Justin Sun: The Man Who Ate a $6.2 Million Banana

TechFlow Selected TechFlow Selected

Justin Sun: The Man Who Ate a $6.2 Million Banana

Sun Yuching may be both a dreamer and a performer.

Writing: Token Dispatch, Thejaswini M A

Translation: Block unicorn

Preface

Justin Sun: This China-born cryptocurrency billionaire founded TRON, acquired BitTorrent for $140 million, paid $4.6 million to have lunch with Warren Buffett, ate a $6.2 million banana, and has just become the top holder of Trump-themed meme coins with a $20 million stake.

From a history student at Peking University to one of the most controversial figures in crypto, Justin Sun built his empire through aggressive marketing, strategic acquisitions, and an uncanny ability to stay ahead of regulators.

How did someone once facing fraud charges from the U.S. Securities and Exchange Commission (SEC) become a guest at a presidential dinner?

Beneath the stunts and regulatory battles lies a more complex question: Is this visionary entrepreneur a savvy marketer or a dangerous opportunist?

From Xining to the Global Stage

Justin Sun’s rise in cryptocurrency began in Xining, a remote city in Qinghai Province, China, where he was born on July 30, 1990.

His family background offered stability but not privilege—his father managed a state-owned enterprise, his mother was a primary school teacher before becoming a journalist, and his late grandfather served as deputy mayor of Xining overseeing education.

It was his academic achievements that granted him access to China’s elite circles.

At Peking University—one of China’s most prestigious institutions—Sun majored in history and demonstrated early flair for publicity by running (unsuccessfully) as an independent candidate for student council president.

In 2011, he appeared on the cover of Asia Weekly, marking his emergence as a notable young voice among Chinese intellectuals.

His graduate studies in the United States brought his crypto breakthrough. In 2012, while pursuing a master's degree in East Asian Studies at the University of Pennsylvania, Sun read an article about Bitcoin.

He became an early Bitcoin investor, laying the foundation for what would become a multi-billion-dollar cryptocurrency empire.

Sun continued his education at Hupan University, an elite business school founded by Alibaba’s Jack Ma. Reportedly its youngest graduate, he gained access to China’s entrepreneurial elite and developed the deal-driven mindset that would define his career.

The Social Media Prelude

Before entering blockchain, Justin Sun first made waves in China’s fiercely competitive social media landscape.

After graduation, Sun dove headfirst into the world of cryptocurrency.

Ripple Labs (2013): Sun’s first major role in crypto was as chief representative and advisor for Ripple Labs Greater China. This gave him firsthand experience with how blockchain technology works in practice and how to navigate regulatory environments in Asia.

Peiwo (2014): Before TRON, Sun founded Peiwo, described as an “audio hybrid of Tinder and live chat rooms.” Users connected via 10-second voice clips, and the app became popular in China.

Peiwo’s success earned Sun early recognition—he made Forbes’ “30 Under 30 Asia” list (2015–2017) and was featured by China Central Television as a young entrepreneur to watch.

But Sun had bigger plans. Audio social apps were just a warm-up.

By 2017, Sun had accumulated enough blockchain knowledge and connections to prepare for his next venture—the project that would catapult him to the top tier of crypto entrepreneurs.

The Origins of TRON

In 2017, 26-year-old Justin Sun launched TRON with the goal of “decentralizing the internet,” creating a blockchain-based content and entertainment system. The timing was perfect… and suspicious.

Sun launched TRON’s initial coin offering (ICO) in September 2017, just days before China imposed a complete ban on ICOs. Was it a coincidence? Reports suggest Sun received advance warning of the impending ban and rushed to complete the token sale, raising around $70 million just before the window closed.

Immediately after the sale concluded, Sun left China for the United States, effectively relocating TRON’s operations overseas. Was it prudent risk management or premeditated maneuvering? You decide.

The move wasn’t without controversy. Critics accused Sun of insider trading based on regulatory intelligence, while supporters praised his decisive action to protect investor funds.

By 2018, TRON launched its own blockchain network, migrating from Ethereum to become an independent platform capable of processing thousands of transactions per second at extremely low cost.

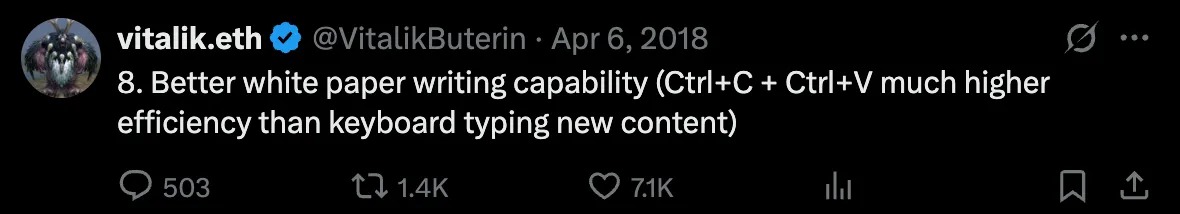

Almost simultaneously, critics alleged that TRON’s whitepaper copied sections from Ethereum and the peer-to-peer file-sharing protocol IPFS (InterPlanetary File System) without attribution. Sun claimed it was a translation error between Chinese and English versions, but the reputation for “borrowing ideas” lingered.

Despite controversies, TRON grew rapidly. By 2020, it ranked among the top 15 cryptocurrencies by market cap, hosting a wide range of applications from decentralized finance (DeFi) projects to gambling dApps.

Beyond technical metrics, TRON achieved real-world utility rare among blockchain projects: practical use. The network powers numerous gambling apps, content platforms, and financial services (MetaWin, LUMINIOUS, JustLend DAO, SunSwap, and Bridgers), serving millions globally.

Sun further expanded into traditional art through the APENFT Foundation, bridging physical and digital art markets via NFTs. His high-profile art purchases reflect both personal passion and strategic marketing for TRON’s cultural initiatives.

Building Through Acquisitions

Justin Sun didn’t just create TRON—he dominated crypto through acquisitions.

BitTorrent (2018): Sun’s biggest move was acquiring BitTorrent Inc. for $140 million.

BitTorrent, the pioneering peer-to-peer file-sharing protocol, brought millions of existing users into the TRON ecosystem. More importantly, it gave Sun access to proven decentralized content distribution technology.

The acquisition led to the creation of the BitTorrent Token (BTT), which incentivizes file sharing through crypto rewards. Within months of launch, BTT became one of the most actively traded tokens in the crypto market.

The acquisition profoundly changed company culture. Under Sun’s aggressive, high-pressure leadership, BitTorrent’s previously relaxed work environment underwent a radical transformation.

Ironically, both cryptocurrency and BitTorrent are built on decentralization principles, yet Sun centralized control entirely under himself.

Poloniex (2019): Sun acquired the U.S.-based cryptocurrency exchange Poloniex from Circle, though he initially denied having control. Under his leadership, Poloniex closely collaborated with TRON, heavily promoting TRX trading and becoming a primary market maker for Sun’s various tokens.

According to The Verge, Sun instructed Poloniex staff to seize $11 million worth of Bitcoin mistakenly sent to the wrong address by users, treating the funds as his own “finder’s fee.”

HTX (formerly Huobi, 2022): Sun joined Huobi Global as an “advisor,” but reports indicate he effectively took control. In 2023, Huobi rebranded to HTX, with Sun playing a key role in operations and strategy.

By 2022, Sun controlled a vertically integrated crypto ecosystem spanning blockchain infrastructure, content platforms, and major exchanges.

Diplomatic Immunity and Political Maneuvering

In December 2021, Sun was appointed Grenada’s ambassador and permanent representative to the World Trade Organization (WTO).

This appointment allowed Sun to publicly use the title “His Excellency” and gave him a platform to advocate for blockchain-friendly policies at international forums.

However, his diplomatic tenure was short-lived. After a government change in Grenada in March 2023, Sun was reportedly removed from his WTO post—coincidentally, just as his legal battle with the U.S. Securities and Exchange Commission (SEC) intensified.

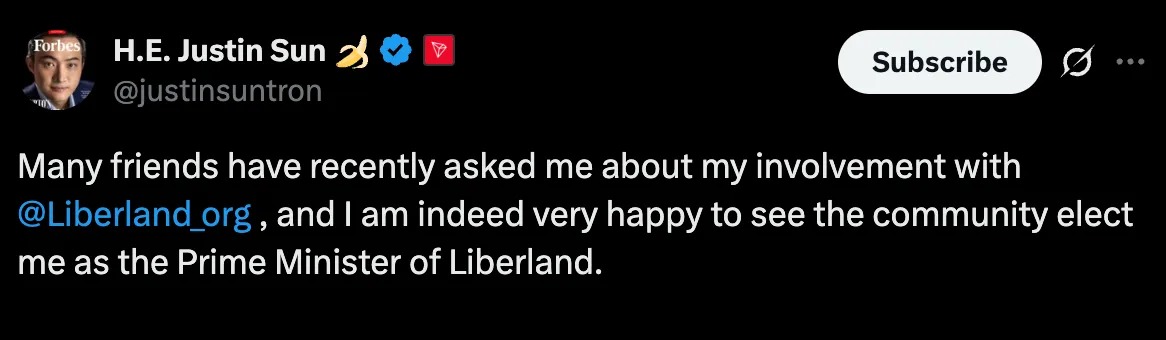

Unwilling to let a good title go to waste, Sun joined Liberland, a self-declared micronation located between Croatia and Serbia. In October 2024, Liberland named Sun “Speaker of Congress” and “Prime Minister”—largely symbolic roles for a largely symbolic nation.

The Art of Controversy

Sun’s business success is matched only by his ability to generate headlines through increasingly bold publicity stunts.

The Warren Buffett lunch perfectly illustrates his marketing genius—and tendency toward overreach. After winning a charity auction for $4.57 million to have a private meal with the legendary investor, Sun promoted the event as a historic meeting between traditional finance and crypto.

But just days before the scheduled lunch, Sun abruptly canceled, citing kidney stones. Chinese media reported authorities were investigating unspecified financial crimes, forcing Sun to issue a lengthy apology on social media.

“My childish, naive, impulsive behavior and big mouth turned this into an out-of-control, failed over-marketing stunt, leading to unintended consequences,” he wrote. He admitted his “excessive self-promotion” attracted unwanted regulatory scrutiny.

The lunch eventually took place quietly in January 2020, achieving Sun’s goal of connecting crypto with traditional finance.

In November 2024, Sun purchased Maurizio Cattelan’s conceptual artwork Comedian for $6.2 million at Sotheby’s—a piece consisting of a banana taped to a wall.

But Sun didn’t stop there. In a move that made international headlines, he ate the banana during a press conference, calling it “a cultural phenomenon connecting art, memes, and the crypto community.”

His verdict? “I could taste a hint of Big Mac banana from a hundred years ago.”

Only Justin Sun would spend $6.2 million on a banana and then eat it for publicity.

Other notable stunts:

Blue Origin space flight: In 2021, Sun won a seat on a Blue Origin flight with a $28 million anonymous bid but missed the flight due to scheduling conflicts.

Tesla giveaway: Sun organized controversial lotteries, including Tesla giveaways, generating massive attention but also accusations of manipulation.

Art collecting: He bid on Beeple’s NFT Everydays: The First 5000 Days at Christie’s, narrowly missing the $69 million final price.

Each stunt serves the same purpose: keeping Justin Sun and his projects in the headlines.

Legal Battles and Regulatory Games

Sun’s aggressive business tactics inevitably drew regulatory scrutiny, culminating in a full-scale lawsuit filed by the U.S. Securities and Exchange Commission (SEC) in March 2023.

The allegations were serious: unregistered securities offerings, market manipulation through wash trading, and orchestrating undisclosed celebrity endorsements. The SEC accused Sun of directing employees to conduct over 600,000 fake trades to artificially inflate TRX trading volume.

Eight celebrities—including Lindsay Lohan, Jake Paul, and Ne-Yo—were also sued for promoting Sun’s tokens without proper disclosure.

Sun responded on social media: “The SEC’s allegations are baseless. The regulatory framework for crypto is still unclear, and we will firmly contest these claims.”

For nearly two years, the case cast a shadow over Sun’s operations, restricting his activities in the U.S. market and potentially exposing him to heavy fines and restrictions.

Yet in February 2025, something unexpected happened: the SEC quietly dropped the case. The timing caught the entire crypto industry’s attention.

Just months earlier, Sun had invested $75 million in World Liberty Financial, a cryptocurrency project backed by former U.S. President Donald Trump and his family.

This investment made Sun the largest known supporter of Trump-linked crypto projects, with reports indicating 75% of the token sale proceeds went directly to the Trump family as fees.

Whether coincidence or calculated strategy, the SEC’s withdrawal cleared a major obstacle for Sun’s continued expansion in the U.S. market.

The $19 Million Dinner Invitation

Sun’s Trump investment strategy peaked in May 2025 when he announced he was the largest holder of TRUMP meme coins, owning approximately $19 million worth of tokens.

This status qualified him for an exclusive dinner with the president at the Trump Golf Club near Washington, D.C.—an event limited to the top 220 token holders.

“What a coincidence: the day after the Senate advances the GENIUS Act, Sun announces he’ll attend the president’s private dinner as his top crypto buyer,” commented Senator Elizabeth Warren. “Everyone must understand—(the GENIUS Act) doesn’t stop corruption; it enables it.”

Sun’s total investment in Trump-related crypto projects now exceeds $90 million—a major bet on the political future of U.S. crypto regulation.

Whether seen as shrewd political investment or brazen pay-to-play, this strategy has made Sun a central figure in the convergence of cryptocurrency and mainstream American politics.

His comments after the dinner:

“All critics should really pay attention,” Sun told CoinDesk. “Something positive is happening in this industry.”

The Dark Side of Success

Sun’s rise hasn’t come without cost—especially for those who worked closely with him.

Former employees describe a harsh work environment marked by extreme performance targets, long hours, and Sun’s erratic management style. In 2020, two former BitTorrent employees filed a lawsuit alleging harassment, wrongful termination, and retaliation against whistleblowers.

The case ultimately went to private arbitration, with details undisclosed, but the allegations paint a picture of a leader willing to cross ethical lines in pursuit of business goals.

Sun’s companies have also faced security challenges. In November 2023, Poloniex suffered a $120 million hack. Sun offered the hacker a 5% bounty ($6.5 million) in exchange for returning the remaining funds.

These incidents highlight a consistent pattern: Sun is willing to bend rules and push boundaries to achieve larger strategic objectives.

Our Take

Justin Sun’s story reads like a crypto fever dream: a Chinese history major becomes a billionaire through aggressive marketing, strategic acquisitions, and precise regulatory navigation.

His empire spans blockchain, exchanges, art collections, and now political ties to the highest levels of the U.S. government. He has survived plagiarism accusations, SEC fraud charges, employee lawsuits, and multiple market crashes.

Arguments in favor of Justin Sun

-

Built one of the largest and most widely used blockchain networks in crypto

-

Demonstrated sustained marketing talent that drives adoption

-

Navigated complex regulatory environments across multiple jurisdictions

-

Delivered real technological innovation in blockchain scalability and decentralized finance (DeFi)

Arguments against Justin Sun

-

A history of controversial business practices and ethical boundary-pushing

-

An aggressive management style that may harm employees and partners

-

A tendency to generate hype beyond actual technological contributions

-

Ongoing regulatory troubles and legal challenges

The reality

Justin Sun may be both visionary and showman. His contributions to blockchain technology are real—TRON handles massive transaction volumes and supports significant DeFi activity. His marketing innovations have reshaped how crypto projects are promoted.

But his methods often involve taking shortcuts, pushing ethical limits, and prioritizing headlines over sustainable business practices.

Whether you admire or despise Justin Sun, his impact on cryptocurrency is undeniable. He has influenced everything from tech development to marketing strategies to regulatory approaches.

Remember: When someone spends $6.2 million on a banana and eats it for publicity, you’re not dealing with an ordinary entrepreneur. You’re dealing with Justin Sun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News