"Game Changer" Backpack: Completing the FTX Puzzle, Leveraging Compliance to Become a TradFi Leader

TechFlow Selected TechFlow Selected

"Game Changer" Backpack: Completing the FTX Puzzle, Leveraging Compliance to Become a TradFi Leader

Using compliance as a lever to guide the deep integration of traditional finance and crypto finance will not only be an exponential growth opportunity for Backpack, but also the essential path for crypto finance to achieve large-scale breakthroughs.

Written by: TechFlow

Trading is the core theme of crypto, making exchanges foundational infrastructure in the ecosystem.

We’ve seen that each market cycle produces a defining exchange that drives innovation in capital efficiency:

BitMEX did so in 2016 by introducing perpetual contracts to the crypto market;

FTX achieved explosive growth in 2020 through innovations like stablecoin settlement, cross-margin accounts, and tiered clearing mechanisms.

Yet in this current cycle, no exchange has emerged as a breakout phenomenon on par with FTX. Amid fierce competition, who will rise to the top?

Hyperliquid may be a contender. After its 2024 airdrop ignited market interest, Hyperliquid’s futures trading volume quickly surpassed the trillion-dollar mark. However, it has since been mired in controversy over price manipulation and community concerns about its liquidation mechanics and decision-making transparency.

Another frequently mentioned dark horse within the community is Backpack: On one hand, due to its deep ties with FTX, comparisons between the two are inevitable. On the other, from day one Backpack has loudly championed compliance—recently finalizing its acquisition of FTX EU while also winning users over with product innovations such as “auto-lending” and “yield-bearing perps.”

If we reflect on the rise and fall of FTX, can we gain clearer insight into the competitive dynamics shaping this cycle’s exchange landscape?

By building on FTX’s strengths while avoiding its pitfalls, could Backpack replicate—or even surpass—the former giant’s glory?

This article aims to dissect Backpack’s product logic, compliance strategy, and future roadmap to uncover more definitive answers.

Made in America: Elevating FTX’s Capital Efficiency at Backpack

“Made in America” has long been a prestigious label in the crypto industry—it signifies superior financial infrastructure, highly skilled talent, open policy environments, and vibrant capital markets. Over the past decade, this ecosystem has given birth to leading companies like Coinbase, ConsenSys, and a16z Crypto.

The influence of U.S.-based projects remains strong in this cycle: First, under President Trump’s pro-crypto stance, the United States is spearheading a global shift toward clearer, more inclusive regulatory frameworks, with compliance becoming a key factor in attracting institutional adoption. Second, amid escalating geopolitical tensions and trade wars driven by tariffs, permissionless, low-friction on-chain finance is poised for rapid growth—providing American crypto ventures with significant inflows of new capital and users.

From FTX to Backpack: Twin Products of “Made in America”

Both FTX and Backpack bear unmistakable hallmarks of being “Made in America”:

FTX was founded in the U.S., and so was Backpack;

FTX founder Sam Bankman-Fried graduated from MIT, a world-renowned institution; Backpack founder Armani Ferrante also holds a top-tier academic background, having studied at UC Berkeley—the so-called #1 public university in the U.S.

Looking eastward from Western roots, both founders shared a strategic focus on Asia: FTX initially established its headquarters in Hong Kong; Backpack chose Tokyo, another economic gateway in Asia.

But the connection between Backpack and FTX runs deeper: Multiple core members of Backpack, including founder Armani Ferrante, were formerly employed at FTX:

According to Armani in interviews, he briefly worked at Alameda Research (SBF’s quantitative crypto trading firm) before joining FTX in September 2020 to lead Solana-related initiatives.

In addition, Backpack has hired numerous former FTX legal and compliance staff, including Can Sun, FTX’s ex-General Counsel, who now serves as Head of Legal at Backpack.

There are also overlapping funding connections between Backpack and FTX:

Both received investments from top-tier crypto VC Jump Crypto; in September 2022, Coral—the company developing Backpack—announced a $20 million funding round led by FTX Ventures.

Built for Traders: A New Challenge for a New Cycle

Great products are inherently altruistic—in other words, great trading platforms must be designed from the trader’s perspective. For traders, two priorities stand above all: effective risk management and maximized capital efficiency.

When we examine the product design itself, it becomes clear that both Backpack and FTX share the same philosophy: “Built for Traders.”

SBF came from a trading background, giving him deep insight into trader needs. FTX pioneered the “tiered liquidation model,” which prevents large portions of user funds from being used to cover bad debt during insolvency. Its other major innovation—unified margin accounts—allowed users to deploy a single collateral pool across multiple derivatives products, using stablecoins as universal margin. This dramatically simplified operations and improved capital turnover. Features like leveraged tokens have since been widely adopted across exchanges.

For Backpack, however, evolving market scale, richer product offerings, and increasingly sophisticated traders mean that building a “trader-first platform” faces even greater challenges—particularly around constructing a more robust risk engine, aggregating multi-chain liquidity more effectively, and pushing capital efficiency to new limits.

Armani’s engineering background, combined with his understanding of trading, enables Backpack to deliver an elevated trading experience.

No Proprietary Market Maker + Three-Stage Liquidation: Backpack’s Robust Risk Engine

Most exchanges operate proprietary market makers to capture additional revenue streams. However, learning from FTX’s catastrophic outcome of lending customer funds to Alameda Research, Backpack chooses not to run its own market maker. This fundamental design eliminates any incentive to liquidate users or act as their counterparty, ensuring that user protection remains paramount during crises.

Additionally, Backpack implements a three-stage liquidation mechanism to ensure system solvency:

-

Order Book Liquidation: When Backpack detects a user’s margin maintenance ratio hitting 100%, the system immediately cancels unfilled orders and attempts to gradually sell or hedge positions on the order book at optimal prices—reducing market impact while protecting users.

-

Backup Mechanism Liquidation: During extreme market conditions where order book liquidity is insufficient, positions are transferred to designated backup market makers who absorb the risk.

-

Auto-Deleveraging Liquidation: If the first two steps fail, the system forcibly hedges or reduces positions to zero out overall risk and prevent platform default.

Moreover, Backpack employs gradual liquidation and price protection bands to minimize market shocks, protect users from unfair liquidations, and enhance fairness throughout the process.

During market volatility triggered by the Trump administration’s tariff hikes, Backpack’s liquidation system demonstrated exceptional resilience. According to data cited in an Alameda Research report: 99.82% of Backpack’s liquidations occurred directly on the order book, only 0.18% fell back to the backup mechanism, and 0% required auto-deleveraging.

Global Margin + Auto-Lending + Auto-PnL Settlement: Backpack Builds a Yield “Perpetual Machine”

To achieve more intuitive asset management and enhanced capital efficiency, Backpack’s innovations center around itsnatively integrated, highly automated lending market:

To lower account management barriers and boost capital utilization, Backpack uses a unique single global margin account: Users can instantly create unlimited sub-accounts under one main account, all compatible across Backpack’s full suite of products.

Different sub-accounts allow users to manage distinct strategies or enable team collaboration—one dedicated to lending, another to spot trading, etc. Transfers between sub-accounts require just a few clicks, enabling high efficiency. Strategy isolation further reduces risk exposure.

Backpack also adopts a “cross-margin + multi-asset collateral” model, automatically accepting all eligible assets as collateral across all products. This accelerates capital turnover and allows users to respond swiftly to fast-moving markets.

For each sub-account, users can enable the “Auto-Lend” feature:

Even with unified margin accounts, idle funds often remain unproductive.

With Auto-Lend, the margin account and lending pool merge seamlessly. Once enabled, all eligible available assets—including idle balances and unrealized floating profits in open contracts—are automatically deposited into the lending pool to earn yield. As borrowers repay, interest accrues in real time to the user’s available balance.

Think of it this way: Eligible chickens lay eggs to generate returns. Even while those eggs are still inside, users can already earn returns on them—and those returns themselves compound further.

All lent assets count 100% toward collateral, meaning users continue earning lending yields even while holding positions. They can also employ hedging or arbitrage strategies to generate extra returns, achieving higher yields and superior capital efficiency.

In pursuit of maximum capital efficiency, Backpack also offers “Auto-PnL Settlement”—a fully automated settlement function that locks in gains and fosters a more efficient, resilient trading market:

Every 10 seconds, Backpack automatically settles PnL without changing contract positions, transferring losses directly from losing parties to winners. Profits become immediately available as “usable balance,” providing more firepower for subsequent trades and eliminating borrowing needs caused by unrealized losses.

For stablecoin holders, this is a highly efficient mechanism. For non-stablecoin holders, Backpack introduces a virtual PnL (vPNL) system via a virtual liquidity fund, syncing unrealized PnL to the lending market—making losers pay interest and winners earn yield—thereby reducing lending risks and margin pressure.

Leveraging these product advantages, Backpack has already earned strong user口碑and impressive on-chain metrics.

Many community members say: Once you get used to Backpack, switching to other platforms feels like “going from luxury to austerity.” When you’re accustomed to a product that consistently anticipates your trading needs, it’s hard to tolerate the opacity, complexity, and inefficiency of others.

On its public beta launch day—January 27, 2025—Backpack surpassed $200 million in total trading volume (spot + perpetuals) within 24 hours. Perpetual contracts alone hit $100 million in volume within the first 20 hours.

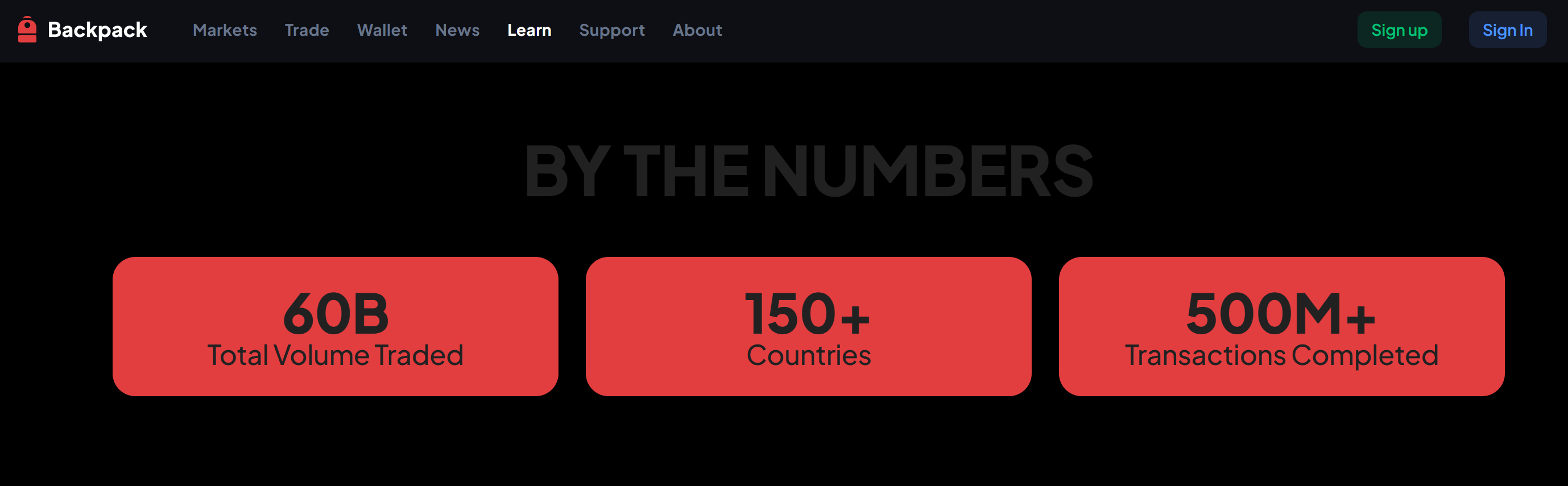

According to official figures, Backpack has now exceeded $60 billion in cumulative trading volume and completed over 50 billion transactions.

Beyond product strengths, another defining trait of Backpack is “compliance.”

Committed to compliance since inception—not only due to lessons learned from FTX’s collapse but also reflecting the team’s deep understanding of industry trends—Backpack has steadily expanded its global compliance footprint. In 2025, as on-chain finance enters a phase of explosive growth, Backpack stands poised for significant expansion.

Compliance Pioneer: Bridging On-Chain and Off-Chain Finance to Become a Core Asset Hub

The crypto industry still vividly remembers the shockwaves sent by FTX’s downfall. Yet viewed historically, FTX’s collapse also served as a catalyst, pushing the entire sector from a wild west era into a new chapter of transparency and regulation.

Making Every Trade Happen in a Glass Room: Backpack’s Commitment to Transparency

Since FTX’s implosion, proof-of-reserves (PoR) has become standard practice for exchanges, and Backpack is no exception: Backpack regularly undergoes third-party PoR audits and publishes detailed results. Public reports from auditor Hacken confirm that Backpack’s assets exceed 100% of liabilities.

Yet, consistent with its history of pushing boundaries, Backpack goes further on transparency—a foundational issue for user trust. Beyond PoR, it implements additional measures: adopting Multi-Party Computation (MPC) technology to enable self-custody, and architecting its exchange infrastructure so that multiple independent nodes must reach consensus on every deposit, withdrawal, and trade. The entire transaction history is replayable and auditable—elevating transparency to new levels.

From the U.S. and EU to Asia: Backpack’s Global Compliance Strategy

Beyond transparency, compliance is the bigger challenge.

The importance of compliance cannot be overstated: It’s the cornerstone of trust, a hallmark of market maturity, and the essential pathway to attract traditional institutions, capital, and users—enabling deep integration between on-chain and off-chain finance.

But the path to compliance is far from easy: It requires balancing product innovation with regulatory demands and demands exceptional skill in navigating diverse regulatory regimes worldwide. Take Japan, whose crypto regulations form a unique framework—gaining approval from the Japan Virtual and Cryptocurrency Assets Association (JVCEA) typically takes over a year.

This is precisely why Backpack’s status as a “globally compliant crypto exchange” carries immense weight:

Backpack’s team includes many former FTX employees from legal and compliance departments. This mature compliance team of dozens gives Backpack a distinct advantage in executing global compliance strategies.

In fact, Backpack’s expanding compliance map over recent years clearly reflects the success of this team.

As a U.S.-based company, Backpack began its compliance journey there, strictly adhering to KYC, anti-money laundering, and related regulations. Its compliant trading services currently operate in 12 U.S. states, with plans to expand to all 50 as favorable policies progress.

In 2023, Backpack obtained a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA)—a major milestone in its Asian expansion.

Shortly after, Backpack became a member of Japan’s JVCEA. Japan is known for its high compliance bar: Before FTX collapsed, only Binance had passed its review. In nearly two years since FTX’s failure, Backpack is the first crypto exchange to clear Japan’s rigorous compliance standards.

This year, Backpack’s most significant compliance development was the formal completion of its acquisition of FTX EU:

Through this acquisition, Backpack will assume responsibility for reimbursing 110,000 European crypto users—an opportunity to directly onboard over 110,000 high-quality trading users and solidify its user base.

More importantly, FTX EU held a MiFID II (Markets in Financial Instruments Directive II) license. By acquiring FTX EU, Backpack instantly became the only crypto exchange in the EU authorized to offer perpetual contracts and other crypto derivatives, granting it access to the entire EU market—covering 20–30% of global crypto trading volume.

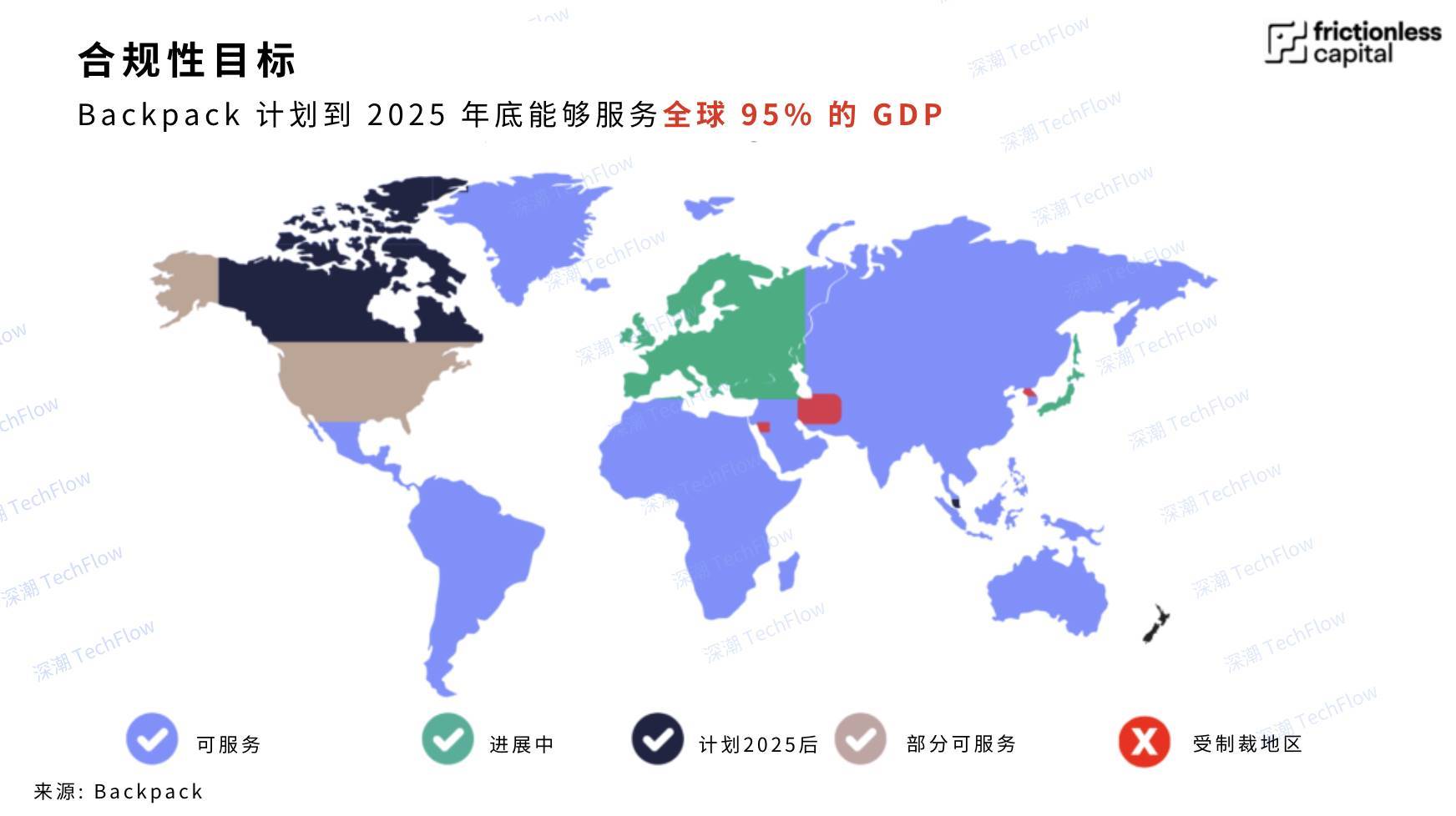

Additionally, Backpack has secured licenses to operate crypto-related activities in Australia, the UK, and other jurisdictions. According to its website, Backpack now operates in over 150 countries/regions. Looking ahead to 2025, Backpack plans to apply for more national licenses and aims to extend its compliant services to users in regions accounting for 95% of global GDP—reaching nearly 1 billion potential users.

2025: The Rise of On-Chain Finance, The Breakout Year for Backpack

While total crypto market cap has surpassed $2.6 trillion, it remains tiny compared to traditional finance. The U.S. stock market (Wilshire 5000), for example, reached $63 trillion in 2024—over twenty times larger than the entire crypto market. In short, leveraging compliance to deeply integrate traditional and crypto finance isn’t just a growth catalyst for Backpack—it’s the essential path for crypto to achieve mass-scale adoption.

Following America’s lead in embracing crypto, traditional institutions are becoming more active. According to a recent Coinbase survey, 83% of respondents plan to increase their crypto allocations this year, and 59% intend to allocate over 5% of their AUM to crypto assets by 2025.

Through unwavering compliance efforts, Backpack removes regulatory friction for traditional finance and provides a compliant, efficient entry point—drawing in more institutions and users.

Indeed, the successful acquisition of FTX EU has laid a strong foundation for Backpack’s TradFi expansion: The MiFID II license isn’t limited to crypto trading—it’s a full financial services license covering bond issuance, stock trading, and wealth management. With this, Backpack could evolve into a Web3 version of Goldman Sachs within the EU market.

Going forward, starting from the U.S. and Europe to serve the West, and anchored in Dubai, Japan, and Singapore to reach the East: Leveraging its first-mover advantage in compliance and groundbreaking product experiences, Backpack is well-positioned to capitalize on the 2025 TradFi boom—potentially emerging as the biggest winner and transforming from a crypto exchange into a global asset hub.

Of course, after understanding Backpack’s success factors and growth drivers, users face a more practical question:

How can they efficiently participate in Backpack?

Season 1 in Full Swing: Rewarding Real Trading Participation, Setting a New Benchmark for Community Incentives

Let’s first grasp the massive engagement sparked by Backpack Season 1 through key data points:

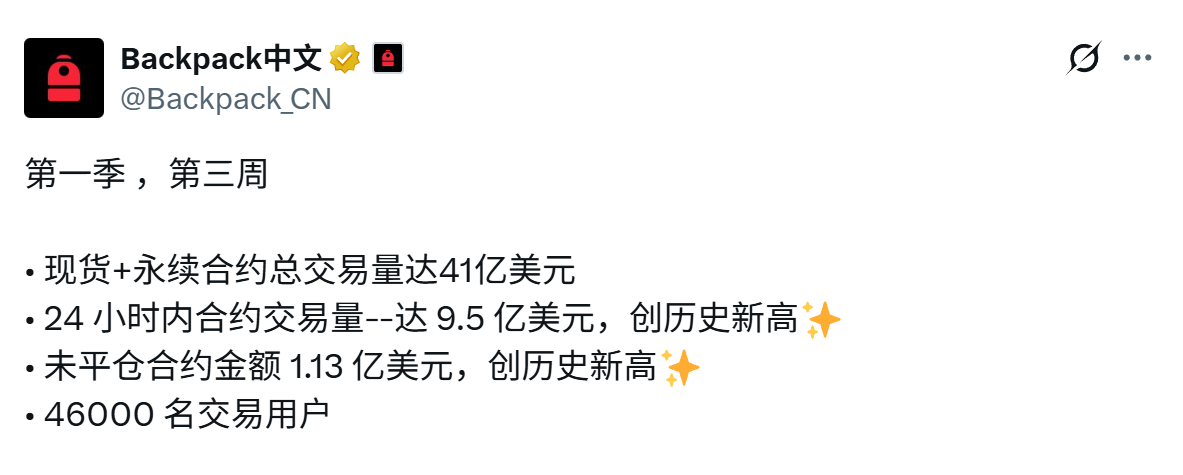

According to Backpack’s official Twitter, during the third week of the campaign, multiple trading metrics hit record highs: 24-hour futures trading volume exceeded $950 million; open interest surpassed $113 million; active trading users exceeded 46,000; and cumulative spot and futures trading volume during Season 1 reached $4.1 billion.

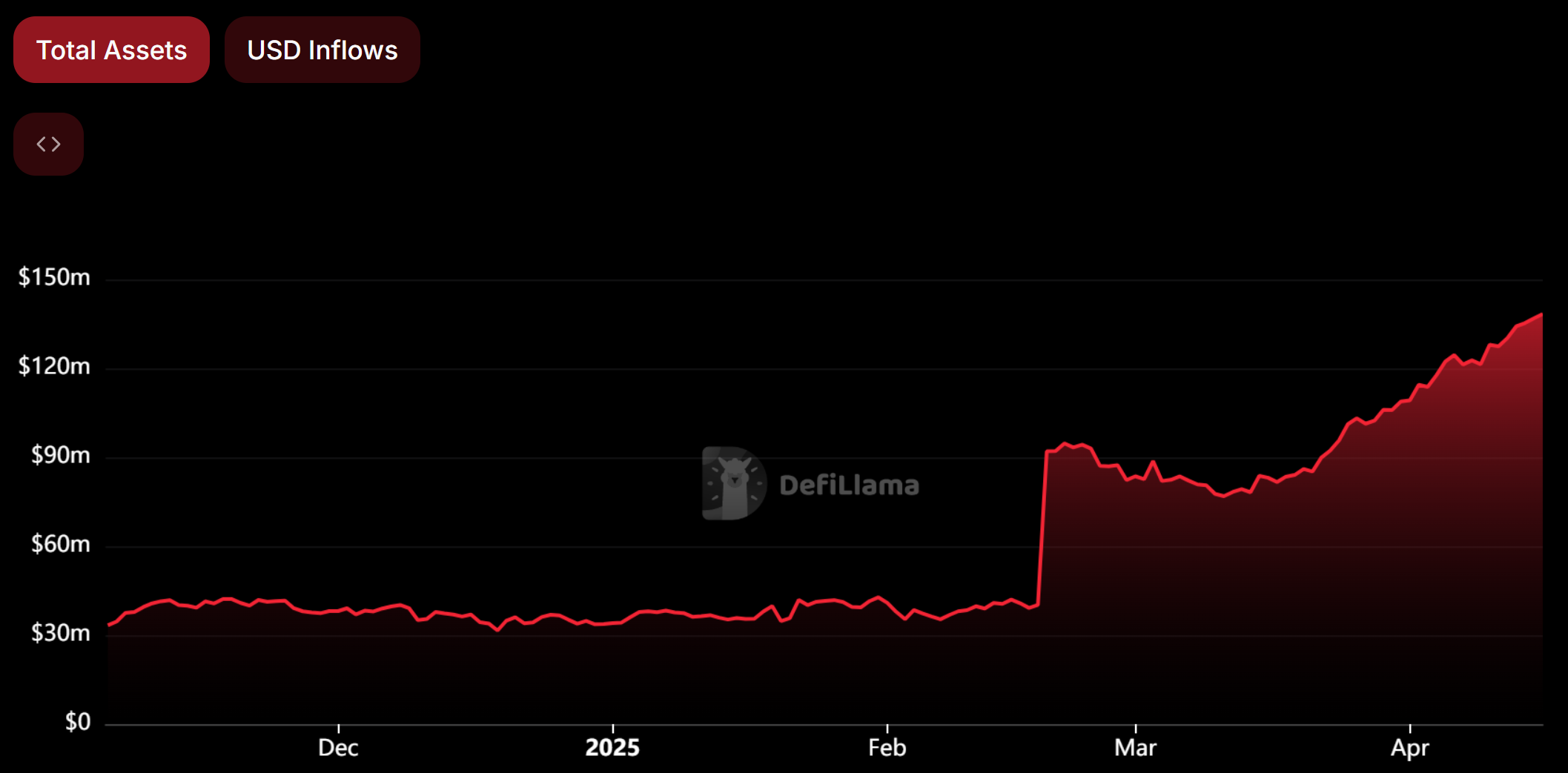

Data from DeFi Llama also shows a sharp upward trend in Backpack’s asset size since the campaign began.

So why has Backpack Season 1 generated such massive participation?

On one hand, participants earn points redeemable for rewards, with strong expectations of a future airdrop. Believing in Backpack’s long-term potential, users naturally want to accumulate as many points as possible.

On the other hand, the unique design of Backpack’s campaign rules plays a crucial role.

Backpack aims to reward genuine traders through Season 1:

Backpack plans to roll out three seasons, each lasting 10 weeks. Each week, 10 million points are distributed, totaling 100 million per season, disbursed every Friday at 10:00 (UTC+8).

During the event, users can explore various features—providing liquidity, inviting traders, holding positions, lending—and every action earns points.

Each week, Backpack dynamically adjusts the point calculation method to prevent users from gaming the system. This discourages quick in-and-out farming behavior and instead encourages sustained, authentic trading activity—ensuring rewards go to real participants.

At the same time, Backpack is committed to fair participation:

Besides distributing initial points to 475,000 users who participated in pre-season and public testing, no points were pre-allocated. Points cannot be bought, transferred, or sold—they belong exclusively to Backpack users.

Backpack has also implemented strict measures to ensure fairness. It previously announced the detection of multiple Sybil attacks and warned users against creating multiple accounts, which may result in point redistribution.

So, how can users participate in Season 1 more efficiently?

Perhaps the most effective approach is simply to follow the rules and embrace authenticity.

Unlike typical point-farming campaigns, Backpack doesn’t reward multi-account farming. Instead, it incentivizes real trading and genuine engagement. Given this, the best strategy is to follow Backpack’s guidance, immerse yourself in the trading experience, and trust that Backpack will reward truly active users in the end.

Backpack also launched an affiliate program, allowing qualified referrers to invite friends and earn additional points.

Currently in its fifth week of a 10-week Season 1, the campaign has received widespread praise for both community feedback and team responsiveness. Numerous detailed tutorials are available on social media for interested traders. As Backpack’s flagship initiative to promote authentic participation and boost platform liquidity, the points campaign is helping cultivate a rapidly growing ecosystem characterized by efficient capital flow, high compliance standards, and strong community involvement.

Conclusion

Some in the community often claim: The exchange landscape is already settled, making it difficult for new players to disrupt the market.

But trading remains the eternal heartbeat of crypto. As long as innovation continues, the exchange格局will never be final.

As Backpack CEO Armani recently shared in a community AMA: The name “Backpack” was inspired by the inventory bag in World of Warcraft. In the game, the backpack is the central tool for storing and managing items. Similarly, Backpack aims to become the primary vessel for all user asset activities—equipping users with the tools they need to traverse the digital world and embark on their financial adventures.

Looking ahead, Backpack will continue advancing in lowering barriers, optimizing liquidity, and expanding global compliance. Soon, it will deepen the integration between its wallet and exchange products, launching a new wallet experience via account abstraction—offering self-custody security without seed phrases. Logging into Backpack Exchange will grant direct access to dApps, eliminating the need for separate wallet extensions. Additionally, Backpack plans to support U.S. stocks, retirement accounts, Apple Pay, and fiat deposits, while aggressively pursuing major global compliance licenses.

A new era of exchange competition has begun. Can Backpack—a platform deeply connected to FTX—leverage features like auto-lending, auto-PnL settlement, and global margin accounts to deliver a revolutionary, capital-efficient trading experience? Can it emerge as the defining innovative exchange of this cycle, while embracing compliance and transparency to bring in TradFi and RWA narratives—ultimately evolving into a core hub bridging on-chain and off-chain asset management for sustainable, long-term growth?

As regulatory friendliness and the rise of on-chain finance define 2025, the stage is set for Backpack to deliver its next chapter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News