Dollar Stablecoin Bill: The Prelude to On-Chain Hegemony

TechFlow Selected TechFlow Selected

Dollar Stablecoin Bill: The Prelude to On-Chain Hegemony

Web3 did not achieve freedom, it just changed regulators.

Author: Sanqing

🇺🇸 Stablecoin Legislation Breaks Ice: GENIUS Act Clears Senate Procedural Vote

[Washington, May 19, 2025] — The U.S. Senate passed a procedural vote on the Generational Innovation in United States Stablecoins (GENIUS) Act on Monday evening by a vote of 66 in favor and 32 opposed, clearing the biggest hurdle for the bill’s final passage. This legislation establishes a comprehensive federal regulatory framework for stablecoin issuance, reserves, redemption, compliance, and consumer protection in the United States.

The bill previously faced political resistance due to its implications for former President Trump’s family cryptocurrency ventures, failing to advance to a full vote in early May. After revisions—including new restrictions on foreign issuers and prohibitions on large tech companies leading stablecoin issuance—several moderate lawmakers shifted their support, enabling the bill to surpass the Senate's 60-vote procedural threshold. A final Senate vote is expected this week, after which it will be sent to the House for consideration.

Bill Overview: Regulation Under the Banner of "Stability"

The GENIUS Act defines stablecoins as “digital assets that promise redemption at a fixed amount and are used for payment settlement,” explicitly excluding central bank digital currencies and traditional bank deposits.

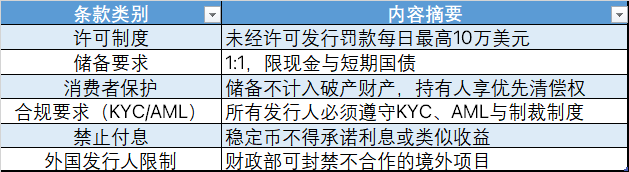

Key Provisions of the GENIUS Act at a Glance

Upon passage, compliant stablecoin issuers such as Circle (USDC) and PayPal (PYUSD) stand to benefit, while entities like Tether (USDT) and most DeFi-based structural stablecoin projects (e.g., RAI, USDe) may face legal challenges in the U.S. market.

Context Deep Dive: The Moment of Dollar Sovereignty on Chain

In structure, the GENIUS Act is not mere tolerance of stablecoins but a formal institutional recognition of dollar sovereignty within blockchain space—an American-style expansion into digital currency. By legitimizing compliant stablecoins, it extends U.S. dollar issuance rights into the Web3 ecosystem: although units like those issued by Circle operate on-chain, they effectively function as “on-chain dollar clearing banks.”

This means:

-

The U.S. dollar remains the pricing benchmark for all on-chain assets, with control firmly held by the Federal Reserve system;

-

Compliant stablecoins gain clearing privileges, while algorithmic stablecoins and structured financial tokens risk marginalization or exit from the U.S. market;

-

Web3 is losing its potential as an “independent value system”, gradually being absorbed into the digital extension of dollar hegemony.

The GENIUS Act transforms blockchains from “currency-neutral platforms” into “settlement appendages of the U.S. dollar.”

Deep Implications for Web3 and Decentralized Finance

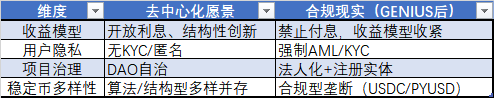

Decentralization Vision vs. Compliance Reality

1. Income-Generating DeFi Assets Marginalized:

The ban on interest-bearing features threatens the viability of structural stablecoins. Designs like sDAI and USDe face limitations and potential classification as securities, undermining core DeFi business models.

2. KYC Compliance Forces DApp Centralization:

Regulatory requirements around stablecoin use will compel DApps to implement AML/KYC mechanisms, contradicting decentralized design principles. DAOs may need to establish legal representative entities to comply.

3. High Concentration in the Stablecoin Market:

Stablecoins with U.S. regulatory approval, such as USDC and PYUSD, will absorb market liquidity, increasing entry costs and innovation barriers for new entrants.

4. Closed-loop Economies Struggle to Form On-chain Units of Account:

Structural initiatives like PAYFi aiming to build non-pegged value units will struggle to gain mainstream trust without fiat off-ramps, facing credit bottlenecks in closed-loop economies.

5. The “Financial Rebellion Lab” Becomes a “Digital Dollar Interface”:

The GENIUS Act signals that Web3 is no longer seen as a threat to the old order, but rather as a sub-module of its infrastructure. Hegemony isn't overturned—it is “protocolized and extended.”

Conclusion: From Gray-zone Currency to Permissioned Finance—Is Compromise Web3’s Next Step?

The GENIUS Act is a milestone in stablecoin legislation and a definitive on-chain assertion of “the U.S. dollar as the global value anchor.” In the short term, it enhances regulatory clarity and opens the door for institutional participation. In the long term, it erects a firewall within the value system, making Web3 increasingly resemble TradFi—and less like the world it once aimed to replace.

If Bitcoin once dreamed of breaking the monopoly of sovereign money, the GENIUS Act declares:

Money hasn’t been redefined—only moved onto chains; Web3 hasn’t gained freedom—only changed regulators.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News