Morph Pay: A New Era Begins, Surpassing BAYC, NFT 3.0 Ushers in the Future of Off-Chain Finance

TechFlow Selected TechFlow Selected

Morph Pay: A New Era Begins, Surpassing BAYC, NFT 3.0 Ushers in the Future of Off-Chain Finance

Every Morph Pay cardholder is writing the history of the next-generation Web3 payments.

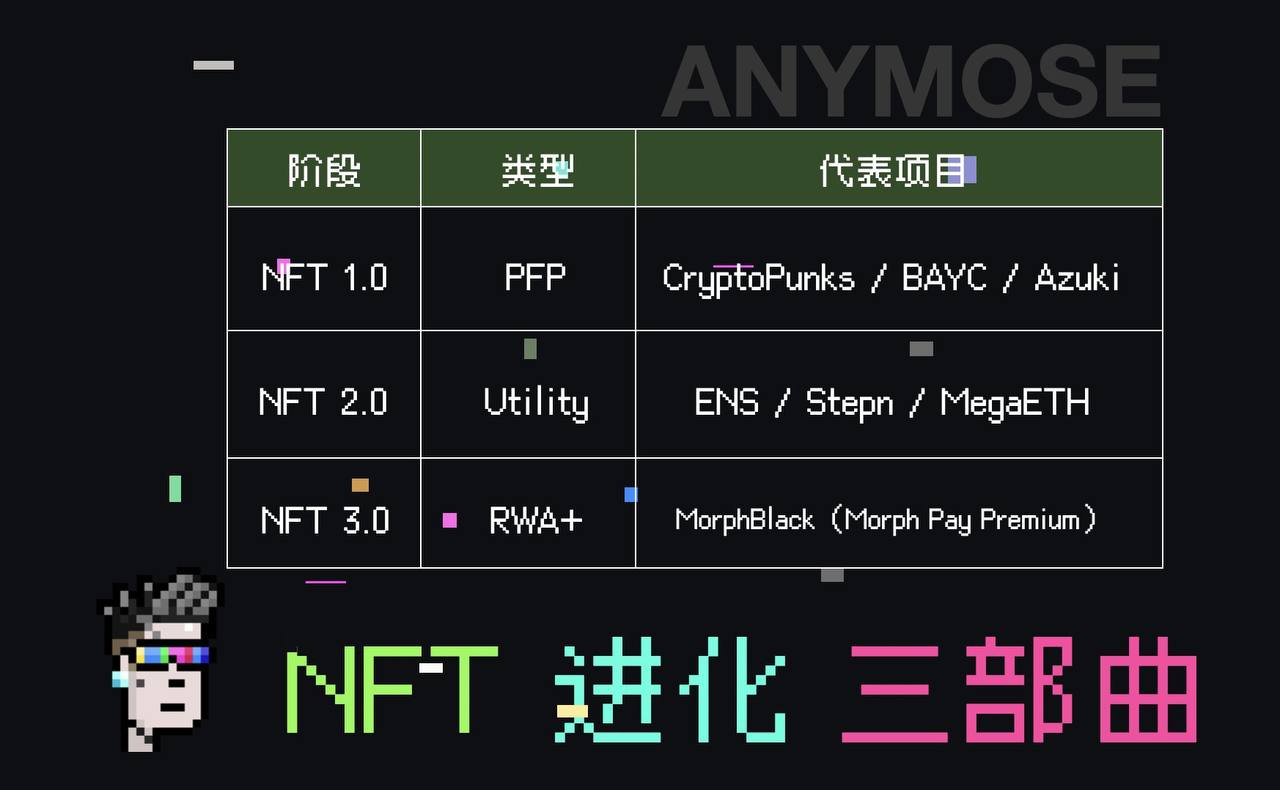

Each crypto cycle carries the central narrative of decentralization—from early ICOs, to DeFi Summer in 2021, and now on-chain narratives in this current cycle. Shifts in asset issuance models and financial power structures continue to profoundly shape the evolution of Web3. At the Crypto Native level, NFTs have officially entered their 3.0 era; at the Web2 gateway layer, PayFi—the bridge connecting traditional finance with Web3—is emerging as the next world-changing, billion-dollar-scale frontier.

On February 25, Morph, a global consumer-grade public blockchain dedicated to driving mass adoption of Web3, officially launched Morph Pay—a comprehensive financial ecosystem that integrates Web2 banking infrastructure with Web3 decentralized finance yield capabilities. Morph Pay is more than just a conventional payment card—it’s a groundbreaking product born from the convergence of RWA and the NFT 3.0 wave.

This article will explore how Morph Pay has emerged as a disruptive force in the PayFi space, and trace the evolutionary logic of NFTs from version 1.0 to 3.0.

PayFi, But Much More Than Just PayFi

PayFi creates new financial primitives and product experiences based on the time value of money, innovatively reshaping capital flows in financial markets. The global payments market alone is estimated to exceed $40 trillion, yet PayFi currently occupies only a small fraction of it. Conservatively, if PayFi captures just 10% of global digital payment transaction volume, its market size could reach $1.8 trillion by 2030.

A One-Click Payment Tool with Integrated 30% APY

The pain points in traditional payments stem from complex multi-party approvals and manual processes within legacy financial and supply chain systems. Even a simple wire transfer requires filling out lengthy forms and waiting for human approval, not to mention high cross-border fees and processing costs—factors that prevent traditional payment providers from offering real benefits to consumers.

From this vantage point, Morph Pay addresses these challenges head-on. Leveraging platform-level advantages, Morph Pay supports multi-currency payments and integration with Google Pay and Apple Pay, enabling seamless cross-border transactions with just a password entry.

As a payment product launched by the consumer-grade public chain Morph, it offers users an all-in-one DeFi yield aggregation solution, delivering up to 30% annualized returns on crypto deposits. It also enables users to automate smart contract operations, allowing DeFi yields to be directly used for everyday spending—seamlessly bridging asset appreciation with real-world payment scenarios. Additionally, users can participate in exclusive ecosystem airdrops and incentive programs offered by Morph and its partners, such as the rapidly growing BulbaSwap and Momodrome.

"Buy Now, Pay Never" is no longer just a buzzword sketched on a PowerPoint slide.

Luxury Black Card Meets Mass Web2 Adoption

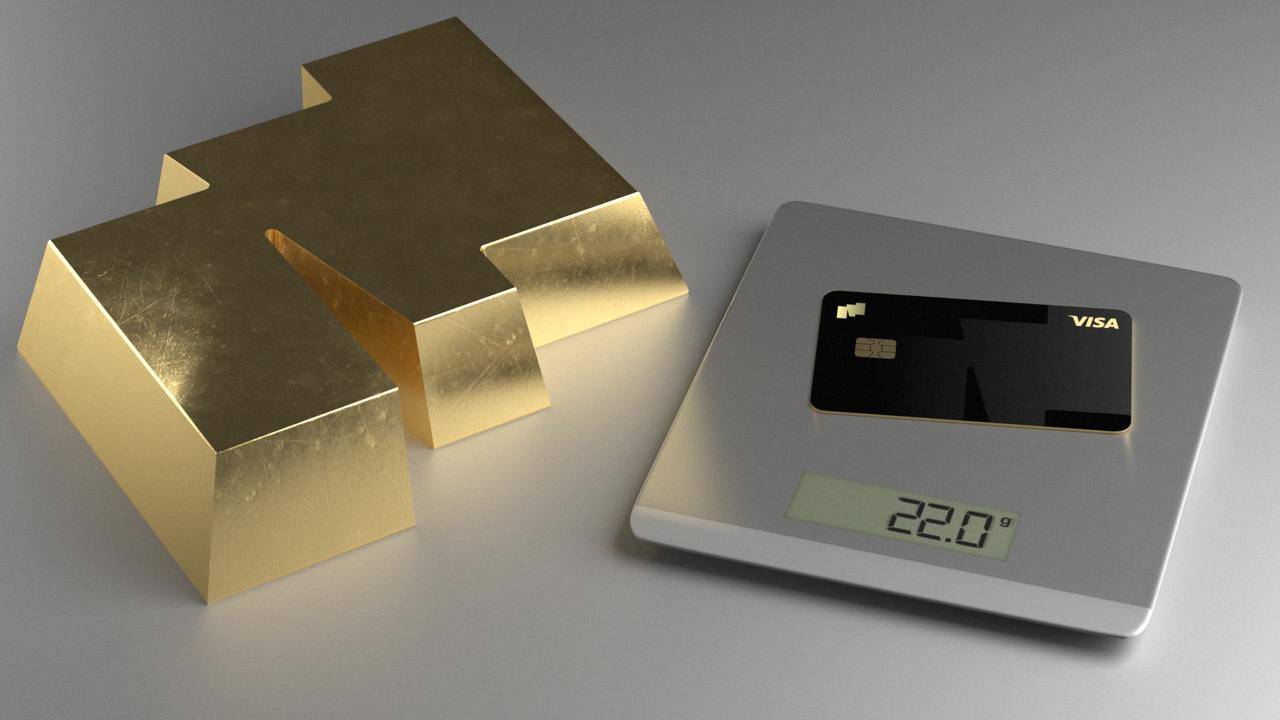

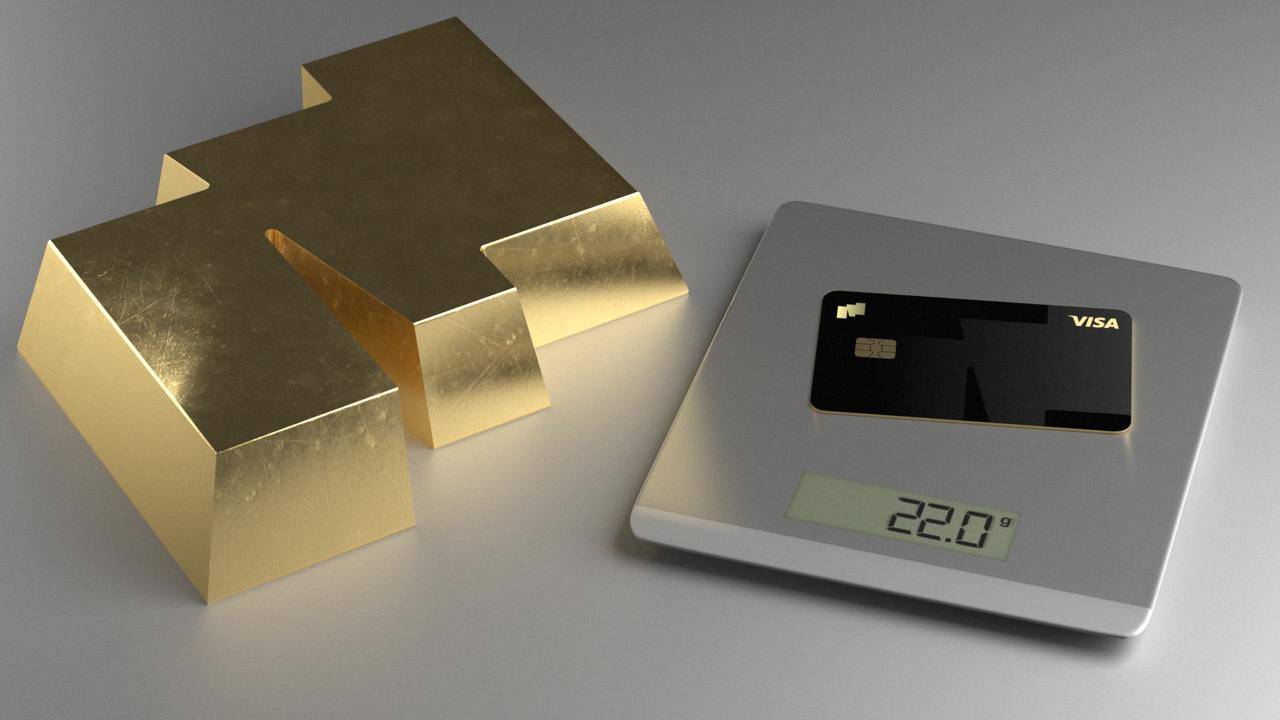

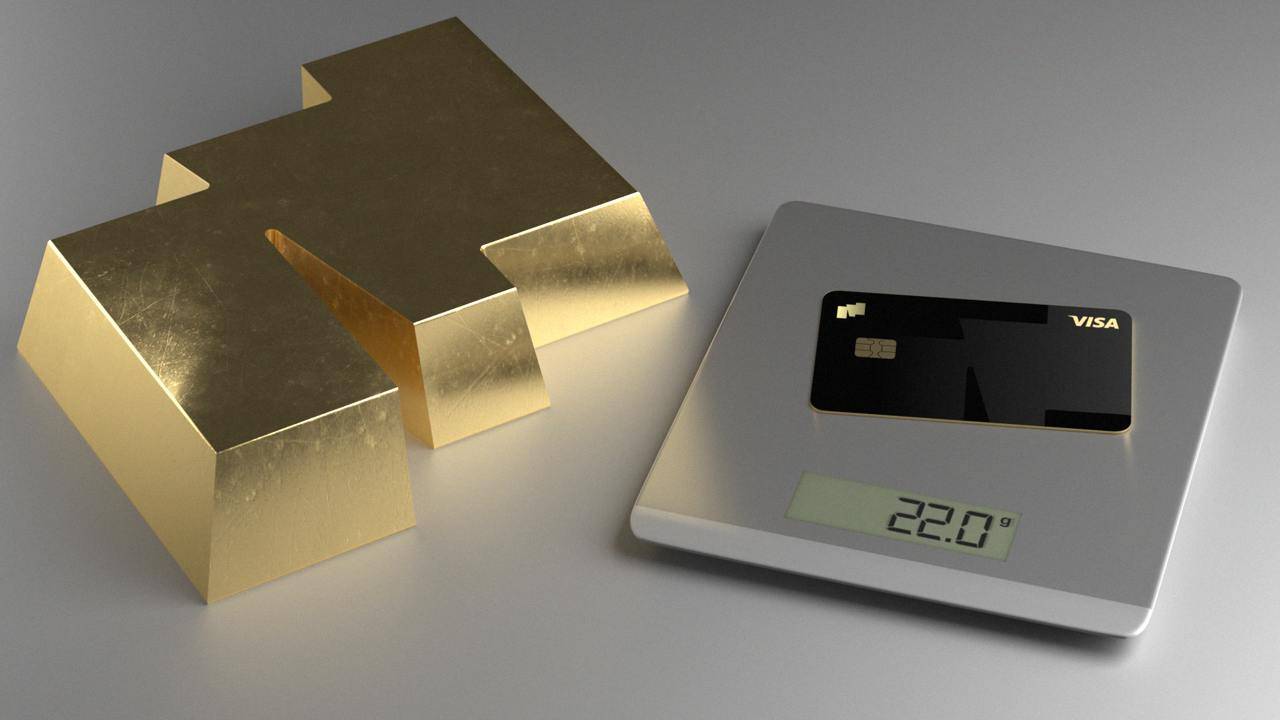

MorphBlack, the flagship version of Morph Pay, is crafted from 22 grams of black gold, combining a physical black card with both financial utility and luxury branding.

In traditional finance, black cards are symbols of wealth and status, typically held by political leaders, billionaires, and celebrities. For example, American Express Centurion (the "Black Card") is reserved for elite clients globally. In China, black card holders are considered top-tier banking customers. Morph Black now brings this prestige into the crypto world: “The first black card for young people” ushers in a new era of luxury financial services in crypto. Cardholders enjoy privileges like access to VIP airport lounges and premium hotel discounts, along with lifetime no annual fee, no lock-up requirements, and instant fiat conversion—delivering a frictionless experience where “crypto assets are available anytime, anywhere.”

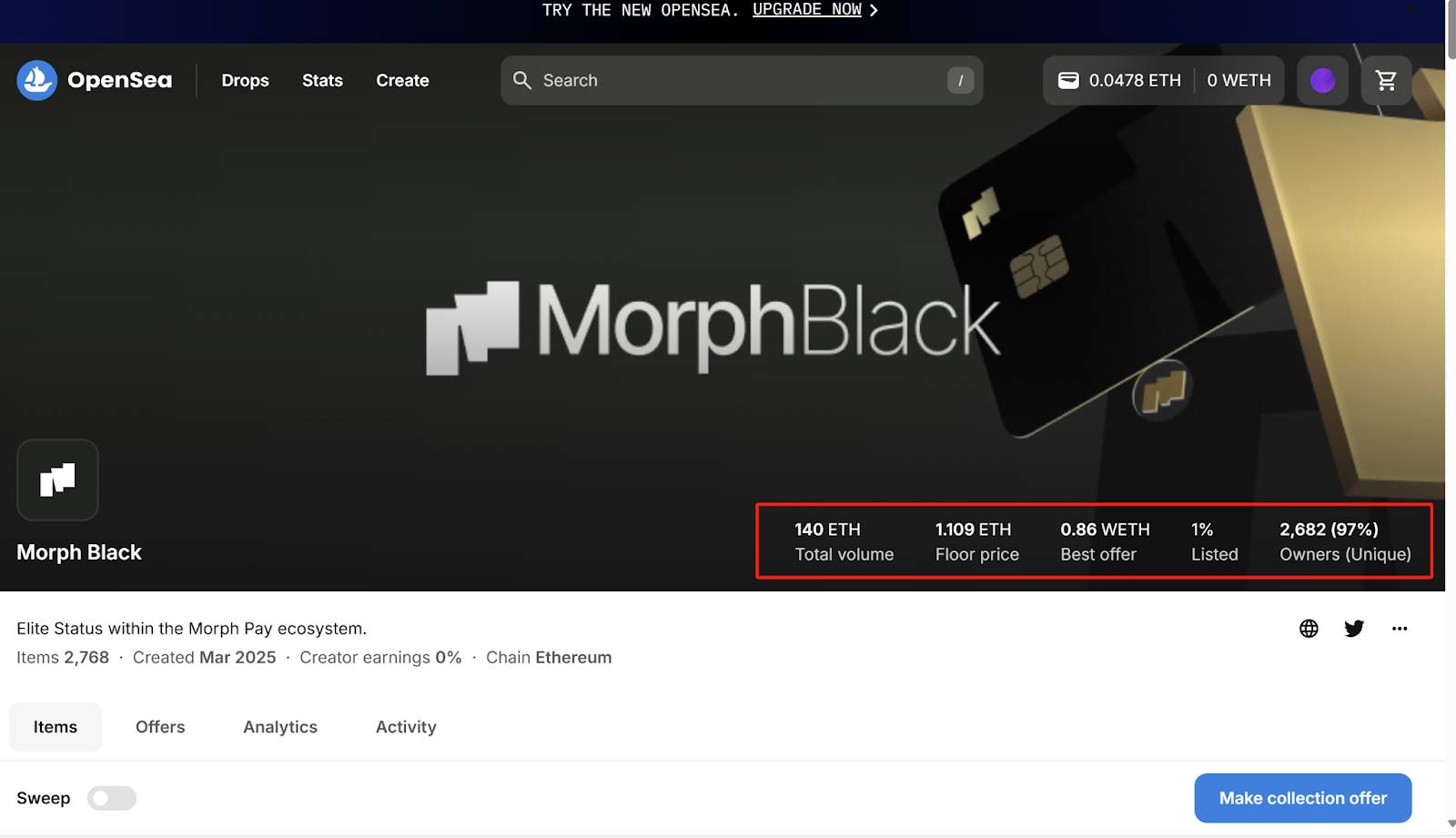

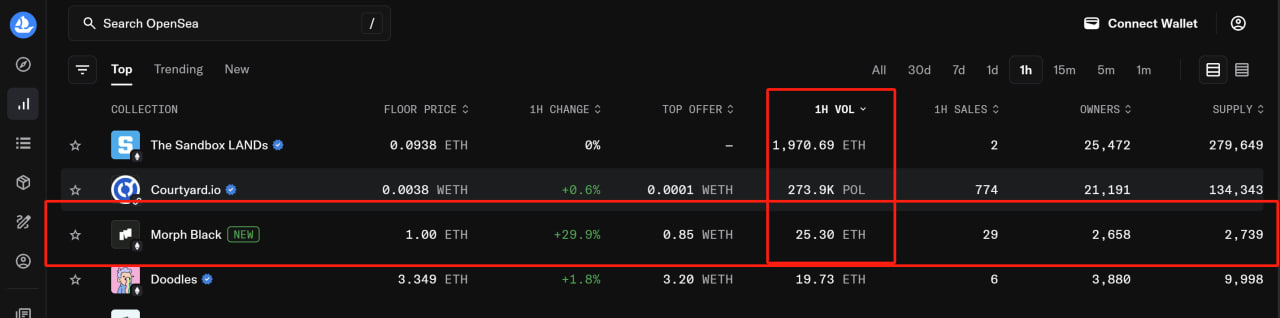

Yet Morph Pay does not merely reinvent the wheel within PayFi. While enhancing user payment experiences, the launch of MorphBlack marks the official arrival of the NFT 3.0 era through a single physical card.

Building the Future of Financial Infrastructure via NFT 3.0

In 2022, the NFT market experienced an unprecedented bubble burst. High-value NFTs like BAYC and Azuki plummeted, prompting many to declare “NFT is dead.” But the truth runs deeper. Just as Google and Amazon emerged after the dot-com crash, NFTs never stopped evolving—they’ve transitioned from “bubble-fueled euphoria” to “digital-physical symbiosis.” NFTs aren’t dead—they’ve simply shed their extravagant skins and evolved into stronger, more resilient forms. When Morph turns an NFT into a physical bank card, it doesn't just change how we pay—it redefines the financial architecture between digital and physical worlds.

Pre-NFT Era: Awakening Amidst the Bubble

NFT 1.0 was defined by PFP (profile picture) avatars—both golden opportunities and speculative bubbles. In 2017, CryptoPunks ignited the NFT revolution with algorithmically generated pixel art. In 2021, BAYC sparked a frenzy around “ape clubs” as social identity symbols. This phase represented pure “digital identity signaling,” where people spent heavily on artistic narratives and community belonging. However, once the market realized the limited practical utility of PFPs, the bubble collapsed.

NFT 2.0 marked the awakening of utility—“moving from abstraction to real use cases.” As the PFP craze faded, the industry began embedding tangible utilities into NFTs, ushering in the NFT 2.0 era. Take ENS domains, which are built on Ethereum's ERC-721 standard—each ENS domain is effectively an NFT, tradable and manageable just like any other NFT. Similarly, gaming item NFTs like StepN’s “move-to-earn” sneakers linked real-world behavior with virtual economies, adding functional depth to NFTs.

These innovations persist today, with rights-bearing NFTs becoming mainstream. Katio grants holders voting rights and airdrop eligibility, while MegaETH creatively uses SBTs as an innovative fundraising mechanism in this cycle. During this phase, NFTs began carrying real functions—but remained fundamentally “online tools,” unable to break beyond the boundaries of the digital realm.

Post-NFT Era: The “Physical Survival” of NFTs

In 2025, as Web3 regulatory frameworks advance, NFT evolution reaches a pivotal turning point: the transition from NFT 2.0 to NFT 3.0. NFTs are now deeply integrating with real-world assets (RWA), becoming bridges to the physical economy. The landmark product symbolizing this revolution is Morph’s world-first physical NFT bank card—Morph Black.

Morph Black unifies on-chain and off-chain benefits. An NFT is no longer just a digital token floating in financial speculation—it becomes a unique, high-end digital identity that can be used for real-life payments, spending, and consumption. This move perfectly aligns with the megatrends of RWA and PayFi.

From a vertical perspective, Morph Black consolidates multiple Web3-native utilities:

(1) Simply holding a Morph Pay card automatically makes you a co-builder of the ecosystem, granting priority access to potential airdrops from Morph and its partners (such as BulbaSwap and Momodrome). According to the official tokenomics, 10% of the ecosystem tokens are allocated specifically to reward Pay users—ensuring early adopters benefit from long-term protocol growth.

(2) Morph Pay returns governance power to the community. Cardholders can deeply influence protocol development through proposal voting and parameter adjustments—deciding critical matters like airdrop distribution rules and yield pool weights. The “cardholder-as-shareholder” model transforms users from passive fund providers into active ecosystem participants.

(3) The Morph Black card, designed for high-net-worth individuals, leverages institutional-grade risk management protocols like Ethena and Huma to build its underlying yield pool. Combined with liquidity subsidies and anticipated airdrops from the Morph ecosystem, it creates a compound yield engine delivering up to 30% APY. This hybrid model—low-risk base returns plus ecosystem incentives—achieves returns far beyond what traditional finance can offer, all while maintaining capital security.

Horizontally, Morph Black pioneers a comprehensive financial ecosystem that merges Web2 banking infrastructure with Web3 DeFi yield capabilities. Morph Pay supports unverified withdrawals of up to $1 million USDT per transaction, completely solving the problem of large-scale asset liquidation. The Morph Pay team has also built an ultra-efficient fee and cashback system: crypto-to-fiat exchange fees as low as 0.3%, and 1% cashback on cross-border purchases—unlocking real purchasing power for digital assets in daily life, free from withdrawal concerns. Morph Black is among the first applications to successfully map RWA onto on-chain rights and achieve genuine real-world adoption in Web2 environments—marking the accelerated arrival of NFT 3.0.

Conclusion

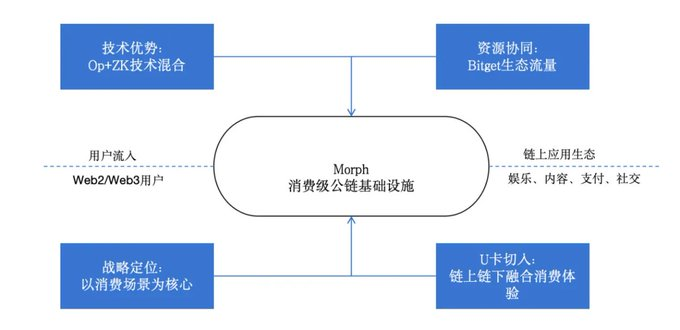

In today’s PayFi landscape, traditional U-cards essentially serve to funnel Web2 users into Web3—they’re savings accounts leveraging high crypto APYs to attract external traffic. Morph Pay, however, is the first true Web3 U-card: it natively connects on-chain rights with the Morph ecosystem, creating end-to-end integration from Crypto Native to real-world Web2 applications.

Morph, as a global consumer-grade public chain, has not yet undergone TGE, and its ecosystem continues to evolve. Moving forward, it plans to collaborate with more projects, financial institutions, and payment solutions to deepen the integration between Morph Pay and the broader Morph ecosystem, expanding its application scope. Morph Pay’s journey—from PayFi to NFT 3.0—is only just beginning. It’s still early.

Here, every purchase embodies “Buy Now, Pay Never”; here, every payment advances the era of rights-bearing NFTs. In this era of profound transformation, Morph Pay will reshape the future of Web3 finance with the 22-gram “weight of the soul.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News