On-Chain Data Academy (VI): A New BTC Valuation Methodology with ARK's Research Participation (I)

TechFlow Selected TechFlow Selected

On-Chain Data Academy (VI): A New BTC Valuation Methodology with ARK's Research Participation (I)

This article will introduce the fundamental principles of Cointime Price and its application for bottom-fishing.

Author: Mr. Berg

Foreword

The Cointime Price series is significantly more advanced than the first five articles. Readers who are new to the "On-Chain Data School" series or wish to learn on-chain analysis are advised to start with the earlier articles.

🔸TL;DR

- The Cointime Price series will be published in three parts—this is the first.

- This article introduces the fundamental principles of Cointime Price and its application for bottom fishing.

- Cointime Price is a novel and efficient BTC valuation method.

- It is stricter than Realized Price and more sensitive than LTH-RP.

🟡 Introduction to Cointime Price

The concept of Cointime Price was first introduced on August 23, 2023, in "Cointime Economics," a joint research paper by Ark Invest and Glassnode.

The calculation logic behind Cointime Price is relatively complex. This article aims to explain it in an accessible manner.

Cointime Price is a pricing model specifically designed for BTC's unique UTXO structure.

In this article, I will skip the intricate calculations and focus directly on explaining the underlying principles.

Simply put, since BTC operates as a blockchain, every block production and transaction undergoes a validation process.

Unlike traditional on-chain valuation methods, Cointime Price adopts a "time-weighted" approach:

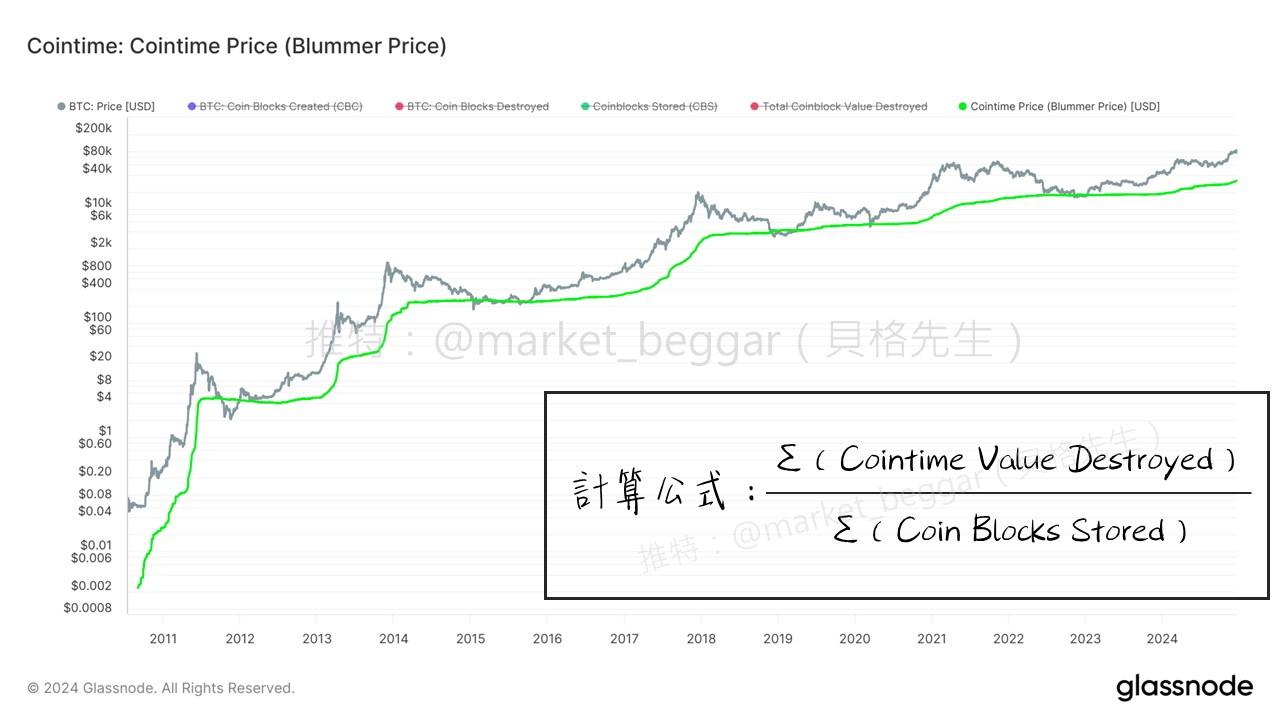

In the chart above, the green line represents Cointime Price, with the formula shown.

Three key concepts are involved:

- Coin Blocks Created (CBC)

In the nth block, CBC equals the total circulating supply of BTC at that time.

- Coin Blocks Destroyed (CBD)

When a certain amount of BTC is transferred, it is considered "destroyed."

Multiply the transferred BTC amount by the number of blocks (i.e., time) it has been held prior to transfer,

and you get CBD. CBD can thus be interpreted as the "time-weighted quantity of BTC."

- Coin Blocks Stored (CBS)

CBS = Sum of CBC - Sum of CBD, which can be understood as the "time-weighted quantity of unspent BTC."

In the formula above, the numerator sums up each CBD value multiplied by its corresponding price at the time of transfer.

Based on this, we can identify three characteristics of Cointime Price:

- Due to the time-weighting mechanism, when long-term holders conduct large-scale transfers (distribution), the rate of change in Cointime Price increases.

- Since transactions involve both buyer and seller, from the buyer’s perspective, the numerator in the formula can be seen as the current market's "total time-weighted expenditure." Dividing this value by CBS yields the "average time-weighted cost of circulating coins."

- Because CBD only counts coins upon transfer, inactive lost coins from ancient times do not generate CBD, effectively eliminating their influence on the metric.

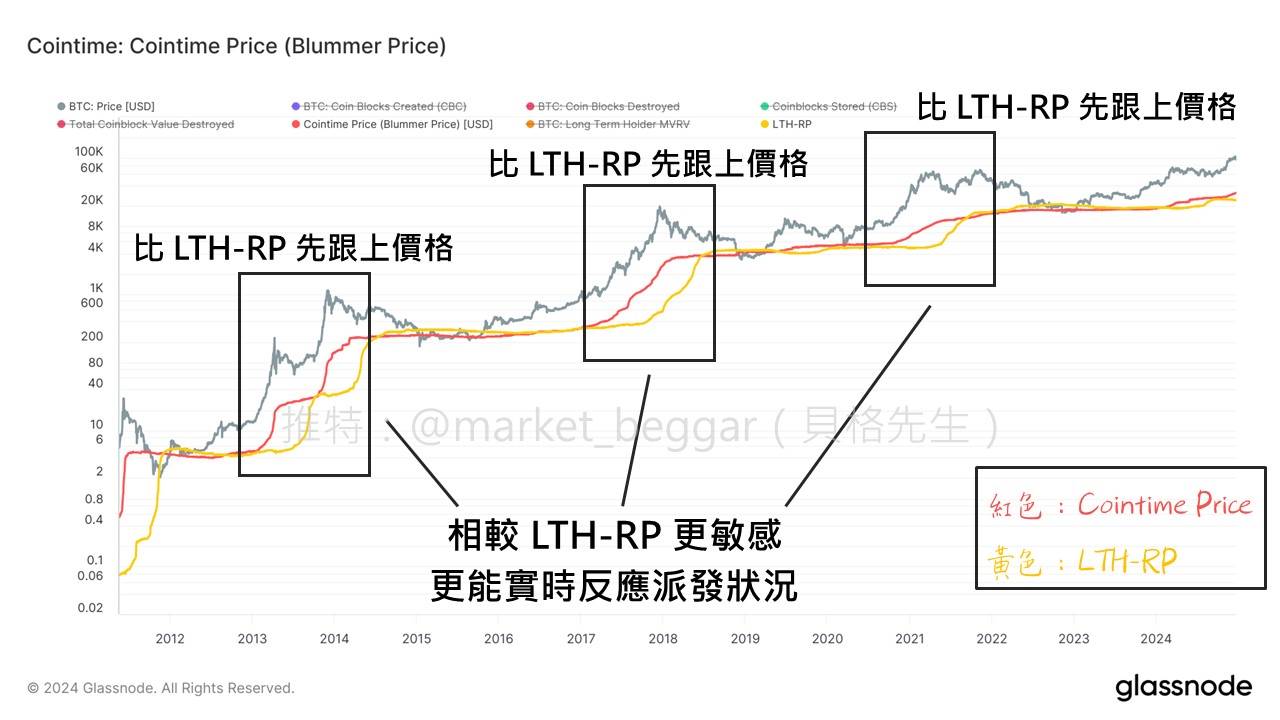

🟡 Comparison with LTH-RP

In previous articles, I introduced LTH-RP, which essentially represents the average cost basis of long-term BTC holders.

However, Glassnode defines long-term holders (LTH) as those holding coins for more than 155 days, offering only a relatively coarse approximation of "long-term" holding.

In contrast, Cointime Price directly considers how long each coin has been held at the moment of transfer,

making it more precise and sensitive compared to LTH-RP.

As shown in the chart above, Cointime Price consistently reacts earlier than LTH-RP ahead of major bull runs, providing more timely signals of distribution activity.

Therefore, in my own analysis, I prefer using Cointime Price to assess market conditions.

🟡 Application for Bottom Fishing

As previously mentioned, Cointime Price provides a fair valuation of BTC through time-weighted measurement.

Thus, when the market price falls below the Cointime Price, it indicates that BTC is trading below its intrinsic value,

which often presents a favorable opportunity to accumulate.

In the chart below, I have marked historical instances when BTC's price traded below Cointime Price—each representing a solid entry point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News