Without perpetual interest rates, can DeFi ever be complete?

TechFlow Selected TechFlow Selected

Without perpetual interest rates, can DeFi ever be complete?

A missing piece in the DeFi ecosystem.

Author: defiance

Translation: zhouzhou, BlockBeats

Editor's Note: DeFi lacks a CME-like perpetual instrument for interest rates, leading to high volatility and inability to hedge rate risks. Introducing interest rate perps could allow borrowers and lenders to lock in rates, enable arbitrage and risk management, and promote integration between DeFi and TradFi—boosting market efficiency and stability.

Below is the original article (slightly edited for clarity):

At the Chicago Mercantile Exchange (CME), daily trading volume in interest rate futures exceeds one trillion U.S. dollars. This massive volume primarily comes from banks and asset managers hedging the risk between floating rates and their issued fixed-rate loans.

In DeFi, we've already built a thriving floating-rate lending market with over $30 billion in total value locked (TVL). Pendle’s incentivized order book has achieved more than $200 million in liquidity in a single market, demonstrating strong demand for interest rate spot products.

Yet we still lack a native DeFi equivalent of CME’s interest rate futures—a tool enabling both borrowers and lenders to hedge interest rate risk (IPOR swaps don’t count—they’re too complex).

To understand why we need such a tool, we must first examine how interest rates work in DeFi.

Take AAVE as an example: its rates adjust dynamically based on supply and demand. However, AAVE’s supply-demand dynamics are not isolated—they exist within the broader context of the global economy.

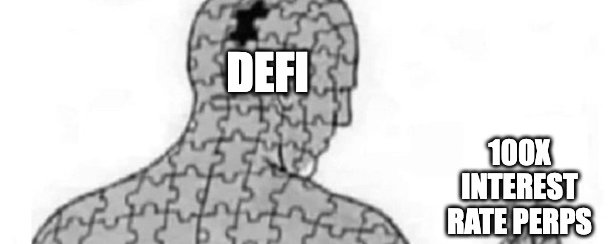

Plotting AAVE’s smoothed USDC floating rate against CME’s 10-year Treasury futures price reveals this macroeconomic correlation:

AAVE’s USDC rate generally follows global interest rate trends but lags behind. The main reason for this lag is the absence of an immediate linkage mechanism between global rates and AAVE rates.

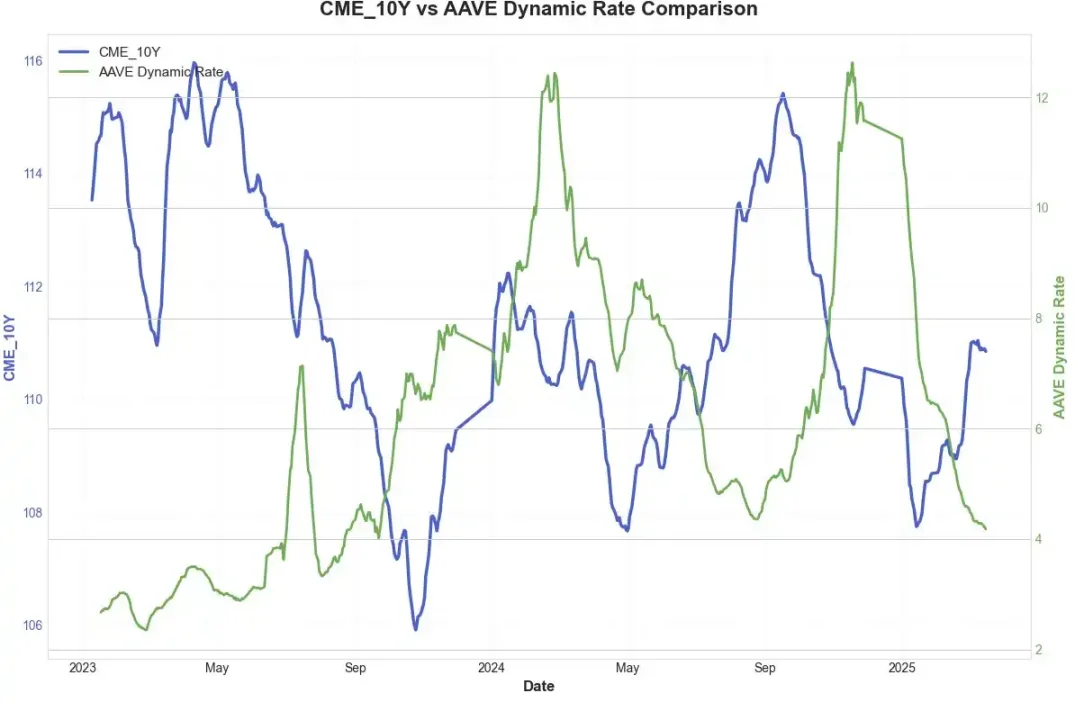

This disconnect means that internal crypto market dynamics play a stronger role in shaping interest rates. When we remove smoothing and directly compare AAVE’s rate with the global 10-year government bond yield, the phenomenon becomes even clearer:

AAVE’s rates are extremely volatile and, for most of the time, carry a significant premium over U.S. 10-year Treasury yields.

The root cause remains the lack of direct connection between these two markets. If there were a simple, two-way mechanism linking DeFi and TradFi interest rates—one allowing for hedging or arbitrage—the two ecosystems could be better integrated.

And **perpetual swaps on interest rates** are precisely the best way to achieve this. Perps have already proven product-market fit (PMF). Establishing a perpetual market covering both AAVE rates and U.S. Treasury yields would bring transformative change.

For instance:

Borrowers can go long on a perpetual swap pegged to AAVE’s borrowing rate. If the annual borrowing rate surges from 5% to 10%, the price of the perp rises, offsetting the increased cost.

Conversely, if rates fall and borrowing becomes cheaper, the perp position incurs a loss—similar to paying an "insurance premium." In effect, borrowers lock in a fixed effective rate by combining borrowing with a long perp position.

For stablecoin lenders, they can short a perpetual swap based on stablecoin lending rates. If lending yields decline, gains from the short perp position offset reduced loan income; if yields rise, the short position loses money, but higher interest earnings compensate—achieving a natural hedge.

Moreover, these contracts can support high leverage. On CME, 10x leverage is standard.

A liquid interest rate market also reduces cascading sell-offs during periods of stress. If market participants are properly hedged in advance, they won't be forced into mass withdrawals or liquidations due to rate fluctuations.

More importantly, this opens the door to genuine long-term fixed-rate loans—if the interest rate perp is fully native to DeFi, various protocols can use it to hedge long-term rate exposure and thereby offer users fixed-rate lending products.

In traditional finance, hedging interest rate risk is standard practice; most long-term loans are backed by interest rate hedging instruments.

Bringing this mechanism into DeFi will not only improve efficiency but also attract more TradFi participants, building a real bridge between DeFi and TradFi.

We can make markets more efficient—and all it takes is the introduction of an interest rate perpetual swap.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News