SEC May Restart DeFi Summer as U.S. Crypto Regulation Takes Shape

TechFlow Selected TechFlow Selected

SEC May Restart DeFi Summer as U.S. Crypto Regulation Takes Shape

For these established, relatively decentralized DeFi protocols, on one hand it's a value reversion, and most importantly, they are now able to make it ashore.

By Will Wang

On June 9, 2025, during a roundtable discussion themed "DeFi and the American Spirit," Paul S. Atkins, the newly appointed Chair of the U.S. Securities and Exchange Commission (SEC), delivered an overwhelmingly positive speech on decentralized finance (DeFi), setting the stage for future SEC regulatory support toward DeFi.

Adams, founder of Uniswap—a project heavily targeted under former SEC Chair Gary Gensler—expressed surprise and joy on X:

"The speed at which DeFi has grown is truly mind-blowing🤯. Back in 2018, the launch of MakerDAO, Compound, and Uniswap felt like the real beginning of the DeFi movement. Before that, the term 'DeFi' didn't even exist. Just seven years later, a government agency publicly recognizes it as a national priority!"

(https://x.com/haydenzadams/status/1932298054343733664)

The crypto market responded positively as well. Legacy DeFi tokens such as Aave, Uni, MKR, and COMP surged in value. Since these established DeFi protocols are primarily built on Ethereum, ETH prices rose accordingly. For these older, relatively decentralized DeFi protocols, this represents not only a revaluation but, more importantly, a path to regulatory clarity and legitimacy.

This article first compiles the content of the DeFi speech, then examines the emerging shape of U.S. crypto regulation (beyond just DeFi), and finally looks ahead to the future of crypto—on-chain financial markets.

1. DeFi and the American Spirit

Paul S. Atkins: The DeFi movement inherently embodies American values such as economic liberty, private property rights, and innovation.

1.1 What Are Blockchain Networks?

Blockchain technology is a highly creative and potentially revolutionary innovation that allows us to rethink ownership, intellectual property, and the transfer of economic assets. Blockchains are shared databases enabling users to own digital assets (i.e., crypto assets) without relying on intermediaries or central authorities. Instead, these peer-to-peer networks use economic incentives to encourage participants to validate and maintain the database according to network rules. These are free-market systems where users pay fees on-demand to network participants to have their transactions included in capacity-limited "data blocks."

1.2 Participants in Blockchain Networks

The previous U.S. administration used lawsuits, speeches, regulations, and threats of enforcement to claim that validators and staking-as-a-service providers might be engaging in securities activities, thereby discouraging Americans from participating in these market-based systems.

I deeply appreciate the Division of Corporation Finance staff for clarifying their view that individuals voluntarily participating in proof-of-work (PoW) or proof-of-stake (PoS) networks as "miners," "validators," or "staking-as-a-service" providers fall outside the scope of federal securities laws. While I welcome this clarification, it is not a legally binding, formally enacted rule—so we cannot stop here.

The SEC must use the authority granted by Congress to establish clear regulations.

1.3 Self-Custody of Assets

Another core feature of blockchain technology is the ability for individuals to self-custody crypto assets in personal digital wallets. The right to self-custody one’s private property is a fundamental American value—and should not vanish when people go online.

I support giving market participants greater flexibility to self-custody crypto assets, especially when intermediaries add unnecessary transaction costs or restrict participation in staking and other on-chain activities.

The previous administration’s regulatory actions claimed that developers of such software could be engaged in brokerage activities, thus undermining innovation in self-custody wallets and other on-chain technologies. Engineers should not be subject to federal securities laws simply for publishing software code. As one court put it:

"It would be unreasonable to hold the developer of a self-driving car liable because a third party uses the car to violate traffic laws or rob a bank. In such cases, people don’t sue the car company for enabling wrongdoing—they sue the individual who committed the act."

1.4 Self-Executing Software Code

Many entrepreneurs are developing software applications designed to operate without any operator oversight. The idea of self-executing software code—accessible to everyone but controlled by no one—enabling private peer-to-peer transactions may sound like science fiction. Yet blockchain technology makes possible an entirely new category of software capable of performing these functions without intermediaries.

I do not believe we should allow century-old regulatory frameworks to stifle technological innovations that may disrupt—and most importantly, improve and advance—our current traditional intermediary models. We should not automatically fear the future.

These on-chain, self-executing software systems have proven resilient during crises. While centralized platforms have faltered and failed under stress in recent years, many on-chain systems have continued operating as designed by open-source code.

1.5 Innovating Regulatory Rules

Most current securities rules and regulations are based on oversight of issuers and intermediaries such as brokers, advisors, exchanges, and clearinghouses. Their drafters likely did not anticipate that self-executing software code could replace these entities. I have asked Commission staff to explore whether further guidance or new regulations are needed to help registered entities transact with these software systems while complying with applicable laws.

I am also excited about issuers and intermediaries using on-chain software to eliminate economic friction, increase capital efficiency, launch novel financial products, and enhance liquidity. Existing securities regulations already account for the use of new technologies by issuers and intermediaries, but I have asked staff to consider whether Commission rules need updating to better accommodate those seeking to manage on-chain financial systems.

As the Commission and its staff work to develop appropriate rules for on-chain financial markets, I have directed staff to consider a Conditional Exemptive Relief Framework—or “Innovation Exemption”—to enable both registrants and non-registrants to rapidly bring on-chain products and services to market.

The Innovation Exemption supports President Trump’s vision of making America the “global cryptocurrency capital” by encouraging developers, entrepreneurs, and companies willing to meet certain conditions to innovate in on-chain technologies within the United States.

2. The SEC's New Regulatory Approach

2.1 SEC Under Gary Gensler

In short, the SEC under former Chair Gary Gensler asserted regulatory authority over DeFi based on the following arguments:

-

Project tokens constitute “securities.” A key example is the SEC v. Ripple case. See: Understanding SEC v. Ripple: Clarifying the Regulatory Fog

-

Staking-as-a-Service Providers create interest-bearing assets that fall under the definition of “securities.” The most prominent example is the SEC’s lawsuit against Kraken’s staking product. See: Deep Dive: Solo Staking on Ethereum Is Not a Security—But Kraken’s ETH Staking Product Is

-

If assets traded on a platform qualify as “securities,” the platform may be deemed to engage in unregistered securities sales and brokerage activities. A notable case is the SEC’s lawsuit against MetaMask, arguing that some of its services—such as staking and brokerage-like trading—involves securities transactions.

Under this regulatory logic, an extremely strict definition of “security” was required—one that challenged not only the U.S. Securities Act of 1933 but also existing judicial and legislative processes. Due to the lack of clear classification and regulatory framework for crypto assets, the SEC resorted largely to enforcement-first regulation, initiating legal actions against major crypto projects including Coinbase, MetaMask, and Uniswap.

2.2 SEC Under Paul S. Atkins

The current Trump administration, led by Paul S. Atkins, marks a fundamental shift: “It is a new day at the SEC.”

Both this speech and his earlier May 12 address on “Tokenizing Assets—The Convergence of Traditional Finance and DeFi” send a clear signal:

To realize President Trump’s vision of making America the “global cryptocurrency capital,” we must encourage developers, entrepreneurs, and companies willing to comply with certain conditions to innovate in on-chain technologies in the U.S., positioning America as the premier destination for global crypto asset market participation.

From Chair Atkins’ two speeches, we can discern the SEC’s new regulatory philosophy:

For Real-World Asset Tokenization (RWA):

-

Establish a reasonable regulatory framework for crypto asset markets;

-

Issuance: Adopt more flexible methods for issuing crypto assets, rather than strictly applying traditional securities issuance rules;

-

Custody: Support greater autonomy for registered institutions in custodying crypto assets;

-

Trading: Allow a broader range of trading products based on market demand, lifting previous SEC restrictions;

-

Create more flexible conditional exemptions to incentivize blockchain innovation to return to the U.S.—MAGA.

(SEC Chair Paul Atkins’ First Crypto Speech Ushers in a New Era of Regulation)

For Decentralized Finance (DeFi):

-

Reframe staking operations on blockchain networks to promote healthy network development and attract node operators;

-

Provide flexibility for self-custody of assets, aligning with American values;

-

Clarify liability for self-executing software code;

-

Offer clear regulatory guidance for DeFi to build on-chain financial markets;

-

Establish a Conditional Exemptive Relief Framework and Innovation Exemption to foster innovation.

2.3 Early Signs of a U.S. Crypto Regulatory Framework

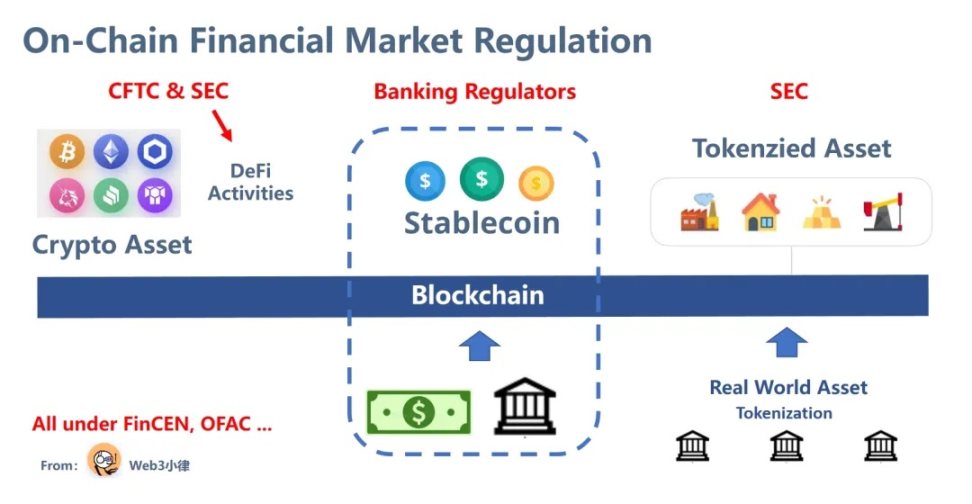

We are now seeing the early contours of a U.S. crypto regulatory framework take shape:

-

Banking regulators leading oversight of “payment stablecoins” via the GENIUS Act;

-

CFTC overseeing crypto commodities;

-

SEC regulating DeFi activities;

-

SEC regulating tokenized assets;

-

FinCEN, OFAC, and others handling KYC/AML/CTF and economic sanctions.

3. What Comes Next?

With the U.S. regulatory landscape becoming clearer, we can begin to glimpse future trends:

-

Legacy DeFi protocols, having weathered volatility, remain strong and are now gaining formal recognition.

-

Innovative DeFi projects will thrive under the “Innovation Exemption,” particularly yield-bearing stablecoin financial products. These differ from “payment stablecoins” defined in the GENIUS Act—they may be called stablecoins, but are actually investment products built using stablecoins.

-

The composability enabled by relatively decentralized DeFi, combined with increasing on-chain presence of stablecoins and tokenized assets, will lead to more diverse financial products.

-

More Web2 fintech companies will begin integrating with Web3 DeFi for innovative combinations.

-

All of this points toward the emergence of on-chain financial markets.

-

This market will be global, democratized, low-barrier, low-cost, universally accessible, and backed by global liquidity—an internet-native market. Crucially, the internet exhibits powerful network effects.

-

Yet under this regulatory framework, the foundation will be dollar-denominated: USD stablecoins, U.S. dollars, and U.S. Treasuries.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News