Solana reinvents MEV with atomic arbitrage dominating half of transactions—hidden treasure trove or new type of收割?

TechFlow Selected TechFlow Selected

Solana reinvents MEV with atomic arbitrage dominating half of transactions—hidden treasure trove or new type of收割?

A new type of atomic arbitrage is becoming the primary source of transactions on the Solana chain.

Author: Frank, PANews

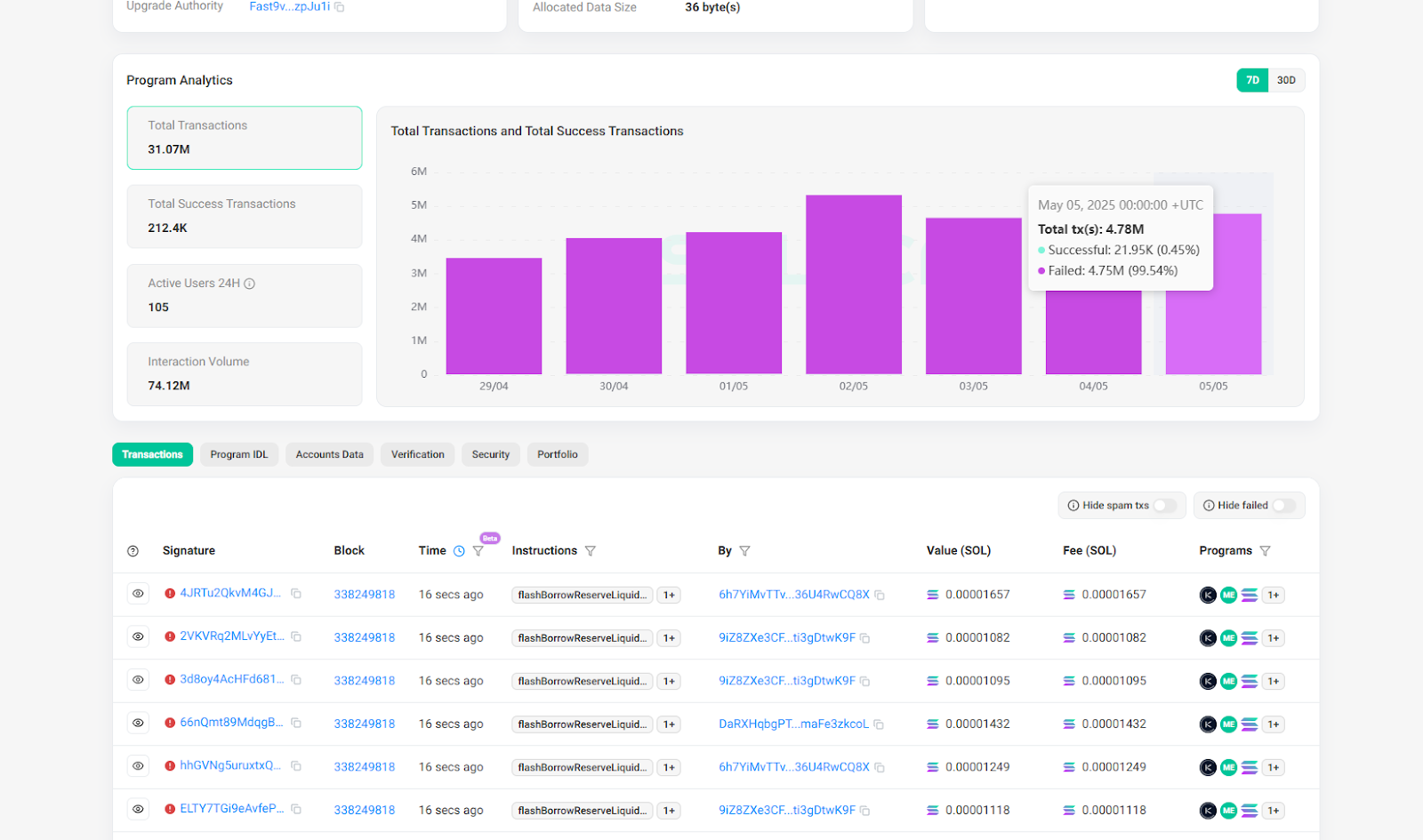

As various DEXs begin offering personalized priority fee options and frontrunning protection measures, sandwich attack profits on Solana have noticeably declined. As of May 6, this figure has dropped to 582 SOL, whereas just a few months ago, the daily average profit for a single sandwich attack bot was nearly 10,000 SOL. However, this is not the end of MEV. A new form of atomic arbitrage is now becoming the primary source of transactions on the Solana blockchain.

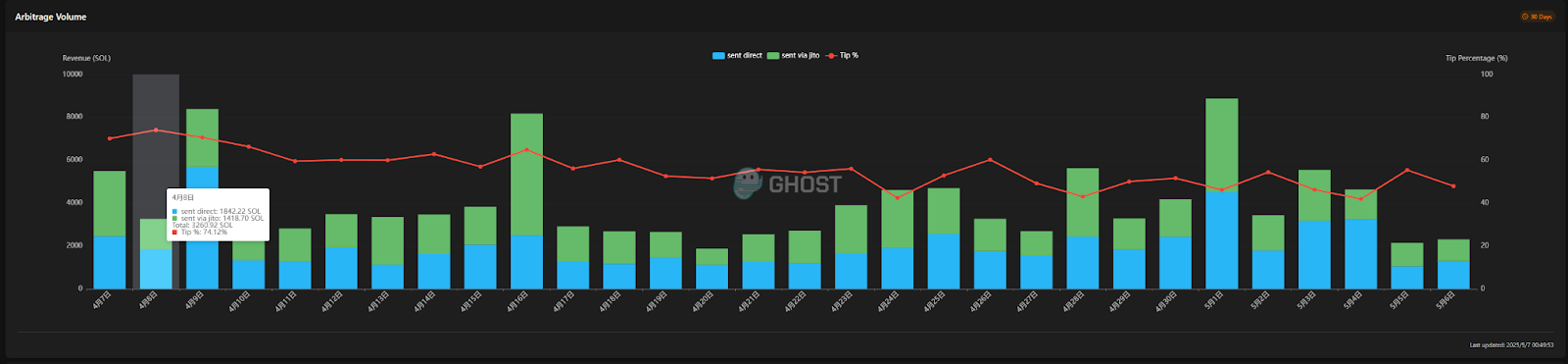

According to data from sandwiched.me, atomic arbitrage has reached an extraordinary level of dominance on-chain. On April 8, atomic arbitrage accounted for 74.12% of all transaction tips, and at other times it generally remains above 50%. This means that roughly every two transactions on Solana today may involve atomic arbitrage.

Yet on social media, discussions about atomic arbitrage are almost non-existent. Is this new arbitrage opportunity a hidden treasure trove, or merely another sophisticated tool for extracting value?

Atomic Arbitrage: A New Approach to MEV Trading

First, what exactly is atomic arbitrage? Atomic arbitrage refers to executing multi-step arbitrage operations within a single, atomic blockchain transaction. A typical example involves buying an asset at a lower price on one decentralized exchange (DEX) and immediately selling it at a higher price on another DEX—all within the same transaction. Because the entire process is encapsulated in a single atomic transaction, it naturally eliminates counterparty risk and partial execution risks present in traditional cross-exchange or non-atomic arbitrage. If the transaction succeeds, profits are locked in; if it fails, aside from losing gas fees, the arbitrageur's assets revert to their original state, avoiding scenarios where only the buy executes without the sell.

Atomicity is not a feature designed specifically for arbitrage but rather a fundamental property inherent in blockchains to ensure state consistency. Arbitrageurs cleverly leverage this guarantee by bundling operations—such as buying and selling—that would otherwise require multiple steps with execution risks into a single atomic unit, thereby eliminating execution risk at the technical level.

Traditional sandwich attacks or trading bots typically focus on identifying profitable opportunities within a single trading pair, using transaction bundling to sandwich opponents' trades or sending sequential transactions to create favorable outcomes. Atomic arbitrage also relies on transaction bundling, but instead focuses on identifying price differences across multiple liquidity pools to capture arbitrage opportunities.

The Myth of High Profits vs. Harsh Reality

From current data, atomic arbitrage appears to offer substantial profit potential. Over the past month, atomic arbitrage on Solana has generated 120,000 SOL (worth approximately $17 million). The most profitable address spent only 128.53 SOL in costs but earned 14,129 SOL—a 109x return. One single transaction achieved even greater returns: spending just 1.76 SOL to earn 1,354 SOL, yielding a 769x return on a single trade.

Currently, there are 5,656 identified atomic arbitrage bots. Each address earns an average of 24.48 SOL ($3,071), with an average cost of around $870. While these figures may not match the earlier profits of sandwich attackers, they still seem like a decent business—especially considering a monthly return rate reaching 352%.

However, it should be noted that the displayed costs here refer only to on-chain transaction fees. Behind atomic arbitrage lies additional expenditure.

According to information published by an MEV developer, hardware requirements for executing atomic arbitrage include a private RPC and an 8-core, 8GB server. In terms of cost, server expenses range from $100 to $300 per month, while setting up a private RPC node costs at least around $50 monthly. Total monthly costs fall between $150 and $500, representing only the minimum threshold. Additionally, to execute arbitrage faster, users often need servers with multiple IP addresses.

Looking at real-world examples, a recent snapshot from an atomic arbitrage deployment platform shows that only 15 addresses earned more than 1 SOL in the past week, with the highest being 15 SOL. Most others earned less than 1 SOL during the week, and many were actually operating at a loss. When factoring in server and node costs, all bots on this platform may likely be running at a net loss. Clearly, many addresses have already stopped arbitraging.

Who Is Actually Profitable? Unveiling the Illusion of "Guaranteed Profits"

Of course, reality seems to contradict the big-picture data. Overall statistics suggest atomic arbitrage bots on Solana are still profitable. Yet the "80-20 rule" still applies—only a small number of highly sophisticated bots capture the majority of gains, while the rest remain the new韭菜 (losers).

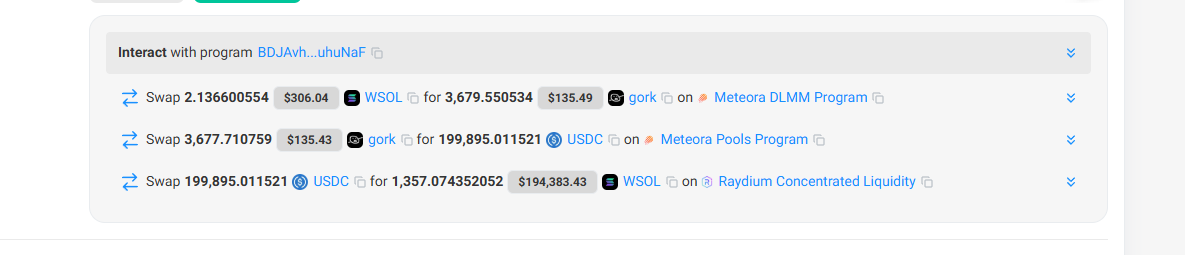

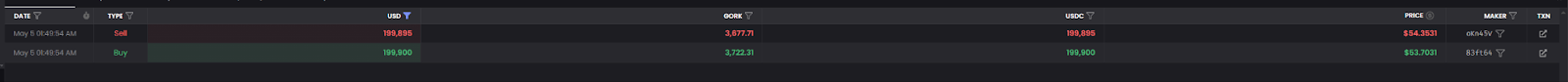

Reviewing the overall logic of atomic arbitrage, the key to profitability lies in identifying arbitrage opportunities. Take the most profitable trade as an example: the transaction initially used 2.13 SOL to purchase 3,679 grok tokens (at ~$0.08 each), then sold them for $199,000 (~$54.36 per token). Clearly, this successful arbitrage exploited a thin liquidity pool, likely triggered by a large buyer who failed to check pool depth.

But such opportunities are inherently rare. Given that nearly all bots on-chain monitor similar events, these occasional large wins resemble winning the lottery.

The recent rise of atomic arbitrage may stem from developers packaging this opportunity as a "risk-free" business, offering free versions and tutorials to novice users while taking a 10% cut of any profits. Additionally, these teams charge subscription fees for helping users set up nodes and servers or providing multi-IP services.

In practice, due to most users' limited technical understanding and reliance on identical monitoring tools, actual earnings are minimal and often fail to cover basic operational costs.

Based on PANews' observations, unless participants possess solid technical expertise, unique arbitrage detection tools, and high-performance servers and nodes, most individuals hoping to join atomic arbitrage are simply shifting from being victims of token speculation to paying for servers and subscriptions. As participation grows, the probability of failed arbitrage increases. For instance, the top-performing bot on sandwiched.me currently experiences over a 99% failure rate—meaning nearly all its transactions fail, yet participating bots still incur on-chain fees.

Before diving into this seemingly attractive wave of "atomic arbitrage," every potential participant must maintain clear judgment, fully assess their own resources and capabilities, beware of overly promoted claims of "guaranteed profits," and avoid becoming another wave of losers in this new "gold rush."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News