The Influence Economy of Crypto Twitter: How a Few Accounts Control the Narrative?

TechFlow Selected TechFlow Selected

The Influence Economy of Crypto Twitter: How a Few Accounts Control the Narrative?

For builders: understand that you must either learn to play the influence game or find allies willing to help.

Author: rosie, Crypto KOL

Translation: Felix, PANews

The crypto Twitter community (CT) brands itself as the most decentralized information network in finance. They call it "permissionless discourse." Anyone can share alpha, anyone can build an audience, and anyone can influence the conversation.

But in reality, about 100 accounts control how millions perceive cryptocurrency, which projects gain attention, and where capital flows. It’s the most centralized influence economy disguised as grassroots community building.

This intricate influence mechanism is so powerful that even traditional media executives would envy it.

The Core Circle of Market Manipulation

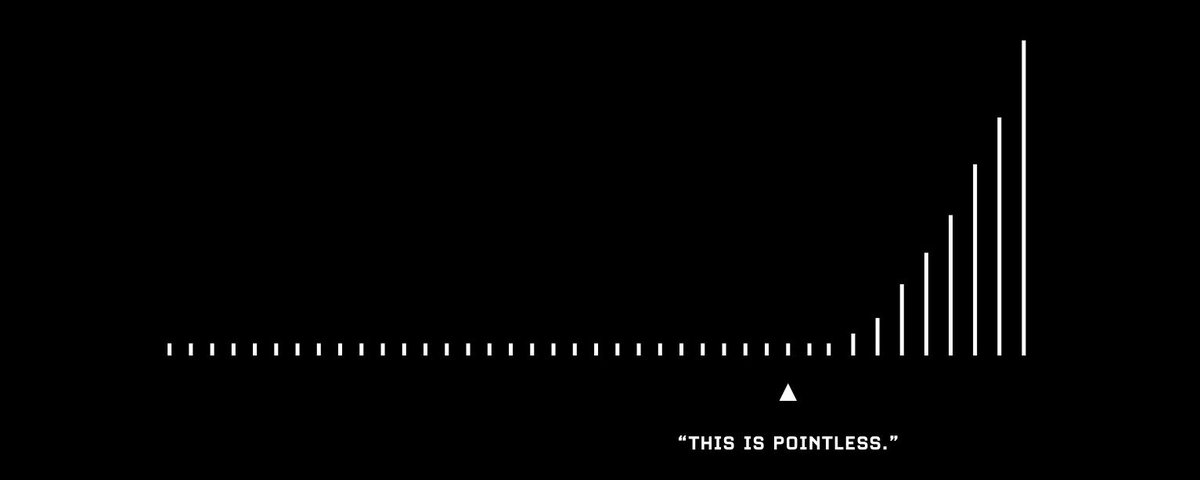

CT isn’t one big conversation—it’s a series of concentric circles, with influence radiating outward from the center in disproportionate ways.

Layer One: Kingmakers (5–10 accounts). These aren’t just popular accounts—they create network effects. When they tweet, hundreds of others retweet within minutes. A casual mention can pump token prices; criticism can kill a project; endorsement instantly grants legitimacy.

When a top-tier account mentions a project, it doesn't just generate engagement—it attracts institutional attention, VC interest, and retail FOMO.

Layer Two: Amplifiers (20–30 accounts). These accounts turn Layer One tweets into trending topics. They quote-tweet, add commentary, and ensure the message reaches niche communities such as venture partners, prominent builders, or ecosystem leads.

Layer Three: Echo Chambers (70–75 accounts). Mid-tier influencers who repeat narratives from Layers One and Two to their own audiences. They rarely originate ideas but are crucial for scaling narratives. Their job is to make Layer One opinions appear as community consensus.

Everyone else: The audience. Consuming and reacting to content already deemed worthy by the top 100.

How Narratives Actually Spread

This process isn’t random—it’s predictable:

Step One: Seeding

A Layer One account shares an insight, observation, or discovery. This could be genuine alpha—or strategic promotion.

Step Two: Amplification

Within 1–3 hours, Layer Two accounts quote-tweet with added interpretation, creating the illusion of independent discovery.

Step Three: Validation

Layer Three accounts pile on, offering supporting evidence and creating social proof that “all the smart people agree.”

Step Four: Cascade Effect

Regular retail accounts spread fragmented pieces of the narrative—often misunderstanding key details—but still transmitting the core message.

Step Five: Institutionalization

Crypto media outlets write articles citing “crypto Twitter sentiment,” turning the narrative into accepted truth.

The entire cycle takes only 24 to 48 hours. By the time most people notice a “hot” crypto topic, the influence economy has already determined its trajectory.

The Economics Behind Influence

Influence on CT isn’t just about reputation—it’s a sophisticated business model:

Direct Monetization:

-

Paid promotions disguised as organic discoveries

-

“Advisor” roles in projects mentioned in their tweets

-

Speaking fees at conferences and events

-

Newsletter sponsorships and premium content

Indirect Value Capture:

-

Early access to project information and tokens

-

Favorable allocations in funding rounds

-

Networking with top-tier VCs and founders

-

Board seats and equity opportunities

Portfolio Pull: Many top accounts are angel investors or advisors in crypto projects.

The Gatekeeping Problem

The concentration of influence creates systemic biases:

Geographic bias: Most top-tier accounts are based in the U.S., resulting in a U.S.-centric global tech narrative.

Network bias: Projects connected to influential accounts receive disproportionate attention regardless of technical merit.

Wealth bias: Accounts with existing crypto wealth gain access to exclusive deals, compounding their advantage.

Language bias: Non-English projects and communities are systematically undervalued.

Professional bias: Financial engineering gets more attention than technological innovation because financiers are better at self-promotion.

What Gets Promoted—and What Gets Ignored

Analyzing CT trends reveals clear patterns in what content gets amplified:

Heavily promoted:

-

New L1 blockchains (especially EVM-compatible ones)

-

DeFi protocols with novel token mechanics

-

Anything labeled “infrastructure” or “scaling”

-

Projects built for developers

Systematically ignored:

-

Projects without tokens or VC backing

-

Technological innovations lacking financial speculation

-

Developers focused on delivery over marketing

-

International projects without U.S. connections

The result is a feedback loop where crypto development prioritizes capturing CT attention over advancing real technology.

The Illusion of Decentralized Discourse

CT presents itself as the antithesis of traditional media, yet its power structure is strikingly similar:

Traditional media: A few editors decide what’s newsworthy, reporters amplify those decisions, and the audience consumes filtered information.

Crypto Twitter: A few top-tier accounts decide what’s worth discussing, secondary and tertiary accounts amplify them, and the audience consumes curated narratives.

The main difference? CT’s influence economy is far less transparent regarding power structures and financial incentives.

Downstream Consequences

The concentration of influence has tangible impacts:

Capital allocation: VCs monitor CT sentiment when making investment decisions. Trending projects get meetings; overlooked ones don’t.

Developer focus: Builders often choose projects based on what they see being celebrated in social dynamics.

Retail behavior: Millions make financial decisions based on narratives from 100 accounts with undisclosed conflicts of interest.

Media coverage: Crypto journalists use Twitter sentiment as a proxy for importance, further amplifying the influence economy’s choices.

Breaking the Cycle

Some observations for navigating this reality:

For builders: Understand that technical excellence without narrative leads to obscurity. Either learn to play the influence game or find allies who will.

For investors: Sentiment on CT is a lagging indicator of top-tier opinions—not true market sentiment. By the time something becomes “popular,” you’re already late.

For users: Follow accounts that consistently share diverse perspectives and deep technical analysis—not those echoing mainstream takes and paid promotions.

For the ecosystem: Recognize that influence concentration on CT undermines the very decentralization it claims to champion.

Summary

CT isn’t broken—it’s working exactly as designed.

The problem isn’t the existence of influence networks (they’ll always exist). It’s the pretense that CT represents organic, decentralized discussion, when in fact it’s a complex influence economy with concentrated power and undisclosed financial incentives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News