Behind the surge of Hong Kong's "Gudongmi" strategy: Memeland's parent company completes backdoor listing through renaming

TechFlow Selected TechFlow Selected

Behind the surge of Hong Kong's "Gudongmi" strategy: Memeland's parent company completes backdoor listing through renaming

The story of Mi Strategy is a reflection of the recent intertwined craze between the cryptocurrency market and stock market in Hong Kong.

By TechFlow

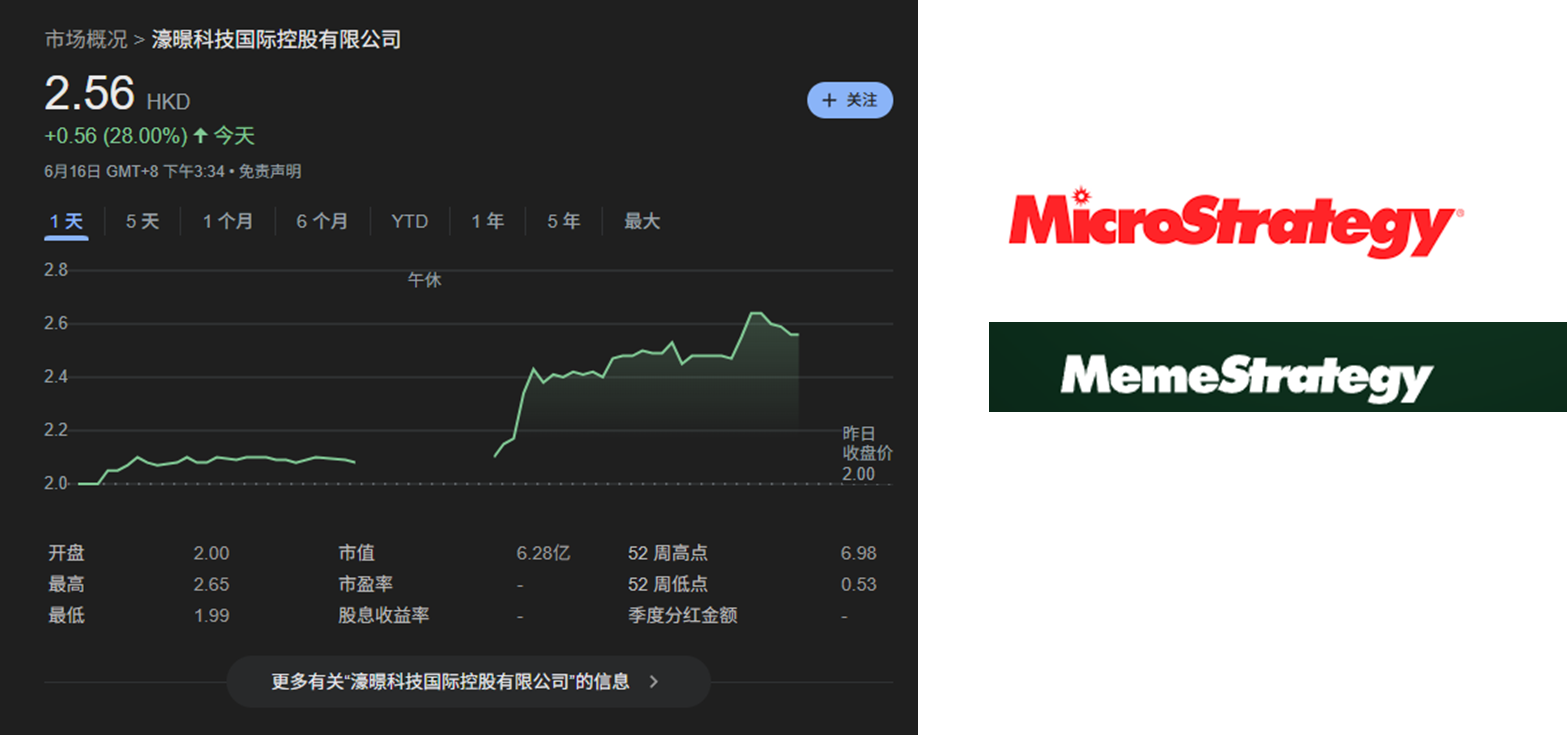

West has MicroStrategy, East has MemeStrategy?

On June 16, Hong Kong-listed company MemeStrategy saw its stock price surge 25% before pulling back.

This newly renamed firm shares a striking resemblance with Nasdaq-listed "Bitcoin giant" MicroStrategy—not only in name but even in logo design.

It's hard to call this a coincidence; it appears more like deliberate imitation and alignment.

Since 2020, MicroStrategy has been steadily accumulating Bitcoin, driving its share price to new highs amid the crypto investment boom. Now, MemeStrategy has announced the purchase of 2,440 SOL tokens and plans to allocate funds toward Bitcoin as well.

But here’s a key detail — the company was previously named Howking Tech Holdings, and this move combines buying SOL with a corporate rebranding. The intention is clear: leveraging a shell company, renaming it, and riding on MicroStrategy’s brand recognition to tap into the crypto asset frenzy and attract speculative capital.

The market now sees it as Hong Kong’s “first meme stock.” Yet this bold naming strategy is far from superficial—behind it lies a team with intricate capital maneuvers and a deeper backstory.

Board and Equity Restructuring: The 9GAG Team Enters

MemeStrategy’s rebranding and transformation began on April 1, 2025.

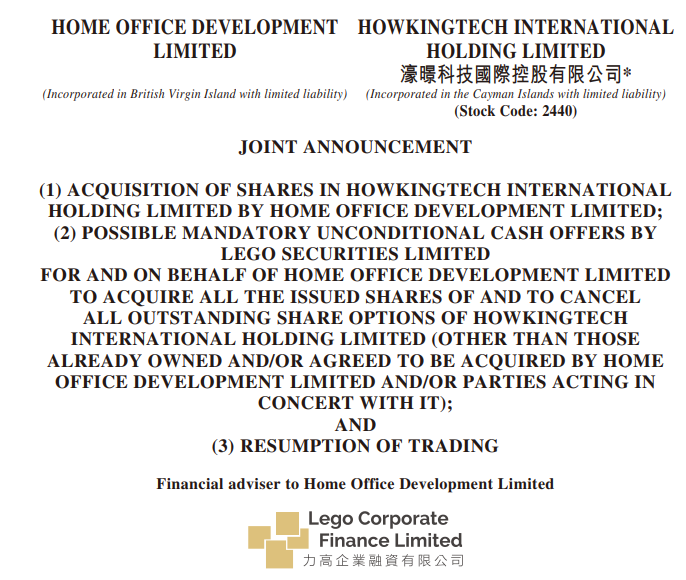

According to Hong Kong media Sing Tao Headline, Raymond Chan, co-founder of 9GAG, acquired 53.83% of Howking Tech Holdings through his holding company Home Office Development Limited for approximately HK$79.65 million (about $10.2 million USD), increasing his total stake to 70.11% after completion.

(Source: PR Newswire; HKEX Announcement)

The company was subsequently renamed MemeStrategy, positioning itself as “Asia’s first publicly listed virtual asset ecosystem venture,” integrating 9GAG’s social media resources, focusing on Solana-based digital assets, and planning Bitcoin allocations.

You may not be familiar with 9GAG, but you’ve likely heard of Memeland—and its associated MEME token.

9GAG is the parent company behind Memeland, founded in 2008 and headquartered in Hong Kong, known for humorous memes and jokes that appeal to younger audiences.

The acquisition and rebranding of Howking Tech by 9GAG’s co-founder also involved significant changes to equity structure and board composition.

Prior to the acquisition, Howking Tech Holdings held 53.83% of shares, with a seven-member board. Afterward, 9GAG insiders and figures from Hong Kong’s crypto scene became key figures at MemeStrategy:

Raymond Chan, former co-founder of 9GAG, will serve as Chairman and CEO, leading overall strategy and operations. His brother, Kenneth Chan, takes the role of Chief Brand Officer—he previously served as Chief Product Officer at 9GAG.

The former Chief Commercial Officer of 9GAG retains the same position at MemeStrategy. Meanwhile, Ming-Hung Li, former CEO of OSL and ex-head of strategy and institutional relations at HashKey Group, joins as Chief Investment Officer. Notably, MemeStrategy’s purchase of 2,440 Solana tokens was facilitated by OSL assistance. Additionally, Peng Cheng, co-founder of Scroll, will serve as an independent non-executive director.

The consolidation of equity and overhaul of the board signal full control of MemeStrategy by the 9GAG team.

Howking Tech was originally an IoT technology firm offering data transmission and processing services—including IoT antennas, 5G equipment, and maintenance—for industries such as manufacturing, transportation, and energy. With a market cap of around HK$500 million, it was labeled a low-value “penny stock” by local media.

Its tech-related profile and small market cap made it an ideal shell for 9GAG’s public listing ambitions.

Today, MemeStrategy’s official website highlights its focus on ABC—AI, Blockchain, and Culture—and brands itself as Asia’s first listed digital asset enterprise.

Recently, it’s become increasingly common in traditional capital markets for crypto entrepreneurs to use small-cap shells to accumulate digital assets. This trend has now reached the Hong Kong stock market.

(Related reading: Buying Bitcoin: The New Wealth Code for U.S. Public Companies)

9GAG and Memeland’s Crypto History

In 2022, 9GAG launched Memeland as a Web3 startup studio.

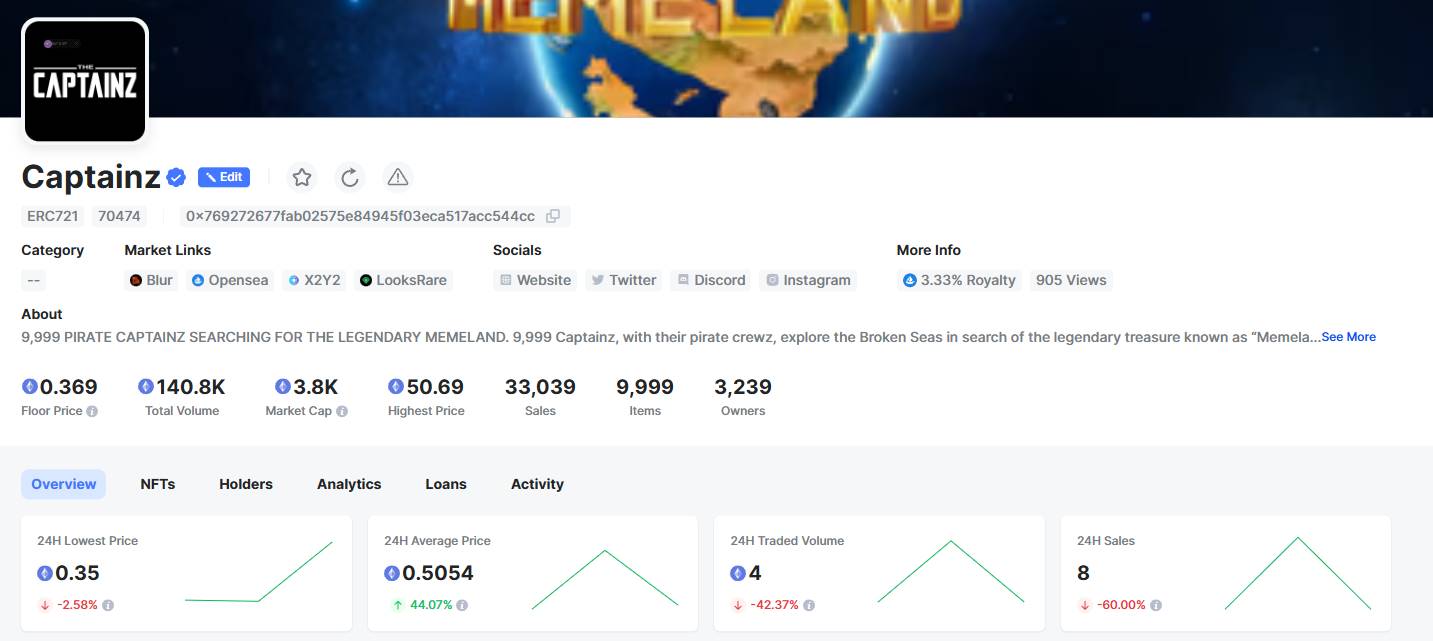

During the peak NFT and meme era, Memeland issued the MEME token and launched NFT projects such as Captainz and Potatoz.

Currently, the MEME token has a market cap of around $80 million—down over 80% from its 2023 high. For comparison, LABUBU, a pure meme coin themed around Pop Mart’s Labubu, recently reached a market cap of about $50 million.

Meanwhile, Memeland’s NFT collections Captainz and Potatoz face even harsher market conditions.

Captainz currently has a floor price of just 0.3 ETH, with single-digit trading volume over the past 24 hours—far below its all-time high of 50 ETH.

How glorious the past was, how quiet the present is.

In 2024, the cooling of the crypto market further damaged Memeland’s business model. With NFT demand fading and meme coin competition intensifying, Memeland’s profitability plummeted.

This downturn in crypto may have been a key motivation for 9GAG to pivot to the Hong Kong stock exchange, leveraging Howking Tech’s low-market-cap shell. The investments in SOL and plans for Bitcoin reflect a continuation of Memeland’s crypto logic—and another timely play on current trends.

MemeStrategy’s story reflects the convergence of crypto and stock market fever in Hong Kong. Beyond the marketing hype, whether this “Hong Kong version of MicroStrategy” can truly succeed remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News