IOSG: Internet Capital Markets: A New Trend, or Just Another Meme Hype?

TechFlow Selected TechFlow Selected

IOSG: Internet Capital Markets: A New Trend, or Just Another Meme Hype?

ICM must build deeper practical value around the concept of "internet capital markets."

Author: Mario @IOSG

TL;DR:

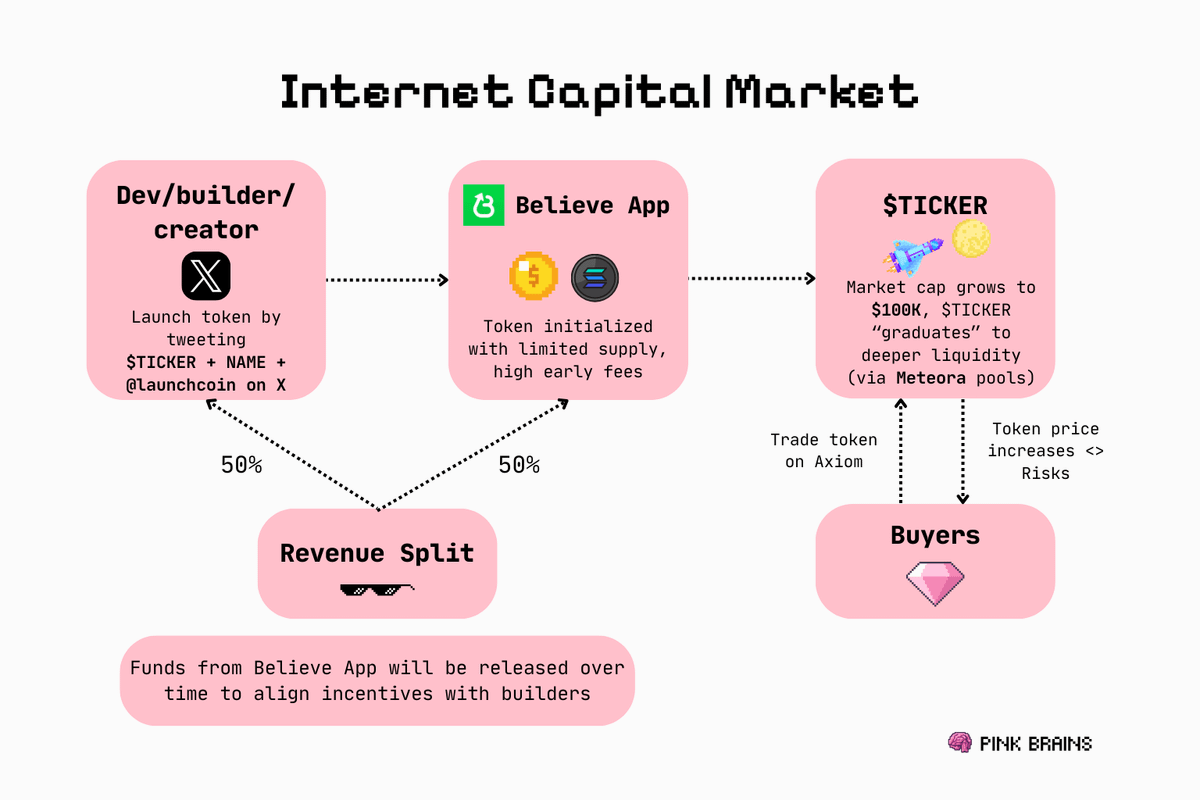

The Internet Capital Market (ICM) is a crypto-native alternative to traditional capital markets (TCM), enabling entrepreneurs to raise funds directly from online communities through tokenization, bypassing cumbersome processes like venture capital and initial public offerings (IPOs). Platforms like Believe App (formerly Clout) are pioneering this shift on the Solana blockchain, allowing users to easily launch and invest in projects simply by mentioning the platform on X (formerly Twitter).

Despite criticism—such as lack of regulation, low project barriers, and the ease of launching misleading tokens—ICM still holds strong potential for mass adoption, especially in introducing Web3 to Web2 users through intuitive user experiences, fiat payment gateways, and viral storytelling. For long-term sustainability, platforms like Believe must move beyond short-term hype by implementing founder accountability mechanisms, optimizing token economics, building DAO governance, and delivering real utility—transforming ICM from a meme-driven trend into a legitimate new paradigm for capital formation.

Background of Traditional Capital Markets

In traditional capital markets (TCM), entrepreneurs often rely on expensive and time-consuming fundraising methods such as IPOs or venture capital. This path comes with significant challenges.

From the fundraiser’s perspective, entrepreneurs must navigate lengthy application procedures, complex legal formalities, and constant pressure to meet investor expectations—diverting focus away from product development and community building.

From the investor’s side, early investment opportunities are largely monopolized by large institutions like hedge funds and mutual funds. Ordinary investors rarely gain access until valuations have already surged.

This model is not only inefficient and closed off but also creates a severe misalignment between creators and supporters. These structural flaws highlight the urgent need for a more open, direct, and participatory funding model—one that ICM aims to solve.

Figure 1: Cost comparison of direct listings

(Adapted from Lily Liu, TOKEN2049 Dubai 2025)[1]

Direct listing is a more cost-effective fundraising method that eliminates expensive and time-consuming intermediaries found in traditional financing, offering entrepreneurs a viable alternative. In many ways, ICM resembles direct listing but offers additional theoretical advantages by enabling entrepreneurs to fundraise directly via blockchain.

What is ICM?

ICM is an emerging narrative in the crypto industry. It allows entrepreneurs to raise funds directly over the internet for their products without going through the complex procedures of traditional capital markets—simply by tokenizing their ideas and instantly receiving support from investors.

Unlike traditional markets, where investor shares are typically held in custody by banks or brokers, in ICM investors hold their assets (token assets) directly in self-custody wallets, maintaining full ownership and liquidity. This approach dramatically lowers the barrier for retail participation while enabling project teams to access funding more efficiently.

Current State of the ICM Ecosystem

Notably, ICM is not just an experimental product narrative—it aligns closely with Solana's own strategic direction. According to a market memo released by the Solana Foundation on November 27, 2024 [19], the foundation outlined a vision of building an "internet-native Nasdaq"—where anyone with a wallet and internet connection can participate in capital markets.

The memo envisions a future where financial assets such as stocks, real estate, and cultural tokens can be freely accessed and traded at any time by anyone via a globally shared blockchain ledger, eliminating many of the barriers and restrictions present in traditional finance.

The current leader in the ICM ecosystem is Believe App (formerly Clout) on Solana. The platform enables founders to launch their own tokens simply by mentioning an account on X (formerly Twitter). It aims to disrupt traditional venture capital by providing a decentralized, community-driven alternative that empowers creators and entrepreneurs.

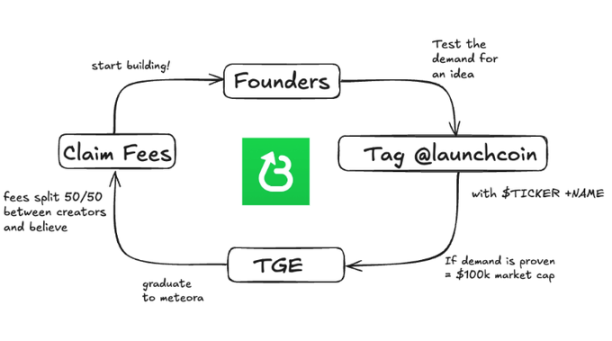

Figure 2: LaunchCoin tokenomics flowchart

(Adapted from @ManoppoMarco, X, 2025)[2]

Figure 3: LaunchCoin price timeline (with author annotations)

Screenshot source: Dexscreener [3]

It all began with Web2 entrepreneur and Forbes "30 Under 30" Ben Pasternak, who launched his token $Pasternak on Clout in January [14]. Its market cap briefly soared to around $77 million, but ultimately collapsed due to technical issues—the token could not "graduate" even when conditions were met [15].

In late April, the platform officially rebranded from Clout to Believe, shifting its core focus from "individuals" to "ideas and projects," fully embracing the ICM vision. $Pasternak was gradually phased out, and the platform introduced a new native token, $launchcoin. Growth accelerated after endorsements from high-profile founders like Nikita Bier and Solana co-founder Toly. Multiple project tokens such as $GOON and $NOODLE achieved success on Believe with high market caps, creating viral traction that pushed the platform’s total market value to $314 million [16].

Clanker vs. Believe: Why Believe Is More Successful

Clanker is another token launch platform that allows users to create tokens through social media interactions, primarily via tweets or Farcaster (a Web3 version of Twitter). Although Clanker and Believe appear similar in terms of issuance mechanics, Believe has clear advantages in user experience, narrative structure, and growth potential, setting it apart from competitors.

Ecosystem Impact

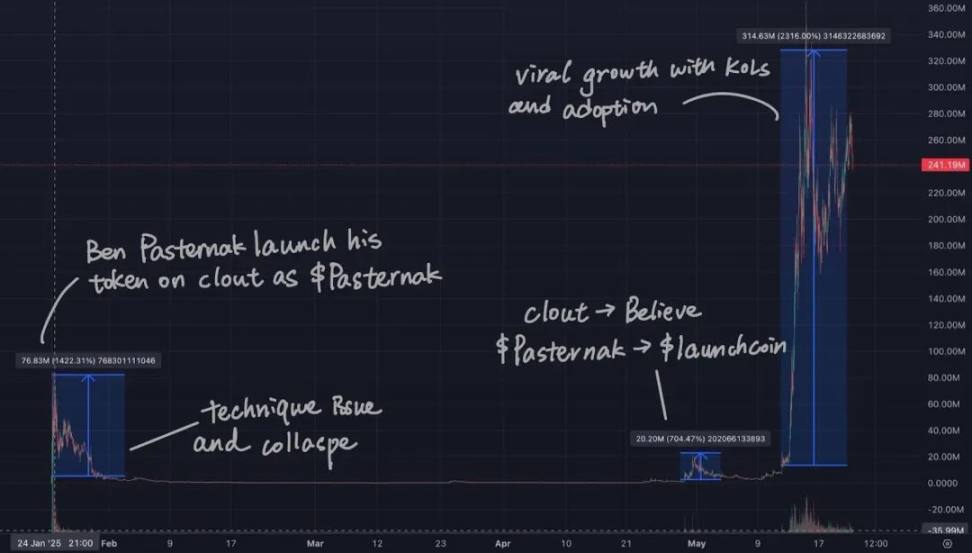

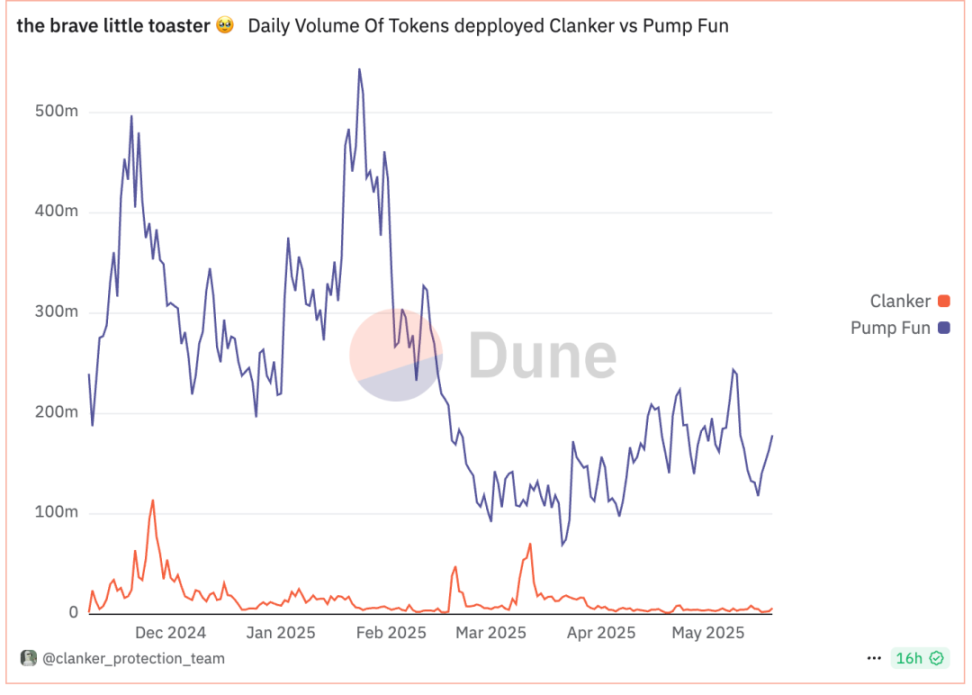

As shown in the chart below, Solana significantly outperforms Base in both trading volume and number of active traders, giving Believe stronger momentum for expansion. Additionally, support from Alliance DAO and amplification by influential figures like Nikita Bier and Toly further accelerated its growth.

Figure 4: Meme coin trading metrics on Solana

(Source: Cointoshi, Dune Analytics) [4]

Figure 5: Daily number of tokens issued: Clanker vs. Pump Fun

(Source: Clanker Protection Team, Dune Analytics) [5]

User Experience

Figure 6: User Rifqi Saputra (@denyosapone) sharing a token launch on X via Clanker (2025) [6]

Figure 7: User Pata van Goon (@basedalexandoor) showcasing a launch on Believe (2025) [7]

Launching on Believe is much simpler—users only need to enter a token ticker and mention @Believe on X. In contrast, Clanker requires additional information such as name and icon.

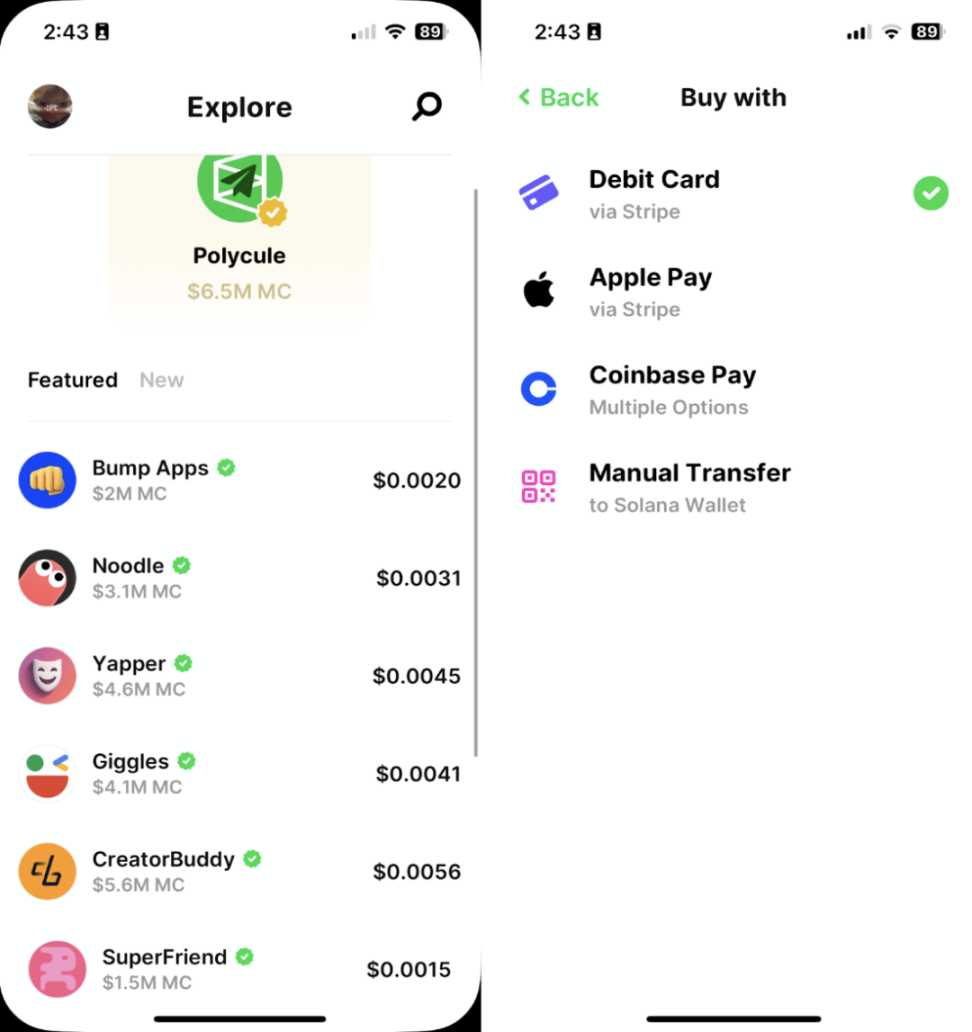

Beyond that, Believe offers a more intuitive and streamlined interface. It has developed a mobile app available on the App Store, allowing users to purchase token assets directly via wallet or credit card. Clanker, however, remains web-only and supports wallet-only purchases—typical of traditional Web3 launch platforms.

Figure 8: Believe app interface showing token list and payment options (2025) [8]

While Clanker simplifies the "sell" process in token issuance, buyers still require some Web3 knowledge—such as how to connect wallets or add networks on the Base blockchain.

Believe, on the other hand, enables users to issue and buy tokens without any Web3 knowledge. You can launch via Twitter and pay with a credit card or Apple Pay. This drastically lowers the entry barrier, attracting a large number of Web2 users into Web3.

For example, Web2 entrepreneur Alex Leiman (developer of the Web3 game noodle.gg, inspired by slither.io) chose to launch his new token $noodle on Believe [9].

Narrative and Vision: The Difference Between ICM and Meme Platforms

Believe was one of the first projects to introduce the "Internet Capital Market (ICM)" narrative, emphasizing token issuance around real ideas and projects to support their development—not just promoting valueless memes. This higher-level vision resonates more deeply with communities, attracting users interested in meaningful creation and long-term value.

In contrast, Clanker functions more like a short-term speculative meme launch platform. Lacking a clear narrative or long-term vision, its appeal is limited to "short-term traders," making it difficult to build lasting user engagement or sustainable ecosystem growth.

Why ICM Might Just Be Another Meme Hype Cycle

The idea behind ICM is undeniably compelling. However, there is always a trade-off between efficiency and safety. By reducing time and entry barriers, you inevitably sacrifice certain protective mechanisms.

Founders Are Not Held Accountable

Unlike traditional capital markets, where IPOs require rigorous roadshows, due diligence, and regulatory approval, in ICM founders can launch a token simply by mentioning @Believe on official Twitter.

The problem is: founders make no delivery commitments or legal obligations, and there are no safeguards ensuring they fulfill their stated goals. This lack of accountability raises serious concerns—especially given real-world cases where high-profile accounts (even "presidential-level") promoted a token contract address, only to later delete the post or claim "account hacked."

Figure 9: Clout's official guide emphasizing tokens must be used in non-security contexts (2025) [10]

According to LaunchCoin's official guidelines, to avoid being classified as securities or investment products, the platform enforces strict legal compliance rules. For example: tokens must not represent equity or imply any form of return. Their intended design is closer to digital collectibles—symbolic gestures of support—rather than income-generating, dividend-paying securities.

This reveals a critical issue: a major disconnect exists between the token and the underlying project. As per the guidelines, tokens are essentially similar to meme coins—they have no practical utility and exist primarily as symbols of support for a founder.

While this mechanism does help projects raise funds and advance development, many investors may mistakenly believe they're participating in a high-quality early-stage investment. Numerous individuals see themselves as angel investors supporting hard-working entrepreneurs, when in reality these tokens promise no returns and offer no protections.

Abuse of the Narrative

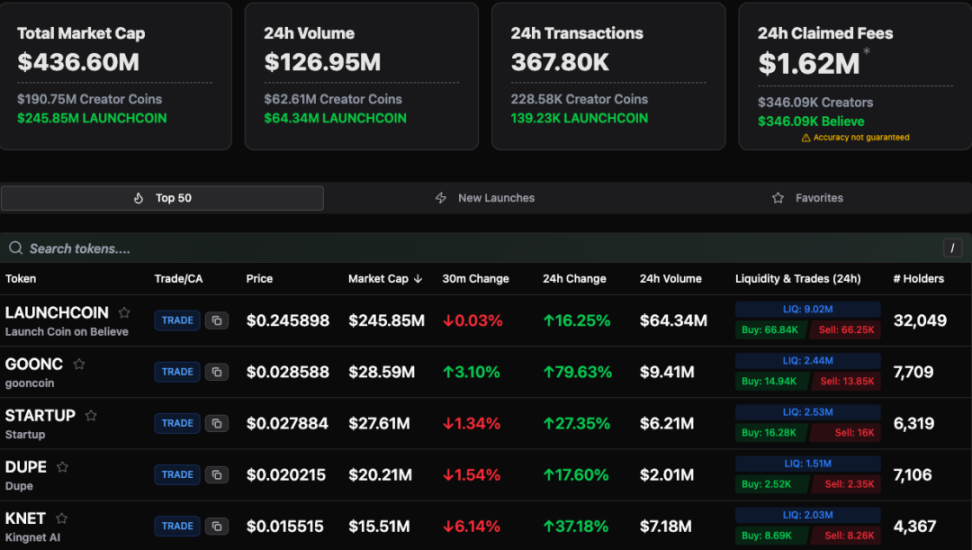

Figure 10: Market statistics for the Believe ecosystem, including top tokens by market cap, trading volume, and 24-hour price changes (2025) [11]

Current market data shows that while ICM's original vision was to support founders and their projects, it is now being clearly abused. Among the top three highest-market-cap tokens on the platform, two are essentially meme coins.

ICM was meant to empower genuinely creative builders, but the current situation is ironic: many people are merely using the "support a project" narrative as packaging, while actually fueling yet another round of meme speculation. These meaningless tokens attract more attention and fame than actual projects in need of funding [17].

What’s Next for ICM?

Currently, launching a token on Believe costs founders nothing, but market performance heavily depends on ongoing project progress. To incentivize founders to continuously update their projects and maintain community interest, Believe should consider optimizing its tokenomics.

For instance, smart contracts could implement penalty mechanisms: if a founder fails to update their project or becomes inactive ("ghosting"), they would lose eligibility to claim trading fee revenues. Additionally, establishing a DAO mechanism is crucial—giving the community voting rights and redemption powers to enhance transparency and founder accountability.

Fundamentally, I believe ICM is more than just a short-term meme trend—it has greater potential, but only if supported by clearer rules and a more mature ecosystem. The concept of ICM reminds me of TON’s growth strategy—leveraging Telegram to onboard vast numbers of Web2 users into Web3.

Currently, all crypto assets combined represent only about 0.56% of the world’s total money supply [18]. To achieve true Web3 adoption, we must provide simpler, more intuitive user experiences. The real value of ICM lies in its ability to attract and convert large numbers of Web2 users without requiring deep Web3 knowledge.

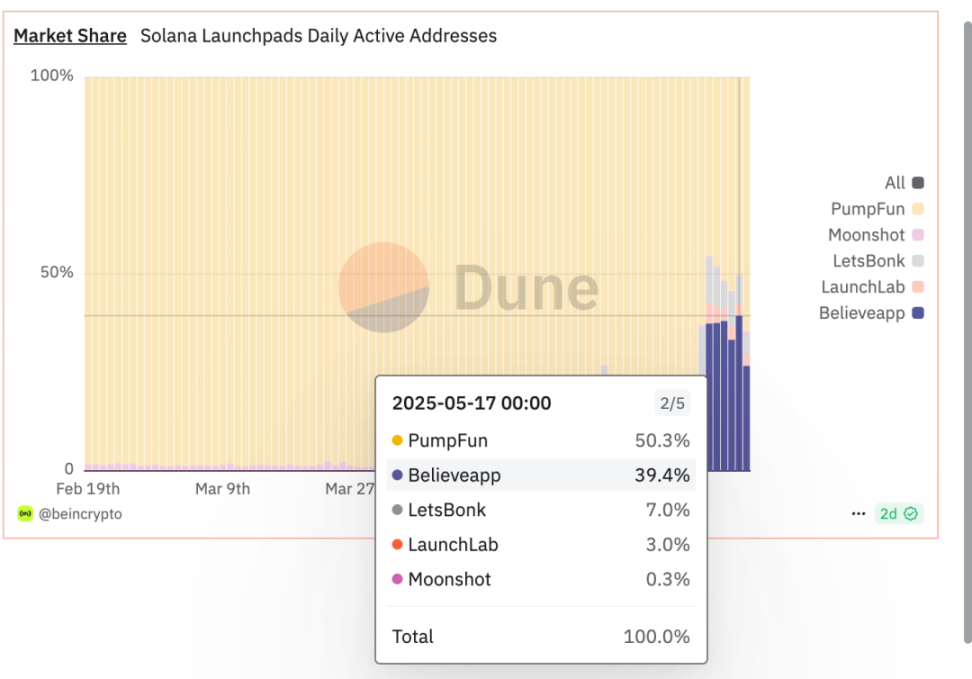

Although some currently view Believe as just another meme launch platform, it is rapidly growing and capturing market share on Solana previously dominated by established platforms like Pump Fun. By diluting Pump Fun’s monopoly, Believe is helping alleviate selling pressure across the Solana ecosystem.

In the past, Pump Fun nearly monopolized the token launch space, forcing users to transact in $SOL and leaving them with few alternatives. Now, Believe’s emergence breaks this dominance, offering retail investors more competitive choices and reducing liquidity risks caused by centralized platforms [17].

Figure 11: Daily active address market share across Solana token launch platforms, comparing BelieveApp against PumpFun, LetsBonk, and others (2025) [12]

In the short term, if Believe can maintain its competitive edge against other traditional launch platforms, the ICM narrative is likely to endure, as achieving mass Web3 adoption remains the ultimate goal of the entire ecosystem.

But to truly establish itself and avoid becoming another fleeting hype platform like Clanker, Believe must strengthen and expand its unique positioning—not just as a launch tool, but as a platform that fosters project incubation and real value creation.

Figure 12: Price chart of Let『sBonk ($BONK), showing initial surge driven purely by "narrative" and subsequent performance (2025) [13]

This means ICM must build deeper utility around the "Internet Capital Market" concept. Specifically, it can focus on the following directions:

-

Developing meaningful community governance mechanisms (DAOs)

-

Establishing systems for sustained founder accountability

-

Integrating projects with real-world use cases to attract broader mainstream users.

If it fails to evolve in this direction, Believe risks being perceived merely as another meme platform and ultimately losing momentum for long-term growth. To create lasting impact, Believe must become more than just a meme coin launcher—it must emerge as an innovation platform that sparks creativity, drives projects forward, connects the public, and advances Web3 adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News