Top Nine DeFi Protocols Without Launched Tokens That Offer Points Mining

TechFlow Selected TechFlow Selected

Top Nine DeFi Protocols Without Launched Tokens That Offer Points Mining

In the crypto space, the "one-click-to-earn" returns are higher than in any other industry.

Author: Ignas

Translation: Felix, PANews

While the crypto market appears dull and dominated by macro factors, a batch of emerging, promising tokenless protocols is worth trying. This article highlights 9 protocols where you can participate in points farming.

1. Ostium

Perpetual exchanges are an extremely competitive space, with leaders constantly shifting: dydx → GMX → Hyperliquid.

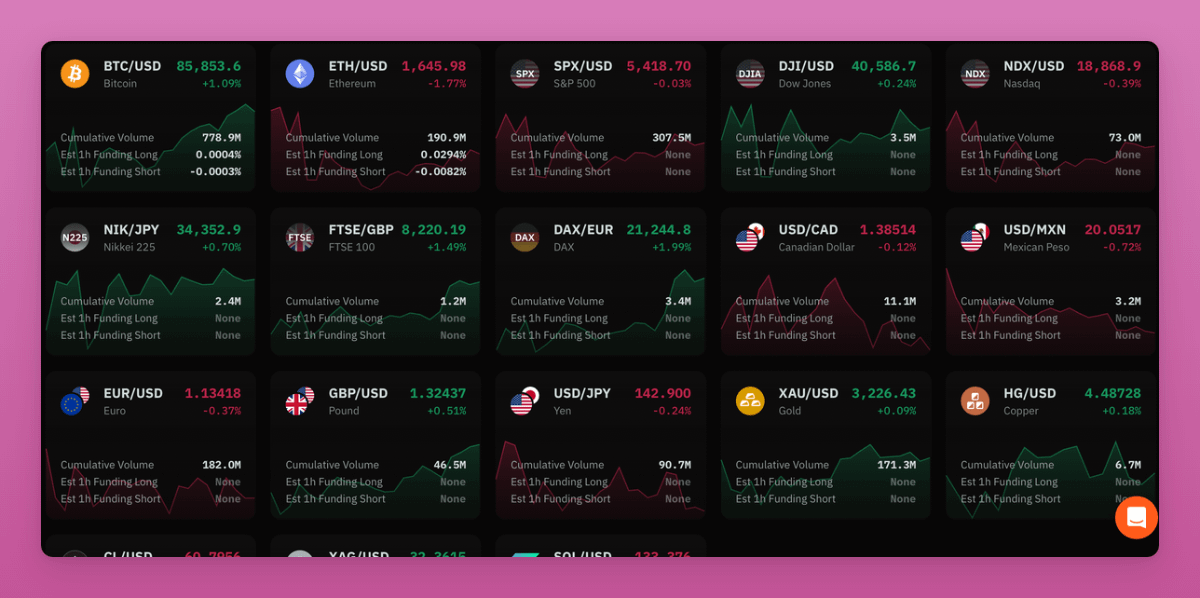

However, Ostium stands out as a unique protocol. It brings leveraged trading of traditional financial assets—such as the S&P 500, Dow Jones, Nikkei, gold, copper, and many others—on-chain.

Built on Arbitrum, these "real-world assets" (RWA) aren't actually backed by real-world collateral. Instead, Ostium provides synthetic on-chain price exposure via oracle pricing.

Although not the first in this category, Ostium has shown solid momentum (source: Dune):

- Ostium Liquidity Pool (OLP) has a total TVL of $46 million, functioning similarly to HLP on Hyperliquid by generating fees from trades and liquidations

- 845 daily active users, 2,225 weekly active users

- Total trading volume reached $2.1 billion

Ostium has been rewarding traders and OLP depositors with points since March 31.

On-chain RWA trading—even through synthetic assets—holds significant potential for many crypto-native users, enabling them to avoid withdrawing stablecoins to traditional finance platforms.

This could turn into a nice airdrop for early adopters.

2. Axiom

You may have heard of Photon, BullX, GMGN, BonkBot, and other Solana-based trading platforms.

But those are products of 2024.

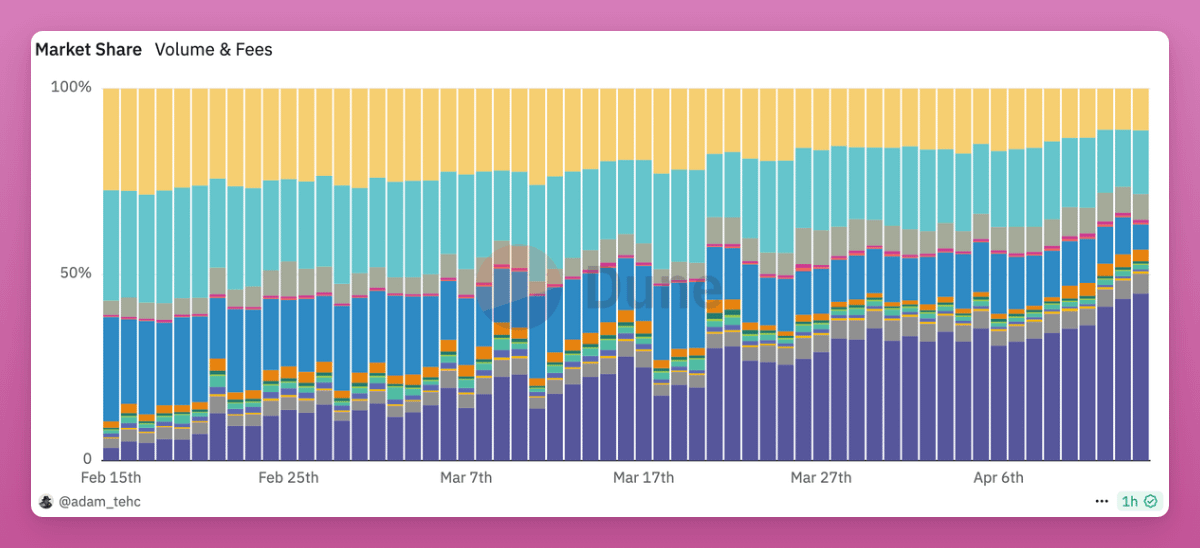

Axiom, backed by Y Combinator, launched in February and has already taken dominance across the entire category (44% market share, shown as the dark blue portion in the dashboard below).

Source: Dune

Interestingly, Axiom’s official X account and co-founders maintain a low profile on X, rarely posting. Marketing seems to be driven purely by word-of-mouth.

Moreover, Axiom’s ultimate goal is to enable trading of any asset across any chain—including perpetuals (via real-time trading on Hyperliquid), yield protocols, wallet tracking, and more.

Axiom benefits when speculative activity returns to the Solana network.

Currently, their points program is live and accessible through trading, completing tasks, and referrals.

3. Fragmetric

If you missed Solayer, Fragmetric might be your second chance (especially since LAYER has actually appreciated post-airdrop).

About Fragmetric, two things to note:

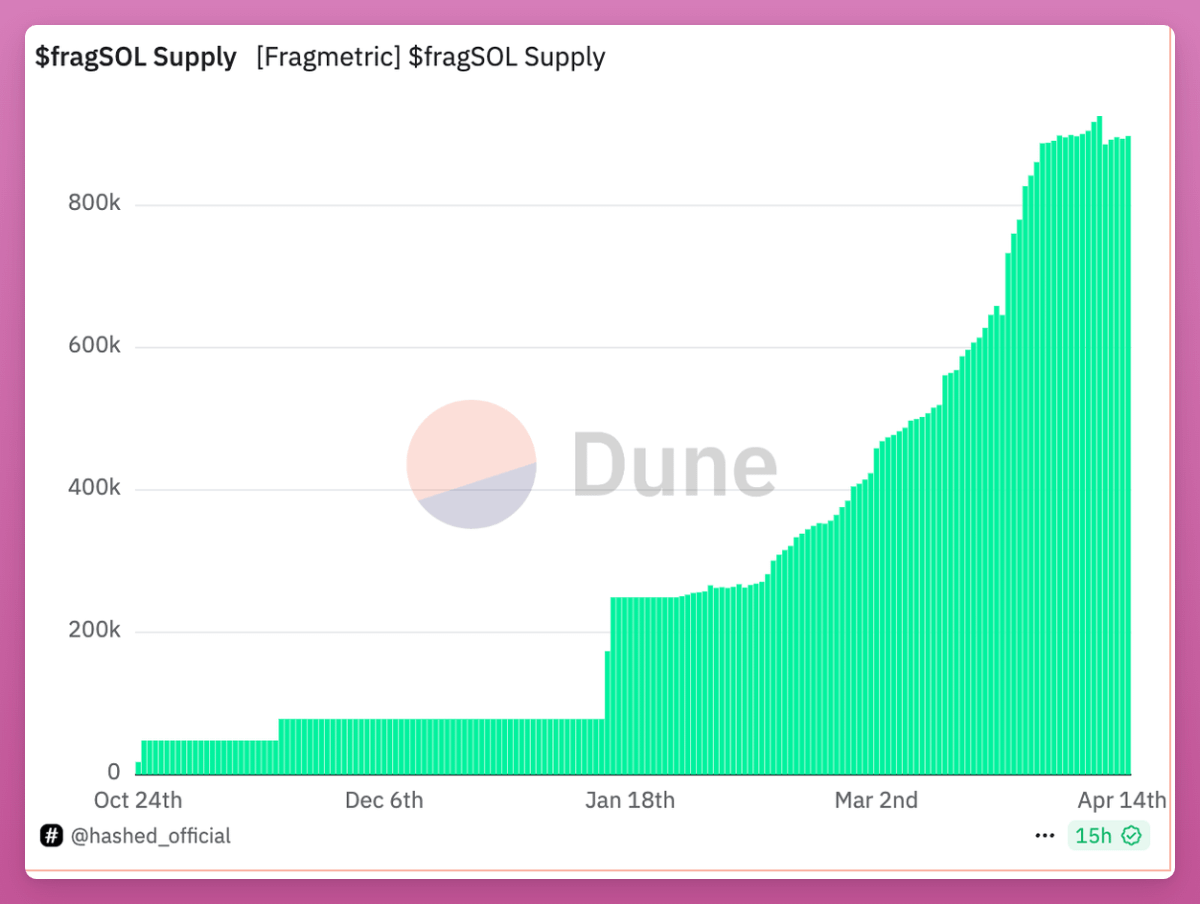

- Bad news: It's not that early anymore—the deposit service opened back in October 2024.

- Good news: It's still not too late. The token hasn’t launched yet, and points are still being tracked. It’s a simple “deposit-to-farm” model.

In short, Fragmetric is a liquidity restaking protocol built on Solana.

When you deposit SOL or LST into Fragmetric, you receive LRT tokens like fragSOL or fragJTO.

Restakers become part of SANG (SolanA Network Guard), a guardian community protecting the Solana ecosystem. Additionally, you can earn extra rewards by securing NCNs/AVSs (new decentralized services).

If you hold idle SOL and want to diversify risk beyond Kamino, Marginfi, and Solayer, this is a very straightforward strategy.

TVL has reached $125 million, so it’s not exactly early—but still worthwhile.

F Points serve as Fragmetric’s loyalty system—users earn them simply by holding LRT. You can earn even more points by wrapping LRT (e.g., wfragSOL for use in DeFi).

Fragmetric has raised $12 million in total. Its latest round of $5 million was funded by RockawayX, Robot Ventures, Amber Group, and BitGo.

In short: Fragmetric is a simple SOL yield farm.

4. Loopscale

Now, Loopscale lets you earn even more yield using your newly acquired fragSOL. More details below.

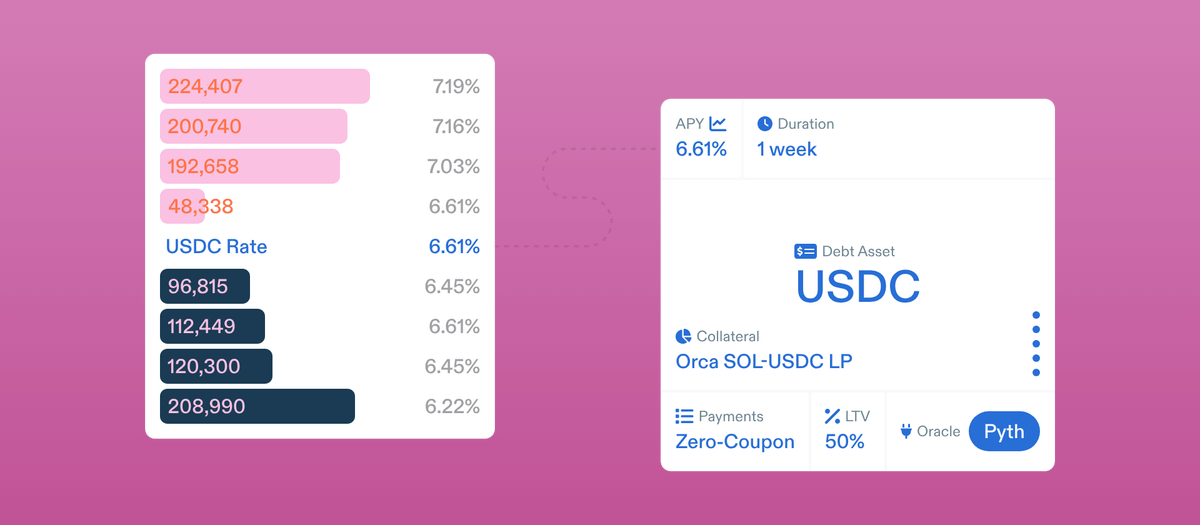

Loopscale introduces modular, orderbook-based lending innovation to Solana DeFi.

This differs from the liquidity pool models used by Kamino, Marginfi, or even Aave:

As stated in Loopscale’s official documentation: “By replacing liquidity pools and algorithmic interest rates with direct orderbook matching, Loopscale improves capital efficiency, enables more precise risk management, and supports new markets difficult to achieve under traditional DeFi architectures.”

Users can lend/borrow, loop (one-click leverage boost similar to Kamino), or join vaults.

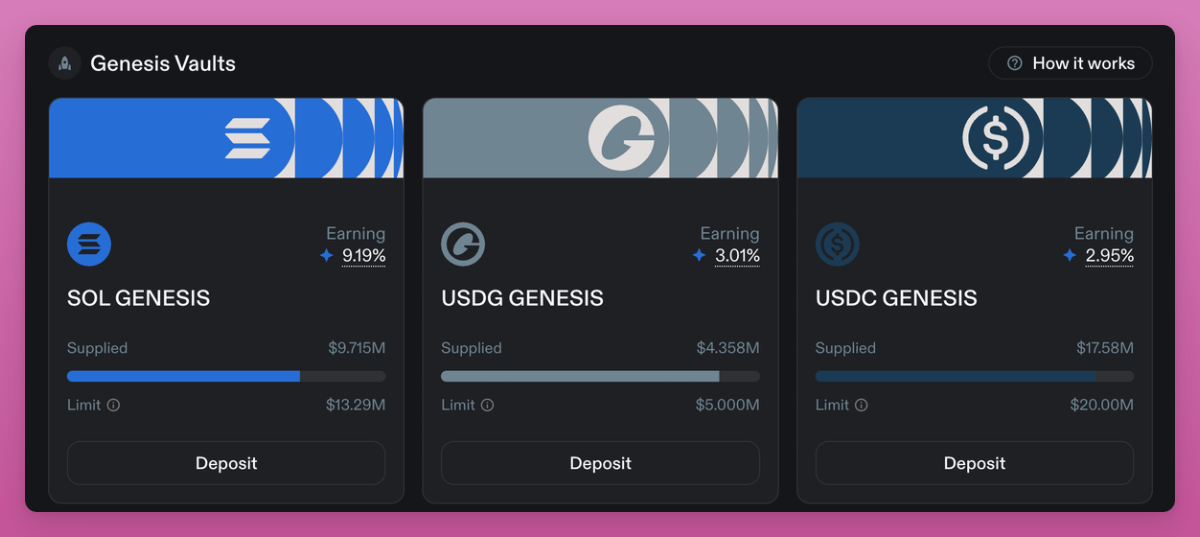

Since ending its closed beta five days ago, Loopscale has launched Genesis Vaults offering over 6x points until caps are reached.

A simple strategy is JUPSOL looping, yielding over 22% APY (similar to Kamino Multiply), which earns double points.

Additionally, the team notes that short-term LST/LRT depegging won’t trigger user liquidation, “but staking yields falling below borrowing costs or poor validator performance may lead to liquidation.”

For more degen users aiming for 32% APY on SOL, there’s another vault option using fragSOL:

- Deposit SOL into Fragmetric

- Obtain PT-fragSOL on Exponent (Solana’s Pendle)

- Loop PT-fragSOL on Loopscale for 32% APY

Current TVL is around $40 million, so it’s still early.

Backers of Loopscale include CoinFund, Solana Ventures, Coinbase Ventures, Jump, and Room40.

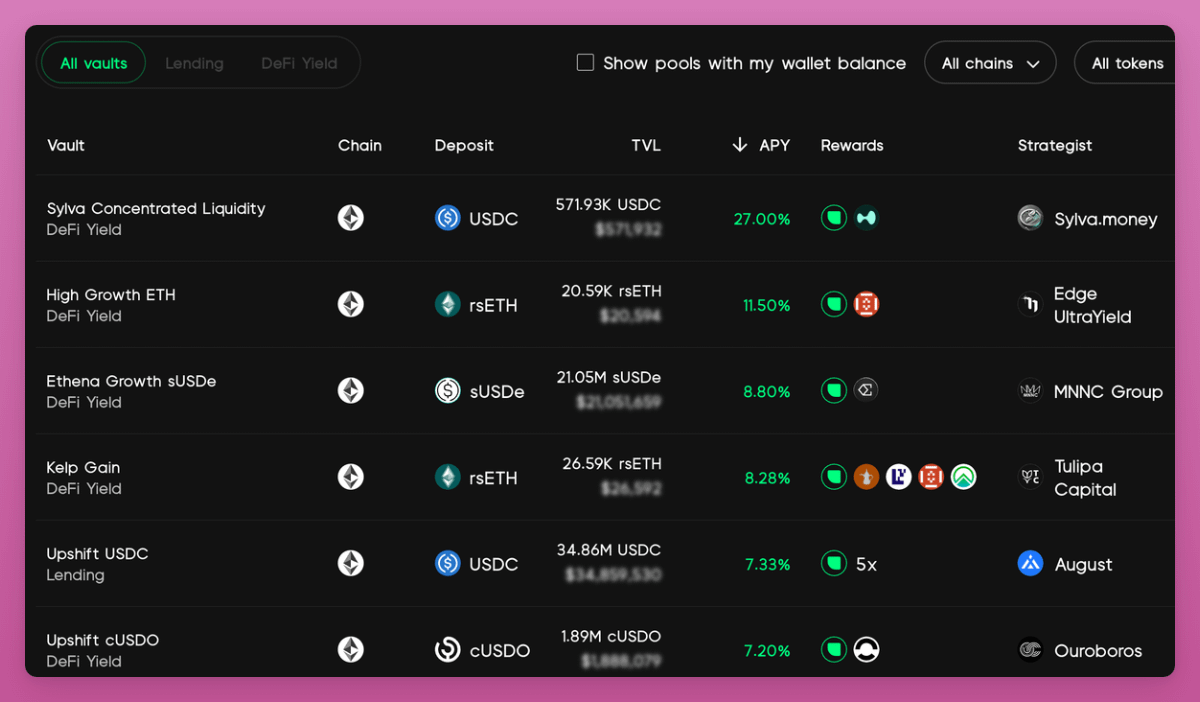

5. Upshift

Do you find DeFi increasingly complex and hunting for high-yield opportunities too time-consuming?

With Upshift, you can deposit crypto into vaults managed by “seasoned hedge funds” and investment managers.

Yield strategies range from looping to more sophisticated products, including delta-neutral hedging, OTC options, or systematic stablecoin DEX market making.

Upshift offers four core products:

- Lending: Provide over-collateralized loans on-chain to vetted institutions

- DeFi Yield: Vaults curated by top-tier DeFi funds

- Vault-as-a-Service: Plug-and-play protocol vaults

- Synergy: Borrow against vault positions to enhance yield and capital efficiency

At the time of writing, total TVL stands at $236 million—decent traction. There’s also a 5x points multiplier active until deposits reach $750 million.

I personally prefer the Hyperbeat Ultra HYPE strategy, which manages yield farming for HYPE tokens within the HyperEVM ecosystem.

The project is backed by Dragonfly VC, Hack VC, 6MV, and Robot Ventures.

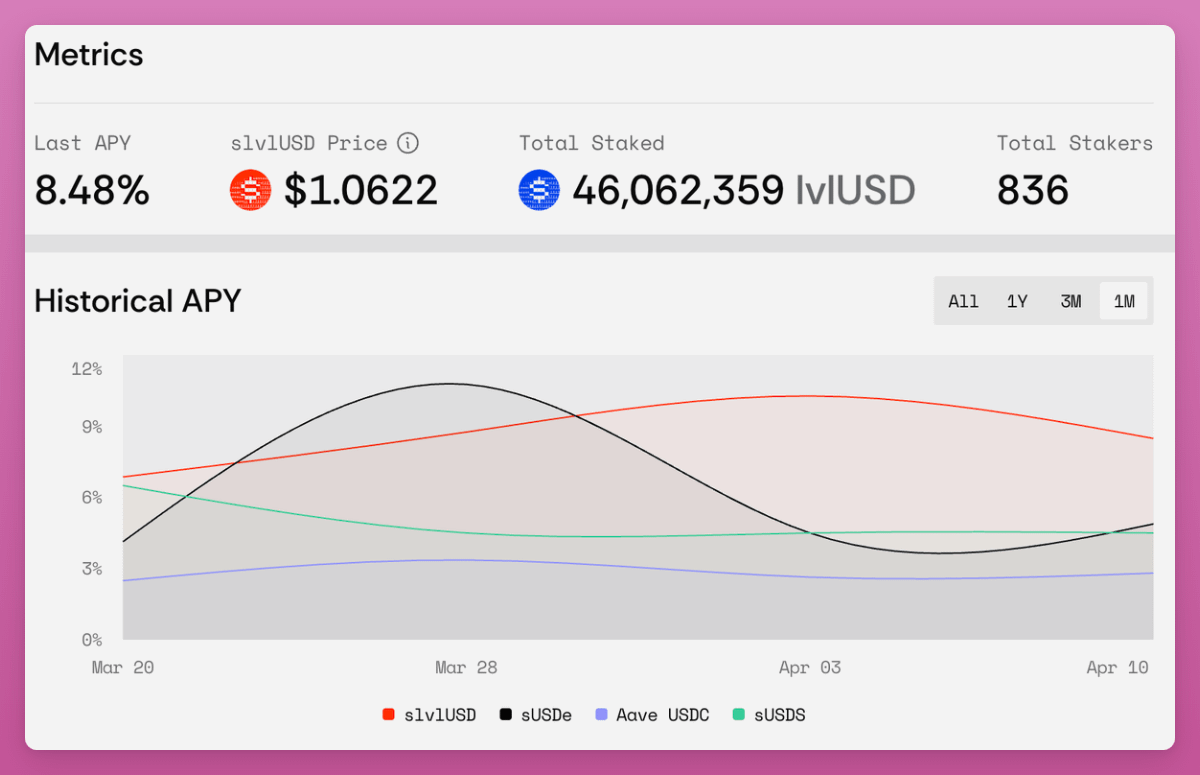

6. Level

If you hold any stablecoins, pay attention:

Level is a stablecoin protocol issuing lvlUSD. lvlUSD itself is a yield-bearing stablecoin backed by USDC and USDT, generating yield through premium lending protocols.

You deposit USDC → it gets deployed into platforms like Aave/Morpho → you receive lvlUSD to use elsewhere in DeFi.

Simply stake lvlUSD into slvlUSD to earn an 8.48% APY.

To earn XP points, however, you need to use lvlUSD in DeFi mining—depositing lvlUSD into Curve, Spectra, or Pendle (where PT currently offers 13% yield).

At the time of writing, TVL is $138.26 million—solid performance. Level’s social following on X is growing, a positive sign ahead of a potential token launch.

The project is backed by Dragonfly VC and Polychain.

Level isn’t the first protocol attempting this model—many have failed to achieve product-market fit. However, given strong yields and an upcoming airdrop, this could be a promising opportunity.

7. Huma

Stablecoins and RWAs are hot topics, but access remains difficult for users. You could wait for Circle’s IPO, but don’t expect 10x gains overnight.

Huma, a PayFi (Payments Finance) network, recently raised $38 million from Hashkey Capital, Folius Ventures, Stellar, and others.

Previously, Huma merged with Arf, a Circle-backed protocol providing liquidity and settlement services for cross-border payments.

What makes Huma unique:

Traditional cross-border payments take days, incur high fees, and let banks capture most profits. Huma solves this using blockchain and stablecoins (USDC), enabling instant, global, low-cost fund transfers.

Huma leverages stablecoins and on-chain liquidity to accelerate real-world payments. Financial institutions can settle large sums globally, eliminating reliance on legacy systems like SWIFT or pre-funding mechanisms.

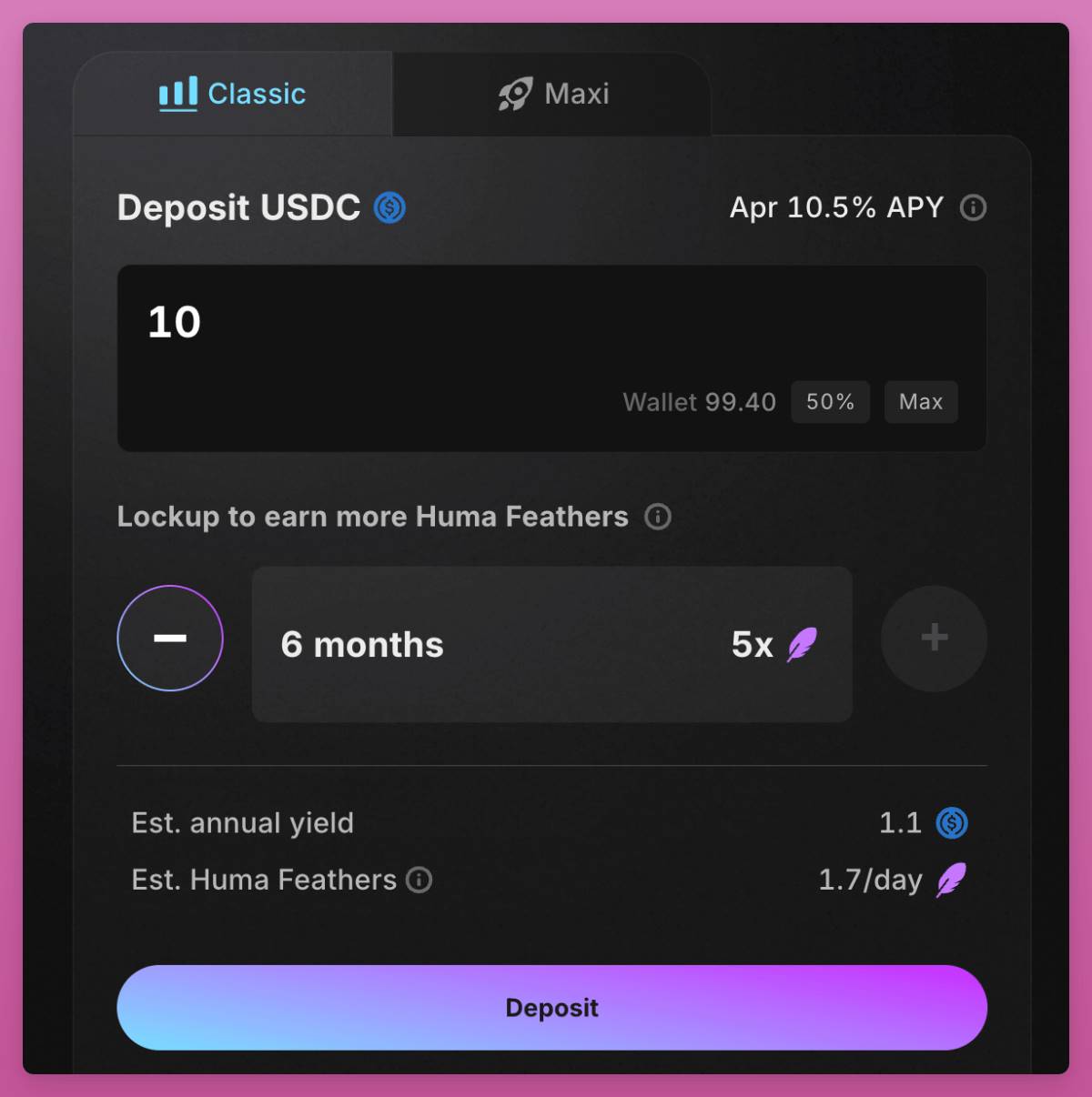

Two earning modes:

- Classic mode: Stable monthly yield + Feathers (points). Current yield exceeds 10%

- Maxi mode: 0% APR, but if you believe in Huma’s future governance token $HUMA, you get 5x Feathers

Users can now deposit USDC → receive $PST (PayFi Strategy Token), a yield-generating token usable across Solana DeFi (tradeable on Jupiter, borrowable against on Kamino).

Even locked positions can exit early via PST liquidity pools.

Data source: Dune

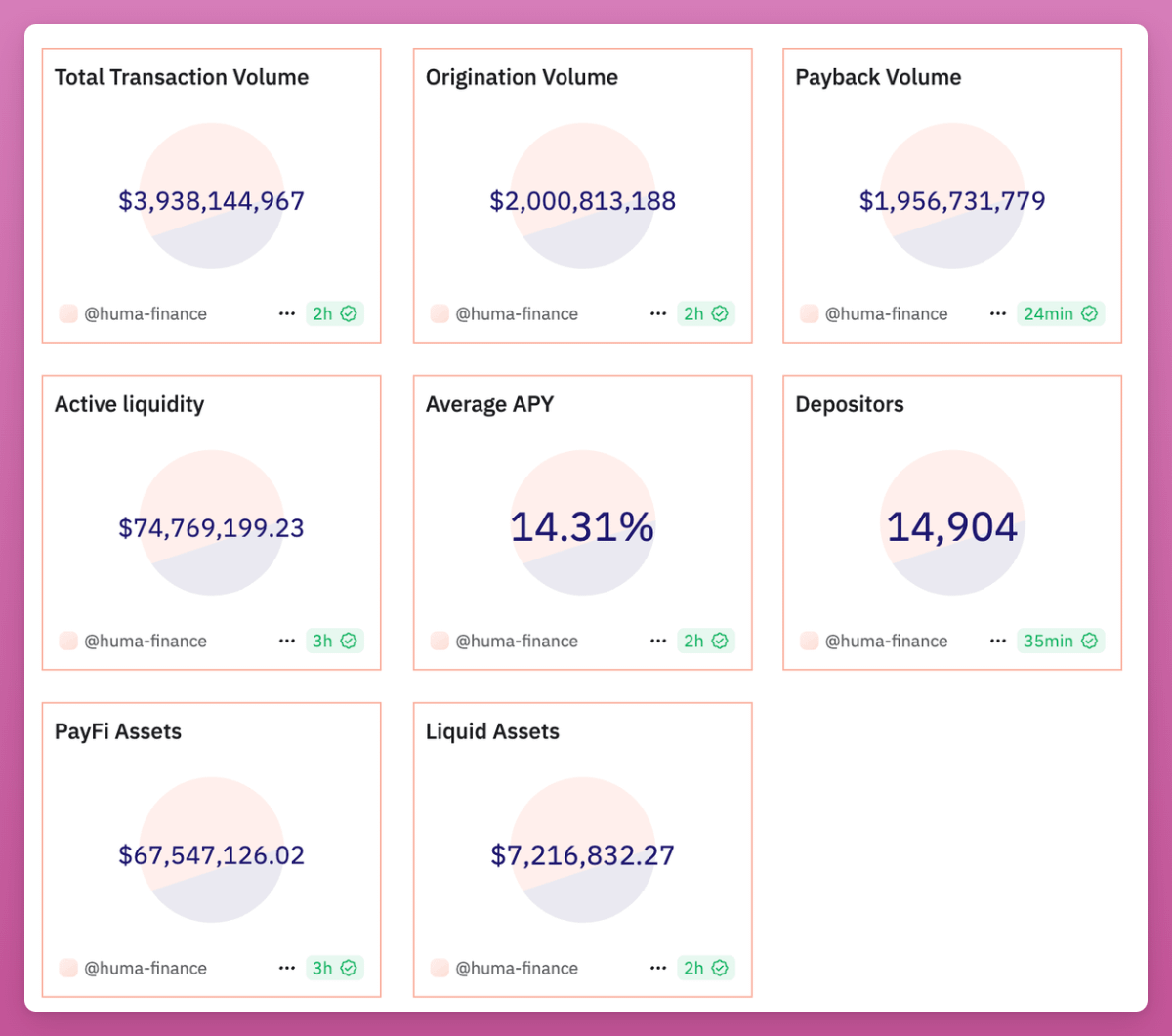

To date, Huma has:

- 10.5% APR on USDC

- $74.7 million in PayFi transaction volume, all yield-generating

- $7.2 million in liquid reserves (stablecoins) held for contingencies, non-yielding

- $81 million in TVL

8. DeFi App

You’ve likely seen frequent promotions for DeFi App on X, but the volume and style of ads might feel off-putting—raising skepticism and giving a strange vibe.

Still, there are reasons to be optimistic:

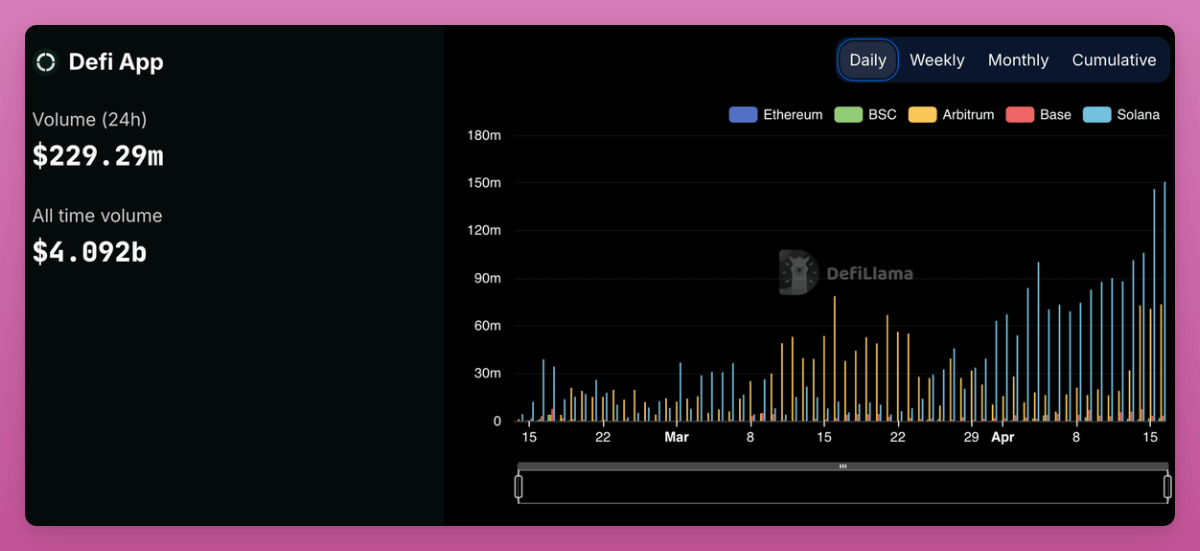

- Ranked third among DEX aggregators, with $229 million daily volume and $991 million weekly volume

- Raised $6 million at a $100 million valuation from VCs including Mechanism Capital, Selini Capital, North Rock Digital, and around 50 angel investors

DeFi App is an all-in-one super app simplifying DeFi.

From the beta version, cross-chain swaps work exceptionally well—no annoying gas fees, supporting both Solana and EVM chains. Features like yield farming and perpetual trading will be added soon.

The HOME token hasn’t launched yet. Users can earn rewards through simple token swaps.

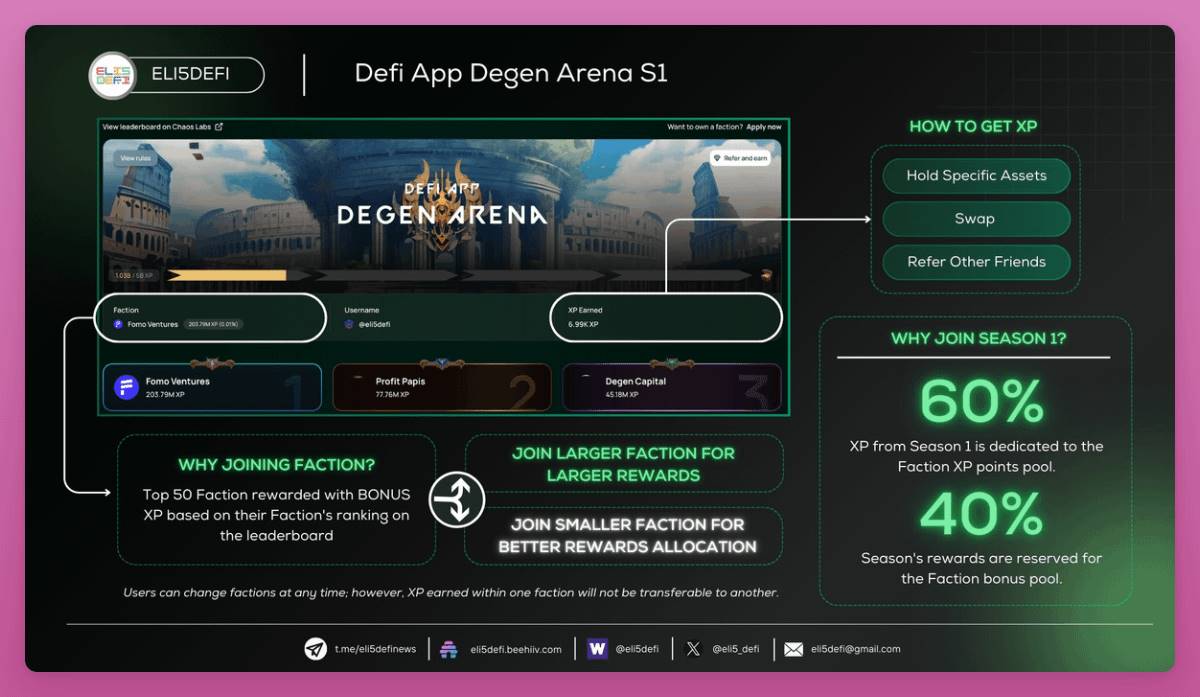

Additionally, users earn points by swapping tokens and joining the Degen Arena.

The top 50 clans earn extra rewards and early access to new DeFi App features. Why join a clan? In Season 1 of Degen Arena, $HOME distribution favors clans:

- 60% of season XP goes to the clan XP pool

- 40% of season rewards go to the clan reward pool

9. Slingshot

If there’s one mobile app capable of swapping all tokens across chains, it’s probably Slingshot.

Before trying it, keep these points in mind:

- Account creation is as easy as a Web2 app

- Magic Eden recently acquired Slingshot, reducing the likelihood of a standalone SLING token airdrop

- Support for Bitcoin Rune tokens is coming soon

So, if you primarily trade crypto on mobile devices, Slingshot is a must-try app.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News