Uniswap: The Crypto Unicorn Under Regulatory Constraints, the Largest DEX Protocol on Blockchain

TechFlow Selected TechFlow Selected

Uniswap: The Crypto Unicorn Under Regulatory Constraints, the Largest DEX Protocol on Blockchain

Uniswap Labs is actively participating in regulatory rulemaking, and combined with ETH's multiplier effect, may迎来 structural favorable opportunities.

Since the recent ETH price rally, ETH has surged 48% online over the past month, driving up prices across various ETH ecosystem projects. Historical data shows that blue-chip assets within the ETH ecosystem generally exhibit a multiplier effect during bull cycles. UNI is one of the key blue-chip holdings in Trend Research's ETH ecosystem portfolio. It has risen 28% over the past month and possesses potential for catch-up gains if the current market momentum continues.

Meanwhile, under the ETH market beta, UNI also demonstrates certain sector-specific alpha potential, driven by three factors: expectations of regulatory easing, leading project business metrics, and structural token price appreciation.

Regulatory Overview

Period of Regulatory Uncertainty (2021–2023)

On September 3, 2021, the SEC initiated an investigation into Uniswap Labs, focusing on its marketing practices and investor services. SEC Chair Gary Gensler repeatedly stated that DeFi platforms might fall under securities regulations and emphasized the need for expanded regulatory authority. This investigation sparked widespread industry debate, making the classification of UNI and similar governance tokens as securities a central issue in crypto regulation.

On August 30, 2023, Uniswap won a class-action lawsuit against it when the court dismissed the claims, ruling that the Uniswap protocol primarily facilitates legitimate uses (such as ETH and BTC trading) and lacks clear regulatory definitions supporting the plaintiffs' securities allegations.

Period of Regulatory Pressure (2023–2024)

On April 10, 2024, the SEC issued a Wells Notice to Uniswap Labs, alleging that the Uniswap protocol may be operating as an unregistered securities exchange, with its interface and wallets potentially functioning as unregistered securities brokers. The notice further suggested that the UNI token and liquidity provider (LP) tokens could be considered investment contracts. On May 22, Uniswap Labs submitted a 40-page Wells response refuting the SEC’s allegations.

Uniswap Labs argued that its protocol is a general-purpose technology platform not specifically designed for securities trading, noting that 65% of trading volume involves non-security assets such as ETH, BTC, and stablecoins. Chief Legal Officer Marvin Ammori stated that the SEC would need to redefine “exchange” and “broker” to justify regulatory oversight, calling the SEC’s position based on incorrect token classification.

Period of Regulatory Easing (2025 to present)

On February 25, 2025, the SEC announced the termination of its investigation into Uniswap Labs, stating it would take no enforcement action. Uniswap Labs announced this outcome on X, calling it a “major victory for DeFi” and emphasizing the technological legitimacy of its protocol. This development reflects a shift in the SEC’s stance toward crypto regulation following the Trump administration taking office. On April 8, 2025, the SEC invited Uniswap Labs and Coinbase to participate in a roundtable discussion on crypto trading regulation.

On May 5, 2025, multiple Republican members from the House Committee on Financial Services and the Committee on Agriculture jointly released a new discussion draft on crypto industry regulation. This draft builds upon and expands the core content of the earlier Financial Innovation and Technology for the 21st Century Act (FIT21), further refining and extending the regulatory framework for digital assets. Page 49 of the new draft aims to clarify that transactions involving digital commodities do not constitute securities offerings as long as buyers do not obtain ownership rights in the issuer’s business, profits, or assets.

The House plans to release an updated version of the Digital Asset Market Structure Act on May 29. The revised text follows the discussion draft released on May 5. The advancement of this market structure legislation is widely seen as laying the foundational blueprint for future U.S. regulation and trading of digital assets. The House will review the crypto market structure bill on June 10.

Currently, from the SEC’s effective termination of its investigation into Uniswap Labs at the beginning of 2025 to the ongoing clarification in the market structure bill regarding what does not constitute a security, Uniswap’s current token economics design means UNI is no longer facing litigation risks.

With the Trump administration in power, the direction of crypto regulation is increasingly oriented toward adapting asset classification methods, the Howey test, and regulatory jurisdiction divisions to better suit the development of the crypto industry. Discussions are being held with leading U.S. crypto teams, with Uniswap Labs playing a significant advisory role. With full regulatory relief expected, there may be further favorable regulatory developments ahead.

Project Business Overview

1. Leading Business Metrics

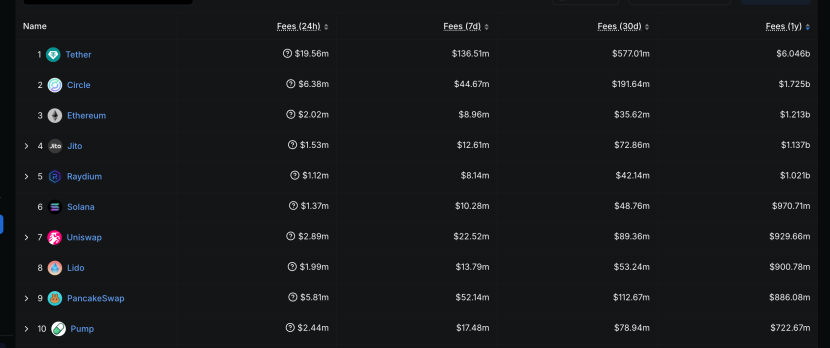

Uniswap is the earliest and largest DEX protocol in the crypto market. It currently has a TVL of $5.12 billion and $84.5 billion in trading volume over the past 30 days, ranking second after Pancake. Prior to the launch of Binance Alpha, Uniswap consistently ranked first in total market trading volume. It generated $929 million in revenue over the past year, ranking seventh. Using traditional valuation methods, its P/E ratio ranges from 4.5 to 6.4, compared to Coinbase’s 33–42, Apple’s 28–35, and Tesla’s 50–70. If UNI’s “fee switch” is activated in the future or regulatory easing enables broader financial use cases (currently, holding UNI does not entitle holders to profit distribution), the current market cap appears significantly undervalued relative to its business profitability.

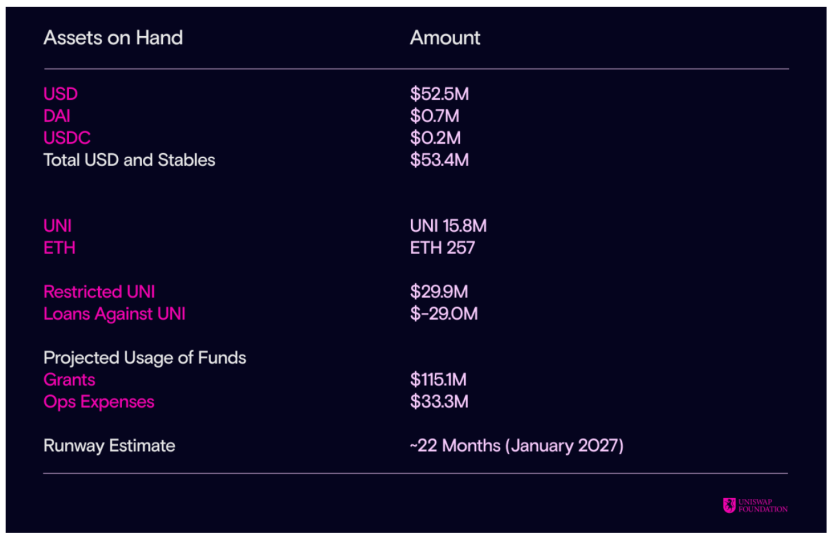

According to the Uniswap Foundation’s Q1 2025 financial summary, as of March 31, 2025, the foundation held $53.4 million in USD and stablecoins, 15.8 million UNI tokens, and 257 ETH. Based on the closing price on May 28, 2025, this equates to approximately $150 million in token value. Funding is expected to last until January 2027, indicating strong financial health.

2. Token Economic Enhancements

In UNI’s previous tokenomics model, methods of generating returns using UNI were limited to providing liquidity by adding UNI to specific trading pairs, or staking UNI to participate in DAO governance to propose buybacks or liquidity incentives. However, these returns were indirect and typically low-yielding. Simply holding UNI did not generate direct income, which was a major reason why the UNI token price struggled to rise significantly. Nevertheless, Uniswap Labs has continuously explored ways to enhance token utility, repeatedly proposing a fee switch mechanism that has not been implemented due to regulatory concerns. The latest fee switch proposal was reintroduced in February 2024, passed a technical vote in May, and could advance to on-chain voting in the second half of 2025. With progressive regulatory developments, activation of the fee switch may become feasible in the future.

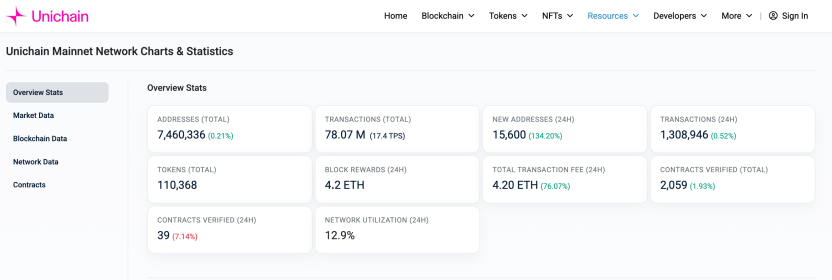

Beyond the fee switch, Uniswap’s newly launched Unichain offers new use cases for UNI. Unichain is a Layer 2 (L2) blockchain announced by Uniswap Labs on October 10, 2024, built on Optimism’s OP Stack Superchain framework, and officially launched its mainnet on February 13, 2025. Uniswap Labs CEO Hayden Adams stated, “After years of building and scaling DeFi products, we’ve identified areas where blockchains need improvement and what’s required to advance Ethereum’s roadmap. Unichain will deliver the speed and cost savings achieved by L2s, enable better cross-chain liquidity access, and achieve greater decentralization.”

Like other L2s, Unichain features a validator network using UNI as the staking token. Node operators must stake UNI on the Ethereum mainnet to become validators in the Unichain Validator Network (UVN). Staking amounts determine the probability of selection into the active validator set. Validators earn 65% of net chain revenue (including base fees, priority fees, and MEV), distributed according to staking weight. While official details on minimum staking requirements have not been disclosed, ongoing support from Uniswap Labs, along with rising yields and expanding ecosystem scale, is expected to attract more UNI staking as validators seeking rewards.

Token Overview

UNI currently has a circulating market cap of $4.2 billion, FDV of $6.7 billion, fully diluted supply, with approximately 37% locked through staking.

Open interest stands at $448 million, with OI/MC at approximately 10.6%. The aggregate long-to-short ratio is 1.02, Binance account long-to-short ratio is 2.16, and large-account long-to-short ratio is 3.87—indicating more long positions are held by large investors. Since the ETH rally began, UNI’s open interest has steadily increased, reflecting active derivatives market participation.

In spot price charts, during ETH’s November 2023 uptrend pattern, UNI mirrored ETH’s price movement but exhibited volatility roughly 2–3 times higher. In the current April 2025 ETH rally, both assets show similar chart patterns, though ETH has outperformed UNI in terms of gains. If the rally persists, UNI may have room for further catch-up appreciation.

Summary

Since Donald Trump’s official election as U.S. President in 2025, how the U.S. regulates and integrates the crypto industry has become the most critical topic. As the largest DEX protocol in the current crypto market, how the U.S. regulates UNI will serve as a benchmark for the entire industry. Uniswap Labs is actively participating in shaping regulatory rules. Combined with the multiplier effect from ETH’s performance, UNI may benefit from structural tailwinds.

The project itself maintains top-tier business metrics, solid profitability, and healthy finances. Advancements like Unichain and the proposed fee switch could bring new utility to the token. For those bullish on the market outlook, UNI remains a notable blue-chip asset within the ETH ecosystem worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News