a16z: 5 Charts That Show the State of Crypto

TechFlow Selected TechFlow Selected

a16z: 5 Charts That Show the State of Crypto

Monthly mobile wallet users +23%, adjusted stablecoin transaction volume +49%.

Author: a16z crypto

Translation: TechFlow

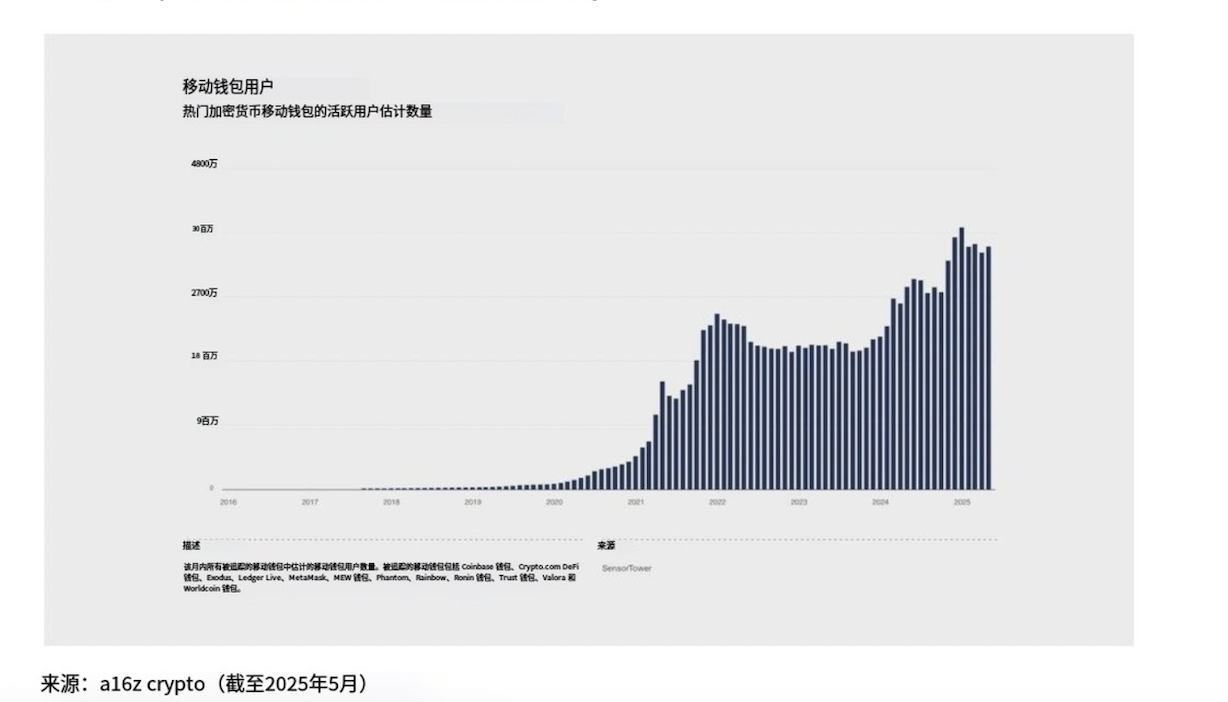

1. Monthly Mobile Wallet Users: +23%

2025 average: 34.4 million monthly active mobile wallet users

2024 average: 27.9 million monthly active mobile wallet users

Why this matters:

Wallet infrastructure has significantly improved—we now have low transaction fees, new account abstraction protocols (EIP-7702), embedded wallet products (Privy, Turnkey, Dynamic), and more. Now is the perfect time to build the next generation of mobile wallets.

Related news:

-

This month, Stripe acquired Privy, a leading wallet infrastructure provider.

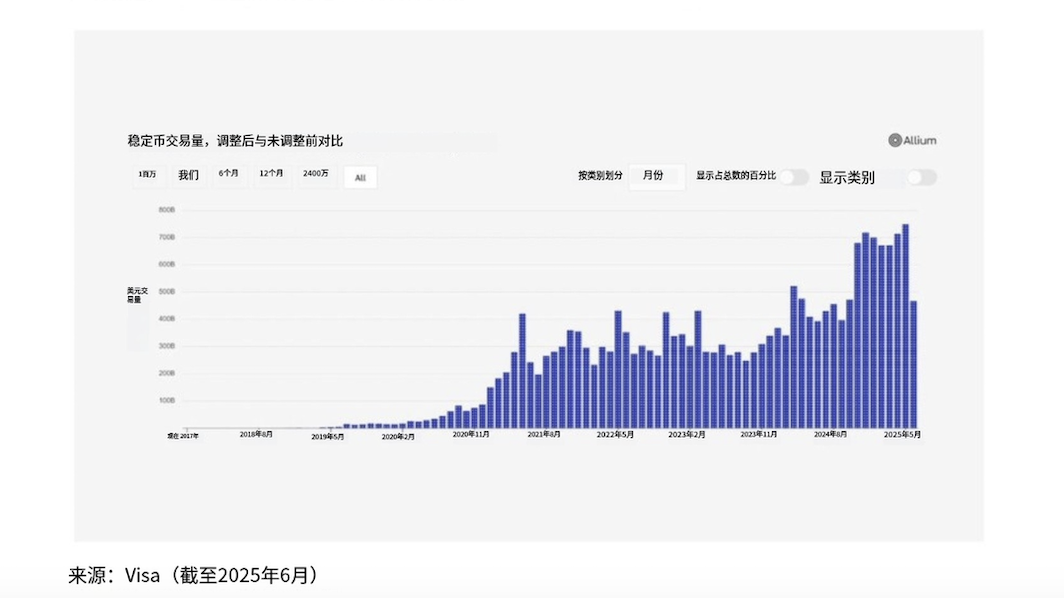

2. Adjusted Stablecoin Transaction Volume: +49%

2025 average: $702 billion in adjusted stablecoin transaction volume per month

2024 average: $472 billion in adjusted stablecoin transaction volume per month

Why this matters:

Stablecoins have achieved product-market fit. We can now send dollars in under one second at a cost of less than one cent, making stablecoins an excellent product for payments. Major financial institutions are seizing this opportunity.

Related news:

-

Dollar stablecoin issuer Circle listed on the New York Stock Exchange

-

Stripe acquired stablecoin infrastructure provider Bridge and announced new product offerings

-

Coinbase released a proxy payment standard supporting stablecoin payments

-

Visa and Mastercard enhanced their support for stablecoins

-

Meta is reportedly in talks to adopt stablecoins as a payment method

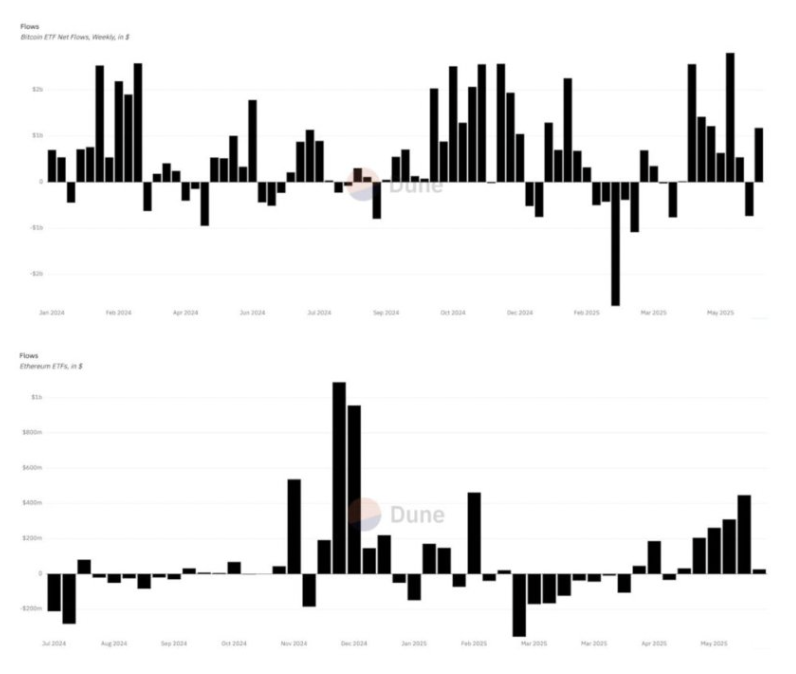

3. ETP Net Inflows (Bitcoin and Ethereum): +28%

June 2025: Total ETP net inflows of $45 billion ($42 billion Bitcoin, $3.4 billion Ethereum)

End of 2024: Total ETP net inflows of $35 billion ($33 billion Bitcoin, $2.4 billion Ethereum)

Why this matters:

Institutional capital entering the cryptocurrency space is a sign of broader industry maturity. As regulation becomes clearer and key issuers come online, net inflows into ETPs should continue to grow.

Related news:

-

The SEC recently requested Solana spot ETF issuers to update their S-1 filings, indicating approval could come soon.

Source: Dune @hildobby (as of June 2025)

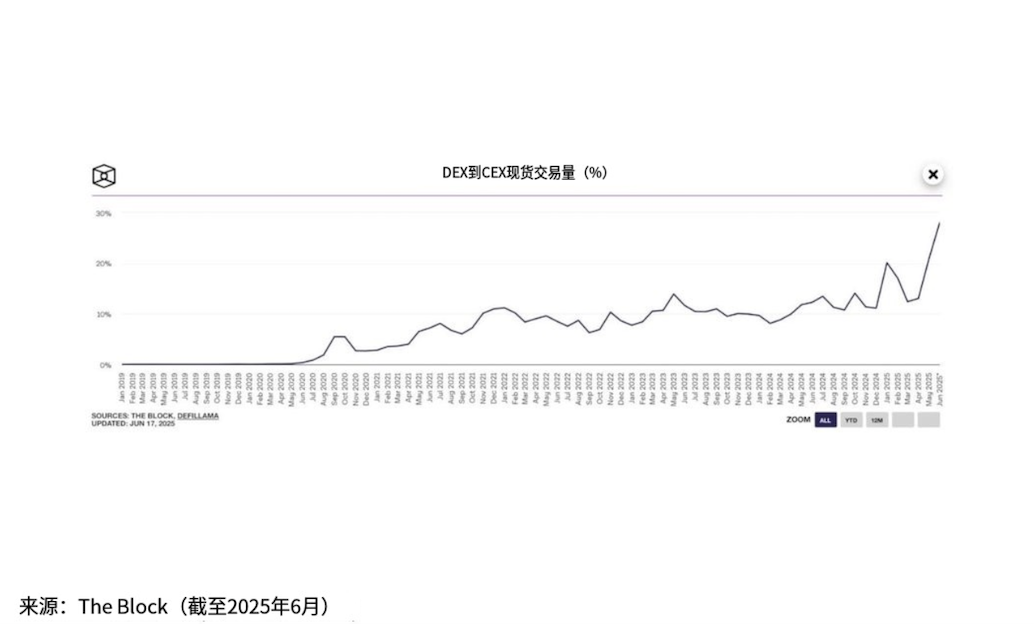

4. DEX to CEX Spot Trading Volume: +51%

2025 average: 17% monthly growth in DEX trading volume relative to CEX

2024 average: 11% monthly growth in DEX trading volume relative to CEX

Why this matters:

As more people go on-chain, we expect decentralized exchange (DEX) usage to increase relative to centralized exchanges (CEX) in crypto trading. This rising ratio highlights the overall development of the DeFi ecosystem.

Related news:

Coinbase just announced native DEX trading directly from the Coinbase app, unlocking thousands of new tradable assets.

5. Transaction Fees (Demand for Block Space): -43%

2025 average: $239 million in monthly transaction fees

2024 average: $439 million in monthly transaction fees

Why this matters:

The total dollar-denominated transaction fee reflects the aggregate demand for block space on a given chain—i.e., real economic value.

However, this metric has many nuances, as most projects explicitly aim to reduce user fees. Therefore, it's also important to consider per-unit transaction costs—that is, the fee associated with a given amount of blockchain resources. Ideally, overall demand (total transaction fees) should rise while gas (cost per unit of resource used) remains low.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News