Zora's Token Launch Faces Wave of On-Chain Criticism: Early Users Betrayed, Average Airdrop Only $37

TechFlow Selected TechFlow Selected

Zora's Token Launch Faces Wave of On-Chain Criticism: Early Users Betrayed, Average Airdrop Only $37

After years of "PUA," Zora has finally launched its token, but the long-awaiting community members were left disappointed—opening their wallets only to find a negligible "reward" that doesn't even cover gas fees, let alone a token with any actual utility. Community sentiment has completely broken down.

Author: Nancy, PANews

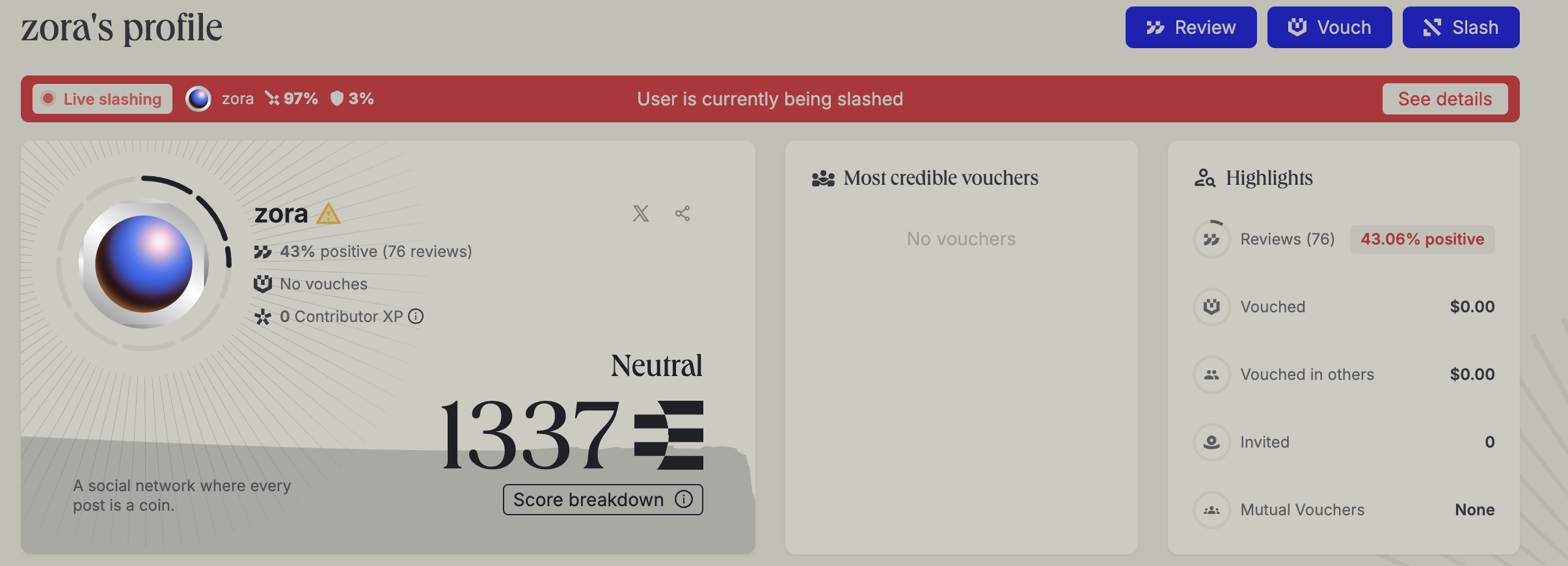

Zora, long teased as a "PUA" project, has finally launched its token—yet the community’s long-awaited “big payout” turned into bitter disappointment. Wallets revealed only meager rewards, often insufficient to cover gas fees, not to mention the token's complete lack of utility. Community sentiment quickly collapsed, with Ethos—a blockchain reputation protocol—becoming an unexpected outlet for frustration. Zora’s misstep is now permanently recorded on-chain, etching a mark of eroded trust.

Airdrop Backfires: Early Supporters Betrayed by Token Distribution

Last month, Zora announced the upcoming launch of its native token, ZORA, sending years of community anticipation soaring. In the lead-up, Base officially amplified the hype with multiple promotional tweets, capturing widespread attention, spawning countless memes, and driving key metrics skyward.

However, the airdrop ultimately became a widely criticized "historic fiasco." On April 23, Zora opened airdrop claims, stating that 1 billion ZORA tokens would be distributed across 2,415,024 addresses. The majority were allocated based on the first snapshot (from January 1, 2020, 8:00 UTC to March 3, 2025, 22:00 UTC), while a smaller portion came from a second snapshot (March 3, 2025, 22:00 UTC to April 20, 2025, 8:00 UTC), which included activity from Coins on Zora’s latest protocol. Allocation amounts were determined by user activity and overall engagement with the current and legacy versions of the protocol, including minting, trading, and referrals.

Meanwhile, ZORA debuted on Binance Alpha, where eligible users received 4,276 ZORA tokens. Yet the results angered many long-term participants in the Zora ecosystem, who received only tiny allocations—often too low to cover gas costs.

In contrast, recent speculators and Binance Alpha users easily claimed large quantities of tokens. This starkly imbalanced distribution sparked broad outrage and was perceived as a betrayal of early supporters. Compounding discontent, Zora split its airdrop snapshots into two phases but never disclosed detailed allocation criteria, rendering the entire process opaque.

Furthermore, Zora faced intense scrutiny over its highly centralized and non-transparent distribution structure. According to its published tokenomics, only 10% of tokens were allocated to the community via airdrops, while 65% went to the team, treasury, and strategic contributors—with unlock schedules beginning after just six months, though specific vesting details remain undisclosed.

Adding fuel to the fire, Zora officially labeled ZORA as a "just for fun" meme coin with no technical or governance functions, intended solely for community rewards and ecosystem incentives. This stance triggered further backlash: if the token lacks real utility, why does the team retain such a dominant share? And why should the community believe ZORA holds any long-term value?

Under mounting disappointment, Ethos’ negative review feature emerged as an emotional release valve. Users flooded the platform with scathing reviews, causing Zora’s credibility score to plummet. Many commented: “On-chain records are immutable—bad actors will be remembered forever.”

Over Half of Tokens Claimed, But Less Than 20% of Eligible Users Participate; Average Payout Only $37

In terms of price performance, Binance data shows ZORA briefly spiked to $0.0466 upon listing, then fell to a low of $0.0172 the next day—a nearly 63% drop—quickly losing market momentum.

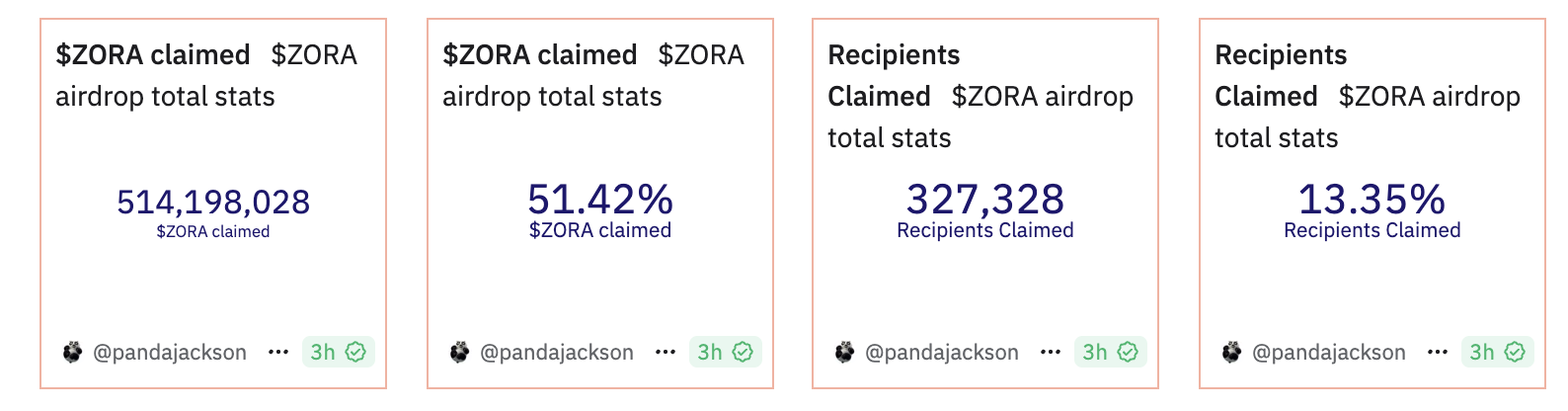

Dune数据显示,截至发稿时,已有超过5.14亿枚代币被用户成功领取。其中,排名前50的地址共领取了超过1.9亿枚,平均每个地址领取了约393.1万枚,按当前价格(约0.0235 美元)计算,价值约9.2万美元,占全部已领取数量的36.9%。这表明空投分配呈现明显的头部地址主导的局面。

At the same time, in terms of user participation, over 320,000 users have claimed tokens, but the average claim was only 1,571.1 ZORA—worth approximately $37 at current prices. This sharp contrast highlights extreme imbalance in distribution: whales received massive payouts, while ordinary users got minimal shares.

In terms of claim progress, about 51.42% of the total token supply has been claimed, yet only 13.35% of eligible users have actually completed the process. This further indicates very low active participation, with most users choosing to abandon the claim altogether.

User Engagement Declines Sharply; Pivot to On-Chain Social Sparks Controversy

Founded in 2020, Zora initially positioned itself as an NFT marketplace protocol. Public data shows the project raised at least $52 million in funding from investors including Coinbase Ventures, Paradigm, and Haun Ventures, with its last valuation reaching $600 million. However, as the NFT market cooled and competition intensified, Zora gradually shifted toward becoming a creator economy and on-chain social ecosystem. It introduced the "Coins" feature, automatically minting each piece of social content (images, videos, text) as an ERC-20 token, and launched its own Layer 2 network, Zora Network.

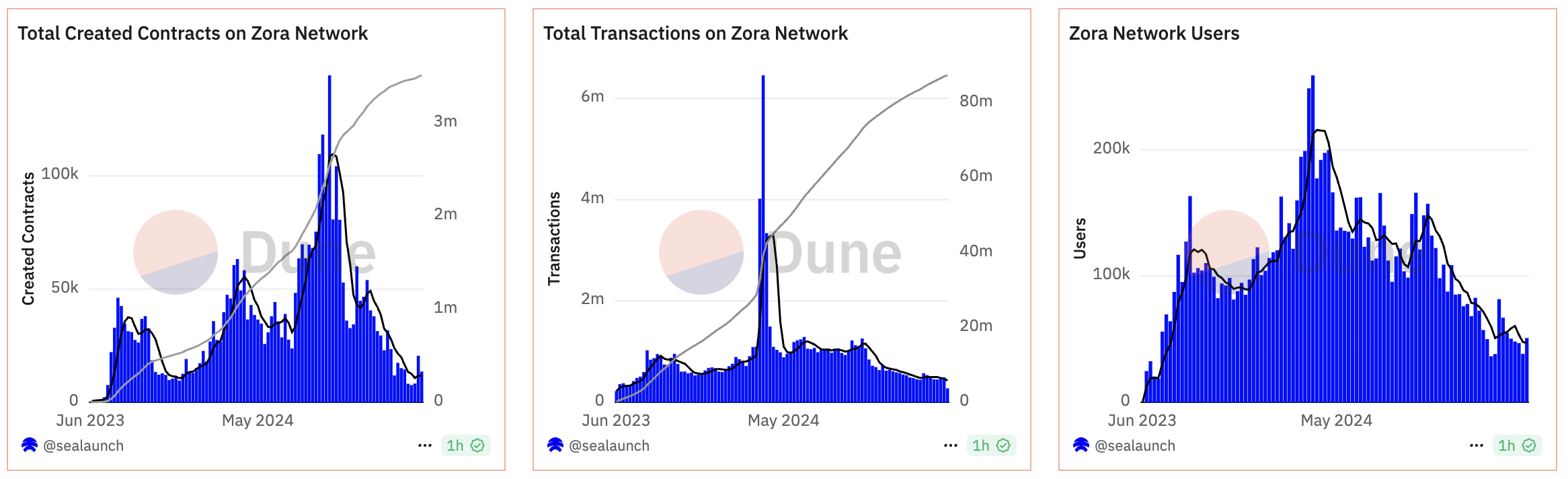

Despite continuously exploring new narratives, Zora’s overall ecosystem activity has significantly declined. According to Dune data, as of April 24, more than 3.51 million smart contracts have been created on the Zora network. However, daily contract creation has dropped from a peak of 144,000 to around 13,000—less than 10% of its high. Similarly, total transactions on Zora Network have surpassed 87.4 million, but daily volume has fallen from a record 3.338 million to about 428,000. While total active addresses have reached 470,000, daily active users have dropped from a peak of 259,000 last year to just 50,900 today, reflecting a clear decline in user engagement.

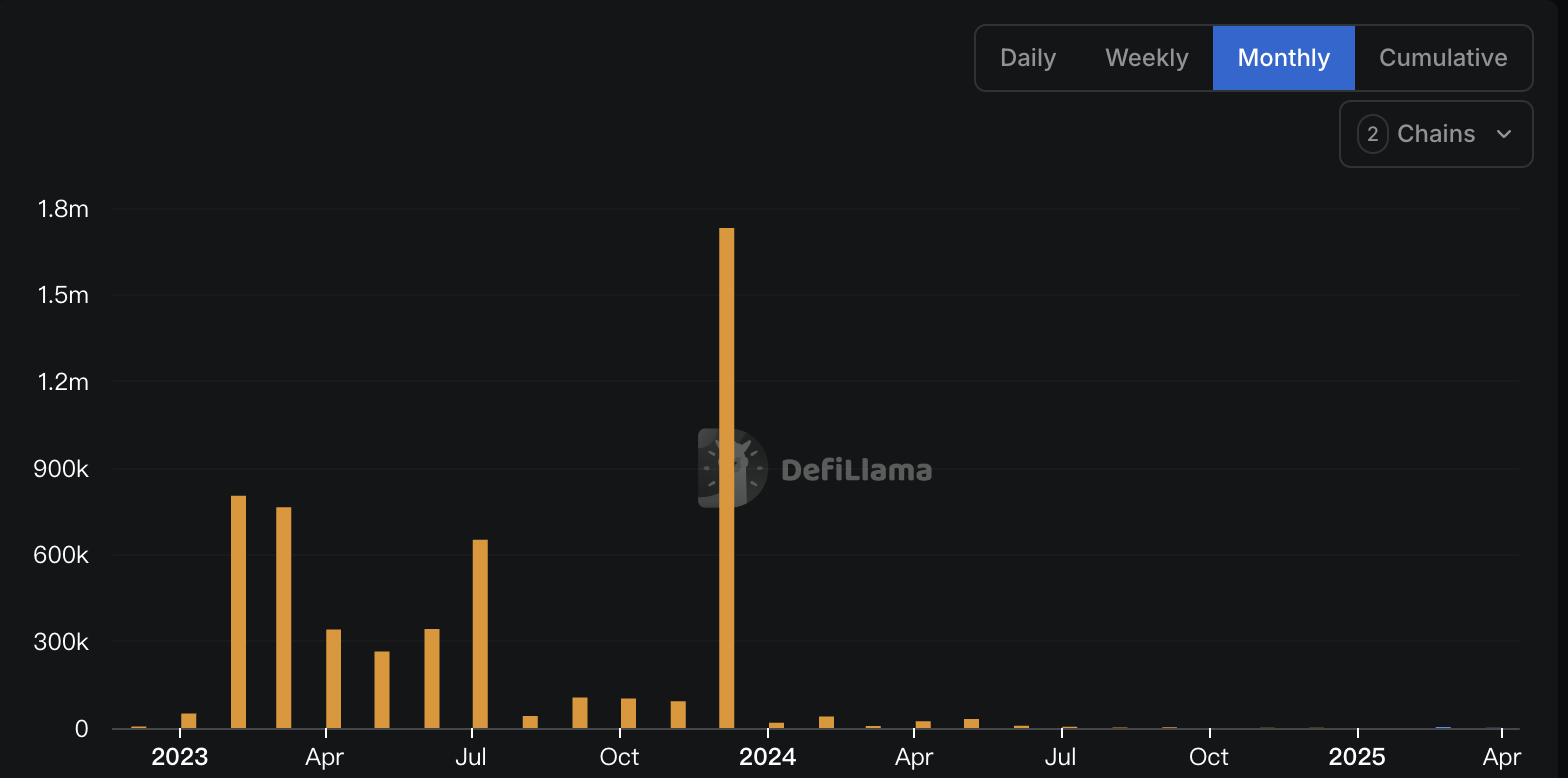

On revenue, DeFiLlama and Dune show Zora has generated only $5.4 million in cumulative revenue, with Zora Network earning just 527.74 ETH—far below market expectations given its $600 million valuation.

Moreover, despite claims of generating millions in earnings for creators, Zora’s experimental, tokenized approach remains controversial. Recently, Base protocol lead Jesse Pollak praised Zora Coins for hitting a record number of active users, but ZachXBT dismissed these tokens as “viruses” with less than $5 million in total market cap. Jesse admitted most content holds little value, with only a few pieces being valuable. ZachXBT questioned why creators should issue large volumes of tokens that dilute their brand. Jesse countered that on-chain creation doesn’t dilute brands—quality content naturally spreads, and market dynamics and algorithms determine value.

In summary, Zora has attempted to reinvent itself through on-chain social and tokenization narratives, but inflated valuations and declining ecosystem activity had already sown seeds of distrust. This poorly executed, insincere airdrop may well be the final blow that collapses community confidence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News