Cyber Capital Founder: From Criticism to Advocacy—Why I Fell in Love with Solana

TechFlow Selected TechFlow Selected

Cyber Capital Founder: From Criticism to Advocacy—Why I Fell in Love with Solana

Perfection is the enemy of excellence, and Solana is already excellent enough.

Author: Justin Bons, Founder of Cyber Capital

Translation: Luffy, Foresight News

Solana has one of the most dramatic comeback stories in crypto history—a project that has long been controversial since its inception. But today, it no longer deserves the criticism. From the infamous collapse of FTX, to fabricated usage metrics, centralized design, and network outages, Solana has weathered countless storms, emerging stronger each time. It has genuinely evolved—and so must our perception of it. Many love to bash Solana, but in reality, we should confront our own damn biases.

This is partly my fault. I admit I bear some responsibility for this perception, as for years I was one of Solana’s harshest critics. Yet today’s Solana is fundamentally different from what it once was. Precisely because of these changes, in 2023 I transitioned from being a critic to a supporter.

In this article, I will dissect all my past criticisms in detail, demonstrating how Solana has improved and why it now deserves our support. Changing our minds isn’t weakness—it’s a superpower, especially when done in service of decentralization and our shared cypherpunk values.

Network Outages

Solana has suffered multiple outages—something truly worthy of serious critique, as a mature blockchain theoretically should never go down.

That said, there's no denying Solana’s stability has steadily improved. The key question is whether technical changes provide sufficient grounds for confidence in the network’s future resilience.

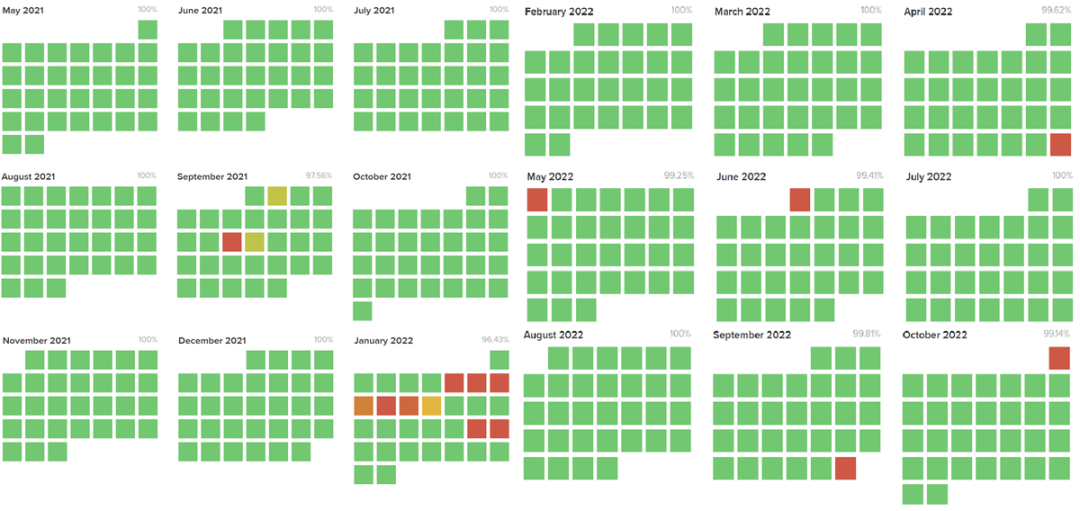

Let’s first examine past incidents and their root causes. The uptime charts for 2021 and 2022 were abysmal:

Source: Solana Status

On September 14, 2021, the Solana network went down for over 20 hours due to excessive node memory usage, making recovery extremely difficult. On June 1, 2022, it crashed again for over four hours due to a transaction spam attack that brought the network to a halt. On October 1, 2022, an invalid block triggered a chain fork, causing another outage lasting over three hours.

I won’t recount every single downtime event—others have documented them thoroughly. The point is clear: Solana faced severe challenges and was clearly flawed at the time. Had it remained in that state, I’d still be criticizing it. But instead, with each resolved issue, it became stronger. Now consider what followed:

Source: Solana Status

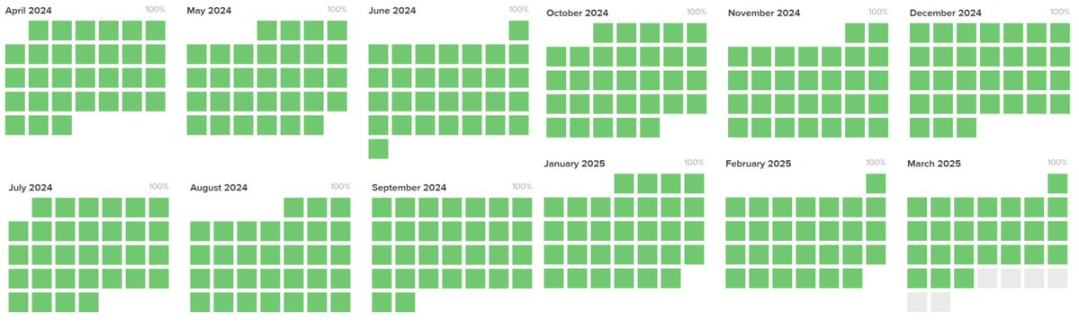

The following year saw significant improvement—not perfect, but remarkably so. Most prior failures stemmed from Solana’s lack of a robust fee market. Its implementation became one of the main reasons I shifted my stance, as it paved the way for near-perfect stability the next year:

Source: Solana Status

Still, Solana faces other issues: congestion, spam, RPC failures, network bottlenecks, etc. For a blockchain consistently breaking usage records, these are natural growing pains. Crucially, however, there have been no full outages—representing massive progress compared to previous years and signaling increasing maturity.

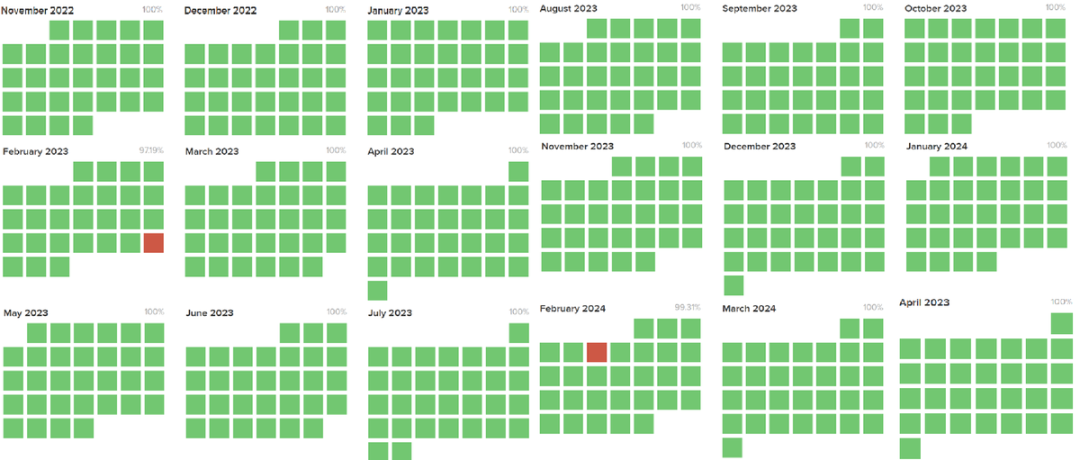

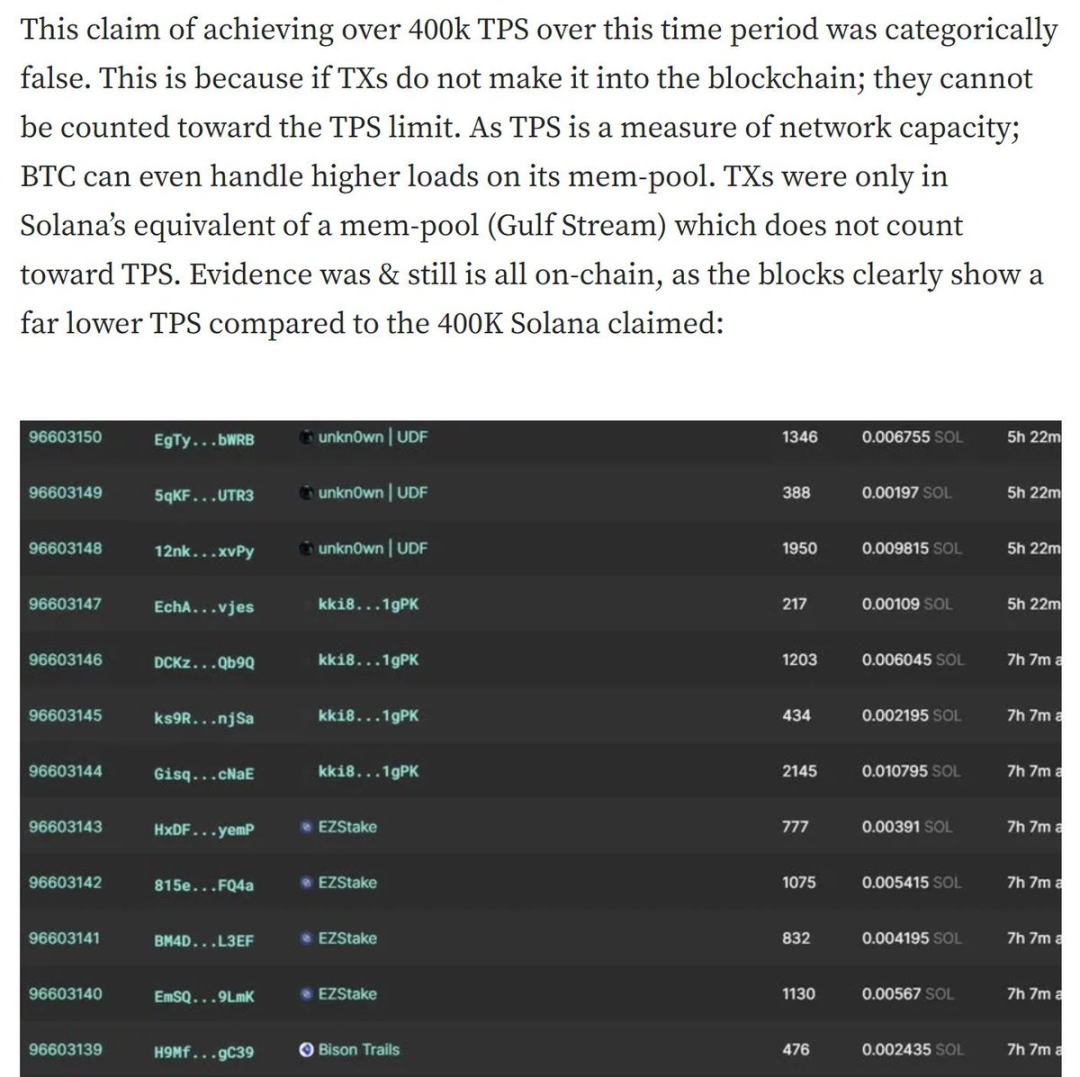

Fake TPS Metrics

Next, let’s address misleading usage data. When I first raised this issue in 2021, Solana had almost no real user activity. Claiming 40,000+ TPS at that time was outright dishonest.

Since then, Solana has cleaned up its external communications and stopped hyping inflated TPS figures. In fact, Solana’s leadership is now far more transparent in public messaging.

Source: Screenshot from "Criticism of Solana: Lies, Fraud, and Dangerous Trade-offs"

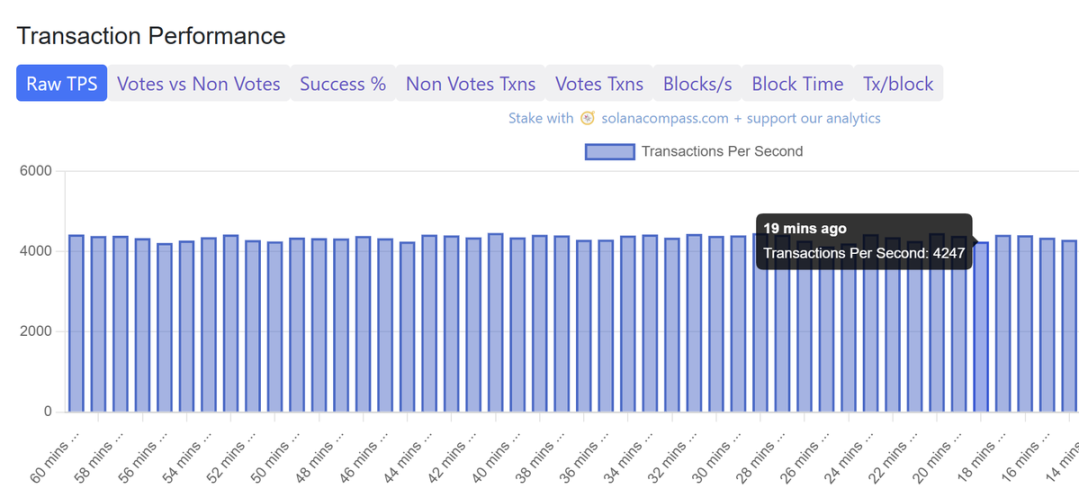

Even today, raw TPS numbers can be misleading. Yet even under conservative adjustments, the resulting figures remain extremely impressive. Let me break it down. Raw TPS currently stands at 4,247:

Source: Solana Compass

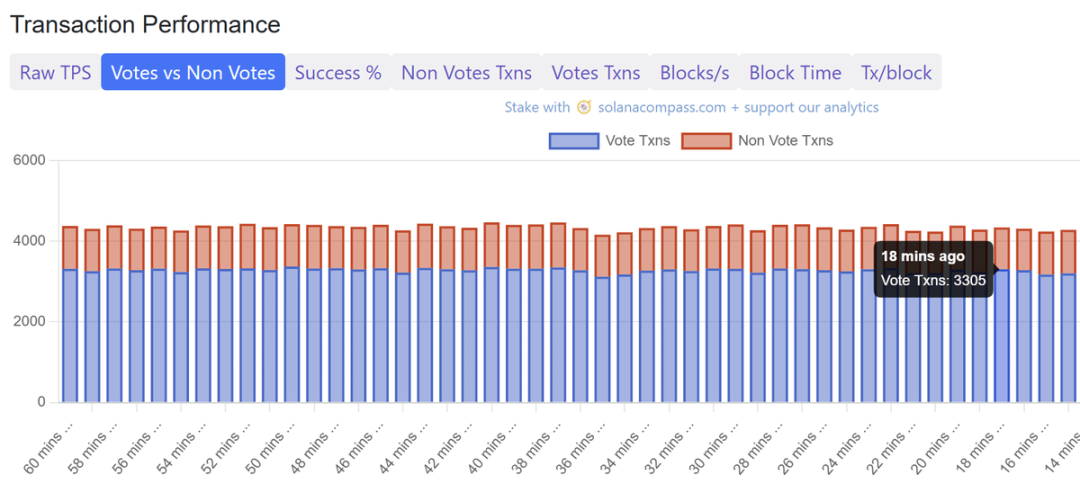

Now subtract vote transactions, leaving 1,109 TPS. For argument’s sake, we can also exclude “failed transactions.”

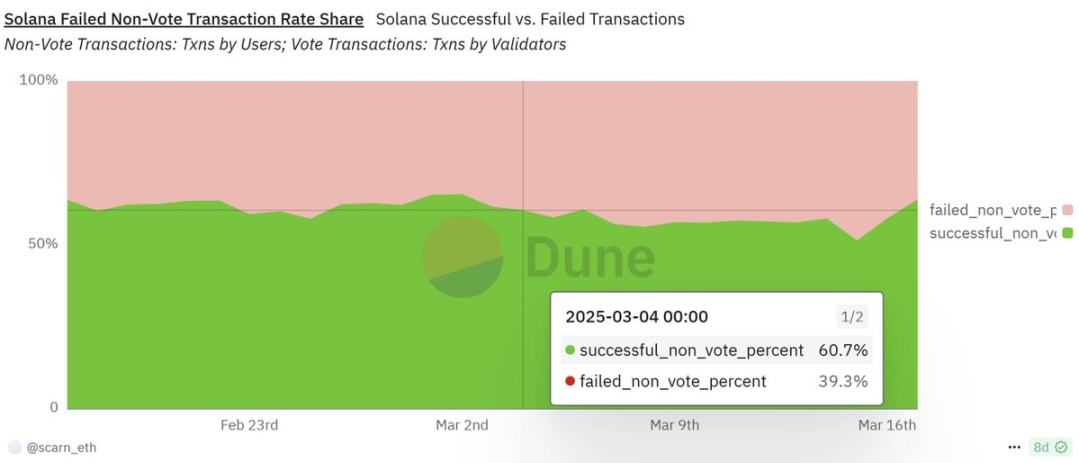

So: 4,247 raw TPS – vote transactions = 1,109; minus failed transactions (estimated at -40%) = 665.

Source: Solana Compass

Source: Dune Analytics

This adjusted usage still exceeds the combined total of all other blockchains today.

This makes Solana the undisputed leader in decentralized applications. This is why certain criticisms feel unfair—they imply Solana isn't leading in usage, yet the facts clearly show otherwise, even under the most conservative estimates.

Moreover, excluding “failed transactions” isn’t entirely fair either, because these transactions were always destined to fail and still required fees. They’re primarily driven by sophisticated actors attempting double payments to get their transactions included faster, expecting most to fail. This doesn’t reflect the average user’s experience—in my own testing, ordinary users face a failure rate below 0.2%, well within reasonable limits.

But even after removing failed transactions, Solana remains unmatched.

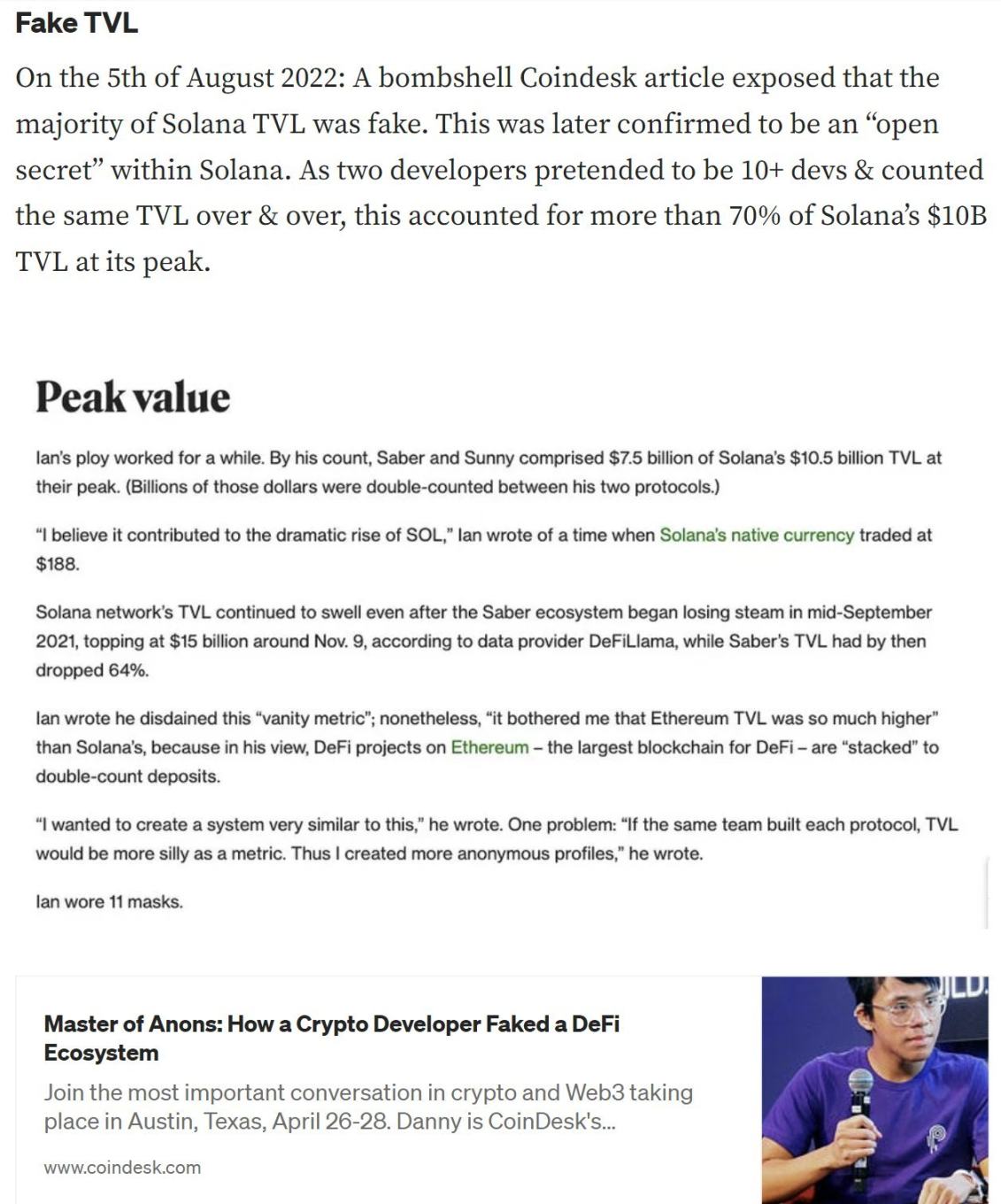

Fake TVL Metrics

TVL data had similar issues, sometimes grossly exaggerated:

Source: Screenshot from "Criticism of Solana: Lies, Fraud, and Dangerous Trade-offs"

Luckily, these were just growing pains. As the ecosystem matured, TVL comparisons have become fairer. While not perfect, current methodologies are consistent across chains—no blockchain reports flawless metrics today. At the very least, ecosystems now apply uniform standards.

Solana’s TVL remains a substantial $6 billion and is growing rapidly, painting a bright picture ahead:

Source: DeFiLlama

Revenue

Despite record-breaking revenue for L1s and DApps, many still refuse to acknowledge reality.

What many fail to grasp is that revenue metrics cannot be faked, precisely because Solana is sufficiently decentralized to prevent manipulation.

The reason? To “fake” these fees, a bad actor would have to pay all costs out of pocket. Since they cannot control which validators receive the fees, they end up fully funding the entire expense. Revenue simply cannot be fabricated.

Source: DeFiLlama

If someone believes Solana’s founders spend up to $5 million daily fabricating fee revenue, I don’t know what to say—that’s pure conspiracy theory. Perhaps such individuals should review their portfolios and check if bias is clouding their judgment.

Revenue is arguably the most important metric—it proves real-world utility and provides a solid, sustainable foundation for future decentralization and security.

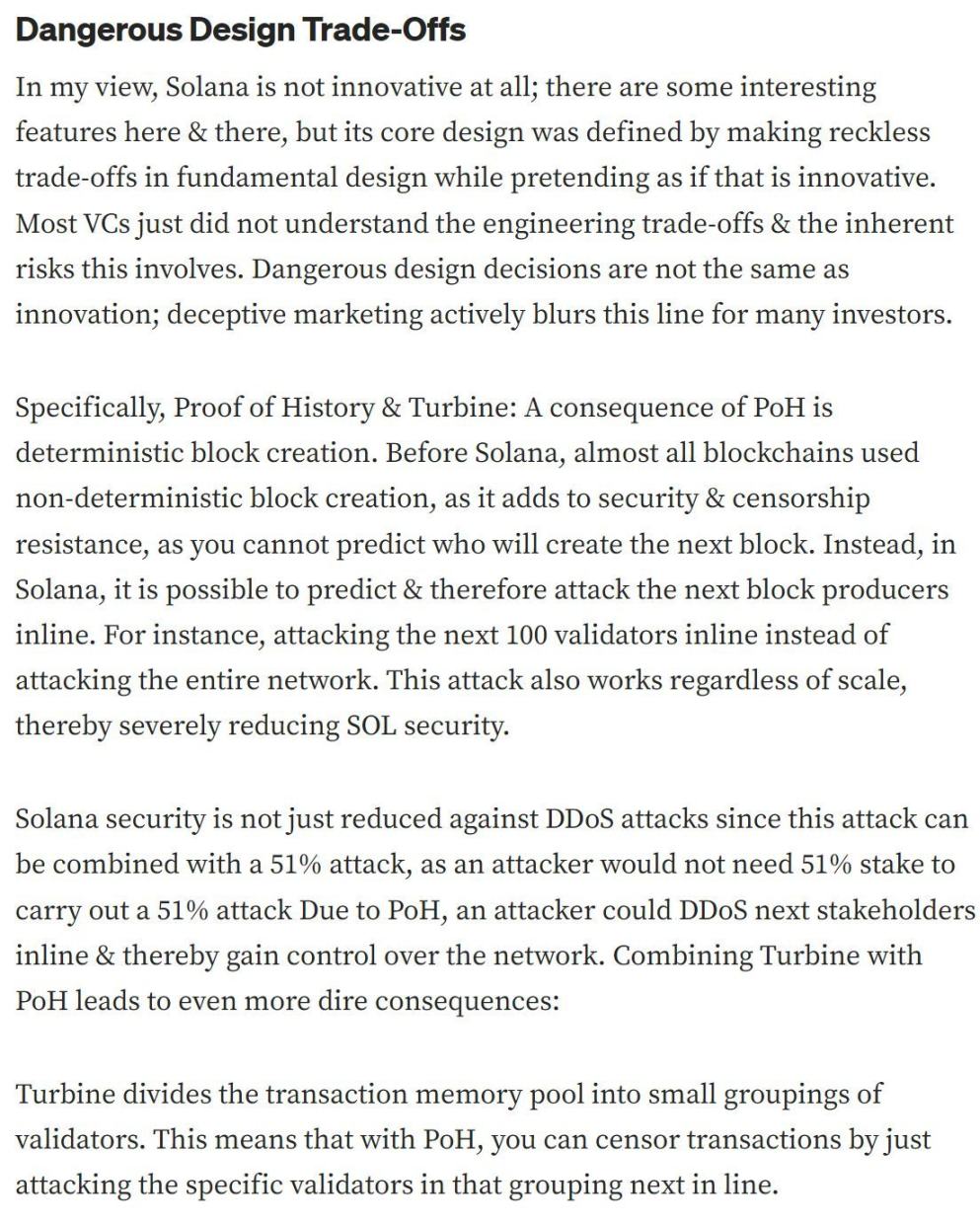

Dangerous Design Trade-offs

Certain Solana design choices—like Proof of History (PoH) and Turbine—did sacrifice some degree of decentralization in pursuit of speed. I must confront this directly: What does it mean? Essentially, it lowers the barrier to attack.

Roughly speaking, perhaps by about 20%. Still, this only slightly weakens economic security. It allows attackers to DDoS the next set of validators likely to become leaders, reducing the amount of tokens needed to execute a “51% attack.” I explained this in greater detail in earlier critiques:

Source: Screenshot from "Criticism of Solana: Lies, Fraud, and Dangerous Trade-offs"

Nevertheless, Solana’s market cap is triple that of its nearest L1 competitor. Even with this trade-off, Solana maintains high security. Is this specific compromise justified? Hard to say.

But what is certain is that today’s Solana is not insecure—it has ultimately achieved balance. In practice, Solana is significantly more secure than competitors with closer valuations.

Decentralization involves multiple interacting factors. For example:

A high-capacity blockchain with 10,000 nodes running on supercomputers is more decentralized than a low-capacity chain with only 100 nodes running on Raspberry Pis.

This is an extreme example, but it illustrates my point. That’s why, despite higher node requirements and centralized design decisions, Solana is actually highly decentralized relative to its scale—because scale plays a crucial role in practical decentralization. Solana achieves this through broad stake distribution across 1,300 validators:

Source: Solana Beach

This validates long-standing theories and debates around maintaining decentralization—dating back to Bitcoin’s block size wars. There’s always tension between scaling and decentralization, epitomized by the “blockchain trilemma.” The solution lies in finding the right balance between extremes, as either end leads to failure—either uselessness or excessive centralization.

Thus, seeing Solana fulfill this vision after Bitcoin and Ethereum abandoned it feels like a dream come true. I hope this better explains my shift—from an old-school big-block Bitcoin advocate since 2013—to supporting Solana today.

Governance and Client Diversity

Solana has multiple competing clients—a major win for decentralization. Without multi-client support, a blockchain effectively operates under single-party governance. You may vote, but you only have one party to choose from.

Multiple clients also greatly enhance network resilience, ensuring a single implementation bug can no longer bring down the entire network.

Very few blockchains achieve this—Solana is among them. This achievement must not be understated; it reflects a strong commitment to decentralization. Maintaining two clients is far more than twice as hard as maintaining one. This explains why few projects attempt it—many prefer to hide obvious centralization while pretending it’s a “meritocracy,” where shadow rulers maintain control over all change.

Solana also has basic on-chain governance mechanisms, though still evolving. Just having this commitment already puts it far ahead of Bitcoin and Ethereum, which in my view operate under de facto dictatorship when it comes to rule changes.

Solana recently failing to pass SIMD228 might seem contradictory, but it’s actually a milestone. Disagreement and conflict are hallmarks of true decentralization. Think about it—the proposal had full backing from Solana’s top leadership, yet stakeholders still rejected it. There’s no better proof of genuine decentralization. Today, checks and balances in Solana’s governance are clearly functioning.

The “Off-Switch” Myth

This is an absurd claim I never mentioned in prior criticism—but worth briefly addressing.

Solana has no “off-switch.” Unlike permissioned chains (e.g., XRP and HBAR) or hybrid chains with permissioned elements (e.g., ALGO and BNB), Solana contains no permissioned components. It is a truly public, trustless, and decentralized blockchain—undeniable fact.

This misconception likely stems from confusion between a blockchain halting due to consensus issues versus having an actual kill switch. Consensus mechanisms are complex—blockchains can stop running in various ways, none of which imply centralized control. I won’t waste time on such ignorant criticism—anyone with basic technical understanding knows the truth.

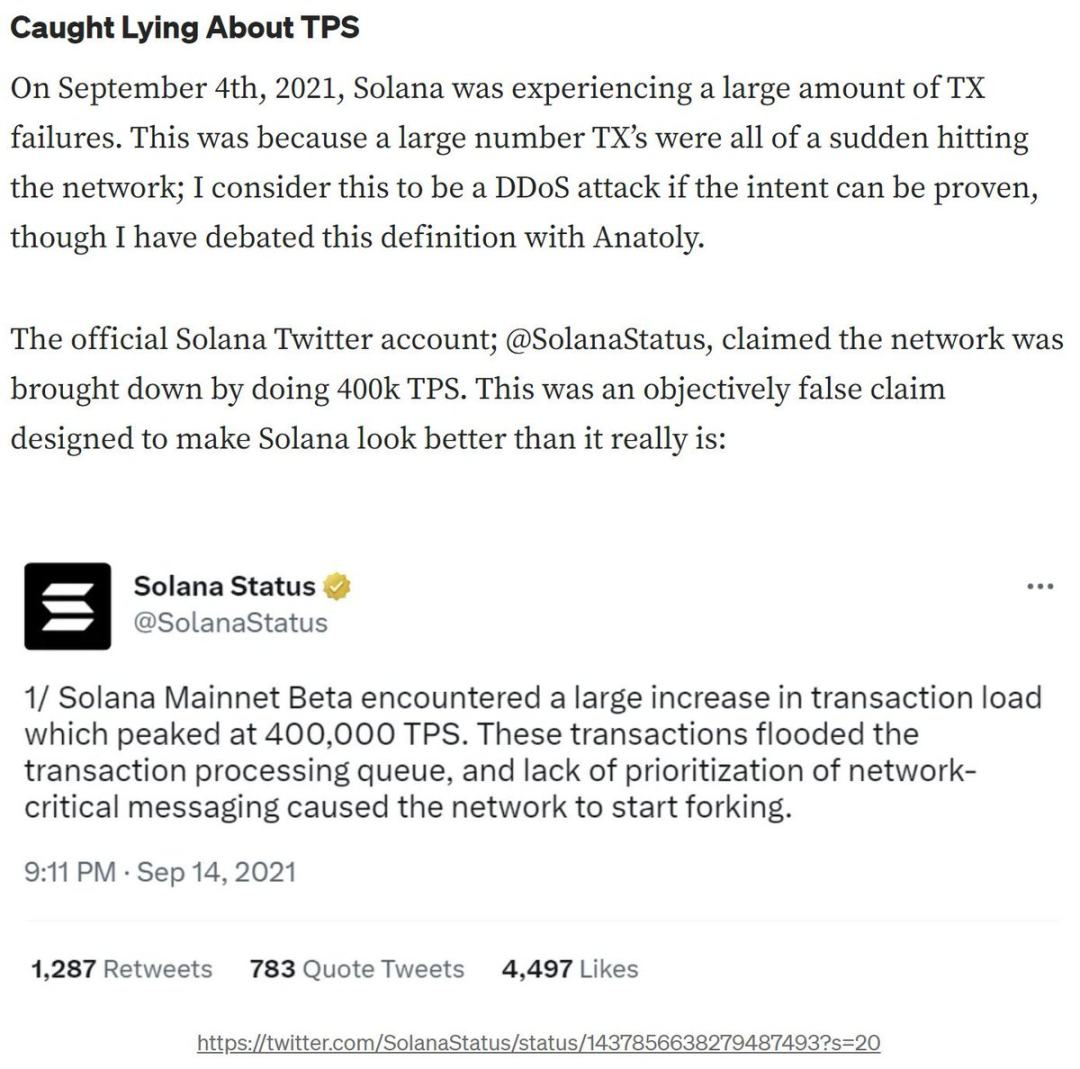

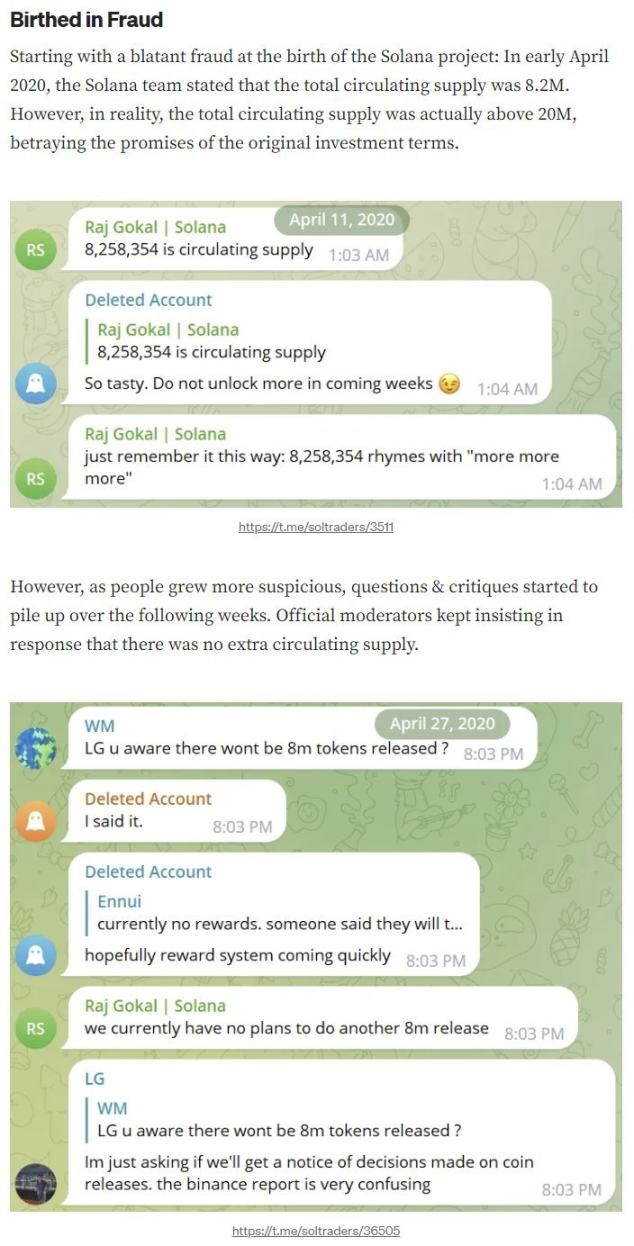

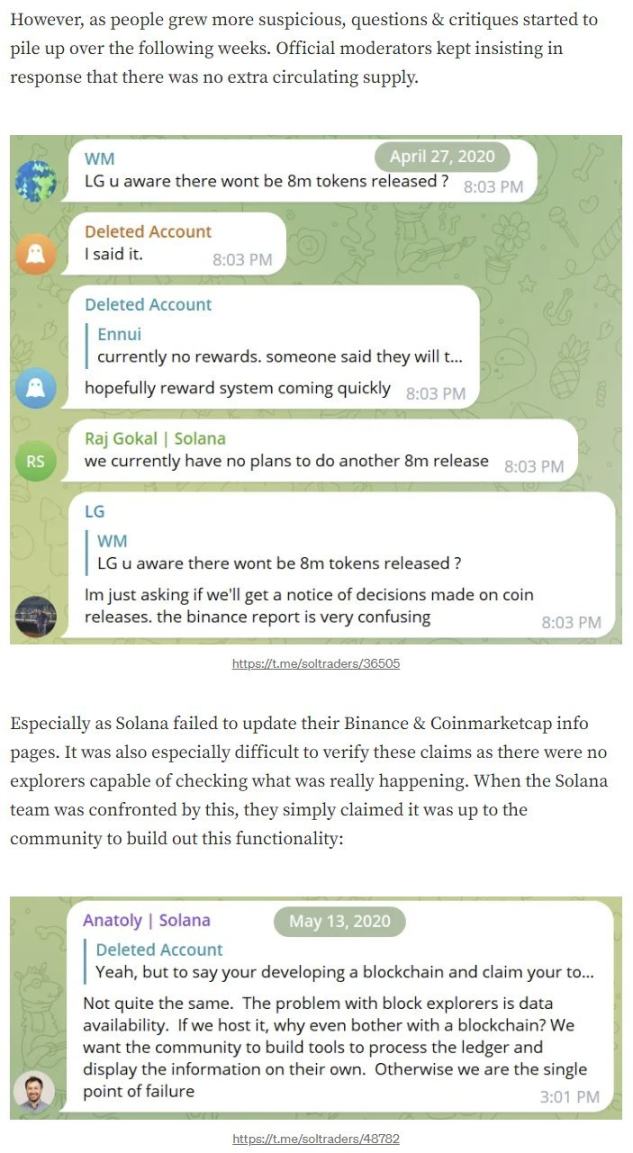

Fraud and Lies

Fraud and deception are harder to excuse. As I previously stated, the Solana team engaged in a pattern of bad behavior over the years. However, they’ve significantly improved in communication honesty and professionalism since then.

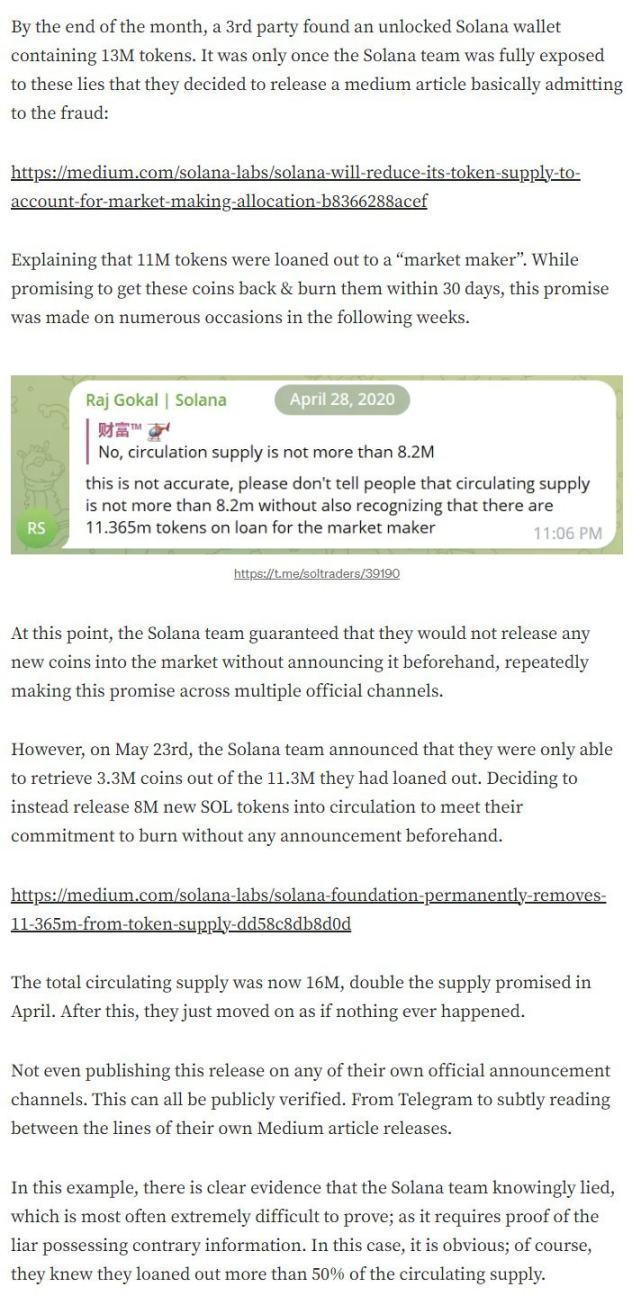

Yet the ugly truth remains: in 2020, the Solana team lied about circulating supply. While those numbers no longer matter materially, it remains a stain on Solana’s history. For full transparency, I covered this in depth before—including evidence:

Source: Screenshot from "Criticism of Solana: Lies, Fraud, and Dangerous Trade-offs"

My response boils down to the concept of decentralization: a blockchain can transcend its origins. Decentralization means Solana isn’t defined by its early leadership. Especially with mass adoption, leadership influence gets diluted and evolves. This means we can support Solana even if we distrust its current leaders.

Personally, I’ve regained confidence in its leadership—the pattern of misconduct has stopped. But my main point is: you don’t actually need to trust the leadership at all.

That’s the essence of decentralization: you don’t need to trust anyone! Past mistakes remain, but we can focus on the future.

Summary of Past Criticisms

To summarize my earlier criticisms—as I did at the time:

-

In 2020, Solana’s leadership lied about supply—but this has no material impact today.

-

Solana has improved its communications, and real TPS continues to hit new highs!

-

Blockchain explorers now display “real TPS.”

-

TVL is no longer “fake.”

-

Most dangerous trade-offs have been corrected.

I’ve always firmly defended crypto principles, adjusting my views as the space evolves. Some accuse me of being a shill, claiming my shift seems sudden.

These accusations are not only ad hominem but plainly ridiculous—just recall how negative my past stance on Solana was. If someone were paying off critics, I’d be the last person they’d target.

Perfect Is the Enemy of Good

If we're too picky, the blockchain space fractures into thousands of chains—bad for crypto’s growth. Or at least, if we aim to advance cypherpunk ideals, we should rationally allocate our support.

Remember, this comes from someone who rejects 95% of blockchains. I loudly criticized the #1 and #2 market cap chains (Bitcoin and Ethereum) in 2016 and 2022 respectively, because they abandoned on-chain scaling.

That’s why, if we reject the third-largest blockchain (Solana), we’d better have an extremely good reason. My life was already hard enough managing the world’s oldest liquidity fund while constantly taking contrarian positions. Which is exactly why, ethically speaking, I can no longer criticize Solana—they’ve fixed the very flaws I pointed out… forcing me to become a supporter.

Ironically, my most popular content was my criticism of Solana. This led many in my audience to resent me for changing sides, while many in the Solana community remain cautious toward me as a former critic. I suppose this is sometimes the price of independent thinking.

Of course, technically superior blockchains may exist—but is any path to mass adoption smoother than supporting Solana? I’d rather present clients with real revenue data than theoretical specs…

Crucially, Solana is already decentralized enough to deliver censorship resistance, immutability, financial sovereignty, and more—all on a blockchain capable of real-world scale today. That’s ultimately what matters.

Conclusion

As a value investor who supports holistic scaling theory, my shift toward Solana was a natural evolution as it began delivering results.

Solana is far from perfect; even then, it wasn’t my favorite design. Yet we must respect its success in usage, where real value resides.

Scaling without decentralization is meaningless; conversely, decentralization without scalability fails too. Critics claim Solana ignores this, but that’s false.

In an environment where Ethereum has effectively given up on L1 scaling, Solana has become the new king. Of course, challengers remain, and diversity is vital. Yet in the areas that truly matter—utility, usage, and revenue—we can no longer ignore Solana’s clear market advantage.

Ignoring this today either stems from serious misunderstanding of Solana or its competitors—or deep-seated bias. We all need to fix our damn biases! That’s why in this industry, the ability to change your mind is a superpower.

As an early adopter of both Bitcoin and Ethereum, I later became a critic when those chains strayed from on-chain scaling.

Solana’s success deserves celebration from us cypherpunks. Only through scalable technology can the masses be liberated—and Solana is realizing that vision right now.

Perfect is the enemy of good—and Solana is already good enough. Live free, or die—you’ll end up loving Solana just like I did.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News