The Next Frontier for Stablecoins: International Payments, Tokenized US Stocks, and AI Agents

TechFlow Selected TechFlow Selected

The Next Frontier for Stablecoins: International Payments, Tokenized US Stocks, and AI Agents

Stablecoins, leveraging their advantages of payment-as-settlement and lightweight account systems, are not only demonstrating disruptive potential in traditional payments but also becoming a key driver in tokenized U.S. equities (RWA) and AI Agent payment scenarios.

Author: Li Xiaoyin, Wall Street Insights

A new frontier is emerging for stablecoins, with tokenized U.S. equities and AI Agents poised to attract global liquidity.

Driven by accelerating legislation, active corporate participation, and rapidly growing trading volumes, stablecoins are transitioning from a peripheral role in cryptocurrency to the core of financial innovation, capturing global market attention.

According to Fengwen Trading Desk, Guosheng Securities analysts Song Jiaji and Ren Heyi stated in their latest research report that thanks to advantages such as payment-and-settlement-in-one and lightweight account systems, stablecoins not only show disruptive potential in traditional payments but also serve as a key driver in tokenized U.S. equities (RWA) and AI Agent payment scenarios.

The report notes that tokenized U.S. equities offer crypto investors more asset allocation options and could drive rapid expansion of the stablecoin market. Meanwhile, AI Agent-based payments may relieve users of operational burdens and give rise to entirely new payment models. The convergence and innovation of these two emerging sectors are expected to become significant catalysts to watch in the second half of the year.

Tokenized U.S. Equities Rekindle RWA Momentum

As a crucial branch of real-world asset (RWA) tokenization, tokenized U.S. equities are entering a critical phase of accelerated implementation.

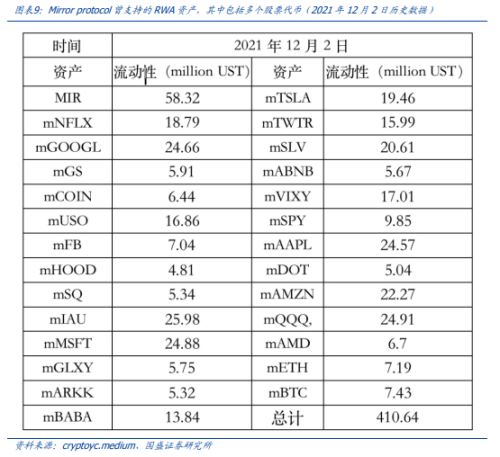

In the past, equity tokenization briefly gained traction on platforms like Mirror Protocol, supporting synthetic tokens for U.S. stocks such as Tesla and Google, but faded due to regulatory concerns and market volatility. Now, with advancing RWA regulatory frameworks, interest in stock tokenization is resurging.

Against a backdrop of increasingly clear regulations, traditional financial institutions like BlackRock and crypto-native firms are actively lobbying regulators to relaunch equity tokenization.

The report reveals that cryptocurrency exchange Coinbase is seeking approval from the U.S. Securities and Exchange Commission (SEC) to offer "tokenized stocks" to its users. Meanwhile, veteran exchange Kraken has taken early action, announcing a partnership with Backed Finance to launch its “xStocks” service, covering over 50 U.S.-listed stocks and ETFs including Apple, Tesla, and NVIDIA.

The service not only provides crypto investors with access to traditional financial assets but could also significantly expand stablecoin circulation by broadening their use cases.

The report estimates that the sheer scale of the U.S. stock market is sufficient to drive rapid growth in stablecoin demand. As on-chain "fiat," stablecoins play an infrastructural role in tokenized equity trading and are poised to become a major new application area.

AI Agents Usher in a New Era of Smart Payments

The deep integration of stablecoins with AI Agents is seen as another high-potential market. Particularly in future AGI (Artificial General Intelligence) scenarios, AI Agents may replace humans in executing numerous payment operations.

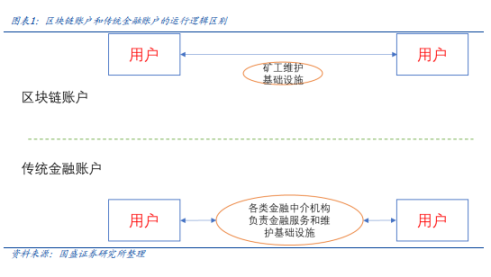

The report points out that traditional financial accounts involve complex authorization processes unsuitable for AI—often requiring multiple steps including user consent and institutional review. In contrast, stablecoins’ blockchain-based lightweight account system is inherently well-suited for control by AI Agents.

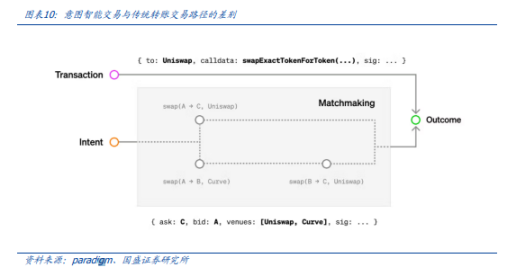

The introduction of blockchain smart contracts further enhances the fusion of AI decision-making and payments, enabling AI Agents not only to provide analytical recommendations but also to directly operate user accounts—achieving truly intelligent payments.

Moreover, blockchain accounts are essentially smart contracts, inherently possessing AI-friendly characteristics. Features like flash loans and automated market maker (AMM) protocols exemplify this trait.

The report cites intent-centric applications as an example: users need only grant one-click authorization, after which the AI can algorithmically optimize transaction paths to efficiently convert from Token A to Token B without manual intervention. This deep integration between AI and blockchain accounts opens vast possibilities for stablecoin payment use cases, especially in automated trading and smart payments.

However, the report adds that AI Agent payments remain in early stages. The decentralized architecture of blockchain networks creates obvious efficiency bottlenecks.

For instance, Ethereum’s mainnet handles only double-digit transactions per second, far below the performance of traditional payment systems—Alipay processed 256,000 transactions per second at its 2017 Singles' Day peak. Technical scalability and network congestion issues must be urgently addressed; otherwise, they will struggle to support large-scale user demand.

Payment Use Cases Grow Competitive, Stablecoins Hold Huge Potential

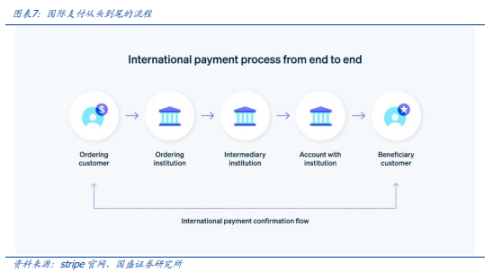

Stablecoins also demonstrate strong potential in international payments, where their peer-to-peer, payment-as-settlement features offer clear advantages over the high costs and inefficiencies of traditional financial systems.

The report highlights that in underdeveloped regions, stablecoins have even achieved a "leapfrog effect"—enabling dollar-denominated payments via simple mobile registration of blockchain accounts, solving the problem of limited banking infrastructure. Additionally, payments giant Stripe acquired Bridge for $1.1 billion to launch a stablecoin financial account service spanning 101 countries, further bridging stablecoins with fiat payment systems.

The report also notes that "non-fungible" characteristics among different stablecoin types have intensified competition in the market.

Even USDC, operated by Coinbase, sees trading volume just one-eighth that of USDT. PayPal's PYUSD stablecoin has reached only around $950 million in size, falling far short of expectations.

The report adds that for stablecoins to achieve widespread adoption in payments, they must overcome efficiency limitations imposed by blockchain’s "impossible trinity." Traditional payment systems like Alipay achieved a peak processing rate of 256,000 transactions per second during the 2017 Singles' Day event, while Ethereum’s mainnet manages only double-digit throughput per second.

The main views in this article are drawn from the research report titled "The Next Frontier for Stablecoins: International Payments, Tokenized U.S. Equities, and AI Agents," published by Guosheng Securities analysts Song Jiaji and Ren Heyi on June 24.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News