Coinbase Monthly Outlook: Global monetary system shift, Bitcoin begins to take a seat at the table

TechFlow Selected TechFlow Selected

Coinbase Monthly Outlook: Global monetary system shift, Bitcoin begins to take a seat at the table

According to a conservative estimate in the report, if Bitcoin is gradually incorporated into the global reserve system, its total market capitalization could increase by approximately $1.2 trillion.

Author: David Duong, CFA - Global Head of Research

Translation: Daisy, ChainCatcher

Editor's Note:

This article summarizes Coinbase's latest monthly outlook research report. The report指出 that as the U.S. "twin deficits" continue to widen and trade protectionism intensifies, confidence in the dollar is weakening, potentially triggering a large-scale global portfolio rebalancing. In this context, Bitcoin—due to its characteristics such as monetary sovereignty neutrality and freedom from capital controls—is increasingly being viewed by nations as a potential supranational reserve asset. According to the report’s conservative estimate, if Bitcoin is gradually integrated into the global reserve system, its market capitalization could increase by approximately $1.2 trillion.

The following is a translated and compiled summary of key points from the report.

Summary

Global capital flows are being reshaped by escalating trade protectionism, challenging the dollar’s dominance as the world’s primary reserve currency. With the U.S. fiscal and current account deficits expanding continuously and debt levels on an unsustainable path, market confidence in the dollar as a safe-haven asset is eroding. This trend may reverse inflows into the dollar, prompting major global institutions to reallocate assets. Over the long term, the dollar could face sustained and significant selling pressure.

Notably, we believe recent months of turmoil have further accelerated a decade-long decline in dollar dominance. The coming shifts may become a pivotal turning point for Bitcoin and the broader crypto market. The evolving dollar system is making store-of-value assets like gold and Bitcoin more attractive alternatives within an emerging monetary landscape. A prime example is gold’s reclassification under Basel III from Tier 3 to Tier 1 assets. Particularly, Bitcoin—with its features of monetary neutrality, immunity to sanctions, and resistance to capital controls—has the potential to serve as a viable supranational unit of account in international trade.

We believe declining demand for the dollar may push more countries toward diversifying their international reserves. Conservatively estimated, this trend could add approximately $1.2 trillion to Bitcoin’s market cap. This also partly explains why an increasing number of nations are now considering strategic Bitcoin reserves, highlighting Bitcoin’s growing geopolitical significance.

Continuation of Dangerous Times

Over the past half-century, U.S. economic management has undergone profound changes. Since the stagflation crisis of the 1970s, economists such as Milton Friedman challenged Keynesian demand management theories, paving the way for the modern central banking framework—centered on inflation targeting and the concept of “natural unemployment.” This model was institutionalized through central bank independence, with monetary policy primarily relying on interest rates (and later some macroprudential tools) to manage money supply and stabilize the economy.

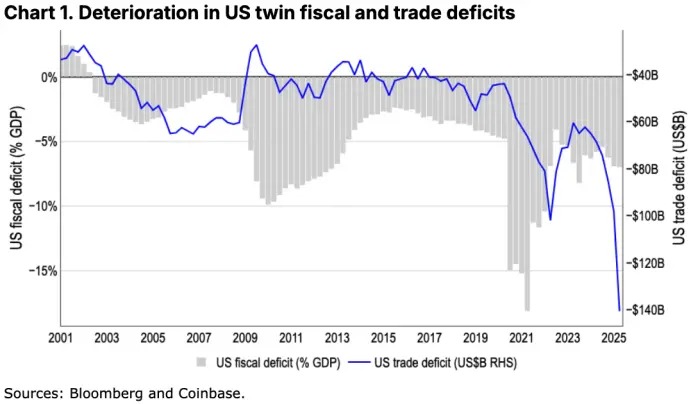

For years, this framework has faced mounting pressure from fiscal activism, including massive deficit spending and multi-trillion-dollar stimulus programs. While some expenditures were necessary responses to crises like the Global Financial Crisis and the pandemic, the U.S. debt-to-GDP ratio has surged from 63% in 2008 to around 122% today, clearly on an unsustainable trajectory. Moreover, the Federal Reserve’s aggressive rate hikes during 2022–2023 significantly increased government borrowing costs, exacerbating fiscal deficits through soaring interest expenses. See Figure 1.

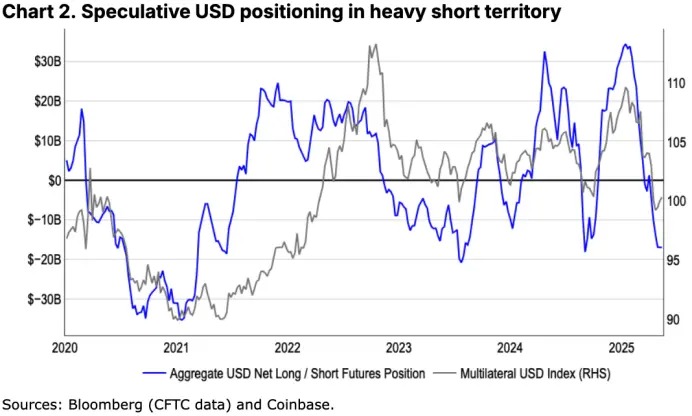

In this environment, rising trade protectionism could reshape global capital flows. The dollar’s status as a safe-haven asset is under threat, suggesting that large institutions (such as non-U.S. pension funds, life insurers, and sovereign wealth funds) may shift their historical investment strategies. Over the past two decades, these institutions held about $33 trillion in dollar-denominated assets—including $14.6 trillion in bonds and $18.4 trillion in equities—with roughly half unhedged systematically (source: Reuters). We believe that in the coming months and years, a new wave of large-scale portfolio adjustments may unfold globally. See Figure 2.

This isn’t the first time the U.S. “twin deficits” (simultaneous fiscal and current account deficits) have triggered a reversal in dollar inflows, but this time it coincides with deep shifts in the global economic landscape. We believe the world is undergoing a major transformation in the dollar-based system, which could spark renewed large-scale dollar sell-offs.

Even if retaliatory tariffs are eventually lifted, we believe this trend is unlikely to reverse. Reasons include: (1) the psychological impact of lost confidence has already taken root among investors; and (2) tariff reductions and tax cuts will reduce government revenue, further straining fiscal deficits. While a weaker dollar may help ease debt burdens via lower interest costs and inflation, and potentially boost U.S. exports, the cost is diminished credibility of the dollar as a store of value and global reserve currency, accelerating the search for alternative assets.

When we discussed “de-dollarization” in December 2023, we noted the dollar was at a critical inflection point—but believed the process might take “many generations” to fully materialize. However, events over recent months appear to have significantly accelerated this transition. In fact, signs of declining dollar influence have long been evident—Harvard economist and cryptocurrency critic Kenneth Rogoff pointed out that dollar hegemony peaked around 2015, and the trend has since accelerated following sanctions imposed after the Russia-Ukraine war.

The Next Frontier

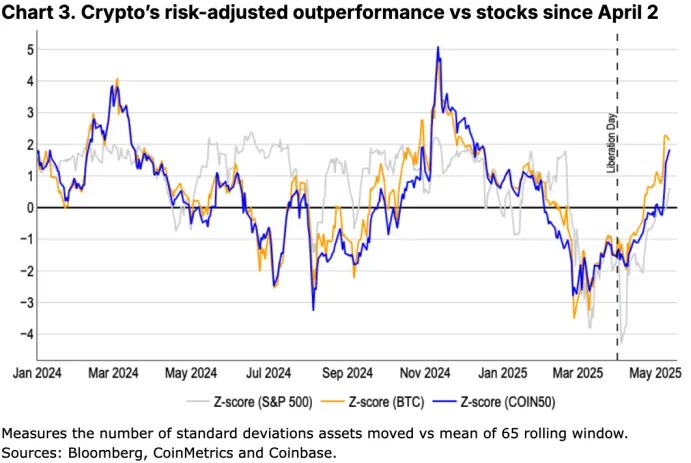

But the question remains: what are the alternatives? When monetary systems undergo fundamental change and the basis of monetary value is redefined, store-of-value assets such as gold—and more recently, Bitcoin—become especially important. Indeed, in recent weeks, Bitcoin’s positioning as “digital gold” has become increasingly clear, particularly given its risk-adjusted performance outpacing U.S. equities, further highlighting its value proposition. In a recent report, Coinbase Asset Management projected that the global store-of-value market could grow from $20 trillion today to $53 trillion over the next decade, with an estimated average real return (inflation-adjusted) of 6% per year.

The rationale is that including assets like Bitcoin and gold in portfolios helps diversify risk (as we’ve previously analyzed) and enhances return stability during systemic transitions. Although Bitcoin is more volatile than gold, its higher return potential complements gold’s stability, enabling a more balanced wealth preservation strategy.

Moreover, we believe Bitcoin’s immunity to arbitrary government confiscation and capital controls sets it apart from gold. A notable case is President Roosevelt’s 1934 Gold Reserve Act, which banned private gold ownership and required citizens to surrender gold to the U.S. Treasury. Internationally, because gold relies on traditional financial infrastructure and physical custody (e.g., banks and vaults), large holdings can be vulnerable to sanctions. For instance, in 2022, over 2,000 tons of Russian gold stored in friendly nations was frozen and rendered unusable. As for capital controls, previous Argentine governments not only restricted access to dollars but also banned gold sales to prevent capital flight.

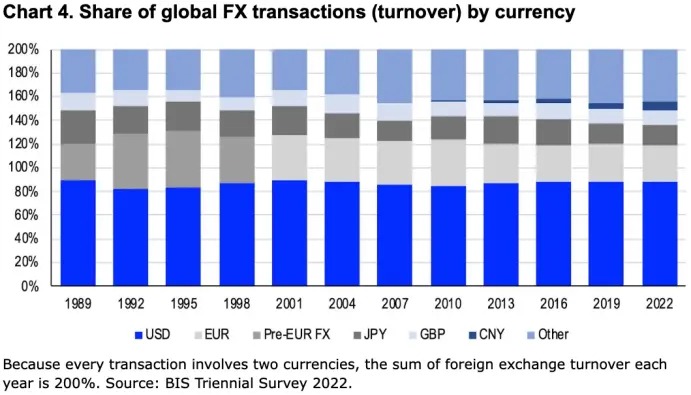

For these reasons, we view Bitcoin as a supranational store of value and believe it holds unique advantages in establishing monetary credibility for international trade. Currently, over 80% of global trade is still settled in dollars (see Figure 4), but as the world moves toward a multipolar system, more countries are becoming uneasy about continued reliance on the dollar as an intermediary. Yet, viable alternatives remain scarce.

For example, currencies of current-account surplus countries may lack sufficient global circulation (a problem known as the “Triffin Dilemma,” identified by economist Robert Triffin, who proposed creating a new reserve unit to address it). Meanwhile, despite being the second-largest reserve currency, the euro’s influence remains far below that of the dollar due to fragmented fiscal policies across the Eurozone and structural constraints on the European Central Bank.

We believe that for politically sensitive trade relationships—especially those involving current-account surplus nations—assets with censorship resistance and monetary neutrality (i.e., supranational assets) will be more appealing. Given the limited options, Bitcoin may currently be the most promising contender. In the long run, this could open substantial asymmetric upside potential for Bitcoin. However, widespread adoption may still be constrained, as many countries are reluctant to relinquish control over their domestic monetary policy. Indeed, given that most commodities are still priced in dollars, the Fed effectively influences the policy direction of most central banks worldwide in practice.

Why Now?

This is precisely why we emphasize not conflating “store-of-value assets” with “inflation-hedging assets,” even though they are closely related. We define “store-of-value” as assets capable of preserving value over long investment horizons, while “inflation-hedging” refers to tools used to protect purchasing power against short-term price shocks. An asset can be excellent for storing value without being effective at hedging inflation, and vice versa.

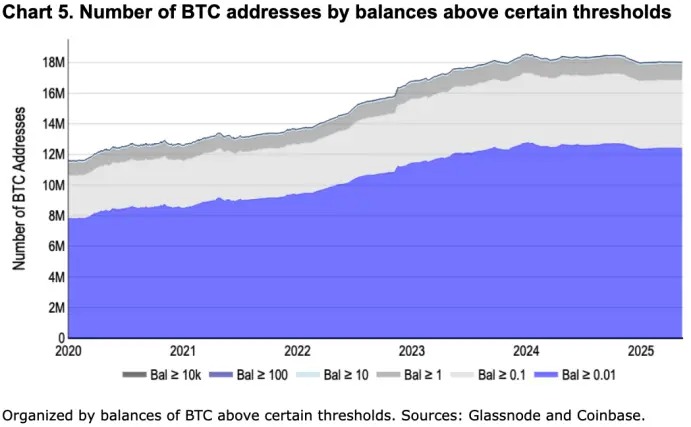

From this perspective, we believe the scale of potential capital flowing into Bitcoin could be substantial—especially in 2025, when cryptocurrencies may finally enter the mainstream. The surge in Bitcoin holdings (see Figure 5) has been driven largely by the introduction of investment vehicles like spot Bitcoin ETFs, which dramatically lowered entry barriers. At the same time, market liquidity and depth have improved markedly over the past five years. Beyond Bitcoin, the crypto payments space is also accelerating, with more institutional participants recognizing the unique efficiency and cost-control advantages of blockchain infrastructure.

The expanding base of Bitcoin investors parallels efforts by several nations (and some U.S. states) to establish strategic Bitcoin reserves (or digital asset reserves). In March 2025, the White House issued an executive order formally establishing a Strategic Bitcoin Reserve using seized government-held Bitcoin, totaling approximately 198,000 BTC. Notably, China may be the world’s second-largest national holder of Bitcoin, with an estimated 190,000 BTC—also primarily sourced from seized assets—though it has not yet officially launched a Bitcoin reserve program. Meanwhile, countries including the Czech Republic, Finland, Germany, Japan, Poland, and Switzerland are studying the feasibility of including Bitcoin in their national reserve systems.

In contrast, according to data from the IMF and the World Gold Council, above-ground gold stocks exceeded 216,000 tons by end-2024, with central banks and sovereign finance ministries holding about 17% (approximately $3.6 trillion) as reserves. On the other hand, global foreign exchange reserves declined from $12.75 trillion in Q3 2024 to $12.36 trillion in Q4 2024 due to exchange rate fluctuations. This means gold holdings (excluding forex reserves) now represent about 23% of total global international reserves, up from just 10% a decade ago. Additionally, Basel III will officially take effect on July 1, 2025, reclassifying gold from Tier 3 to Tier 1 “high-quality liquid assets,” which could further accelerate de-dollarization in global asset allocation.

As demand for the dollar weakens, we believe more countries will seek to diversify their foreign exchange reserves. Conservatively, if just 10% of total global international reserves were allocated to Bitcoin, its market capitalization could increase by approximately $1.2 trillion over the long term.

Conclusion

The global monetary system is undergoing a significant transformation, marked by growing concerns over U.S. fiscal and trade policies and the gradual erosion of dollar dominance—creating unique opportunities for alternative store-of-value assets. We believe Bitcoin, due to its monetary neutrality and resistance to international sanctions, is increasingly being seen by nations as a potential strategic reserve asset and stands to benefit significantly from this trend. Furthermore, the reclassification of gold under Basel III and the slowing pace of central bank gold accumulation further confirm this structural shift. Overall, we believe the world is accelerating its move away from traditional dollar dependence, and Bitcoin could emerge as a key component of the future global financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News