exceeding $25 billion, compared to Coinbase’s $1.86 billion and $3.85 billion respectively.

But speed comes at a cost. While Coinbase built strong relationships with U.S. regulators, OKX actively courted American clients despite being barred from operating in the U.S. Their attitude seemed to be “ask for forgiveness, not permission”—a mindset that works until you’re forced to beg forgiveness from the Department of Justice.

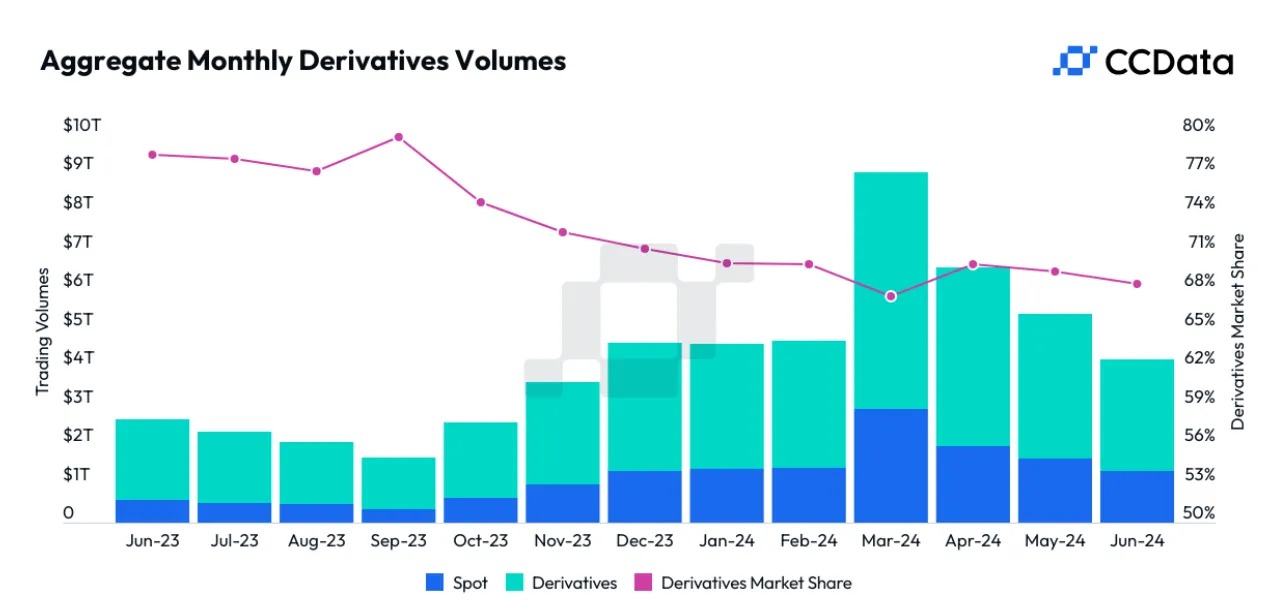

Here’s the catch: crypto exchange revenue depends entirely on people continuing to trade crypto with enthusiasm. When the market booms, exchanges profit handsomely. When it cools, revenues can plummet overnight.

For example, in June 2024, combined spot and derivatives trading volumes at exchanges dropped over 50% from their ~$9 trillion peak in March.

OKX’s $500 million settlement served as a costly education in how U.S. financial markets actually work. They appear to have learned from their expensive mistakes. They’ve hired Roshan Robert, a former Barclays executive, as CEO for the U.S., opened compliance offices in San Jose, New York, and San Francisco, hired 500 employees, and begun talking about building a “defining super app”—corporate speak suggesting serious reform efforts are underway.

The question is whether investors will buy this redemption narrative.

Valuation Game

Benchmarked against trading volume, OKX’s valuation should theoretically match—or even exceed—Coinbase’s.

Coinbase trades at roughly one times its average monthly trading volume—$92 billion per month, with a market cap above $90 billion. OKX averages $98.19 billion per month, 6.7% higher. At the same multiple, OKX would be valued at $85.4 billion.

Yet valuation isn’t just math—it’s also perception and risk.

OKX’s regulatory baggage may lead to a valuation discount. Their international operations mean profits depend on rapidly shifting regulatory landscapes—as they’ve experienced firsthand in Thailand, where regulators recently banned OKX and several other exchanges.

If we apply a 20% “regulatory risk discount,” OKX’s valuation could fall to $68.7 billion. But given their global reach, dominance in derivatives, and higher trading volumes, a valuation premium is justifiable.

Reasonable valuation range: $70–90 billion, depending on how much investors prioritize growth versus governance.

Advantages

OKX’s investment appeal rests on several competitive advantages absent at Coinbase.

Global Scale: While Coinbase focuses largely on the U.S., OKX serves markets experiencing explosive crypto adoption—Asia, Latin America, and parts of Europe with underdeveloped traditional banking.

Derivatives Dominance: OKX controls 19.4% of the global crypto derivatives market, while Coinbase’s derivatives business remains negligible. Derivatives generate higher fee income and attract more sophisticated traders. Coinbase’s recent announcement of perpetual futures means OKX will face stiffer competition from established, regulated players like Coinbase.

Volume Leadership: Despite being a private company with recent regulatory issues, OKX already surpasses publicly traded Coinbase in spot trading volume.

Coinbase has strengths too—its clean regulatory record and strong relationships with institutional investors who prefer predictable compliance costs over complex, globally scaled growth stories.

Potential Risks

OKX faces significant risks—distinct from typical IPO concerns.

Regulatory Volatility: OKX operates across dozens of jurisdictions with rapidly changing rules. The Thailand ban is just the latest example. Any major market could lose substantial revenue overnight.

Market Cyclicality: Exchange revenues fluctuate with trading activity. When crypto markets calm down, exchange revenues can collapse.

Reputational Risk: Despite settlements, OKX remains vulnerable to severe reputational damage from any future regulatory scandal. Crypto exchanges are inherently high-risk; technical failures or security breaches could destroy customer trust overnight.

Our View

OKX’s potential IPO could be a fascinating test of whether public markets will overlook the exchange’s problematic past.

Setting aside the regulatory drama, OKX is actually better positioned than Coinbase—the only crypto exchange to successfully go public. They dominate in derivatives and global user reach.

Whether OKX truly learned from its mistakes—costly lessons often stick—may matter less than whether public market investors are willing to pay growth multiples for a company operating across dozens of unpredictable regulatory environments. Coinbase built a moat through U.S. compliance credibility; OKX built a global trading empire and is now retrofitting compliance around it.

Both strategies can work—but they attract very different investors. Coinbase is the safe choice for institutions seeking regulated crypto exposure. OKX may appeal to those who believe crypto’s future lies in global adoption and advanced trading products.

Circle proved investors will back a clean crypto story. OKX is betting they’ll do the same—even with a complicated past.

Whether OKX’s reformed image resonates in public markets will reveal how much investors truly value growth versus governance in crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News