Trump reaps crypto windfall on dual fronts: company secures approval for $2.3 billion Bitcoin reserve, personal annual earnings hit $57 million

TechFlow Selected TechFlow Selected

Trump reaps crypto windfall on dual fronts: company secures approval for $2.3 billion Bitcoin reserve, personal annual earnings hit $57 million

Trump's crypto earnings far exceed his traditional businesses.

By BitPush

On Friday local time, Trump Media & Technology Group (stock ticker: DJT) announced that its S-3 registration statement has been declared effective by the U.S. Securities and Exchange Commission (SEC).

This means the company’s previously announced agreements with around 50 investors for equity and convertible notes have officially entered the execution phase, amounting to approximately $2.3 billion in total funding. Most of this capital—according to prior disclosures—will be used to purchase Bitcoin, making DJT the next publicly traded company after Strategy to hold Bitcoin as a core treasury asset.

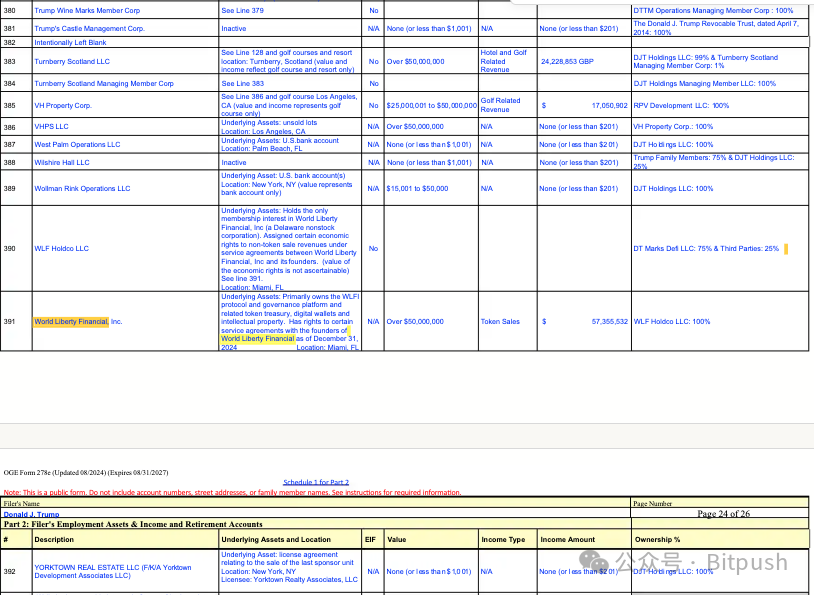

At the same time, financial disclosure documents from the U.S. Office of Government Ethics obtained by the New York Post reveal that Donald Trump personally earned $57.35 million last year from World Liberty Financial, a cryptocurrency platform linked to his family, making it one of his most significant income sources.

Trump's crypto-related earnings far surpass those from traditional businesses. In addition to the $57.35 million from World Liberty Financial, other ventures under his name—including "45 Guitar" (earning $1.05 million), "Trump sneakers and perfumes" ($2.5 million), and the Trump-branded watch ($2.8 million)—collectively generated over $60 million in annual non-political income.

The filings also disclose a substantial portfolio of stock and bond investments, with related details spanning nearly 145 pages of the document.

"Patriot Economy"

Devin Nunes, CEO of Trump Media, made no effort to conceal the strategic intent: "We are rapidly advancing our expansion plans, including enhancing our social media platform, growing our streaming business, and building a Bitcoin reserve."

He described these initiatives as positioning Trump Media as an essential component of the "Patriot Economy." Nunes repeatedly emphasized the company's mission to "end Big Tech's suppression of free speech," calling Bitcoin "the ultimate tool for financial freedom."

This move is not isolated. Since 2024, Trump Media’s strategy in the cryptocurrency space has become increasingly clear: first announcing the fintech brand Truth.Fi, then partnering with Crypto.com to plan a Bitcoin ETF.

At the recent "Bitcoin2025" event in Las Vegas, key figures from Trump’s inner circle—including Vice Presidential candidate J.D. Vance, Donald Trump Jr., Eric Trump, and “crypto tsar” David Sacks—made high-profile appearances, further cementing Trump’s image as America’s first “crypto president.” This fusion of political narrative with financial strategy makes DJT stand out on Wall Street.

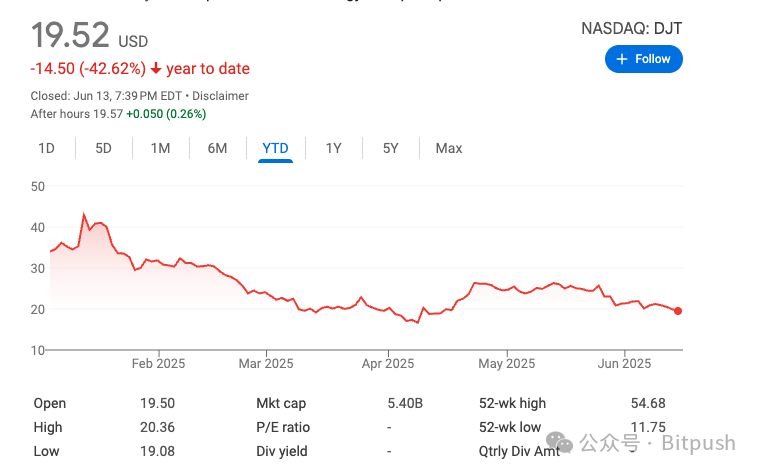

However, market reactions have not been entirely positive. Despite relatively stable Bitcoin prices, Trump Media’s stock has fallen 42% this year. Its 2024 financial report shows only $3.6 million in revenue, while losses reached $400 million.

Some analysts question whether the company’s valuation relies more on political storytelling than actual profitability.

The Controversy of Presidential "Pumping"

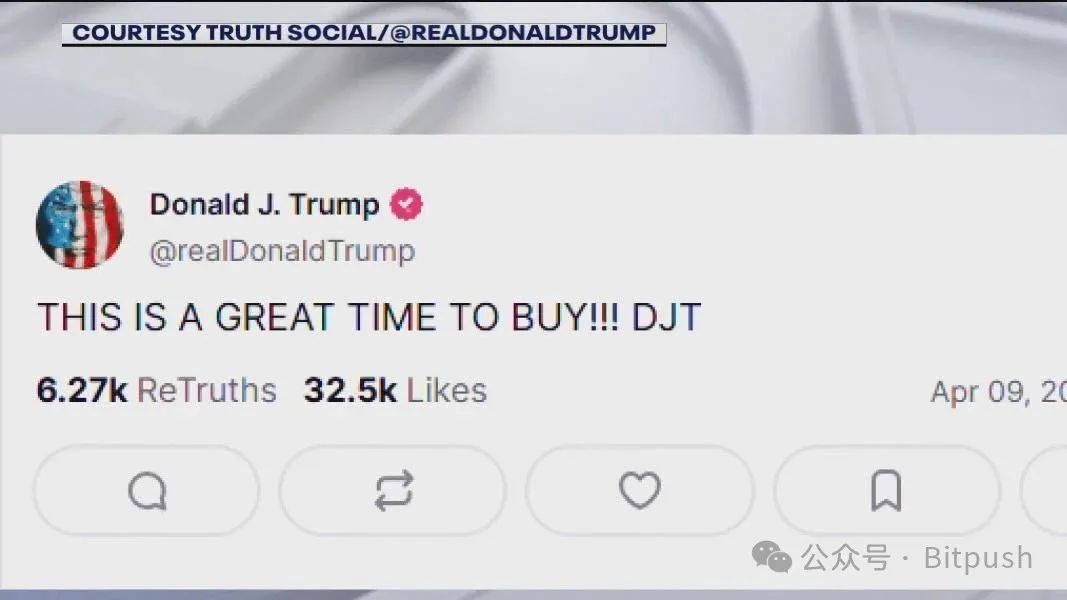

More controversial is Trump’s personal role. As a major shareholder (holding approximately 114 million shares through a trust), he previously posted on Truth Social urging investors to "buy DJT," after which the stock price promptly rose. Such actions blur the line between presidential authority and private commercial interest, sparking debate over potential market manipulation.

According to CNBC, DJT’s moves are closely tied to growing discontent within the Republican Party over perceived discrimination against conservative businesses in banking.

Several Republican leaders, including Trump himself, have publicly accused traditional financial institutions of "excluding" conservative clients. The launch of DJT’s Truth.Fi platform and the rise of Trump-affiliated cryptocurrencies are seen as the private sector’s active response to this "de-banking" trend.

Converting corporate treasury assets into Bitcoin has become a popular strategy this year. Pioneered in 2020 by Michael Saylor’s Strategy, it is now reaching new heights driven by Trump’s political movement and his crypto allies. The core objective of this strategy is to continuously increase Bitcoin holdings per share, leveraging Bitcoin’s potential appreciation. New entrants such as Jack Mallers’ Bitcoin company backed by Tether and SoftBank, and David Bailey’s Nakamoto Holdings, are actively entering this space, aiming to replicate—and surpass—Strategy’s success model.

Now, with the S-3 registration effective, Trump Media’s Bitcoin strategy has entered a substantive implementation phase. If executed successfully, it could become the world’s third-largest corporate holder of Bitcoin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News