Recent Thoughts on DeFi: DeFi Unshackled, Repeal of the Broker Rule, and More

TechFlow Selected TechFlow Selected

Recent Thoughts on DeFi: DeFi Unshackled, Repeal of the Broker Rule, and More

Unichain launches liquidity mining with $5 million in $UNI token rewards across 12 pools.

Author: Chen Mo

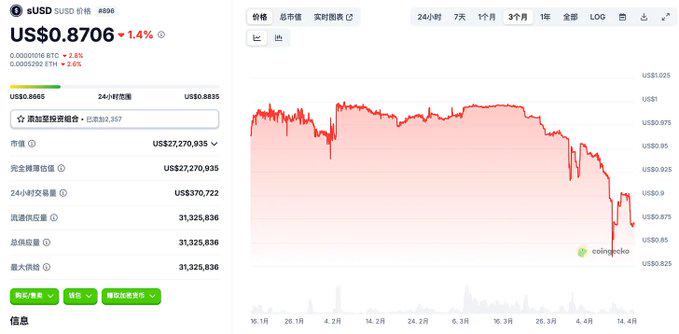

1/ sUSD remains off-peg — why hasn't it been fixed?

Since the approval of SIP-420 at the beginning of the year, sUSD has shown signs of de-pegging, recently entering a severe de-peg zone below $0.9. The key change in this proposal was the introduction of the "delegation pool," a mechanism designed to encourage users to mint sUSD with benefits including:

-

200% collateralization ratio (originally designed above 500%)

-

Debt can be linearly transferred to the protocol

-

After full transfer, users no longer need to repay

-

The protocol resolves debt through revenue streams and $SNX appreciation

The advantages are clear: improved SNX capital efficiency for minting and elimination of liquidation risk for borrowers. If the market has strong confidence in SNX, this could create a positive feedback loop.

However, problems quickly emerged:

-

The market still suffers from severe PTSD regarding SNX-sUSD as an endogenous collateral pair

-

Lack of confidence, combined with increased sUSD supply due to higher minting efficiency, has caused significant imbalances in Curve pools

-

Due to the delegation pool design, users no longer actively manage their debt, removing the ability to profit by buying discounted sUSD on the market to repay and arbitrage

The most pressing question—can it re-peg? This heavily depends on the project team, as they must increase demand for or incentives around sUSD. @synthetix_io clearly understands this, but whether the market will accept algorithmic stablecoins backed by endogenous collateral remains uncertain. The shadow of LUNA is still too large. That said, from a design perspective, Synthetix's model is advanced—it might have thrived if launched during the early days of algorithmic stablecoins.

(This is not investment advice; only an explanation of events for educational purposes.)

2/ veCAKE governance attack: cakepie protocol faces shutdown

Ironically, the ve model was originally designed to prevent governance attacks, yet veCAKE was killed by centralized intervention.

We won’t recount the full event here. The main controversy lies in PancakeSwap’s claim that @Cakepiexyz_io used its governance power to direct CAKE emissions toward low-efficiency liquidity pools, which Pancake deemed a “parasitic” behavior harmful to its ecosystem.

However, this outcome does not violate the operational principles of the ve mechanism. CAKE emissions are determined by vlCKP, the locked governance token of cakepie, which represents voting power and naturally enables bribery markets—the very reason protocols like cakepie and Convex exist.

The relationship between Pancake-cakepie mirrors that of Curve-Convex. Frax and Convex grew by accumulating large amounts of veCRV voting power. Moreover, the ve model never directly ties fees and emissions together. The criticism that cakepie misdirected emissions reflects insufficient competition for governance rights rather than a flaw in the system itself. Standard solutions include waiting for or encouraging market competition. If human intervention is necessary, better alternatives exist—such as setting emission caps per pool or incentivizing broader participation in veCAKE voting.

3/ Following up on the veCAKE governance issue: Curve founder @newmichwill proposes a quantitative method:

-

Measure the amount of CAKE locked into veCAKE via Cakepie (these CAKE tokens are permanently locked).

-

Compare it to a hypothetical scenario: if the same veCAKE were used to vote for “high-quality pools,” and all resulting rewards were used to buy back and burn CAKE, how many CAKE would be burned?

-

This comparison helps assess whether Cakepie’s actions are more efficient than direct token burning.

Based on Michael’s experience, on Curve, the veToken model is approximately three times more effective at reducing CRV circulating supply than direct token burning.

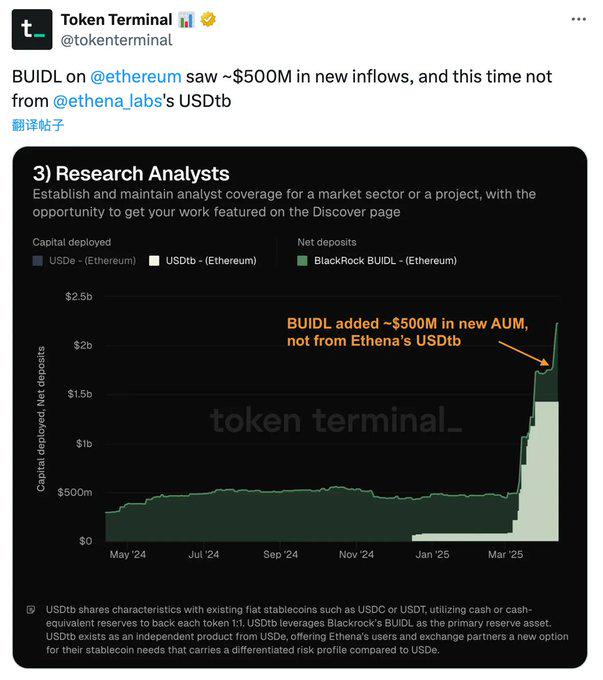

4/ BUIDL continues growing — up 24% over 7 days

(1) Previously noted when surpassing $2 billion; now approaching $2.5 billion

(2) The recent $500 million increase did not come from Ethena

(3) Likely attracting a new investor base

(4) On-chain traces suggest possible inflows from Spark, the lending protocol under Sky (MakerDAO)

RWA continues steady growth but remains poorly integrated into the broader DeFi ecosystem, currently existing in a state “disconnected from the market and retail investors.”

5/ IRS DeFi broker rule officially repealed

On April 11, U.S. President Trump signed legislation formally repealing the IRS crypto broker rules as they apply to DeFi.

The DeFi sector saw a modest uptick. In my view, this is a major positive for DeFi—regulatory pressure is easing, potentially unlocking more room for application innovation.

6/ Unichain launches liquidity mining: $5M in $UNI rewards across 12 pools

Supported tokens: USDC, ETH, COMP, USDT0, WBTC, UNI, wstETH, weETH, rsETH, ezETH

It’s been five years since Uniswap last ran liquidity mining—in 2020 alongside the launch of UNI. This round aims to bootstrap liquidity on Unichain. Many users are expected to participate, given the opportunity to acquire UNI tokens at low cost.

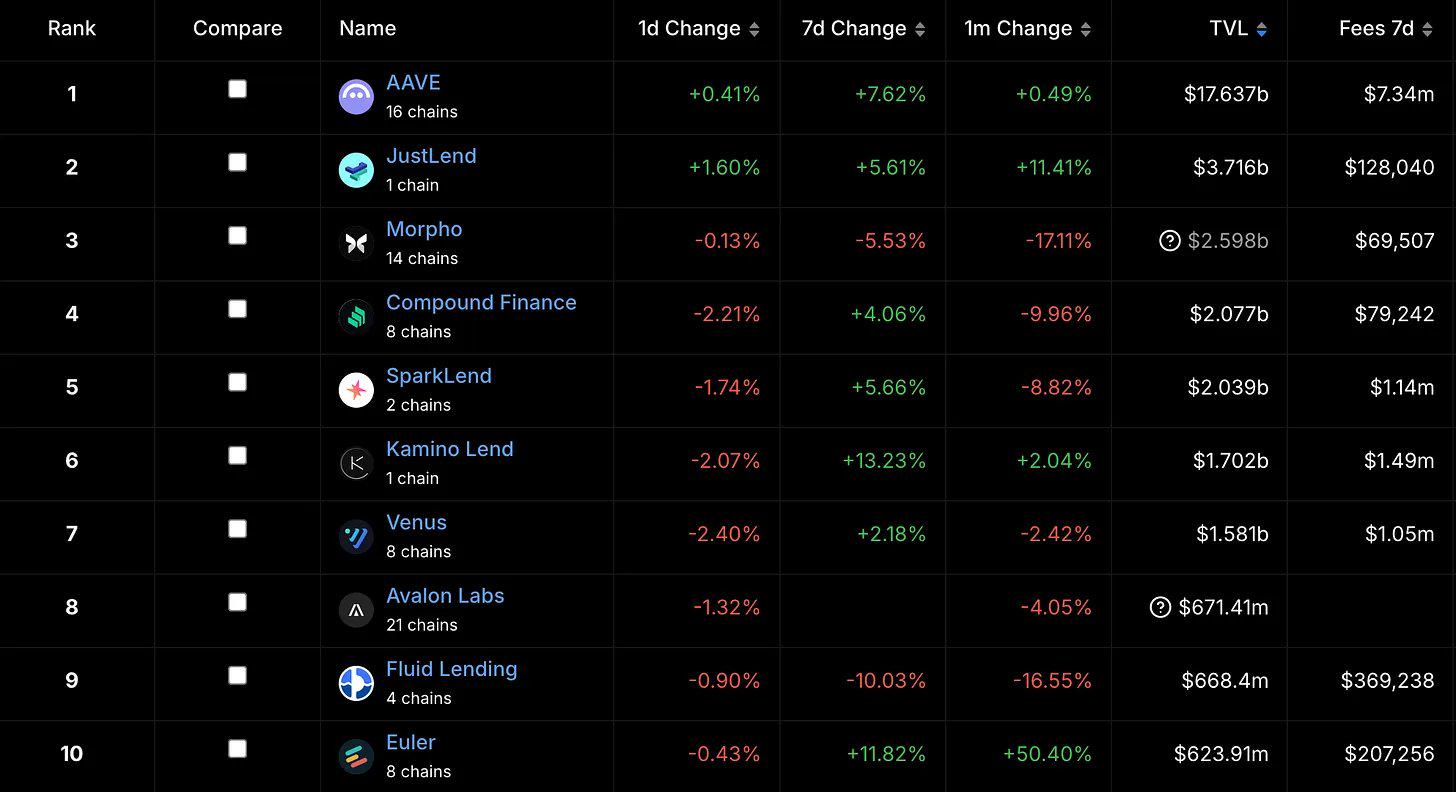

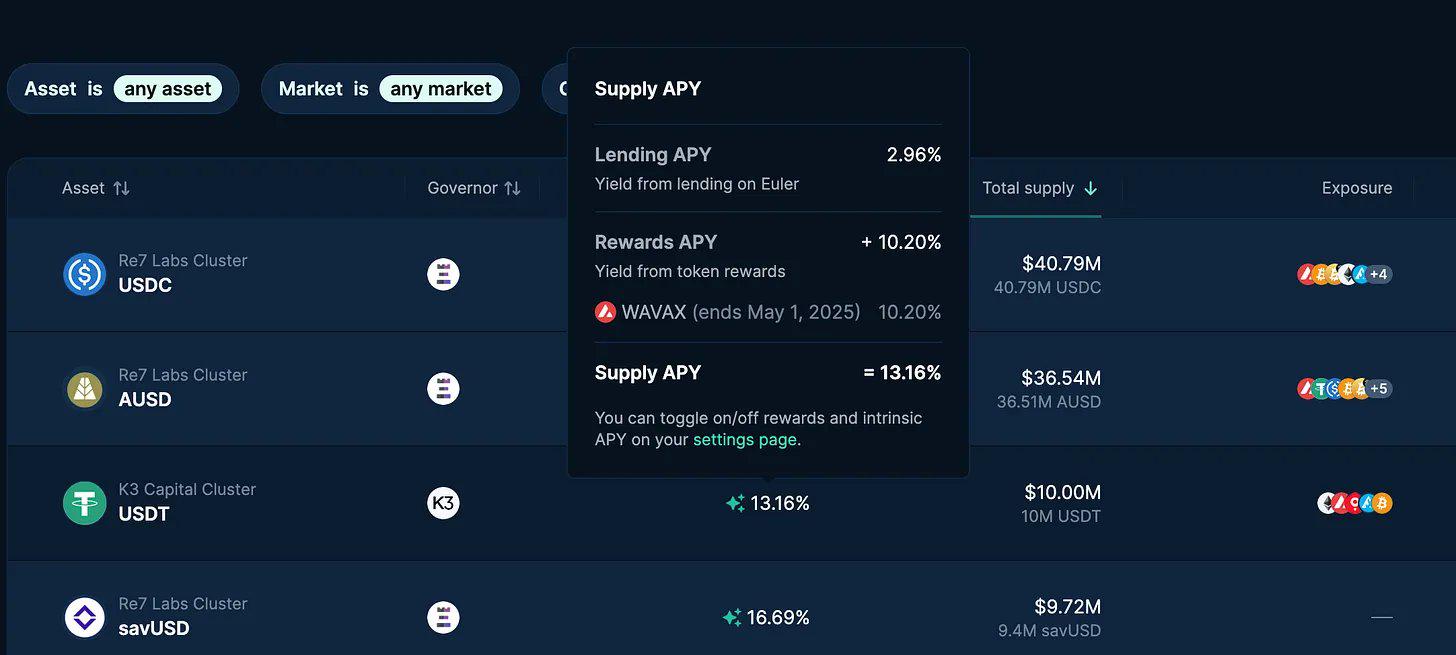

7/ Euler expands to Avalanche — TVL now ranks among top 10 lending protocols

(1) TVL increased by 50% in one month

(2) Most growth driven by incentives from Sonic, Avalanche, and EUL

8/ Cosmos IBC Eureka officially launches

(1) Based on IBC v2

(2) Gas fees paid in $ATOM are burned per transaction

(3) Enables cross-chain interoperability between Cosmos and EVM chains

(4) Currently supports major assets from Ethereum mainnet and Cosmos; not yet extended to L2s

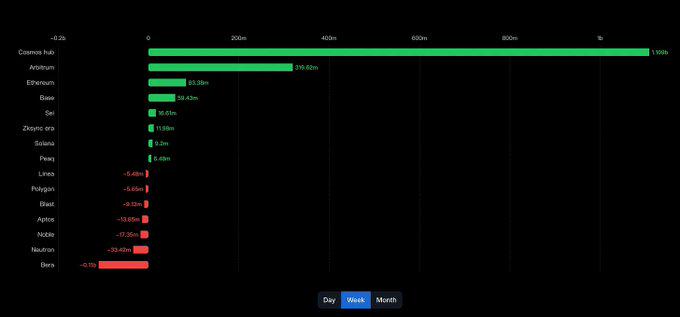

(5) Over the past week, $1.1 billion flowed into Cosmos Hub via cross-chain transfers

This strongly empowers ATOM: any chain within Cosmos that attracts significant capital inflows may now drive ATOM value appreciation—a notable improvement compared to the Luna-era, when ecosystem booms had little impact on ATOM.

Although substantial inflows occurred recently, transforming ATOM’s fundamentals will require sustained activity over time.

9/ Buybacks

(1) AaveDAO begins official token buybacks

(2) Pendle proposes listing PT token on Aave

10/ Berachain farming updates

(1) Updated POL reward distribution rules: capped individual Reward Vault allocations at 30%

(2) Berachain governance introduces a new Guardian Council responsible for reviewing and approving RFRVs

(3) OlympusDAO prepares to shift some POL liquidity in response to new rules, aiming to maintain high incentives for the $OHM pool

(4) Yearn’s $yBGT launches on Berachain

After a golden March, both token price and TVL on Berachain entered a correction phase. The team responded to concerns about inefficient incentive distribution with adjustments and limits. Despite continuous outflows over the past few weeks, Berachain remains one of the most DeFi-native chains. Continued monitoring of further protocol integrations and TVL trends is warranted.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News