After deleting Twitter, I finally learned not to impulsively buy and sell

TechFlow Selected TechFlow Selected

After deleting Twitter, I finally learned not to impulsively buy and sell

The only "Alpha" you need is yourself.

Author: WSM

Translation: TechFlow

Distracted? Then you're NGMI ("Not Gonna Make It").

Do you genuinely want to get rich, or would you rather entertain yourself while watching your portfolio shrink against Bitcoin, Ether, and the dollar?

Many people are wealthier than I am, but the "blueprint" you're about to see is exactly the same. What does their wealth have to do with mine? In my personal investment journey, I've already surpassed my wildest dreams—self-made, average IQ, mentally stable. And my last trade was three years ago. The crypto world in 2025 is utterly boring; the only move left is to "hold forever," because it's now part of your net worth.

Bitcoin and Ether have no top, because fiat has no bottom. Fiat depreciation is by design—and that’s not a bad thing. Too many crypto players think they’ve uncovered some grand conspiracy, as if this weren’t the intended outcome all along.

Humanity’s all-time high (ATH) is always right now. Nostalgia often blinds us to an objective reality: overall, humanity has never lived in a more prosperous era than today.

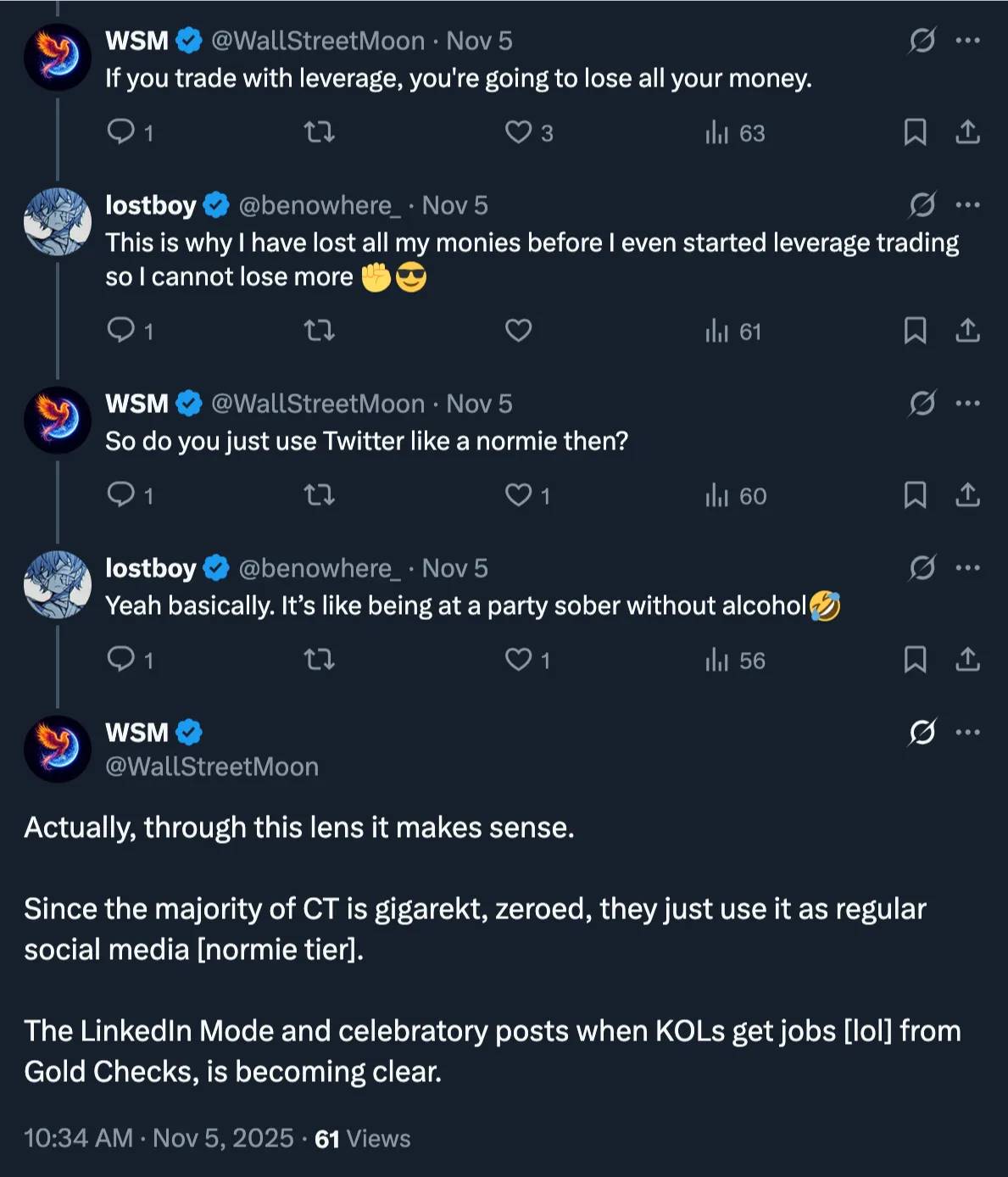

Contrary to popular belief, Crypto Twitter (CT) is an information bubble. I've never seen Twitter as a good source—I only use it to gauge market sentiment. There's a big difference.

The only reason I'm still on Twitter now is because I’m in startup mode (I've only posted for 30 days). My mindset remains unchanged from 4.5 years ago:

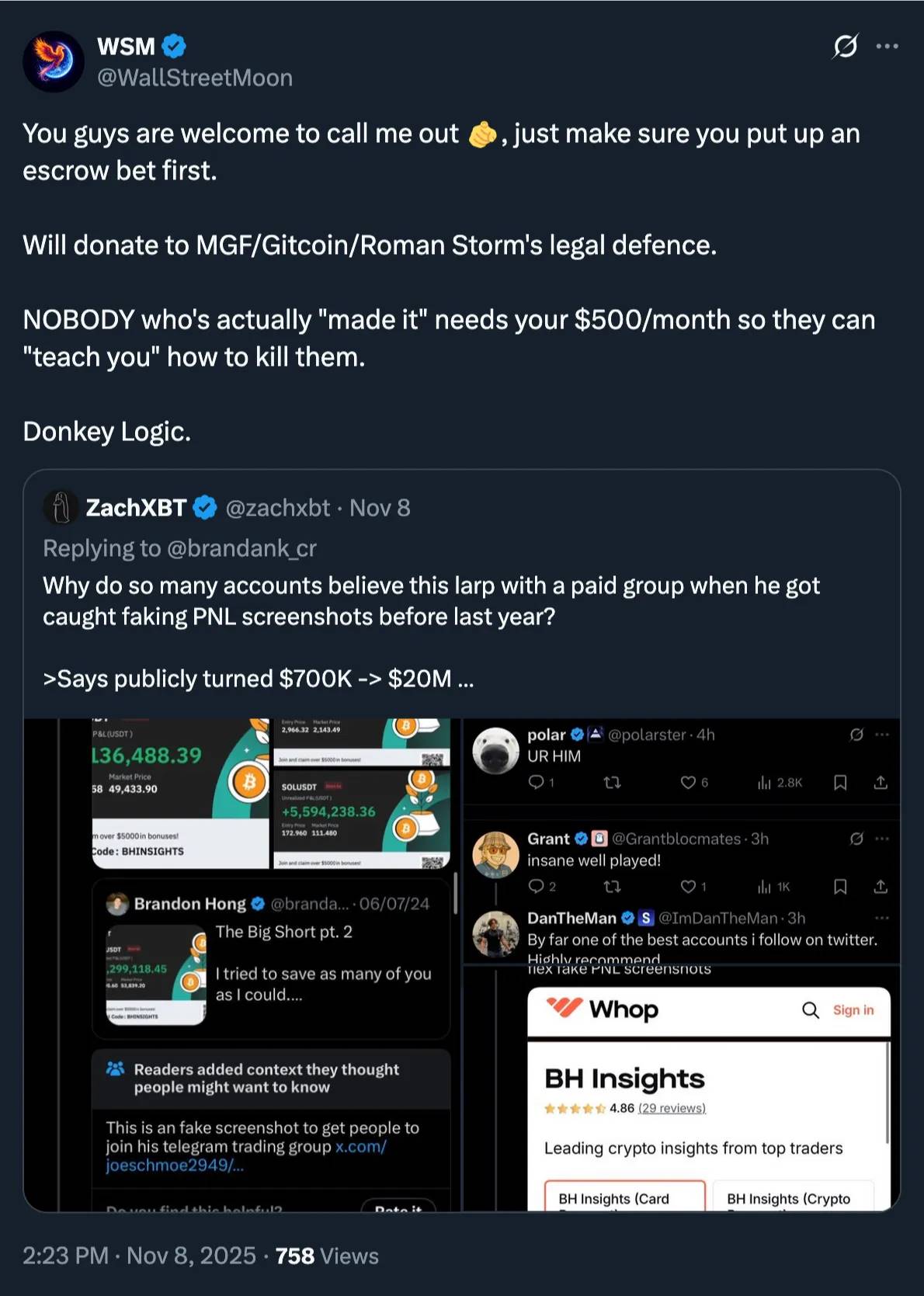

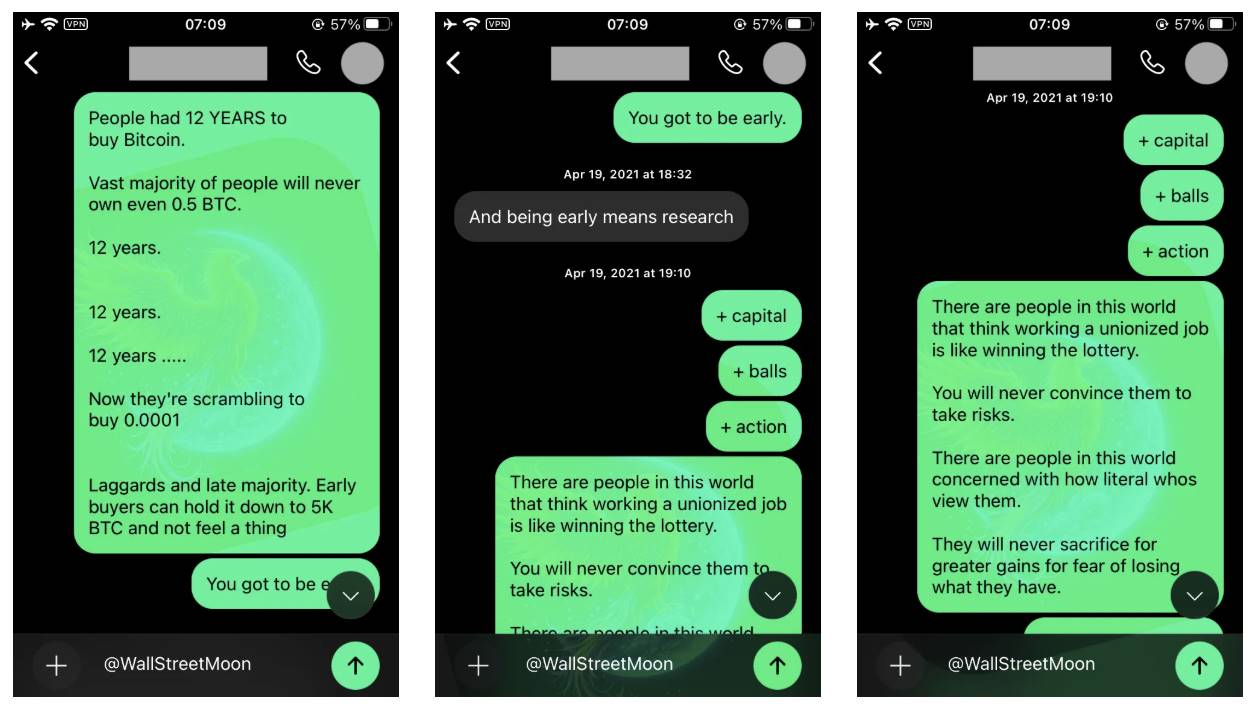

By the way, I see far too many LARP ("Live Action Role Play") screenshots on Crypto Twitter.

It’s unbelievable that anyone actually believes this stuff:

The vast majority of crypto participants don’t use Twitter at all and couldn’t care less about what happens on it.

Why should they?

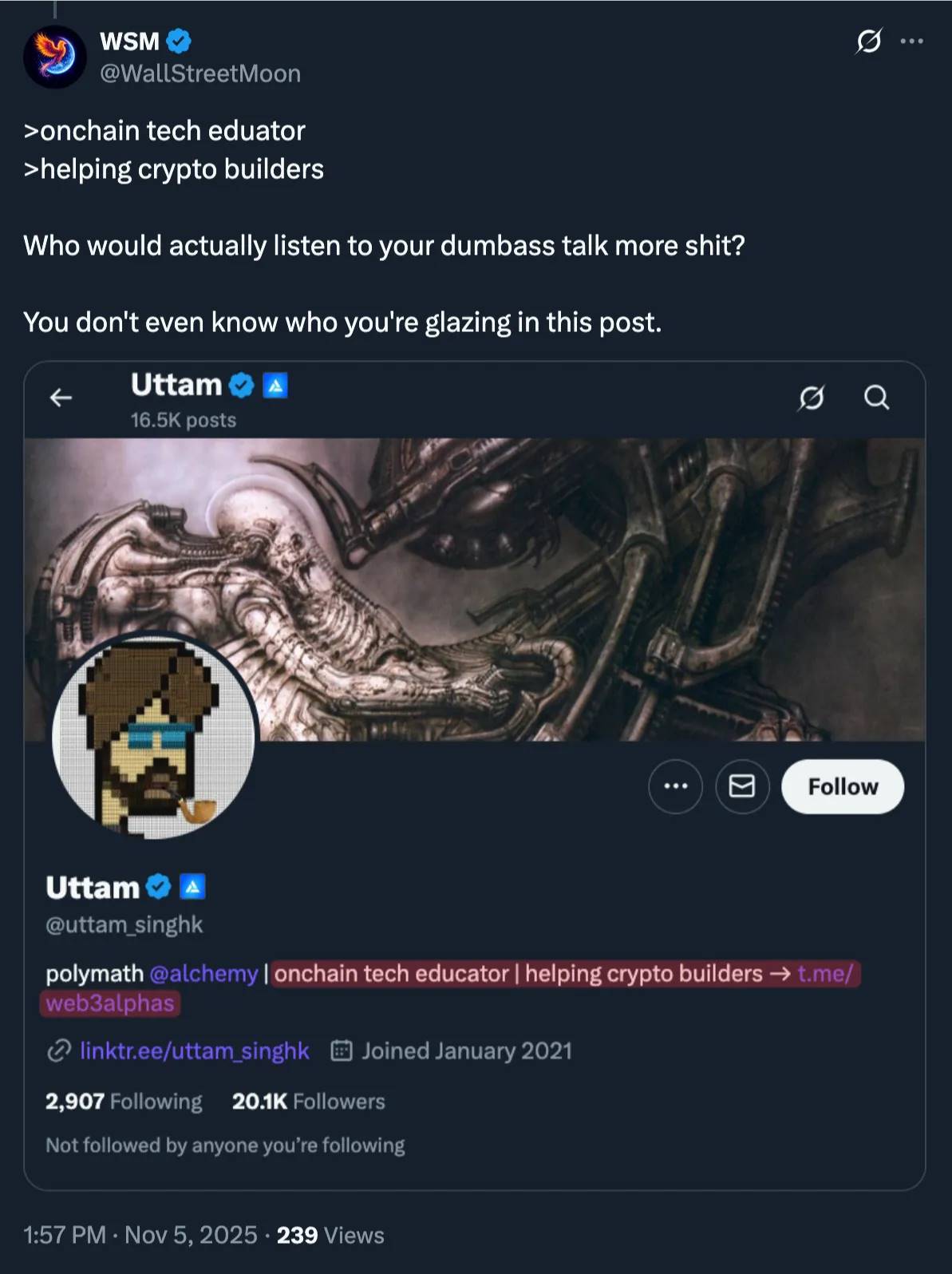

Who logs onto Twitter to listen to your dumb ass ranting?

If you’re so smart, why didn’t you buy Bitcoin when it was cents and just hold?

If you’re so smart, why are you still trading in 2025?

Did 12.6 million times return on Bitcoin not make you retire?

Was 16,666x on Ether not enough?

With countless 10x, 100x, 1000x returns, airdrops, DeFi yields—why are you still stuck on this app?

No trader has ever outperformed early crypto holders. Not one. Zero.

So who’s the real fool? Huh? Fool?

Freeze Bitcoin and Ether prices at today’s level, exit the market forever. Is that enough? That’s the only true measure of an “early” investor.

Where are those people on Twitter with five affiliate links, running $500/month paid Discord groups, listening to your nonsense?

You sold your future and ruined your wealth stack. You’re just a washed-up worker pretending to be a KOL (Key Opinion Leader), surviving off paid group chats. People celebrate your golden ticket job opportunity on their timelines—what you call "Work to Earn."

There’s nothing wrong with that—but then you pretend to be an “expert,” make others believe you’re an expert, charge for your “expert” opinions, and then what?

You send innocent people into the meat grinder of Rekt City™. All your assets bleed against Bitcoin and Ether. No cryptocurrency can justify its existence, because they’re all tokenized fiat—Tether—getting absolutely crushed.

If you can’t even beat fiat—the very purpose for which crypto was created—then what’s your point?

And yet, you still boldly talk about taking down Ether, the second-ranking asset, which has already surpassed Tether.

You keep babbling confidently about Bitcoin, the number one king, heading toward collapse.

Babbling.

Babbling.

Babbling.

Ranting without basis.

The Bitcoin whitepaper is 17 years old. Will a hero come to save the market? No hero is coming.

You don’t actually want to challenge Bitcoin, let alone the Holy Trinity of crypto.

In fact, if you held enough of the Holy Trinity to achieve financial freedom, you’d stop trading right now.

Gamblers addicted to speculation cannot be saved—they have no end goal. They gamble purely for gambling’s sake, their dopamine receptors numbed by overstimulation—a full-blown addiction.

Shitcoins should just use centralized databases on AWS. It would be faster, cheaper, safer, and more honest, because they’re essentially fully centralized—unlike Bitcoin and Ether. Most projects fake decentralization (LARP), only a few admit the truth. Adopting centralized solutions might reduce the massive losses from blockchain or smart contract exploits across the "industry."

The real reason shitcoins exist is to offer teams a "Devil’s Swap":

-

You give them: your valuable Bitcoin, Ether, or dollars

-

You get: their freely minted shitcoin

Stop and think. Any Devil’s Swap means the team dumps newly created supply directly on top of you from day one. They take your real value and give you air in return.

Then, your shitcoin must compete endlessly in the open market against the Holy Trinity (Bitcoin, Ether, USD). Every morning, holding a shitcoin means worrying whether other holders will suddenly "wake up" and dump it for the Holy Trinity to preserve value.

This is why all shitcoins bleed satoshis over time. Ether is the only asset since its ICO to outperform Bitcoin and firmly claim second place. We’ll dive deeper into that in another piece.

Shitcoin teams don’t care what happens to their tokens—they’ve already gotten what they wanted via the Devil’s Swap: Bitcoin, Ether, and dollars. Whether the shitcoin crashes to zero doesn’t affect them at all.

But it matters to you—because you’re holding it and watching your money drain away.

Capital preservation is the most important rule in investing. Without it, you will go bankrupt—no amount of skill can overcome ruin risk.

Like Reddit, Twitter rewards hive-mind "donkey consensus." That’s the core issue. A post being popular, liked, or trending doesn’t mean it’s correct.

When do we all win together? Never.

Pareto distribution doesn’t let donkeys win together. Wealth will always concentrate in the hands of a few, regardless of conditions. Crypto itself is indeed a generational wealth transfer—but only a tiny minority benefit. Think about it.

And who are the ultimate winners? Bankers and governments—not cypherpunks.

What about the "smart guys"? They’re especially prone to missing opportunities. They care too much about the prestige of being contrarian instead of simply buying Bitcoin or Ether outright.

Beware of those who think they’re smart and have complex theories explaining why things won’t work—they’re too clever by half and end up sabotaging themselves. I call them "Jeremiahs" (pessimists).

Smart people usually work for those who are "dumber" but have higher risk tolerance. The only way to get rich is to own, nothing else. Offer smart people job security and "golden handcuffs," and they’ll become your employees. That’s the truth.

Steve Jobs didn’t write iOS code, but he became incredibly wealthy through Apple stock—far richer than any genius engineer.

At the end of the day, it’s just money, right?

Back then, people warned you like preachers—buying Bitcoin was like catching leprosy; Ethereum was a scam that would kill you.

"Institutional investors" didn’t perform better than retail in the last cycle. Now they’re buying in at higher prices than us, with terrible entry points. Fully committing in a nascent industry like crypto requires special courage.

You’re late.

Can I get a GM? Shut up.

Crypto Twitter has now become LinkedIn, and the reason is simple—all the quality content has been "siphoned off," leaving behind concentrated "exit liquidity" and scattered speculators.

People fight tooth and nail over scraps—that’s why "timeline trading" has become trendy.

Even "vicarious trading" has emerged—you’re getting rekt, so you watch others trade like gaming streamers instead of playing yourself.

When even the scraps are gone, people start devouring each other.

The rug pulls this cycle are exceptionally vicious because there’s no surplus value left to extract. Excuses and "meta narratives" have vanished. Trying to package crime as "cool" is merely a result of increased market efficiency narrowing the Pareto bottom further.

Imagine: in 2025, which truly successful, already-rich person would sit on Twitter wasting their competitive edge teaching you how to beat them?

Use your brain.

No one teaches you how to kill them. Never.

In fact, recently I had an epiphany chatting with some users (in no particular order):

I never believed in self-deprecating jokes. You should always believe in yourself:

@AzFlin [deleted post] did a recap of all the "smart" people who got rekt on Stream Finance. To me, it’s pure comedy:

Some donkey licking a scammer’s boots.

When I say BNB is a "child asset" of Ethereum, I mean it:

-

BNB: Originally an ERC-20 token on Ethereum.

-

BSC (Binance Smart Chain): A fork of Ethereum’s Go Ethereum (Geth).

-

PancakeSwap: A fork of Uniswap.

-

opBNB: A fork of Ethereum’s OPStack.

By 2025, owning a "suicidal" target of 21 Bitcoins is unaffordable. Yes, this minimum threshold—21 BTC—has always been the benchmark for joining the "Millionaire Club":

Satoshi must be rolling in his grave:

Completely shocking those in the trenches.

Here are my personal views on the current state of crypto in 2025:

When some of us entered crypto in early 2017, we naively thought we were changing the world. By 2019 and DeFi Summer, we matured—our only goal became crushing the enemy.

Crypto is an extreme PVP (player versus player) game: it’s a negative-sum game, not zero-sum.

Intermediaries sit comfortably, gleefully watching traders slaughter each other in the arena. They take zero risk but harvest all profits while you get rekt. Worse, they provide referral links, luring more victims into Rekt Graveyard™ for endless profit. It’s no coincidence nearly every exchange founder became a billionaire.

They surpassed everyone because they were early adopters—some even secured positions across multiple tiers of the wealth ladder. They almost can’t fail.

Wealth Ladder:

-

CEX (Centralized Exchange) Founders

-

Layer 1 Blockchain Founders

-

Various Project Founders

-

Early Adopters

-

Top Elite Traders

-

Latecomers [Rekt]

-

Ordinary Traders [Rekt]

If you use leverage in crypto markets, you will eventually lose all your money.

It’s not “if,” it’s “when.”

Crypto markets are too small compared to traditional ones; your opponents engage in criminal activity and insider trading. Yet most still trade manually with childlike emotional control. Utterly insane.

I never saw myself as a "trader," because buying early and holding, watching my peers destroy each other in the market, is the proven winning strategy. How could you possibly outperform an early adopter?

Trading seems smooth until it suddenly collapses.

Those trying to "optimize" their Bitcoin and Ether holdings through trading (gambling)? Only one outcome: rekt.

Rekt City™

Their "bodies" float down the river, and you win forever doing nothing.

I’ve grown tired of winning—it’s the agony of "success overdose."

All the "monsters" who dominated previous cycles have long converted their wealth into Bitcoin, Ether, and dollars and exited years ago. They understand the game. They’re not here anymore.

Why would they come back? Why would they tweet for you? Do you have their private phone numbers? Do you hang out with them? Have you met their families and kids?

Use your brain.

Once you have enough Bitcoin, Ether, and dollars—your "make it stack"—there’s nothing left to do. Just wait quietly; these assets are now part of your net worth.

What could you possibly sell them for? You’ve reached endgame.

Imagine never having to check price charts again—how beautiful would that be?

The "monsters" still active in the market today mostly emerged from the fire of 2017. Nearly all are founders or later became founders. That’s why they’re still here. And it all ties back to Ethereum—their initial capital was raised via ICOs on Ethereum.

Ethereum brought more mainstream adoption to crypto than any other cryptocurrency. Everything you see in crypto today stems from Ethereum’s R&D, driving the entire industry’s adoption and development.

Did you enter crypto because of Bitcoin, or because of narratives spun from Ethereum’s R&D? Most fall into the latter category.

Ethereum is the DeFi lab for the entire crypto market. Even Solana and others benefited greatly: they observed Ethereum mainnet’s success, learned what could be improved, experienced real market testing, then launched their own tech aiming to solve those bottlenecks. I’ll discuss in another article why "better tech" has zero impact on price.

I don’t even need to mention Ethereum’s price performance—your face would turn red: from ICO to now, 16,666x gain.

Ethereum hasn’t underperformed—the one who underperformed is you, because you arrived late.

As an ordinary person under normal market conditions, you had countless chances to buy Ethereum below $300, $200, even $100—and buy big. You could’ve allocated your entire net worth into Ethereum multiple times. If you didn’t "believe" in Ethereum, switch to Bitcoin—same effect—or buy both like I did.

Reddit’s "boomer fags" were busy making memes back then, mocking Ethereum at $300 like it was a stablecoin. It stayed flat at that price for ages. Even if Vitalik "cured cancer," Ethereum remained stuck at $300.

How could you let Reddit’s "boomer fags" outperform you?

Utter humiliation.

You got beaten by Reddit!

Actually beaten by Reddit!

Reddit is worse than Crypto Twitter, because its upvote/downvote system encourages emotionally invested "bagholders" to steer discussions in their favor. And if those bearded moderators are also bagholders, they might even ban or delete your comments out of fear.

Yes, I obviously outperformed Reddit’s "boomer fags." Otherwise, I’d be ranting online like them, right? I won’t reveal my edge to strangers online, but I’ve always tried to help close ones and kept my trading journal. You should too. Money is the strongest tool to solve all your immediate problems.

I’ll show you one generational trade—one that likely won’t repeat in my lifetime. I think. It was perfect timing, luck, and preparation. Too many people let pride prevent them from admitting luck plays a major role in success.

But I’d rather be lucky than skilled. Always. Who prays for a harder market?

"Oh, if only the market were harder, I could brag on Crypto Twitter about my superior skills."

Give me a break.

Bottom Fishing During the March 2020 Pandemic Crash

During the March 2020 market crash triggered by the pandemic, I aggressively bought the dip while panic flooded Crypto Twitter. I’d already learned about the Wuhan outbreak (being online constantly actually helps) and prepared in advance. At worst, I’d just be hoarding canned food and paying some interest.

When the opportunity came, honestly, it was terrifying. This was the biggest "nuclear blast" I’d seen in crypto markets. But I was young—if I failed, I could restart. Humanity survived worse disasters.

So I went all-in: Bitcoin at $4,000, Ether at $100, deploying all remaining fiat and stablecoins.

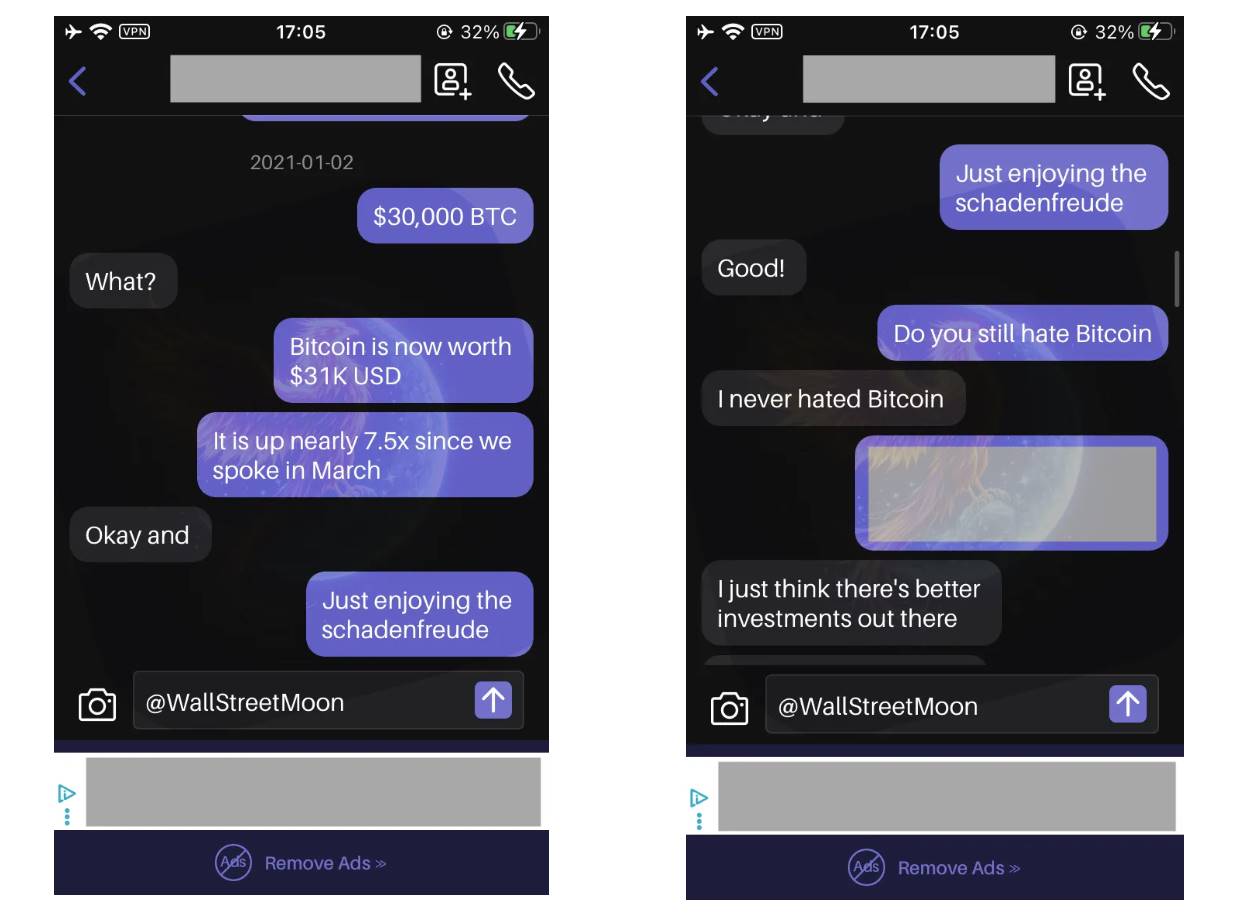

I advised a "friend" to act rationally and seize the chance, but she was arrogant. I don’t blame her—the uncertainty was high. Later, I lightly mocked her:

"Better investment? Where? Show me."

During DeFi Summer, I told friends missing this opportunity would regret it for life, because the market wouldn’t replay these prices. Once the "normies" wake up, it’s over.

Even seasoned crypto veterans from the last bull run struggled with PTSD from the 2018 bear market (including me). They simply couldn’t hope for the future.

I stopped there—can lead a horse to water, but only they can drink. As a friend, I want those I care about to succeed. Not empty words—money is the most powerful real-world placebo. I disagree with other views because I’ve stood on both sides of this path.

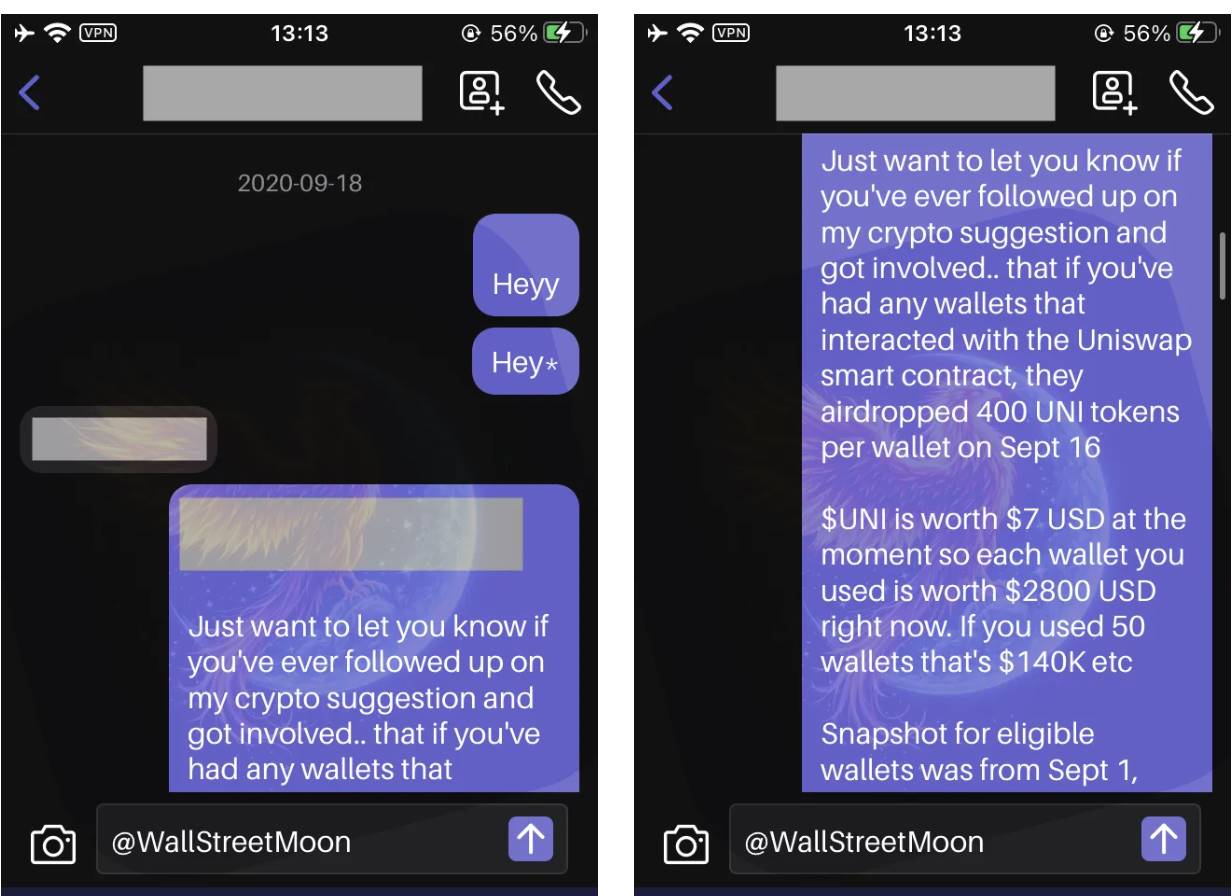

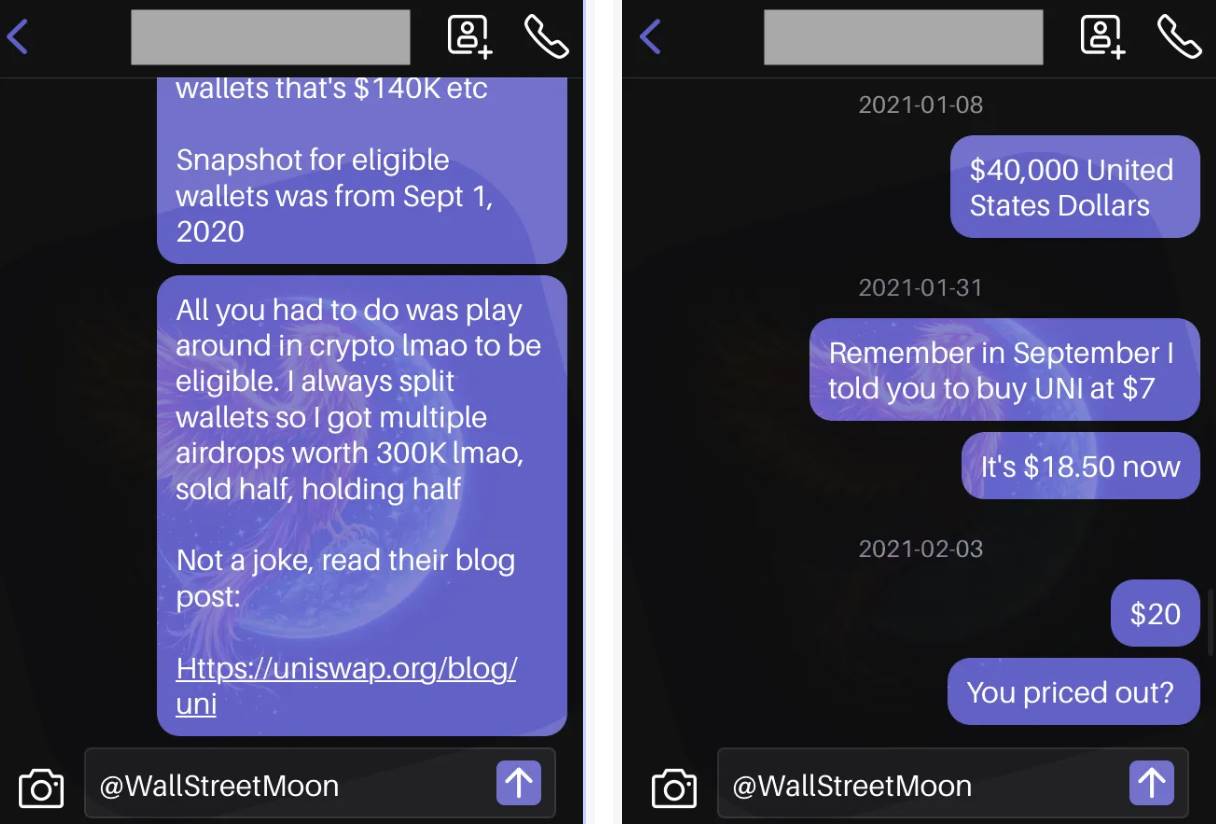

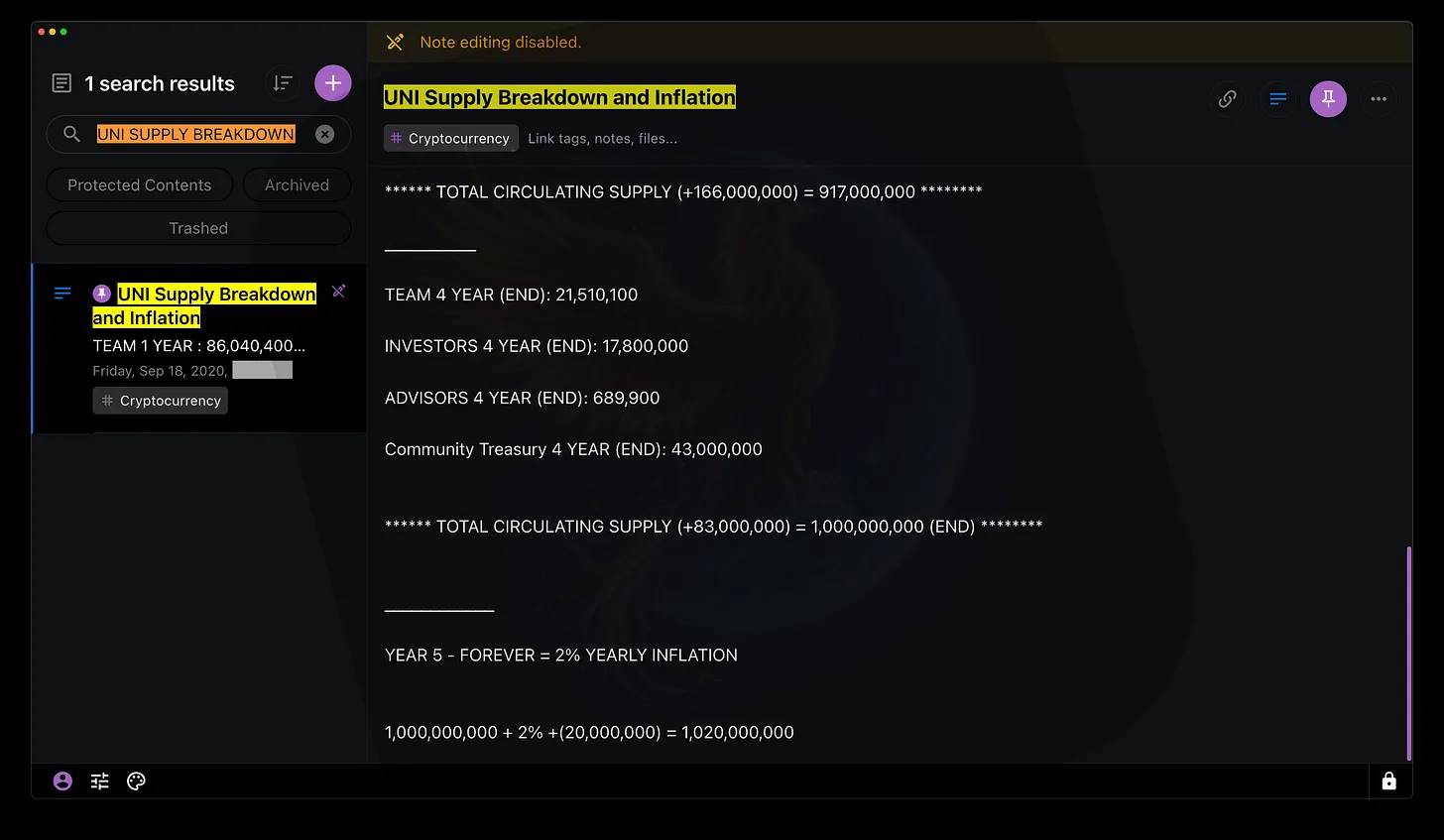

Seven-Figure Uniswap Airdrop

Well, not literally seven figures—the airdrop was worth about $300,000 at the time. But by holding and adding profits from other trades, I grew it into seven figures.

Initially, I doubted Hayden Adams (Uniswap founder) and sold half. Later, after doing my own research (DYOR) and crunching numbers, I gained confidence the market would severely punish those treating Uniswap airdrops as "free money" and dumping. Too many "fools" escape market punishment. Pareto will have its revenge.

If you get my joke about "selling your airdrop for a PS5," we’re from the same circle (Twitter isn’t my home). Those who didn’t believe dumped $UNI to such low prices—pathetic, undeserving of holding!

If you held $UNI to today, each wallet earned up to $3,000 (current valuation). Not bad, right?

Yes, we used to manually analyze tokenomics and make rational investment decisions, not blindly follow名人 KOL recommendations on Twitter timelines like today:

The jealousy and anger practically burst through the screen.

Were you priced out of the market?

...and I’ve only just begun.

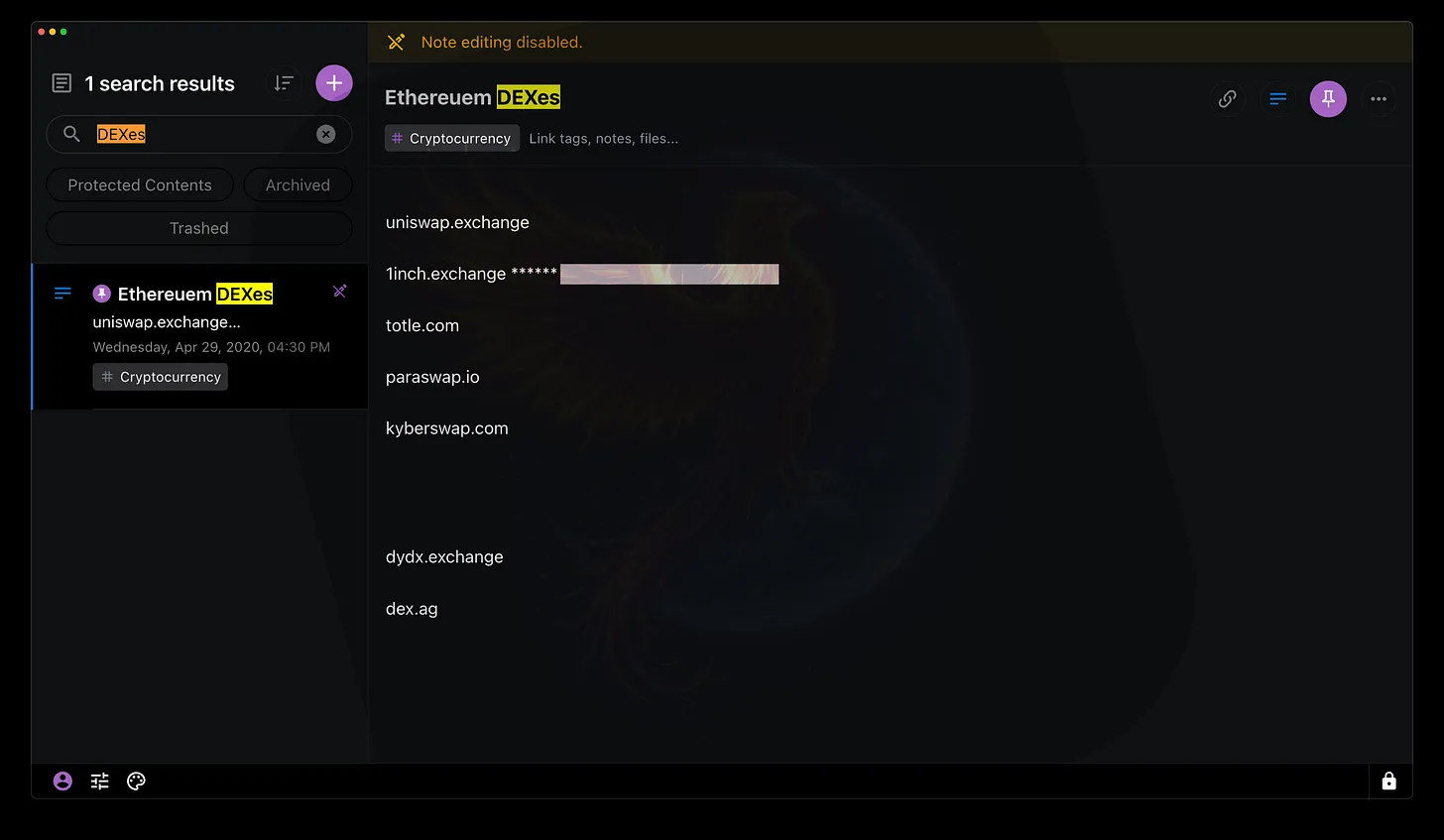

1inch Airdrop

If you participated in DeFi Summer, you could easily get the 1inch airdrop. Under certain conditions, 1inch even outperformed Uniswap.

They didn’t just do one airdrop—they did two! And the first announcement was on Christmas Day. As an adult, receiving a generous airdrop on Christmas brings indescribable joy.

Time has blurred other DEXs I interacted with, but undoubtedly, Uniswap and 1inch stood out.

Now in 2025, if I recommend a DEX, I’d pick these:

-

Uniswap

-

1inch

-

Matcha

-

Cow (newer platform, use cautiously)

Maybe better options exist, but I prefer "legacy" projects—I prioritize security over risking getting rekt.

Beware of Shiny New Things

I see too many people excitedly testing new protocols and apps on Twitter timelines like guinea pigs. I just say: don’t.

I once suffered significant loss testing limit orders on a DEX. These features were experimental—on-chain limit orders were unreliable. You had to monitor manually or use sketchy bots requiring private key access. Impossible for me.

I was testing Velox Global. I just wanted to sleep peacefully, bro—I spent 16–18 hours daily researching, utterly exhausted. I wanted orders to execute automatically while I slept. Well, let’s just say routing errors occurred.

Matcha’s limit orders suck, but at least they fail silently instead of donating your funds like Velox.

My Only Trusted Ethereum Wallets in 2025

-

MetaMask

-

Rabby

I trust MetaMask’s core code security, while Rabby focuses more on user interaction safety. Both excel in their domains.

I often see Twitter complaints about MetaMask, but none relate to security. If you mention Infura’s data tracking (only discovered in 2022? LOL), just monitor outbound connections with a firewall—you’d know instantly and easily switch RPCs.

What does MetaMask’s airdrop have to do with security?

Also, some of you may not even know MetaMask has a blue logo.

OPSEC is a different field—maybe I’ll write a dedicated article.

Exiting at the April 2021 Peak

April 2021 was the risk-adjusted peak of that bull cycle. If you held to November 2021, you’d get rekt. Bitcoin crashed ~53% afterward, barely making a weak new high, while most altcoins nearly zeroed. By April 2021, you should’ve switched to stablecoins.

Those KOLs chanting "Bitcoin to $100K by year-end 2021"? Unfollow immediately! That’s my "donkey consensus." Crypto is a zero-sum game—Pareto Principle ensures not everyone wins together.

Even long-lost "friends" popped up at the absolute April 2021 peak asking if they should enter. I honestly told them not to touch it—the market was wildly overvalued, waiting for "nuclear blast" was wise.

I predicted the top before GCR (renowned crypto trader), not because I’m better (I’m not a trader), but to show: too many rely on others’ "alpha" instead of trusting their own judgment.

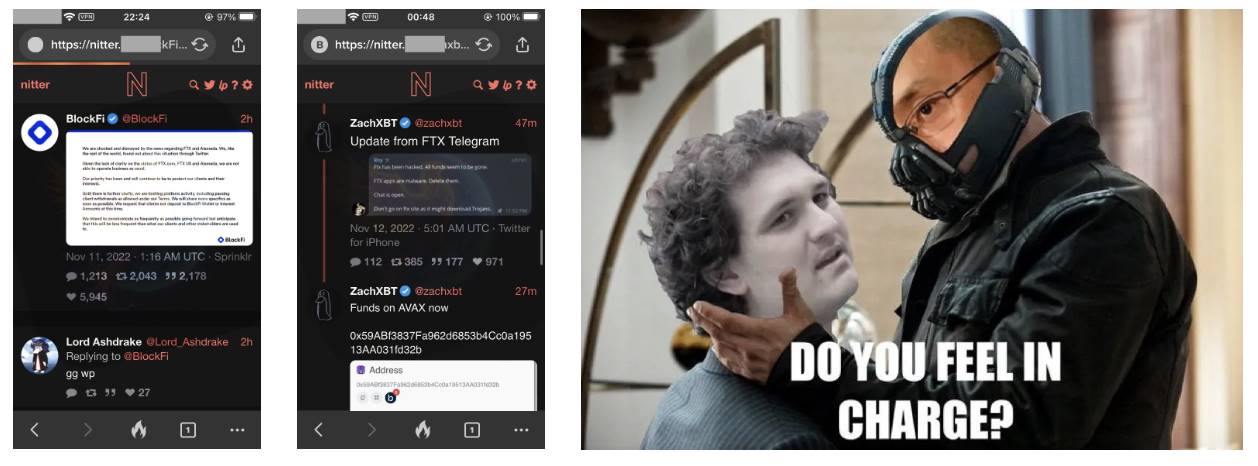

The Following Market Massacre

Pareto began harvesting "corpses":

I awakened my "Sharingan" after the 2018 bear market—the market’s illusions can’t fool me anymore. I’ve aligned with Pareto, undefeated since 2020. In crypto, everything is just a tool to acquire more Bitcoin, Ether, and USD (BTC, ETH, USD).

If in 2025 you still promote "community," you’re destined to get rekt. Community is just glue binding bagholders together.

Profitable people won’t tell you (why would they?), and the schadenfreude of being the sole survivor while everyone else gets destroyed is indescribable. We play the same game with the same tools, but only a few survive. That’s crypto’s essence as a negative-sum game, which your "community" conveniently ignores. Where do you think the money comes from?

You’re in a video game, and Bitcoin, Ether, and USD are the ultimate "graduation gear."

Imagine Pareto as a "God of Tricks" sitting atop. When Pareto sees too many "donkeys" profiting, it triggers massive liquidations to reset the landscape:

-

Mt. Gox

-

Bitconnect

-

OneCoin

-

Luna

-

FTX

-

Cross-chain bridge exploits

-

CEX hacks

-

Various scams

-

Rug pulls

No matter the method, Pareto implants these events into the simulation. Even sky-splitting extreme events aren’t impossible.

"Latecomers and the majority. Early buyers can easily withstand $5,000 Bitcoin with zero volatility."

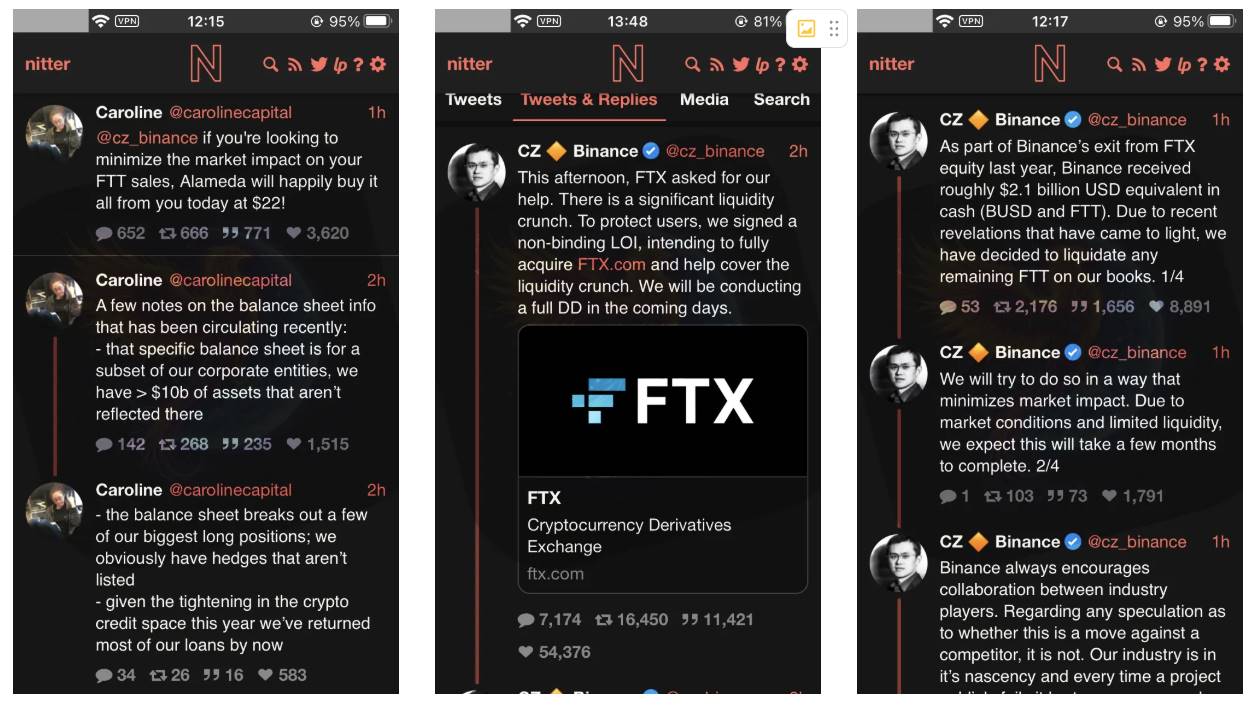

Why Bottom at FTX Collapse, Not Luna?

There’s a reason I bottomed during FTX’s November 2022 collapse, not Luna’s.

Simply put, Do Kwon didn’t have the market influence he thought. Luna’s collapse didn’t impact Bitcoin enough. Its "contagion effect" couldn’t even pull Bitcoin below July 2021 levels—it was just a "small event."

Still, I sympathized with all affected by Luna and publicly called out KOLs pushing it:

There’s no secret formula. I don’t do TA (technical analysis)—I see it as "male astrology." My secret? Simple: I study historical cycles. Past bear markets show Bitcoin typically drops ~80%+ from ATH.

So from ~$69,000 in Nov 2021 or ~$64,000 in Apr 2021, I calculated a re-entry range: $10,000–$14,000.

Anyone claiming they knew the "exact bottom" is lying (LYINNNNNGGGGGGG)! No one perfectly nails absolute tops and bottoms. That’s why I use a "range" and scale in gradually ("feather" the range).

No, it’s not risky. We live in a simulation, and I believe in Pareto. Our only reference is history. Pareto rewards its "children"—Bitcoin, Ether, USD—after cleansing the market of "trash fish."

Believe it or be left behind

Though I only recently started posting on Twitter, I’ve always been reading. Scrolling to earliest posts, my purpose is clear: I use Twitter to read market sentiment, not to gain knowledge. Information is free—you should do your own research, not rely on others filtering for you. They might be wrong, or worse, deliberately misleading you for their own agenda.

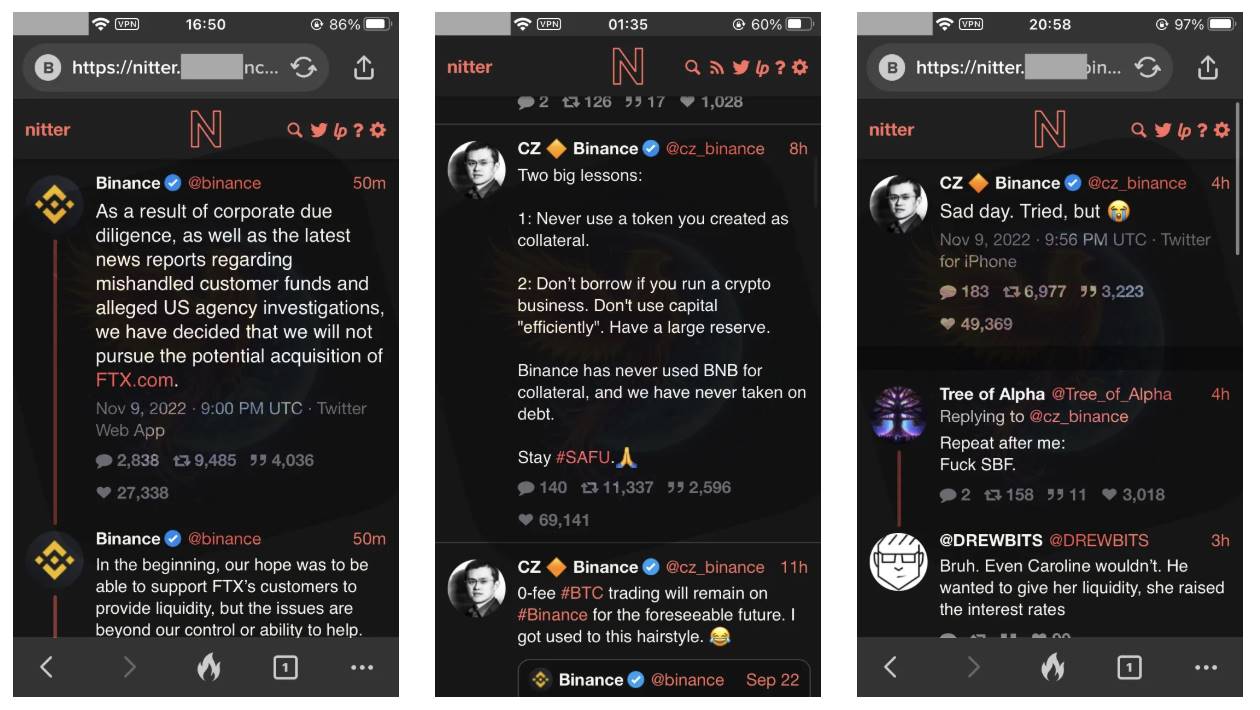

The interface below is called Nitter, a localized third-party Twitter client functional before Elon Musk shut down Twitter API. Now only scattered servers remain, highly unstable—so by 2025, you’re basically forced to use native Twitter.

I couldn’t sleep. Wide awake all night, eyes glued to the screen, monitoring price swings. This moment I’d waited over 1.5 years for. I had to stay alert to successfully redeploy all funds into Bitcoin & Ether.

Honestly, I even whispered prayers hoping for another North Korean exploit to crash prices below $10,000.

Sorry, bros.

Bitcoin didn’t fully enter my target range ($10k–$14k). But this is where many err: they stubbornly cling to arbitrary "target numbers" in their heads. The market doesn’t care about you or your plans. There’s no guarantee Bitcoin would crash like past cycles. I saw this as Pareto testing market participants, filtering out the "unworthy."

When CZ "ended" SBF, I thought, if this isn’t the bottom, what is? I had to discard bias and conclude: this was my optimal re-entry window.

Long-term, does $15k Bitcoin differ vastly from $10k? Numerically yes, but practically, it won’t decisively impact your life.

Looking back, FTX collapse marked the bottom—pure luck. I never aimed for this event. Who knows which specific event becomes the turning point? I only knew Luna’s ripple wasn’t enough to create sufficient panic—Pareto needed more "sacrifices," and FTX’s fall became the catalyst for the "cleansing event."

Three Classic Trades

So what actually happened? Here are what I consider crypto’s three "Holy Trinity" trades:

-

Bottom fishing during the COVID-19 crash.

-

Selling at the April 2021 bull market peak.

-

Buying back during the FTX collapse.

This is the endgame. Possibly the three most profitable trades of my life, achieved simply by acting early, then doing nothing. Truly, just patience.

So what now? Answer: nothing.

I hope you realize the content KOLs and "experts" post on Twitter is mostly garbage. Why are they still on Twitter? Because they’re mostly LARPs (Live Action Role Players), not truly "successful." They still need to sell you something: courses, paid groups, shitcoins, referral links. They need you as their exit liquidity.

Trust yourself. After earning, live your life. Social media is a virus infecting your mind.

Remember, only two types have legitimate reasons on Crypto Twitter: founders and brands.

"God Trade": Another Seven-Figure Story

To vividly illustrate "early positioning and patience," I’ll share another story. This time, I won’t take credit—alone, I’d never have bought this project. This profit I "gifted away," because spiritually speaking (lol), I don’t feel it was mine. Still, it yielded a seven-figure return.

I won’t include personal details—they’re irrelevant and unnecessary. I simply wanted to support her journey. Seeing her passion for Axie Infinity warmed my heart.

When I mention Axie Infinity, I mean 2020—before $AXS token, before Ronin network. Axie ran on Ethereum Mainnet, without millions of Filipino players flooding Discord to "maximize" gameplay. No "ambassadors" either, unlike today’s timeline spam.

Early players were just regular people, no profit motive. They joined for community, friends, and love of the game. In Adventure Mode, you could farm infinite $SLP, as it was nearly worthless. Axie Infinity was obscure then.

You could build a strong team for just $100, as cheapest Axies cost ~$2. Some couldn’t afford breeding due to high Ethereum gas. I could’ve single-handedly "break" the entire economy. Not boasting—just capturing Axie’s early atmosphere.

The community had remarkable individuals—by my limited view, a vibrant, passionate group. Reminds me of early 2017 crypto. I sincerely hope all who participated thrived.

You treated her kindly, patiently answering all her "noob questions" (she pretended to be male to avoid awkwardness).

Truthfully, I initially wanted her to occupy herself with crypto gaming so I could focus on "real crypto" (lol). Wasn’t meant as serious investment. Ironically, this trade’s single-cycle % return in 2021 outperformed mine (though absolute profit didn’t).

She had no idea I bought substantial $AXS at pennies. Why? I planned to gift it later as support. I never imagined $AXS exceeding $5, let alone peaking at $164.90 ATH. I read its tokenomics whitepaper and disagreed with its value proposition.

Another key investing rule: operate within your circle of competence. Hence I avoided meme coins and NFTs—I don’t understand them or their community culture.

After transferring $AXS to Binance (deepest liquidity exchange), I completely forgot it. Not exaggerating for storytelling. $AXS soared so high purely because I was "forced to HODL." If I remembered, I’d have sold in April 2021.

You may ask: "How forget an investment?"

During bull markets, money loses meaning—just score digits. Plus multiple wallet apps, CEXs, DeFi protocols, hardware wallets, accounts, hundreds of addresses, various keys, emails, notes, laptops, desktops, phones… forgetting things is easy. I might even have 1 BTC scattered somewhere (lol).

This $AXS investment started accidental but became an unexpected winner. More than an investing drama, it’s a lesson in patience, competence, and serendipity.

By December 2021, I heard mainstream news hype about Axie Infinity. The so-called "scholarship program" was still hyped (lol), the whole market frenzied. I decided to investigate and checked $AXS price.

Holy sh*t, what the hell?

That reminded me of my purchase.

Recall, I’d exited markets by April 2021. By then, I watched Bitcoin price as a barometer for re-entry timing.

I immediately called her to meet—she was now a millionaire. Of course, she thought I was joking. So I recorded a screen video, sent it, and walked through every buy record, plus $AXS current price on CoinGecko and CoinMarketCap.

That day was emotionally intense.

Next, I’ll blur details—private video, I don’t care about proving anything to internet strangers. Some, devastated by losses, can’t accept others achieving 546x ATH returns on $AXS (still ~320x post-drawdown), so dismiss it as "LARP" to comfort themselves. But you were just late. In crypto, 10,000x gains happened.

Probability-wise, consider:

-

It’s a screen recording, not a screenshot.

-

People only record when profits are jaw-dropping.

-

If fake, I’d need to perfectly replicate 2021 Binance UI.

-

Plus perfectly replicate 2021 CoinGecko UI.

-

Similarly, perfectly replicate 2021 CoinMarketCap UI.

-

Nobody records line-by-line unless showing profits to someone.

-

This video exists nowhere online.

-

If fake, I’d have saved it for 4 years just to show internet strangers now.

-

You see MacOS Calculator app, copy-pasting to show a seven-figure sum.

-

Use your brain. Jealousy only worsens you, while facts stand clear.

Words of Wisdom

I haven’t even mentioned other insane moonshot investments. I participated in projects you’ve never heard of, but I won’t leak my edge to internet strangers. Still, all my moves follow a universal blueprint, summarized as:

What’s the real insight?

-

Everyone is BSing. Your only "Alpha" is yourself.

-

Traders fear early entrants. First-mover advantage is insanely powerful.

-

Do nothing. Sit with popcorn watching newbies shaken out by volatility—Pareto Principle will tilt victory to you.

-

Stop waiting for others to feed you.

-

Breaking even (protecting principal) is a major win.

-

Always consolidate assets into

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News