Why are there so many payment cards in this cycle?

TechFlow Selected TechFlow Selected

Why are there so many payment cards in this cycle?

As an essential need in the crypto ecosystem, payment cards are becoming a consumption vehicle for the crypto community.

Author: Pzai, Foresight News

As the crypto asset market flourishes, we are entering a "big payment card" era where nearly every protocol eagerly launches its own crypto card business to maximize user retention within their ecosystem. Behind the dazzling array of choices lies a vast network of payment providers bridging the gap between traditional and crypto-based payments. Meanwhile, the unique on-chain asset environment offers abundant support for the growth of payment cards in terms of asset types and yield opportunities. Why are there so many payment cards this cycle? This article will analyze the phenomenon from multiple angles.

Operating Model Overview

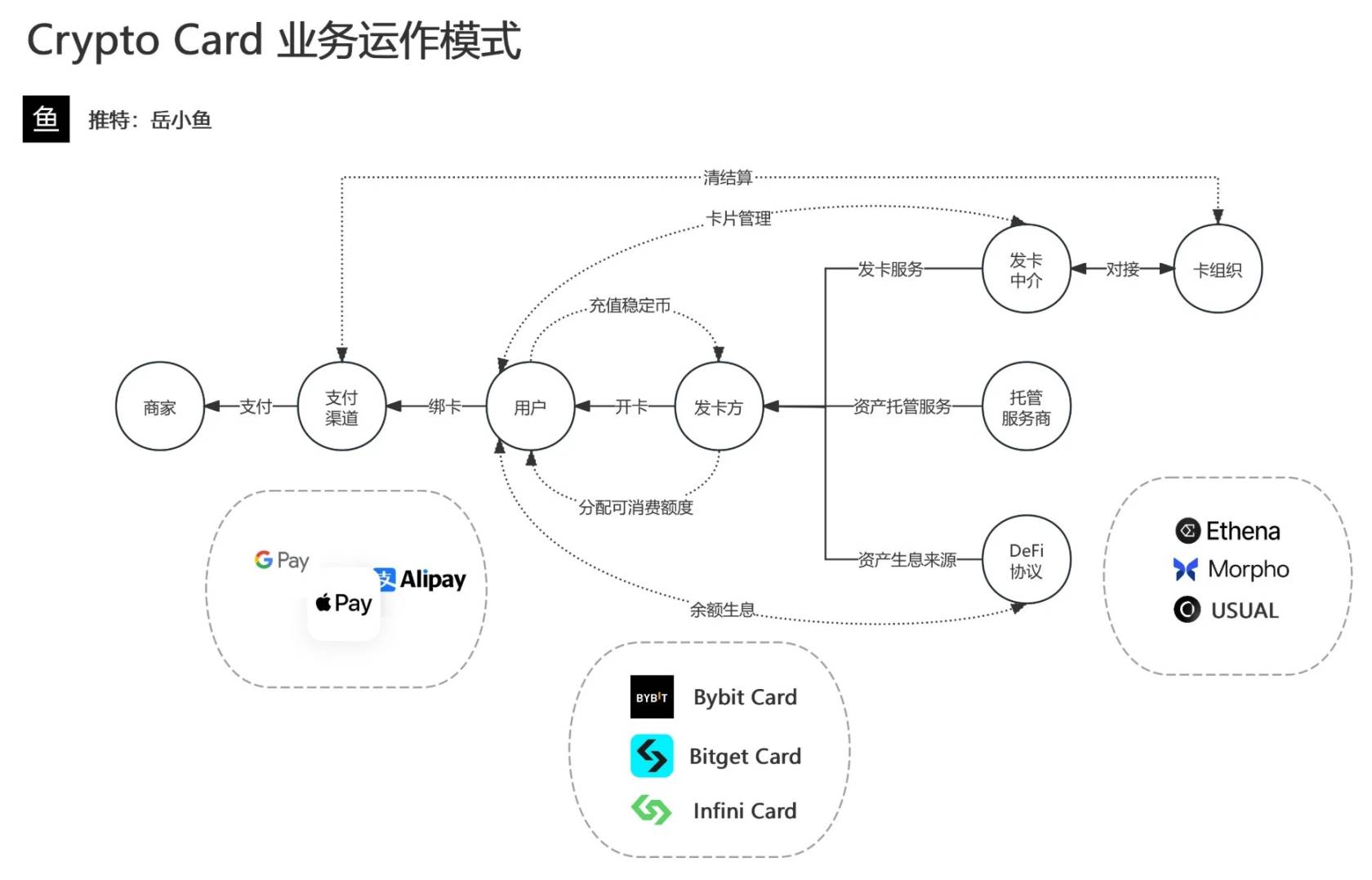

Crypto payment cards are essentially bridges connecting the cryptocurrency ecosystem with traditional payment networks. The system involves multiple parties including users, card issuers, custodial service providers, payment channels, merchants, and card networks. Users first apply for a crypto payment card through an issuer, which interfaces with card networks like Visa or Mastercard via issuing intermediaries to complete card issuance. At the same time, custodial service providers manage users’ crypto assets and may allocate part of the funds into yield-generating activities, forming a closed-loop capital management cycle.

When users make purchases with a crypto payment card, the system automatically executes real-time conversion from cryptocurrency to fiat currency. The specific process is as follows: the user swipes the card at a merchant, the payment request is processed through the payment channel, the system deducts the equivalent amount of cryptocurrency from the user’s custodial account and converts it into fiat, and finally completes the payment to the merchant. To the merchant, this process is indistinguishable from traditional bank card payments, while users achieve the goal of directly using digital assets for daily spending.

Current crypto payment card products have widely integrated mainstream payment methods including Google Pay, Apple Pay, and Alipay, greatly enhancing usability. Major market offerings include the Crypto.com Visa Card, Binance Card, Bybit Card, Bitget Card, among others—typically launched by large cryptocurrency exchanges. On the technical side, some issuers have also integrated DeFi protocols such as Ethena, Morpho, and USUAL to provide users with value-added asset services, building a comprehensive financial service ecosystem spanning payments and wealth management.

Image source: X (formerly Twitter): Yue Xiaoyu

Growth Driver: Booming Demand-Side Dynamics

According to a report by The Brainy Insights, the global crypto credit card market was valued at $25 billion in 2023 and is projected to exceed $400 billion by 2033. The fundamental reason behind various protocols rushing into the payment card space is a fierce competition for growth. Although the direct profit margin from payment cards themselves may be relatively limited for protocols, the strategic value in user acquisition, ecosystem development, and capital accumulation is extremely high. As such, exchanges, asset managers, and Web3 projects remain willing to invest, as these cards can drive broader user adoption, business expansion, and further ecosystem scalability.

Within the crypto space, foundational demand based on payments has given rise to numerous PayFi products. However, a survey by Bitget Wallet shows that despite clear advantages of crypto payments in transaction speed (chosen by 46% of users), cross-border costs (37% emphasize low fees), and financial autonomy (32% seek decentralization), actual usage remains significantly behind traditional payment systems. Traditional payment markets currently reach several trillion dollars globally, covering the vast majority of everyday transactions, whereas crypto payments occupy only a tiny share, primarily confined to niche areas such as cross-border remittances and digital asset trading.

The core reasons users prefer traditional payment methods can be summarized in three points:

-

Trust and Security: Crypto users worry about security risks associated with crypto payments (e.g., hacking and fraud). In contrast, traditional payments benefit from mature banking infrastructure, legal protections, and dispute resolution mechanisms, significantly reducing transaction risk.

-

Stability and Convenience: Price volatility makes cryptocurrencies difficult to use as stable mediums of exchange, while stable fiat currencies are better suited for daily consumption. Additionally, users perceive limited merchant acceptance as a major barrier to practicality, whereas traditional payments offer seamless coverage through widespread POS terminals and online integrations.

-

User Experience Inertia: Traditional payment tools have low operational barriers and long-established user habits, while the complexity and technical learning curve of crypto wallets hinder mass adoption.

Therefore, payment cards serve as a bridge between crypto assets and traditional payment ecosystems, unlocking potential by leveraging existing merchant settlement networks to instantly convert crypto assets into fiat for transactions. This extends the utility of on-chain assets into real-world spending scenarios while reducing cross-border processing costs and exposure to price volatility.

Regulatory Arbitrage: Mitigating Off-Chain Risks and Reducing Costs

Geographically, payment settlement providers must meet compliance requirements for both cryptocurrencies and fiat currencies, leading to a concentration of operations in Europe. According to research by Adan.eu, European countries average over 10% cryptocurrency adoption rates, especially pronounced among younger demographics and fintech-active regions. Consumer preference for flexible payment options, combined with the expanding stablecoin ecosystem, positions crypto payment cards as a key bridge between traditional finance and the Web3 world.

Additionally, due to the strong cross-border liquidity of the U.S. dollar and euro—and because payment cards often involve stablecoin transactions—using crypto payment cards allows individuals in certain jurisdictions to bypass systemic banking risks and access more flexible financial services. From a tax perspective, the direct conversion of crypto assets into fiat through payment channels can, to some extent, avoid taxation during intermediate transaction steps, creating another incentive for some users to adopt crypto cards.

However, under current incomplete regulatory frameworks on both settlement and blockchain sides, gray areas have attracted numerous payment providers, giving rise to potential money laundering and regulatory evasion. Yet regulators in Europe and the U.S. are accelerating efforts to pass and implement relevant legislation (for example, the EU’s MiCA requires companies offering such services to obtain compliant licenses within EU member states and operate under defined limitations), signaling that such arbitrage models will not last indefinitely.

Business Model: Bridging On-Chain and Off-Chain Asset Access

On the settlement side, crypto payment cards exhibit diverse operational models, with stablecoin-backed credit/prepaid cards being the most common. Debit card models, involving more complex fund management and risk control mechanisms, are offered by only a few providers. When users wish to use the card, they first deposit stablecoins into their account, increasing their available spending limit accordingly. Within this capital flow chain, conversions between cryptocurrency and fiat limits generate revenue for issuers through exchange rate spreads and transaction fees. Typically, issuers charge a 0.5%–1% fee during the crypto-to-fiat conversion process, making deposit-related fees a significant income stream for payment card businesses.

On-chain, some payment cards integrate with DeFi protocols to deploy idle user funds into yield-generating strategies. For instance, by integrating with DeFi protocols like Morpho, Infini can automatically allocate users’ unused stablecoin balances into yield protocols, allowing users to earn on-chain returns even while spending. Under this model, issuers not only earn interchange revenue from traditional payment networks but also capture a share of DeFi yield income, establishing a dual-revenue structure. Simultaneously, users gain access to asset value-added services beyond what traditional bank cards offer, all while enjoying payment convenience.

Thus, from a revenue standpoint, the crypto payment card model consists of two main components:

-

On-chain Tax: Interest Income / Product Revenue from Reserve Assets

Stablecoin issuers earn interest by holding reserve assets such as U.S. Treasuries. In Q1 2025, Coinbase reported approximately $197 million in stablecoin-related revenue, with annualized yields typically ranging from 2% to 5%. Prior to the emergence of on-chain payment cards, users had no way to access such yield opportunities while using payment instruments. Integrating on-chain protocols removes this barrier and presents a new strategy for crypto card issuers: innovating capital deposit channels, lowering funding acquisition costs, and transforming into alternative “asset managers.” Once a certain scale of total value locked (TVL) is achieved, crypto card issuers could further innovate in asset types and investment paradigms to create greater value for users.

-

Off-chain Tax: Fee Sharing Between Payment Network Operators and Card Issuers

When users pay via USDC through a payment card network like Visa, Visa typically charges an interchange fee of 1.5% to 3% of the transaction amount—usually borne by the user. Additionally, the card issuer may impose extra fees such as a 2% foreign transaction fee or ATM withdrawal fee. Most of these fees go toward the settlement layer, while the card issuer primarily bears the cost of cryptocurrency-to-fiat conversion.

The Future of Payment Cards: From Payment Tool to Ecosystem Gateway

With the rapid advancement of blockchain technology and cryptocurrencies, crypto payment cards are evolving beyond simple payment tools into crucial gateways for the crypto ecosystem. Amid the “on-chain liquidity wars,” payment cards are no longer just spending conduits but strategic beachheads driving mass adoption of blockchain technology. By enabling on-chain assets to directly enter real-world consumption, crypto payment cards shorten the path for users to enter Web3—for example:

-

Users from the traditional financial world typically face complicated processes to move funds into crypto markets. Crypto payment cards allow them to use digital assets more easily, achieving rapid off-chain integration.

-

Exchanges and DeFi platforms promote the adoption of crypto payment cards, simultaneously boosting traffic and integrating closely with core business operations, extending protocol functionality and creating new revenue streams. For instance, payment card users might earn platform points or token rewards with each purchase, which can then be used for on-chain investments, DeFi staking, or other ecosystem services, forming a positive feedback loop between users and the platform.

-

New users can begin by using a crypto payment card for everyday spending before gradually exploring the broader on-chain ecosystem—a “consumption-driven” user onboarding approach that could become a dominant traffic acquisition strategy in Web3.

Looking ahead, competition among crypto payment cards will shift further from standalone tools toward full-fledged, ecosystem-integrated financial platforms. Projects must leverage technological innovation, regulatory compliance, and superior user experience to break the “short-lived” curse associated with many previous payment card initiatives. The future of crypto payment cards lies not merely in spending, but in becoming comprehensive financial platforms combining payments, investment, credit assessment, and ecosystem incentives. Through deep integration with Web3 elements such as DeFi, NFTs, and on-chain governance, payment cards will become the primary gateway for users to enter the decentralized world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News