Securitize selects RedStone as its primary blockchain oracle partner, collaborating to fully integrate tokenized assets into the DeFi ecosystem

TechFlow Selected TechFlow Selected

Securitize selects RedStone as its primary blockchain oracle partner, collaborating to fully integrate tokenized assets into the DeFi ecosystem

As an official oracle partner of Securitize, RedStone will provide price data for tokenized RWAs such as BUIDL.

As a leader in the tokenization of real-world assets (RWA), Securitize today announced a partnership with blockchain oracle provider RedStone, which will deliver data support for existing and future tokenized products including BlackRock's USD Institutional Digital Liquidity Fund (BUIDL), Apollo's Diversified Credit Tokenized Fund (ACRED), and Hamilton Lane's Senior Credit Opportunities Sidecar Fund.

Driving Traditional Finance On-Chain Through Tokenized RWAs

By 2025, the global securities market is projected to reach $300 trillion—highlighting a stark contrast with the current decentralized finance (DeFi) market size of approximately $90 billion, while underscoring the immense growth potential of on-chain economies. Thanks to blockchain’s inherent advantages over traditional closed financial systems, major financial institutions are increasingly interested in asset tokenization and integration into the DeFi ecosystem. As a pioneer in RWA tokenization, Securitize is collaborating with global asset management leaders such as BlackRock, Apollo, Hamilton Lane, and KKR to drive the migration of the $300 trillion securities market onto blockchain networks.

"To fully unlock the potential of blockchain technology, tokenized securities must thrive on permissionless public blockchains like Ethereum—the most efficient settlement layers for value transfer," said Carlos Domingo, co-founder and CEO of Securitize. "Our collaboration with RedStone not only enables trading of tokenized securities on-chain but also integrates them into existing DeFi infrastructure and unlocks new financial primitives, enabling deep convergence between traditional financial institutions and crypto-native applications."

How Securitize Leverages RedStone

New on-chain assets cannot be directly used within DeFi protocols; secure price feeds delivered by blockchain oracles are required to reflect real-time valuations and ensure safe integration into DeFi applications. As Securitize’s official oracle partner, RedStone will provide pricing data for tokenized RWAs such as BUIDL. Securitize has selected RedStone as the first oracle provider to establish price feeds for its tokenized assets.

The initial phase of collaboration will include net asset value (NAV) data streams—delivered via both push and pull mechanisms—as well as daily interest rate data streams across networks including the Ethereum mainnet. These data streams will enhance fund transparency and stability, increasing investor appeal. RedStone’s services will significantly expand the utility of underlying assets—for example, enabling the creation of money market platforms for tokenized assets or using them as collateral in DeFi—opening new use cases and attracting on-chain participants focused on enhancing RWA utility.

Why RedStone Is the Optimal Solution for RWA

Securitize and the broader RWA sector require precise, reliable, and adaptable data infrastructure—and RedStone stands out as the ideal choice. With the deepest price discovery capabilities and high-fidelity data, RedStone has maintained a zero-pricing-error record since mainnet launch, ensuring unmatched accuracy and trustworthiness. Its modular architecture supports customized pricing solutions for RWA providers, delivering the flexibility needed for seamless integration.

RedStone delivers secure, high-quality data streams compatible with both EVM and non-EVM chains, safeguarding Securitize’s unlimited growth potential in DeFi. Users gain confidence backed by the highest standards of security, compliance, and reliability. By choosing RedStone, Securitize secures a foundational pillar to accelerate RWA adoption and reshape the future of DeFi.

"Securitize has firmly established itself as a leader in the tokenized asset space," said Marcin Kazimierczak, co-founder and COO of RedStone. "After months of due diligence, we’re proud to become the first oracle partner supporting its expansion into the DeFi ecosystem. Leveraging our modular infrastructure, RedStone has emerged as the fastest-growing blockchain oracle, and we will empower Securitize’s products to rapidly penetrate DeFi and on-chain finance."

On-Chain Finance Is the Future

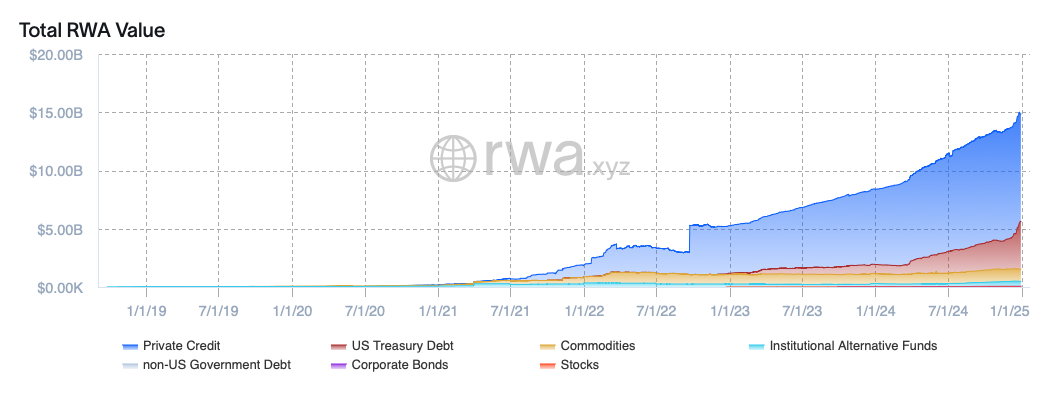

RWAs represent an emerging segment of the on-chain economy (excluding stablecoins), with a current total market cap of approximately $15 billion. Institutional demand for crypto assets is undeniable—Bitcoin ETFs have been hailed as the most successful ETF launches in history, while products like BUIDL demonstrate strong market appetite for tokenized assets, further legitimizing DeFi. (Source: rwa.xyz)

As technological interest and DeFi momentum grow, exponential expansion is expected in the coming years. Positioned uniquely at the forefront of this trend, Securitize is capturing rising demand for tokenized assets, while RedStone proudly serves as its oracle partner, driving deeper integration between traditional finance and DeFi within a unified on-chain financial environment.

About RedStone

RedStone is a modular oracle built for DeFi and income-generating on-chain financial assets, particularly serving value-accumulating stablecoins, liquid staking, and restaking tokens. It delivers secure, reliable, and customizable data feeds across more than 60 blockchains, and is trusted by institutions including Ethena, Securitize, and Morpho.

About Securitize

As a leading RWA tokenization platform, Securitize partners with top-tier asset managers such as Apollo and BlackRock to bring global assets on-chain through tokenized funds. Its subsidiaries hold SEC-registered broker-dealer, digital transfer agent, and fund administrator licenses, operate an SEC-regulated Alternative Trading System (ATS), and were named to Forbes’ 2025 Fintech 50 list.

Compliance Statement

Securities are offered through Securitize Markets, LLC, a FINRA/SIPC member broker-dealer. Securitize Markets and its affiliate Securitize Capital (an exempt reporting adviser) do not participate in RWA tokenization services. Digital assets are speculative, high-risk investments with limited liquidity and exposure to market manipulation. Securitize, Inc. is a technology provider; its affiliate Securitize, LLC is an SEC-registered transfer agent; Securitize Markets operates an alternative trading system; Securitize Capital is a Florida-registered exempt advisor.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News