Behind the Campus Cryptocurrency Money Laundering Case: Southeast Asian Fraud Industry Infiltrating Hong Kong

TechFlow Selected TechFlow Selected

Behind the Campus Cryptocurrency Money Laundering Case: Southeast Asian Fraud Industry Infiltrating Hong Kong

In less than three months, just one money laundering ring has already illegally laundered over $310,000 in Hong Kong using the same method.

Authors: Bitrace & Manqin

Hong Kong, a well-known free port and international financial center, saw the emergence of a thriving crypto economy years before official preferential policies were introduced. Among this ecosystem, virtual asset over-the-counter service providers (VAOTCs) operating through physical stores and online groups have become particularly distinctive, working alongside local and overseas virtual asset trading platforms (VATPs) to offer token exchange and on/off-ramp services for Hong Kong's virtual asset investors.

However, due to the highly anonymous and borderless nature of blockchain-based virtual assets, various cryptocurrencies linked to criminal activities—especially stablecoins—can flow unimpeded into Hong Kong’s crypto ecosystem, contaminating the business addresses of local operators and ordinary investors and creating legal and compliance risks.

This article uses a recent incident involving mainland Chinese university students money laundering in Hong Kong as an analytical starting point to explore how Southeast Asian fraud industries have harmed Hong Kong's crypto economy and discloses related data.

Incident Description

On March 26, 2025, a mainland university student received a part-time job offer via a secondhand goods trading platform, instructing them to travel to Hong Kong to purchase a certain amount of Tether (USDT) through a local currency exchange shop and transfer it to a designated blockchain address. The process involved receiving RMB via their personal bank card, exchanging it for HKD cash at a local fiat exchange, then visiting a specified cryptocurrency exchange shop to buy USDT and having the shop directly send it to the designated wallet.

After purchasing USDT worth tens of thousands of RMB using this method, the student's bank card and WeChat Pay account were frozen by law enforcement authorities on the mainland, who informed them that the received funds originated from victims of upstream fraud incidents.

Subsequent investigations by Bitrace and Manqin Law Firm revealed this to be a typical case of "card-to-crypto" money laundering closely associated with organized crime networks in Southeast Asia.

On-Chain Analysis

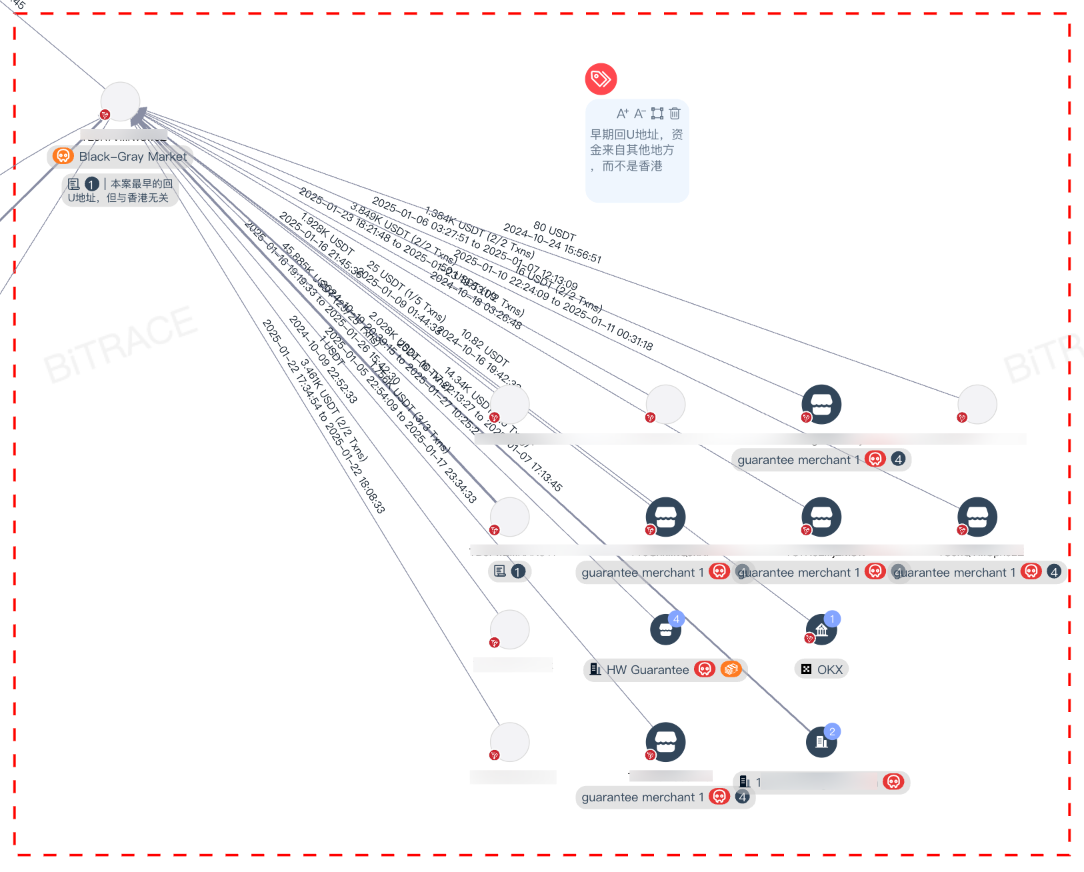

Funds analysis of the designated receiving address TTb8Fk shows that the student purchased 2,396 USDT from the specified exchange shop. These funds subsequently flowed into the escrow platform merchant address TKN5Vg, which has long maintained business ties with two Southeast Asian entities: HuioneGuarantee and NewcoinGuarantee.

These two escrow platforms have long provided services for organized crime operations in Southeast Asia, including illegal online gambling, black-gray industry activities, money laundering, and fraud. In this incident, they played a role in processing upstream fraudulent funds.

This indicates a malicious incident where a Southeast Asian fraud group exploited Hong Kong-based cryptocurrency exchange shops to launder money.

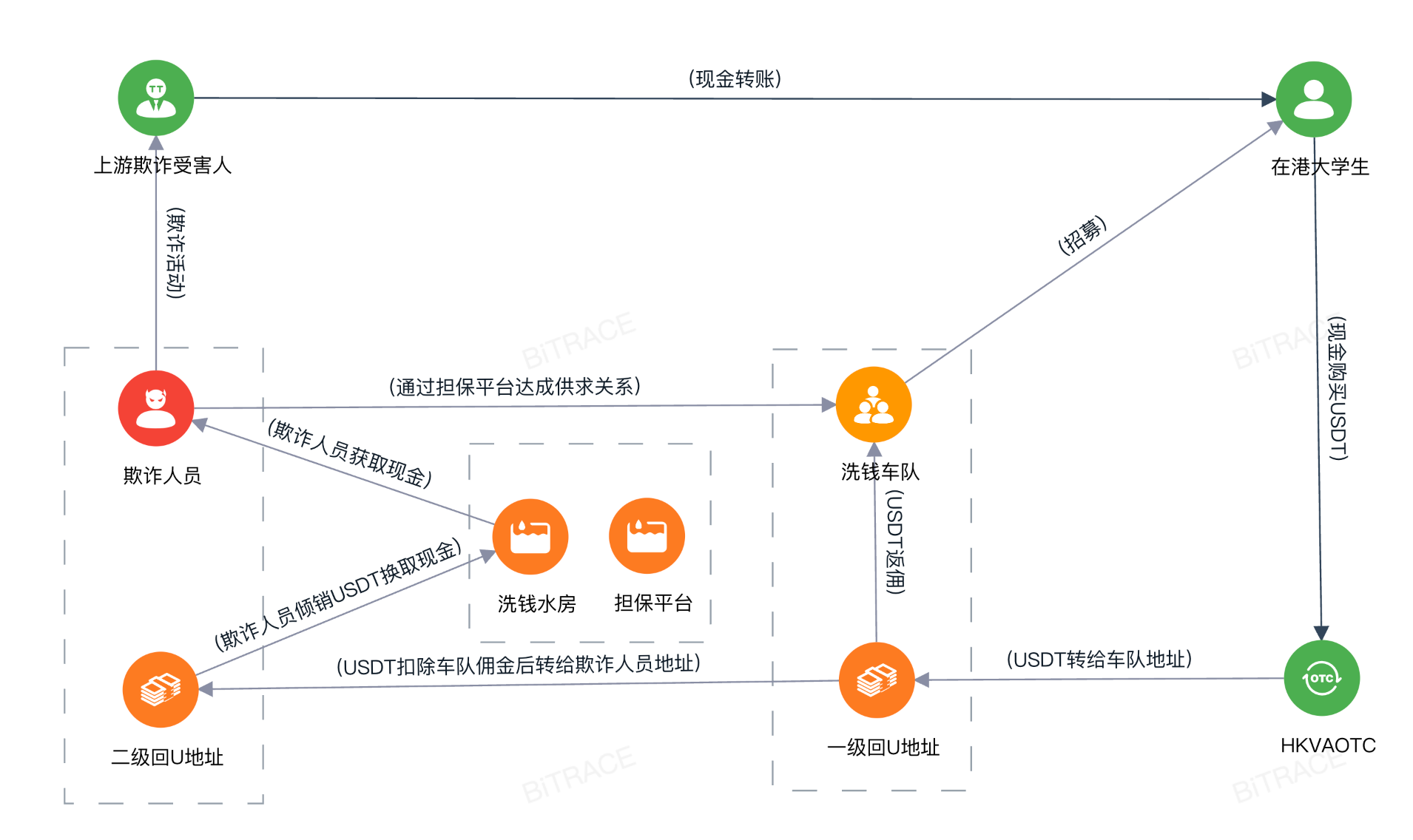

The model follows the common "card-to-crypto (Crypto-based money laundering)" method: after obtaining illicit fiat funds from fraud victims, money launderers quickly convert them into USDT via over-the-counter markets and transfer them back to the fraudsters’ blockchain addresses, earning commissions in the process. Since purchasing USDT requires numerous bank cards and real-name information, launderers often recruit large numbers of part-timers to form a "money laundering syndicate (Crypto Laundering Syndicate)." These individuals are commonly referred to as "card farmers" or "runners."

In this incident, the mainland student unknowingly became a money laundering runner, assisting the launderers together with Hong Kong VAOTCs in completing the fund conversion. The acquired USDT first entered the syndicate’s address; after deducting commissions (calculated at a 33% rebate rate), the funds were transferred to escrow merchants and ultimately settled through the escrow platforms.

Industrialization of Crime

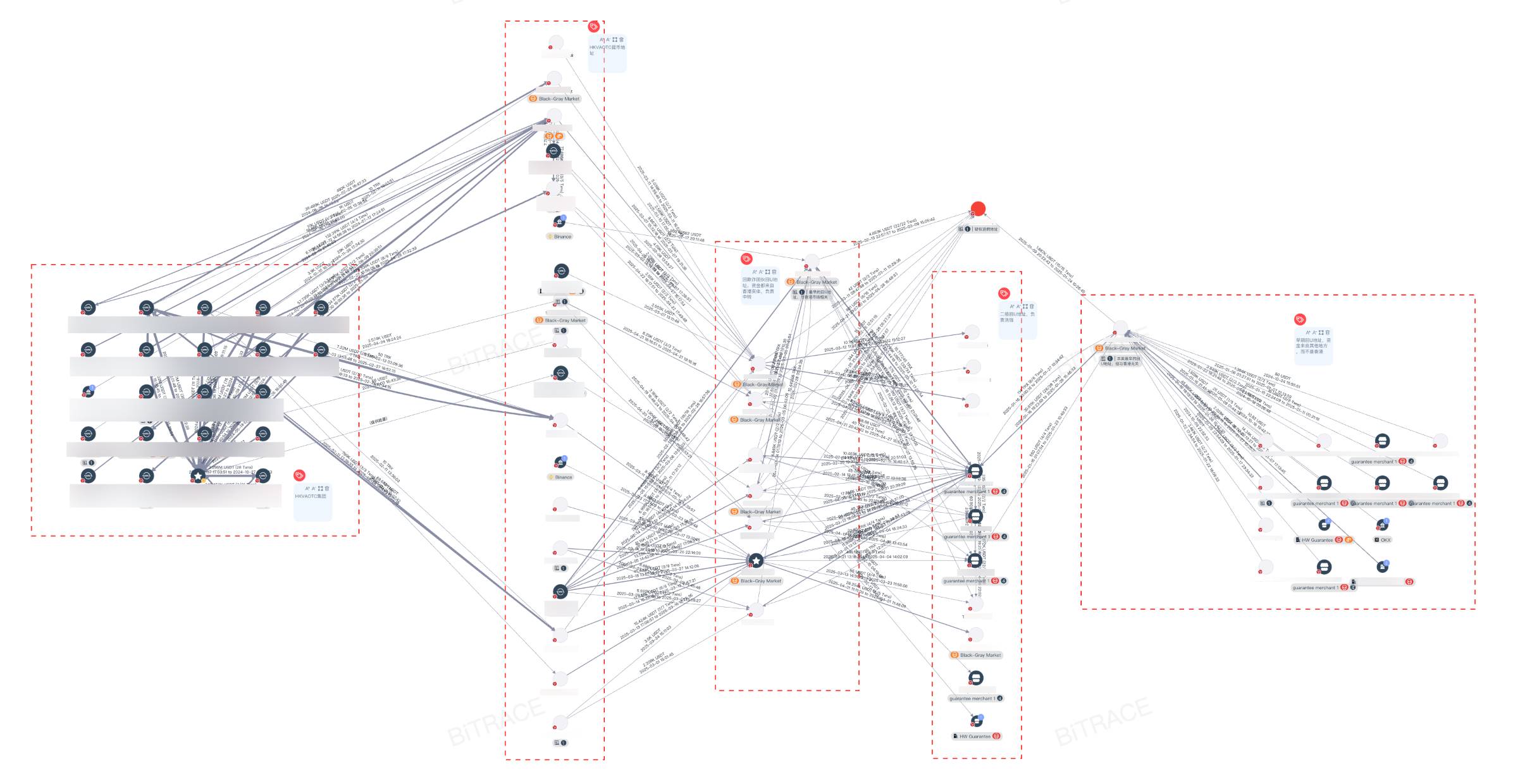

Bitrace further expanded its investigation on the syndicate’s rebate address TGeZzC, revealing that this money laundering incident is not isolated but merely the tip of a highly industrialized large-scale money laundering gang.

Tracing the funding sources of the rebate address, seven other primary "return-U" addresses (top three on left) were identified. These addresses operate at the same level as TTb8Fk and receive varying amounts of USDT from Hong Kong exchange shops (first and second on left, HKVAOTC). Of these funds, 33% is sent to the rebate address (highlighted in red), while 67% goes to secondary "return-U" addresses (second on right), each then offloading funds through escrow platforms. The entire process exhibits clear division of labor.

Analysis shows these addresses have been active since 2024. Initially, their funding sources were unrelated to Hong Kong but instead linked to numerous high-risk black-gray industry addresses in Southeast Asia, further indicating the gang’s deep connections with organized crime networks in the region.

In less than three months, this single money laundering syndicate has already illegally laundered over $310,000 through Hong Kong using the same methods. Considering that other addresses in this case remain unexpanded or other gang addresses undetected, the actual scale of such industrialized money laundering exploiting HKVAOTCs may be significantly larger.

Hong Kong's VAOTC Industry on the Brink of Dawn

Shao Shiwei, a lawyer at Shanghai Manqin Law Firm, stated that globally, regulatory frameworks for OTC traders have yet to achieve full uniformity. However, major OTC operating jurisdictions such as Hong Kong, the EU, and the United States have begun formulating relevant legislation and licensing regulations.

Taking Hong Kong as an example, the Financial Services and Treasury Bureau (FSTB) released a legislative consultation paper in February 2024 regarding virtual asset over-the-counter (OTC) services. The document proposed a key recommendation: introducing a licensing regime for OTC providers under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). Under this proposal, Hong Kong plans to establish a licensing management system for OTC providers via AMLO, with the core objective of ensuring these companies meet compliance requirements such as anti-money laundering (AML) and know-your-customer (KYC).

This means all companies providing virtual asset over-the-counter services, including OTC dealers, must apply for corresponding licenses from Hong Kong Customs (CCE) and strictly comply with relevant laws. However, as of now, the legislation remains in the consultation phase, with specific implementation rules and effective dates pending official government announcement.

Industry Operators Must Proactively Respond to Regulation

Current VAOTCs have become an indispensable part of the cryptocurrency market, playing an extremely critical role in market stability and industry development. With Hong Kong poised to introduce OTC compliance policies, industry operators must adopt a more proactive and positive attitude toward meeting regulatory requirements.

Operators within the industry not only need to strictly adhere to the upcoming licensing regime but also establish and improve internal compliance systems to ensure all transaction activities meet AML and KYC compliance standards.

At the same time, operators should further strengthen communication with regulatory bodies, actively understand the latest policy developments, and actively participate in industry self-regulatory organizations to contribute to the standardized development of the entire industry.

During this process, industry operators especially need to prioritize refusing any association with crypto funds involved in illegal activities. By implementing strict customer due diligence and transaction monitoring measures, they can identify and resist suspicious fund flows, avoiding providing convenience for illegal activities.

This not only helps maintain the company's own reputation but also represents an important fulfillment of corporate social responsibility.

Overall, the upcoming OTC compliance policy in Hong Kong presents a significant opportunity for the virtual asset over-the-counter trading industry to achieve standardized development. Industry operators should firmly seize this opportunity, proactively adapt to changing regulatory environments, continuously enhance their compliance levels, and thereby strengthen their competitiveness. Only in this way can they remain invincible in Hong Kong’s flourishing crypto economy market and achieve long-term, stable growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News