Crypto Morning News: U.S. Senate passes the "Beautiful Big Bill," Resupply protocol releases emergency remediation proposal

TechFlow Selected TechFlow Selected

Crypto Morning News: U.S. Senate passes the "Beautiful Big Bill," Resupply protocol releases emergency remediation proposal

Lido DAO voted to approve the dual governance structure proposal, granting stakers the right to delay or veto.

Author: TechFlow

Yesterday's Market Dynamics

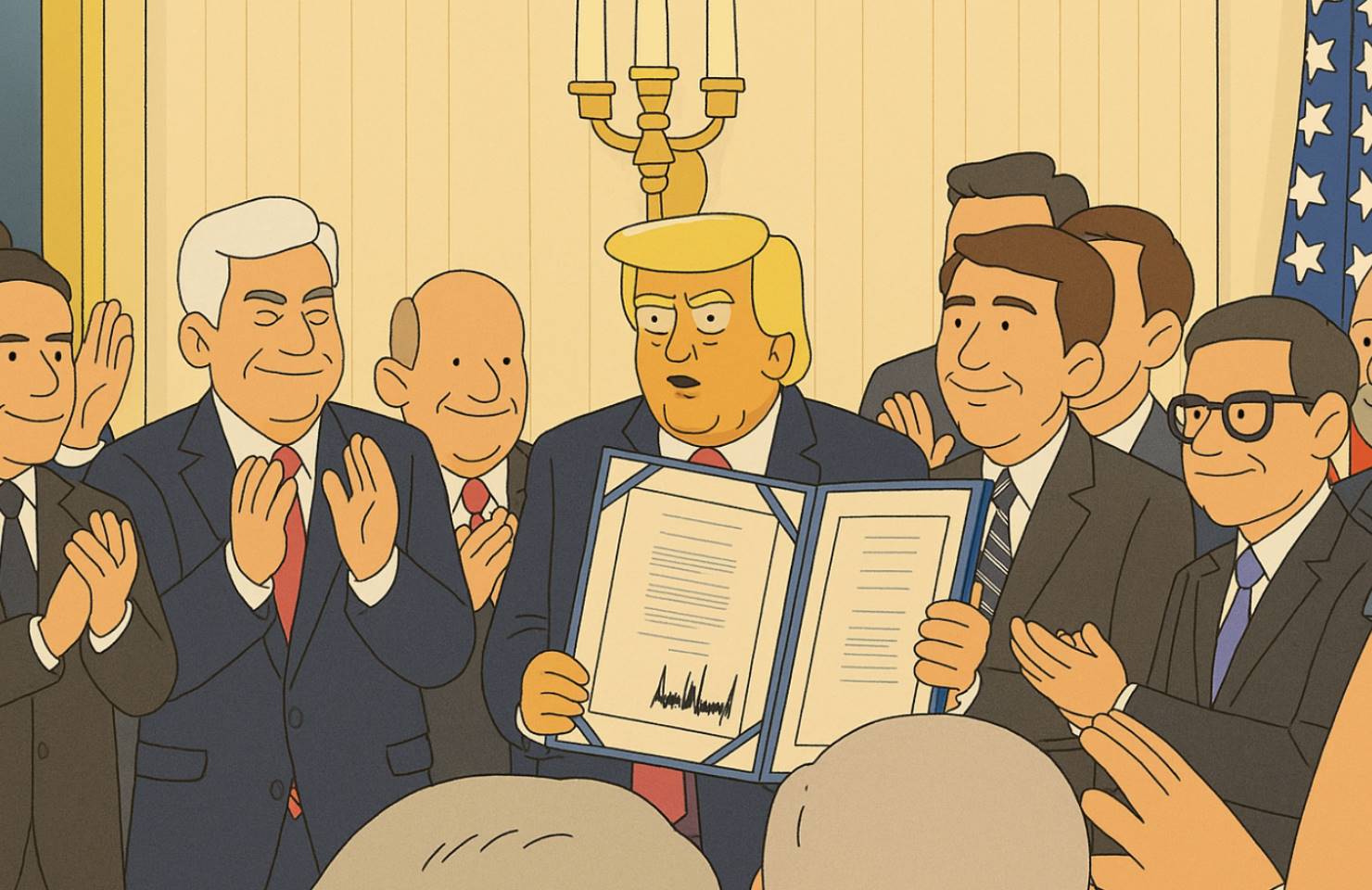

U.S. Senate passes procedural vote on Trump’s “Big Beautiful” tax bill

According to Jin10, market news indicates that the U.S. Senate secured sufficient votes (51 in favor, 49 opposed) in a procedural vote to advance Trump’s tax reform legislation, increasing the likelihood of its passage in the coming days.

Trump's approval rating drops to historic low

Citing Reference News and referencing a report from the U.S. Newsweek website, a recent Newsweek poll shows President Trump’s approval rating has hit a historic low. The survey reveals that 43% of Americans currently approve of Trump’s performance, while 53% disapprove, resulting in a net approval rating of negative 10%. The report notes that Trump’s polling numbers initially dropped sharply after he announced "Liberation Day" tariffs in April. Although his support quickly rebounded, his recent actions appear to have reignited public dissatisfaction with the White House.

Bank for International Settlements: Trump’s criticism of Fed rate decisions does not threaten its independence

According to Jin10, the Bank for International Settlements stated that Trump’s criticism of the Federal Reserve’s interest rate decisions does not threaten its independence. Uncertainty surrounding U.S. economic policy is dampening economic growth, but no “worrisome” signs linked to a decline in the dollar exchange rate have been observed. Rising protectionism and trade fragmentation are “particularly concerning.”

Data: Retail investor demand hits six-month low, down 10% over 30 days

CryptoQuant analyst Maartunn noted that retail investor demand—measured by transfer volume between $10 and $30 on the 0-day moving average—has declined by 10% over the past month, reaching a six-month low.

Resupply protocol releases emergency remediation proposal to address $10 million ReUSD bad debt

The Resupply protocol’s official team has launched a remedial proposal within the community to respond to the $10 million ReUSD bad debt incident earlier this week. The proposal outlines a set of governance actions aimed at eliminating the protocol’s bad debt and offering retention incentives to affected users.

Phase one measures include burning 6,000,000 ReUSD of bad debt through the insurance pool—representing 15.5% of the 38.7 million reUSD held in the pool—and repaying the remaining $1,131,168 in bad debt via a combination of future revenue sources. Additionally, the proposal shortens voting timelines to accelerate decision-making and introduces an IP retention plan for insurance pool depositors, incentivizing them to remain in the pool with additional RSUP tokens.

OneKey founder: Resupply’s solution is “robbing users after being rugged”

Yishi, founder of OneKey, once again criticized the “Curve ecosystem DeFi protocol Re-supply hack report and remediation measures,” condemning the project’s irresponsible and predatory behavior. He stated: “I haven’t seen any action from Resupply to report the incident or track down the hacker—not even the superficial gesture of publicly calling on the hacker to return the funds. Instead, they’ve turned directly against the victims. Their first response to getting rugged is to reach into users’ pockets: extending lock-up periods, blocking withdrawals, and then resorting to insulting users in the community, kicking people out, banning them, even racial discrimination… After years in DeFi, I’m truly amazed. Hats off to you.”

Cosine, founder of SlowMist, added: “This project is the first in history not to issue a public statement or offer a bounty. If I were the attacker, I’d be completely confused… When will the project team say something? Should I act as a black hat or a white hat?”

Tether CEO: Open-source password manager PearPass in testing, soon to be open-sourced

Tether CEO Paolo Ardoino announced on X that the open-source password manager PearPass is currently undergoing testing and will soon be open-sourced. PearPass will support mobile and desktop versions, along with a browser extension rollout.

Ardoino described it as “fully localized, private, peer-to-peer synced across your devices, supporting mobile, desktop, and upcoming browser extensions.”

Previously, Tether’s CEO responded to the global password leak incident: “Cloud services have let us down again—we’re developing a new password management solution called PearPass.”

Lido DAO votes to pass dual governance structure proposal, granting stakers delay or veto power

According to The Block, Ethereum staking protocol Lido DAO has voted to approve a dual governance structure proposal, giving stakers (users holding stETH tokens) the ability to delay or veto governance decisions made by LDO token holders. The main voting phase concluded with near-unanimous support—53.6 million LDO tokens voted in favor, just surpassing the required threshold of 50 million LDO, with only 1.18 LDO opposed. Under the new model, stakers can signal opposition by depositing stETH into a custody contract. If deposits reach 1% of Lido’s total staked ETH, the proposal will be delayed by five days; if they reach 10%, the proposal will be frozen. The final result will be confirmed on June 30 at 10:00 a.m. Eastern Time, unless a large-scale opposition emerges during the “objection” phase.

Fiserv partners with PayPal and Circle to launch dollar-backed stablecoin FIUSD

According to Catenaa, U.S. fintech giant Fiserv announced plans to collaborate with PayPal and Circle to launch FIUSD, a U.S. dollar-backed stablecoin.

The stablecoin is expected to launch before year-end, initially operating on the Solana blockchain and integrated with Fiserv’s Finxact core banking platform. FIUSD aims to facilitate payment settlements, remittances, and invoice reconciliation using tokenized dollars.

This move follows the U.S. Senate’s recent passage of stablecoin legislation, reflecting a clearer regulatory environment and growing institutional confidence in regulated digital dollar alternatives.

Fiserv emphasized that FIUSD will operate compatibly with other stablecoins, potentially attracting more partners and driving broader adoption. The company is also exploring deposit tokens, enabling banks to offer digital payment solutions while maintaining regulatory safeguards and traditional capital advantages.

Michael Saylor posts Bitcoin Tracker update again, likely to accumulate BTC next week

Michael Saylor, Executive Chairman of Strategy, posted updated Bitcoin Tracker information on X, writing: “21 years from now, you’ll wish you had bought more.” Based on previous patterns, Strategy typically discloses its Bitcoin accumulation the day after such announcements.

Yucheng Technology: Engaged in deep discussions with stablecoin issuers, signed NDAs

According to Cailian Press, Yucheng Technology (300674.SZ) released an investor relations activity report, stating that recent policy breakthroughs in the stablecoin space align closely with the company’s global development strategy. Yucheng has begun systematic planning at the corporate level to strengthen its existing overseas operations, including: 1) actively engaging key participants across the stablecoin ecosystem, particularly in-depth discussions and signing NDAs with issuing entities, focusing on full-cycle issuance needs, clarifying responsibilities, identifying feasible technical solutions, and integrating respective strengths and resources; 2) communicating with institutions in emerging technology hubs like Singapore to explore practical pathways for RWA tokenization, including selecting suitable underlying assets, designing compliant tokenization frameworks, and formulating issuance strategies; and 3) discussing with companies in closed-loop industrial chains in the Middle East, where stablecoins can serve as a use case due to the need for seamless integration across upstream and downstream segments. Using stablecoin blockchain technology, transaction transparency and end-to-end payment systems can be established across the entire chain.

Market Update

Suggested Reading

This article provides an in-depth analysis of the multi-chain DeFi platform Maple Finance, covering its development journey, business model, and the performance of its token SYRUP in the market. It explores Maple Finance’s strengths and challenges in institutional lending and analyzes the reasons behind SYRUP’s counter-trend surge.

"Stablecoin’s First IPO": Circle’s IPO Puzzle – A Founding Team’s Missed $5 Billion Exit

This article delves into the IPO puzzle surrounding Circle, issuer of the USDC stablecoin, examining the motivations behind the founding team and early investors cashing out significantly during the IPO, as well as the enthusiastic market reception of its future potential. It also offers a detailed breakdown of Circle’s business model, the design philosophy behind its flagship product USDC, and its unique position in the crypto world.

This article tells the story of Tahini's, a Canadian Mediterranean and Middle Eastern fast-casual chain, which successfully combats inflation by integrating Bitcoin into its financial strategy and competing with industry giants like McDonald’s. Through regular Bitcoin investments, deploying Bitcoin ATMs, and innovative media strategies, the company has significantly optimized its operations and maintained a long-term investment approach even during bear markets.

The Wall Street Journal: The Small Nation of Bhutan Bets Big on Bitcoin Mining

This article discusses Bhutan, a small country renowned for its traditional culture, which has recently emerged as a pioneer in the cryptocurrency space. Since 2020, Bhutan has leveraged its abundant hydropower resources to establish Bitcoin mining facilities and now holds $1.3 billion worth of Bitcoin reserves—approximately 40% of its GDP. While Bitcoin mining has brought economic benefits to Bhutan, the initiative also carries risks and controversy.

Tiger Research: Why Are CEXs Rushing Into DeFi?

This article analyzes why major centralized exchanges (CEXs) such as Bybit, Binance, and Coinbase are aggressively entering the DeFi space, exploring their strategic motivations and implementation paths. By launching on-chain services, CEXs aim to capture early access to new tokens, prevent user attrition, and blur the lines between centralized and decentralized platforms, thereby promoting convergence and development within the crypto ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News