From Cantor to Securitize, Crypto Buys Washington

TechFlow Selected TechFlow Selected

From Cantor to Securitize, Crypto Buys Washington

From the president to the secretary of commerce, and on to the SEC chair and the "crypto tsar," these key figures' intersections with the cryptocurrency industry resemble a tightly nested cycle of interests.

Last week, the Financial Times reported a major development: Wall Street veteran Cantor Fitzgerald is teaming up with SoftBank, Tether, and Bitfinex to form a Bitcoin investment consortium exceeding $3 billion. Notably, the firm’s leader, Brandon Lutnick, is the son of Howard Lutnick, the current U.S. Secretary of Commerce. Against the backdrop of the Trump administration's pro-digital currency policies, this new alliance has sparked widespread speculation about political-business connections.

Tether’s Hidden Hand: Cantor, Where Politics Meets Finance

Cantor Fitzgerald, a Wall Street institution founded in 1945, is renowned for government securities trading, investment banking, and bond brokerage. As one of the 24 primary dealers authorized by the U.S. Treasury, Cantor directly participates in the issuance and trading of U.S. Treasuries, maintaining close operational ties with the Federal Reserve and the Treasury Department. The firm operates in over 20 countries and employs more than 12,500 people globally.

Yet what truly brought Cantor into the spotlight is its relationship with Tether. For this mid-sized Manhattan-based investment bank, Tether has become its most lucrative client—serving as the primary custodian for Tether’s dollar reserves, managing nearly 99% of its U.S. Treasury holdings, amounting to tens of billions of dollars.

The partnership proves mutually beneficial. Once struggling to turn a profit, Tether now earnsbillions annually in interest from U.S. government debt held at Cantor. According to Forbes, Cantor not only provides high-security custody but also leverages its bond market expertise to help Tether convert high-risk commercial paper into low-risk U.S. Treasuries, significantly reducing systemic risk. A source revealed that Cantor purchases short-term U.S. Treasuries with maturities of 3–6 months for Tether, ensuring high liquidity, while dynamically adjusting the ratio of Treasuries to cash via an asset management system. In 2023 alone, this strategy generated approximately $2 billion in interest income for Tether—nearly one-third of its $5.6 billion annual profit.

At the heart of this collaboration stands Howard Lutnick. The 63-year-old billionaire, former CEO of Cantor, transformed his bank into the backbone of the Tether ecosystem. After federal regulators eased restrictions on banks holding digital assets in 2020, Lutnick began exploring ways into the crypto space—and discovered Tether. Cantormanages a portfolio of up to $39 billion in U.S. Treasuries for Tether, making it the custodian of USDT’s dollar-backed reserves. With Tether’s tokenized market cap surpassing $130 billion, Cantor holds the majority of the U.S. Treasury bonds backing these tokens.

Howard Lutnick, former CEO of Cantor

Their partnership traces back to2021. At that time, Tether had issued over 50 billion tokens, yet persistent doubts remained over whether it actually held $50 billion in equivalent reserves. That February, the company agreed to pay an $18.5 million fine to the New York Attorney General to settle allegations of misleading disclosures about its reserves. With multiple U.S. banks refusing to process its transactions and key regulators fearing a potential bank run, Tether faced existential crisis. At this critical juncture, Howard stepped in to provide a lifeline. Sources say in return, Tether paid Cantor tens of millions of dollars and granted it a minority equity stake.

Prior to this, Tether kept most of its funds in Bahamian bank accounts and invested part of its reserves in higher-yielding but riskier assets like Chinese commercial paper. This model relied heavily on Bahamian banks acting as intermediaries with U.S. financial institutions. However, when Tether paid a $41 million penalty to the Commodity Futures Trading Commission (CFTC) in October 2021 over reserve misrepresentation claims, this channel was severely compromised.

After obtaining sufficient proof that Tether indeed held full reserves, Howard proposed a solution. As a primary dealer in U.S. Treasuries, Cantor could easily access large volumes of secure government debt. He pledged that as long as Tether converted its holdings into U.S. Treasury bills, Cantor would take them on as a client.

On Tether’s side, the negotiations were led by Giancarlo Devasini, CFO and largest shareholder. According to the Wall Street Journal, their dealings were highly secretive. “Howard made sure only a handful of top executives knew about the relationship,” with some employees completely unaware. Howard often personally handled communications with Devasini, even meeting him via private jet.

This Italian entrepreneur, once involved in plastic trading, is widely seen as Tether’s “shadow leader.” Devasini stated that Cantor’s custody services allow the company to “more efficiently meet regulatory requirements for liquidity and stability,” adding, “Howard will use his political influence to mitigate threats against Tether.” Howard himself deeply values the partnership—in a recent investment deal, he unusually took direct charge of negotiations, securing Cantor a 5% stake in Tether valued at around $600 million.

Howard has also laid the groundwork for the next generation. The current Bitcoin consortium is being led by his son, Brandon, aiming to pool $1.5 billion from Tether, $900 million from SoftBank, and $600 million from Bitfinex. This structure closely mirrors MicroStrategy (now renamed Strategy), the company that skyrocketed to a $91 billion market cap through aggressive Bitcoin accumulation.

Intriguingly, Brandon previously interned at Tether and was instrumental in introducing Tether to the right-leaning video platform Rumble Inc. According to Bloomberg, Cantor facilitated Tether’s $775 million investment in Rumble. When the deal was announced, Rumble’s stock surged 81%, increasing Cantor’s stake value by $54 million.

Brandon Lutnick (far left); Howard Lutnick (second from left)

In February, Howard narrowly won confirmation as Commerce Secretary by a 51–45 vote. The former Cantor CEO has repeatedly voiced public support for Tether: “I hold their Treasuries; they hold a lot too. I’m a big fan of Tether,” emphasizing stablecoins’ contribution to the U.S. economy.

While Howard pledged upon appointment to resign from his corporate roles and “intend to sell my shares in those companies to comply with U.S. government ethics rules,” opposition remains. Senator Elizabeth Warren voiced strong concerns: “I am deeply troubled by Howard Lutnick’s past association with a company tied to sanctioned entities—Tether. The Commerce Secretary should fight for America’s interests—not his own or those of former clients whose actions compromise our national security.”

Still, Howard appears to have followed through on his commitment, stepping down from Cantor to avoid direct ties with Tether. However, the baton had already been quietly passed—to Brandon.

From the Commerce Department to the SEC: Crypto and the Trump Administration’s Close Ties

The Cantor-Tether model is not unique. BlackRock, the world’s largest asset manager, launched its BUIDL fund in 2024, which this year became a leading player in the RWA sector with over$2.5 billion in assets under management. The designated custodian for BUIDL? A company called Securitize.

Why would BlackRock invest in a crypto firm? The answer likely lies in Securitize’s network. Looking solely at its leadership might suggest it's a traditional finance newcomer packed with Wall Street veterans—but shift focus to Washington, and another picture emerges. In 2021, Securitize hired Brett Redfearn, former Director of the SEC’s Division of Trading and Markets, who remains Senior Strategic Advisor and Chair of the Advisory Committee.

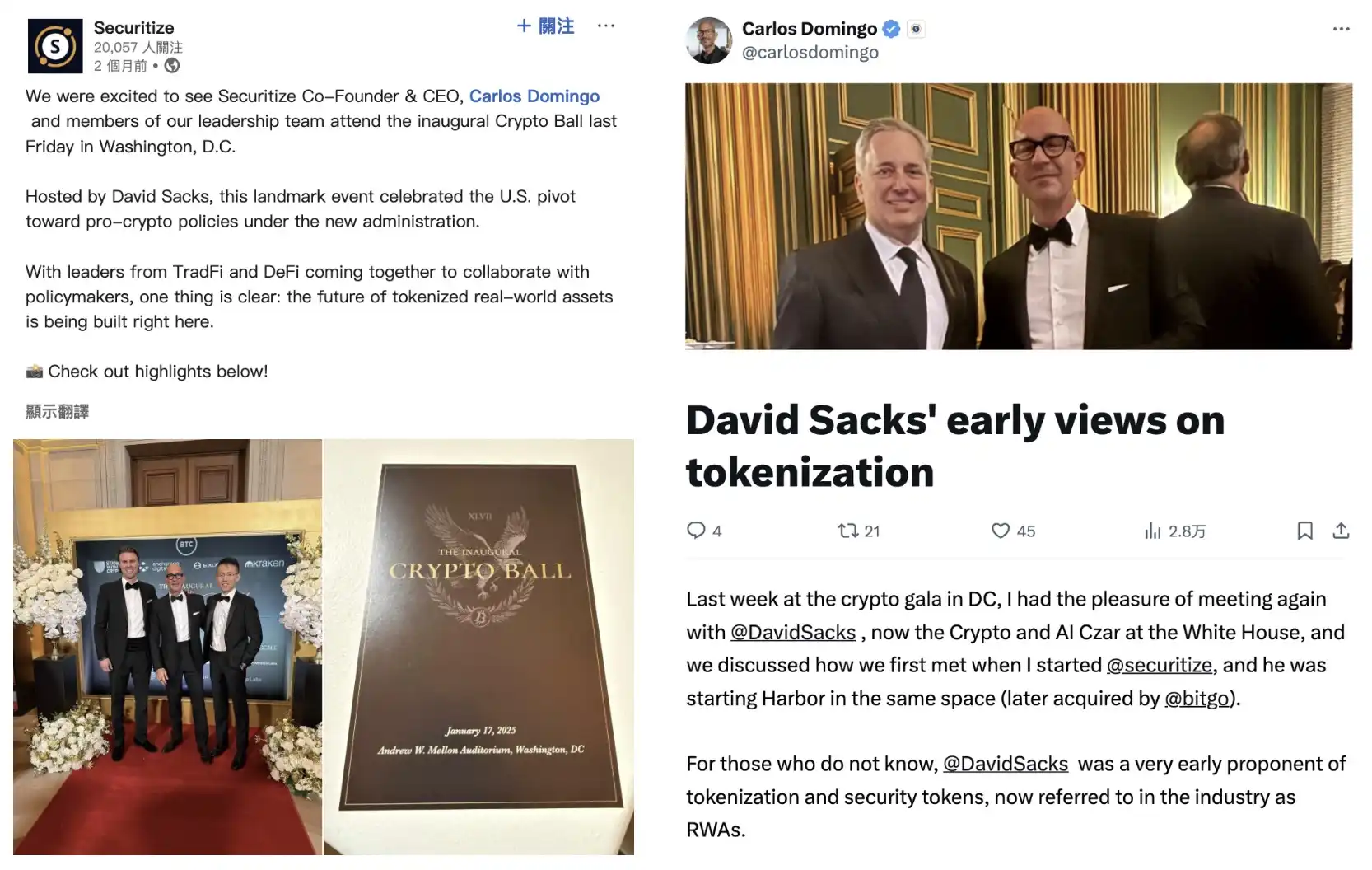

The SEC connection runs deeper. Paul Atkins, the newly appointed SEC Chair, has long-standing ties with Securitize. Atkins joined the company back in 2019, serving as advisory board member and board director until just February 2025, during which time he held up to $500,000 in call options. Coincidentally, it was also in 2019 that Securitize became a registered broker-dealer with the SEC and an SEC-regulated Alternative Trading System (ATS) operator.

When Trump announced Atkins’ nomination as next SEC Chair, Carlos Domingo, CEO of Securitize, publicly congratulated him on LinkedIn: “We are thrilled about this appointment; though we lose a great advisor, we gain an outstanding new SEC Chair.” The official Securitize LinkedIn account also shared a custom celebratory graphic.

It’s not just the SEC. Carlos Domingo also appears to have a cordial relationship with David Sacks, the White House’s so-called “Crypto Czar.” Though there’s no direct business link between Sacks and Securitize, Domingo was invited to the “Crypto Ball” in Washington this February, where he “reconnected” with Sacks and later posted a lengthy reflection on Sacks’ early views on tokenization and RWA.

The Ultimate Channel for Political Monetization?

When thinking about leveraging political influence and personal branding for crypto marketing, who comes to mind first? Despite calling Bitcoin a “scam” on Fox Business in 2021, three years later, the Trump family-backed DeFi project WLFI emerged in October 2024 with a bold $1.5 billion valuation. Donald Trump serves as “Chief Crypto Advocate,” his son Barron as “DeFi Visionary,” while Eric Trump and Donald Trump Jr. actively promote the project. In March 2025, WLFI launched its own stablecoin USD1, operating on Ethereum and Binance blockchains, competing directly with Tether’s USDT and Circle’s USDC.

WLFI’s funding sources and investment strategy have drawn significant attention. Through two token sales, the project raised $550 million, including a $30 million investment from Justin Sun, who became a key backer. Sun had previously faced SEC litigation over alleged securities fraud, but in February 2025, the SEC suspended its investigation. Forbes reported that Sun’s investment could yield the Trump family around $400 million in potential gains, given their control over75% of WLFI token revenues.

The Trump family’s crypto footprint continues to expand far beyond WLFI. According to Bloomberg’s analysis of public data, their diversified investments in NFTs, meme coins, Bitcoin ETFs, and mining operations have generated paper profits approaching $1 billion.

Trump’s first foray into crypto dates back to December 2022, when he launched a series of personalized NFT trading cards. These digital collectibles, styled as superhero figures, were proposed by Trump’s longtime friend Bill Zanker, founder of The Learning Annex. The release triggered a buying frenzy among collectors. In hindsight, this successful trial may have revealed to Trump the commercial potential of crypto.

In 2025, the Trump family accelerated its crypto activities. In January, both Donald and Melania Trump launched individual meme coins, generating initial price surges and $11.4 million in profits. Through two entities—CIC Digital and Fight Fight Fight LLC—the family controls 80% of the token supply, with a three-year gradual unlock schedule. Just last week, Trump announced that the top 220 holders of $TRUMP would have the chance to dine with him.

In February, Trump Media & Technology Group partnered with Crypto.com to file for a “Truth.Fi Bitcoin Plus ETF”—coincidentally around the time the SEC concluded its investigation into Crypto.com. By late March, the Trump family went further, announcing a collaboration with North American mining giant Hut 8 to enter Bitcoin mining, and launching their own dollar-pegged stablecoin USD1 to compete with Tether and Circle for market share.

From President to Commerce Secretary, SEC Chair to “Crypto Czar,” the interlocking relationships between top officials and the crypto industry appear to form a tightly nested cycle of mutual benefit. As the Trump administration advances its pro-digital currency agenda, Cantor, Securitize, and WLFI may be just the tip of the iceberg. Whether these deep entanglements between power and profit will trigger stronger public scrutiny and regulatory oversight—or become accepted norms and even new unwritten rules—remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News