On the other side of the world, a set of "tokenized apartments" sold out within a day

TechFlow Selected TechFlow Selected

On the other side of the world, a set of "tokenized apartments" sold out within a day

"Ultra-retail" investors can now directly invest in real estate, but...

Author: jk, Odaily Planet Daily

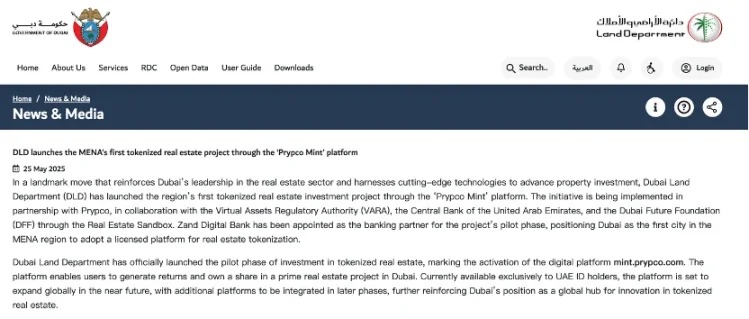

On the other side of the world, a "tokenized apartment" sold out in one day. On May 26, 2025, Dubai Land Department (DLD) partnered with real estate fintech company Prypco and blockchain infrastructure provider Ctrl Alt to officially launch the Middle East's first real-world asset (RWA) tokenization platform, "Prypco Mint." The platform successfully completed full financing for its first RWA apartment on the XRP Ledger within just one day. This initiative is a key component of the UAE government's blockchain strategy, aiming to bring approximately 7% of Dubai’s real estate transactions on-chain by 2033, with an estimated total asset value reaching $16 billion.

Prior to this, most RWA property projects remained independent ventures without official endorsement, relying almost entirely on the credibility of individual companies. Due to the relatively short history of the Web3 industry and users' lack of trust in such projects, there has been no widely recognized RWA real estate project. Dubai's move may finally fill this gap.

Why Dubai?

Another reason many previous RWA projects failed to gain mainstream attention was that their tokenized properties were not located in prominent real estate markets. In contrast, Dubai stands as a globally recognized hotspot in the real estate sector. Its booming property investment market attracts significant foreign capital. Search "Dubai" on social media, and you’ll likely see "real estate" automatically suggested.

Why is Dubai famous? Simply put: high appreciation potential and exceptional rent-to-price ratios.

In recent years, Dubai’s real estate market has continued to heat up. According to CBRE, Dubai residential prices rose an average of 18% in 2024, with a further 20% increase recorded in Q1 2025. Transaction volumes also hit record highs, reaching 45,474 deals in Q1 2025—a 22% year-on-year increase. This growth is driven by Dubai’s “Golden Visa” policy, which effectively grants five- or ten-year residency through property ownership, attracting large numbers of high-net-worth investors. Additionally, Dubai’s strategic location, political stability, and diversified economy provide a solid foundation for sustained real estate growth.

From an investment return perspective, Dubai’s market performs exceptionally well. Data shows a rent-to-price ratio of about 1:132, with rental yields ranging from 8% to 9%, thanks to a foreign population占比 of nearly 90%. This far exceeds cities like Shanghai, where yields are only 2%–3%. Such high returns allow investors to recoup costs in roughly 10 to 12 years. Moreover, the UAE imposes no personal income tax or capital gains tax, further boosting investment appeal.

This isn’t an advertisement—it reflects the reality of the Middle Eastern real estate market over the past decade.

Of course, given the market’s strong performance over the past ten years, some argue that 2025 might mark the peak of Dubai’s real estate cycle, citing factors such as high construction volume and slowing population inflow. However, based on historical data alone, property investment in Dubai remains extremely hot.

So what exactly was the asset that sold out in one day?

The business model of RWA real estate is straightforward: tokenize ownership of a property so that token holders own a fractional share. Appreciation and rental income are distributed among all owners proportionally based on their token holdings. This allows investors who can’t afford an entire property to include real estate in their portfolios, with significantly better liquidity upon exit.

Possibly as a form of scarcity marketing, PrypcoMint offered only one apartment for tokenization on its launch day.

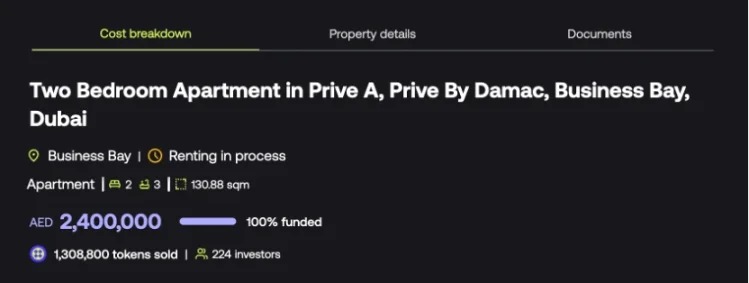

The financed property is a two-bedroom unit located in Business Bay, one of Dubai’s core districts. Part of the Prive by Damac residential complex developed by renowned builder Damac, it features a layout of two bedrooms and three bathrooms, covering approximately 130.88 square meters. The unit boasts panoramic lake views and comes with hotel-style amenities.

Details of the first tokenized property, source: Prypco official website

Within one day, the property achieved 100% funding on Prypco Mint, raising 2.4 million AED (approximately 5.8 million CNY). A total of 1,308,800 tokens were issued, with 224 investors participating. Likely an early investor incentive, the sale price was notably below market value: according to DLD valuation, the unit is worth 2.89 million AED—about 16.96% higher—giving investors an unrealized paper gain potential of 20.42%.

In terms of returns, the unit is projected to generate annual rental income of 175,000 AED, translating to a net rental yield of 5.17% in the first year. Combined with expected capital appreciation, the estimated annual total return could reach up to 14.77%. To date, realized net returns stand at 5.31%, and the property has already entered the leasing process.

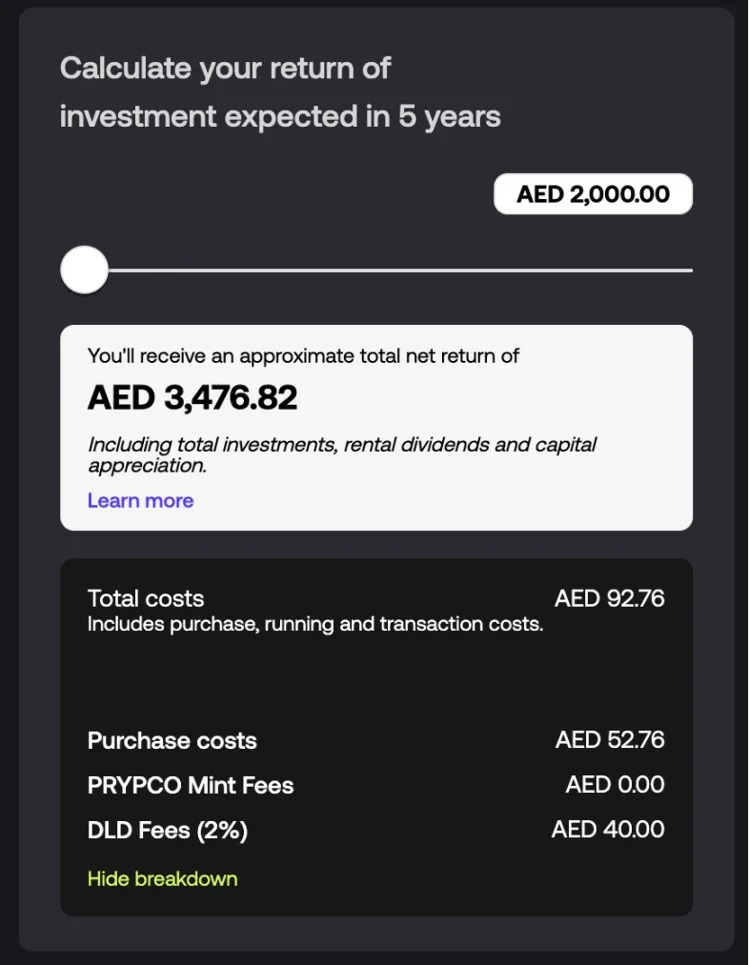

According to the official website, the minimum investment threshold is as low as 2,000 AED (around 4,000 CNY), with an estimated value of 3,476.82 AED after five years, representing a cumulative five-year return of 73.84%. Note that these are projections provided by the website and do not guarantee actual returns.

Five-year revenue projection, source: Prypco official website

Regarding transaction fees, the platform currently charges no tokenization fees; investors only pay official government fees. However, this may be limited to early adopters and unlikely to continue long-term. Full ownership of the property has been recorded on the XRP Ledger via Ctrl Alt’s technical architecture, with title information synchronized in real time with Dubai Land Department’s government database.

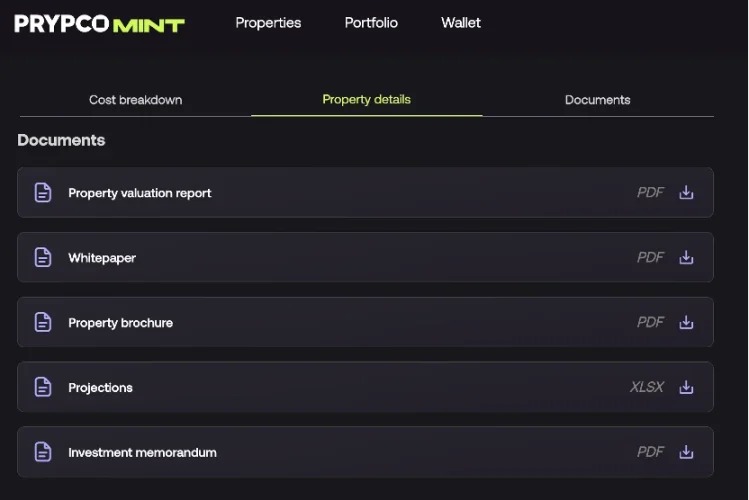

Comprehensive reports available on the website, source: Prypco official website

Can I buy it? Is it good news for XRP?

Unfortunately, non-UAE residents cannot purchase, and sales of this specific unit have already concluded—though future offerings may open up.

From a compliance standpoint, the tokenized project is currently only open to UAE ID holders. Eligibility requires working or studying in Dubai, or holding a Golden Visa through prior property ownership. Payments are accepted only in AED, requiring a local bank account. The regulatory framework involves the Central Bank of the UAE, Dubai Virtual Assets Regulatory Authority (VARA), and Dubai Future Foundation. Zand Digital Bank is the financial partner for the project.

Official press release from Dubai Municipality, source: Dubai Municipality website

Strictly speaking, this isn't the ideal RWA project you might envision. An ideal RWA project should meet the following criteria:

-

Different investors can invest in a single property, with ownership clearly defined by token holdings;

-

Payments can be made directly using on-chain assets;

-

Token prices track property value gains or losses;

-

Rental dividends are distributed periodically based on token holdings;

-

Tokens can be sold fully or partially at any time.

Currently, PrypcoMint’s effort fulfills only points 1, 3, and 4—ownership is clearly defined and distributed, and returns are tracked and shared. However, payments must be made in fiat, and the exit mechanism remains unclear. It resembles traditional structures where property is held via a company or trust, with shares or beneficial interests traded on a securities exchange.

Even so, this marks a significant step forward for RWA. This apartment is among the first real estate assets in Dubai’s government plan to go on-chain, forming part of the city’s $16 billion tokenization strategy—an official estimate based on tokenizing around 7% of Dubai’s real estate transactions by 2033.

Therefore, near-term benefits for XRP are likely limited, as only ownership records and tokens are on-chain, with no public on-chain sales yet enabled. However, if such sales open in the future, the gas demand from a $16 billion tokenized real estate market would undoubtedly be substantial. Today may represent a low point in value capture. But all of this depends on the continuous rollout of this RWA platform, which could spark a new wave of Dubai real estate investment driven by a broader base of retail investors.

P.S. From another angle, consider this: property records fully on-chain, purchase prices transparent and verifiable, future possibilities for public on-chain sales and instant token trading... Isn’t this precisely the vision decentralized finance once promised—the disruptive elimination of financial intermediaries? Could this signal the eventual downfall of Dubai’s real estate brokerage industry? Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News