The logic behind Tether's resistance to EU regulation: What are the flaws in MiCA regulations?

TechFlow Selected TechFlow Selected

The logic behind Tether's resistance to EU regulation: What are the flaws in MiCA regulations?

Tether's exit from MiCA highlights global regulatory chaos in cryptocurrency.

Author: Bradley Peak, Cointelegraph Columnist

Translation: J1N, Techub News

Does Tether Comply with MiCA Requirements?

The European Union's newly introduced Markets in Crypto-Assets regulation (MiCA) represents a major attempt by a leading global economy to establish clear regional rules for the crypto sector—and stablecoins are at the center of it.

If a stablecoin is to be traded in the EU, its issuer must follow several strict rules:

1. You need a license

To issue a stablecoin in Europe, you must become a fully authorized electronic money institution (EMI). This is the same type of license required by traditional fintech companies offering e-wallets or prepaid cards. The requirement is costly and involves a lengthy process.

2. Most reserves must be held in European banks

This is one of the most controversial aspects of MiCA. If you issue a stablecoin, at least 60% of its reserves must be deposited in banks within the EU. The rationale is to safeguard the financial system.

3. Mandatory full reserve transparency regime

MiCA requires regular, detailed disclosures. Issuers must publish a whitepaper and provide up-to-date information on their reserves, audits, and operational changes.

4. Non-compliant tokens will be delisted

If a token does not comply, it cannot be traded on regulated EU platforms. For example, Binance has already delisted USDT trading pairs for users in the European Economic Area (EEA). Other exchanges are following suit.

The European Securities and Markets Authority (ESMA) clarified that individuals in Europe can still hold or transfer USDT, but it cannot be offered to the public or listed on official venues. In other words, you may still have USDT in your wallet, but you won't be able to trade it on regulated platforms.

Main Reasons Why Tether Refuses to Comply with MiCA Regulations

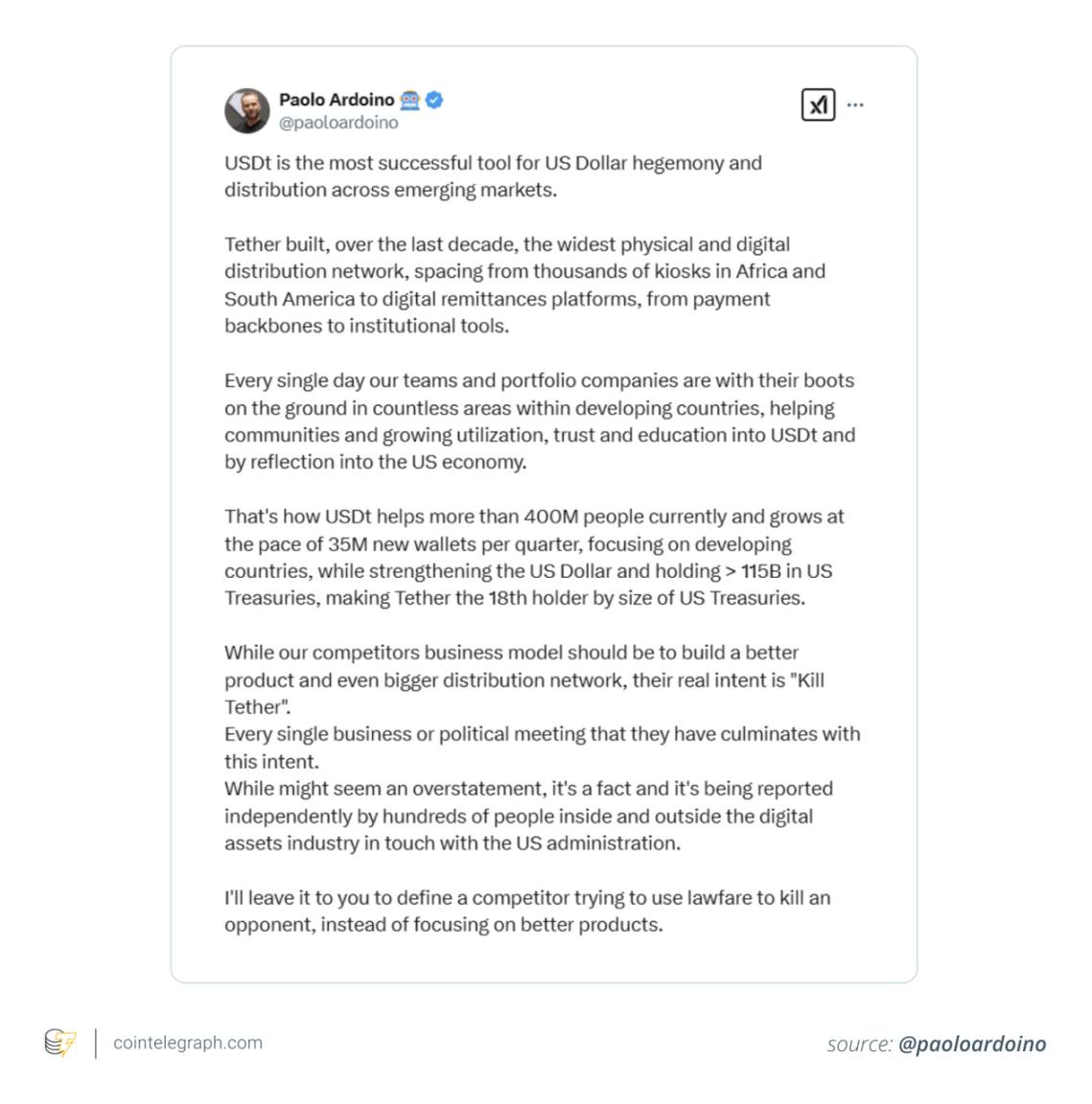

Tether holds a unique perspective on MiCA regulations. Executives including CEO Paolo Ardoino have explained why they are unwilling to engage with MiCA, arguing that the regulation has serious flaws involving financial risks, privacy concerns, and misalignment with the true target audience of stablecoins.

1. Banking rules could backfire

Regarding the rule that "MiCA requires stablecoin issuers to keep at least 60% of reserves in European banks," Paolo Ardoino warns this could create new problems. Forcing stablecoin issuers to rely heavily on traditional banks might make the entire system more fragile.

After all, if there’s a wave of redemptions and these banks lack sufficient liquidity, we could simultaneously face bank distress and a stablecoin crisis.

In contrast, Tether prefers to keep most of its reserves in U.S. Treasuries—liquid, low-risk assets that can be quickly liquidated when needed.

2. They don’t trust the digital euro

Tether also raises broader concerns about Europe’s direction, especially regarding the digital euro. Ardoino has publicly criticized it and warned about its privacy implications.

He believes centrally controlled digital currencies could be used to track how people spend money, and even restrict or block transactions when someone falls out of favor with the system.

Privacy advocates share similar concerns. Although the European Central Bank insists privacy is paramount—for instance through features like offline payments—Tether remains unconvinced. In their view, placing such significant financial power in a single institution is asking for trouble.

3. Tether’s users aren’t in Brussels—they’re in Brazil, Turkey, and Nigeria

At its core, Tether sees itself as a lifeline for people in countries suffering from inflation, unstable banking systems, and limited access to the U.S. dollar.

In places like Turkey, Argentina, and Nigeria, USDT is often more useful than local currencies.

MiCA’s licensing restrictions and reserve requirements would force Tether to shift focus and invest heavily to meet EU-specific standards. Tether says it’s unwilling to do so at the expense of markets it believes need tools like USDT the most.

"Turkey is one of the countries with the highest cryptocurrency adoption rates, with 16% of its population participating in crypto activities. This high adoption rate is largely due to the depreciation of the Turkish lira and economic instability, prompting citizens to seek alternatives like stablecoins to preserve purchasing power."

What Happens If Tether Doesn’t Comply With MiCA?

Tether’s decision not to comply with MiCA hasn’t gone unnoticed. But it’s already having real effects on European exchanges and users.

1. Exchanges are dropping USDT

Giants like Binance and Kraken have made concessions. To meet EU regulators’ requirements, they’ve delisted USDT trading pairs for EEA users. Binance delisted them by the end of March 2025. Kraken followed closely behind, removing not only USDT but also other non-compliant stablecoins like EURT and PayPal’s PYUSD.

2. Fewer choices for users

If you hold USDT in Europe, you can still withdraw or exchange it on certain platforms. But you’ll no longer be able to trade it on major exchanges. This has already driven users toward alternatives that fully comply with MiCA, such as USDC and EURC.

Even mainstream crypto payment gateways in Europe are phasing out support for USDT, leaving users with fewer direct options for using crypto.

3. Hit to liquidity? Possibly.

Delisting USDT from European exchanges could make markets more volatile. Reduced liquidity, wider spreads, and increased volatility during sharp price movements are all possible outcomes. Some traders will adapt quickly—but others may not.

"Tether (USDT) is the most traded cryptocurrency globally, with daily trading volume even surpassing Bitcoin. In 2024, it facilitated over $20.6 trillion in transactions and serves a global user base of more than 400 million."

Tether vs. MiCA Regulation

Tether may be out of step with the EU, but the company isn’t standing still—it’s doubling down elsewhere, seeking friendlier jurisdictions and broader horizons.

First, Tether relocated its headquarters to El Salvador after obtaining a Digital Asset Service Provider license, primarily because the country has fully embraced cryptocurrency.

Additionally, after generating over $5 billion in profit in early 2024, Tether is deploying its capital into operations:

-

Artificial Intelligence: Through its venture arm Tether Evo, the company has invested in firms like Northern Data Group and Blackrock Neurotech. Tether has also launched Tether AI—an open-source, decentralized AI platform designed to run on any device without centralized servers or API keys. Its goal is to use AI to improve operational efficiency and potentially build new tools along the way.

-

Infrastructure and Agri-tech: Tether has invested in Adecoagro, a company focused on sustainable agriculture and renewable energy. This move may seem surprising, but aligns with Tether’s broader strategy of supporting resilient real-world systems.

-

Media and beyond: There are signs Tether wants a foothold in content and communications, suggesting its vision extends far beyond cryptocurrency.

Tether’s Exit From MiCA Highlights Global Regulatory Chaos in Crypto

Tether’s withdrawal from MiCA is just a symptom of a larger problem in the crypto space: how difficult it is to build a business in a world where every jurisdiction operates under its own rules.

The classic regulatory arbitrage game

This isn’t the first time Tether has faced regulatory challenges. Like many crypto companies, it’s adept at regulatory arbitrage—always finding the most favorable jurisdiction and setting up shop there.

Europe introduces strict rules? Fine—Tether chooses El Salvador, where crypto is warmly welcomed.

But this raises important questions. If large firms can easily cross borders to avoid regulation, how effective are these rules really? Do they protect retail users—or just confuse them further?

A fragmented crypto world map

The bigger issue is that the global regulatory landscape is extremely fragmented. Europe pushes for full compliance, transparency, and audited reserves. The U.S. sends mixed signals. Asia is divided: Hong Kong embraces crypto while China remains cold.

Hong Kong has passed its Stablecoin Bill, issuing licenses to fiat-backed issuers and advancing its Web3 ambitions. Meanwhile, Latin America is actively embracing crypto as a tool for financial inclusion.

For companies, it’s a mess. You can’t build for a single global market—you must constantly adapt, restructure, or exit entirely. For users, it creates massive access barriers. A cryptocurrency usable in one country may be inaccessible in another simply due to local policy.

In the end, consider this: Tether’s resistance to MiCA seems less like a protest against bureaucracy—and more like a bet that the future of crypto will be shaped outside Brussels, not within it. (Note: The future of crypto will be driven by free markets and decentralized innovation, not by regulatory bodies like the EU.)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News