Gold at $3,357 Magic Level Triggered: Historical Data Reveals Bitcoin's 5-Month Law for Breaking New Highs

TechFlow Selected TechFlow Selected

Gold at $3,357 Magic Level Triggered: Historical Data Reveals Bitcoin's 5-Month Law for Breaking New Highs

Investors should pay attention to the complementary nature of gold and Bitcoin to cope with economic turmoil.

By Lawrence

In April 2025, Bitcoin's price continued to oscillate between $83,000 and $85,200, failing to break through the critical resistance level of $86,000. This price movement closely correlates with subtle shifts in macroeconomic data.

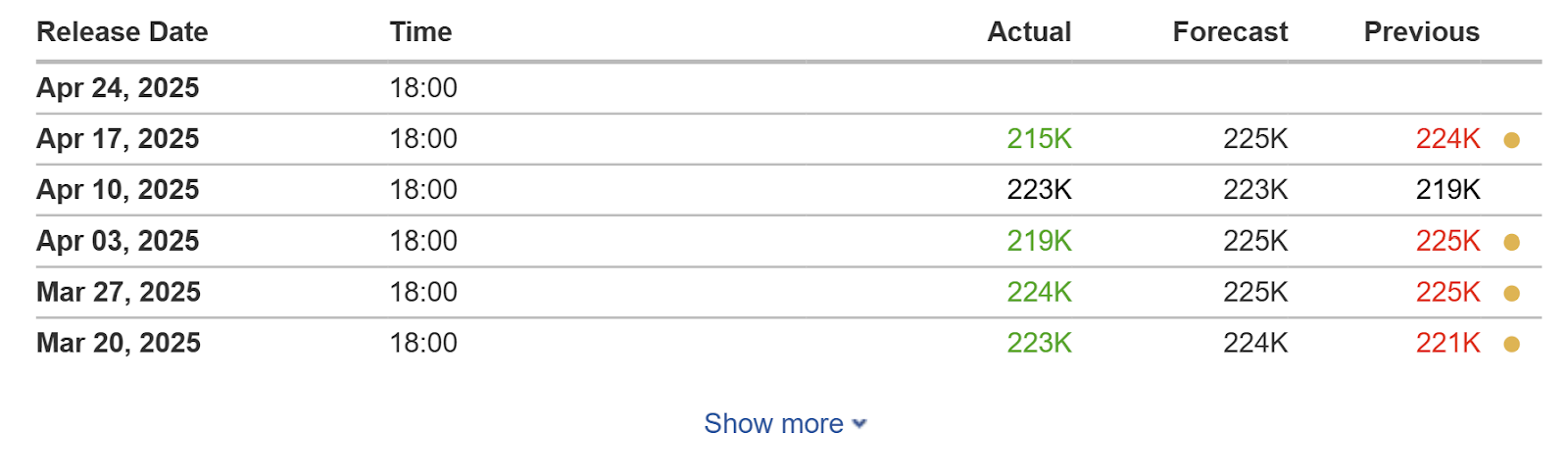

U.S. initial jobless claims data.

On April 17, the U.S. Labor Department reported that initial jobless claims came in at 215,000—lower than the expected 225,000—indicating resilience in the labor market. While this signals economic stability, it has also reduced market expectations for Federal Reserve rate cuts, dampening short-term speculative sentiment toward risk assets.

Fed Chair Powell stated on April 16 that the recently implemented "reciprocal tariffs" in the U.S. had far exceeded expectations, potentially creating dual pressures of rising inflation and slowing economic growth.

Meanwhile, Trump said at a press conference: "I think he (Powell) is terrible, but I can't complain," noting that the economy was strong during his first term. He went on to criticize Powell, accusing the central banker of "playing politics," and described him as "someone I never particularly liked."

Trump later added: "I think Powell will cut rates eventually. The only thing he knows how to do is cut rates."

Although the Fed has clearly stated it will not intervene in markets or initiate rate cuts, the European Central Bank has already lowered interest rates from 2.50% to 2.25%, reaching its lowest level since late 2022, aiming to mitigate the economic impact of tariff policies. This divergence in global monetary policy further increases market uncertainty, prompting investors to reassess the safe-haven attributes of assets like Bitcoin.

From a technical perspective, Bitcoin is at a critical turning point. Anonymous trader Titan of Crypto noted that BTC prices have been consolidating within a tightening triangle pattern, with the RSI indicator hovering above 50 and attempting to breach resistance levels—suggesting an imminent directional breakout. Order flow analyst Magus warned that if Bitcoin fails to break above $85,000 soon, long-term charts could turn bearish. The battle over this price range is not only significant for short-term trends but may also determine whether Bitcoin can sustain the bull market that began in 2024.

Historical Correlation: Bitcoin’s Lagging Effect Following Gold’s New Highs

On April 17, gold surged to a record high of $3,357 per ounce, drawing widespread attention to Bitcoin’s potential trajectory.

Historical comparison of Bitcoin and gold price movements.

Historical data reveals a notable lag correlation between gold and Bitcoin: after gold reaches new highs, Bitcoin typically follows suit and breaks past its previous peaks within 100–150 days.

For example, after gold rose 30% in 2017, Bitcoin hit its historical peak of $19,120 that December; following gold’s breakthrough above $2,075 in 2020, Bitcoin climbed to $69,000 by November 2021.

This relationship stems from their complementary roles during times of economic uncertainty. As a traditional safe-haven asset, gold usually reflects inflation expectations and monetary easing signals first, while Bitcoin—due to its fixed supply and decentralized nature—acts as a delayed force under the “digital gold” narrative.

Correlation between Bitcoin and gold price movements.

Joe Consorti, Growth Lead at Theya, pointed out that Bitcoin’s lag behind gold trends is tied to its market maturity—institutional investors require more time to shift allocations from traditional to digital assets.

Currently, the surge in gold prices resonates with uncertainty surrounding Fed policy.

Mike Novogratz, CEO of Galaxy Digital, described this phase as America’s “Minsky Moment”—the tipping point where unsustainable debt meets collapsing market confidence. He believes the concurrent strength in both Bitcoin and gold reflects growing concerns over a weakening dollar and the $35 trillion national debt, with tariff policies exacerbating global economic disorder.

Cycle Models and Long-Term Outlook: Bitcoin’s “Power Law Curve” and the $400,000 Target

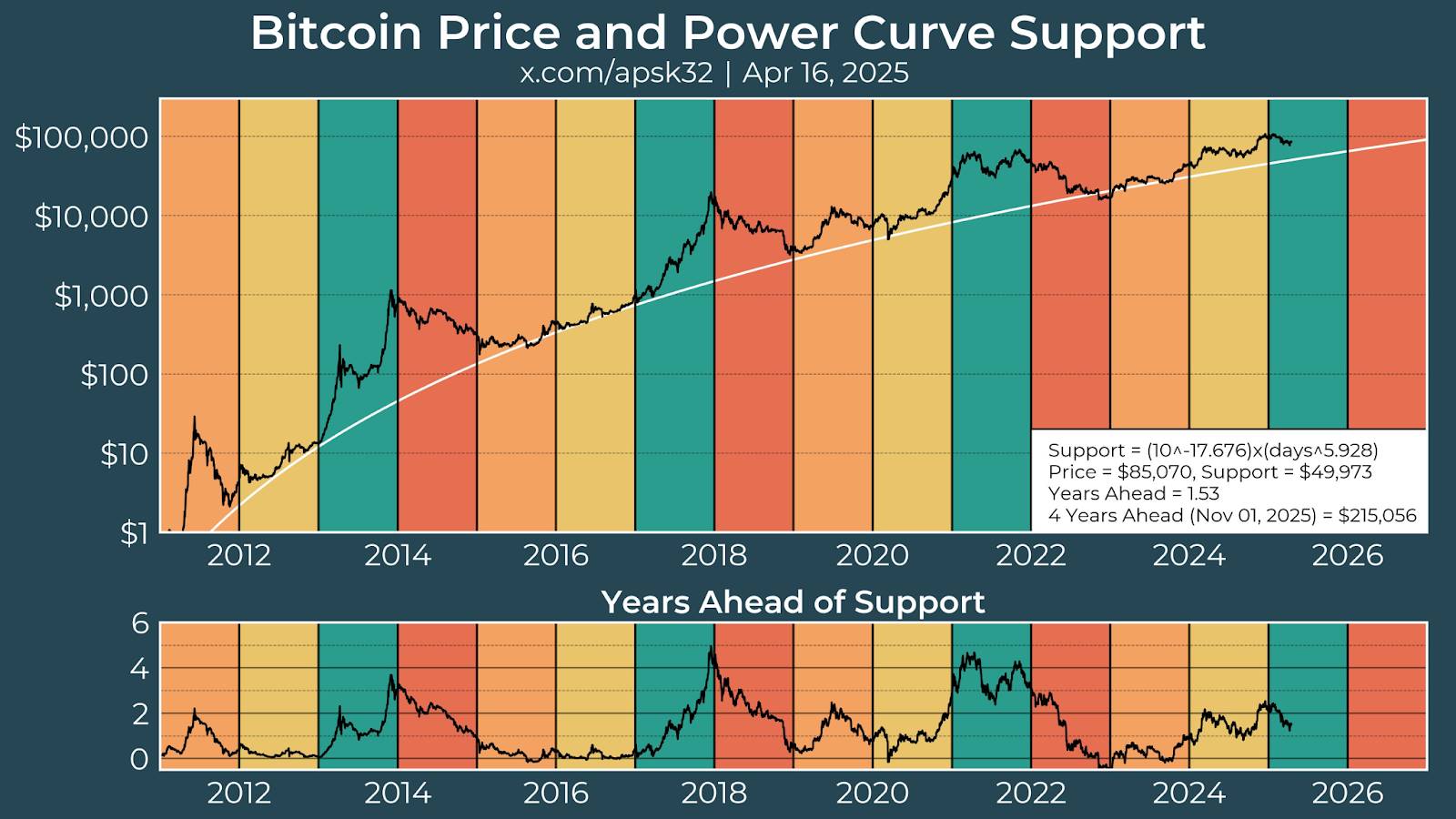

Despite near-term volatility, analysts remain optimistic about Bitcoin’s long-term prospects. Anonymous analyst apsk32, using the “power law curve time profile” model, predicts Bitcoin will enter a parabolic growth phase in the second half of 2025, with a target price as high as $400,000.

The model standardizes Bitcoin’s market cap against gold’s and measures Bitcoin’s value in gold ounces, revealing a potential valuation logic based on its role as “digital gold.”

Bitcoin price and hash rate chart.

Historical cycle patterns support this forecast. Bitcoin’s halving effect—occurring roughly every four years—typically triggers a bull run 12–18 months afterward. The April 2024 halving event may thus gain momentum in Q3 to Q4 of 2025.

At the same time, institutional investors continue accumulating Bitcoin via compliant instruments such as ETFs. By February 2025, total net assets under management in BTC ETFs reached $93.6 billion, further cementing its status as a mainstream asset.

However, markets must remain alert to the risk of “expectation exhaustion.” The current bull market is primarily driven by institutional accumulation and ETF inflows, while retail participation remains weak. Exchange-based BTC balances have dropped to their lowest since 2018, intensifying liquidity trap risks. If Bitcoin fails to expand into broader use cases—such as payments or smart contracts—its valuation could face downward pressure.

Policy Variables: Tariffs, Liquidity Crises, and Market Restructuring

In April 2025, U.S. tariffs on Chinese goods soared to 104%, with Japan and Canada also facing steep tariff shocks. These policies have not only heightened global inflation expectations but reshaped capital flows. Bloomberg data shows these tariffs increased U.S. consumer prices by about 2.5%, adding nearly $4,000 to average household annual spending. To counter economic strain, the Fed may be forced to restart quantitative easing, and monetary expansion would further strengthen Bitcoin’s anti-inflation narrative.

Tariff policies also highlight Bitcoin’s decentralized advantages. Amid disruptions to traditional cross-border payments, stablecoins like USDT—with their low cost and instant settlement—have become tools for emerging markets to circumvent capital controls. For instance, stablecoin premiums in countries like Argentina and Turkey have remained persistently high at 5%-8%, reflecting urgent demand amid fiat currency crises.

Yet, the short-term market turbulence triggered by tariffs cannot be ignored. On April 9, Bitcoin briefly fell to $80,000, a one-day drop of 7%, with over $1 billion in derivatives positions liquidated in a single day. Such volatility indicates Bitcoin has not fully shed its label as a “high-risk asset,” remaining highly sensitive to macro sentiment and leveraged liquidations.

Conclusion: Asset Allocation Logic in a New Economic Paradigm

The core tension in today’s market lies in the mismatch between exhausted policy expectations and underlying momentum. Bitcoin’s long-term value hinges on overcoming dual challenges: regulatory frameworks and technological bottlenecks.

Investors should recognize clearly that 2025–2026 could represent Bitcoin’s “final狂欢” (“final celebration”).

In this shifting landscape, the complementarity between gold and Bitcoin becomes increasingly evident. Gold, backed by historical consensus and superior liquidity, remains the ultimate crisis hedge. Bitcoin, meanwhile, validates its identity as “Digital Gold 2.0” through demonstrated de-correlation, emerging as a core component in diversified portfolios.

For individual investors, allocating across physical gold and major cryptocurrencies, while watching for “oversold opportunities” in emerging market bonds, may offer the best defense against turbulence.

History doesn’t repeat itself, but it often rhymes. Whether it’s Bitcoin’s pivotal $85,000 level or gold’s new high at $3,357—an echo of restructuring global economic order lies beneath these numbers. Only with rationality and foresight can one seize new opportunities amid uncertainty.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News