Wall Street on LABUBU and Moutai: Déjà vu or paradigm shift?

TechFlow Selected TechFlow Selected

Wall Street on LABUBU and Moutai: Déjà vu or paradigm shift?

Bank of America believes that while both Labubu and Moutai possess social currency attributes, there is a clear generational difference.

By Ye Zhen, Wall Street Insights

Labubu, dubbed the "Maotai for young people," has taken the market by storm. But what exactly do the two have in common—and how do they differ?

According to Wind Trading Desk, Bank of America recently released a report comparing this trendy new IP with traditional liquor giant Maotai, aiming to determine whether this reflects a historical replay of consumer cycles or a profound paradigm shift.

Bank of America analysts Alice Ma, Chen Luo, and Lucy Yu pointed out that while both serve as social currencies, Labubu’s social attributes stem more from shared interests and values among younger generations, whereas Maotai's social function relies heavily on power and hierarchical relationships. This contrast highlights the fundamental difference between “new consumption” and “traditional consumption.”

The report notes that like Maotai, Pop Mart also faces dual challenges stemming from IP life cycles and investment attributes. If there is a long gap between Labubu and the next hit IP, the company’s global growth could slow down.

Additionally, investors must not overlook two major risks: regulation and market overcrowding. The report warns that the current surge of capital into the “new consumption” sector closely resembles the earlier phenomenon of fund concentration in Maotai-led consumer blue chips. Such crowded trades are inherently fragile and could significantly impact valuations.

Bank of America maintains a Buy rating on Pop Mart with a target price of HK$275. According to data, Pop Mart’s stock traded between HK$34.4 and HK$283.4 over the past 52 weeks, closing at HK$244.2 as of Monday.

Generational Differences in Social Currency

Bank of America’s research team believes that although Labubu and Maotai both function as social currencies, they reflect clear generational differences. Maotai serves more as a productivity tool—a “social/business lubricant”—while Labubu represents younger generations’ pursuit of emotional value, offering immediate, nuanced, and affordable “dopamine hits” in the era of digital social media.

The analysts note that in a digital world where consumers face increasing stress and a sense of meaninglessness, Labubu signals China’s gradual transition from an investment-driven to a consumption-driven economy. While deeply rooted in traditional Chinese culture, Maotai remains in the early stages of globalization. In contrast, Labubu—aligned with global zeitgeist—has already achieved significant international success.

-

Social Attributes: Maotai’s social role depends largely on power and hierarchy, primarily serving business contexts; Labubu reflects youth-driven, interest-based socializing that emphasizes emotional value and instant gratification.

-

Consumption Drivers: Maotai acts as a “productivity tool” (a business enabler), while Labubu caters to young people’s desire for emotional fulfillment and “dopamine-driven” consumption in digital social environments, reflecting China’s broader shift from investment-led to consumption-led growth.

-

Globalization Progress: Maotai is deeply embedded in traditional Chinese culture and still in the early phase of going global; Labubu, resonating with global trends, has already seen substantial international success.

The Double-Edged Sword of IP Lifecycle and Investability

While experiencing rapid growth, Pop Mart faces challenges similar to those once faced by Maotai—namely, the risks associated with IP lifecycle and product investability.

Bank of America argues that whether Pop Mart achieves RMB 8 billion or RMB 10 billion in net profit in 2025 matters less than how fast Labubu units are shipped. More importantly, the key lies in balancing short-term growth with sustainable IP lifecycle management.

IP Lifecycle Risk: With a century-long heritage and official endorsement, Maotai has proven its ability to withstand economic cycles. In contrast, Pop Mart and Labubu have only existed for 15 and 10 years respectively—making IP longevity a core risk.

The report suggests that while Pop Mart’s diversified IP portfolio helps mitigate risk, Labubu remains critical to its global success. A prolonged gap between Labubu and the next viral IP could decelerate global expansion. Moreover, the mainstreaming of subcultures may dilute Labubu’s unique social identity, potentially alienating its core fanbase.

The Pros and Cons of Investability: Maotai’s history shows that “investability” is a double-edged sword—it amplifies gains during upswings but exacerbates losses during downturns.

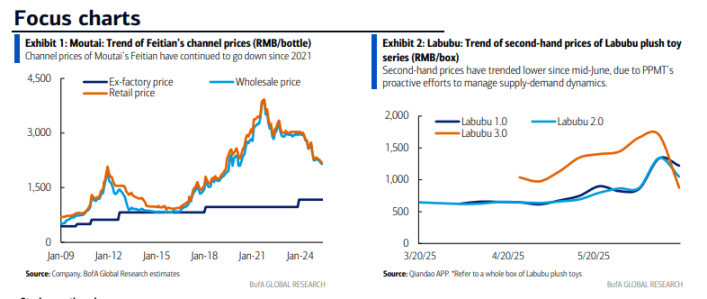

The report observes that Pop Mart is actively managing secondhand market prices to maintain appeal among young consumers and create favorable conditions for launching new IPs and products. The recent decline in secondhand prices for Labubu plush series is seen as evidence of Pop Mart’s proactive supply-demand management.

Regulatory and Market Crowding Risks That Can’t Be Ignored

The report concludes by highlighting regulatory scrutiny and market sentiment as two additional risks investors must confront.

Regulatory Risk: Maotai has long been affected by price controls and anti-corruption campaigns. Similarly, Pop Mart does not operate in a regulatory vacuum. Recent commentary in the People’s Daily served as a reminder of potential risks. However, Bank of America analysts believe that as Pop Mart’s consumer base becomes increasingly diverse, its “mainstreaming” reduces exposure to risks related to minors in the Chinese market. Meanwhile, growing overseas operations—expected to account for over half of sales by 2025—help hedge against regulatory risks in any single market. Still, such risks could negatively affect fundamentals or trigger volatile “headline noise” impacting share prices.

Fragility of “Crowded Trades”: Each market cycle brings dominant, crowded investments. The capital inflow into consumer blue chips led by Maotai between 2016 and 2021 bears a strong resemblance to today’s concentration in “new consumption” names like Pop Mart. Shifts in capital flows and positioning can greatly influence valuations—Maotai’s forward P/E ratio peaked near 60x in early 2021 but now stands at just 18–19x. Although recent shifts in investor sentiment have already pressured stocks like Pop Mart, the report suggests that given the scarcity of high-quality investment opportunities, such crowding may persist for some time. A real turning point may only emerge when meaningful inflection points appear in high-frequency data from overseas markets or when a robust recovery in the Chinese economy gives investors broader options.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News