Interpreting a week of DeFi developments: established DeFi projects make new moves, Ethena launches new public blockchain

TechFlow Selected TechFlow Selected

Interpreting a week of DeFi developments: established DeFi projects make new moves, Ethena launches new public blockchain

What happened in DeFi over the past week?

Author: Chen Mo cmDeFi

Discussion on Ethereum engine refactoring;

Ethena launching its chain within the Arbitrum ecosystem;

Established DeFi protocols like Unichain and MakerDAO are moving;

Recent week's thoughts on DeFi.

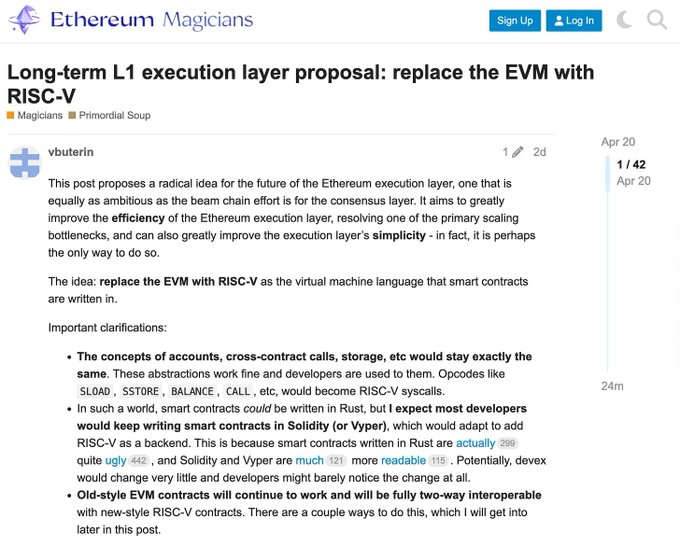

1/ First, regarding ETH: Vitalik proposes using RISC-V to replace EVM as the long-term execution layer.

A simplified explanation:

(1) Think of it as replacing the engine—aimed at improving efficiency

(2) Preparing for potential massive computational demands in the future

(3) Breaking through performance ceilings that are hard to overcome under the current EVM framework

(4) This change would only affect the底层 execution engine

(5) It won’t alter Ethereum’s account model or contract calling methods

(6) Users and developers won’t need to change how they interact with smart contracts

In summary, Vitalik believes that in the long run, Ethereum’s execution layer may face bottlenecks where execution becomes so resource-intensive that verification requires special hardware, thus limiting scalability. RISC-V is seen as a solution to this issue. Why is RISC-V better? Loosely speaking, RISC-V represents a general-purpose and highly efficient computing model, with more mature hardware and software ecosystems. This is still in the discussion phase—the actual implementation would be a major upgrade, likely taking several years to materialize.

2/ Ethena’s Chain Launch

I was personally surprised by Converge’s choice of the Arbitrum camp. After all, OP Superchain hosts strong players like Unichain and Base. Arbitrum clearly appears weaker in comparison. While both Arbitrum Orbit and OP Superchain are L2-based scaling solutions, their designs differ:

(1) Orbit allows developers to create dedicated Rollups or AnyTrust chains—either anchored directly to Ethereum as L2s, or to Arbitrum as L3s.

(2) OP Superchain envisions a network composed of multiple parallel L2s (called OP Chains), all built on a shared OP Stack codebase.

Loosely speaking: Orbit enables vertical scaling, while Superchain focuses on horizontal scaling. Their philosophies on modularity and flexibility differ. Orbit promotes openness—for example, Orbit chains can choose data availability (DA) options such as publishing data directly on Ethereum (Rollup mode), relying on a Data Availability Committee (DAC) (AnyTrust mode), or integrating with external DA networks like Celestia. In contrast, Superchain emphasizes EVM execution environments equivalent to Ethereum, prioritizing consistency and multi-chain standardization, with cautious approaches to modular changes.

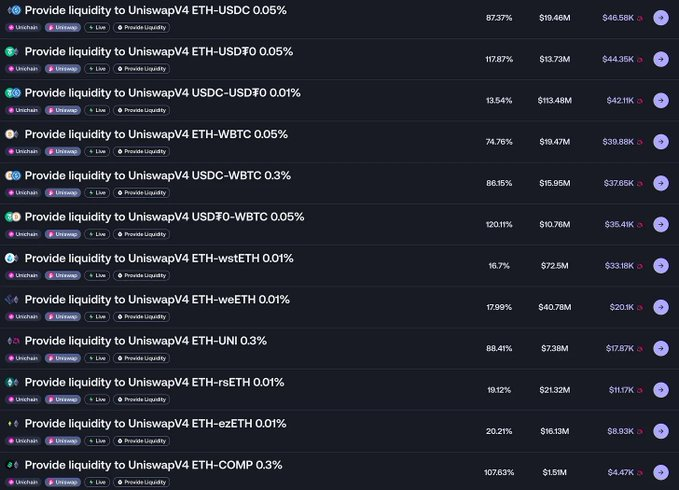

3/ Unichain Liquidity Mining Status

Yields are decent, but users must manage price ranges themselves. Mining across full ranges lacks impact (APRs shown on Merkl are inaccurate—you need to calculate based on your capital and chosen range). Compared to the previous version, the门槛 and complexity have increased. Newcomers show little interest, nor do meme-focused participants. The current user base remains largely veteran miners. For them, the absence of new competitors chasing rewards is actually favorable. Despite complaints, they keep participating—everyone plays their own game. Using this to bring DeFi into the mainstream remains challenging.

4/ Ripple’s stablecoin RLUSD has entered major DeFi protocols

(1) Aave has added RLUSD to its V3 deployment

(2) Curve Pool has deployed $53M in liquidity

Stablecoins are indeed hot this year—it seems this sector always finds relevance in every cycle. When regulations are unclear, algorithmic stablecoins take center stage; when compliance improves, big players step in.

5/ Optimism launches SuperStacks campaign, preparing for upcoming Superchain interoperability features

(1) Runs from April 16, 2025, to June 30, 2025

(2) Encourages users to engage in DeFi across the Superchain and earn XP

(3) Protocols can add their own incentive layers

(4) OP officially states there will be no token airdrop—this is framed as a social experiment

Worth participating in if you follow Superchain developments. For instance, mining on Unichain also earns XP. Not recommended to farm aggressively. I’ve been closely watching Superchain’s interoperability progress—curious to see what changes it brings upon official launch.

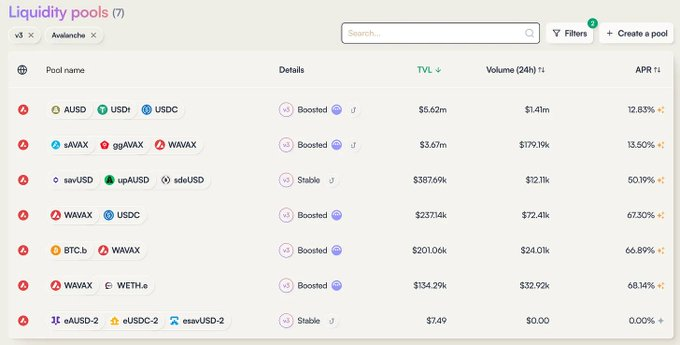

6/ Balancer V3 launches on Avalanche with $AVAX incentives

Rewards are reasonable, though capacity is limited. BAL was previously delisted by Binance, yet the protocol continues active development, including ecosystem collaborations and upgrades. This legacy DeFi project hasn’t reached the dominance of Uniswap or Aave, nor does it enjoy the token-launch benefits of newer DeFi projects—it’s struggling to survive. Its hopes rest on a broader on-chain market surge.

7/ Circle launches CPN network targeting global payments

A compliant, seamless, and programmable framework aggregating financial institutions, designed to coordinate global payments via fiat, USDC, and other payment-oriented stablecoins. The network aims to overcome infrastructure barriers stablecoins face in mainstream adoption—such as unclear compliance requirements, technical complexity, and secure digital cash storage.

Initially addressing cross-border payments, replacing slow and expensive traditional systems. Previously, Ripple comes to mind, though not well understood. With added programmability, this is positive overall—driving blockchain adoption. If every country had an on-chain stablecoin, the landscape would shift significantly. In practice, this also encourages more nations to issue regulated stablecoins.

8/ "Bridge" War

(1) GMX selects LayerZero as the messaging bridge for its multi-chain expansion plan

(2) a16z crypto purchases $55M worth of LayerZero tokens, locked for three years

(3) Wormhole releases its future roadmap

Some thoughts:

This sector is extremely essential but crowded. Most revenue comes from transaction fees, leading to intense competition—which benefits users due to lower costs. From a protocol integration perspective, stability and security are paramount considerations.

These giants carry super-high valuations, making economic design difficult. From this angle, such services might be better suited as standalone blockchains, or adopting mechanisms similar to PoS chain token models.

9/ Spark (MakerDAO) deploys $50M into Maple

Notably, this marks Spark’s first deployment outside U.S. Treasury-related assets, albeit capped at $100M.

Who is Maple?

Maple specializes in connecting on-chain and off-chain unsecured lending, with core products including the main platform Maple Finance and derivative platform Syrup:

(1) Maple serves qualified investors and institutions on both sides

(2) Syrup expands on-chain user deposits through SyrupUSDC

A key role within Maple:

Pool Delegates: Typically reputable institutions or trading firms responsible for managing loan pools. They are central managers in the Maple ecosystem, with responsibilities including:

- Conducting credit assessments on borrowers and approving loans

- Setting loan terms (e.g., interest rates, duration)

- Monitoring loan execution and repayments

- Asset recovery in case of borrower default

Clearly, the protocol’s operation heavily depends on Pool Delegates.

Maple is an older project that wasn’t popular last cycle, mainly because its model involves collecting on-chain deposits and then centrally issuing unsecured loans to off-chain clients—a concept previously hard to accept. However, due to shifts in regulatory environments and user mindsets, it’s gradually gaining traction. Still, personally, choosing Maple for USDS fund deployment remains a relatively high-risk move.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News