Interview with Alliance DAO Partner qw: Crypto entrepreneurs are fleeing to AI, 90% of Crypto+AI projects are pseudo-proposals

TechFlow Selected TechFlow Selected

Interview with Alliance DAO Partner qw: Crypto entrepreneurs are fleeing to AI, 90% of Crypto+AI projects are pseudo-proposals

One of the most successful crypto VCs in this cycle, how to approach "cross-border investing" in Crypto and AI?

Interview: Jack, BlockBeats

Editing: Zhouzhou, BlockBeats

In this market cycle, AllianceDAO stands out as arguably the best-performing early-stage investment firm in crypto—at least among retail investors, it remains the legendary "VC that incubated a billion-dollar revenue application." While the broader crypto primary market languishes, fund managers are publicly comparing IRR and DPI figures to showcase their struggles. Some funds have pivoted from venture investing to trading in secondary markets; others have ceased operations altogether. At this moment, Qiao Wang, Founding Partner of AllianceDAO, says: We're increasing investments and becoming more aggressive.

Of course, Alliance isn't being blindly optimistic or simply following the mantra of "be greedy when others are fearful." They’re facing a Web3 world where narratives have collapsed and an industry experiencing continuous talent drain. At the crossroads between crypto and AI, how should a vertical-focused VC make strategic choices and redefine its positioning? These aren’t simple questions—they’re exactly what Qiao Wang must grapple with. Fortunately, he understands one key truth: "Most VCs in this industry don’t know how to invest in application layers."

The Most China-Savvy Dollar-Funded VC—Decides Whether to Invest Within 5 Minutes

From “Trump supporter” to “Trump critic,” few groups have shifted their stance on U.S. politics more dramatically over recent months than those in the crypto space. After Trump launched his meme coin $TRUMP, liquidity in the sector began drying up. The bullish sentiment that had built since his election win in November gradually faded, and the so-called "tariff black swan" on Inauguration Day became the catalyst for a complete 180-degree reversal in sentiment.

Today, many in crypto have become avid followers of macroeconomics. Hardly anyone still cares about undervalued gems or "the next big crypto narrative." According to industry reports, primary market fundraising and investment activity has hit a multi-year low. Yet AllianceDAO is choosing to double down—now making investment decisions after just five minutes of conversation with startup teams.

BlockBeats: As founding partner of a crypto-focused VC, do you often consider how macroeconomic shifts might affect your firm?

Qiao Wang: As a lean startup ourselves, external conditions don’t impact us much. We never spent heavily to begin with, and our core expenses remain stable regardless of market cycles. So long as we maintain a lean operational philosophy, the impact is minimal.

However, I believe the biggest issue between China and the U.S. is mutual misunderstanding—this is fundamental. For example, the U.S. assumes that imposing tariffs will force China to concede, but this completely misreads the situation. Such tactics might have worked in 2018, but today China’s reliance on exports to the U.S. has significantly decreased, and its economy is undergoing transformation, actively reducing dependence on America.

Moreover, trade wars actually strengthen domestic unity. While there may be economic pressure, external threats bring people together. The U.S. has fundamentally mishandled this. Of course, I'm not an expert—this is just my observation. I hope people can learn more.

BlockBeats: Is this lack of understanding reflected in English-speaking crypto communities? How significant is its impact on the crypto industry?

Qiao Wang: Yes, this misunderstanding runs deep. Over the past decade, across government, media, and society, the U.S. has broadly viewed China as an "enemy" rather than a competitor. This zero-sum mindset—"if China wins, we lose"—has shaped policies, cultural narratives, and societal decisions, and it won't change quickly. It's systemic and deeply entrenched.

The crypto community is somewhat different. Most practitioners are smarter and have a more nuanced worldview than the average American. Among the people I interact with, China is generally seen as a respected competitor, not an enemy. This contrasts sharply with mainstream U.S. media and government views, where ordinary Americans, influenced by media, tend to see China as a threat.

In the medium to long term, macroeconomic factors have limited direct impact on crypto. Short-term volatility exists because crypto markets often follow equities. But several executive orders signed by Trump were very positive for crypto, creating an overall favorable environment. For us, the priority remains identifying strong projects—the macro backdrop doesn’t alter our investment logic.

BlockBeats: Many believe U.S. stock performance largely determines BTC trends, while others argue global M2 is the main driver of BTC prices. What’s your outlook for the crypto market this year?

Qiao Wang: I don’t have a strong view on short-term crypto movements due to two opposing forces. On one hand, U.S. equities could decline in the next 3–6 months due to signs of recession or inflation, dragging crypto down with them—especially given current high valuations. On the other hand, global liquidity is expanding (e.g., money printing), which could push crypto asset prices higher. I can’t predict which force will dominate. So while I’m uncertain about crypto’s near-term direction, I do expect U.S. stocks to likely fall.

M2 definitions vary—some include China or other countries, others don’t. But overall, global M2 is rising, and crypto’s long-term trajectory correlates strongly with M2. In the short term, however, factors like equity market swings play a bigger role.

BlockBeats: Recent data shows primary market investment activity in crypto has dropped to historic lows. Has AllianceDAO felt this cooling trend?

Qiao Wang: Over the past one to two years, primary market VC investment in crypto has been flat. If public markets (token prices) rise while private deals stay flat, it means primary underperforms secondary. Once public markets fall, private valuations may drop even harder—and we could see further declines over the next one to two quarters. However, Alliance’s incubator isn’t affected by how many deals other VCs do. If others pull back, we might invest more. The key question is whether good projects exist—we won’t invest blindly without them.

BlockBeats: AllianceDAO has always had a unique approach to product startups and incubation, especially evident during the MEME boom. Now that the MEME cycle appears to be over, are you re-evaluating your past investment and incubation strategies?

Qiao Wang: We constantly reflect and review daily, but our core investment methodology won’t shift because one sector declines. We focus on exceptional teams and promising directions. Over the past year, we’ve optimized our decision-making process: previously, we’d spend an hour across two deep conversations.

Now we’ve found that after thoroughly reviewing application materials, 20 minutes of discussion suffices, with decisions made within 24 hours. Early on, information is limited—intuition and industry experience matter most. Key signals—clarity of thinking, communication ability, hunger for success—are often clear within five minutes.

BlockBeats: When judging team potential in five minutes, what specific details do you look for?

Qiao Wang: First, logical clarity—can they explain complex problems simply? Second, passion—do they genuinely want to build something meaningful? The rest of the time is mostly about clarifying unfamiliar domains or project specifics, but the overall impression of the team is usually formed within five minutes. At the earliest stage, the exact direction or sector isn’t critical.

Crypto Founders Are "Fleeing" to AI

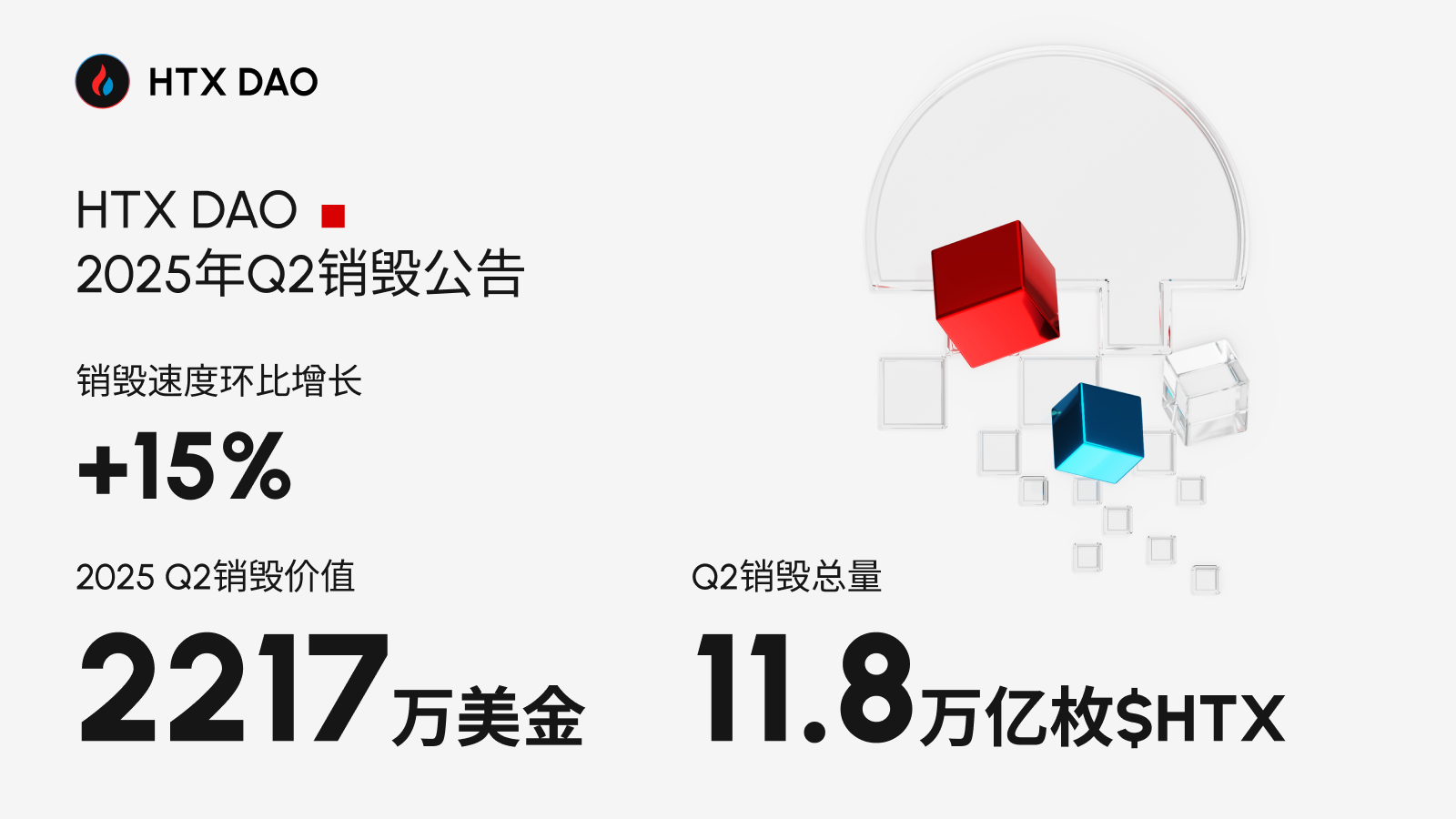

Recently, Jocy, founding partner at IOSG, posted on social media expressing concern about another portfolio company shifting to AI—a sign of growing unease about crypto’s future.

"Crypto founders are fleeing to AI"—it’s a painful statement, but it reflects reality. Qiao Wang doesn’t deny this trend. In the latest AllianceDAO cohort, one-third of projects are pure AI startups. In previous cohorts, pure AI ventures were only a small fraction. Since then, numerous projects have pivoted toward AI.

Venture capital firms focused on crypto are increasingly being "forced" into AI investing. As their portfolios unexpectedly fill with AI startups, fund managers must ask: What advantages do we have in AI? And how should we position our fund?

Crypto VCs Are Being Forced Into AI Investing

BlockBeats: This cycle, many fund managers report seeing multiple portfolio companies pivot to AI. Has AllianceDAO experienced similar shifts?

Qiao Wang: Our latest cohort includes 25 projects, about one-third involving AI. Some teams started with pure AI ideas, while others transitioned from crypto. They chose us because they have crypto backgrounds and understand our incubation model.

BlockBeats: Why would pure AI startups choose a crypto-focused institution as their incubator?

Qiao Wang: These teams previously worked or founded companies in crypto and now want to enter AI. They know us, so they applied. Their AI applications are typically vertical-specific—education, law, advertising—where domain expertise matters more than AI technical depth.

BlockBeats: When did this shift start becoming frequent?

Qiao Wang: Around six months ago, starting from late last year.

BlockBeats: Do these teams make the pivot independently and inform you afterward, or do they co-decide with you?

Qiao Wang: Some teams come with strong convictions, having already decided before talking to me. Others consult me first, seeking advice on next steps. I offer input—if I sense they deeply understand a particular user base or market, I might even suggest AI-related ideas. Then we jointly decide. So both scenarios happen.

BlockBeats: Back when Web3 was booming, many internet teams chased the trend. Now crypto founders are chasing AI. How do you distinguish genuine innovation from trend arbitrage? And are you concerned about the success rate of serious AI transitions?

Qiao Wang: We’re extremely cautious about this. In 2021, during the Web2-to-Web3 wave, we funded some teams who were clearly just chasing hype. Now, when engaging with AI teams, we dive deep into product details, target markets, user pain points, and motivations. The core test is whether they truly understand the industry and address real problems. Best-case scenario: they’re solving a problem they personally face—that motivation is most authentic.

The leading cause of startup failure is solving non-existent problems. Web2-to-Web3 teams often assumed demand existed, but it didn’t. With AI teams, we prioritize: Who is the user? What’s the pain point? How is it validated? Ideal cases involve teams solving their own problems—they know the pain is real.

For instance, one team we backed consists of former Uniswap PMs who discovered TikTok ad costs were too high and used AI to drastically reduce them. That’s pain-driven entrepreneurship. Sometimes, founders feel intense personal urgency—if they don’t solve this problem, it bothers them deeply—so they *must* act.

BlockBeats: Founders worry rapid LLM advancements could render vertical AI apps obsolete. How does your investment thesis differ for AI versus crypto?

Qiao Wang: The key is whether the project offers value beyond what large models provide—unique UX or proprietary data. Take Cursor, for example: it uses AI to assist coding. Though reliant on large models, its value grows alongside them thanks to developer data and superior user experience.

When investing in AI applications, we care less about technical pedigree and more about deep industry insight and real problem-solving. Focus stays on product and market: Who is the user? What pain point is addressed? Why this market? What gaps remain? Questions vary per project, but the goal is consistent: verify deep thinking and genuine understanding of user needs.

BlockBeats: In your view, what primarily drives most founders transitioning to AI?

Qiao Wang: Primarily opportunity and trend-chasing. But crucially, they also find the work itself interesting—that’s vital.

BlockBeats: What do you mean by “interesting”?

Qiao Wang: Interesting means they find the technology inherently fascinating and believe it can solve real user problems. For example, one major issue in crypto over the past decade is that many teams weren’t solving actual problems.

But in AI, they see tangible pain points they believe AI can fix—that’s what makes it exciting. See? Like you mentioned earlier—many ex-big tech founders, say from Tencent, build strong products and scale fast, but ultimately rely on token issuance. Clearly, they’re not solving real problems—they’re just trying to make money.

BlockBeats: Does the exodus of peers to AI affect morale among other crypto founders in your portfolio?

Qiao Wang: Absolutely—it has an impact. Every crypto founder feels this. It could be peer influence or media sentiment. People naturally wonder: Why am I still doing crypto? Why not switch to AI? That psychological effect is normal.

BlockBeats: Crypto founders seem to be showing the same enthusiasm for AI that internet entrepreneurs once showed for Web3 and metaverse.

Qiao Wang: Yes. Last cycle had two dominant narratives: metaverse and Web3 metaverse. I always thought that was a "fake narrative"—nothing truly compelling to me. But Web3 itself? That I found genuinely interesting. I still do.

Web3 achieved something fundamentally important: decentralized social media. That’s inherently valuable—it prevents excessive power from being concentrated in companies like Twitter or Facebook. Though perhaps users didn’t feel a strong need back then, or the tech wasn’t mature enough to solve real pain points.

From Crypto-Native to General Tech: Alliance Reconsiders Its Branding

BlockBeats: After pivoting to AI, do these startups require adjustments in funding models or amounts?

Qiao Wang: At the application layer, financing models haven’t changed much. But I believe AI’s first true killer app has been dramatically improving developer productivity.

You may have seen my recent posts—I’ve been asking our portfolio teams since ChatGPT emerged around November 2021: How much has AI improved your engineering efficiency?

Initially, answers ranged from 20% to 50% gains. I track this annually. Just one or two months ago, I asked again—the response? Efficiency gains of 2x to 4x. From 20–50% to 2–4x—that’s staggering progress.

If this trend continues, entrepreneurs will need less capital over the next 5–10 years. One engineer could accomplish what four engineers once did. Based on this, our investment philosophy is now simple: We give you $500K, you take two or three people and work for two years—you should be able to reach product-market fit.

Once you achieve PMF, either you’re already generating revenue and can hire more, or raising a Series A or later seed round becomes easier, enabling scaling. For application-layer startups—whether AI or crypto—the model is essentially identical. Of course, if you're building deeper infrastructure, you’ll likely need more capital.

BlockBeats: Does AllianceDAO have any AI projects that transitioned from crypto and successfully reached PMF?

Qiao Wang: My definition of product-market fit is quite strict. True PMF means weekly or monthly growth consistently at 10%–30% or higher, with annual revenue reaching seven figures or more.

Most importantly, user demand floods in faster than your team can handle—that’s what I consider real PMF. By this standard, I haven’t yet seen any crypto-turned-AI project achieve this level.

BlockBeats: Is this because they’re just getting started, or are there underlying challenges?

Qiao Wang: Mainly because they’re early. The crypto-to-AI shift only gained momentum about six months ago, so they need more time to find PMF.

Also, AI competition is fierce—extremely cutthroat. Nearly every vertical has dozens, sometimes hundreds, of teams building similar things. The competition is brutal.

BlockBeats: Returning to AllianceDAO itself—originally a crypto-focused fund—now with pure AI startups in your portfolio, are you reconsidering your brand identity?

Qiao Wang: Yes, we’re thinking about branding and gradually refining it. Ultimately, we want to keep running an accelerator for crypto, but also expand beyond it.

Tech waves come one after another, each lasting 5–10 years or longer. Once a wave passes, early-stage opportunities diminish, so you must anticipate the next wave. Eventually, we aim to run accelerators across multiple domains.

BlockBeats: As a crypto VC entering AI, do you feel increased risk exposure? And does this founder exodus affect your confidence in the industry?

Qiao Wang: I don’t perceive higher risk, although AI is indeed highly competitive. But it's also a massive trend—possibly an order of magnitude larger than crypto.

So overall, I don’t see greater risk. Regarding AI’s impact on crypto—yes, it’s real. I’ve personally seen many crypto founders move to AI. Both subjectively and based on data, significant talent is flowing into AI.

“We Fund Every Founder Who Moves From AI to Crypto”

BlockBeats: Are you worried that as more projects shift to AI and fewer people build in crypto, the industry might appear hopeless?

Qiao Wang: I do worry about that. But my biggest concern is whether the founders we back can succeed.

If someone wants to pivot to AI, I focus on two things. First: Have they lost passion for their current work? Do they no longer see a viable long-term path? I need to clarify that.

Second: Are they prepared for the new direction—like AI? Do they have the necessary skills and resources? More importantly, will their new project solve real user pain points? If both answers are yes, I won’t stop them—I’ll even encourage them to try.

BlockBeats: You mentioned crypto is losing top talent to AI. Are these mainly developers or visionaries?

Qiao Wang: Both. Talent drain in crypto stems from two main causes: AI, which I’ve directly observed, and the U.S. government’s crackdown over the past four years. Together, they’ve driven away visionary founders and developers alike.

BlockBeats: Can I assume most of these departing founders entered crypto in the last cycle?

Qiao Wang: Yes. Actually, over the past six months, some Web2 professionals have expressed interest in entering crypto. They could go into AR, but they choose crypto instead because they find it genuinely interesting. There are maybe four or five such cases—we’ve invested in nearly all of them, because these individuals are fascinating.

They could easily join the AI wave, yet they opt for crypto, bringing solid ideas. These people are particularly compelling. So yes, they exist—but far outnumbered by those moving the other way, possibly by an order of magnitude.

BlockBeats: So for every 4–5 new crypto-native projects, there are 10–20 pivoting to AI?

Qiao Wang: Exactly—perhaps even more. Across the industry, there could be dozens, hundreds, or more such transitions.

BlockBeats: What directions are these committed crypto founders pursuing now?

Qiao Wang: They’re exploring hybrid social-speculative projects. They’ve seen examples like Palm Fantasy, Moonchat, and other social-focused experiments. Some failed, but they believe the core concept was sound—just poorly executed. So they want to revisit it.

At the same time, they see AI as overly competitive and doubt their chances of success there. So they prefer something meaningful yet less crowded.

BlockBeats: Conversely, what verticals do AllianceDAO’s AI portfolio companies currently focus on?

Qiao Wang: We haven’t invested heavily in AI—about one-third of the latest cohort, roughly seven or eight projects. Their focus varies: some target developers, like Y Coding-style tools that generate code via natural language—very compelling.

Others include the AI video ad team I mentioned, teams building educational tools for kids and younger students, and teams using AI to generate games directly from text. A wide range, though we haven’t deployed much capital.

All eight teams came from crypto backgrounds—either ran crypto startups or worked at strong companies like Uniswap or Coinbase.

BlockBeats: So they have strong crypto pedigrees.

Qiao Wang: Despite strong crypto backgrounds, as I said earlier, AI experience isn’t necessarily crucial for building AI applications.

BlockBeats: It’s quite sad—many of the industry’s top talents no longer wish to stay in crypto.

Qiao Wang: There are still strong teams fully dedicated to crypto. But last cohort had far less AI overlap—essentially zero initially, though one or two may eventually pivot. They joined as crypto builders, worked for about half a year, then shifted to AI.

Is There a Future for Crypto + AI?

BlockBeats: The "Crypto + AI" narrative remains hot. Do you consider it a "pseudo-narrative"?

Qiao Wang: I’d say 90% is pseudo-narrative, but 10% might produce something meaningful. Imagine crypto and AI as two large circles—their intersection is tiny. While both fields are vast individually, the overlap is small. But within that narrow intersection, there might be interesting possibilities—like decentralized training, which could be compelling.

We’ve seen some such projects, but most are infrastructure-focused. Many VCs chase them, offering sky-high valuations, making it hard for us to participate. While the teams are strong and I admire them, these projects are extremely difficult and may take years to materialize. So far, decentralized training hasn’t made significant progress.

The biggest challenge is aggregating small models trained across data centers. Transferring data between centers is extremely expensive—network transmission costs are prohibitive. Thus, it remains unclear whether decentralized training can ever be cheaper than centralized approaches.

BlockBeats: Given current market conditions, has valuation and interest in Crypto+AI projects noticeably declined in the primary market?

Qiao Wang: There are still large funds with limited options, so they continue concentrating on these types of projects. As a result, multiple VCs often co-invest in the same major initiative.

I think many VCs don’t truly understand crypto application layers, so they default to funding technical infrastructure. But there aren’t many compelling stories there. Take Layer 2s—there are already hundreds on the market. You can only identify slightly more interesting niches and focus investment there.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News