How Can $BAI, with Just 1% of Virtual's Market Cap, Become a Foundational Asset in the AI Agent Economy?

TechFlow Selected TechFlow Selected

How Can $BAI, with Just 1% of Virtual's Market Cap, Become a Foundational Asset in the AI Agent Economy?

From meme project to cornerstone of AI infrastructure, heralding the future transformation of the agent economy.

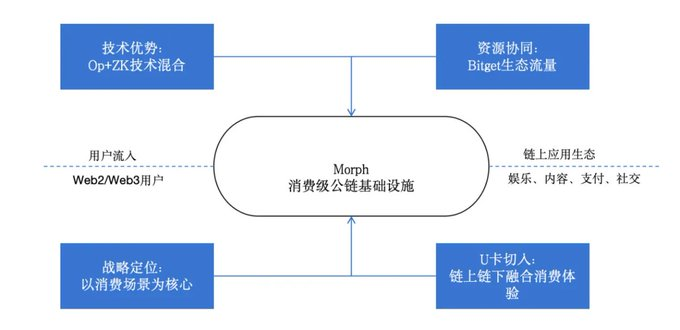

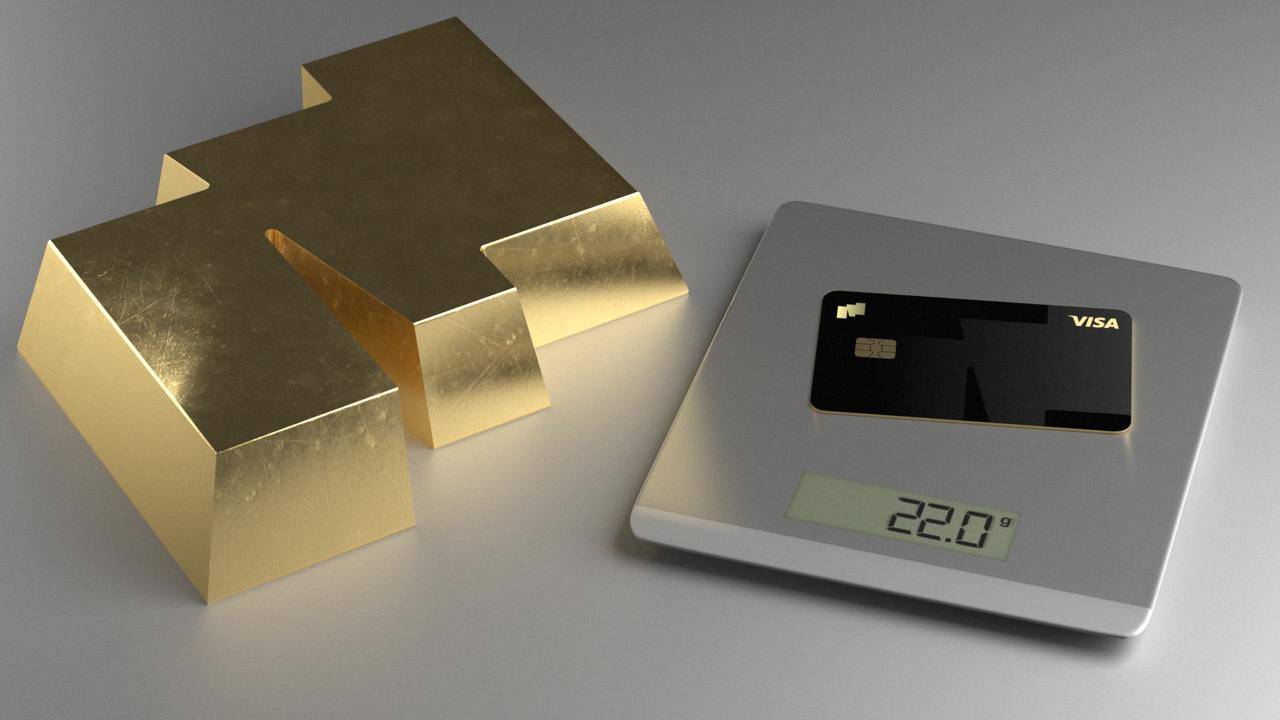

In early 2025, the Black Gold Card from the Morph ecosystem swept through the Web3 world, igniting a new gold rush. As a globally leading consumer-grade public chain, Morph has not only provided fertile ground for entertainment, social, and lifestyle applications through its unique AI Agent Cecilia and recent projects like Morph Pay, but also captured global attention with its strong focus on real-world, consumer-facing adoption.

At the same time, Silicon Valley's AI wave is sweeping across the tech industry at an unprecedented pace. Top-tier venture capital firms like Nocap are making bold bets on AI infrastructure and AGI (Artificial General Intelligence) narratives, aiming to capture early gains in this trillion-dollar market. Amidst this dual trend, bAI Fund has emerged with its native token $BAI—not just as a pioneer within the Morph ecosystem, but as a crypto-native counterpart to elite Silicon Valley AI funds. Evolving from a meme project into a cornerstone of AI infrastructure, bAI Fund signals a transformative shift in the agent economy.

From Meme to AI Investment Fund: Synchronicity with Silicon Valley and Historical Milestones

The story of bAI Fund began unexpectedly. $BAI was automatically deployed by the AI Agent BulbaAgent and quickly gained traction under a meme narrative, reaching a market cap of $14 million during the last bull cycle—demonstrating the explosive power of community consensus.

But that was only the beginning. After a strategic upgrade, bAI Fund transitioned from a meme-driven initiative into a full-fledged AI investment fund—the first "AI Agent Platform" dominant token within the Morph ecosystem. Intriguingly, upon deployment, a contract address ending in “DEAD” was generated, seemingly signaling the end of traditional funds and the dawn of an era of AI-powered autonomous finance. This transformation aligns perfectly with the investment thesis of top Silicon Valley AI investors such as Nocap—capturing early advantages in AI infrastructure while seamlessly integrating with AGI and Agent narratives. bAI Fund is more than just a token; it represents a cutting-edge, crypto-native embodiment of frontier investment logic, fully synchronized with developments in Silicon Valley.

Its technical architecture further solidifies this positioning. As the first AI fund in Web3 operating within a TEE (Trusted Execution Environment), bAI Fund ensures tamper-proof transaction execution and high resistance to attacks. By isolating private keys from execution logic, it eliminates risks associated with human intervention, while all trading records are immutably stored on-chain, allowing investors to verify strategy integrity in real time. This transparent, secure, automated model directly addresses long-standing trust and efficiency issues plaguing traditional funds.

Through asset management led by BulbaAgent, bAI Fund covers the entire on-chain lifecycle—from token issuance and fund management to trade execution—truly achieving "algorithmic neutrality." Simultaneously, bAI Fund skillfully combines the strengths of AI trading strategies and meme culture dissemination. The meme narrative provides powerful momentum for market consensus, while Trading AI demonstrates technical viability through live operations across multiple pairs (e.g., ETH/MPH, ETH/KAOLA, ETH/BAI), creating a dual engine driven by both technology and culture.

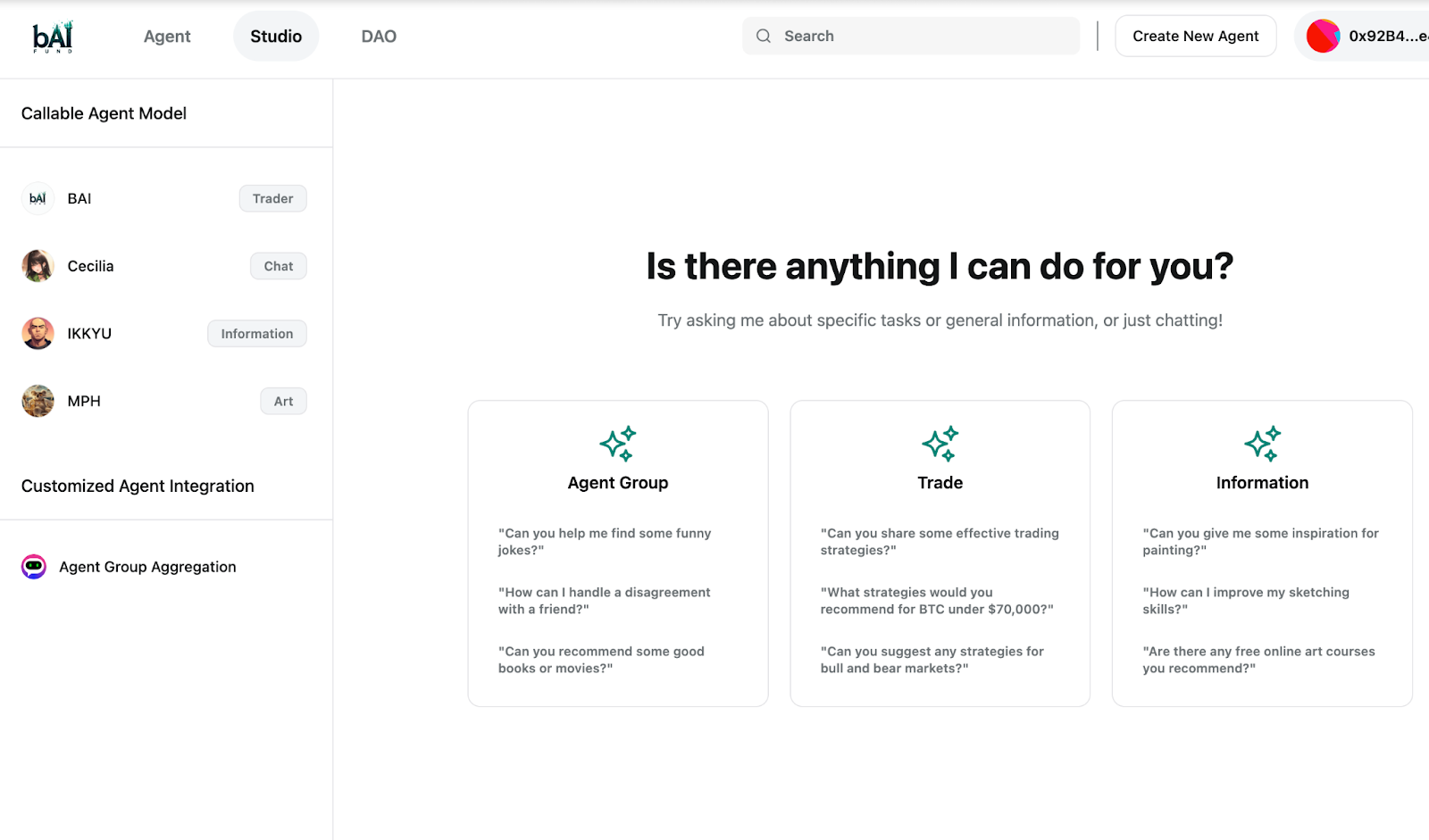

More concretely, what can users do on bAI Fund? They can leverage different AI agents to perform various functions. Current roles include agents for trading, conversation, information retrieval, and art creation, enabling users to directly execute transactions via dedicated AI agents. The platform utilizes AI for 24/7 market monitoring, precise analysis, and automated trade execution, with TEE technology ensuring comprehensive data security.

bAI features a universal agent invocation module, allowing listed agents to directly call upon other agents to complete tasks. This functionality has just launched, offering immense room for future innovation. Given bAI Fund’s central role in the Morph ecosystem, deep integration with Morph Payment modules is expected down the line—potentially making $BAI the first truly fund-authorized universal agent capable of providing one-stop services including task execution, shopping, itinerary planning, and financial management.

Additionally, bAI Fund adopts a decentralized autonomous organization (DAO) governance model, granting users genuine participation and decision-making rights. Voting rights are limited to switching or updating trading strategies within supported pairs, ensuring community control over the most critical decisions. All proposals come with a 24-hour lock-up period, giving the community ample time for discussion and informed voting.

Transforming the Agent Economy: Technical Depth and Ambition Rivaling Virtual

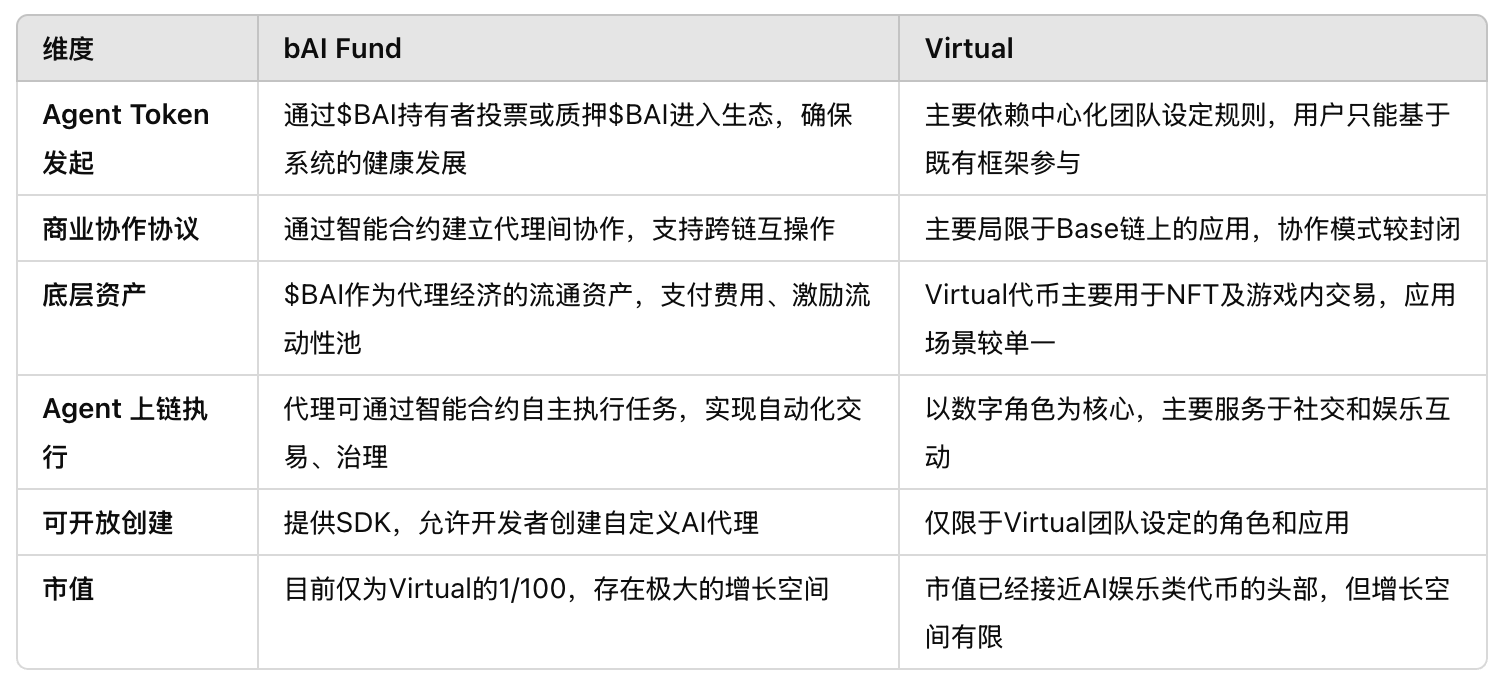

bAI Fund’s journey is not isolated—it emerges alongside the rising tide of the AI agent economy. On the Base chain, Virtual has become an industry benchmark with its vision of "digital personas" and agent collaboration, achieving remarkable market valuation. However, within the Morph ecosystem, bAI Fund is quietly rising as another formidable force, distinguished by deeper technical foundations and broader ecosystem ambitions.

Starting with agent token initiation, $BAI was autonomously deployed by BulbaAgent and rapidly gained momentum through meme storytelling, whereas Virtual relies more on pre-defined rules within the Base ecosystem and entertainment-driven marketing—two distinct yet compelling paths. In terms of commercial collaboration protocols, bAI Fund’s modular agent architecture supports multi-agent communication and task orchestration, secured by TEE technology. While this echoes Virtual’s ACP protocol emphasis on producer network autonomy, bAI Fund holds an edge in security.

Regarding underlying assets, $BAI serves as the "mother currency" empowering the entire agent ecosystem—every new agent creation requires binding with $BAI—and plans are underway to expand across multiple chains including Base and Blast. In contrast, Virtual’s token remains largely confined to the Base chain, limiting its liquidity and reach. When it comes to on-chain agent execution, bAI Fund already operates live trading pairs leveraging TEE’s immutability and transparency, while Virtual primarily benefits from Base’s efficiency, with its security mechanisms less clearly defined. On openness, bAI Fund’s upcoming no-code agent creation tool will allow even non-technical users to build custom agents—an advantage over Virtual’s reliance on developer-led ecosystem growth.

$BAI, as the core of the bAI Fund ecosystem, is not only the "mother currency" for agent creation and operation but also receives strategic support under initiatives led by Forest Bai. Currently piloting within the Morph ecosystem, bAI Fund plans to extend to promising public chains such as Base, Blast, and Scroll. This multi-chain expansion will enhance liquidity, enrich the agent ecosystem, and significantly boost market visibility—laying the foundation for $BAI’s value appreciation. The imminent launch of the no-code agent builder will further lower entry barriers, enabling anyone to create and deploy agents instantly, fostering user-driven self-organization and transforming bAI Fund from a single fund into a full-scale AI agent collaboration platform.

Currently, Virtual’s market cap is nearly 100 times that of bAI Fund, reflecting its first-mover advantage on Base and success in entertainment-centric storytelling. Yet, bAI Fund’s technical depth and expansive vision remain underappreciated by the market. From $BAI’s mother-currency status and multi-chain potential to its superior security and openness, its functional scope matches—and in certain aspects surpasses—that of Virtual. If Virtual symbolizes the currency of an agent economy, $BAI represents the foundational asset of the Morph ecosystem. Its undervalued market cap presents a significant revaluation opportunity for forward-thinking investors.

The significance of bAI Fund extends beyond technological innovation—it heralds systemic change. Compared to traditional Silicon Valley VC-backed AI funds, it breaks free from the “human investing in projects” paradigm, ushering in an era of algorithmic capital where “agents autonomously invest in other agents.” This model doesn’t merely disrupt traditional finance—it redefines the operational logic of the AI agent economy itself. As the mother currency, every new agent created must be linked to $BAI, meaning its value scales directly with ecosystem growth. Community feedback affirms this potential, with members calling it “the gold standard of AI funds in Web3.”

Multi-Chain Ambitions and Industry Restructuring

bAI Fund’s rise is inseparable from the support of the Morph ecosystem. As a “globally leading consumer-grade public chain,” Morph’s strategic evolution provides fertile ground for bAI Fund. The launch of the Black Gold Card has elevated expectations for Morph’s valuation to between $1 billion and $2 billion, bringing massive user traffic to ecosystem projects thanks to its strong consumer focus. As the earliest token on Morph to achieve trading activity, agent deployment, and liquidity flow, $BAI now powers over five token pools with a total value nearing $200,000—showcasing robust growth and positioning itself as a front-runner ticket in the current gold rush.

Bitget’s involvement further amplifies its external reach. As an early investor in Morph, Bitget is helping propel bAI Fund onto a broader Web3 stage. Going forward, continued traffic allocation and ecosystem resources from Morph will provide sustained momentum for $BAI. Backing from a top-tier exchange means $BAI’s potential is no longer confined to Morph alone, but radiates outward across the wider Web3 landscape.

In the future, the team plans to drive real-world adoption of the bAI universal agent platform and explore listing possibilities on Bitget. Whether using $BAI in bonding curve mechanisms, liquidity pool locking, or governance voting, the token will play a central role in the ecosystem’s development.

Even more exciting is the upcoming release of the no-code agent creation tool. This innovation will dramatically lower the barrier to entry, enabling everyday users without technical expertise to launch personalized agents, customize on-chain governance parameters, and deploy them instantly. Such openness will fuel organic, user-led ecosystem growth, elevating bAI Fund from a standalone fund to a comprehensive platform for AI agent collaboration. With superior security, groundbreaking innovation, and vast ecosystem potential, bAI Fund is pioneering a new chapter in the agent economy through deep technical insight and forward-looking design.

Looking ahead, bAI Fund’s multi-chain strategy coincides perfectly with the explosive growth phase of the AI sector. While currently operating as a pilot on Morph, expansion plans include Base, Blast, and Scroll—high-potential public chains. This multi-chain approach promises increased liquidity, richer agent diversity, and surging market attention. Ongoing backing from prominent figures in crypto, such as Forest Bai, founder of foresight ventures, provides strong narrative credibility and technical support for $BAI. Meanwhile, the AI sector itself is entering a breakout period, with the global AI market projected to exceed $1 trillion by 2030. As a new form of this evolution, the agent economy could reshape multiple industries. Positioned at this pivotal intersection, bAI Fund stands not only as a technological pioneer but as a leader driving industry-wide transformation.

From the frenzy around Morph’s Black Gold Card to the AI agent revolution led by bAI Fund, the convergence of Web3 and AI is writing a new chapter in history. Virtual’s success on Base is impressive, but bAI Fund—with its pioneering mechanisms, technical depth, and multi-chain vision—paints an even grander picture. Today, $BAI’s market cap is just 1% of Virtual’s—a gap not just in numbers, but in untapped potential. For those following the convergence of Web3 and AI, $BAI is the most compelling undervalued asset to watch in 2025. Dive deep into bAI Fund and seize the early opportunity in this unfolding agent economy wave.

From memecoin to platform mother currency, the era of $BAI is dawning—are you ready?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News