Morph: Firing the first shot for consumer-grade public chains—why does it have the chance to become a super entrance?

TechFlow Selected TechFlow Selected

Morph: Firing the first shot for consumer-grade public chains—why does it have the chance to become a super entrance?

If you believe the future of Web3 is lifestyle-oriented and widespread, then Morph is worth following closely.

1. From an industry cycle perspective, why are consumer-grade blockchains a must-have in this cycle?

In past crypto cycles—from DeFi Summer to the NFT boom, then infrastructure leaps and meme-driven narratives—the industry has continuously innovated.

But now, increasingly rich infrastructure stands in sharp contrast to shrinking liquidity and slowing user growth. This structural contradiction has become the biggest challenge facing the industry today.

Especially in the blockchain sector, the dominant narrative used to be: "higher TPS + lower gas fees + more DeFi apps." But as technical gaps narrow and innovation converges, the model of simply "hype new blockchains" is rapidly losing effectiveness, with declining speculation momentum and shifting real demand.

Put simply: people no longer want a "faster casino," but rather a "usable chain."

Against this backdrop,新一代 blockchains like Morph—focused on consumer use cases—are becoming an inevitable product of industry evolution.

There are two deep underlying drivers:

On a macro level, Web3 as next-generation internet infrastructure must evolve beyond pure financial functions to support real-world consumption, social interaction, content, and broader needs.

On a micro level, the industry’s traffic logic must be rebuilt. Future growth engines must rely on experience-driven organic traffic—daily high-frequency scenarios where users willingly stay and spend.

To enable this transformation, traditional finance-oriented blockchains (e.g., those overly focused on DeFi) are inherently unsuitable. Consumer-grade blockchains will become the new gateway and experiential foundation. Morph may be positioned precisely at this inflection point.

2. Morph: Technological and Strategic Breakthroughs for a Consumer-Grade Blockchain

1. Core Technical Advantages: Balancing Performance and Security

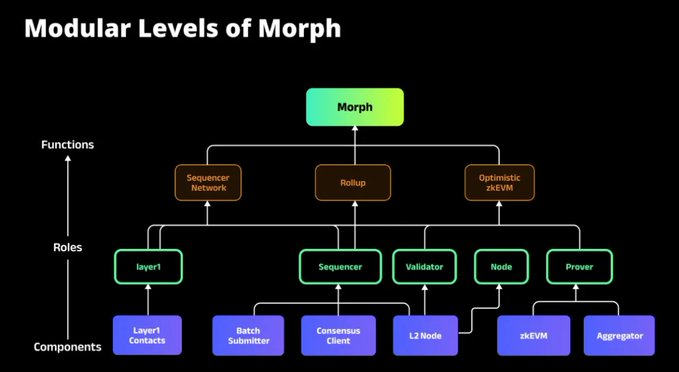

Architecturally speaking, without over-explaining, it's broadly similar to other blockchains—mainly sequencers for consensus and execution, proof mechanisms for state validation, and data availability. On top of this, the project introduces its own innovations and optimizations.

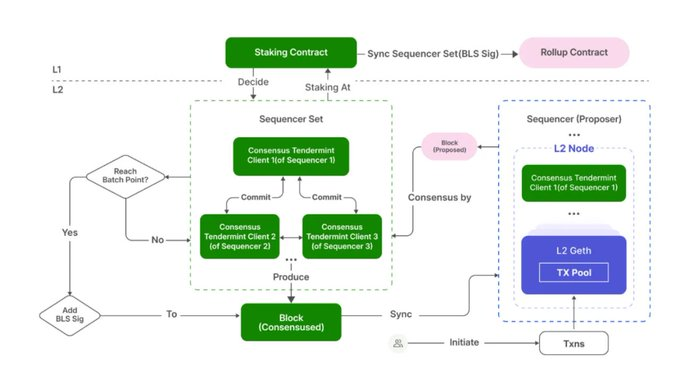

1. Hybrid Rollup innovation (Optimistic + ZK): Morph uniquely combines Optimistic zkEVM with Responsive Validity Proofs (RVP), merging the low cost of Optimistic Rollups with the high security of ZK Rollups. This greatly reduces the challenge window, speeds up withdrawals, and lowers overall fees.

2. Decentralized sequencer: No longer relying on a single centralized sequencer, effectively resolving one of the biggest pain points in traditional Layer2s—MEV monopolization and transaction censorship—ensuring fairness and high availability in transaction processing.

3. Modular architecture: Supports independent upgrades and evolution of different modules, enabling flexible adaptation to future scalability needs such as EIP-4844 and SP1 zkVM, ensuring Morph's long-term technological adaptability.

From a technical standpoint, Morph’s architectural logic isn’t about isolated breakthroughs, but systemic integration and innovation—achieving a balance among performance, security, and user experience.

2. Strategic Positioning Advantage: Extending from Transactions to Daily Life

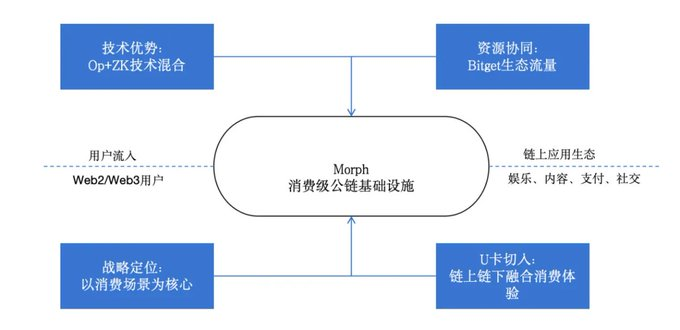

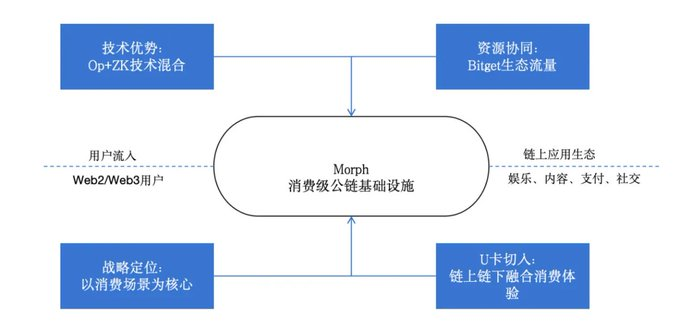

1. Centered on "consumer scenarios," Morph is not just another chain touting "TPS" or "DeFi." Instead, it clearly positions itself as infrastructure serving "on-chain consumer applications" (entertainment, social, lifestyle). Morph focuses on areas like on-chain content, social, entertainment, and payments—scenarios capable of truly activating daily needs for hundreds of millions of users, moving beyond mere financial speculation.

2. By leveraging strong resources and traffic synergies with platforms like Bitget, Morph creates potential co-growth effects, sharing users, brands, and channels to accelerate real user acquisition and ecosystem cold-start. For such projects, traffic barriers are critical early on; blockchains with stable, efficient user onboarding channels will find it easier to build initial ecosystem momentum.

3. More than a U-card: Building Web3’s Alipay—product and brand strength on the rise

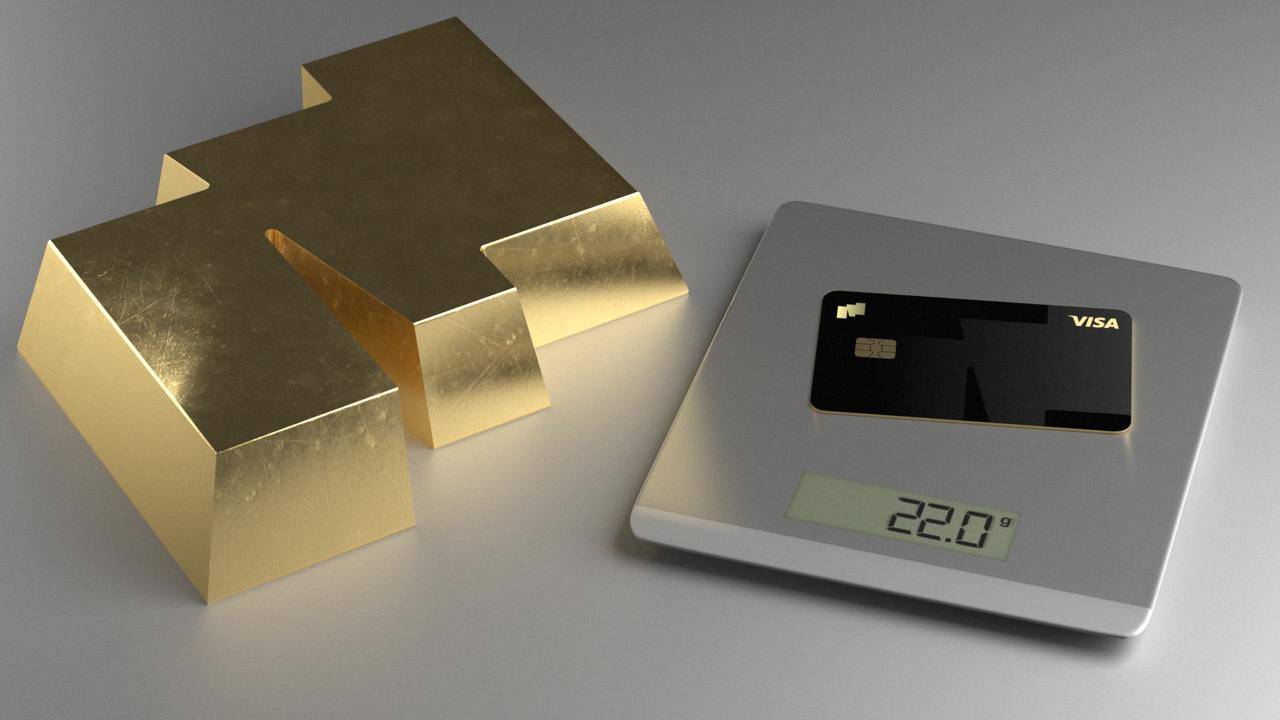

Backed strongly by Bitget and DCS—one of Singapore’s top-tier card issuing institutions—Morph’s Black Card sparked immediate industry buzz upon launch, generating widespread discussion within Web3 and successfully breaking into the Web2 consumer finance space.

Despite some operational controversies, there is near-consensus on one point: the Morph Black Card, as a consumer product bridging on-chain and off-chain worlds, has preliminarily validated the vast real demand for frequent connections between on-chain financial services and everyday life.

This reflects Morph’s deep strategic thinking and compliance planning. While superficially resembling traditional "U-cards," it fundamentally transcends tool functionality—it’s more like a foundational Web3 gateway connecting on-chain financial accounts, off-chain consumer benefits, and compliant clearing networks.

The Morph Black Card is issued by DCS, a licensed bank in Singapore, with full integration into card networks, product structure review, KYC, AML certification, and risk control audits—all conducted under MAS (Monetary Authority of Singapore) regulation.

Moreover, Morph doesn’t treat the Black Card merely as a "payment tool." It incorporates a comprehensive benefits system typically reserved for premium Web2 credit cards. This layered value not only makes the card scarce but also reflects Morph’s deep vision for a "consumer-grade entry point": turning on-chain identity into credentials for premium real-world experiences and transforming crypto assets into everyday usable "credit assets."

Morph’s deliberate strategy reveals that the project’s core ambition isn't to cash in on short-term hype, but to build a long-term system that is compliant, secure, convenient, and globally accessible.

4. Underlying Account System Enables Ecosystem Closure: Card Issuance Is Just the Beginning

The Morph Black Card is not an isolated financial product—it’s a key component of Morph’s broader account system. This system supports not only card issuance and payments, but will also serve as the foundational infrastructure for future Web3 wealth management, identity, loyalty points, and membership systems: enabling on-chain accounts linked to off-chain identities; supporting crypto storage, exchange, and investment—similar to a Web3 version of "Alipay"; and integrating various Web3 apps and third-party financial tools to create an open financial ecosystem.

Building on this, Morph is creating an "account-as-financial-entry" system: every card and every account is not just a payment tool, but a central identity hub connecting diverse Web3 services (consumption, trading, finance, social).

3. Morph’s Potential Challenges and Long-Term Value

Although consumer applications are widely seen as the next growth curve, their cold start difficulty and operational demands far exceed those of DeFi protocols.

First, from a risk perspective, challenges remain in implementation timelines and industry competition—areas requiring ongoing development and breakthroughs.

Challenge 1: Consumer scenario adoption requires sustained, robust operations

The earlier disputes around the Morph Black Card and Platinum Card benefits were a microcosm of operational difficulties—not just testing the project’s understanding of the "card" concept, but also its ability to design effective user experiences. The product still falls under "consumer financial services," meaning users consider not just perks and experience, but also service continuity, security, and compliance when making medium- to long-term decisions. Even though the Black Card opened new possibilities, the project must still deliver experiences that make daily use natural and intuitive—and continue user education efforts.

Challenge 2: Intensifying competition demands faster, more effective branding and ecosystem building

As Morph opens the "consumer-grade blockchain" narrative window, it's foreseeable that more L2s—and even some new L1s—will quickly follow, entering the on-chain consumer market. Some high-TPS blockchains have already begun focusing on "content ecosystems," and Ethereum Rollup chains might soon join the race for consumer narratives.

Under these conditions, establishing brand recognition and building an initial ecosystem before the narrative becomes saturated will directly determine Morph’s competitive standing. This means it’s not enough to explain *what* it is—they must make users *feel* it works well.

Although consumer-grade blockchains face long cold starts and extremely high operational demands, based on Morph’s current technical architecture, strategic positioning, and resource synergy capabilities, it possesses multiple potentials to overcome early hurdles and enter the next growth phase:

Value 1: On-chain consumer applications are a long-term trend; Morph’s positioning is highly unique

As the industry moves toward saturation-level competition, blockchains that genuinely bridge on-chain apps with users’ daily consumption are extremely rare. On the demand side, Web3 users are no longer satisfied with DeFi speculation—they want on-chain platforms to support real, continuous, high-frequency life experiences like payments, socializing, and content consumption.

On the supply side, most L1s and L2s remain stuck in native financial apps (DEXs, lending) and short-cycle narratives (e.g., memes), with very few projects truly focused on on-chain consumer experiences and actual deployment capability.

As a first-tier player in the consumer-grade blockchain space, Morph has the potential to capture user mindshare over the next 2–3 years and establish a rare position as the "entry point for on-chain daily consumption."

Value 2: Morph has exceptional technical scalability, adaptable to future narrative shifts

Thanks to its modular design and hybrid Rollup architecture, Morph can flexibly adapt to industry evolution. For example, as sharding advances, Morph can quickly reduce data availability costs; through sequencer decentralization, it can build a more secure and censorship-resistant base layer; and in the future, it could support emerging on-chain consumer applications like on-chain advertising and subscription services. Overall, Morph is not locked into a single technical framework, but is an open platform capable of dynamic evolution alongside the industry—endowed with long-term technological vitality.

Value 3: Clear advantages in resources and capital, with strong long-term synergy potential

Setting aside recent public opinion noise, in the medium to long term, Morph benefits from powerful platforms like Bitget, which provide continuous traffic, distribution channels, and brand resources—injecting users and capital into the on-chain consumer ecosystem. It may eventually close the loop between on-chain and off-chain consumption, forming a unique user moat. On the capital side, Morph has secured strategic investments from multiple top-tier funds, providing solid backing for ecosystem support and application incubation.

Value 4: The account system forms the basis of a super gateway—with strong systemic moats

Morph’s essence isn’t measured by "how many cards it issues," but by using the account system behind the cards to build a super entry point capable of hosting asset management, identity binding, on-chain payments, loyalty points, and even Web3 social.

In the future, all user on-chain activities can expand within this account system to include wealth management, lending, payments, memberships, and more. This will become the foundational barrier for any consumer application aiming for scale.

Therefore, the Morph Black Card is not an isolated product, but a crucial piece in building the vision of "account-as-financial-hub." In the long run, this system represents the true foundational moat that sets Morph apart from other Layer2 projects.

4. Conclusion: Morph Could Become the Super Entry Point for On-Chain Living Infrastructure

Judging from current industry trends, we must acknowledge that Web3 is undergoing a profound shift in fundamental logic—moving from asset speculation to real consumption; evolving from financial leverage to life experience; transitioning from purely on-chain systems to integrated on-chain/off-chain models.

Within this trend, Morph offers a comprehensive, systematic solution combining technology, strategy, and resource synergy. Despite unfavorable recent publicity, in the longer term, if it can steadily advance application deployment, complete cold start efficiently, and gradually grow its base of real users, Morph’s long-term value will extend far beyond being just another blockchain. It could become the foundational infrastructure for next-generation on-chain living—potentially evolving into Web3’s Alipay, WeChat, or even a super entry point.

Overall, Morph—a consumer-grade blockchain with clear positioning, solid technology, and forward-looking strategy—has indeed hit a pivotal moment in the industry’s narrative shift.

Whether Morph can fully realize this potential hinges on its operational capability, ability to capture user mindshare, and continuous strengthening of its ecosystem moat.

From an investment research perspective, if the keyword of the last cycle was "protocol depth," the keyword of the next cycle will be "experience breadth." What Morph aims to achieve is打通 the entire user lifecycle path across "assets-identity-consumption-credit."

We must recognize that in a new era that has moved beyond crude growth toward refined operations, Morph is attempting to offer a vision much closer to the real future: on-chain living, not just on-chain speculation.

And this path may be the necessary journey for Web3 to truly go mainstream and change the world.

If you believe Web3’s future is one of everyday life and mass adoption, then Morph is worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News