Finding the Next Circle: Backpack's Unique Competitive Edge in the Crypto Stock Market Boom

TechFlow Selected TechFlow Selected

Finding the Next Circle: Backpack's Unique Competitive Edge in the Crypto Stock Market Boom

Backpack truly centers its business logic on "native crypto products + wallet + asset issuance + community governance," precisely addressing traditional capital markets' urgent demand to capture genuinely promising crypto opportunities.

Author: TechFlow

Over 25 times oversubscribed in its initial public offering, expanding shares from 24 million to over 34 million, surging 168% on its first trading day with multiple circuit breakers triggered, briefly pushing the stock price above $118...

As the first stablecoin company listed on the New York Stock Exchange, Circle is undoubtedly a success and of great significance. With Circle as a pivotal milestone, a new financial order is taking shape—crypto, as an emerging financial force, is stepping into the mainstream and winning favor from Old Money. The broad rally in U.S. crypto-related stocks over these two days further confirms capital markets’ growing attention toward crypto equities.

Beneath the hype: numerous crypto companies are gearing up for IPOs, while investors eagerly search for the next Circle.

Besides Kraken, Ripple, and Bullish—frequently highlighted as top contenders for the "next Circle"—Backpack has recently emerged as another strong candidate, thanks to its seamless fiat on-ramp/off-ramp functionality that has attracted massive user adoption, along with the official launch of withdrawal processes for former FTX EU users. Leveraging dual advantages in product innovation and regulatory compliance, Backpack has become a key nominee in the race to be the next Circle.

Rarity of True Web3 Attributes Amid the Crypto IPO Boom

As crypto equities take center stage in market discussions, we’ve compiled an overview of major global stock exchange-listed crypto-related companies:

With more and more crypto-focused firms going public, the crypto industry is demonstrating increasingly significant influence within traditional finance.

Circle’s remarkable IPO success not only reflects traditional financial investors’ interest in crypto but, at a deeper level, reveals their preference for natively built crypto projects—an understandable trend: when it comes to profiting from crypto, assets that better represent the spirit of crypto naturally stand out.

Yet among currently listed crypto concept companies, truly native crypto businesses remain scarce.

In composition, among the 45 crypto-listed companies reviewed, cryptocurrency mining firms account for the largest share—24 companies (53%), including Bit Digital, a leader in Bitcoin mining operating green-energy-powered mining facilities across North America and Asia, which has recently diversified into AI computing services for new revenue streams. Investment and financial service firms follow, totaling nine companies (over 20%), with Strategy being a prime example—steadily increasing Bitcoin holdings through debt financing, now holding more Bitcoin than any other publicly known entity.

These two categories together constitute over 73% of all listed crypto firms surveyed. However, strictly speaking, neither group qualifies as genuine crypto enterprises.

Just recently, Backpack founder Armani Ferrante pointed out sharply on X: "From traditional capital markets’ perspective, true Web3 companies are extremely rare. Wall Street wants investable, measurable crypto firms—but such targets are still far too few."

This is a real test of capability: Who better understands the core of crypto and implements it into products? Who can present crypto offerings in ways more easily digestible by traditional finance? Who is better equipped to navigate compliance and operational norms in traditional finance?

Beneath the Circle craze, how do today's frontrunners stack up? Who is most likely to become the next Circle?

There are many crypto projects that have explicitly announced IPO plans for 2025, including exchanges like Kraken, Gemini, and Bullish; Ripple, the issuer of XRP; and crypto custody firm BitGo.

We observe that following successful listings by predecessors such as Coinbase and Robinhood, there is no shortage of exchange platforms waiting in line. Exchanges boast the clearest business model—transaction fees—and occupy the central position in crypto’s economic structure.

Within the same exchange赛道, compared to established players like Kraken and Gemini, Backpack may appear less competitive in terms of development timeline or scale. Yet Backpack excels through strategic integration: building a closed-loop user journey via innovative native crypto product suites, while aggressively advancing compliance globally. Combined with rapid growth fueled by incentive programs, Backpack’s overall structure closely resembles a U.S.-style financial platform, securing its seat at the table in the “next Circle” race.

Product Matrix: A Triad Super-Ecosystem of Wallet + Exchange + Mad Lads

Why is Backpack considered the closest to replicating Circle’s model?

Like Circle, Backpack operates on a core logic of “native crypto products + wallet + asset issuance + community governance.” Its comprehensive and robust Web3 product suite directly addresses traditional capital markets’ urgent demand for authentic crypto-native investment opportunities.

Backpack Wallet: Gateway to Web3

A wallet is not only a crucial tool for everyday Web3 exploration but also the first step for new users entering the ecosystem. Thus, a simple and user-friendly wallet plays a vital role as a traffic gateway to the broader Web3 landscape.

As the foundational component of Backpack’s vision for “inclusive Web3 finance,” Backpack Wallet focuses on security and usability to deliver a truly consumer-oriented product. It supports multiple blockchains including Solana, Ethereum, Optimism, Arbitrum, Polygon, Base, and Sonic, available via mobile app and browser extension, and is already listed on Apple Store and Google Play. Users can perform essential functions such as sending, receiving, swapping, and staking digital assets—covering nearly all daily crypto transaction needs.

xNFTs are one of Backpack Wallet’s defining features: xNFTs are both tradable assets and dApps running inside the Backpack wallet. This transforms the wallet into an open, programmable platform. The “wallet + executable NFT” model mirrors a Web3 version of “WeChat + Mini Programs,” using the wallet as a hub to build a super-app ecosystem and guide users deeper into the crypto world.

Moreover, the seamless integration between Backpack Wallet and Backpack Exchange delivers lower barriers and smoother interactions.

Backpack Exchange: Core Financial Hub

Designed specifically for traders, Backpack Exchange centers on delivering higher capital efficiency under stricter compliance and security frameworks, maximizing profit opportunities for users.

On one hand, Backpack Exchange does not operate its own market-making desk, and its three-stage liquidation mechanism ensures system solvency, creating a more resilient risk engine.

On the other hand, through its innovative global margin system, auto-lending, and automatic P&L settlement, all eligible idle assets are automatically deposited into lending pools to earn yield with real-time payouts—maximizing capital turnover efficiency.

Additionally, Backpack Exchange’s recent launch of fiat onboarding/offboarding functions establishes compliant bridges between the traditional world and crypto, enabling more Web2 users to seamlessly enter on-chain finance. This marks a critical piece in Backpack’s mission to build inclusive Web3 finance.

Read more about Backpack: “The Disruptor” Backpack: Completing the FTX Puzzle, Aiming to Lead TradFi with Compliance as Leverage

Mad Lads: Carrier of Community Culture

No project can sustain long-term growth without a strong, active community. Maintaining such a community requires deep investment in identity recognition, member cohesion, brand visibility, and continuous enhancement of participation and belonging—ultimately forming a self-driven, sustainable ecosystem.

As the leading NFT project in the Solana ecosystem, Mad Lads embodies the spirit of Backpack’s community. Its initial release was a major success, attracting over 8,000 unique holders and quickly forming a genuine, highly engaged fanbase, generating over $8 million in initial revenue.

Since then, initiatives like the team’s content creation incentive program have demonstrated Mad Lads’ resilience. High-quality community-generated content spreads widely across social media platforms such as Twitter, YouTube, Instagram, and TikTok—not only showcasing the brand but also drawing more people to experience and contribute to new products and technologies.

Meanwhile, Mad Lads holders enjoy various privileges across other Backpack-related products, further aligning community members with ecosystem growth—achieving mutual empowerment between community and platform.

In short, through the integrated strategy of wallet + exchange + Mad Lads, Backpack has created a tripartite super-app paradigm combining the functionalities of Robinhood + MetaMask + USDC Network. Highly integrated features and seamless experiences cover the full lifecycle of Web3 services—from ecosystem discovery and financial trading to identity recognition—making Backpack a truly consumer-facing, inclusive trading platform for the Web3 era.

Compliance First: Serving Users Across Regions Accounting for 95% of Global GDP by 2025

Beneath the surge in crypto equities lies a deeper trend: the deeper integration between crypto finance and traditional finance.

Under this converging trend, compliance—though challenging—is an unavoidable path and a key differentiator in the competition for crypto IPOs.

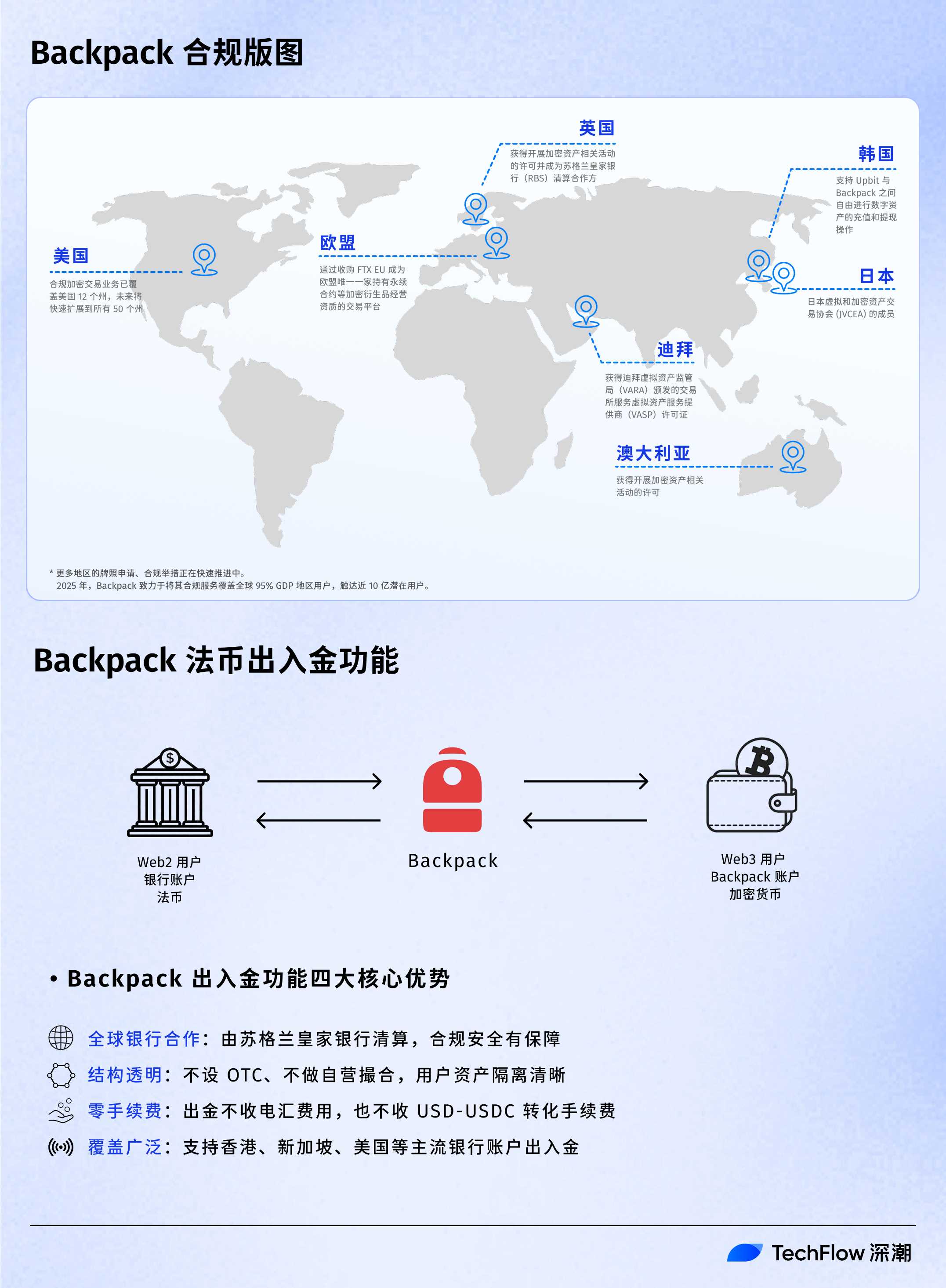

As one of the few crypto companies committed to compliance since inception, Backpack has achieved multi-front breakthroughs worldwide after years of effort:

At a time when crypto equities are capturing attention from both crypto and traditional finance, Backpack’s recent launch of “fiat on/off ramps” further opens a compliant, frictionless channel between traditional finance and crypto—laying a solid foundation for gaining recognition and widespread adoption in traditional markets.

Simultaneously, Backpack has incorporated USDC and pyUSD into its “U.S. dollar equivalent pool.” When Auto-Lend is enabled, users can earn APY combining U.S. Treasury yields and lending rates supported by stablecoins. Current annual yields reach as high as 5.56% (4% from Treasuries + 1.56% from lending), delivering superior capital efficiency atop seamless fiat access.

Notably, amid the wave of crypto firms pursuing U.S. listings, Backpack’s steadfast commitment to compliance may give it a distinct edge in the race to become the next Circle:

Recall that Circle’s IPO triumph came after seven grueling years of preparation (2018–2025), filled with obstacles.

Kraken, another strong contender, has faced a similarly rocky road. In June 2021, then-CEO Jesse Powell boldly declared plans to go public within 18 months. But due to various issues, Powell stepped down in September 2022, and Kraken’s IPO plans were shelved—only revived again in 2024.

Backpack, however, benefits from a team enriched with former FTX employees from legal and compliance departments. This mature, multi-person compliance unit gives Backpack a sharper understanding of how to advance global compliance strategies and greater agility in navigating complex regulatory landscapes across jurisdictions.

Conclusion

One of the most successful IPOs in recent years, Circle’s achievement highlights not only investor appetite for crypto exposure exemplified by CRCL, but also, through a unique phenomenon of liquidity mismatch between traditional Web3 and U.S. markets, reflects the profound empowerment traditional capital can provide to Web3 ventures.

In essence, Circle has laid out a clear blueprint for future Web3 projects: traditional financial markets place substantial premiums on Web3 assets with strong cash flows and solid compliance. Compliance, innovation, and market readiness are the keys to entry—and those capable of mastering them will achieve exponential growth backed by global capital.

Clearly, whether in product design—being the “closest to a U.S.-style structure”—community vitality with sustained engagement and growth, or compliance leadership, Backpack possesses immense potential to become the next Circle.

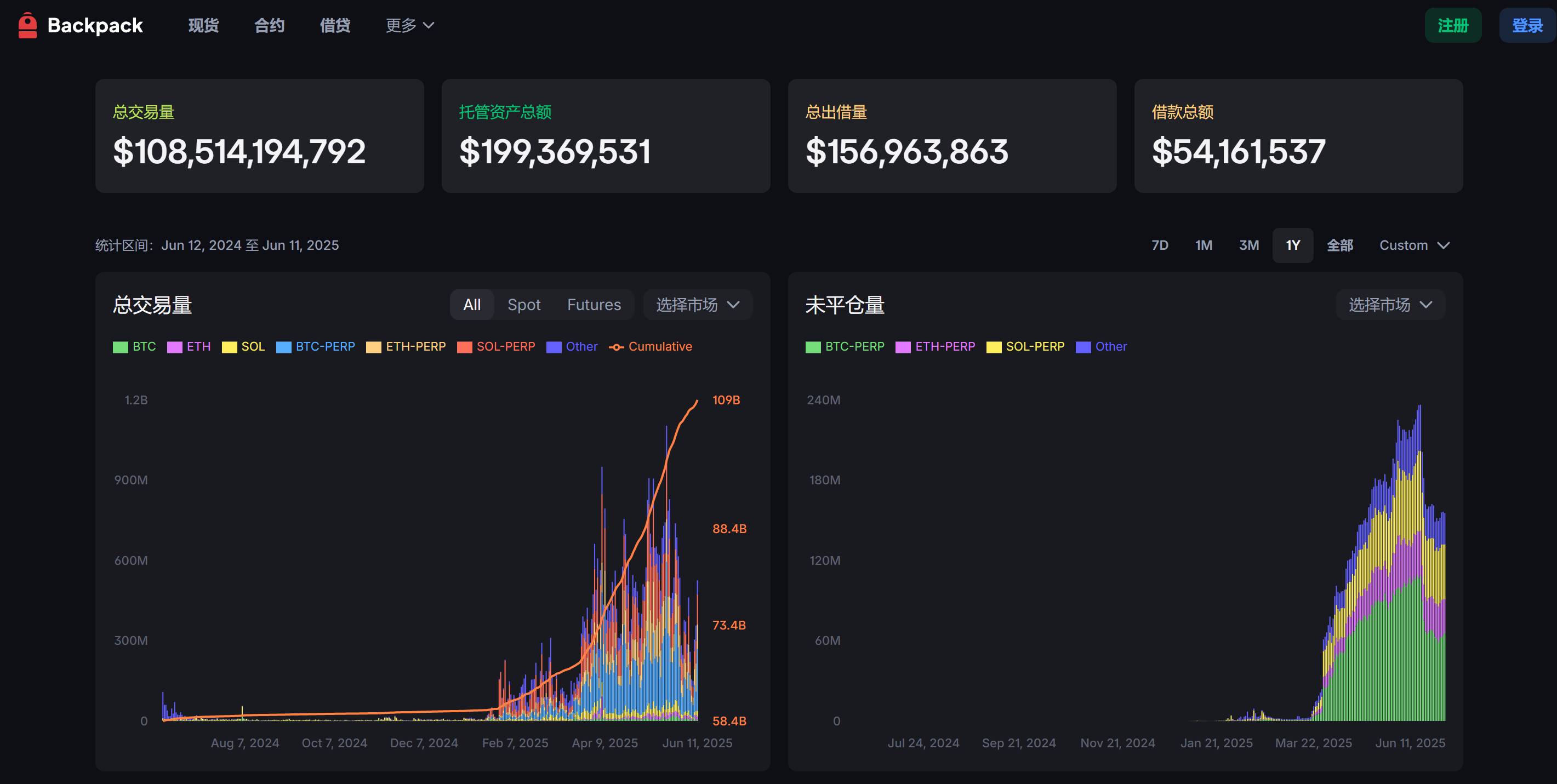

Since the start of 2025, Backpack’s core metrics have shown exponential growth—seemingly validating market recognition. Especially during Season 1’s points campaign: Backpack distributed 10 million points in total, 24-hour perpetual contract trading volume surpassed $1.1 billion, total lent assets exceeded $165 million, and borrowed assets topped $56 million. As the representative of Backpack’s ecosystem rights, points will unlock more utilities in the future.

Prior to the official launch of Season 2’s points program, Backpack recently initiated the “Season Side Story: Month of Rewards,” a series of events featuring randomized multi-tier rewards designed to create excitement and anticipation, continuously driving user engagement and product exploration.

As the integration between the crypto industry and traditional finance accelerates, could Backpack be the one to set the next milestone? With continued product innovations and strategic market moves, we look forward to seeing Backpack bring more breakthroughs to the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News