On his 154th day in office, Trump paid off more than $100 million in debt.

TechFlow Selected TechFlow Selected

On his 154th day in office, Trump paid off more than $100 million in debt.

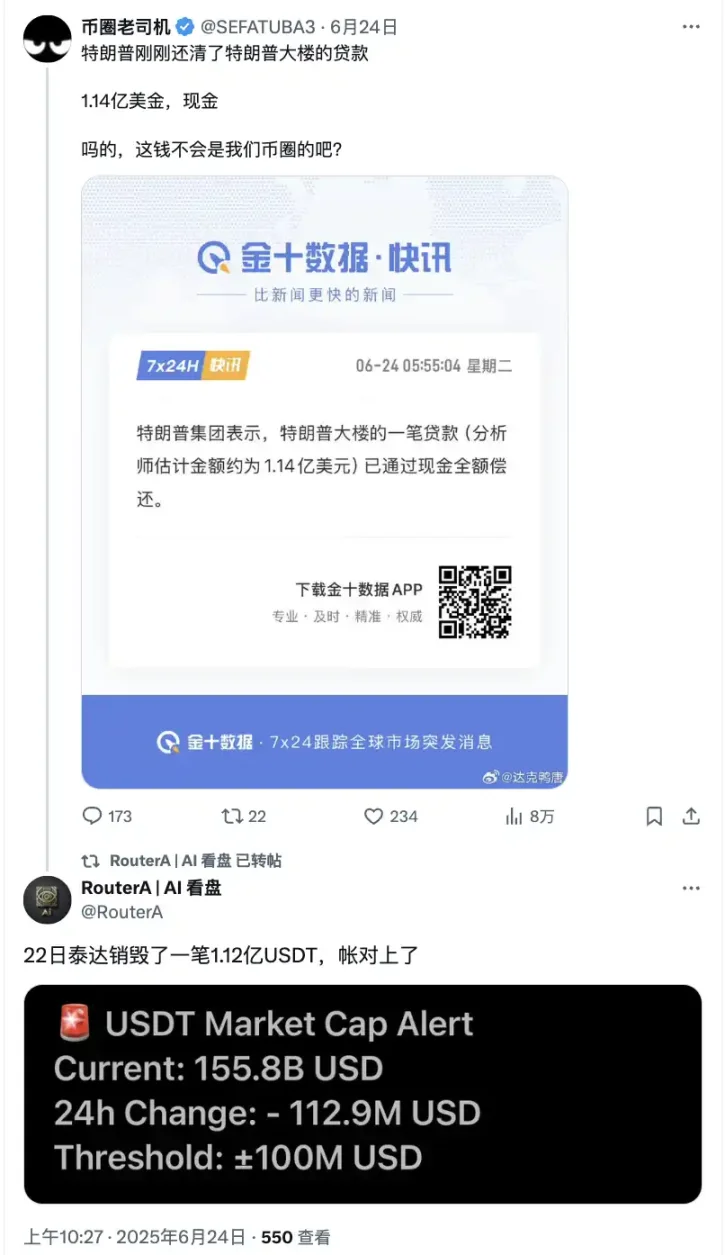

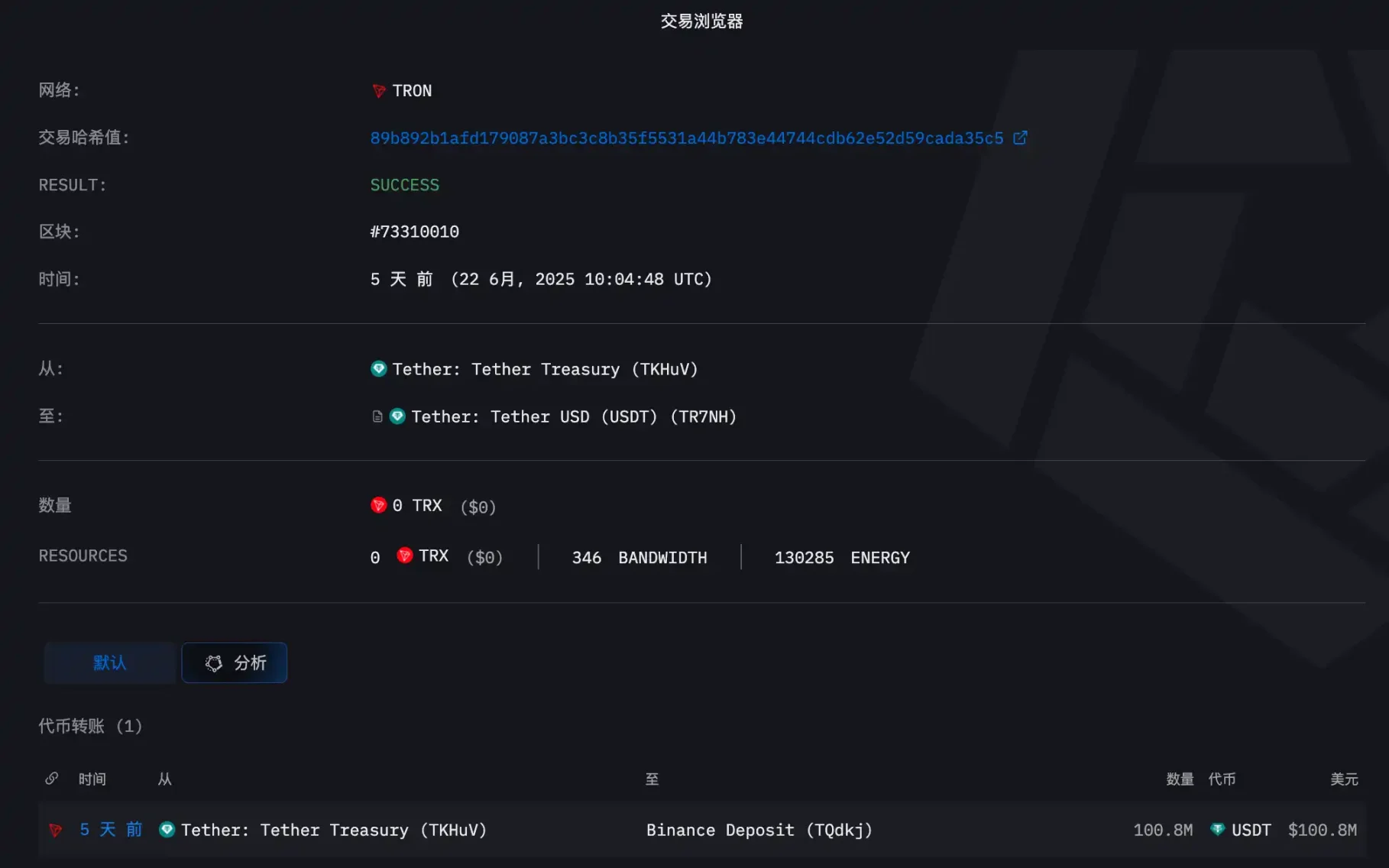

The day before the loan repayment, a sum of 112 million USDT was converted into U.S. dollars.

By Jaleel, BlockBeats

U.S. presidents are limited to two terms, so it's often said that during a second term, the main agenda shifts from governance to "making money."

On June 23, Donald Trump entered the 154th day of his second presidency by paying off in full the most troublesome debt in his business empire—$114 million in cash, settled 13 days before the loan’s maturity.

This $114 million equals 400 years’ worth of a U.S. president’s salary. Using the most popular estimation—"one carry-on suitcase can hold $1 million in $100 bills"—it would take at least 114 suitcases to pack and transport this sum.

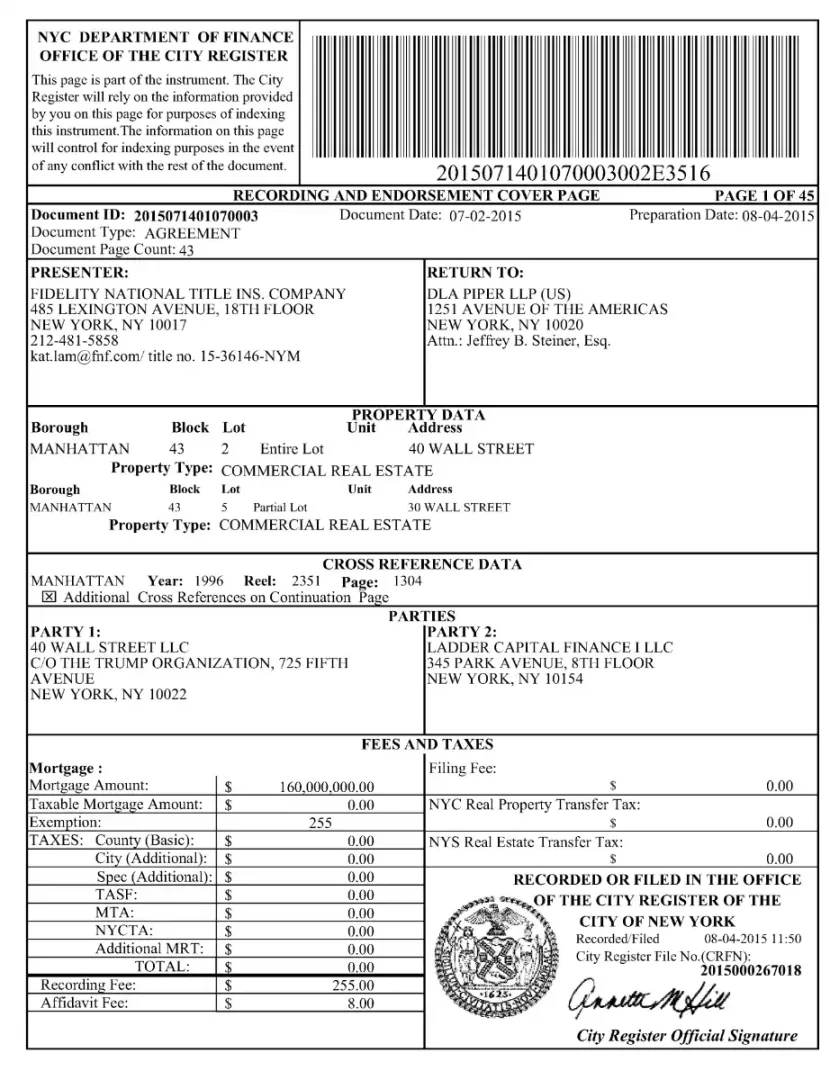

The loan originated from his iconic Manhattan skyscraper at 40 Wall Street, also known as The Trump Building.

40 Wall Street, also known as The Trump Building

Shadow Banks: Trump’s Lenders

"When Trump needs a loan, he usually calls Ladder Capital," an insider once revealed.

In 2015, facing the imminent maturity of a $5 million loan from Capital One, Trump decided to refinance 40 Wall Street. This time, instead of turning to traditional banks, he went to Ladder Capital—a small, low-profile shadow bank.

After evaluation, Ladder quickly agreed to issue a $160 million commercial mortgage loan on the building at a remarkably low interest rate of just 3.67%. Within weeks, the debt was packaged, divided into four tranches, and sold alongside dozens of other real estate assets to investors, entering the subprime financial market.

Ladder Capital and the debt notes tied to The Trump Building

For Trump, this was a lifeline loan.

In fact, since the early 1990s financial crisis, major banks like Citigroup and JPMorgan Chase have largely avoided doing business with Trump. After a series of failed investments left him nearly bankrupt—resulting in bank seizures of assets like the Plaza Hotel and Trump Air—these institutions suffered heavy losses. Deutsche Bank was the last major financial institution willing to lend to him, but even their relationship soured after a dispute over delayed repayments on a Chicago project in 2008. Although Deutsche Bank did extend another loan for a Washington D.C. project in 2014, trust was never fully restored.

Ladder Capital not only agreed to lend but offered an exceptionally low rate. Typically, U.S. commercial real estate loans carry interest rates between 5.5% and 10%, with office properties often higher. For years, Ladder Capital and Deutsche Bank were Trump’s largest creditors; Deutsche Bank charged Trump Group interest rates of 5%-7%, making Ladder’s 3.67% offer extremely favorable by comparison.

Where there is abnormality, there is likely intrigue.

Reports suggest that the relationship between Ladder Capital and Trump goes far beyond a simple lender-borrower dynamic. Jack Weisselberg, a senior executive on Ladder’s founding team, is the son of Allen Weisselberg, CFO of the Trump Organization. This connection allowed Trump to access hundreds of millions in funding at ultra-low rates—even as mainstream Wall Street banks shunned him.

As a real estate investment trust (REIT), Ladder Capital specializes in financing high-risk projects that traditional banks avoid. It doesn’t rely on customer deposits but instead uses securitization—quickly bundling and selling loans—to generate liquidity and returns. According to Trump’s 2017 financial disclosures, Ladder Capital held claims on at least four of his properties, including Trump Tower on Fifth Avenue, totaling over $280 million in debt.

As Trump grew increasingly isolated from the conventional financial system, he leaned more heavily on shadow banking institutions like Ladder Capital. This symbiosis also reflects the rise of New York’s shadow banking sector.

Shadow banks refer to non-bank financial institutions operating outside traditional banking regulations, including hedge funds, private equity, money market funds, and REITs. They provide lending and financing services without being subject to the same regulatory requirements as commercial banks. The U.S. shadow banking system manages around $14 trillion in assets—comparable in scale to the $16 trillion traditional commercial banking sector.

Yet, shadow banks represent a fragile link in America’s financial architecture. Unlike commercial banks, which operate on government-insured deposits, shadow banks depend on short-term funding—meaning they can face instant liquidity crises when market conditions tighten, as seen with Lehman Brothers and Bear Stearns in 2008.

But this is merely one facet of Trump’s aggressive business approach.

Gwenda Blair, author of *The Trumps: Three Generations That Built an Empire*, noted that Trump initially gained access to Wall Street because his father, Fred Trump, was one of the most respected developers in New York real estate. Banks trusted Fred and were willing to give his son a chance.

But patience wore thin under Trump’s “Don-like” risk-taking. Bankers began fearing that continued lending might lead not only to unrecoverable losses but also accountability issues before boards and shareholders. Gradually, major banks quietly blacklisted him from mainstream credit markets.

40 Wall Street: A Skyscraper That Can’t Be Leased

Trump has long touted 40 Wall Street as one of his greatest investment triumphs.

He frequently mentions the deal in speeches and writings: "I acquired this building in 1995 for just $1 million." In his autobiography *Never Give Up*, he wrote: "When people ask me about my proudest investment, I always think of 40 Wall Street—it has a special magic that sets me apart forever."

Indeed, built in 1930, this 70-story, 282.5-meter skyscraper briefly held the title of world’s tallest building before the Chrysler Building was completed. Located in Manhattan’s financial heart, it was designated a New York City landmark in 1998. It has witnessed the rise and fall of Wall Street—and Trump’s own ascent from developer to president.

What many don’t know is that Trump does not own the land beneath the building. He holds only a long-term lease, renewable up to 200 years. The actual landowners are a group of discreet German industrialists and billionaires. In 1995, Trump took over the lease and restructured it, agreeing to pay fixed annual ground rent to these Germans.

It was against this backdrop that Trump pursued refinancing in 2015. He secured the $160 million loan from Ladder Capital to replace the maturing $5 million debt from Capital One.

The Trump Building, photo source: New York Times

At the time, Ladder Capital had strong confidence in the building’s cash flow. Data showed a 94.5% occupancy rate in 2015—1 percentage point above similar office buildings. Projections estimated annual revenue of $43.1 million, operating costs under $20.6 million, and net income exceeding $11 million.

But the building’s performance hasn’t lived up to those 2015 expectations, prompting concerns among financial institutions that Trump might default again.

Since 2019, amid the pandemic and declining office demand, occupancy dropped from 89.1% to 74.2% in 2023. Rental income fell from $41.7 million in 2019 to $30.9 million in 2022, recovering slightly to $33 million in 2023—but still far below initial forecasts.

Meanwhile, operating costs have remained stubbornly high, rising from $20.9 million in 2017 to $23.2 million in 2023. Maintenance expenses alone are nearly double original estimates. By 2023, the building’s net operating income had dwindled to just $12.8 million. In August 2023, rating agency Fitch downgraded the loan’s credit rating from BBB- (investment grade) to BB (junk status).

And it gets worse.

The annual ground rent Trump pays to the Germans rose from $1.6 million in 2015 to $2.3 million today. More critically, under the lease reset clause kicking in after 2033, this payment will skyrocket to $16 million—effectively consuming all profits.

After paying $9.8 million annually in loan interest and covering renovation and leasing costs, Trump pockets only about $1.2 million in actual profit from the building.

Anchor tenant Duane Reade terminated its lease four-and-a-half years early. Other tenants either delay move-ins or refuse to renew. As of Q1 2025, the building has only "barely achieved break-even." Given rising interest rates and persistent cost pressures, this balance appears increasingly fragile—an illusion rather than reality.

From Casinos to Skyscrapers: Trump’s Six Bankruptcies

How Trump repaid this loan has become a key indicator of his financial health and political leverage. What’s more alarming is that last year, the New York Attorney General explicitly warned that if Trump fails to pay damages in a civil fraud case, this building could be seized by the state.

One possible solution remains: using personal funds to repay part of the principal and taking out new loans for the rest. But multiple institutions have voiced concern—will Trump default again, just as he did before? Alternatively, he might simply declare bankruptcy for 40 Wall Street.

If so, it would mark his seventh corporate bankruptcy filing. Amiyatosh Purnanandam, a finance professor at the University of Michigan, noted that unless Ladder Capital still holds a portion of the loan, it would have little recourse. "The real victims would be the investors who bought these bonds," he said. "They could be banks, insurers, or hedge funds."

Since the 1990s, Trump has been known for his aggressive strategy: high leverage, big bets, and gambling on the future. He has declared bankruptcy six times across various ventures.

His first bankruptcy came in 1991, involving the Atlantic City casino he once called the "eighth wonder of the world," built at a cost of $1.1 billion and financed largely through junk bonds at 14% annual interest. When the 1990 recession hit, cash flow collapsed, and the casino rapidly declined. Trump filed for Chapter 11 protection, shedding assets and converting creditors into shareholders to retain control.

The second through fourth bankruptcies occurred in 1992, when Trump Castle, Trump Plaza, and the Plaza Hotel simultaneously faced severe debt distress. The Plaza Hotel alone carried over $550 million in liabilities and collapsing cash flow. Again, Trump used Chapter 11 restructuring—share dilution, debt-for-equity swaps—to save operations while preserving management rights and keeping the "Trump" brand alive.

During this period, in 1999, his father Fred passed away, passing the real estate empire to Donald. But soon came the fifth bankruptcy. In 2004, Trump Hotels & Casino Resorts filed for bankruptcy with $1.8 billion in debt and nearly $50 million in losses in the first quarter. Another round of Chapter 11 followed. Trump injected capital and reduced his stake to avoid personal liability, while continuing to collect management fees.

That same year, Trump began appearing frequently on TV—cameo roles, hosting the hit reality show *The Apprentice*—reigniting public interest. Media exposure soared, but then the global financial crisis struck. In 2008, Lehman Brothers’ collapse triggered a sharp contraction in real estate, dragging down all of Trump’s property ventures.

In 2009, Trump Entertainment Resorts filed for bankruptcy again due to failure to repay $53.1 million in debt. In 2014, amid deteriorating operations, it filed once more—this time, Trump relinquished management and sold the casinos to billionaire Carl Icahn and hedge funds.

Notably, all six bankruptcies occurred at the corporate level. Trump himself never filed for personal bankruptcy. Thanks to legal separation, he protected his personal wealth. More importantly, in each restructuring, he fought to retain management or branding rights—ensuring the name "Trump" continued generating cash flow.

Historically, Trump excels at three things: using bankruptcy to escape crises, leveraging PR and media to rebuild image, and monetizing his brand through licensing. But this time, he paid off the entire $114 million loan—not through restructuring or new debt—but entirely in cash.

Yet this very act—paying in full with cash—has sparked fresh questions: How much money does Trump actually have? And where did this cash come from?

Cash Payment in Full: Where Did Trump’s Money Come From?

Shortly after news of the loan repayment broke, sharp-eyed observers noticed something unusual: On June 22, $112 million worth of USDT was burned (removed from circulation) on the TRON blockchain. This amount may well have been the source of his repayment.

(Note from BlockBeats: When USDT is "burned" or transferred to an exchange, it typically means redemption into fiat dollars—i.e., withdrawal from the blockchain back into a real-world bank account.)

Moreover, BlockBeats found via ARKHAM data that on June 22 UTC at 10:00, exactly $100 million in USDT was transferred from the TRON network to a Binance deposit address starting with TQdkj. The timing and path align closely with online speculation.

Data source: ARKHAM

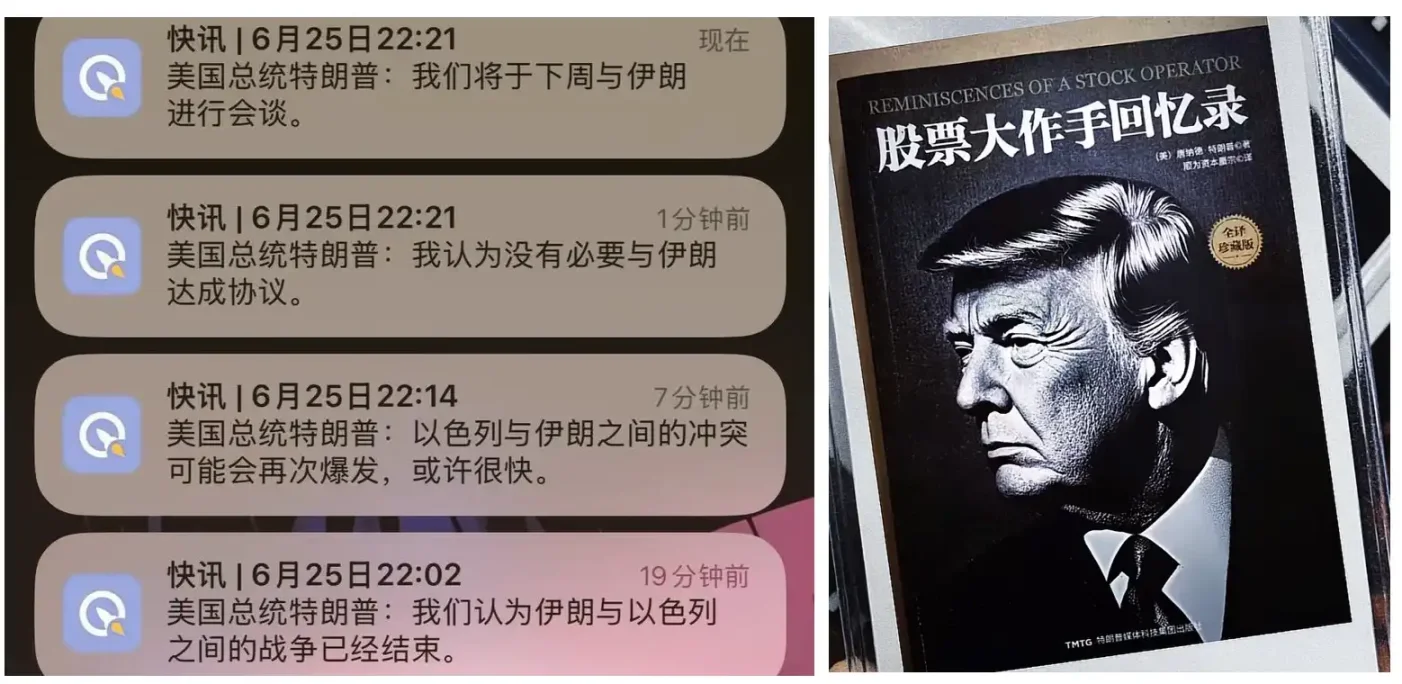

Even more intriguing is another theory circulating: Were Trump’s recent flip-flopping statements on Israel-Iran tensions purely diplomatic moves—or calculated attempts to manipulate market sentiment for profit?

Source: Twitter

On June 20, Trump hinted at a "pause" in action against Iran, triggering a drop in U.S. stocks and a 2% plunge in oil prices. At the same time, Bitcoin surged about 2%, rebounding to $106,000. This market movement closely mirrored Trump’s shifting rhetoric on the Israel-Iran conflict—market sentiment shifted instantly, and risk assets bounced back.

On the 23rd, he further claimed that "Israel and Iran have agreed to a ceasefire." Bitcoin spiked 5% intraday, breaking above $105,000. Crypto stocks like Coinbase jumped 12%, MicroStrategy rose over 1%, and the entire crypto sector rallied. The sequence—statement → market reaction → potential cash-out—appears highly orchestrated.

Looking back at his past behavior, this isn’t the first time such manipulation suspicions have arisen:

On April 9, just before announcing a tariff pause, Trump posted on Truth Social: "Now is a great time to buy, DJT!" Hours later, he suspended tariffs on most countries, sending U.S. stocks up 9.5% and the Dow soaring 8%. Trump rarely signs posts with his initials—but here, "DJT" coincidentally matches the stock ticker of Trump Media & Technology Group, the company behind Truth Social. That day, Truth Social’s stock surged 22%, sparking immediate accusations of insider trading and market manipulation, drawing congressional scrutiny.

During the crypto peak in March, analysts like Peter Schiff accused Trump of running a "pump-and-dump" scheme with digital assets and called for a congressional investigation into whether he manipulated cryptocurrency markets through policy statements. As early as 2019, JPMorgan created the "Volfefe Index" based on Trump’s tweets to measure their immediate impact on U.S. Treasury markets.

Meanwhile, debates over the sources of Trump’s wealth and his market motivations have reached new heights.

Last Friday, Trump’s team submitted a 230-page financial disclosure report—the first formal balance sheet released since the start of his second term. Covering data up to early 2025, it includes all campaign-era cash flows and new assets from 2024.

The most eye-catching item: $57 million in income from selling cryptocurrency tokens via WLFI. WLF is a family-controlled crypto firm, with Trump’s three sons listed as co-founders on its website.

Beyond direct proceeds from WLFI token sales, Trump holds 15.75 billion governance tokens in an ETH wallet. These are valued in the financial documents at $1,000–$15,000, with income recorded as less than $201. However, WLFI’s first sale priced tokens at $0.015, the second at $0.05. If the current OTC price is $0.10, Trump’s holdings would be worth $1.575 billion.

Besides WLFI, the Trump family controls another covert exit channel—meme coins.

His personal meme coin "$TRUMP," though launched in January 2025 and thus not included in the financial report, can be gauged through his wife Melania’s "$MELANIA" coin. According to Lookonchain monitoring, Melania’s team sold 821,800 MELANIA tokens—8.22% of total supply—across 44 wallets over the past four months, cashing out approximately $35.76 million.

$TRUMP has significantly higher market cap and liquidity than $MELANIA. Extrapolating from this, the couple may have already realized over $100 million in combined profits from both coins since late 2024.

In addition, he holds between $1 million and $5 million in Ethereum, reinforcing his image as the "most crypto-friendly president." During campaigns, he openly advocated for a "more relaxed and non-interventionist" regulatory stance compared to previous administrations.

If crypto assets represent Trump’s hidden wealth, brand licensing is his cash cow.

He has authorized dozens of products bearing his name and likeness—from a "God Bless America" edition Bible, limited-edition Trump sneakers, and perfumes, to Swiss-made "Trump watches" and a signed guitar engraved with "45."

These products generated millions in royalty income in 2024. Just three Florida golf courses and Mar-a-Lago Club contributed $21.77 million in annual cash flow.

He is also the largest shareholder in Trump Media & Technology Group (DJT.US), holding over 53% of shares. Listed on Nasdaq, the company values his stake in the billions—held in a revocable trust managed by his eldest son.

Current estimates place Trump’s net worth at approximately $4.8 billion, with cash and liquid assets accounting for about $400 million. Yet he also carries over $600 million in debts, many tied directly to pending legal judgments.

For instance, he owes $454 million in civil fraud penalties to the New York Attorney General; in defamation lawsuits brought by writer E. Jean Carroll, he was ordered to pay $5 million and $83 million respectively—though all cases remain under appeal and not yet finalized.

Having weathered six bankruptcies, countless lawsuits and trials, and even becoming the first U.S. presidential candidate to run while criminally convicted, Trump has now not only repaid a decade-long loan but also built a new trans-reality wealth empire spanning physical goods and digital assets through cryptocurrency, personal branding, and media platforms.

Perhaps after dodging that bullet, Trump truly believes he is destined to beat fate by half a move.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News